Converting $100,000 USD into South African Rands should be simple, but it rarely is. The number you see on a quick Google search is almost never the amount that actually lands in your business bank account.

The final figure can be significantly less, thanks to a maze of hidden fees, inflated exchange rates, and transfer costs that quietly chip away at your funds.

Why Your $100,000 USD Transfer Isn't What It Seems

When your business needs to move $100,000 USD to ZAR, think of the number you see online as the sticker price of a car. It looks great on paper, but by the time you add on delivery fees, licensing, and other "admin" costs, the final invoice tells a very different story.

Foreign exchange works in a similar way. The difference between the advertised rate and the real-world payout comes from several factors that traditional banks and payment providers build into their services. These aren't just small handling fees; they can carve out a substantial chunk of your revenue.

Here’s what’s really going on behind the scenes:

- The Exchange Rate Spread: This is the most significant cost, yet it's often the least visible. It's simply the difference between the wholesale rate a bank gets and the less favourable rate they offer you. This margin is their profit, and it comes directly out of your pocket.

- SWIFT and Admin Fees: These are the more obvious charges—fixed fees for processing an international payment through the global SWIFT network.

- Intermediary Bank Charges: Your money doesn't always travel in a straight line. Sometimes, it's routed through one or more intermediary banks on its journey, and each one might take a small fee for its trouble.

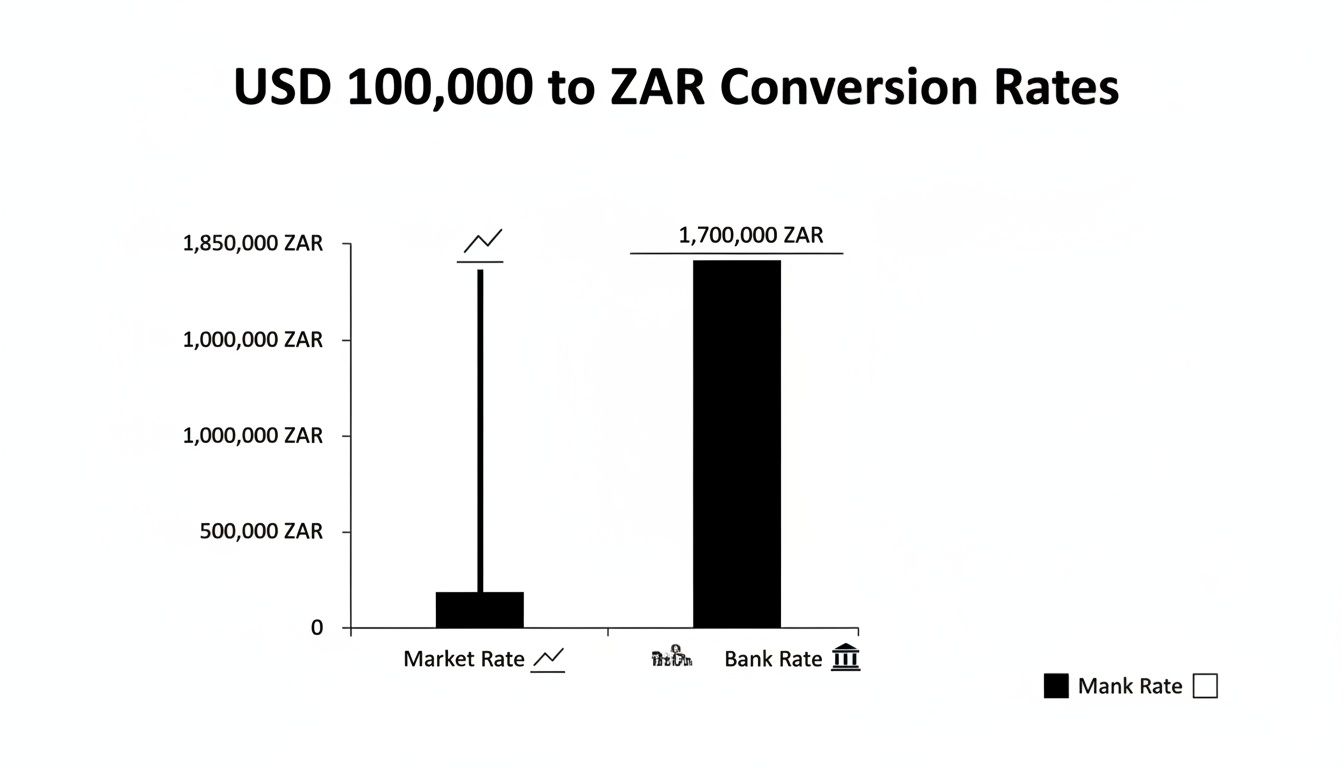

The bar chart below paints a clear picture of this gap, showing the difference between the 'real' market rate and a typical bank rate for a $100,000 transfer.

This visual shows you the immediate financial hit your business takes when using services with marked-up rates. For instance, over the six months leading up to January 2026, the average USD/ZAR rate was 17.1536. At that rate, $100,000 should convert to roughly R1,715,360.

However, with typical bank fees and spreads of 2-5%, the real cost for many South African businesses often pushed the effective exchange rate much higher, sometimes resulting in a final amount closer to R1,630,000. You can always explore historical rate data to get a better feel for how these currency pairs fluctuate.

Let's break down how these costs add up with a practical example.

Illustrative Payout for $100,000 USD to ZAR

This table clearly illustrates how an unfavourable exchange rate and hidden fees can dramatically reduce the amount of Rands you receive from a $100,000 transfer.

| Scenario | Exchange Rate (USD to ZAR) | Fees & Spread | Final Amount Received (ZAR) |

|---|---|---|---|

| Real Market Rate (Ideal) | 17.1536 | 0% (No spread or fees) | R1,715,360 |

| Typical Bank Rate | 16.5500 | ~3.5% combined spread & fees | R1,655,000 |

As you can see, the difference is stark. In this example, using a traditional bank instead of a service offering the real market rate would cost your business over R60,000 on a single transaction.

The Hidden Costs Eating Into Your International Payments

When you look up the conversion for 100 thousand dollars in rands, the number you get is rarely the amount that lands in the bank account. That initial figure is just the starting point. Below the surface, a whole ecosystem of hidden costs and fees is waiting to take a slice of your money before it ever arrives.

It’s a bit like ordering a product from overseas. The advertised price is one thing, but by the time you add shipping, customs, and handling fees, the final cost can be a nasty surprise. International money transfers work in much the same way.

The biggest, and often least understood, of these costs is the exchange rate spread. This isn't a line item you'll ever see on an invoice. It's the gap between the 'real' mid-market exchange rate—the one banks use to trade currencies among themselves—and the marked-up rate they offer you as a customer.

That markup is pure profit for the bank, and on a large transfer, it can mean thousands of rands simply evaporate.

Unpacking the Layers of Transfer Fees

Beyond the spread, your international payment has to run a gauntlet of other explicit charges that chip away at the total. These are often presented as standard administrative costs, but for businesses making regular global payments, they add up fast.

Here are the usual suspects that shrink your transfer:

- SWIFT Fees: Most international bank transfers go through the SWIFT network (Society for Worldwide Interbank Financial Telecommunication). Using this system involves a standard processing fee, usually a fixed amount for each transaction.

- Intermediary Bank Charges: Your money almost never travels in a straight line from your bank to the recipient’s. It often gets routed through one or more 'intermediary' or 'correspondent' banks, and each one might skim a handling fee off the top for their trouble.

- Receiving Bank Fees: Finally, once the funds arrive in South Africa, the recipient's bank may charge its own fee for processing the incoming international payment and depositing it.

Think of your $100,000 as a bucket of water being passed down a line of people. Every person who touches the bucket spills a little. By the time it reaches the end of the line, a significant amount is gone. That’s exactly what these layered fees do to your money.

The Real Impact on Your Bottom Line

On their own, these charges might not seem like much. A R300 SWIFT fee or a R200 intermediary bank charge can easily be overlooked. But when you add them to a hefty 2-4% exchange rate spread, the total loss on a $100,000 transfer becomes painfully clear.

For a South African business paying overseas suppliers or importing goods, these costs are a direct hit to your profit margins. A deal that looks great on paper can quickly become far less profitable once all this financial friction is factored in. This lack of clarity makes budgeting a nightmare and introduces a level of unpredictability that no business needs.

Understanding where these costs come from is the first step to taking back control. Once you see how and where your money is disappearing, you can start looking for better solutions—ones that give you the transparency and efficiency you need to ensure more of your 100 thousand dollars in rands actually lands where it's supposed to.

How Market Volatility Can Change the Value of Your $100,000 Transfer

So, we've talked about fees and spreads. But there’s another, more unpredictable factor that can massively change how many rands you get for your dollars: market volatility. The USD/ZAR exchange rate isn't a fixed price on a shelf. It’s alive, flickering up and down every second in response to global news, political shifts, and investor confidence.

For a business, this means timing isn't just important—it can be everything.

Let’s imagine two South African import businesses, both needing to settle a $100,000 invoice with a supplier in the US. The only thing separating them is when they make the payment. You'd be amazed at how this one small detail can create a massive difference in their bottom line.

A Tale of Two Transfers

Let's look at a quick, real-world example to see how this plays out.

- Company A's Transfer: On Monday, the exchange rate is R17.25 for every dollar. Company A sends its $100,000 payment, which costs them exactly R1,725,000. Simple.

- Company B's Transfer: Just three weeks later, sentiment in the market has shifted, and the Rand has weakened. When Company B goes to pay their identical invoice, the rate is now R17.80. Their $100,000 transfer costs R1,780,000.

Think about that for a second. By waiting a few weeks, Company B spent an extra R55,000 to pay the exact same US dollar debt. That's not a fee or a hidden markup; it’s the raw, unfiltered impact of market movement. This kind of unpredictability can make cash flow planning a nightmare for any business trading internationally.

The foreign exchange market is a constantly moving target. Relying on luck to get a good rate for your international payments is not a sustainable business strategy. It introduces a level of risk that can erode profits and complicate budget forecasts without warning.

The Real Cost of Rand Volatility

The South African Rand is famously volatile, and this creates a huge headache for local businesses. You only need to look at the history books to see it.

For instance, in early 2025, the USD/ZAR rate hit a high of around 18.2174 on August 1st. At that point, converting $100,000 would have netted you R1,821,740. Compare that to the rate of roughly 15.88 on January 30, 2026—that’s a swing of over 15%. This is the harsh reality for South African exporters, whose profit margins were squeezed by the Rand's 8.5% slide against the dollar between January and August 2025 alone. You can dive deeper into these historical currency shifts to see the trends for yourself.

This constant up-and-down movement turns cost and revenue forecasting into a guessing game. A fantastic export deal can see its profits vanish simply because the Rand strengthened before the dollars were brought home. This is precisely why businesses need solutions that offer predictability and control over their forex, moving them away from the gamble of market timing.

So, Which Way Should You Send Your Money?

When you’re looking to bring 100 thousand dollars into South Africa, the service you use to do it makes a world of difference to the final rand amount that lands in your account. It’s not just about getting the money from A to B; it's about the speed, the cost, and how much you can actually see what’s happening behind the scenes.

Choosing the right partner can mean the difference between protecting your bottom line and watching a chunk of your hard-earned revenue vanish into thin air. For South African businesses, the old guard is being challenged by newer, smarter ways of moving money. Let's break down the typical choices.

The Old Faithful: Traditional Banks

For most businesses, the first port of call is their bank. It feels like the safest, most familiar option, doesn't it? After all, your accounts are already there, and they handle everything from the currency conversion to the SWIFT transfer.

But that familiarity comes at a cost. Banks are well-known for padding the exchange rate with a hefty spread—often hiding their profit in a rate that looks nothing like what you see on the news. On a $100,000 transfer, that hidden markup can easily shave off thousands, or even tens of thousands, of rands. And that's before you even get to the fixed SWIFT fees and the other potential charges from correspondent banks along the way.

The Middle Ground: Wire Transfer Services

Next up are the specialised wire transfer companies. Their whole business is built around international payments, so they’re often a bit faster and offer better rates than your average high-street bank. For a one-off payment, they can seem like a decent alternative.

The catch? Their fee structures can be a maze. The headline rate might look appealing, but you often find tiered fees, percentage-based commissions, or receiving charges that weren't obvious at the start. You get a bit more transparency than with a bank, but you're probably still not getting the real, unadulterated mid-market rate.

The Modern Solution: Fintech Platforms

This is where a new breed of financial technology (fintech) platforms like Zaro are changing the game. They were built from the ground up to fix the problems of the old system. The core idea is simple: total transparency and efficiency.

Instead of hiding fees in the exchange rate, they give you the real mid-market rate with zero spread. Their business model revolves around a small, clear, and predictable fee. You know exactly what you're paying, which makes financial planning a whole lot easier.

This is especially critical now. As South Africa's export market grows—the SARB recently noted a 14% surge in USD inflows in 2025—local businesses are more exposed than ever to currency swings. When you combine that volatility with hidden bank markups averaging 3.8%, companies are losing out big time. You can dig deeper into these market dynamics and historical rates to see for yourself.

Choosing a payment provider isn't just an admin task; it's a strategic business decision. The right partner protects your profit margins, smooths out your cash flow, and gives you the clarity you need to compete on a global stage.

To put it all into perspective, let's look at how these options stack up side-by-side.

Comparison of International Payment Methods for SA Businesses

This table breaks down the key differences you'll find when comparing your options. It highlights how each method performs on the factors that matter most to your bottom line: the rate, the fees, and the overall experience.

| Feature | Traditional Banks | Wire Transfer Services | Fintech Platforms |

|---|---|---|---|

| Exchange Rate | High markup (2-5% spread) | Moderate markup (1-3% spread) | Real mid-market rate (0% spread) |

| Fees | High SWIFT & intermediary fees | Variable, often complex fees | Low, transparent, fixed fees |

| Speed | 3-5 business days | 1-3 business days | Often same-day or next-day |

| Transparency | Low | Moderate | High |

As you can see, the choice becomes quite clear when you focus on maximising the rands you receive. While banks offer familiarity, and wire services offer a slight improvement, fintech platforms are designed to give your business the best possible outcome through transparency and fair pricing.

A Smarter Way to Manage Your Business Forex

It’s pretty clear that hidden fees and market volatility can take a huge bite out of your international transfers. For a long time, South African businesses just had to accept that this was the cost of doing business globally. Sticking with traditional banks meant paying inflated rates and dealing with unpredictable costs.

But that’s not the only way anymore. Modern financial platforms have completely changed the game.

These platforms were built to solve the biggest headaches in forex: high fees and uncertainty. They don’t hide their profits in a marked-up exchange rate. Instead, they’re built on transparency, giving you access to the real mid-market exchange rate—the one banks use between themselves.

For a transfer of 100 thousand dollars in rands, that single difference can put tens of thousands of rands back into your pocket. You get to keep more of your own money, just by avoiding the artificial spreads that banks have relied on for decades.

Beyond the Exchange Rate

The advantages aren't just about saving money on a single transaction. A modern financial toolkit is designed to fix the wider operational pains that come with managing international money. It’s a complete system for controlling your cash flow and minimising risk.

Here are a few features that really make a difference:

- Multi-Currency Accounts: You can hold both USD and ZAR in one place. This means you can receive dollars from international clients without being forced to convert them right away when the rate is poor. You get to decide when to make the switch.

- Predictable, Low Fees: Forget trying to untangle a messy web of SWIFT charges and hidden intermediary bank fees. These platforms typically charge one small, clear fee, so you know exactly what a transfer will cost before you hit send.

- Enhanced Control and Security: Your finance team gets total visibility and control over every payment. Features like multi-user access, custom permissions for team members, and top-tier security bring real governance to your financial operations.

A modern financial platform isn’t just a tool for cheaper currency conversion; it's a strategic asset for managing your business’s international operations. It replaces guesswork with predictability, allowing for smarter financial planning and healthier profit margins.

This approach shifts forex from being an unpredictable cost centre to a smooth, efficient part of your business. It lets you focus on growth, knowing you aren't losing money to outdated and inefficient systems.

To really get the most out of these tools and integrate them into a solid financial plan, getting expert guidance can be a game-changer. An external provider of CFO services for small businesses can help you build a cohesive strategy, ensuring every rand is working as hard as it can for you.

Getting the Best Deal on Your Next Transfer

Alright, you've got the theory down. Now, let's put that knowledge into practice. Getting the most value when you convert 100 thousand dollars into rands isn't about luck; it's about following a smart, simple process every single time. Here’s a checklist to guide your business through its next international payment.

The first, and most important, step? Demand total transparency. Before you even think about committing to a provider, you need to ask some direct questions about how they make their money. Insist on seeing the real mid-market exchange rate and ask specifically about their spread, any SWIFT fees, and potential charges from intermediary banks. Never, ever accept a single, bundled rate without seeing a full cost breakdown.

Your Forex Checklist for a Better Return

Use these steps to protect your bottom line and make sure more of your money arrives where it's supposed to.

- Check the Real Rate First: Before you do anything else, use a neutral, third-party source (like Google or Reuters) to see the live mid-market USD/ZAR rate. This is your benchmark for what a fair deal looks like.

- Challenge Every Single Fee: Ask for a complete, itemised list of all possible charges. Don't be shy. If a provider is cagey or can't give you a straight answer, that's a massive red flag. It’s time to walk away.

- Look Beyond Your Bank: Traditional banks are rarely your best bet for forex. Explore modern fintech platforms like Zaro that are built differently. They often offer the real rate with just one clear fee, giving you the predictability and control your business needs.

Getting a handle on your international payments is a huge part of your company's financial health. In fact, hidden fees and poor exchange rates are often a key factor in solving cash flow problems.

The single biggest decision you can make is choosing a partner who values transparency. An honest rate and a clear fee structure aren't just nice-to-haves; they show that a service is genuinely invested in your business's success, not just their own profit.

By following these straightforward but powerful steps, you can start making smarter forex decisions today.

Your Questions, Answered

Sending large sums like $100,000 across borders can feel a bit daunting. It’s only natural to have a few questions. Here are some clear, straightforward answers to the things we get asked most often by South African businesses.

Is It Safe to Use a Fintech Platform for Large Transfers?

It’s a fair question, and the short answer is yes—as long as the platform is properly regulated.

Reputable fintechs like Zaro are Authorised Financial Services Providers, which means we operate under the same kind of strict oversight as the big banks. We use bank-level encryption and carry out rigorous compliance checks to keep your money safe. In fact, these platforms are often built from the ground up to handle large business transactions with more transparency than you might get from a traditional bank. The key is to always check a provider’s regulatory credentials before you commit.

What Are South African Exchange Control Regulations?

Think of exchange control as the system used by the South African Reserve Bank (SARB) to keep an eye on money moving in and out of the country. For a business, this usually means you need to report your international transactions and ensure they’re for legitimate business purposes.

It sounds complex, but modern payment platforms are designed to make this painless. They help you declare your funds and handle the necessary documentation digitally, ensuring every transfer is above board and fully compliant without the headache.

What Does Mid-Market Rate Actually Mean?

Simply put, the mid-market rate is the real exchange rate. It's the midpoint between what buyers are willing to pay and what sellers are willing to accept for a currency on the global market—the same rate you see on Google or Reuters. It’s the purest, most honest rate you can get.

The big banks and traditional brokers almost never offer this rate directly to their customers. Instead, they add a markup. Transparent fintech providers, on the other hand, often use the mid-market rate as their starting point. This single difference can save you tens of thousands of rands on a $100,000 transfer because you’re not losing money to a hidden fee.

How Quickly Will the Rands Arrive in My Account?

This is where the difference between old and new really shows. A traditional bank transfer using the SWIFT network can take a slow 3 to 5 business days to clear, and sometimes even longer if it gets held up by intermediary banks along the way.

In contrast, most modern fintech platforms can get the job done much faster. It's common for the entire process—from converting the dollars to the rands landing in your account—to be wrapped up within the same day or by the next business day at the latest.

Ready to see how much more of your 100 thousand dollars in rands you could actually keep? Zaro gives you the real exchange rate with zero spread and no hidden fees. Get started with Zaro today and discover a smarter way for your business to handle international payments.