When you're looking to convert €1,500 into rands, you'll likely see a figure around R31,000 pop up. Think of this as your starting point. It’s based on something called the mid-market exchange rate, which is the "purest" rate you can find, but it’s rarely the one you’ll actually get.

The final amount that lands in the South African bank account is almost always different, thanks to fees and the specific rate your chosen service offers. Let's break down what's really going on behind the scenes.

What €1,500 in Rands Looks Like Today

That number you see from a quick Google search? That’s the mid-market rate. It's the midpoint between what banks are willing to buy and sell a currency for, and it’s the rate they use when trading massive amounts with each other. For the rest of us, it's more of a benchmark than a reality.

Most money transfer services and banks make their money by adding a small margin, or markup, to this rate. This means the rate you're offered will be a bit less favourable. It’s a completely standard practice, but the size of that markup can make a huge difference to your final total.

Factors That Influence Your Final Amount

So, what exactly chips away at your €1,500 before it becomes rands? It really comes down to a few key things:

- The Exchange Rate Markup: This is the hidden fee. It’s the gap between the mid-market rate and the consumer rate you're given.

- Transfer Fees: These are the more obvious charges. They might be a flat fee per transaction or a percentage of the amount you’re sending.

- Receiving Bank Fees: This one can catch people by surprise. Sometimes the bank in South Africa will charge its own fee just to process the incoming international payment.

A quick look at historical data shows just how much things can move around. Between mid-2020 and mid-2025, the Rand has typically hovered around 0.048 to 0.049 EUR for every 1 ZAR. To put that in perspective, a rate of 1 ZAR = 0.04839 EUR (like on 7 August 2025) would turn €1,500 into roughly R31,000. You can explore more detailed historical EUR to ZAR rates on Wise. This constant fluctuation is precisely why locking in a great rate is so crucial.

To illustrate how much of a difference the rate makes, let's look at a couple of scenarios.

Example Conversion Scenarios for €1500

The table below shows how different exchange rates can affect the final amount you receive when converting €1,500. Notice the difference between a mid-market rate (the benchmark) and a typical rate offered by a bank, which includes a markup.

| Rate Type | Example EUR to ZAR Rate | Estimated Rands Received |

|---|---|---|

| Mid-Market Rate | 20.70 | R31,050 |

| Typical Bank Rate | 20.25 | R30,375 |

As you can see, even a seemingly small difference in the exchange rate can result in receiving hundreds of rands less. This is why it pays to shop around and find a service with transparent pricing and competitive rates.

Why Does the EUR to ZAR Rate Fluctuate?

If you've ever checked the price of 1500 euros in rands on different days, you've seen it firsthand: the exchange rate is constantly on the move. It's not random—it’s a direct reflection of the economic health and investor confidence in both the Eurozone and South Africa.

Think of it as a tug-of-war between the two economies. When South Africa's economy looks strong, maybe due to low inflation or booming exports, investors want to hold Rands. This demand pulls the Rand's value up, meaning your Euros would buy you fewer Rands. The opposite is true if there's any hint of instability; the Rand weakens, and your Euros suddenly have more buying power.

The Big Picture: What Makes the Rate Move?

So, what exactly are these economic forces at play? A handful of key indicators are the real drivers behind the EUR/ZAR rate you see on your screen.

For South Africa specifically, things like inflation rates, interest rate decisions from the South African Reserve Bank, and global prices for commodities like gold and platinum have a massive impact. Since the country is a major exporter of these raw materials, a swing in their value can directly strengthen or weaken the Rand. Keeping an eye on these factors gives you a much better sense of why the rate for 1500 Euros is what it is today versus last week. You can even see these trends play out by looking at how currency rates are impacted by economic history.

It’s amazing what a difference a few cents can make. Even a small shift in the exchange rate can easily mean a difference of several hundred Rand when you’re transferring €1,500. That’s a decent dinner out, just for timing your transfer right.

Getting a handle on these fluctuations is a core part of managing foreign exchange risk.

Ultimately, this all comes down to timing. By understanding what's driving the market, you can go from being a passive sender to an informed one, ready to make your move when the rate is in your favour.

Getting to Grips with the Real Cost of Your Transfer

Let's be honest, the exchange rate you see on Google is rarely what ends up in your recipient's bank account. When you're looking to send €1,500 in rands, the real cost is often tucked away in the fine print, and those hidden charges can take a serious bite out of your money.

Knowing what to look for is the best way to keep more of your cash. Most services, especially the big traditional banks, make their money in two ways: a clear-as-day transfer fee and a much sneakier markup on the exchange rate itself.

Finding Your Way Through Fees and Markups

The costs for sending money overseas are all over the map. You might see tempting "zero fee" offers, but I've learned that's often a warning sign. What you save on an upfront fee, they usually claw back by giving you a poor exchange rate.

So, what are you actually paying for? The costs typically fall into a few buckets:

- Fixed Fees: This is a flat charge for every single transfer, no matter how much you send. Banks love this one, and it can make sending smaller amounts painfully expensive.

- Percentage-Based Fees: Here, the fee is a percentage of the total amount you’re sending.

- The Exchange Rate Margin: This is the big one. It’s the gap between the mid-market rate (the real rate you see on the news) and the less favourable rate you’re actually offered.

After the transfer goes through, keeping a clean record is essential for tracking the true costs. If you’re running a business, it’s a good idea to master bank reconciliation to make sure your books always line up perfectly.

Here’s a real-world example: A bank might offer you 20.25 ZAR for your Euro when the mid-market rate is actually 20.70. On a €1,500 transfer, that tiny-looking difference means your recipient loses out on over R675 before any other fees are even touched.

That’s exactly why just looking at the transfer fee is a classic mistake. A more modern service might charge a small, transparent fee but give you the real mid-market rate, which can save you a bundle in the long run. The trick is to always look at the final rand amount you'll receive after every single cost is deducted. That's the only number that matters.

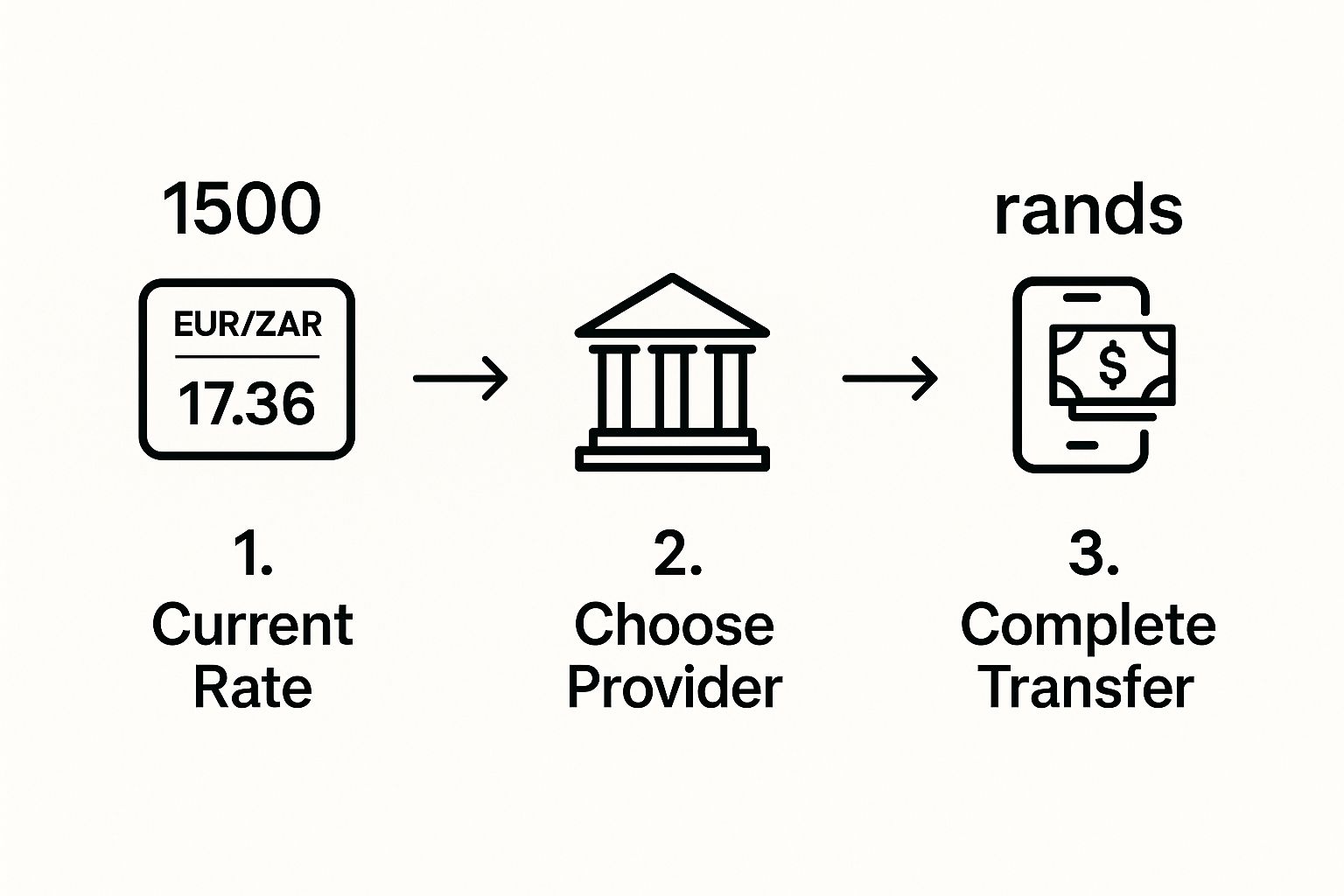

How to Send €1,500 to South Africa: A Practical Walkthrough

Alright, you understand the theory behind rates and fees. Now, let’s get practical and walk through exactly how to send €1,500 to a South African bank account. Forget the confusing jargon; this is what the process actually looks like on a modern, transparent platform like Zaro. The goal is to feel in control and completely clear on the numbers from beginning to end.

First things first, you'll enter the amount you want to send—our €1,500. A good service will instantly show you the live exchange rate and, crucially, the final ZAR amount that will land in the recipient's account. All the costs are broken down right there. No surprises, no hidden deductions later on. You see the real figures before you hit 'send'.

Locking in Your Rate and Adding Recipient Details

Once you're happy with the amount, it's time to provide the recipient’s South African bank details. This is the part where you want to be extra careful, as a single typo can cause frustrating delays.

You'll need a few key pieces of information:

- Recipient's Full Name: Make sure it matches their bank account exactly.

- Bank Name and Branch Code: This is essential for getting the money to the right place.

- Account Number: Double-check, and then check it again.

Many of the better platforms today have built-in verification tools that can spot common errors in these details, which is a fantastic safety net. After you confirm everything is correct, you’ll formally lock in the exchange rate. This is a game-changer because it protects your €1,500 to ZAR conversion from any wild market swings while the transfer is being processed. The rate you see is the rate you get.

This simple flow shows just how straightforward it can be to get your euros converted into rands.

The whole point of a modern transfer service is to put you in the driver's seat at every stage.

Funding the Transfer and Getting it Done

The last piece of the puzzle is funding the payment. You’ll typically do this with a simple local bank transfer from your Euro-based account to the payment provider. Services like Zaro make this incredibly efficient by providing you with local bank account details. This smart setup completely sidesteps the slow and expensive international SWIFT network, saving you both time and money.

Once your funds are received, the platform takes over. It handles the currency conversion and sends the payment directly to the South African account. You should get progress updates along the way, so you're never left wondering where your money is. Before you know it, the transfer is complete, and your €1,500 has successfully arrived as rands.

So, How Do You Get the Most Rand for Your Euro?

When you're converting €1,500 into Rands, timing can be everything. The EUR/ZAR exchange rate is notoriously jumpy, which can feel a bit like a lottery. One day your €1,500 gets you a great return, the next, not so much. But it's not all down to luck; a bit of strategy can make a real difference.

The key is to move from being a passive rate-taker to an informed decision-maker. This starts with keeping a casual eye on exchange rate trends. You don't need to be a Wall Street trader, but just getting a feel for the currency pair’s recent highs and lows helps you spot when a rate is genuinely good, not just "today's rate."

Playing the Market: Smart Timing for Your Transfer

Let's talk real numbers. Looking back, the Euro to Rand rate has seen some pretty wild swings. For example, at one point in early 2025, it touched a high of nearly 21.809 ZAR to the Euro, but it also dipped to around 19.000 ZAR. That's a massive swing of almost 15% in a matter of months. For a more detailed look, you can always check out some EUR-ZAR historical data on Exchange-Rates.org.

So, how do you use this to your advantage without getting a headache? Here are a few practical tips I've picked up over the years:

Sidestep the Weekend Slump: The forex markets close over the weekend. This often means banks and transfer services widen their spreads to cover any risk from market movements on Monday morning. Your best bet is usually to make transfers between Tuesday and Thursday when the markets are most active and stable.

Let Technology Do the Work: Most modern platforms, like Zaro, offer rate alerts. You simply tell the system, "Hey, let me know when the rate hits 21.50," and it will ping you when it does. It’s a simple, set-and-forget way to catch a favourable rate without having to check your phone every five minutes.

Lock It In When You See It: Found a rate you’re happy with? Some services will let you lock it in for 24 or 48 hours. This is a brilliant feature because it protects you if the market suddenly takes a nosedive right before you send your money.

At the end of the day, these small adjustments can add up. It’s the difference between just accepting whatever rate you're given and actively making sure you get the best possible outcome for your money. You're not just hoping for a good deal—you're making one happen.

Your Questions About Converting Euros to Rands, Answered

Sending a sum like €1,500 overseas naturally brings up a few questions. Getting these sorted out beforehand is the difference between a smooth transfer and one filled with frustrating delays and unexpected costs. Let's walk through what people usually ask.

How Long Does It Actually Take?

This is probably the most common question I get. The truth is, it depends entirely on the method you choose. If you go the old-school route with a traditional bank, you could be looking at a wait of three to five business days. The hold-up is often due to the money hopping between several intermediary banks.

On the other hand, a modern online platform like Zaro can often get the job done in under 24 hours. The difference is pretty stark when you need the funds to arrive promptly.

What Details Do I Need to Have Ready?

To make sure your money gets to the right person in South Africa without any hiccups, you’ll need a few key pieces of information from them. It's a good idea to gather all of this before you even start the transfer process.

Here’s a quick checklist of what you'll almost always be asked for:

- Recipient's Full Name: Make sure it's exactly as it appears on their bank account. No nicknames!

- Their Physical Address: A full residential address in South Africa is usually required.

- Bank Details: You'll need the name of their bank, their account number, and the bank’s SWIFT/BIC code.

- Reason for Transfer: For compliance reasons, some services will ask for the purpose of the payment (e.g., "family support," "invoice payment").

Having this information organised and ready to go will make the whole thing a lot quicker.

A great tip I always share is to be strategic about when you send the money. Try to avoid initiating a transfer on a Friday afternoon or over the weekend. Major currency markets are closed, meaning rates can be less favourable, and your transfer will likely just sit there until Monday morning. For the best results, I've found that mid-week (Tuesday to Thursday) is the sweet spot for more stable rates and faster processing. This simple bit of timing can genuinely affect the final Rand amount you get from your €1,500.

Ready for a transparent and fast way to handle your international payments? With Zaro, you get the real exchange rate with zero hidden fees. See how much you can save on your next transfer at https://www.usezaro.com.