At its core, a bank overseas transfer is simply a way to send money from your South African bank account to an account in another country. It's the traditional, old-school method for making international payments. While it’s been the go-to for decades, it’s often not the quickest or most cost-effective route, mainly because it depends on a whole network of banks to get your money from A to B.

What Really Happens in a Bank Overseas Transfer?

When you send money abroad through your bank, it’s easy to imagine your funds zipping directly from your account to the recipient's. The reality is more like an international relay race. Your money is the baton, and it gets passed between several financial institutions before it finally crosses the finish line.

This system is certainly reliable, but all those handovers involve multiple steps and different players. Naturally, each one adds a bit of time and cost to your transfer. Getting to grips with how this all works is the first step in making better choices for your international payments.

Let's pull back the curtain on this global financial network.

The Key Players in Your Transfer

Every single bank overseas transfer has a few key players working behind the scenes. Sticking with our relay race analogy, think of them as the runners. Each has a very specific job to do to get your money where it's going.

Here’s a breakdown of the main participants:

- Your Bank (The Sending Bank): This is where it all starts. Your bank kicks off the transfer, takes the money from your account, and sends the payment instructions out into the big wide world of global banking.

- Intermediary Banks (Correspondent Banks): These are the runners in the middle of the race. It’s rare for your bank to have a direct line to every other bank in the world. So, it uses one or more of these "middlemen" banks to pass the funds along. And yes, each one usually skims a small fee for their trouble.

- The Recipient's Bank (The Receiving Bank): This is the final runner, waiting at the end. They get the funds from the last intermediary, process the incoming payment, and finally credit the money to your recipient's account.

This multi-step process is exactly why a simple transfer can take several business days to complete. The more "runners" in the chain, the longer it takes and the more it costs.

SWIFT: The Global Postal Code System

So, how do all these banks know where to send the money? They use a standardised messaging system called SWIFT (Society for Worldwide Interbank Financial Telecommunication). It’s important to know that SWIFT doesn't actually move the money itself; instead, it sends secure payment orders between the banks.

The easiest way to think of SWIFT is as the postal service for international finance. Every bank gets a unique address, called a SWIFT or BIC (Bank Identifier Code). This code makes sure your payment instructions are sent to the correct financial institution, no matter where it is in the world.

A SWIFT/BIC code is a string of 8 or 11 characters that packs in a lot of information:

- Bank Code: Identifies the bank.

- Country Code: Tells you which country the bank is in.

- Location Code: Points to the city of the bank's head office.

- Branch Code (Optional): Narrows it down to a specific branch.

Trying to send a transfer without the right SWIFT/BIC code is like mailing a letter with a vague address—it’s bound to get lost or sent back, causing delays and costing you more money. This is why getting every detail right is so critical when you set up a bank overseas transfer.

While this system has been the global standard for years, its complexity is what has opened the door for newer, more direct alternatives that can often do the job faster and cheaper. We'll dive into those a bit later.

The True Cost of Sending Money Internationally

When you arrange a bank overseas transfer, the first fee you see is the one they advertise. It looks simple enough, but that upfront charge is really just the tip of the iceberg. The final amount that actually lands in the recipient's account is often a lot less than you expected, leaving you scratching your head about where the rest of your money disappeared.

The truth is, the advertised fee is rarely the full story. The traditional banking system has hidden charges baked into the process, quietly chipping away at the value of your transfer. To really understand what you're paying, you have to look past that initial fee and uncover all the costs lurking beneath the surface.

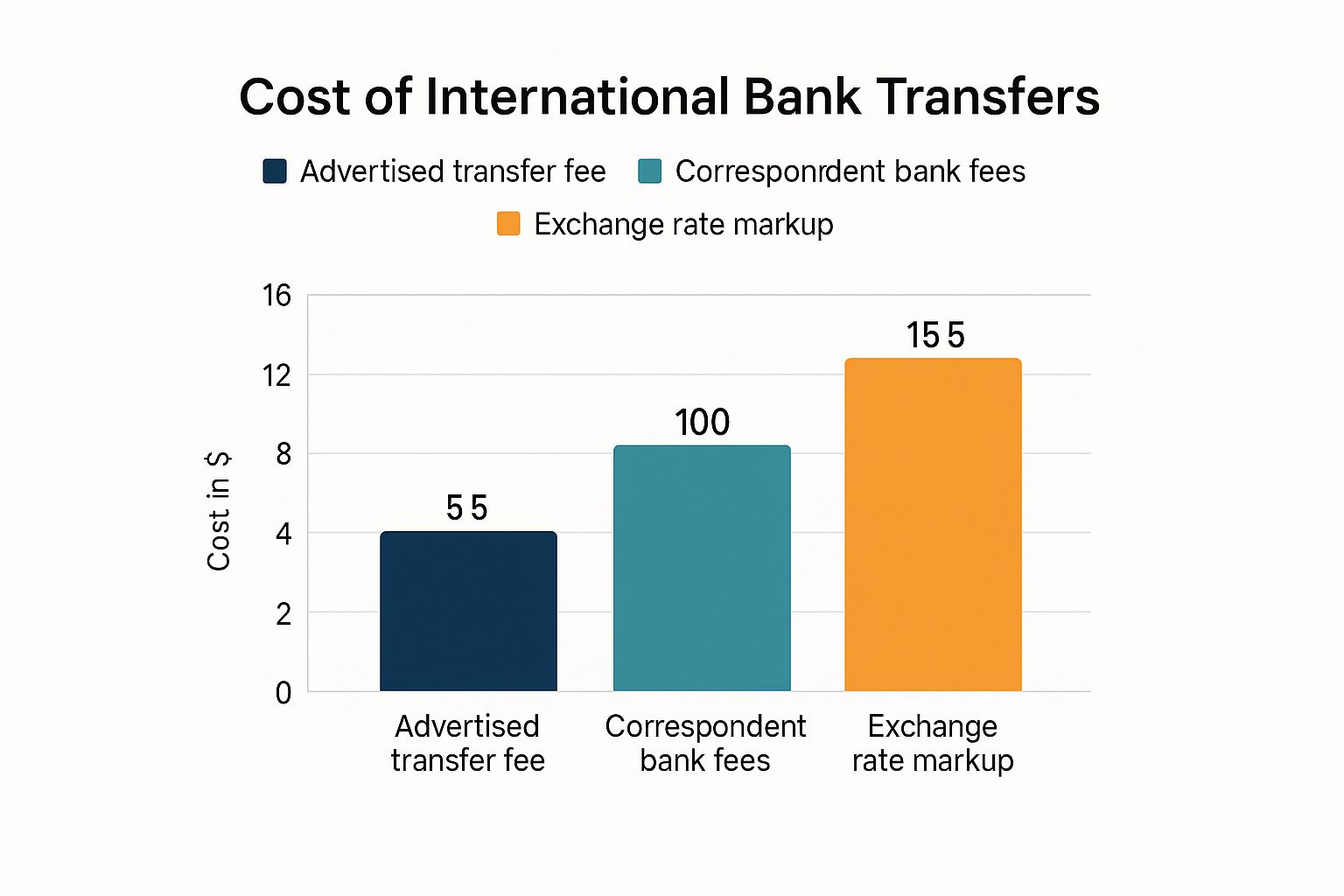

This infographic gives you a quick visual breakdown of where your money actually goes.

As you can see, the exchange rate markup is often the biggest culprit, costing you far more than the visible "transfer fee" you were quoted.

The Problem with Intermediary Banks

As we touched on earlier, your money doesn't fly directly from your bank to the destination. It gets passed along a chain of one or more intermediary banks, sometimes called correspondent banks. Each bank in this chain provides a service to help route the payment, and naturally, they take a fee for their trouble.

The catch is that these fees are both unpredictable and completely non-transparent. You often have no idea how many banks are in the chain or how much each will skim off the top until the transfer is already done. It’s a bit like sending a parcel and having every courier along the way take a small item out of the box as payment.

The result? The final amount your recipient gets is smaller, and you're left in the dark about the exact charges that were applied along the way.

The Biggest Hidden Fee: The Exchange Rate Markup

By far, the most significant hidden cost in a bank overseas transfer is the exchange rate markup. This is the gap between the exchange rate your bank gives you and the real, mid-market rate you’d see on Google or a financial news site.

The mid-market rate is the true, wholesale price of a currency—it’s the midpoint between what buyers are willing to pay and what sellers are asking. It’s the fairest rate out there. Banks, however, almost never give you this rate. Instead, they create their own less favourable rate and pocket the difference as pure profit.

Think of it like a currency exchange booth at the airport. You know the rate they’re offering is worse than the real one, and that difference is their profit margin. Banks do the exact same thing with international transfers, just on a much larger scale.

This markup can easily add 2% to 5% or even more to your transaction cost. On a large transfer, that seemingly small percentage can translate into thousands of Rands lost, making it the single most expensive part of the whole process.

For businesses in South Africa, these costs are particularly steep. Sending money out of South Africa via bank transfers is far more expensive than receiving it. In the first quarter of the year, the average cost to send $200 from South Africa was a staggering 13.2%. That’s more than double the cost of receiving the same amount and well above the G20 average of 6.39%. You can dig into more data on these costs in this report on South African remittance costs from Statista.

This really drives home why you need to understand every single fee component to manage your international payments properly.

Comparing Fees for a R10,000 Overseas Transfer

To show you how this plays out in the real world, let's break down the costs for sending R10,000 overseas. The table below compares a typical bank transfer against a modern fintech alternative like Zaro, showing how both visible and hidden fees stack up.

| Cost Component | Traditional Bank Transfer | Fintech Service (e.g., Zaro) | What This Means for You |

|---|---|---|---|

| Advertised Fee | R250 - R500 | R150 (Example fixed fee) | This is the upfront charge for the service. It’s what most people focus on, but it's only part of the cost. |

| Intermediary Fees | R150 - R400 (Estimated) | R0 | These are unpredictable fees deducted by other banks in the SWIFT network. Fintechs often avoid this network entirely. |

| Exchange Rate Markup (e.g., 3%) | R300 | R50 (Example markup of 0.5%) | This is the hidden profit made on the currency conversion. A lower markup means more of your money arrives. |

| Total Estimated Cost | R700 - R1,200 | R200 | The true cost of a bank transfer can be 3 to 6 times higher than a transparent fintech service. |

This comparison makes it crystal clear: focusing only on the advertised transfer fee is a costly mistake. The hidden charges, especially the exchange rate markup, are what truly determine how much your bank overseas transfer will cost you. Now that you know what to look for, you can start exploring alternatives that offer far better transparency and value.

How to Make a Bank Overseas Transfer Step by Step

Sending money overseas for the first time can feel a bit daunting, but it’s really just a series of straightforward steps. Whether you’re comfortable using your bank’s app or prefer to do things in person at a branch, the core process is the same. The real secret is in the preparation—getting everything lined up correctly ensures your money gets where it needs to go without a hitch.

Think of it like setting up your GPS before a road trip. If you punch in the right coordinates from the start, you can relax and trust the process. Let’s walk through it together.

Step 1: Gather the Recipient’s Details

Before you send a single rand, you need to get some key information from the person or company you're paying. This is the part where you want to be extra careful, as a simple typo is the number one cause of failed or delayed transfers.

Here’s exactly what you’ll need from them:

- Recipient's Full Name: Their complete legal name, exactly as it appears on their bank account. No nicknames!

- Recipient’s Full Physical Address: Banks need this for security and compliance checks.

- Bank Account Number or IBAN: For many countries, especially in Europe, you'll need an International Bank Account Number (IBAN). It's a longer, standardised version of a regular account number.

- Bank Name and Address: The official name and physical address of their bank branch.

- SWIFT/BIC Code: This is the bank’s unique global address. It works like a postcode, telling the international banking system exactly which financial institution to send your money to.

Pro Tip: Don’t risk retyping a long string of numbers. The best way to avoid errors is to ask the recipient to copy and paste their banking details directly into an email or message for you.

Step 2: Prepare Your FICA Documents

Here in South Africa, every international money transfer falls under the Financial Intelligence Centre Act (FICA). It’s a legal requirement for your bank to verify who you are and why you’re sending the money. It’s all about preventing financial crime.

If you’re heading into a branch, bring your South African ID book or card and a recent proof of address (a utility bill works perfectly). For online transfers, your bank might already have these details on file. However, it’s a good idea to have digital copies ready, just in case they ask you to upload them, particularly for larger amounts.

You'll also need to state the reason for the payment—something simple like "payment for goods" or "gift to a family member" will do.

Step 3: Choose Your Transfer Method and Initiate

With all your information and documents at hand, you’re ready to make the transfer. You’ve generally got two main options.

Option 1: Online Banking Portal

For most people, this is the quickest and easiest way. The process usually looks like this:

- Log in to your online banking profile.

- Find the section for "International Payments," "Global Payments," or "Forex."

- Enter all the recipient’s details you gathered earlier. Double-check everything!

- Specify the amount you want to send and the currency they should receive.

- Review the summary screen. It will show you the exchange rate, transfer fees, and the final estimated amount.

- Confirm the payment using your bank’s security measure, like a one-time PIN (OTP).

Option 2: In-Person at a Bank Branch

If you feel more comfortable with a face-to-face transaction or if your bank requires it, you can always visit a branch. A consultant will walk you through the transfer form, check your FICA documents, and handle the processing for you. It can be more time-consuming, but it offers peace of mind if you're new to this.

Once the transfer is done, your bank will give you a transaction reference number. Hold onto this! It’s your proof of payment and the first thing you’ll need if you ever have to track your money’s journey.

Navigating South African Exchange Control Regulations

When you send money out of South Africa, you’re not just dealing with your bank. You’re also navigating a set of rules from the South African Reserve Bank (SARB), known as exchange control regulations. Think of them as the financial traffic rules for money leaving the country, designed to keep the economy stable.

Understanding these regulations is non-negotiable for anyone making a bank overseas transfer. They dictate how much you can send, why you can send it, and what paperwork is involved. Get it right, and your transfer sails through smoothly.

While it might sound intimidating, the system is built around a couple of key allowances that are actually quite straightforward once you know them. Let's break down what you need to be aware of.

Understanding Your Annual Allowances

SARB gives South African residents two main allowances for sending money offshore each year. They are separate from each other and are designed for different needs, giving you options for everything from personal gifts to major investments.

The first, and by far the most common, is the Single Discretionary Allowance (SDA).

- What it is: This gives every South African resident over 18 a yearly allowance of up to R1 million.

- What it covers: It's a catch-all for personal expenses. You can use it for sending gifts to family, covering travel costs, making donations, or simply supporting loved ones abroad. Best of all, you don't need any special tax clearance to use it.

This allowance resets every calendar year (January to December), making it a simple, reliable tool for most everyday international payments.

Moving Larger Amounts with the FIA

So, what happens if you need to send more than R1 million, specifically for an investment? That’s where the Foreign Investment Allowance (FIA) steps in.

- What it is: An extra allowance that lets you send up to R10 million offshore per calendar year.

- What it requires: To access this, you'll need to get a Tax Clearance Certificate from the South African Revenue Service (SARS). This is simply SARS confirming that your tax affairs are up to date.

The FIA is specifically for offshore investments, like buying property overseas or investing in foreign shares. Because it's a separate allowance, it means an individual can potentially send a combined total of up to R11 million abroad in one year.

Key Takeaway: The SDA (R1 million) is for general use and needs no tax clearance. The FIA (R10 million) is for investments and requires a Tax Clearance Certificate from SARS. Together, your total potential annual allowance is R11 million.

Why Your Bank Needs FICA Documents

Every time you arrange a bank overseas transfer, your bank will ask for your FICA documents—usually your green bar-coded ID book or ID card and a recent proof of address. This isn't just a bank policy; it's the law.

The Financial Intelligence Centre Act (FICA) is South Africa’s primary tool for fighting financial crime, such as money laundering. By verifying who you are, banks help ensure every transaction is legitimate, keeping the whole system secure and aligned with global standards.

It's a two-way street, of course. While South Africa is a net exporter of remittances (more money flows out than in), every transaction is monitored. Inflows from other countries, though smaller, are a stable part of the economy, making up about 0.24% of the nation's GDP recently. If you're interested in the numbers, you can explore an analysis of South Africa's remittance inflows from TradingEconomics.com. This careful oversight is what maintains the integrity of our financial system.

Comparing Banks with Modern Transfer Services

For decades, if you needed to send money abroad, the process was simple: you went to your bank. Whether in person or through their online portal, the bank overseas transfer was the only real game in town. It was familiar, if a bit clunky.

Today, that’s all changed. A new wave of financial technology (fintech) services has emerged, offering a powerful alternative. These modern platforms were designed specifically to fix the very issues that make traditional bank transfers slow and costly. To pick the right service, you need to understand how fundamentally different they are under the hood.

The Core Differences in Cost and Speed

The biggest split comes down to cost and speed. Your high-street bank relies on the SWIFT network, an old but reliable system that’s a bit like a relay race. Your money is passed between several intermediary banks, and each one takes a cut and adds a delay.

Modern transfer services play a different game entirely. They often use their own network of local bank accounts. So, when you send money, you’re just making a local payment to their South African account. Then, they pay your recipient from their local account in the destination country. It’s a clever way to sidestep the international banking maze, making things much faster and cheaper.

- Cost Structure: Banks tend to layer their charges. You’ll see transfer fees, hidden intermediary charges, and a hefty markup on the exchange rate. In contrast, modern services are usually upfront, charging a small, transparent fee and giving you the real mid-market exchange rate.

- Transfer Speed: A bank SWIFT transfer can easily take 2-5 business days to arrive, sometimes longer. Because fintech services use local payouts, they can often get the job done in a few hours—some are nearly instant.

For businesses involved in global trade, this is more than just a convenience. Efficiently managing international sales revenue is critical, and a slow, expensive transfer method can directly hit your cash flow and profits.

Evaluating Transparency and User Experience

Think about the last time you sent money with your bank. Once it was sent, you likely had very little idea where it was until it arrived. That lack of visibility is a common frustration.

Fintech platforms are built for the digital age, prioritising clarity and control. You get real-time tracking, a clear breakdown of fees before you hit send, and a guaranteed amount for your recipient. This level of transparency removes the guesswork and stress that often comes with a traditional bank overseas transfer.

The average cost of sending an international bank transfer of $200 to South Africa was 6.6% in a recent quarter, slightly higher than the G20 average of 5.62%. This highlights the persistent challenge of making global money movement more affordable.

This data shows just how much those hidden costs can add up, even for money coming into the country. It’s exactly this problem that modern services were designed to solve by ditching the inflated markups.

Which Option Is Right for You?

So, bank or modern service? There isn’t a single right answer for everyone. It really depends on what you value most.

Here’s a simple way to think about it:

- Cost-Effectiveness: If your main goal is to save money and get the most cash to your recipient, a fintech service is almost always the better choice. The exchange rates are just that much better.

- Urgency: Need to pay an international supplier by tomorrow? The speed of a modern service is a massive advantage over the multi-day waiting game you’ll play with a bank.

- Familiarity and Comfort: Some people just prefer the institution they know. If you value face-to-face service or feel more secure using your long-time bank, then sticking with them might be worth the extra cost.

- Transparency: If you want to know exactly what you’re paying and precisely how much will arrive, the clear, upfront model of a fintech platform offers genuine peace of mind.

Ultimately, the arrival of these alternatives is great news for you. It puts the power back in your hands, giving you the freedom to choose a service that truly fits your needs.

Common Questions About Overseas Bank Transfers

Even when you think you have a handle on the process, sending money overseas can throw up a few curveballs. The world of international finance has its own set of rules, and it’s easy to run into unique situations or roadblocks. Let's tackle some of the most common questions people ask.

We'll cover everything from how long it all takes to what happens if something goes wrong. The goal is to give you clear, practical answers so you can manage your transfers with confidence.

How Long Does a Bank Overseas Transfer Take?

This is usually the first question on everyone's mind: when will the money actually arrive? A standard international transfer using the SWIFT network typically lands in the recipient's account within two to five business days. But think of that as a guideline, not a guarantee.

A few things can really slow things down:

- Where it's going: Sending money to a major financial hub like London or New York is usually faster than sending it to a more remote location with a less connected banking system.

- The number of stops: Think of it like a relay race. The more intermediary banks the money has to pass through, the longer it’s going to take.

- Time zones and holidays: A public holiday in either your country or the recipient’s country will put a pause on everything.

- Extra checks: Sometimes, a bank along the way might flag a payment for extra security or compliance checks, holding up the entire process.

Because of all these moving parts, it’s always a good idea to send time-sensitive payments well in advance. A little bit of planning can save you a lot of stress.

What Information Do I Need from the Recipient?

Getting the details right is absolutely critical. One small mistake can cause your payment to be delayed, rejected, or worse, sent to the wrong person.

Before you even start the transfer, you need to get the following information from the person or business you're paying. Double-check every single letter and number.

- Recipient's Full Legal Name: This needs to be an exact match to the name on their bank account. No nicknames or shortened versions.

- Recipient's Full Physical Address: Banks need this for their security and compliance records.

- Bank Account Number or IBAN: For many places, especially in Europe, you’ll need an International Bank Account Number (IBAN).

- Bank's Name and Full Address: The official name and street address of the recipient's bank.

- Bank's SWIFT/BIC Code: This is like an international post code for the bank. It’s a unique code that tells your money exactly where to go.

A single wrong digit in an IBAN or a slightly misspelled name is all it takes for a transfer to fail. The safest bet? Ask the recipient to copy and paste their details directly into an email or message. That way, there’s no chance of a typo.

If you’re doing business regularly in another country, getting familiar with its banking system is a smart move. For instance, understanding the ins and outs of opening a Turkish bank account as a foreigner can make your transactions there much smoother.

What Happens If I Use the Wrong Account Details?

This is probably one of the most common and costly mistakes you can make. The outcome can range from a minor headache to a complete loss of your funds.

If the details you entered don't match any existing bank account, the transfer will eventually bounce back. The good news is you’ll get your money back. The bad news? It can take weeks, and you won’t get the full amount. The sending, intermediary, and receiving banks will all have deducted their fees from the returned sum.

The worst-case scenario is when your typo accidentally matches someone else's real, valid account. The money could land in a complete stranger's account. Trying to get it back is an uphill battle—it's incredibly difficult, takes a long time, and often fails. You’re relying entirely on the honesty of the person who received it and the policies of their bank. There's simply no guarantee you'll ever see that money again.

Can I Track My International Bank Transfer?

Yes, you can track it, but it’s not quite like tracking a package from Amazon. You won’t get a minute-by-minute update. Most banks will show you in your online portal when the money has left your account, but that's often where the easy part ends.

Some banks now use something called "SWIFT gpi" (Global Payments Innovation), which does offer better end-to-end tracking as your money hops between banks. However, not all banks have adopted this yet, so it isn't a standard feature.

If your transfer is taking longer than expected, your first port of call should be your own bank. Give them the transaction reference number and ask them to run a trace. They can then start contacting the other banks in the chain to find out where the hold-up is.

Ready for a smarter way to manage your international payments? Zaro offers South African businesses a fast, transparent, and cost-effective solution. Send and receive funds at the real exchange rate with no hidden markups or SWIFT fees. Get the financial control your business deserves by visiting https://www.usezaro.com today.