Finding the best foreign exchange rates in South Africa can often feel like navigating a complex maze. Hidden fees, confusing spreads, and slow transfer times can significantly erode the value of your money before it even reaches its destination. For businesses paying international suppliers, CFOs seeking transparency, or individuals sending funds abroad, securing a favourable rate is not just a preference, it's a critical financial decision.

This guide cuts through the noise. We provide a clear, comparative look at the top seven providers and platforms for 2025, designed to help you make an informed choice. You will gain a direct understanding of their unique strengths, from the zero-spread models of innovative fintechs to the established convenience of traditional banks.

Each entry includes a detailed breakdown, screenshots for easy navigation, and direct links to get you started immediately. We delve into the crucial details of fees, transfer speeds, and security so you can confidently select the right service for your specific needs. Our goal is to empower you with the insights needed to make cost-effective decisions and maximise every rand you exchange, ensuring your money works harder for you on the global stage.

1. Zaro

Zaro emerges as a formidable fintech solution specifically engineered for South African businesses, positioning itself as a top contender for securing the best foreign exchange rates South Africa has to offer. It fundamentally overhauls the traditional, often cumbersome, process of international payments by delivering a platform built on speed, transparency, and significant cost savings. For SMEs, CFOs, and business owners managing cross-border transactions, Zaro presents a compelling alternative to legacy banking systems.

The platform's core value proposition lies in its direct approach to foreign exchange. Zaro provides access to real exchange rates without adding any spread, a common practice among traditional banks that inflates costs. This zero-spread model, combined with the elimination of standard SWIFT fees, translates directly into measurable savings on every single transaction, optimising cash flow and reducing operational overheads for businesses that frequently trade with partners in the US and Europe.

Why Zaro Stands Out

Zaro distinguishes itself through a powerful combination of efficiency and enterprise-grade functionality. The platform’s ability to execute international transfers in as little as 30 minutes is a game-changer, drastically cutting down the multi-day waiting periods that can hinder business agility. This speed is complemented by a streamlined onboarding process, allowing businesses to quickly activate ZAR and USD accounts through a simplified Know Your Business (KYB) procedure and fund them via standard bank transfers.

Furthermore, its security architecture is designed for the modern organisation. Multi-user access with customisable team permissions provides CFOs and financial managers with granular control over funds, enhancing governance and ensuring complete visibility of all financial activities.

Key Features and Practical Benefits

- Zero-Spread FX Rates: By offering the real market exchange rate, Zaro ensures businesses are not losing money to hidden markups. This transparency makes financial planning and forecasting far more accurate.

- Ultra-Fast Settlements: Transactions are completed in approximately 30 minutes, a significant improvement over the 2-5 business days typical of traditional bank transfers. This is particularly beneficial for time-sensitive payments to international suppliers or service providers.

- Dual-Currency Debit Cards: Zaro issues debit cards denominated in both ZAR and USD. This allows businesses to make direct overseas purchases for software, travel, or inventory, accessing low-cost FX rates at the point of sale and avoiding hefty bank charges.

- Robust Security Controls: Enterprise-level features like customisable team permissions and multi-user access give businesses total control over who can initiate, approve, and view transactions, mitigating internal fraud risks.

| Feature | Traditional Bank | Zaro |

|---|---|---|

| Exchange Rate | Mid-market rate + Spread | Real mid-market rate |

| Transaction Fees | SWIFT fees + Correspondent bank fees | No SWIFT or transaction fees |

| Transfer Speed | 2-5 business days | ~30 minutes |

| Account Setup | Lengthy, branch-based process | Streamlined online KYB |

Pros & Cons

Pros:

- Ultra-fast 30-minute international transfers significantly reduce waiting times.

- Zero spread on exchange rates and no SWIFT fees eliminate hidden costs, ensuring maximum savings.

- Enterprise-level controls with multi-user access and customisable permissions enhance security and governance.

- Simple onboarding with streamlined KYB and dual currency (ZAR and USD) accounts funded via bank transfers.

- Issued debit cards in ZAR and USD allow businesses to access low-cost FX rates directly for overseas spending.

Cons:

- Currently supports cross-border transfers primarily between South Africa, the US, and Europe, limiting options for other regions.

- As a fintech leveraging blockchain stablecoins, some businesses may require additional education or reassurance about the technology.

Website: https://www.usezaro.com

2. FNB – Foreign Exchange

For South African businesses and individuals already integrated into the First National Bank ecosystem, the FNB Foreign Exchange platform offers a seamless and trusted solution for managing international currency needs. Its primary strength lies in convenience, consolidating rate monitoring, international payments, travel cash orders, and multi-currency account management within a familiar online banking environment. This makes it an excellent choice for users who prioritise security and simplicity over chasing the absolute lowest specialist rate.

Unlike standalone platforms, FNB’s offering is deeply woven into its core banking services. This means existing customers benefit from pre-verified compliance (KYC), single sign-on access, and direct debits from their FNB accounts, streamlining the entire transaction process from start to finish.

Standout Features and Practical Use

FNB provides a comprehensive suite of FX tools that cater to diverse business requirements. The platform is not just a rate board; it’s an actionable hub for international finance.

- Integrated Product Suite: Users can effortlessly switch between viewing live indicative rates, ordering foreign cash for collection at a branch, executing international SWIFT payments, and managing funds in a Global Account. This centralisation eliminates the need to use multiple providers for different FX tasks.

- Proactive Rate Monitoring: A unique and practical feature is the ability to subscribe to twice-daily email updates for specific currency pairs. This helps business owners and CFOs stay informed of market movements without needing to constantly check the website.

- Personalised Pricing: While the public rates are indicative, FNB offers preferential or discounted rates for existing clients, particularly for larger transaction volumes. This is a key benefit for businesses with significant, recurring international payment needs.

Pro Tip: When planning a large transaction (e.g., over R500,000), always contact an FNB Forex advisor directly. The rates they can offer are often more competitive than the standard pricing available through the online banking portal.

Final Assessment

FNB’s platform excels in providing a secure, all-in-one solution for its existing customer base. The convenience of managing FX alongside regular business banking is its biggest selling point. However, it’s crucial to remember that the displayed rates are indicative and do not include fees. The best foreign exchange rates on this platform are typically reserved for established clients transacting larger sums.

- Best For: Existing FNB business or private clients who value convenience, security, and a consolidated financial overview.

- Key Consideration: The final executed rate will differ from the indicative rate shown online once bank fees and commissions are applied.

Website: https://www.fnb.co.za/rates/ForeignExchangeRates.html

3. Standard Bank – Shyft Global Wallet

Shyft Global Wallet by Standard Bank has emerged as a powerful, app-based solution for South Africans needing to manage foreign currency digitally. It bridges the gap between traditional banking and modern fintech convenience, allowing users to buy, hold, spend, and send multiple currencies directly from their smartphone. Its key advantage is its transparent, "what you see is what you get" pricing model, which often provides some of the best foreign exchange rates in South Africa for retail and travel purposes.

Unlike offerings locked within a bank's main ecosystem, Shyft is accessible to both Standard Bank and non-Standard Bank customers who meet the eligibility criteria (e.g., possess a valid South African ID). This open approach, combined with a user-friendly digital onboarding process, makes it a highly competitive choice for travellers, online shoppers, and individuals sending money abroad.

Standout Features and Practical Use

Shyft is designed around practical, everyday international currency needs, offering a suite of tools that are both powerful and easy to use.

- Multi-Currency Wallet and Cards: Users can instantly buy and store major currencies like USD, EUR, GBP, and AUD in the app. Shyft provides up to 10 virtual cards per currency for secure online shopping and a physical Shyft Mastercard for international travel, allowing you to spend like a local and avoid costly point-of-sale conversion fees.

- Transparent Live Rates: The app displays live exchange rates, and the price you lock in is the final price you pay, with no hidden commissions or fees added on top. This clarity is a major differentiator from the indicative rates shown by many traditional banks.

- International Transfers: The platform facilitates sending money to overseas bank accounts directly from the app, providing a streamlined and cost-effective alternative to in-branch SWIFT transfers for smaller amounts.

Pro Tip: Before a trip, load your Shyft card with your destination's currency when the ZAR exchange rate is favourable. This allows you to lock in a good rate in advance and budget effectively, protecting you from negative market movements while you are travelling.

Final Assessment

Shyft excels by offering competitive retail forex rates within a secure, intuitive, and highly convenient mobile app. Its accessibility to non-Standard Bank clients and transparent pricing make it a top contender for individuals managing their Single Discretionary Allowance. While it is subject to South African exchange control limits, it represents a significant step forward in making foreign currency management more accessible and affordable.

- Best For: Individuals, frequent travellers, and online shoppers looking for competitive, transparent forex rates and a convenient digital card solution.

- Key Consideration: Users must be South African residents or meet other specific eligibility criteria, and all transactions fall under the annual R1 million Single Discretionary Allowance.

Website: https://www.shyft.co.za/

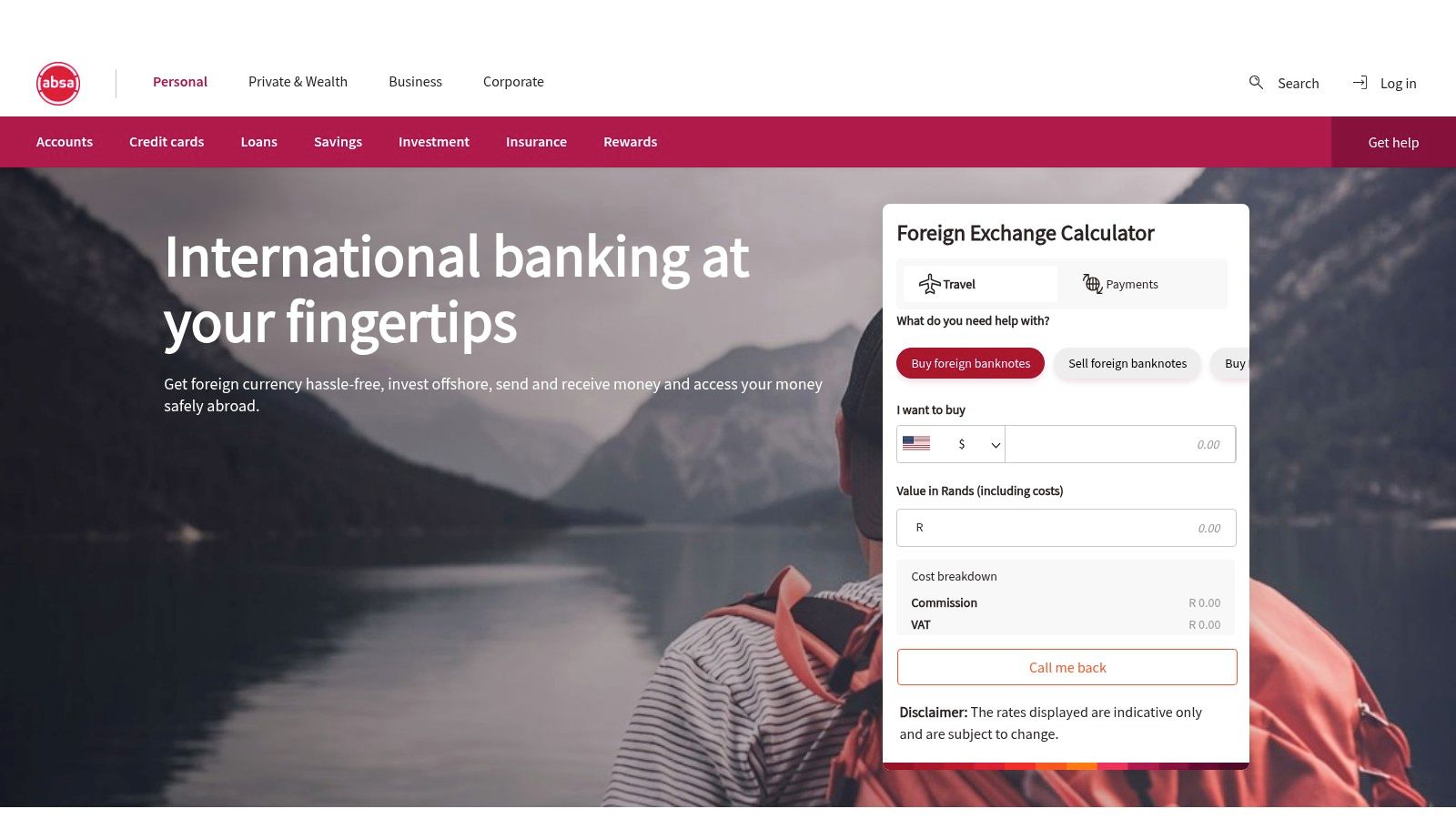

4. Absa – Exchange Rates + Foreign Exchange Services

For individuals and businesses seeking absolute clarity in forex rate structures, Absa’s Foreign Exchange Services platform is a standout. Its primary advantage is the transparent and detailed presentation of exchange rates, clearly differentiating between telegraphic transfers (digital) and foreign bank notes (cash). This makes it an ideal hub for users who need to make informed decisions about whether to send money electronically or purchase physical currency for travel, all within the ecosystem of a major South African bank.

Unlike platforms that show a single mid-market or indicative rate, Absa provides specific "we buy" and "we sell" rates for both transaction types. This level of detail empowers users to accurately calculate the costs associated with their specific needs, whether they are paying an international supplier or organising travel allowances for staff.

Standout Features and Practical Use

Absa’s platform is designed as a practical, multi-faceted portal for a range of international currency needs, supported by an extensive physical and digital network.

- Detailed Rate Transparency: The public-facing rate table is one of the most comprehensive among South African banks. It clearly separates Telegraphic Transfer rates from Foreign Notes rates, allowing for precise cost comparisons before initiating a transaction.

- Flexible Cash Delivery: A key convenience feature is the ability to order foreign currency online and have it delivered to a home or office address in major metropolitan areas. This saves valuable time for busy executives and business owners preparing for international travel.

- Multiple Payment Corridors: Absa provides diverse options for sending money internationally, including traditional SWIFT transfers for large business payments, Western Union for wider remittance reach, and Visa Direct for faster, card-based transactions.

Pro Tip: Before placing a large order for foreign notes, compare the "we sell" notes rate against the "we sell" telegraphic transfer rate on Absa's site. For non-urgent needs, transferring funds to a travel card or foreign account can sometimes offer a better effective rate than purchasing physical cash.

Final Assessment

Absa excels in providing transparent, clearly segmented rate information that helps users make strategic FX decisions. Its strength lies in its combination of a user-friendly digital interface and a robust physical network for services like cash collection and delivery. While its rates are competitive for a major bank, they are still indicative and will include bank fees upon final execution.

- Best For: Individuals and businesses who value rate transparency and require a mix of digital transfer and physical cash services from a trusted provider.

- Key Consideration: The convenience of home or office delivery for foreign notes is limited to major South African cities, and final rates will always incorporate service fees or commissions.

Website: https://www.absa.co.za/indices/exchange-rates/

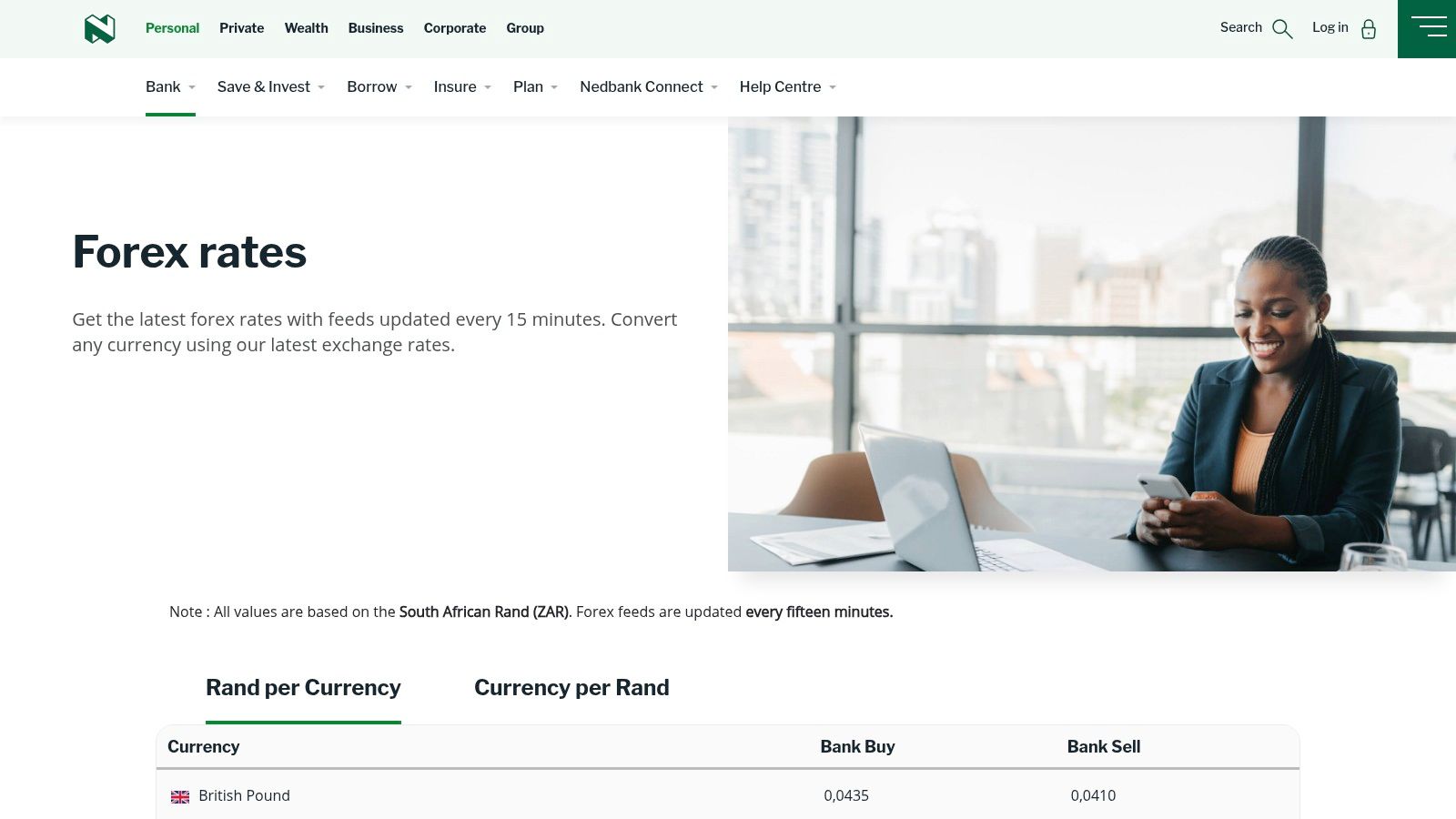

5. Nedbank – Forex Rates

For individuals and businesses seeking a straightforward, bank-backed reference point for currency values, Nedbank's Forex Rates page serves as a valuable resource. Its core strength is its simplicity and frequent updates, providing a clear, real-time snapshot of the market directly from a major South African financial institution. It’s an ideal starting point for Nedbank clients planning international transactions or anyone wanting a quick, indicative benchmark.

Unlike dedicated transfer platforms, this page is primarily a rate information tool rather than a transactional one. It gives users a transparent look at Nedbank’s base rates before they engage with specific products like foreign currency accounts or international payment services, helping them to time their transactions more effectively.

Standout Features and Practical Use

Nedbank’s rate display is designed for clarity and rapid assessment, catering to users who need quick information to make timely financial decisions.

- Frequent Rate Refreshes: The rates are updated approximately every 15 minutes during market hours. This near-live data is crucial for businesses looking to capitalise on favourable market movements for payments or currency purchases.

- Dual Display Format: The tables clearly present rates in both 'Rand per currency' and 'Currency per Rand'. This dual view is highly practical, eliminating the need for manual calculations whether you are converting ZAR to a foreign currency or vice versa.

- Broad Currency Coverage: The page lists a comprehensive range of major and minor currencies, making it a useful one-stop reference for businesses dealing with diverse international partners, from the US dollar to the Botswanan Pula.

Pro Tip: Use this page to set an internal benchmark before you contact a Nedbank forex advisor. Knowing the current indicative rate gives you a stronger starting point for negotiating a preferential rate on a large commercial transaction.

Final Assessment

Nedbank’s Forex Rates page excels at providing clear, frequently updated indicative rates, making it a reliable tool for quick market checks. Its primary value is for existing or potential Nedbank customers who need a trustworthy reference before initiating a transaction through the bank's channels. However, it's vital to recognise these rates are a guide; the final cost will include bank fees and a potentially wider spread depending on the product used.

- Best For: Nedbank customers and businesses needing a quick, reliable reference for indicative exchange rates before making a transaction.

- Key Consideration: The displayed rates are indicative only and do not include any commissions, service fees, or the final spread applied at the point of transaction.

Website: https://www.nedbankfranchising.co.za/content/nedbank/desktop/gt/en/personal/forex/forex-rates1.html

6. Bidvest Bank – Forex Online

For South Africans preparing for international travel, Bidvest Bank’s Forex Online platform offers a highly specialised and convenient service focused exclusively on travel money. Its core strength is the ability to order foreign currency notes and load a multi-currency World Currency Card entirely online, with options for delivery. This makes it a leading choice for travellers who value a streamlined, secure process for obtaining physical and card-based forex without visiting a bank branch.

Unlike the major banks that bundle forex into a wider suite of services, Bidvest has carved a niche as a travel money specialist. The platform is designed for a single purpose: to get foreign currency into the hands of travellers efficiently. The online compliance process, which handles FICA and proof of travel documentation digitally, removes significant friction from the user journey.

Standout Features and Practical Use

Bidvest Bank streamlines the often cumbersome process of acquiring travel money, making it a go-to for holidaymakers and business travellers. The platform’s features are tailored specifically for this use case.

- End-to-End Online Ordering: Users can complete the entire process online, from selecting currencies and amounts for notes or the World Currency Card to uploading compliance documents and making payment. This is a significant time-saver compared to traditional in-branch processes.

- Convenient Delivery Options: The platform offers home delivery of the World Currency Card nationwide. Critically, foreign cash can also be delivered directly to addresses in Gauteng, KwaZulu-Natal, and the Western Cape, a key differentiator in the market.

- Specialised Travel Focus: The platform is built around the needs of a traveller. It supports the popular World Currency Card, a reloadable prepaid card that can hold multiple foreign currencies, providing a secure alternative to carrying large amounts of cash.

Pro Tip: Always place your order at least 4-5 business days before your departure. The delivery timeline is stated as 72-96 hours after payment confirmation, so building in a buffer ensures your funds arrive well before you need to pack your bags.

Final Assessment

Bidvest Bank’s Forex Online platform excels in convenience for the specific purpose of obtaining travel money. Its user-friendly interface and delivery options make it a powerful tool for travellers in major provinces. While it might not always offer the absolute best foreign exchange rates in South Africa compared to specialist transfer services, its value lies in the hassle-free, secure, and dedicated service model for getting travel-ready currency.

- Best For: Individuals and families in South Africa planning international travel who need foreign cash, a travel card, or both, and prefer an online ordering and delivery process.

- Key Consideration: Cash delivery is restricted to major provinces. Users in other areas will need to select a branch for collection, which slightly reduces the convenience factor.

Website: https://forexonline.bidvestbank.co.za/

7. Exchange4free – Non-bank FX and International Transfers

As a specialist Money Transfer Operator licensed by the South African Reserve Bank, Exchange4free positions itself as a direct, non-bank alternative for individuals and SMEs. Its core value proposition is delivering more competitive foreign exchange rates than traditional banks by operating with lower overheads. The platform is tailored specifically to the South African regulatory environment, making it a strong contender for users seeking expert guidance on exchange control alongside cost-effective transfers.

Unlike the big banks, Exchange4free focuses exclusively on cross-border payments. This specialisation allows it to offer more aggressive pricing, particularly for larger transaction volumes where even fractional rate differences can result in significant savings. It is designed for those who are comfortable moving away from their primary bank to secure a better financial outcome on their international payments.

Standout Features and Practical Use

Exchange4free blends a digital platform with hands-on advisory services, which is particularly useful for navigating South Africa’s complex exchange control regulations. This dual approach makes it an effective tool for both simple and more intricate transactions.

- Dedicated Exchange Control Support: The platform provides advisory support for completing documentation related to Single Discretionary Allowances (SDA), Foreign Investment Allowances (FIA), and obtaining tax clearance certificates. This is invaluable for clients making large outward investments or emigrating.

- Aggressive Rate Structure: As a non-bank operator, its pricing model is designed to consistently undercut the retail rates offered by major financial institutions. The larger the transfer amount, the more competitive the rate becomes, making it ideal for substantial transactions like property purchases abroad.

- Global Reach: The service facilitates both inward and outward international transfers to over 100 countries, covering a wide range of currencies and business payment requirements from a single, centralised platform.

Pro Tip: For transactions over R1 million, engage directly with an Exchange4free consultant. Their team can often structure the deal with a sharper rate and will guide you step-by-step through the required SARB and SARS approvals.

Final Assessment

Exchange4free excels as a cost-effective solution for South Africans who prioritise securing the best foreign exchange rates over the convenience of an all-in-one banking platform. Its specialised knowledge of local regulations is a significant advantage. However, potential users should be mindful of mixed customer reviews regarding processing times and support, and understand that its licensing category has specific limits for smaller personal transfers.

- Best For: SMEs and individuals making significant international transfers (e.g., foreign investment, emigration) who need expert exchange control guidance.

- Key Consideration: While rates are highly competitive, the user experience and support level may vary compared to the established processes of a major bank.

Website: https://exchange4free.co.za/

Top 7 South Africa Forex Rates Comparison

| Platform | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Zaro | Moderate: fintech platform with KYB step | Low: bank transfers onboarding + cards | High: ultra-fast transfers, zero spread | SMEs, CFOs needing fast, low-cost cross-border payments | Fast 30-min transfers, no hidden fees, strong security |

| FNB – Foreign Exchange | Low: integrated with existing banking | Medium: requires FNB banking relationship | Medium: indicative rates, large transactions benefit | FNB customers wanting trusted FX products | Integrated FX products, scheduled rate updates |

| Standard Bank – Shyft Global Wallet | Low to Moderate: app-based onboarding | Low: digital wallet & cards | Medium: retail FX rates, convenient cards | SA residents & select foreigners needing multi-currency spending | Competitive retail FX, virtual cards, transparent pricing |

| Absa – Exchange Rates + FX Services | Low: retail & online FX services | Medium: retail network, delivery services | Medium: clear rates, multiple FX options | Users wanting clear rate differentiation and varied FX products | Transparent pricing, wide retail coverage |

| Nedbank – Forex Rates | Low: online rate display | Low: quick reference resource | Low to Medium: indicative rates updated fast | Users comparing rates before Nedbank FX use | Fast refresh, clear buy/sell display |

| Bidvest Bank – Forex Online | Low: online ordering platform | Medium: requires proof/compliance and delivery | Medium: travel cash/card access, delivery options | SA travelers needing seamless travel FX solutions | Convenient ordering/delivery, specialist travel FX |

| Exchange4free – Non-bank FX & Transfers | Moderate: license & compliance intensive | Medium: documentation & advisory support | High: competitive rates for larger transfers | SMEs and individuals seeking non-bank FX solutions | Competitive rates, exchange control advisory |

Making the Smartest Choice for Your Rands

Navigating the world of foreign exchange can seem complex, but as we've explored, South African businesses and individuals now have a powerful array of options at their fingertips. The journey to securing the best foreign exchange rates South Africa has to offer is no longer about simply accepting the first quote you receive. It's about a strategic evaluation of your specific needs against the strengths of different providers.

The traditional "big four" banks, including FNB, Standard Bank, Absa, and Nedbank, offer convenience and integrated services that are deeply familiar to many. Their digital platforms, like Standard Bank's Shyft Global Wallet, provide a reliable and accessible route for everyday forex needs. However, for businesses where every basis point impacts the bottom line, the real revolution is happening outside of traditional banking halls.

Key Takeaways for Maximising Your Rands

The core lesson is to look beyond the advertised "fee-free" claims and scrutinise the total cost of your transaction. Your primary considerations should always be:

- The Spread: This hidden cost, the difference between the interbank rate and the rate you're offered, is often the most significant expense. Fintech disruptors like Zaro have built their model on eliminating this entirely, offering the real mid-market rate.

- Transfer Fees: While some providers waive these, others have fixed or percentage-based fees. Always calculate how this impacts your total transaction value, especially for smaller, more frequent transfers.

- Speed and Support: How quickly do you need the funds to arrive? Does the provider offer dedicated support for business clients? These operational factors are critical for maintaining cash flow and resolving issues promptly.

- Transparency: A trustworthy provider makes all costs clear upfront. If you have to hunt for information on spreads and additional charges, it's a significant red flag.

A Practical Framework for Your Decision

Making the right choice requires a clear understanding of your use case. An exporter looking to repatriate US dollars will have vastly different priorities from a family sending a small remittance abroad.

To truly make the smartest choice for your Rands, considering these various factors and analysing market data can be crucial. For those managing complex spreadsheets of international transactions and supplier payments, you can also explore how to leverage AI for data analysis in Excel to process information and potentially identify cost-saving trends. By aligning the provider's strengths with your primary goal, whether it's maximising profit margins on a large trade or ensuring a simple, low-cost personal transfer, you empower yourself to secure genuine value.

Ultimately, the power has shifted to you, the consumer. Armed with the right information and a clear understanding of the market landscape, you can confidently move your money across borders, knowing you've made the most cost-effective and intelligent decision for your financial goals.

Ready to stop losing money to hidden spreads and slow transfers? Experience the future of foreign exchange with Zaro, where South African businesses get the real mid-market rate with zero spread and zero commission. See how much you can save on your next international transaction by visiting Zaro today.