Navigating the complexities of foreign exchange can significantly impact your bottom line, whether you're a small business managing import/export costs, a CFO seeking financial transparency, or a BPO handling international payroll. Finding the best forex rates in South Africa isn't just about securing a good deal on a single transaction; it's about establishing a reliable, cost-effective process for all your international payments and currency needs. The difference between a competitive rate and an average one, compounded over multiple transactions, can amount to substantial savings or losses.

This guide gets straight to the point. We have compiled a comprehensive resource list detailing the leading platforms and services available to South African businesses and individuals. Forget wading through marketing jargon and ambiguous fee structures. Here, we provide a practical breakdown of each provider, including their core strengths, potential limitations, and ideal use cases. You will find a clear, honest assessment to help you make an informed decision based on your specific requirements, such as transaction volume, currency pairs, or desired platform features.

Each entry includes screenshots for a visual preview and direct links to get you started quickly. Our goal is to equip you with the necessary information to move beyond standard bank offerings and discover specialised services that offer superior rates and greater transparency. This list is your starting point for optimising currency exchange, reducing hidden costs, and improving your financial efficiency when dealing with the global market. We'll cover a diverse range of options, from dedicated forex specialists like Zaro and Incompass Forex to global platforms like Wise and analysis tools such as Good Money Guide and BrokerChooser.

1. Zaro

Best For: South African businesses requiring institutional-grade forex rates and rapid international payment settlement.

Zaro has established itself as a formidable force for South African enterprises seeking to optimise their international financial operations. By fundamentally re-engineering the cross-border payment process, the platform delivers an unparalleled combination of speed, cost-efficiency, and robust security, making it a standout choice for obtaining some of the best forex rates in South Africa. Its core value proposition is built on transparency, directly challenging the opaque fee structures and sluggish settlement times common in traditional banking.

This fintech platform is specifically engineered for businesses, from agile exporters to established companies with complex financial oversight needs. It allows companies to execute global payments and manage multi-currency accounts with remarkable ease and predictability.

Key Strengths and Use Cases

Zaro’s most compelling advantage is its pricing model. It offers an exceptionally tight spread of just 3 cents (approximately 0.17%) from the mid-market rate, and critically, it eliminates intermediary SWIFT fees. This transparent approach provides finance teams with predictable costs, stripping away the hidden charges that often inflate international transactions.

Practical Applications:

- Paying International Suppliers: A local manufacturer can pay an overseas supplier in USD, converting ZAR at a near-perfect rate and ensuring the funds arrive in as little as 30 minutes, strengthening supplier relationships.

- Repatriating Export Revenue: An export-focused business can receive USD payments into their Zaro account quickly and convert the funds back to ZAR with minimal value lost to exchange rate margins.

- Managing Overseas Expenses: Teams can use the ZAR and USD debit cards for international software subscriptions or travel expenses, locking in favourable exchange rates at the point of purchase.

The platform also excels in its enterprise-grade features. Multi-user access with customisable permissions allows CFOs and finance managers to delegate tasks while maintaining complete oversight and control over transaction approvals, ensuring robust governance. The streamlined Know Your Business (KYB) process and automated compliance checks further reduce administrative overhead, allowing teams to focus on core business activities rather than paperwork.

Website: https://www.usezaro.com

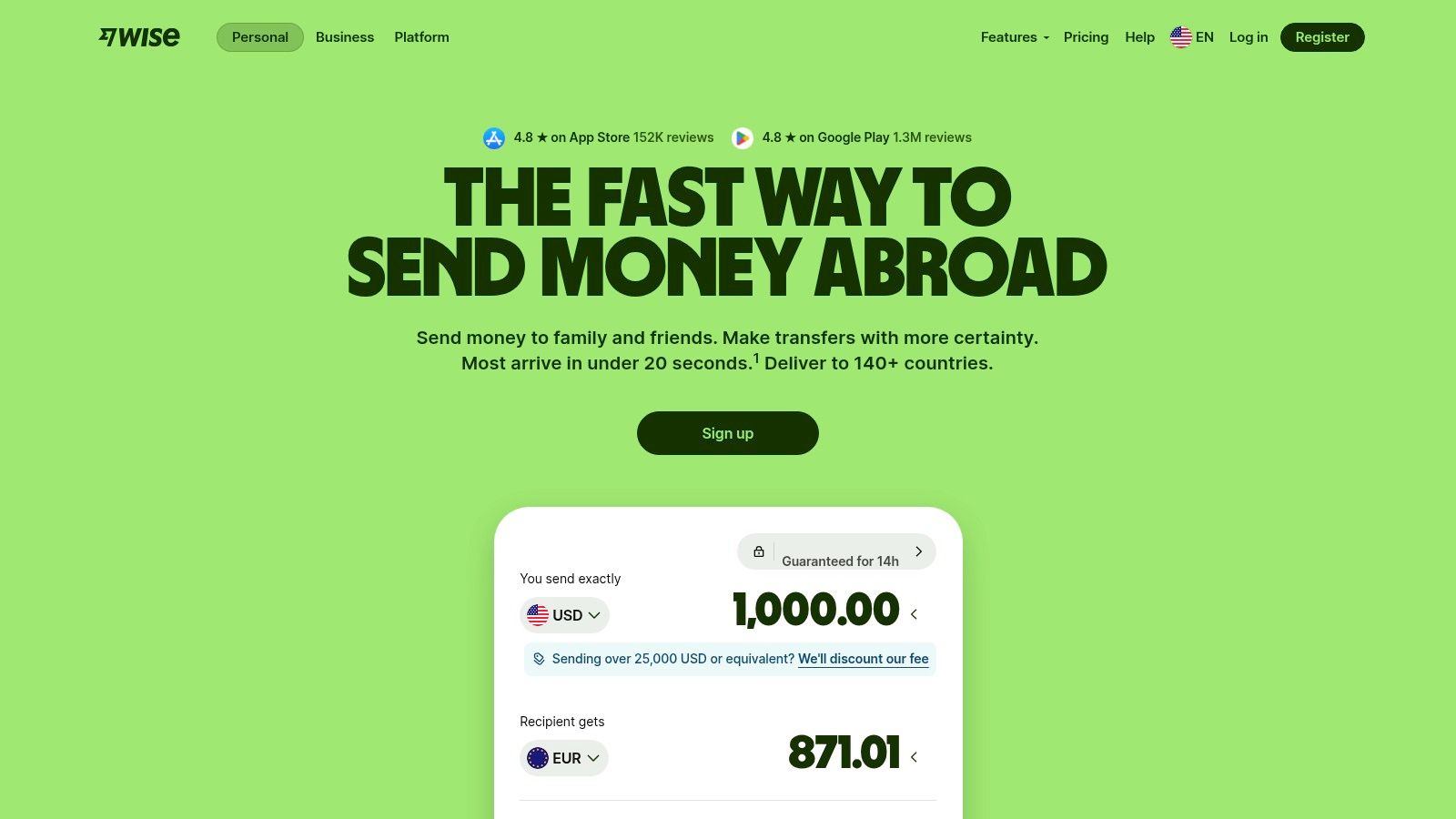

2. Wise (formerly TransferWise)

Wise has carved out a significant niche in the international money transfer space by championing transparency and fairness. For South African businesses and individuals tired of the opaque fees and marked-up exchange rates common in traditional banking, Wise offers a refreshing alternative. Its core principle is simple: you get the real, mid-market exchange rate-the one you see on Google or Reuters-with a small, upfront fee. This approach makes it a strong contender for those seeking the best forex rates in South Africa.

The platform is exceptionally user-friendly, with both a website and a mobile app that clearly display the total cost of your transfer before you commit. This clarity is invaluable for CFOs and business owners who need precise cost control for international payments, whether paying overseas suppliers or receiving funds from international clients. Transfers are often significantly faster than conventional bank wires, with many completed within hours.

Key Considerations for South African Users

- Ideal Use Case: Best suited for small to medium-sized businesses and individuals making frequent digital transfers up to R1 million per transaction (the individual allowance). It's perfect for freelancers, BPO businesses receiving payments, or companies paying for international software subscriptions.

- Fee Structure: Wise charges a transparent, variable fee that depends on the currency and transfer amount. There are no hidden markups in the exchange rate itself.

- Limitations: While excellent for digital transactions, Wise has limited support for cash pickups in South Africa, making it less suitable for recipients without bank accounts. Additionally, not all global currencies are available for sending funds from ZAR, so it's crucial to check your specific currency corridor.

Website: https://wise.com

3. Incompass Forex

Incompass Forex distinguishes itself by combining competitive exchange rates with a highly personalised service model. For South African individuals and businesses navigating the complexities of large-scale international transactions, such as emigration, offshore investments, or property purchases, Incompass provides expert, one-on-one guidance. Their approach focuses on securing favourable rates while ensuring full compliance with the South African Reserve Bank's exchange control regulations, making them a trusted partner for significant financial milestones.

Unlike purely digital platforms, Incompass assigns a dedicated dealer to each client, offering tailored advice and real-time rate updates. This hands-on approach is particularly valuable for CFOs or business owners who need to de-risk large transfers and optimise timing. The promise of no service or administration fees adds a layer of transparency, ensuring the quoted rate is the primary cost factor. This specialised service is a key reason many consider them for the best forex rates in South Africa, especially for more complex needs.

Key Considerations for South African Users

- Ideal Use Case: Best suited for high-value individual transactions like financial emigration, inheriting foreign assets, or purchasing overseas property. It is also ideal for businesses needing expert guidance on exchange control regulations for large import/export payments.

- Fee Structure: Incompass does not charge explicit service or administration fees. Their revenue is built into the exchange rate spread, which they aim to keep highly competitive against bank rates.

- Limitations: The service is less focused on instant, small-scale digital transfers and has limited online transaction capabilities compared to fintech platforms. Its emphasis on personalised, dealer-led service means it primarily caters to South African residents and may not be the quickest option for simple, recurring payments.

Website: https://www.money-transfers.co.za

4. Good Money Guide

While not a direct transfer service, Good Money Guide is an indispensable resource for anyone serious about finding the best forex rates in South Africa. It functions as an independent comparison and review platform, offering detailed analysis and educational content on forex brokers and money transfer services. For CFOs and business owners, it's a strategic tool to research and vet potential partners before committing, ensuring they choose a service that aligns with their specific financial needs and transaction volumes.

The platform excels by providing in-depth, unbiased reviews that cut through marketing jargon. It compares providers based on crucial metrics like fees, exchange rate markups, transfer speeds, and customer service. This approach empowers South African businesses to make informed decisions, whether they are looking for a broker for forex trading or a cost-effective solution for international payments. The educational guides are particularly useful for those new to the complexities of foreign exchange.

Key Considerations for South African Users

- Ideal Use Case: Best for the research and due diligence phase. It is a vital tool for CFOs, business owners, and finance managers who need to compare different forex providers objectively before selecting one for their international transactions or trading activities.

- Fee Structure: The platform is free to use. Its value comes from helping you find services with the lowest fees and most competitive exchange rates, saving you money indirectly.

- Limitations: Good Money Guide does not facilitate transactions itself; it is purely a research and comparison website. Users must still sign up with the provider they choose. While it has a South African section, some content may be geared more towards a UK audience, requiring users to verify details for local relevance.

Website: https://goodmoneyguide.com/za/fx/

5. SAShares

While not a direct forex provider, SAShares serves a crucial role for South African businesses and traders seeking to engage with the forex market. It functions as a comprehensive research and review platform, specifically focusing on identifying the best discount forex brokers available to South Africans. For a CFO or business owner exploring currency trading or hedging strategies, SAShares offers an invaluable educational starting point to understand the landscape, compare broker fees, and find a platform that offers the best forex rates in South Africa for trading purposes. It demystifies the complex world of brokerages.

The website provides in-depth reviews, comparing brokers on critical factors like spreads, commissions, platform tools, and regulatory compliance. This focus on cost-effective trading solutions makes it a vital resource for minimising the expenses associated with forex trading. Instead of blindly choosing a broker, users can leverage SAShares' detailed analysis to make an informed decision that aligns with their financial strategy and risk appetite, ensuring they don't overpay on transactional costs.

Key Considerations for South African Users

- Ideal Use Case: Best for businesses, CFOs, and individual traders conducting due diligence before committing to a forex trading platform. It's an essential research tool for finding brokers with low spreads and transparent fee structures.

- Fee Structure: The platform itself is free to use. It generates revenue through affiliate relationships with the brokers it reviews, but the content is structured as informational guidance.

- Limitations: SAShares is purely an informational and educational resource; you cannot execute any transfers or trades on the site. Its findings should be used as a primary research step, but users should always cross-reference information directly with the brokers before opening an account.

Website: https://sashares.co.za/best-discount-forex-brokers/

6. EconomyWatch

While not a direct transfer service, EconomyWatch plays a crucial role for South African businesses and individuals navigating the complex world of forex trading. It functions as a comprehensive comparison and review platform, specifically tailored to the local market. For anyone looking to engage in speculative forex trading rather than simple international payments, this site offers the detailed analysis needed to find a broker offering the best forex rates in South Africa, alongside favourable trading conditions. It demystifies the jargon and presents clear, side-by-side data on spreads, fees, and platform features.

The platform stands out by offering in-depth reviews and educational guides that cater to both novice and seasoned traders. This educational component is invaluable for business owners or CFOs considering using forex trading as part of a hedging strategy or for investment purposes. The user-friendly interface allows for quick filtering and comparison, enabling users to make informed decisions based on their specific trading style, risk appetite, and capitalisation, rather than just marketing claims.

Key Considerations for South African Users

- Ideal Use Case: Best for individuals, traders, and businesses looking to compare and select a forex trading broker. It is an educational and research tool, not a transactional platform for sending money abroad.

- Fee Structure: The website is free to use. The costs you will encounter are the trading fees and spreads charged by the brokers reviewed on the site. EconomyWatch provides detailed breakdowns of these potential costs.

- Limitations: The platform itself does not facilitate any financial transactions or currency exchange. A key consideration is that while it reviews a wide range of brokers, users must perform their own due diligence to ensure any chosen broker is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

Website: https://www.economywatch.com/za/brokers/forex-brokers

7. Punch Nigeria

While not a direct forex provider, Punch Nigeria offers a valuable resource for South African traders and businesses venturing into the speculative forex market. It serves as an informational hub, curating detailed lists and reviews of the best forex brokers accessible to South African users. Instead of providing rates, it guides users on where to find platforms that offer competitive spreads and trading conditions, making it an essential preliminary research tool for those looking to engage in forex trading rather than simple currency conversion.

The platform meticulously profiles various brokers, detailing their regulatory compliance, account types, fees, and leverage options. This allows businesses that need to hedge against currency fluctuations, or individuals looking to trade currencies, to make an informed decision. By focusing on reputable, regulated brokers, Punch Nigeria helps users sidestep potential scams and find a trading partner that aligns with their financial strategy, ultimately helping them secure some of the best forex rates South Africa has to offer in the trading space.

Key Considerations for South African Users

- Ideal Use Case: Best suited for businesses or individuals conducting due diligence before selecting a forex trading broker. It is an excellent starting point for understanding the trading landscape, comparing broker services, and verifying regulatory status.

- Fee Structure: Access to the information on Punch Nigeria is free. The fees discussed are those charged by the third-party brokers it reviews.

- Limitations: The platform is a research tool, not a service provider, so you cannot execute transfers or trades directly. Its primary audience is Nigerian, so some broker promotions or features may not be entirely applicable to the South African market without verification.

Website: https://punchng.com/best-forex-brokers-in-south-africa/

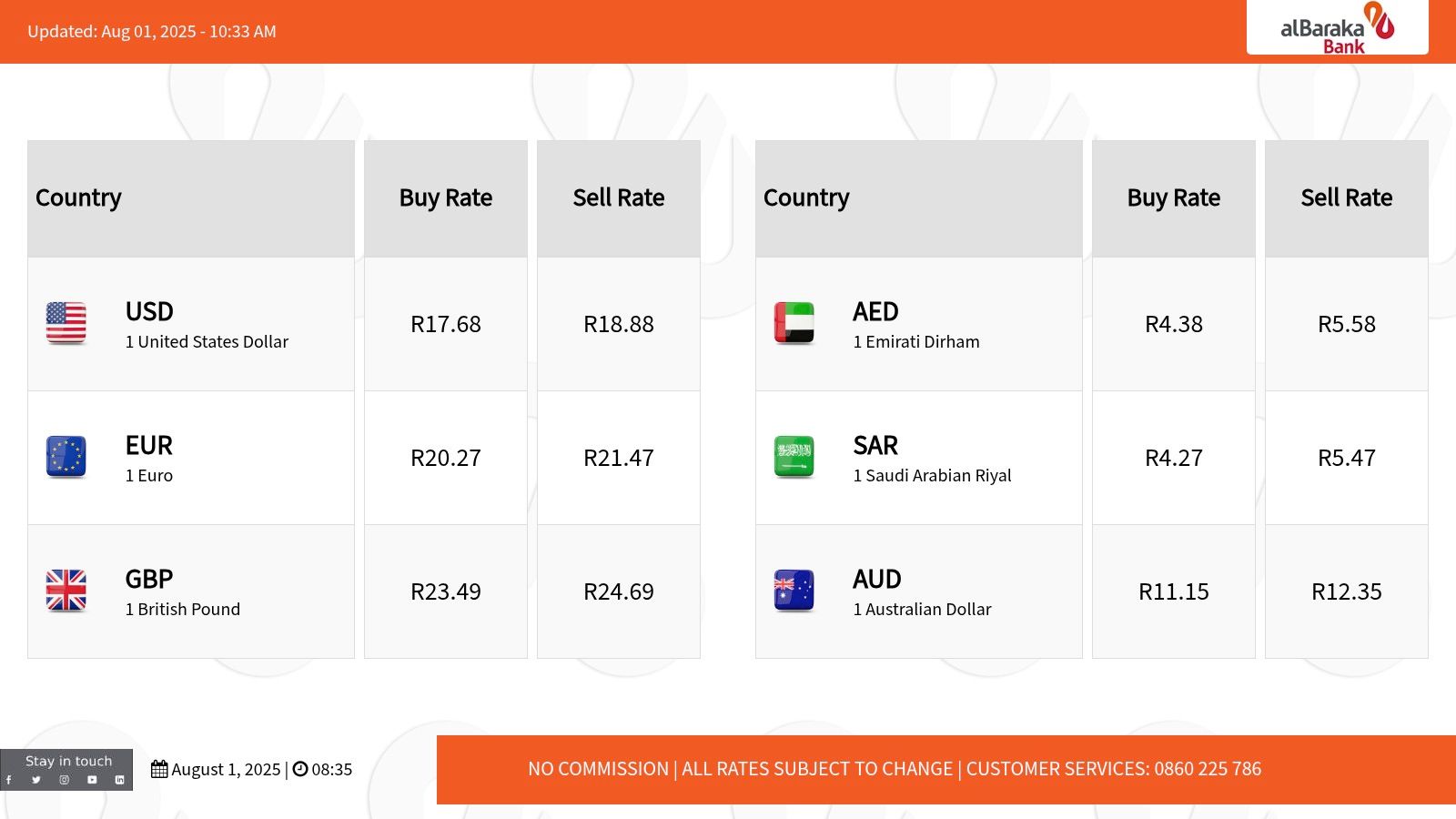

8. Al Baraka Bank South Africa

Al Baraka Bank brings an established banking reputation to the foreign exchange market, offering a unique proposition for its clientele in South Africa. As an institution rooted in Shari'ah principles, it emphasises ethical and transparent financial dealings. This philosophy extends to its forex services, where the bank attracts customers by offering competitive exchange rates with a straightforward, no-commission structure on transactions, making it a noteworthy option for those seeking some of the best forex rates in South Africa.

The bank provides dedicated customer service for forex inquiries, ensuring clients receive personalised guidance. Unlike purely digital platforms, Al Baraka offers the security and direct support of a traditional bank, which can be crucial for business owners and CFOs managing significant or complex international payments. The rates are regularly updated and publicly available on their website, allowing for easy comparison before committing to a transaction.

Key Considerations for South African Users

- Ideal Use Case: Best for existing Al Baraka Bank clients, both individuals and businesses, who prefer the security and direct support of a traditional bank for their forex needs. It is particularly suitable for those who value a no-commission fee model.

- Fee Structure: The primary appeal is the zero commission on foreign exchange transactions. The cost is built into the competitive exchange rate offered, which simplifies cost calculations for international transfers.

- Limitations: The service is primarily available to Al Baraka Bank account holders, which limits accessibility for the general public. Furthermore, certain transactions may require a physical visit to a branch, making it less convenient than fully digital alternatives for users who are not near a branch.

Website: https://www.albaraka.co.za/pages/forex-board

9. IG South Africa

While primarily known as a trading platform rather than a money transfer service, IG South Africa is an indispensable resource for businesses and individuals who need to actively monitor foreign exchange markets. It provides institutional-grade data, offering live, real-time forex rates, advanced charting tools, and in-depth market analysis. For CFOs or business owners who need to time their large international payments or hedge against currency fluctuations, IG’s platform offers unparalleled insight into market movements, helping them secure the best forex rates in South Africa by making informed decisions.

The platform is not for sending money directly like a remittance service. Instead, its value lies in its powerful analytical capabilities. Users can track over 80 currency pairs, set up alerts for specific rate thresholds, and access a wealth of educational content to better understand forex dynamics. This makes it a crucial complementary tool to be used alongside a dedicated international payment provider.

Key Considerations for South African Users

- Ideal Use Case: Best for businesses, treasury departments, and experienced individuals who need to perform deep market analysis, track live rates, and develop currency hedging strategies. It's an excellent tool for research before executing a large transfer with another service.

- Fee Structure: Access to the platform's rate-tracking and charting tools is generally free. Costs are associated with actual trading activities, such as spreads, commissions, and potential inactivity fees on trading accounts.

- Limitations: IG South Africa is not a money transfer service for paying overseas suppliers or receiving client payments. Its purpose is market analysis and trading, which may be overly complex for users simply wanting to send money from A to B.

Website: https://www.ig.com/za/forex/markets-forex

10. BrokerChooser

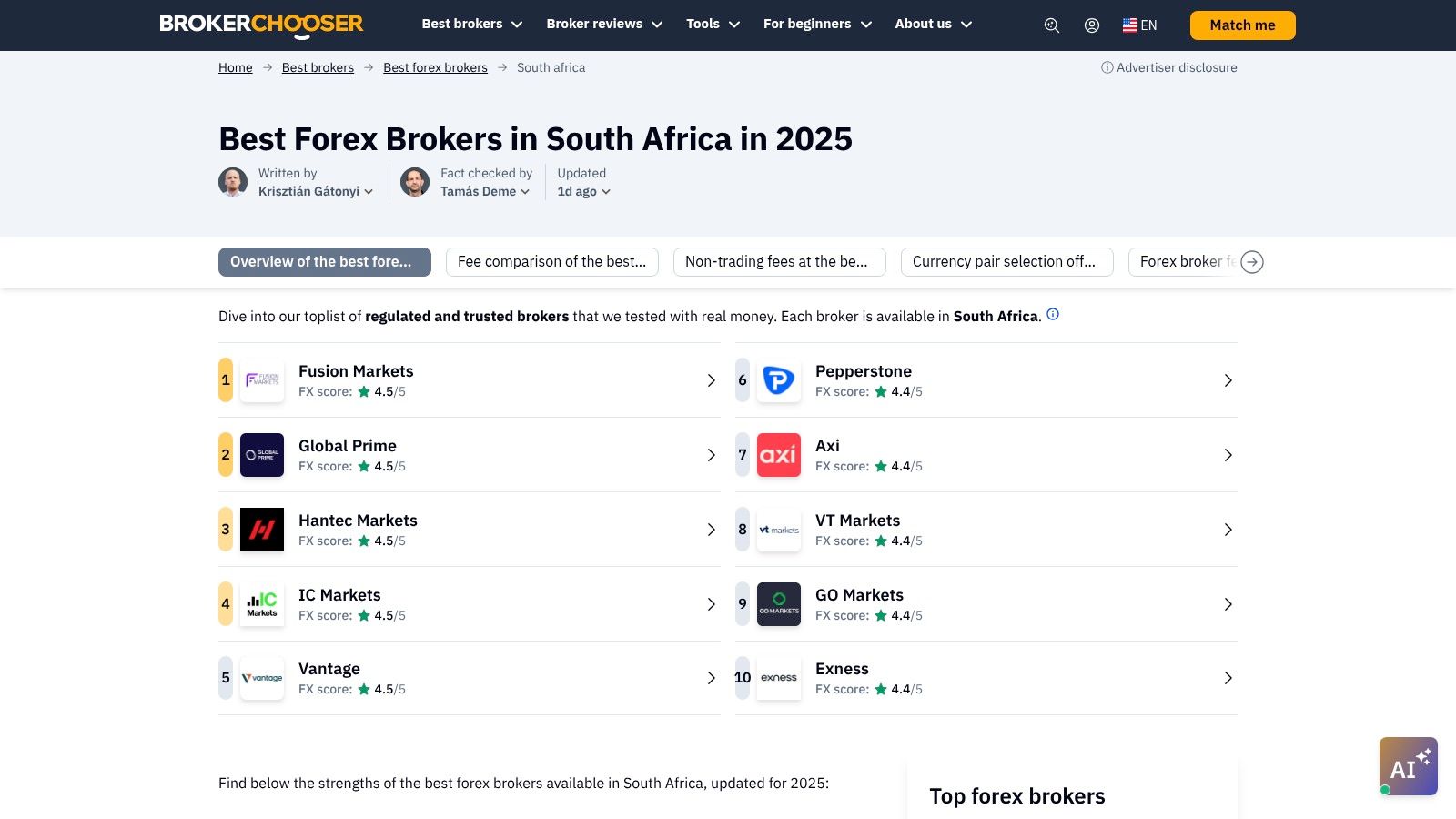

While not a direct transfer service, BrokerChooser serves a critical role for South Africans venturing into forex trading. It acts as an independent, data-driven referee in the complex world of online brokers, providing detailed, unbiased reviews and comparisons. For anyone looking to actively trade currencies rather than just transfer them, finding a trustworthy platform with competitive spreads is paramount. BrokerChooser demystifies this process, offering an essential resource for securing the best forex rates in a trading context.

The platform’s strength lies in its rigorous methodology and user-friendly comparison tools. It evaluates brokers on over 500 data points, including fees, platform usability, charting tools, and customer service quality. This allows South African traders, from beginners to seasoned professionals, to filter and compare brokers that specifically cater to the local market, ensuring they find a platform that aligns with their trading strategy and risk appetite. The depth of their reviews provides a level of transparency that is often hard to find.

Key Considerations for South African Users

- Ideal Use Case: Best for individuals and businesses in South Africa who are actively looking to engage in forex trading and need to compare different brokerage platforms to find the lowest spreads and fees. It's a research tool, not a transfer service.

- Fee Structure: The service is free for users. Its value comes from helping you identify brokers with the most favourable fee structures (e.g., low commissions, tight spreads).

- Limitations: BrokerChooser does not facilitate any financial transactions itself. Users must be diligent and verify that any broker chosen through the site is regulated by the South African Financial Sector Conduct Authority (FSCA), as not all reviewed brokers may hold this specific license.

Website: https://brokerchooser.com/best-brokers/best-forex-brokers/south-africa

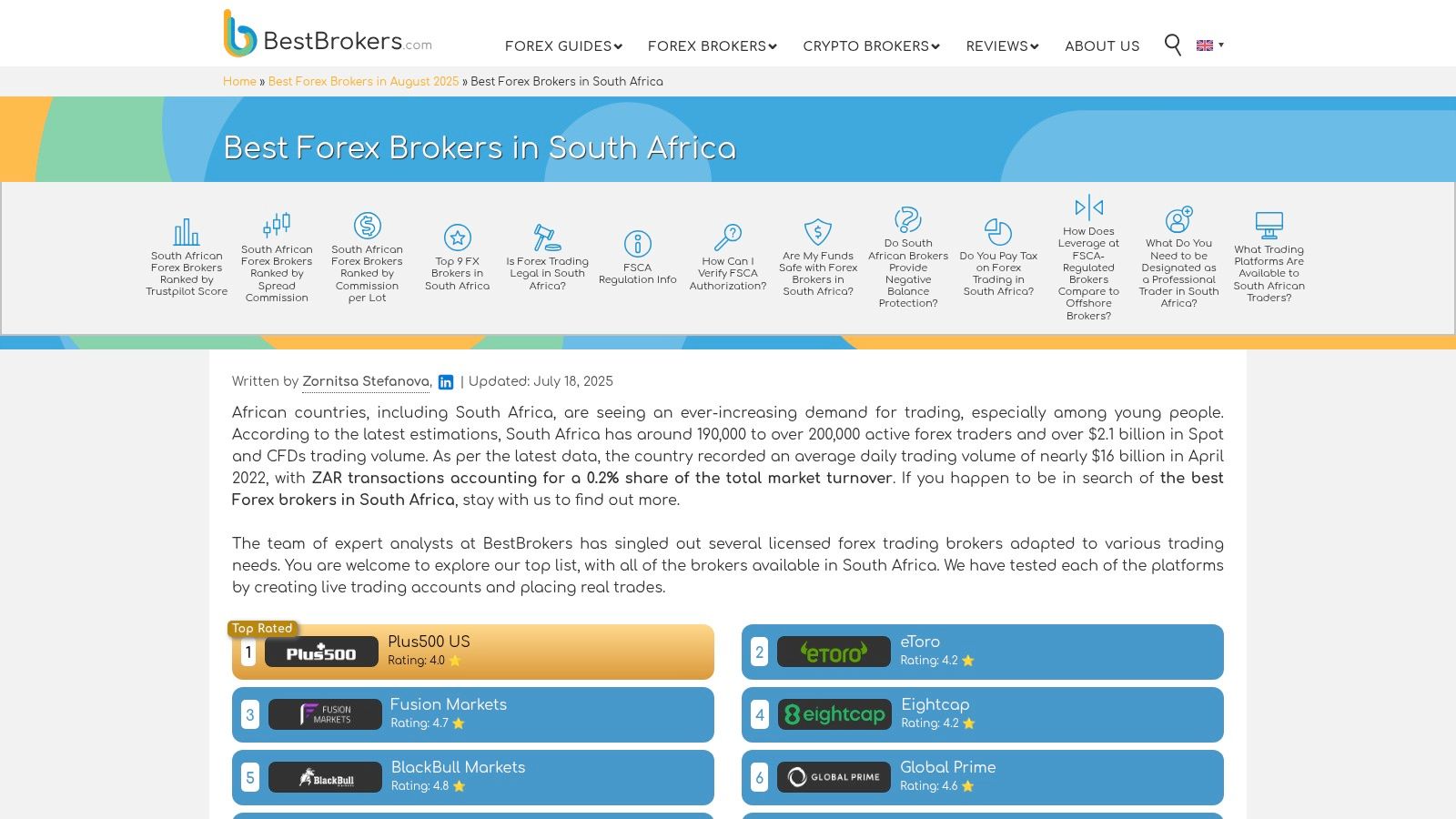

11. BestBrokers.com

For South African businesses and individuals stepping into the world of forex trading rather than simple transfers, navigating the landscape of brokers can be daunting. BestBrokers.com serves as an essential research and comparison tool, offering detailed analysis specifically tailored to the South African market. Instead of providing direct forex services, its value lies in aggregating and reviewing brokers, helping users find providers that offer the best forex rates, lowest spreads, and most reliable platforms. It's a crucial first step for anyone looking to engage in active currency trading.

The platform stands out by presenting its findings in a clear, comparative format, breaking down complex fee structures, commission rates, and trading conditions. By integrating Trustpilot scores, it provides an additional layer of social proof, allowing users to gauge the real-world experiences of other traders. This focus on transparency and user feedback makes it an invaluable resource for CFOs or business owners considering speculative forex trading or more advanced hedging strategies, ensuring they partner with a reputable and cost-effective broker.

Key Considerations for South African Users

- Ideal Use Case: Best suited for individuals, traders, and businesses conducting due diligence before selecting a forex trading broker. It is an educational and comparison resource, not a transactional platform.

- Fee Structure: The website is free to use. It generates revenue through affiliate relationships with the brokers it reviews, but the analysis aims to be objective and data-driven.

- Limitations: BestBrokers.com does not offer direct trading or money transfer services itself. All information, while regularly updated, should be cross-verified on the actual broker’s website before making a final decision, as rates and terms can change.

Website: https://www.bestbrokers.com/forex-brokers/best-forex-brokers-south-africa/

12. Alpari

Alpari is a well-established international forex broker that has a strong presence among South African traders. While not a traditional money transfer service, it offers an environment where businesses and individuals can engage with the forex market directly. This makes it relevant for those looking to actively trade currencies rather than just send money, providing access to market rates that can be more competitive than those offered by retail banks. For businesses with a treasury function or individuals sophisticated in market dynamics, Alpari provides the tools to potentially secure some of the best forex rates in South Africa through strategic trading.

The platform is built around the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) terminals, which are powerful but come with a learning curve. Alpari supports South African clients with ZAR-denominated accounts, simplifying funding and withdrawal processes. The availability of various account types, from micro accounts for beginners to ECN accounts for seasoned traders, allows users to choose a structure that matches their trading volume and strategy, influencing the final cost through spreads and commissions.

Key Considerations for South African Users

- Ideal Use Case: Best suited for experienced individuals or businesses that actively manage their currency exposure through trading. It is not designed for simple A-to-B international payments but for speculative trading or hedging strategies.

- Fee Structure: Costs are based on spreads (the difference between buy and sell prices) and, on some accounts, a fixed commission per trade. Spreads are variable and can be very competitive on major pairs. Be aware of potential inactivity fees on dormant accounts.

- Limitations: Alpari’s primary focus is on forex trading, not international remittances, so it lacks the simplicity of a dedicated money transfer service. The platform requires a significant level of financial knowledge to use effectively and safely, as trading involves substantial risk.

Website: https://alpari.com

Top 12 Forex Rate Providers Comparison

| Platform | Core Features / Security ✨ | User Experience / Speed ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| Zaro | Real exchange rate, zero SWIFT fees, multi-user controls 🏆 | Fast transfers (~30 mins), enterprise-grade | Ultra-low 0.17% spread, no hidden fees 🏆 | South African businesses & exporters 👥 | Debit cards in ZAR & USD, KYB onboarding 🏆 |

| Wise (formerly TransferWise) | Real mid-market rates, transparent fees, mobile app | Fast transfers, easy platform ★★★★☆ | Competitive with no hidden fees | SA individuals & businesses 👥 | Transparent pricing, trusted global player |

| Incompass Forex | Personalized service, no admin fees, forex control guidance | Personalized support, rate updates ★★★☆☆ | No service fees, ISO accredited | South African residents & businesses 👥 | Expert forex advice, transparent rates |

| Good Money Guide | Reviews & comparisons, educational content | Informative & updated content ★★★☆☆ | Free resources for cost-effective options | Forex beginners & cost-conscious users 👥 | Independent reviews, South Africa focus |

| SAShares | Forex broker reviews, trading tools info | Detailed broker info ★★★☆☆ | Brokerage cost focus, educational content | South African traders & investors 👥 | Discount broker focus, trader education |

| EconomyWatch | Broker comparisons, fees & spreads info | Up-to-date market info ★★★☆☆ | Detailed broker selection assistance | SA forex traders & investors 👥 | Wide SA market coverage, user-friendly |

| Punch Nigeria | Top brokers ranking, regulatory info | Updated broker profiles ★★★☆☆ | Focus on reliable brokers | Mainly Nigerian, also SA traders 👥 | Detailed compliance insights |

| Al Baraka Bank SA | No forex commission, updated rates, customer service | Conventional banking experience ★★★☆☆ | Competitive rates, no commission fees | Al Baraka account holders, SA businesses 👥 | Established bank with strong reputation |

| IG South Africa | 80+ currency pairs, advanced tools, educational resources | Full trading platform, live charts ★★★★☆ | Competitive spreads, regulated broker | Serious traders & investors 👥 | Advanced tools, 24/5 support |

| BrokerChooser | Broker rankings, detailed reviews, comparison tools | User-friendly & updated ★★★☆☆ | Unbiased info for smart broker choice | South African traders 👥 | Interactive comparison platform |

| BestBrokers.com | Broker fees, Trustpilot reviews, commission info | Transparent broker data ★★★☆☆ | Trusted South African brokerage rankings | Forex users seeking trust & fees info 👥 | Trustpilot user feedback integration |

| Alpari | Multiple accounts, MetaTrader 4 & 5, educational content | Flexible accounts, solid support ★★★☆☆ | Competitive spreads, beginner-friendly | Beginners & experienced SA traders 👥 | Popular platforms, strong customer support |

Final Thoughts

Navigating the complex world of foreign exchange can feel overwhelming, but securing the best forex rates in South Africa is an achievable goal for any business, from a budding exporter to an established CFO. Throughout this guide, we have journeyed through a diverse landscape of tools, platforms, and resources, each offering a unique pathway to optimising your international transactions. The key takeaway is clear: the era of passively accepting bank-set exchange rates is over. Proactive management is the new standard for financial efficiency.

We have seen how dedicated fintech platforms like Wise and Zaro are disrupting the traditional forex model by prioritising transparency and offering rates close to the mid-market. Simultaneously, established specialists like Incompass Forex provide a high-touch, personalised service that is invaluable for large or complex transfers. This highlights a critical theme: the "best" provider is entirely subjective and depends on your specific operational needs.

Synthesising Your Strategy: From Information to Action

The journey from understanding your options to implementing a robust forex strategy requires careful consideration. The tools we have analysed, from direct providers like Al Baraka Bank to analytical resources like BrokerChooser and SAShares, all contribute to a more holistic view of the market. Your primary task now is to synthesise this information into a concrete action plan.

To do this effectively, start by auditing your own business requirements. Ask critical questions:

- What is our average transaction volume and frequency? A business making daily small payments has different needs from one making a single, large annual transfer.

- How much hands-on support do we need? Do we prefer a self-service digital platform or the guidance of a dedicated account manager?

- What is our tolerance for complexity? Are we comfortable navigating CFD platforms like IG South Africa for hedging, or do we need a straightforward payment solution?

- How important is speed versus cost? Some providers may offer slightly better rates but have longer settlement times, a trade-off that must align with your cash flow needs.

Answering these questions will immediately narrow down your options. A small BPO business paying international contractors will likely find the low fees and user-friendly interface of a tool like Wise most appealing. In contrast, a CFO of a large export company might leverage information from Good Money Guide to vet a provider like Incompass Forex for a multi-million Rand transaction, valuing their expertise in compliance and personalised service.

Key Implementation Considerations

Once you have shortlisted potential providers, the implementation phase begins. This is not merely about signing up; it is about integrating the new solution into your existing financial workflows.

A crucial first step is to conduct a live rate comparison. Do not rely solely on the marketing claims on a provider’s homepage. Initiate small, parallel transactions with your top two or three choices to see the real, all-in cost - the rate you get, minus all fees. This empirical data is the most reliable determinant of value.

Furthermore, consider the administrative side. How easy is it to onboard your business? What are the FICA and SARB documentation requirements? A seamless onboarding process can save your finance team significant time and frustration. Look into the platform’s reporting capabilities. Can you easily export transaction histories for reconciliation and accounting purposes? These operational details are just as important as the headline exchange rate.

Ultimately, finding the best forex rates South Africa has to offer is an ongoing process, not a one-time decision. The market is dynamic, and new, innovative solutions will continue to emerge. By adopting a mindset of continuous evaluation and leveraging the diverse resources at your disposal, you can transform your foreign exchange operations from a necessary cost centre into a strategic advantage, protecting your bottom line and empowering your global growth.

Ready to move beyond mere comparison and start actively saving on your international payments? Zaro offers a powerful platform designed for South African businesses, providing transparent, market-beating exchange rates and streamlined global payment solutions. Take control of your forex strategy today by exploring how much you could save at Zaro.