The Bidvest Bank exchange rates you get for an international payment aren’t just a simple conversion; they have a built-in markup over the mid-market rate, and that’s what really determines your final cost. For any South African business looking to get smarter with its foreign exchange, figuring this out is the first, most important step.

Decoding Bidvest Bank Exchange Rates and Their True Cost

When your business has to pay an international supplier or bring foreign earnings home, the exchange rate you lock in can make or break your profitability. For many South African SMEs using traditional banks like Bidvest, the rate they’re quoted is the only number they see. The problem is, that single figure hides a few different costs that aren’t always obvious.

The rate a bank offers you is almost never the real exchange rate. That's called the mid-market or spot rate, and it’s the price banks use to trade currencies between themselves on the global market. The rate you get as a customer includes a markup, known as a spread, which is where the bank makes its profit on the deal.

Understanding the Components of Your Payment

To get a handle on the true cost, you have to look past the headline rate. There are two key elements that decide how much foreign currency actually lands in the recipient's account.

- The Exchange Rate Spread: This is the gap between the mid-market rate and the rate you’re offered. The wider the spread, the more cost is baked into your currency conversion.

- Explicit Transaction Fees: These are the straightforward charges for processing the payment itself. Think SWIFT fees, admin costs, or fees charged by intermediary banks along the way.

Put these two together, and you have the landed cost—the total amount you've actually spent on your international payment. For an importer paying a USD invoice or an exporter converting revenue back to ZAR, this landed cost hits the cash flow and bottom line directly. What looks like a tiny percentage difference in the rate can easily mean thousands of rands lost or saved, especially on bigger transactions.

For South African SMEs, getting a clear picture of the 'landed cost' isn't just good financial practice. It's a crucial tool for staying competitive on pricing, managing supplier relationships, and keeping your budget on track in a shaky global market.

A Tale of Two Costs

Let's break it down with a simple comparison between what a typical bank offers and how a modern fintech alternative, which uses the real mid-market rate, operates.

| Cost Component | Traditional Bank (e.g., Bidvest) | Modern Fintech Platform (e.g., Zaro) |

|---|---|---|

| Exchange Rate | Mid-market rate + hidden spread | The real mid-market rate with zero spread |

| Transaction Fee | SWIFT fees and administrative charges | A single, transparent fee or percentage |

| Transparency | Often murky; total cost is blended together | Fully transparent; all costs are clearly itemised |

This basic difference in how costs are structured is precisely why a proper comparison is so vital. By peeling back the layers of Bidvest Bank exchange rates, your business can start asking the right questions and make much sharper decisions to protect your profit margins. The next step is to dig into exactly how these spreads and fees add up.

Where Bank Spreads and Fees Really Hit Your Bottom Line

When you get an exchange rate quote from a bank like Bidvest, you're not seeing the whole picture. It’s far more than a simple conversion from one currency to another. Traditional banks build their profit directly into the rates they offer, meaning the actual cost to your business is often buried where you can't easily see it. If you want to make smarter financial decisions, you need to know exactly where these costs come from.

Essentially, two things inflate the cost of your international payments: the exchange rate spread and the explicit transaction fees. They both contribute to your total cost, but they work very differently. Getting a handle on this difference is the first step to wrestling back control of your foreign exchange expenses.

The Spread: A Hidden Cost in the Bidvest Bank Exchange Rate

The biggest and most easily missed cost is the spread. Simply put, it's the gap between the ‘mid-market rate’—the real wholesale rate banks use to trade currency among themselves—and the retail rate they offer you. You can think of it as the bank’s silent profit margin for doing the conversion.

Let's say the true mid-market rate for ZAR to USD is R18.50. The bank might offer to sell you dollars at R18.87. That R0.37 difference is the spread. It doesn't sound like much on a single dollar, but for a business sending or receiving large amounts, it adds up incredibly fast and quietly eats into your profits.

The spread isn't a line item on your invoice. It's a markup woven directly into the exchange rate itself. This makes it incredibly difficult for businesses to compare providers fairly and figure out what they're truly paying for the currency.

This model is a core part of how financial institutions make money. Bidvest Bank has been a significant force in South Africa's foreign exchange scene for decades, operating as a top FX specialist since getting its full banking licence back in 2000. When the rand is volatile—like the period of weakness around 2012 when their profits after tax hit R317 million—the high transaction volumes and wider spreads can be very good for a bank's bottom line.

Spreads vs. Explicit Fees: What’s the Difference?

Unlike the hidden spread, explicit fees are the charges you can actually see on your transaction summary. These are the straightforward administrative costs for sending money across borders. It’s vital to factor these in, too, when you’re working out the true landed cost of a payment.

You'll typically run into fees like these:

- SWIFT Fees: A charge for using the global SWIFT network, which is the messaging system banks use to coordinate international payments.

- Correspondent Bank Fees: Sometimes your money has to pass through intermediary banks to get to its final destination, and each of these banks might skim a fee off the top.

- Administrative Charges: This is often a flat fee the bank charges you just for handling the transfer.

A Simple Analogy for Business Owners

Think about it like this: imagine you import goods from a wholesaler. The wholesaler buys a product at a base price (this is your mid-market rate). They then sell it to you at a higher retail price (the customer exchange rate), and the difference is their profit (the spread). But that's not all. They also charge you a separate delivery fee to get the goods to your door (the transaction fees).

To get the best deal, you wouldn't just look at the delivery fee, would you? You’d look at the total cost—the price of the product plus the delivery. Foreign exchange works the same way. If you only focus on the SWIFT fee and ignore the much bigger cost hidden in the Bidvest Bank exchange rate spread, you're missing where most of your money is going. Understanding this is fundamental to properly judging any currency quote you get.

A Real-World Look at Bank Rates vs. Fintech Alternatives

It’s one thing to talk about spreads and fees in theory, but what does it actually mean for your bottom line? The only way to truly understand the cost is to see the "landed amount"—how much foreign currency actually arrives in your supplier's account after every single cost is stripped away.

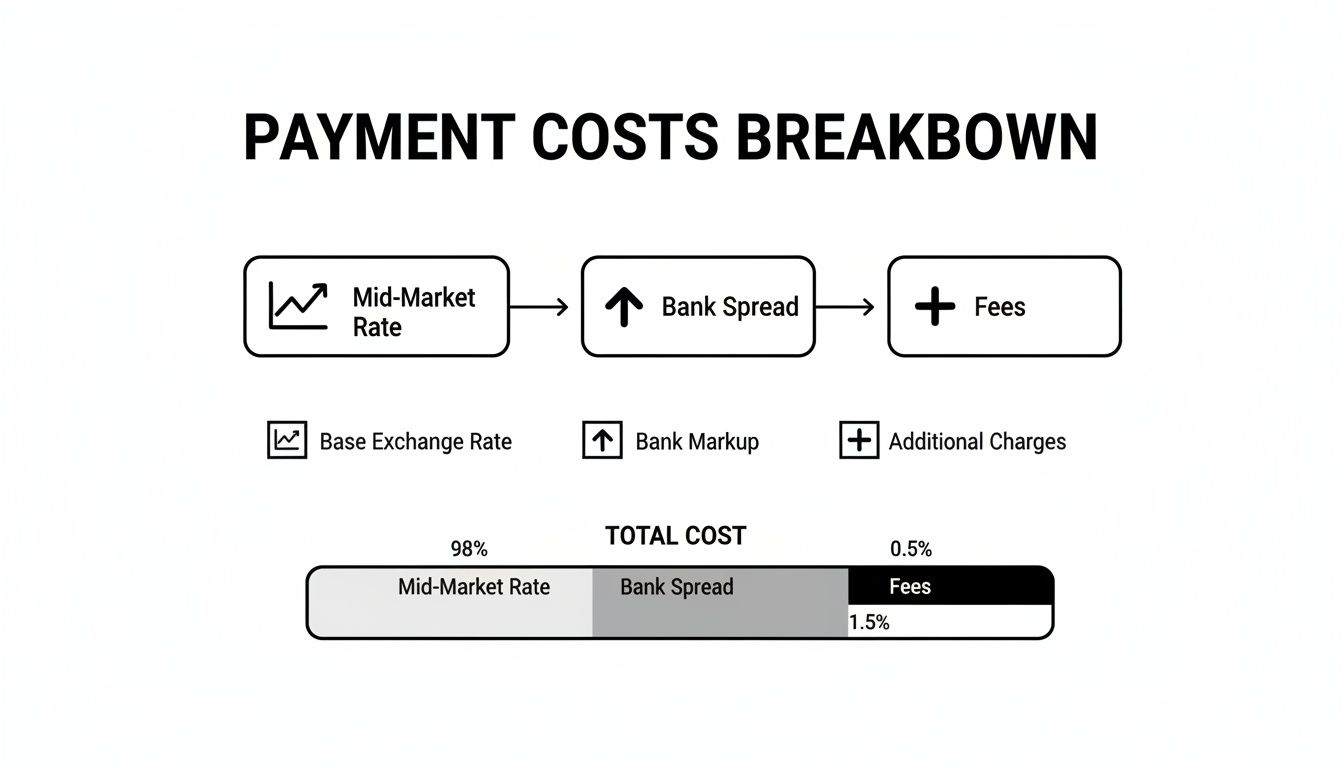

Let's break down how a typical international payment is structured. The diagram below shows exactly how your initial amount gets chipped away by both the bank's hidden spread and its upfront fees.

As you can see, the real cost isn’t just the admin fee you’re quoted. The spread is where the real value erosion happens.

How Seemingly Small Percentages Create Massive Differences

To make this tangible, let's run the numbers on three common payment sizes for a South African business paying a USD invoice: R50,000, R250,000, and R1,000,000. We’ll compare a typical rate you might get from a bank like Bidvest against a modern fintech provider that operates differently.

Here are the assumptions for our comparison:

- The real mid-market exchange rate (the 'true' rate) is ZAR 18.50 / USD.

- A typical bank quotes you ZAR 18.87 / USD, which includes their 2% spread, plus a R500 admin fee.

- A zero-spread fintech gives you the real rate of ZAR 18.50 / USD and charges a simple, transparent fee of 0.5% on the payment value.

Let's see how they stack up.

Cost Analysis: ZAR to USD International Payment Comparison

This table breaks down the total cost and final USD received for three common payment sizes, comparing a typical bank offering against a zero-spread fintech.

| Metric | Typical Bank Rate (e.g., Bidvest) | Zero-Spread Fintech Alternative |

|---|---|---|

| Amount to Convert | R50,000 | R50,000 |

| Quoted Exchange Rate | 18.87 ZAR/USD | 18.50 ZAR/USD |

| Transaction Fee | R500 (Admin Fee) | R250 (0.5% of R50,000) |

| Total ZAR Cost | R50,500 | R50,250 |

| Final USD Received | $2,649.97 | $2,702.70 |

The results speak for themselves. The seemingly lower flat fee from the bank is a misdirection; the real cost is buried in the poor exchange rate they offer.

Transaction One: A R50,000 Payment

For smaller, everyday payments, it’s easy to dismiss small differences in the rate. But these small amounts add up fast, especially if you’re making several payments each month.

On a R50,000 transfer, the fintech route puts an extra $52.73 in your supplier’s pocket. It might not sound like much, but if you make ten of these payments a year, that’s over $500 in savings. It's clear the hidden spread costs you far more than the bank's visible fee.

Transaction Two: A R250,000 Payment

When the payment values climb, the impact of the spread becomes impossible to ignore. This is where a bank's percentage-based markup really starts to sting.

The difference here jumps to $262.83. At this point, the bank's hidden spread has completely overshadowed its flat admin fee. The fintech's transparent fee, while a higher rand value, results in a much better outcome because you aren't also losing money on a marked-up rate.

Transaction Three: A R1,000,000 Payment

For large transactions like settling a major invoice or moving export revenue, your choice of forex provider directly hits your profit margins. That 'small' 2% spread is no longer small—it’s a massive hidden cost.

On a one-million-rand payment, the difference is a staggering $1,051.32. This is the ultimate proof that the hidden spread in Bidvest Bank exchange rates (and those of other traditional banks) is the real cost driver, making any admin fee almost irrelevant.

Ultimately, this comparison shows that looking only at the quoted rate is a recipe for losing money. The true test is how much foreign currency lands on the other side. By getting rid of hidden spreads, modern platforms offer a much clearer and more affordable way for businesses to handle their money across borders.

Putting Forex Rates to the Test: Real-World Scenarios for SA Businesses

Theory is one thing, but what really matters is how these exchange rates play out in the real world. For any South African business trading internationally, the choice between a traditional bank and a fintech provider isn't just an admin task—it directly hits your bottom line, influencing everything from profit margins to your ability to predict cash flow.

Let's walk through two everyday situations for a local SME: an importer paying a supplier in US dollars and an exporter bringing foreign earnings home. These examples will show you just how much the hidden costs baked into typical Bidvest Bank exchange rates can really cost your business.

Scenario One: The Importer Paying a USD Invoice

Imagine your business has a $15,000 invoice to pay an overseas supplier. Getting this payment sorted efficiently is key to keeping that supplier happy and, more importantly, protecting your profit on the goods.

With a traditional bank, you’re usually quoted a rate that already has their spread built in. It might seem like a small percentage, but when combined with the rand's natural volatility, it injects a huge amount of uncertainty into your costing.

For businesses involved in international trade, securing financing from lenders is a critical part of their operations, indirectly influencing their foreign exchange needs. Transparent cost structures, including clear foreign exchange rates, are vital for maintaining the financial health required by these financial services for lenders.

Just look at the recent ZAR-USD swings—at one point, the rate plunged 5.7% from its six-month average. For an importer, a drop like that can blow your budget. A standard 2% bank spread on a R1 million payment (at a rate of 16.38 ZAR/USD) already costs you an extra R32,760. When you add currency risk on top, it’s clear why transparent, real-time rates are so vital for predictable cash flow. You can discover more insights about the operational review of financial services on bidvest.co.za.

Let's crunch the numbers on that $15,000 invoice, assuming the mid-market rate is 18.50 ZAR/USD:

- Traditional Bank: Offers you a rate of 18.87 ZAR/USD (which includes a 2% spread) and adds a R500 admin fee. Your total landed cost is R283,550.

- Modern Fintech: Gives you the real rate of 18.50 ZAR/USD and charges a clear 0.5% fee. Your total landed cost comes to R278,887.50.

The difference here is R4,662.50. That’s not just a "saving"—it's cash you can put straight back into your business for stock, marketing, or anything else. For an importer, this has a direct impact on the landed cost of your goods, which in turn affects your retail price and how competitive you can be.

Scenario Two: The Exporter Bringing Revenue Home

Now, let's flip the coin. An exporter has just earned $50,000 and needs to convert it to rands to pay local salaries, rent, and other operational costs. The goal is simple: get the most rands for your dollars.

The process is the reverse of importing, but the mechanics are identical. The bank will quote a "buy" rate for your dollars that’s lower than the mid-market rate, creating a spread that works in their favour, not yours.

Using the same mid-market rate of 18.50 ZAR/USD, here’s how it breaks down:

- Traditional Bank: Buys your dollars at a rate of 18.13 ZAR/USD (a 2% spread applied the other way). After their fee, you receive R906,500.

- Modern Fintech: Converts your funds at the real 18.50 ZAR/USD rate, minus a simple 0.5% fee. You receive R920,375.

By going the fintech route, you end up with an extra R13,875 in your bank account. That's a serious boost to your cash flow, making it easier to run your business without leaving a chunk of your hard-earned revenue on the table due to opaque banking fees. These scenarios make it crystal clear: choosing your foreign exchange provider is a strategic financial decision, not just a box to tick.

Actionable Strategies to Reduce Your Foreign Exchange Costs

Knowing about the hidden costs in foreign exchange is one thing, but actually doing something to reduce them is what really counts. For any South African business trading internationally, shifting from just accepting the first rate you're given to actively managing your FX costs can free up a surprising amount of cash. It starts with treating every single international payment as a chance to get the best possible value.

The main goal is simple: bring some much-needed transparency to what has always been a murky process. When your finance team understands the game, they can start peeling back the layers of fees and spreads that quietly eat into your profits. This puts your business back in the driver's seat, turning you from a price-taker into a sharp financial operator.

Always Benchmark Against the Mid-Market Rate

Before you even think about accepting a forex quote, you need a baseline. That baseline is the mid-market rate—the true, neutral exchange rate at any given moment. Think of it as the midpoint between what banks are willing to buy and sell a currency for.

You can find the live mid-market rate in seconds on financial news sites like Reuters or even just with a quick Google search. This number is your most powerful tool. When your bank gives you a quote, compare it to the mid-market rate right away to see the spread they've built in.

For instance, if the mid-market ZAR/USD rate is 18.50 but your quote is 18.87, you can immediately see you're being charged a spread of about 2%. This simple check cuts through the jargon and shows you the real cost of the deal.

Demand a Full Breakdown of All Fees

The spread is often just the beginning. International payments are notorious for a trail of other fees that can quickly add up. To understand the total damage, you have to insist on a full breakdown of costs before you agree to the transfer.

Ask your provider to list out every single charge. This should include:

- SWIFT Fees: The cost of using the global payment network.

- Correspondent Bank Fees: Charges from intermediary banks that might handle the payment along the way.

- Administrative or Processing Fees: A simple flat fee for processing the transaction.

Only when you can see the spread and all the itemised fees can you calculate the true "landed cost" of your payment.

Your goal should be to eliminate as many variables as possible. The more elements of the cost are hidden or bundled, the less control you have. Aim for providers who unbundle costs and show you exactly what you're paying for.

Explore Modern Financial Platforms

These frustrations with hidden spreads and bundled fees are exactly why modern financial platforms were created. They run on a completely different model built around transparency. Instead of making their money from an inflated spread, they give you direct access to the real mid-market rate.

Platforms like Zaro provide businesses with the mid-market rate and then charge a single, clear fee for the service. This approach takes all the guesswork out of international payments. You know the exact rate and the precise cost upfront, which makes budgeting accurate and cash flow predictable. For South African importers and exporters, the real profitability of goods is directly tied to the exchange rate, making understanding and calculating gross margin a critical skill—one made much easier with transparent FX costs.

By putting these strategies into practice, your business can seriously cut its foreign exchange overheads. The key is to be proactive: always check the rates, demand full transparency, and look at alternatives that actually fit your financial goals.

Your Bidvest Bank Exchange Rate Questions, Answered

Foreign exchange can feel like a minefield, especially when you're trying to protect your business's profit margins. Let's tackle some of the most common questions South African business owners have about Bidvest Bank's rates and how they stack up against newer, more transparent options.

How Do I Find the Real, Live Bidvest Bank Exchange Rate for My Business?

Getting a firm, executable exchange rate from a traditional bank isn't as simple as checking their website. The rates you see publicly displayed are usually "indicative" – they're a guide, not the final rate you'll actually get for your transaction.

To get a real rate for a business payment, you need to contact the Bidvest forex desk directly or log into their business banking portal and request a live quote for your specific amount and currency pair. It’s critical to remember that this quote will have their profit margin, the spread, already built into it.

The only way to know the true cost is to compare the rate Bidvest quotes you against the live mid-market rate. You can find this easily on sites like Reuters or even with a quick Google search. This simple check instantly reveals the real markup you're being asked to pay.

Are There Hidden Fees When I Use Bidvest Bank for International Payments?

The biggest 'hidden' cost is almost always the exchange rate spread. It's the gap between the wholesale rate banks trade at and the retail rate they offer you. It's not listed as a fee, but it works like a hefty markup on the currency itself, directly eating into the final amount that gets delivered.

But the spread isn't the only thing to watch out for. Several other charges can unexpectedly inflate the total cost of your payment. Keep an eye out for:

- SWIFT Network Fees: A standard charge for using the global SWIFT network to send money abroad.

- Correspondent Bank Fees: These are tricky. They're fees charged by intermediary banks that might handle your funds on their way to the final destination. These are often unpredictable and can be skimmed off the top of your payment without warning.

- Admin or Processing Fees: A flat fee the bank might charge just for handling the transaction.

To avoid any nasty surprises, always ask for a complete, detailed breakdown of all fees before you give the go-ahead. It’s the only way to calculate your true landed cost and make a smart decision.

How Can Modern Platforms Offer Better Rates Than a Major Bank?

It really boils down to two completely different business models. For decades, banks have made a significant chunk of their revenue from the spread on foreign exchange; it's a core profit centre. This model has always relied on a certain lack of transparency, where the real cost is hidden inside the rate.

Modern fintech platforms were built specifically to challenge this. Their entire structure is designed around transparency and efficiency. They cut out the hidden costs by giving businesses direct access to the real mid-market exchange rate—the very same rate banks use when they trade with each other.

Instead of a variable spread plus a cocktail of other fees, these platforms usually charge one single, clear fee. This upfront approach means you see the full cost from the start, taking the guesswork out of international payments and seriously cutting down the overhead. The focus is on providing a clean, efficient service, not on profiting from the currency conversion itself.

Can I Lock in a Rate with Bidvest Bank for a Future Payment?

Yes, absolutely. Bidvest Bank, like other big banks, offers tools to manage currency risk, most commonly through Forward Exchange Contracts (FECs). An FEC is a simple agreement that lets your business lock in an exchange rate today for a payment that needs to be settled at a future date.

This is an incredibly useful tool for any business needing to nail down its budget. For instance, an importer can lock in a rate for a supplier payment due in 90 days, completely protecting the business from the rand weakening in the meantime.

But here’s the crucial part: the forward rate the bank quotes you will also include their spread over the mid-market forward rate. So, while an FEC gives you certainty and protects you from volatility, you're still paying that underlying cost of conversion. When you're considering an FEC, you should still benchmark the bank's forward rate to see what the built-in cost is and compare it to alternatives. This way, you're not just managing risk—you're optimising your costs too.

At Zaro, we give South African businesses direct access to real, mid-market exchange rates with zero spread. This makes your international payments transparent, predictable, and far more cost-effective. Stop losing money to hidden markups and see exactly how much you can save by visiting https://www.usezaro.com.