If your South African business trades internationally, you know the drill. You’re constantly juggling currency swings, tricky payment systems, and a mountain of regulations. This guide is all about how Bidvest Bank Foreign Exchange services are built to tackle these very problems. We'll get into the specifics of their approach, which is all about helping businesses like yours protect their profits and make cross-border transactions a whole lot simpler.

A Practical Guide to Bidvest Bank Forex

Consider this your roadmap. We’ll walk through everything from their core services and how they price them, to real-world examples of local companies putting their tools to good use. Let's be honest, the foreign exchange world can feel like a maze of jargon and hidden fees designed to chip away at your revenue.

Whether you’re importing parts, paying for overseas software, or bringing your export earnings back home, getting this right is crucial for your financial health. A sudden dip in the Rand can wipe out the profit on a deal, and clunky payment systems can mean late payments to suppliers, which nobody wants.

This is exactly where a specialist partner like Bidvest Bank steps in. Their whole game is to bring some predictability and control back into your international finances.

What You Will Learn in This Guide

Over the next few sections, we're going to break down some complex topics into simple, practical advice. You'll get a solid handle on:

- Core Forex Services: How tools like Spot Contracts and Forward Exchange Contracts (FECs) actually work on a day-to-day basis.

- Pricing and Fees: A clear breakdown of exchange rates, spreads, and SWIFT fees so you know exactly what you're paying for.

- The Transaction Process: We'll map out an international payment step-by-step, from getting your account set up to the moment the money lands.

- Real-World Use Cases: Tangible examples showing how local importers and exporters use these services to gain an edge.

By the time you're done, you’ll have a clear picture of whether Bidvest is the right fit to help your business take on the global market.

A Look Inside Bidvest Bank's Core Forex Services

When you're running a business that trades internationally, you need practical tools, not abstract financial theories. Bidvest Bank's foreign exchange services are built to solve the real-world problems South African companies deal with every day, from paying suppliers in another country to shielding your profits from a shaky Rand.

Let's unpack what they actually offer.

The most basic tool in the box is the Spot Contract. Think of it like buying foreign currency "on the spot" for an immediate need. You agree on a rate today, and the deal is done within two business days. It’s the go-to solution for those one-off payments you need to get out the door now.

This pay-as-you-go method is perfect for settling a last-minute invoice or making a quick international purchase. The trade-off for this simplicity, of course, is that you’re exposed to whatever the market is doing on that day. You get the rate you get, for better or worse.

Locking in Future Rates with Forward Exchange Contracts

For businesses that need to plan ahead, Bidvest offers Forward Exchange Contracts (FECs). An FEC is essentially a price-lock for your future currency needs. You agree on an exchange rate today for a payment that will only happen weeks or even months down the line.

This is a game-changer for importers who need to know their exact cost of goods. By locking in a rate, you take the guesswork out of your profit margin, no matter how the Rand fluctuates between placing an order and paying the supplier.

An importer in Johannesburg needs to pay a US supplier $100,000 in three months. They’re worried the Rand might weaken, eating into their profits. So, they book an FEC with Bidvest Bank. This guarantees their exact ZAR cost today, completely removing the currency risk and giving them absolute budget certainty for that shipment.

Having this kind of foresight is what separates good financial management from wishful thinking in international trade. It turns one of your biggest variables—the exchange rate—into a fixed, predictable cost.

Getting Your Money Where It Needs to Go

Of course, exchanging currency is only half the battle; you also have to move it. Bidvest also handles the actual mechanics of global payments, ensuring your money reaches suppliers, partners, or service providers across the world. They navigate the complexities of the SWIFT network to make sure your cross-border transfers are executed without a hitch.

As a bank with deep roots in the South African market, this is where Bidvest's experience really shows. With over 150 years in the forex game, their services are fine-tuned for the specific needs of local importers and exporters. Their recent performance tells a compelling story: loans and advances jumped by 24.1% to R4.2 billion, fuelled by a solid understanding of how to navigate exchange controls in over 30 currencies. For a deeper dive, you can check out their 2024 annual results.

The bank’s own website gives a straightforward overview of how these services are packaged for businesses, showing a clear focus on providing a complete toolkit—from simple transactions to more advanced hedging tools—all designed for South Africa's unique regulatory landscape.

How to Read Bidvest Bank Forex Rates and Fees

When you’re dealing with international payments, understanding the real cost of a Bidvest Bank foreign exchange transaction is crucial for protecting your profit margins. It’s not just about the exchange rate you see on the screen; a few different components make up the final amount that leaves your account. Getting to grips with these is the key to budgeting properly and avoiding any nasty surprises.

The Real Exchange Rate: More Than Meets the Eye

It all starts with something called the interbank rate. Think of this as the wholesale price for currency – it’s the rate banks use to trade huge sums with each other. But here’s the thing: that’s not the rate you get.

The rate you’ll be quoted includes a spread. The spread is simply the difference between that wholesale interbank rate and the retail rate the bank offers you. It’s how the bank makes its money on the deal, covering its own risk and service costs.

A simple way to think about it is like a fruit and veg wholesaler selling apples for R10 a kilo. Your local grocer buys them and sells them to you for R12. That R2 difference is their margin, or spread. In the world of forex, the bank is the grocer, and the spread is their built-in fee.

Breaking Down the Total Cost

Beyond the spread hidden inside the exchange rate, you’ll usually find a couple of other direct costs. These are the straightforward fees for the service of physically moving your money from South Africa to another country.

The most common one is the SWIFT transfer fee. The SWIFT network is the global messaging system that financial institutions rely on to send secure payment instructions across borders. Like any other bank, Bidvest charges a fee to cover the admin and network costs of sending your payment through this system.

This fee is almost always a flat amount, no matter how much money you’re sending. If your business makes frequent, smaller payments to overseas suppliers, these fixed fees can really start to stack up, so they’re an important part of the equation.

A Practical Payment Example

Let's walk through what this looks like in a real-world scenario. Imagine your business owes a supplier in Germany €5,250 and you need to pay them from your ZAR account.

Here’s a simplified look at how the costs might break down:

- The Interbank Rate: First, we check the wholesale rate. Let’s say the ZAR/EUR rate is R20.00 for every €1.00.

- The Quoted Rate (with Spread): Bidvest Bank might quote you a rate of R20.15 to the Euro. That extra R0.15 is their spread.

- Currency Conversion Cost: To buy the €5,250 you need, the calculation is: €5,250 x R20.15 = R105,787.50.

- SWIFT Fee: On top of that, you’ll have the transfer fee. Let’s use a standard figure of R350.

- Total Cost: The total debit from your account will be R105,787.50 + R350 = R106,137.50.

By piecing together the base rate, the bank's spread, and any transfer fees, you get a crystal-clear picture of the total cost before you hit send. That kind of clarity is absolutely essential for sharp financial planning and keeping your supplier relationships on solid ground.

A Practical Guide to Making a Forex Transaction

Sending money overseas for the first time can feel a bit daunting. There are rules, documents, and jargon to navigate. But once you understand the key steps, it becomes a straightforward process. With a partner like Bidvest Bank, the journey from setting up your account to your supplier getting paid is a well-defined path, built to satisfy South Africa's strict exchange control regulations.

Let's walk through it, starting with the setup.

Getting Started: The Onboarding Process

Before you can even think about exchange rates, your business needs to be onboarded and verified. This means setting up a business forex facility.

This first step is heavy on compliance, but it’s non-negotiable. South African law, specifically the Financial Intelligence Centre Act (FICA), requires every business to provide a full set of documents. This isn’t just Bidvest Bank’s internal policy; it's a legal safeguard against financial crime, ensuring all cross-border payments are transparent and legitimate.

To get going, you'll need to gather a few key documents:

- Company Registration Papers: Your official CIPC documents.

- FICA for Directors: Certified ID copies and recent proof of residential address for every director.

- Proof of Business Address: A recent utility bill or a similar official document confirming your company's physical location.

- Account Opening Resolution: A formal, signed decision from the company's directors authorising the opening of the forex facility.

Once your paperwork is approved and the account is active, you're ready to trade.

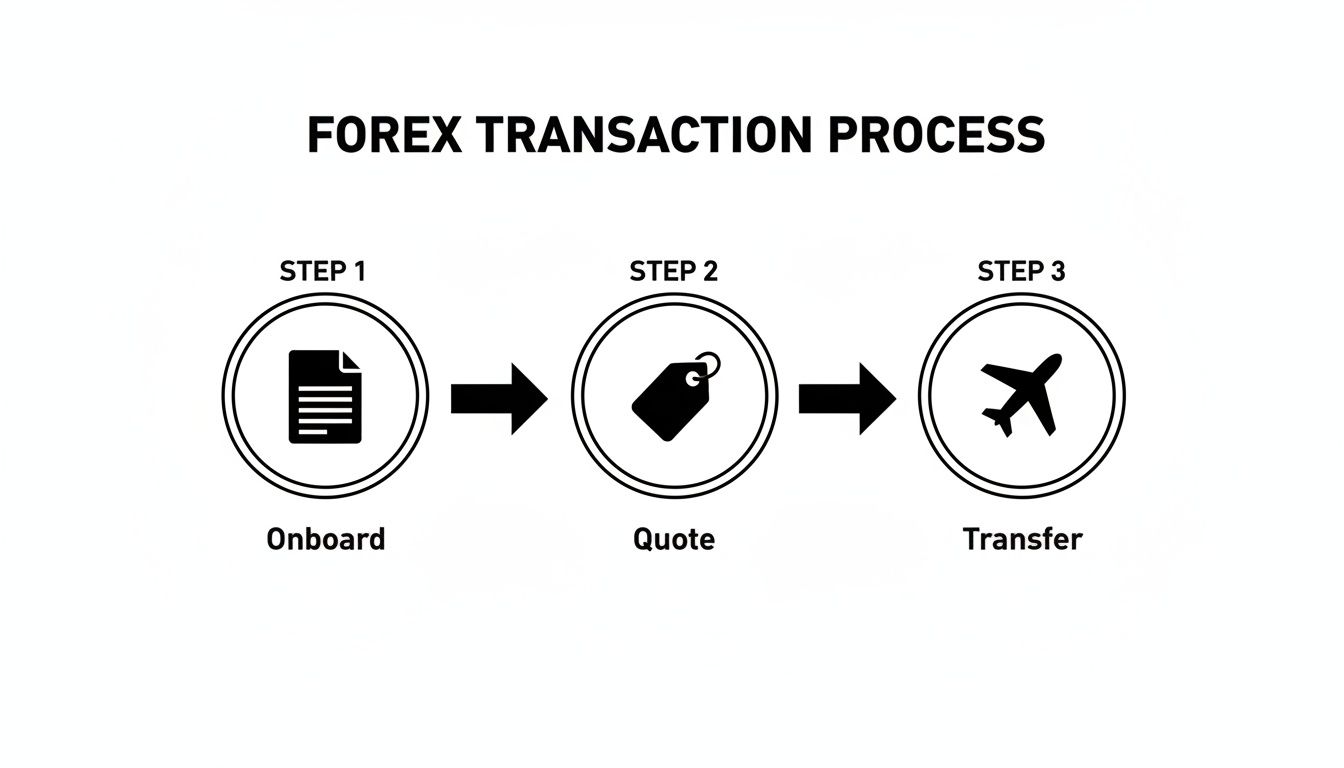

The infographic below breaks down the typical Bidvest Bank foreign exchange transaction into three simple stages.

It really boils down to three core actions: getting your account set up, locking in your rate, and sending the funds on their way.

Executing Your International Payment

With your account in place, making a payment is a clear, sequential process. Every step is designed to ensure the transaction is compliant with South African Reserve Bank (SARB) regulations, which demand a valid reason and supporting proof for every cent that leaves the country.

Here's how a standard transaction plays out:

- Get a Live Quote: You'll connect with your Bidvest Bank dealer to get a live exchange rate for the currency pair you need (e.g., ZAR to USD). Remember, these rates move constantly, so the quote is only valid for a very brief window.

- Book the Rate: If the rate works for you, you verbally agree to "book" it. This is important – it’s a binding commitment to transact at that exact price.

- Submit Supporting Documents: Now you need to provide the paperwork that validates the payment. For most businesses, this is simply the supplier's invoice, which must clearly state what goods or services you're paying for.

- Funds Transfer via SWIFT: With the rate booked and documents approved, Bidvest Bank processes the payment through the global SWIFT network. The funds are then sent from your account to your supplier’s bank.

Most international SWIFT transfers take between 1 to 3 business days to land in the recipient's account. It's always smart to factor in potential delays like different time zones, international public holidays, or weekends, especially when a payment is time-sensitive.

How South African Businesses Use Bidvest Forex

Financial theory and jargon can only take you so far. To really get a feel for what a service can do, you need to see it in the real world. So, let’s look at how Bidvest Bank foreign exchange solutions play out in the day-to-day operations of South African businesses. These scenarios highlight how the right tool can solve very specific challenges in global trade.

Picture a boutique wine exporter in the Western Cape. They’ve just been paid €50,000 for a large shipment to Germany. Their biggest headache? Converting those euros into rands without a sudden, nasty swing in the currency market eating into their hard-won profits. This is precisely where Bidvest's expertise comes in.

Protecting Revenue for Exporters

For our wine exporter, just converting the euros on the day they arrive is a roll of the dice. If the rand happens to strengthen against the euro that day, their revenue shrinks right before their eyes.

To sidestep this risk, they can use a Forward Exchange Contract (FEC). Weeks before the payment is even due, they work with Bidvest to lock in a favourable EUR/ZAR rate. When the €50,000 finally lands, the conversion happens at that pre-agreed rate. No surprises, no last-minute panic. Their rand income is guaranteed, regardless of what the live market is doing.

By securing a rate in advance, the exporter transforms a volatile variable into a fixed number on their financial forecast. This proactive step is crucial for businesses operating on tight margins, ensuring that a successful sale remains profitable when the money comes home.

Streamlining Payments for Importers

Now, let's flip the coin. Think about a retailer in Gauteng who imports electronics from China. They have a $75,000 invoice to settle, and their main worry is getting the payment to their supplier promptly and without a hitch. A delayed or incorrect payment could throw their entire supply chain into chaos and damage a crucial business relationship.

Using Bidvest for a spot transaction, the retailer can get a live USD/ZAR rate, book it instantly, and have the funds sent efficiently through the SWIFT network. The bank manages the complexities of the international transfer, making sure the right amount hits the supplier’s account with all the necessary regulatory paperwork sorted.

This seamless execution is everything. For an importer, paying on time is just as important as getting a good price on the goods. A reliable banking partner removes the operational friction from international procurement.

Managing International Operational Costs

It's not just about large import and export transactions. Consider a local software company that uses various international cloud services and subscribes to software billed in US dollars. These small, recurring monthly payments can become a real financial headache if you don't manage them properly.

A Bidvest Bank foreign exchange facility gives this tech firm an efficient way to handle these critical payments. They can either make individual spot payments each month or, if the costs are substantial, use an FEC to lock in a rate for several months' worth of subscription fees at once.

This kind of practical support has been a core focus for the bank since it became fully licenced in 2000, quickly establishing itself as a leading specialist with a national footprint. They even pioneered prepaid currency cards offering up to 12 currencies—the widest range in the country—showing a long-standing commitment to solving diverse international payment needs. You can dig deeper into their historic financial services offerings to see how far back this expertise goes.

To make this even clearer, the table below shows how different business needs line up with specific Bidvest solutions.

Matching Business Needs with Bidvest Forex Solutions

| Business Scenario | Challenge | Recommended Bidvest Solution | Key Benefit |

|---|---|---|---|

| Exporter receiving EUR | Protecting rand value of foreign income from currency volatility. | Forward Exchange Contract (FEC) | Locks in a future exchange rate, guaranteeing revenue and profit margin. |

| Importer paying USD | Ensuring a supplier is paid quickly and accurately to avoid delays. | Spot Transaction via SWIFT | Fast, reliable, and compliant international payment execution. |

| Tech firm with monthly USD bills | Managing recurring small international payments efficiently. | Spot Payments or FEC | Simplifies operational costs and provides budget certainty. |

| Freelancer repatriating income | Bringing foreign earnings home without excessive fees or poor rates. | Inward SWIFT Transfer | Securely receives funds from abroad into a local ZAR account. |

These examples show that whether you're moving large sums for trade or managing smaller operational costs, having the right forex tool is key to navigating the global market successfully.

Choosing Your Forex Partner: Bank vs. Fintech

When it comes to managing your business's international payments, you're standing at a fork in the road. On one path, you have the institutional heft of a traditional bank like Bidvest. On the other, the agile, tech-first approach of a modern fintech.

There’s no single "right" answer. The best partner for your business hinges entirely on your specific needs—how much you send, how often you send it, and how complex your transactions are.

The Case for a Traditional Bank

A bank like Bidvest Bank foreign exchange brings decades of hands-on experience and regulatory know-how to the table. Their real strength is in the human element: personalised advice from dedicated dealers who can help structure large or complex deals.

Imagine you're a major importer needing to hedge against a volatile Rand. A bank's expertise in creating sophisticated financial instruments is invaluable. That deep institutional knowledge offers a layer of strategic security that pure technology often can't match.

The Rise of Fintech Alternatives

Then you have the fintechs, like Zaro. These platforms were born from technology, and it shows. They typically offer slick, intuitive user interfaces, incredibly fast onboarding, and often tighter spreads, particularly for smaller, more frequent payments.

A freelance developer getting paid from the US every month or a small e-commerce shop paying dozens of suppliers in China would likely find a fintech's self-service model far more efficient. The whole game is about speed, transparency, and putting you in control through a simple online dashboard.

Ultimately, you’re weighing a trade-off. Do you need the deep advisory relationship and complex products a bank offers? Or does the speed, simplicity, and potential cost savings of a fintech better suit your day-to-day transactions?

It’s also worth noting that the lines are blurring. You'll find many of the leading banks embracing stablecoins and digital assets as they adapt to the new financial landscape.

To make the right call, map your business reality against what each provider does best. Take a hard look at your typical transaction size, frequency, and complexity. This simple exercise will give you a clear picture of whether the robust, relationship-driven banking model or an agile, tech-forward fintech is the right fit for your global ambitions.

Got Questions? Here Are Some Straight Answers

When you're getting into the nitty-gritty of a Bidvest Bank foreign exchange facility, a few questions always pop up. Let's get them answered clearly and directly.

Account and Transaction Basics

What paperwork will Bidvest Bank ask for to open a business forex account?

You'll need the usual suspects: your CIPC company registration documents, proof of your business address, and FICA documents for all the directors (ID and proof of residence). Bidvest will also need a formal company resolution authorising the account opening and will give you a full checklist so nothing gets missed.

How long does it actually take for an international payment to arrive?

Once you’ve locked in a rate and sent through all the correct paperwork, a standard international payment via SWIFT should land within 1 to 3 business days. Keep in mind, this can stretch a bit depending on where the money is going and if there are any public holidays on either side.

Holding and Hedging Currency

Can my business hold foreign currency in a Bidvest Bank account?

Absolutely. Bidvest Bank offers what's known as a Customer Foreign Currency (CFC) account. These are perfect for businesses that get paid and need to pay out in the same foreign currency, as it lets you sidestep unnecessary conversion costs.

A CFC account is a game-changer for managing currency risk. Imagine holding US dollars from a client and using those same dollars to pay an American supplier. You avoid converting from rand every time, which protects your bottom line from a volatile market.

Is there a minimum amount for a Forward Exchange Contract?

The minimum deal size for a Forward Exchange Contract (FEC) isn't set in stone; it can change depending on what the market is doing and which currencies you're dealing with. The best move is to have a quick chat with a Bidvest Bank forex dealer for the most up-to-date info.

For businesses looking for a different approach with zero hidden markups, Zaro provides cross-border payments at the real exchange rate, completely free of SWIFT fees. You can see how to simplify your international finance at the Zaro website.