When Bidvest Bank quotes you a forex rate, what you're seeing isn't the raw market rate. Instead, they take the live interbank exchange rate and add a markup, which is known in the industry as a forex spread. This difference between the wholesale rate banks get and the rate you, the client, receive is where they make their money. That spread, combined with other fees like SWIFT charges, makes up the true cost of your international payment.

Decoding Bidvest Bank Forex Rates For Your SMB

If you're running a South African small or medium-sized business (SMB) that trades internationally, getting to grips with the real cost of foreign exchange is non-negotiable. It's a classic mistake to just Google a currency pair and assume that’s the rate you'll get. What you’re seeing online is the mid-market rate—the perfect, halfway point between what buyers are paying and sellers are asking on the global markets.

Unfortunately, that's not the rate your business will ever transact at with a bank.

Bidvest Bank, like any commercial bank, will offer you a client rate. The gap between that client rate and the mid-market rate is the forex spread, and it’s the bank's main profit driver on your transaction. This cost is rarely broken out for you, which means it’s a hidden fee that can quietly eat into your profit margins over time.

Key Cost Components

It's not just about the spread, though. A handful of other explicit fees get tacked on, adding to the total expense of sending money abroad. You need to watch out for:

- SWIFT Fees: A standard charge for sending payments through the international SWIFT network.

- Administrative Fees: The bank's own processing fees for handling the transaction.

- Receiving Bank Fees: A sneaky one. This is a fee deducted by the beneficiary’s bank before the funds even hit their account.

The Bidvest Bank website does a good job of positioning its services for businesses that need to navigate these international waters.

They lean heavily on their reputation as a specialist in foreign exchange, a core part of their identity in the South African financial scene. But to accurately budget for paying suppliers or bringing profits home, you have to look past the marketing and add up all these costs.

The crucial takeaway for any business owner is to calculate the 'landed cost' of every transaction—the final amount in ZAR after all spreads and fees are accounted for. Only then can you make a true comparison between providers.

To make this clearer, let's break down the main cost drivers you'll encounter with a bank like Bidvest.

Key Cost Components of Bidvest Bank Forex Transactions

The table below gives a quick summary of the primary costs you'll face in a typical forex transaction. Understanding where these charges come from is the first step to managing them effectively.

| Cost Component | Description | Impact on Your Business |

|---|---|---|

| Forex Spread | The percentage markup added to the mid-market exchange rate. | This is typically the largest hidden cost, directly reducing the value of your currency conversion. |

| Transaction Fees | Fixed charges for processing payments, such as SWIFT or admin fees. | These fees add a flat cost to each payment, disproportionately affecting smaller, frequent transactions. |

| Receiving Bank Fees | Charges levied by the recipient's bank to process the incoming funds. | An unpredictable cost that can reduce the final amount your supplier or partner receives. |

By being aware of each component, you can start asking the right questions and avoid surprises.

It's also worth noting that despite a tough economic climate, Bidvest Bank seems to be managing its risk well. Their credit loss ratio improved to 0.3% from 1.0% in the previous year, which points to stability in a volatile market. You can dig deeper into their performance by checking out their latest annual results presentation.

Unpacking The True Cost Of Forex Spreads And Fees

When you check Bidvest Bank forex rates, the headline rate is just the beginning. Hidden margins and explicit charges determine the total sum that comes out of your ZAR account. Breaking down each component is the only way to forecast costs with confidence and protect profits.

The single biggest drag on your budget is the forex spread. This silent margin is the difference between the mid-market benchmark and the client rate you’re quoted. In effect, it’s the bank’s fee for handling currency conversion. Over time, and especially with large or frequent transfers, those few cents per dollar can translate into thousands of rand.

That spread isn’t a fixed figure. It flexes with market volatility, transaction value and the depth of your relationship with the bank. A high-volume client might squeeze a tighter margin, while smaller, infrequent transfers often attract wider spreads.

Explicit Fees You Will Encounter

Aside from the spread, Bidvest adds several clear-cut charges to international payments. These might feel smaller individually, but they stack up—especially on low-value transfers.

• SWIFT Transfer Costs: A standard flat fee for moving money through the SWIFT network.

• Administrative Charges: Bidvest’s own processing or service fee.

• Receiving Bank Fees: Often overlooked, this is what the beneficiary’s bank deducts before crediting funds.

On a R10 000 payment, a R500 SWIFT fee eats up 5% of your transfer. Switch to a R1 000 000 transaction and that same R500 is just 0.05%.

Worked Example: Paying A USD Invoice

Imagine settling a $10 000 USD invoice for a US supplier. Here’s how the numbers break down with Bidvest.

| Rate Type | Rate |

|---|---|

| Mid-Market Rate | 1 USD = R18.20 |

| Bidvest Client Rate | 1 USD = R18.55 |

| Spread Per USD | R0.35 |

| SWIFT & Admin Fee | R450 |

Step 1: Convert at the Client Rate

$10 000 USD × R18.55 = R185 500

Step 2: Reveal the Spread Cost

$10 000 USD × R18.20 = R182 000

Hidden margin = R185 500 – R182 000 = R3 500

This R3 500 represents a 1.92% markup on the mid-market rate.

Step 3: Add Explicit Fees

R185 500 + R450 = R185 950

The final landed cost of R185 950 is what leaves your account to clear that $10 000 USD invoice. Remember, Bidvest’s visible rate isn’t the whole story—you’re paying an extra R3 950 (spread plus fees) on top. Use this figure when you compare providers or build your budget.

How Forex Rates Play Out in the Real World

It's one thing to talk about spreads and fees in theory, but where it really hits home is in your day-to-day business operations. That tiny difference of a few cents on the Bidvest Bank forex rates can snowball into thousands of rands on a single transaction, squeezing your cash flow, eating into profit margins, and even straining supplier relationships.

Let's ground these concepts in reality. We'll walk through two bread-and-butter scenarios for any South African business trading internationally: paying a supplier overseas and bringing export earnings back home. These examples will show you exactly how the forex spread and those extra transaction fees stack up to a total cost that’s often much higher than you'd expect.

Scenario 1: Paying a German Supplier

Let's say your business needs to settle an invoice for €50,000 with a supplier in Germany. You head to Bidvest Bank to make the international payment.

For this example, we’ll use these hypothetical numbers:

- Mid-Market Rate: 1 EUR = R19.80

- Bidvest Client Rate: 1 EUR = R20.15

- SWIFT & Admin Fee: R500

Step 1: Calculating the Base Cost

First things first, let's work out the cost using the rate Bidvest actually gives you. This is the rand amount you need to buy the euros.

€50,000 × R20.15 = R1,007,500

This is the figure you’ll see on your transaction slip from the bank. It seems straightforward enough.

Step 2: Uncovering the Hidden Spread Cost

But what would this have cost at the "real" mid-market rate? This is where we uncover the bank's built-in margin.

€50,000 × R19.80 = R990,000

The difference between what you paid and what it could have cost is the true price of the spread:

R1,007,500 – R990,000 = R17,500

That R17,500 is pure profit for the bank, earned just on the currency conversion. It works out to a markup of roughly 1.77%.

Step 3: Finding the True Landed Cost

Now, to get the full picture, we add the explicit fees to find out what really left your account.

R1,007,500 (Conversion Cost) + R500 (Fees) = R1,008,000

To settle that €50,000 invoice, your business ultimately paid R18,000 more than the mid-market value. This "cost of conversion" is a direct hit to the profitability of the goods you’re importing.

This is the business model that ensures financial stability for institutions like Bidvest. The bank's forex services are supported by solid asset quality and profitability. In fact, non-interest revenue, which includes forex fees, grew by 6% as of June 2019. You can read the full Moody's report on Bidvest Bank for a deeper understanding of its market standing.

Scenario 2: Bringing Revenue Home from the US

Now, let's flip the coin. Your company has just earned $100,000 USD from a client in the States and you need to get it into your South African bank account. When you're selling foreign currency to the bank, they buy it from you at a rate below the mid-market rate.

Here are the numbers for this scenario:

- Mid-Market Rate: 1 USD = R18.20

- Bidvest Client Rate (Buy): 1 USD = R17.85

- Administrative Fee: R350

Step 1: Calculating Your Payout in Rands

First, let's see how much you’ll actually receive in ZAR based on Bidvest's "buy" rate for dollars.

$100,000 × R17.85 = R1,785,000

Step 2: Revealing the Spread's Opportunity Cost

Next, what could you have received if the transaction happened at the mid-market rate?

$100,000 × R18.20 = R1,820,000

The difference between what was possible and what you got is the revenue you lost to the spread:

R1,820,000 – R1,785,000 = R35,000

That R35,000 is an opportunity cost of about 1.92%, which directly reduces your top-line income.

Step 3: Calculating Your Final Net Receipt

Finally, we subtract the bank’s admin fee from the amount you received to find out what actually lands in your account.

R1,785,000 – R350 = R1,784,650

When all is said and done, your hard-earned $100,000 USD becomes R1,784,650. The total cost to bring your money home—combining the spread and fees—comes to R35,350. For an exporter, that's a significant operational cost that needs to be baked into your financial planning and pricing strategies to protect your bottom line.

How Does Bidvest Bank Stack Up Against Modern Forex Alternatives?

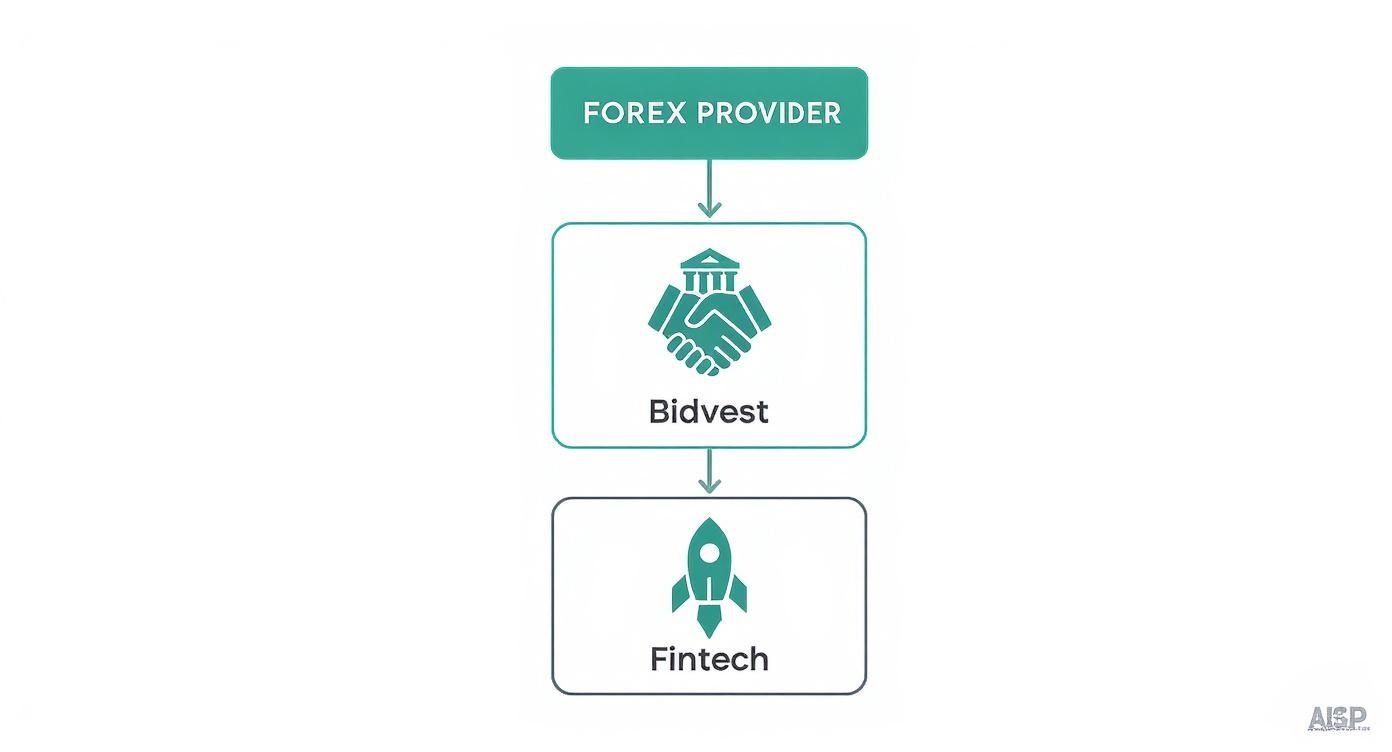

For South African SMBs dealing with international payments, the choice often boils down to two camps: a traditional, established bank like Bidvest or one of the newer fintech services. It’s not just about who moves your money; it’s a trade-off between costs, speed, and the kind of support you get. Getting this choice right is fundamental.

Bidvest Bank has a long-standing reputation as a currency specialist in South Africa. After securing its full banking licence in 2000, it grew its footprint significantly. By 2012, it was already serving clients through 100 branches and offering multi-currency cards for 12 different currencies, a story of diversification you can read about on their investor relations page.

But how does that traditional model compare to the new kids on the block? Let's break it down based on what really matters to a business owner.

Key Differences: The Old Guard vs. The New Wave

When you’re sending money overseas, a few core things make all the difference:

- Rate Transparency: Do you know the real exchange rate, or is there a hidden markup?

- The Spread: What percentage is the provider actually taking on each transaction?

- Speed: How long does it take for your money to actually land in the supplier’s account?

- Usability: Is the platform a dream to use, or a clunky nightmare?

- Support: Can you get a real person on the line when something goes wrong?

For fintechs, the appeal is obvious. They often offer near-spot rates with zero spread, predictable fees with no hidden SWIFT charges, and same-day settlement through modern payment networks. Their platforms are built for self-service, with multi-user access and real-time alerts that give you a clear audit trail.

On the other hand, Bidvest brings the weight of an established bank. You get the trust that comes with a full banking licence, access to complex services like trade finance and structured credit, and the ability to walk into one of their 100 branches for in-person support. They also offer customised hedging strategies and integrated products like currency cards and business loans.

To make things clearer, let's look at a side-by-side comparison.

Feature Comparison Bidvest Bank vs. Modern Fintech Forex

This table gets straight to the point, showing how a traditional bank and a modern fintech approach forex services differently. It highlights the key trade-offs an SMB needs to consider.

| Feature | Bidvest Bank | Modern Fintech Providers |

|---|---|---|

| Rate Transparency | Client rates with hidden spreads are the norm. | You get near-mid-market rates with minimal or zero spread. |

| Typical Spread | Expect a 1.5–2.0% markup on the mid-market rate. | Spreads are much tighter, typically between 0–0.3%. |

| Transaction Speed | Standard transfers usually take 1–2 business days. | Execution is often instant or settled on the same day. |

| Platform Usability | A traditional banking portal, supported by a branch network. | Intuitive online dashboards with modern features like multi-user controls. |

| Dedicated Support | In-person relationship managers, ideal for complex trade finance. | Support is typically online via chat, with scalable support tiers. |

As you can see, the choice isn't black and white. Fintech platforms are designed for transparent pricing and a slick digital experience, while Bidvest excels in providing robust financing solutions and face-to-face advice from seasoned experts.

Fintech providers excel at near-mid-market pricing, while Bidvest’s full-service model supports large, complex deals with in-country expertise.

Your decision should really come down to your specific business needs. If you’re making lots of smaller, frequent payments, a fintech model will likely save you a significant amount of money. But if your business requires structured trade finance or high-value funding, a traditional bank is often the better partner.

Making the Right Call: Situational Recommendations

- For Large or Complex Trade Deals: Go with Bidvest Bank. Their expertise in trade finance, in-person support, and ability to offer structured credit facilities are invaluable for these kinds of transactions.

- For Frequent, Lower-Value Payments: A fintech provider like Zaro is your best bet. You’ll benefit directly from zero spreads, no SWIFT fees, and incredibly fast execution.

- A Hybrid Approach: Many businesses find a sweet spot by using both. Use a fintech platform for your day-to-day supplier payments and keep your relationship with Bidvest for specialised financing needs.

A quick tip on negotiation: Don't be afraid to ask for better terms. By consolidating your transaction volume or committing to a minimum monthly flow, you can often negotiate tighter spreads and get some fees waived.

Building a strong business relationship can yield better forex rates and priority service across all providers.

A Deeper Look at Spreads and Usability

The spread is the hidden margin that eats into your profits on every FX trade. Fintechs typically apply a tiny 0–0.3%, whereas Bidvest’s spread averages around 1.5–2%.

Let's put that into perspective.

- On a R1 million transfer to the US, a fintech's spread might cost you R3,000.

- With Bidvest, that same transfer could cost you R15,000 in spread alone.

That difference adds up incredibly quickly over a year.

It's a similar story with platform usability. Bidvest’s online portal is functional and integrates with its core banking services, but often requires manual data entry. In contrast, Zaro offers API access, allowing you to automate payment reconciliation and get real-time notifications directly into your systems.

Customer Support: Human Touch vs. Digital Efficiency

Here, the models diverge completely. A traditional bank like Bidvest offers relationship managers and dedicated phone lines. You can schedule reviews or walk into a branch for a face-to-face meeting.

Fintech support is digital-first. Think 24/7 online chat, email support, and guided digital onboarding. For many, this is more than enough. The right choice depends entirely on your operational style and how much you value direct, human interaction.

A Quick Case Study

Imagine an SMB paying two European suppliers R500,000 each every month.

- Using a fintech with a 0.2% spread, they would save R1,000 per transaction.

- With Bidvest’s average 1.8% spread, that same payment would cost R9,000 in spread.

Over a year, managing multiple currency payments this way can free up a substantial amount of working capital that could be better used to grow the business.

Key Takeaways for Your Business

- Match your volume to the provider: Align your transaction patterns with the provider's optimal spread tier.

- Use specialists for special needs: For high-value or complex deals, lean on Bidvest’s trade financing and local expertise.

- Embrace efficiency for routine payments: For frequent, smaller transfers, use a fintech for cost savings and speed.

- Automate where you can: Look for providers with APIs that can integrate with your accounting software to cut down on manual work.

Armed with this insight, South African SMBs can approach their forex providers with confidence, negotiate better rates, and build an international payment strategy that is both cost-effective and built for the long term.

Choosing The Right Forex Provider For Your Needs

Picking the right forex partner isn’t about finding a single "best" option. It’s about finding the right fit for how your business actually operates. The best choice really comes down to your transaction volume, the complexity of your deals, and what you value most: speed, cost, or personal support. For most South African SMBs, the decision boils down to a choice between an established bank and a modern fintech.

Making a smart call means looking past the advertised Bidvest Bank forex rates and weighing up the entire package. A traditional bank like Bidvest brings a full financial ecosystem to the table—think trust, well-worn compliance pathways, and access to complex credit instruments that are non-negotiable for certain types of business.

On the other hand, fintechs are built for one thing: efficiency. They attack the main pain points for routine international payments—cost and speed. They do this by stripping away the layers of fees and murky pricing that have been standard in banking for decades, offering a direct, transparent alternative.

When To Choose Bidvest Bank

There are clear-cut situations where sticking with a traditional institution like Bidvest Bank is the smarter strategic move. Their strengths shine in areas where relationships, trust, and complex financial structuring are everything.

You should probably stick with Bidvest Bank if your business:

- Handles large, complex trade finance deals. Bidvest’s deep expertise in structured trade finance, letters of credit, and guarantees provides a level of security and support that fintechs just aren't set up to offer.

- Needs a dedicated, in-person relationship manager. If you value face-to-face advice and having a single person to call for all your banking needs, Bidvest's model is simply better.

- Wants fully integrated banking services. If you need your forex services woven seamlessly into business loans, asset finance, and other corporate banking products, a full-service bank offers a tidy, consolidated solution.

For these high-stakes, intricate transactions, paying a slightly wider spread is often a small price for the specialised support and risk management a bank provides.

When A Fintech Provider Is The Logical Choice

For a growing number of SMBs, the game is all about managing day-to-day operational costs and making cash flow more efficient. This is exactly where fintech platforms like Zaro really come into their own, offering big advantages for routine payments.

A fintech is likely your best bet if your business:

- Makes frequent, smaller international payments. When you’re regularly paying multiple overseas suppliers or contractors, the cumulative cost of bank spreads and SWIFT fees can be staggering. Fintechs often eliminate these, leading to massive savings over time.

- Puts speed and cost-efficiency above all else. If getting money to your beneficiary as fast and as cheaply as possible is the goal, the near-instant settlement and zero-spread models of many fintechs are impossible to beat.

- Prefers a self-service, digital-first platform. Finance teams that are comfortable with tech and prefer online dashboards, automation, and real-time tracking will find the user experience of a fintech far more in sync with their workflow.

This decision tree gives you a quick visual guide to which path might be best for your specific business.

The key takeaway here is pretty clear: the nature of your transactions—whether they're big and complex or small and frequent—should be the main factor driving your choice.

Practical Tips For Negotiating Better Rates

No matter who you choose, remember that the first rate you’re quoted is rarely the final one. Your business has more leverage than you think, especially as your international transaction volume grows. You have to be willing to negotiate.

A strong, long-term business relationship and consistent transaction volume are your most powerful tools for securing better forex rates and having fees waived with any provider.

Here are a few practical tips to help you get a better deal:

- Consolidate Your Volume: Don't spread your forex transactions across multiple providers. By consolidating them with one, you instantly increase your negotiating power. A provider is always more likely to offer preferential rates to a high-volume client.

- Ask for Rate Transparency: Demand a clear breakdown of the spread. Ask your provider, "If the mid-market rate is X, what client rate can you offer me?" This question forces a direct conversation about the margin they’re adding.

- Get Competing Quotes: Before you pull the trigger on a large transaction, get quotes from at least two different providers. Don't be shy about sharing the better quote with your preferred partner and asking if they can match or beat it.

- Discuss Fee Waivers: For businesses with significant volume, it's completely reasonable to ask for a reduction or even a full waiver of administrative or SWIFT fees. Frame it as part of building a long-term, mutually beneficial partnership.

By being strategic—picking the right kind of provider for your needs and actively negotiating your terms—you can turn forex from a hidden cost into a well-managed part of your international growth plan.

Bidvest Forex: Your Questions Answered

When you're dealing with international payments, a few key questions always come up. How do the rates really work? What paperwork will I need? Are there limits? Getting straight answers is crucial for keeping your South African business running smoothly and protecting your profit margins.

Let's cut through the jargon and get into the practical details. Understanding the nuts and bolts of how Bidvest Bank handles forex helps you move from being a passive rate-taker to someone who actively manages their currency strategy. It's about knowing the rules so you can make them work for you.

How Can My Business Get a Better Forex Rate From Bidvest Bank?

Getting a better rate from Bidvest isn't a given, but you've got more negotiating power than you probably realise. The standard "client rate" they show you is just a starting point; the final number is often flexible.

Your best bet? Volume. Banks are always more willing to sharpen their pencils for clients who push a lot of currency through their books. If you’re currently splitting your international payments across a few different providers, think about consolidating them with Bidvest. It instantly makes you a more valuable customer.

Here’s how to approach it:

- Just Ask: Don't hesitate to pick up the phone and speak to your relationship manager, especially if you have a large transfer coming up. If you can get a quote from a competitor, even better. Use it as a bargaining chip.

- Commit to a Flow: Propose a standing arrangement. Tell them you can commit to a certain minimum volume each month or quarter in exchange for a tighter, pre-agreed spread. This gives them predictable business, which they love.

- Play the Long Game: A solid, long-term relationship is your best leverage. If you've been a loyal client for years, you're in a far stronger position to ask for a better deal than someone walking in off the street.

What Documents are Needed For International Payments?

In South Africa, compliance is king. Every single time you send money overseas, you need a paper trail to satisfy both FICA (Financial Intelligence Centre Act) and SARB (South African Reserve Bank) regulations. This is all part of the Balance of Payments (BOP) reporting system, which is there to make sure every cross-border deal is above board.

The exact documents can change depending on what you're paying for, but as a rule of thumb, you should have these ready:

- The Commercial Invoice: This is the big one. It needs to show exactly who you're paying, what goods or services you're paying for, and the total amount due in the foreign currency.

- Transport Documents (for goods): If you're importing physical products, you'll likely need a Bill of Lading or an Air Waybill to prove they've been shipped.

- Proof of Import (for goods): Customs clearance forms, like the SAD500, are often required to complete the picture.

Get your documents sorted before you even think about making the payment. The single biggest cause of transfer delays is a last-minute scramble for the right paperwork. A little bit of prep work here will save you a world of headaches.

Are There Limits on International Transfers?

Yes, South Africa’s exchange controls are very much in effect for both individuals and businesses. For companies making payments for legitimate trade (like paying an overseas supplier), there isn't a hard annual cap. The catch is that every single transaction must be justified with the correct documentation.

Where it gets trickier is for payments that aren't for day-to-day trade, such as making an offshore investment. These fall under different rules and often have specific limits and require pre-approval from the SARB. If you have a large or unusual payment to make, your first call should be to your forex advisor at Bidvest. They can help you navigate the current exchange control regulations and make sure you have all the necessary approvals in place.

Tired of watching hidden spreads and slow transfer times chip away at your profits? Zaro gives South African businesses the real exchange rate with zero markup and no SWIFT fees, making sure more of your money arrives where it’s needed. Find a faster, more transparent way to handle your international payments by visiting the official Zaro website.