For South African businesses that deal with money across borders, Bidvest Currency Exchange is a name that comes up time and again. It's the foreign exchange division of Bidvest Bank, a deeply established player in the local financial scene. For many, it represents the traditional, brick-and-mortar approach to forex—think physical branches, international wire transfers, and face-to-face service.

Getting to Grips with Bidvest Currency Exchange

If you're a CFO in South Africa, you're no stranger to the complexities of foreign exchange. It's a critical part of the job. For decades, Bidvest has been a cornerstone of this space, serving as a go-to for both individuals and companies needing to move money internationally. Their model is that of a classic bank, built on a physical footprint and a reputation that’s stood the test of time.

This means that when a business works with Bidvest, the process feels very structured. Sending a telegraphic transfer to pay an overseas supplier or bringing export revenue back home often involves a fair bit of paperwork and direct interaction with the bank. For many, this hands-on, manual process provides a certain sense of security and control.

What’s on the Table for Businesses?

Bidvest’s offerings are built around the essential needs of any company involved in international trade. Businesses typically lean on them for a few key things:

- International Payments: This is the bread and butter—sending money to suppliers, partners, or service providers abroad using the global SWIFT network.

- Receiving Foreign Currency: When an international customer pays you, Bidvest helps convert those incoming funds back into South African Rand (ZAR).

- Foreign Bank Notes: A classic service that's still important for business travel. If you need physical cash in another currency, they can supply it.

- Risk Management Products: They provide tools like forward exchange contracts (FECs), which let you lock in an exchange rate for a future payment. It’s a crucial way to protect your business from the market’s ups and downs.

At its heart, Bidvest is a massive service, trading, and distribution company with deep South African roots. The financial services arm is just one piece of a much larger, diversified puzzle, which gives it a great deal of stability and reach across the local economy.

The bank's history really highlights its firm position in our financial system. After securing its full banking licence back in 2000, Bidvest Bank grew steadily, reaching 100 branches across the country by 2012. You can dig into their journey and market standing in the Bidvest 2012 annual review.

Unpacking the Real Cost of Bidvest's FX Rates

It's easy to get fixated on the fee you see on a quote from Bidvest for a currency exchange. But the real cost to your business isn't always that obvious. It's actually tucked away inside the exchange rate itself. We're talking about the exchange rate spread.

Think of it this way: a farmer sells avocados to a supermarket for R10 each. The supermarket then sells them to you for R12. That R2 difference isn't listed as a separate "fee" on your slip; it’s the market's profit margin, or "spread," baked right into the price you pay. Foreign exchange works on the same principle, and that markup is where the significant costs hide.

This spread is the gap between the mid-market rate—the real, live rate banks and financial institutions use to trade currencies among themselves—and the rate you, the customer, are offered. For every dollar, pound, or euro you convert, a small slice is taken as a margin. On large international payments, those small slices add up and start to eat into your profits.

The Bottom-Line Impact of Hidden Markups

This pricing model is incredibly profitable for traditional providers. Just look at Bidvest's currency exchange division, which saw its core trading profit jump by an impressive 62.8% to R533.0 million recently. A weaker rand played a part, as it often allows for wider margins on forex deals. You can see the full breakdown in their 2024 annual results booklet.

These figures show how banks can turn currency volatility into profit—the very same volatility that makes it so hard for your business to predict costs.

For any CFO or financial manager handling large export revenues or paying overseas suppliers, this lack of transparency is a major headache. It makes it nearly impossible to accurately forecast the final landed cost of imported goods or know the exact rand value you'll receive from a foreign sale. To really get a grip on this, a solid understanding cash disbursements and financial control is non-negotiable. Every fraction of a percent saved on that spread flows directly to your bottom line.

The real cost of a foreign exchange transaction is rarely the visible fee. It is the invisible spread—the markup on the exchange rate—that quietly chips away at a company's international earnings and inflates its overseas expenses.

How to Calculate Your True FX Cost

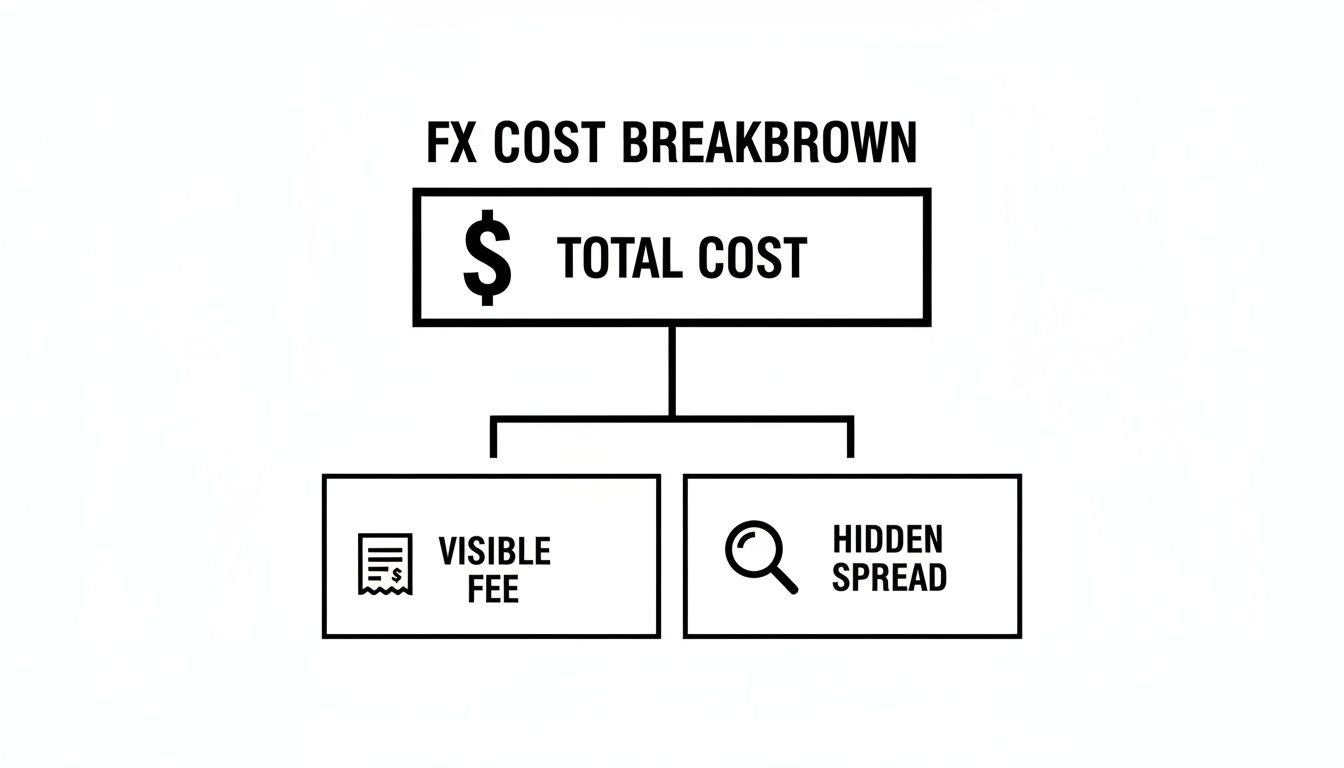

To see what you're really paying, you have to compare the rate you're quoted against the live mid-market rate at that exact moment. The total cost of any Bidvest currency exchange is made up of two parts:

- Visible Fees: These are the straightforward charges you see on your transaction paperwork, like an "admin fee" or "telegraphic transfer fee."

- Hidden Spread: This is the markup built into the exchange rate. You can calculate it by finding the percentage difference between the rate you got and the real mid-market rate.

Add those two together, and you'll have the genuine total cost of your international payment. This simple calculation shines a light on how seemingly small markups can become substantial costs over the course of a year, especially if you're making dozens or even hundreds of transactions.

Weighing Up the Pros and Cons of a Traditional Bank FX

Picking a partner for your foreign exchange is always a bit of a balancing act. For a lot of South African businesses, established players like Bidvest Currency Exchange offer a real sense of security. Their long history and physical branches give a comfort factor that many finance teams still value, especially when a massive, make-or-break payment is on the line. That peace of mind is a big tick in the 'pro' column.

There's also a certain comfort in the old-school, hands-on process. You can actually walk into a branch, talk to a person, and get physical paperwork for your transaction. For decades, this was just how international trade worked, and it's a system many businesses are still very comfortable with.

The Hidden Costs of Sticking with Tradition

But let's be honest, that traditional model comes with some serious drawbacks for a modern, fast-moving business. The biggest headache? The pricing is often a black box. You might see a clear, upfront fee, but the real cost is usually hidden away in the exchange rate spread. This makes it incredibly difficult to know what you're actually paying.

This chart shows you exactly where the costs are hiding in a typical bank FX transaction.

As you can see, the "visible fee" is often just the tip of the iceberg. The hidden spread is where the real, and often unpredictable, cost lies.

It’s not just about the money, though. The operational side can be a real drag. Most international payments are pushed through the SWIFT network, which can be painfully slow. We're talking several days for funds to actually land. That kind of delay can mess with your cash flow and frustrate overseas suppliers who are waiting to get paid.

Operational Bottlenecks and a Lack of Digital Smarts

The problems don't end with slow payments. The compliance process for a Bidvest currency exchange can feel like drowning in paperwork. Manual checks and extensive documentation for every single transaction chew up hours that your finance team could be using for more important, strategic work.

On top of that, the digital platforms offered by traditional banks often feel like they're stuck in the past. They're missing many of the basic features that a modern business needs to run smoothly, which ends up creating huge bottlenecks.

- No Real-Time Tracking: Once you’ve sent a payment, you're pretty much in the dark. There's no way to see where it is or when it will arrive.

- Limited User Access: Often, only one person can access the platform. This slows down everything from approvals to simple payment runs, creating a single point of failure in your finance team.

- Manual Reconciliation: The platforms don't talk to your accounting software. This means someone has to manually reconcile every single payment to close the books each month.

For any business that imports or exports, these delays and admin burdens aren’t just annoying inconveniences. They are genuine roadblocks that stifle growth, kill agility, and eat into your profits in a fiercely competitive global market.

So, while the trust and security of a big bank are undeniable, they come at a steep price: a lack of transparency, slow processes, and outdated technology. This leaves CFOs and finance managers stuck between the comfort of the familiar and the very clear financial and operational wins offered by newer, smarter alternatives.

Bidvest Currency Exchange vs Zaro: A Feature Comparison

To make the differences clearer, let's look at a direct, side-by-side comparison. It really highlights the gap between a traditional bank's offering and what a modern fintech platform like Zaro brings to the table for South African businesses managing international trade.

| Feature | Bidvest Currency Exchange (Traditional) | Zaro (Fintech Alternative) |

|---|---|---|

| Pricing Transparency | Often opaque; costs hidden in the spread | Fully transparent; interbank rates with a clear, low fee |

| Payment Speed | Slow; 2-5 business days via SWIFT | Fast; same-day or next-day payments on many routes |

| Real-Time Tracking | Not available; no visibility after sending | Yes; end-to-end tracking from send to receipt |

| Multi-User Access | Typically limited to a single user | Yes; unlimited users with customisable permissions |

| Accounting Integration | Manual reconciliation required | Yes; seamless integration with Xero and other software |

| BoP Reporting | Manual process involving physical forms | Automated; integrated digital BoP reporting |

This table shows it's not just about small improvements. The difference represents a fundamental shift in how businesses can manage their international payments. For a CFO or exporter, the features offered by Zaro translate directly into saved time, lower costs, and better control over the entire financial workflow.

Exploring Modern Fintech Alternatives for Global Payments

For years, Bidvest Currency Exchange has been a reliable, go-to option for many South African businesses. But the world of international payments has been completely shaken up. A new wave of financial technology (fintech) companies is changing the game, offering a fundamentally different way to handle money across borders that sidesteps the old banking model.

This shift presents a massive opportunity for local businesses. Platforms like Zaro operate on a philosophy that’s worlds away from traditional foreign exchange. Instead of making their money on hidden markups buried in the exchange rate, their model is built on total transparency. You get direct access to the real mid-market exchange rate—the same one banks use between themselves—and they charge a simple, upfront fee for the service.

Suddenly, foreign exchange is no longer just a cost you have to swallow. It becomes a strategic tool, giving you the clarity and predictability that CFOs have been fighting for.

A New Standard for International Payments

At their core, these fintech platforms are designed to solve the real-world headaches that businesses face with legacy systems. They’re packed with features built for the kind of speed and control that a modern finance team needs.

- Zero-Spread FX: By giving you the mid-market rate, they get rid of the single biggest hidden cost in any international payment.

- Instant Digital Onboarding: Forget about drowning in paperwork for weeks. You can get your company verified and ready to transact in a fraction of the time.

- Enterprise-Grade Controls: Finance leaders can easily set up multi-user access with specific permissions. This means tight security and proper governance without creating frustrating bottlenecks for the team.

This is what it looks like in practice. The clean, user-focused interface is designed for real-world financial management, not for a banker.

It’s all about efficiency and showing you exactly where you’re saving money, hitting the main pain points of old-school FX services head-on.

Taking Back Control of Your Finances

This new approach isn’t just about getting a better rate; it’s about giving CFOs and finance teams genuine, hands-on control over their company’s global money. Real-time payment tracking means no more guessing where your funds are. Automated compliance and direct integration with your accounting software slash the time spent on manual admin, freeing up your people to focus on work that actually grows the business.

For a South African exporter or importer, this level of control is a game-changer. It means predictable costs, getting money to your suppliers faster, and having a crystal-clear picture of your company's cash flow at any given moment.

Ultimately, these modern alternatives are built to be financial partners, not just providers. They give you the tools to manage currency risk, speed up your operations, and protect your profit margins in a tough global market. The choice is no longer about simply finding a provider for a Bidvest currency exchange; it’s about choosing a platform that actively helps build your bottom line.

Choosing the Right FX Partner for Your Business

Picking a foreign exchange partner is a serious decision, one that directly hits your company’s bottom line and determines how quickly you can move. It really all comes down to a simple question: what does your business truly need right now? Are you looking for the old-school stability of a big institution, or the sheer efficiency and cost savings you get from a modern, digital platform?

For years, the default answer for many South African businesses was a traditional provider like Bidvest Currency Exchange. It’s a known entity—a secure, if sometimes clunky, way to handle payments abroad. If your company only sends money overseas once in a blue moon and you really value that face-to-face service and established brand name, then this path can still feel like the safest one.

Evaluating Your Business Needs

But for any business with serious global ambitions, the goalposts have shifted. When every single percentage point on an invoice can make or break your margins, things like transparency and speed are no longer just “nice-to-haves.” They’re critical for survival, let alone profitability.

When you’re looking at FX partners, you need to apply the same financial discipline you’d use for any other major business decision. It's a lot like measuring business ROI on a marketing campaign; you have to weigh the real benefits against all the costs, both the ones you can see and the ones hidden in the fine print.

The right FX partner isn't just a service provider; it's a strategic asset. The choice should reflect your company's ambition—whether that's maintaining the status quo or equipping your finance team with the tools to compete on a global scale.

This is exactly where fintech alternatives like Zaro really shine. We're not talking about small improvements here; we're talking about a complete overhaul of how your financial operations can work.

- Cost Optimisation: Getting access to the real mid-market exchange rate means you eliminate the hidden spread. That directly boosts your profit on every single transaction.

- Operational Speed: Think fast, trackable payments and instant digital onboarding. This gets rid of the operational drag that slows down your business and keeps your suppliers waiting.

- Strategic Control: Enterprise-level features give CFOs total visibility and control over payments. This transforms the finance team from a reactive cost centre into a proactive, strategic part of the business.

At the end of the day, while a Bidvest currency exchange has its place, businesses that are serious about financial optimisation and scalable growth will find that a fintech solution provides the tools they need to actually thrive.

A Few Common Questions

When you're a finance manager weighing up your options, from traditional banks to newer digital platforms, a few questions always seem to pop up. Let's tackle some of the most common ones we hear from South African businesses.

What's the Real "Hidden" Cost with Bidvest Currency Exchange?

Hands down, the biggest cost that often goes unnoticed with a service like Bidvest currency exchange is the exchange rate spread. Think of this as a markup baked into the rate you're offered, compared to the real mid-market rate you see on Google.

On its own, that small percentage might not seem like much. But when you're dealing with large business transactions, that margin quietly balloons into a significant expense—often dwarfing any flat transfer fee you were quoted. The lack of transparency here makes it incredibly difficult to know what your international payment truly cost you.

Is Bidvest a Good Fit for a Business Making Frequent International Payments?

Bidvest is a well-known, reliable name in the space, no question. But for businesses that are constantly sending or receiving money across borders, it might not be the most efficient or cost-effective choice.

The combination of those exchange rate spreads, potential SWIFT network fees, and often manual processes can add up. It creates friction in your workflow and can slowly eat into your profitability. If you're managing a high volume of transactions, a fintech platform is usually built to handle that kind of pace and pressure with far lower costs.

The real challenge for businesses with regular global payments isn't just the visible fees; it's the cumulative impact of hidden markups and slow processing times that silently erodes the bottom line.

How Can a Fintech Possibly Offer Better Exchange Rates Than a Bank?

It really comes down to a completely different business model. A traditional provider profits by taking a slice from the exchange rate itself. Fintech platforms like Zaro don't do that.

Instead, we give you direct access to the real mid-market rate—the same one banks use when they trade with each other. Our revenue comes from a clear, upfront subscription or a small, flat fee. This model gets rid of hidden markups entirely, so you can be sure you're getting the best possible value on every single transfer.

Ready to eliminate hidden fees and take control of your global payments? Discover how Zaro offers zero-spread FX, enterprise-grade controls, and transparent pricing to help your South African business grow. Visit https://www.usezaro.com to get started.