Understanding Business International Transfer Fundamentals

For South African businesses looking to expand their reach globally, understanding the fundamentals of business international transfers is crucial. This goes beyond simply transferring money across borders. It involves navigating complex regulations, partnering with the right financial institutions, and understanding the intricacies of foreign exchange. Successfully managing these elements is essential for maintaining healthy cash flow and driving international success.

One key difference to grasp is how international transfers contrast with domestic payments. Domestic transactions typically occur quickly and inexpensively within the same currency and regulatory environment. International transfers, however, introduce added complexities like foreign exchange rates, international banking regulations, and potentially longer processing times. These factors can significantly influence your profitability if not managed effectively.

International trade plays a vital role in the South African economy. In April 2025, South Africa's exports reached R166,173,907,831, while imports totalled R152,097,083,433, demonstrating a trade surplus. This dependence on global trade emphasizes the need for efficient and cost-effective international transfer mechanisms for businesses. For more detailed information, explore the SARS Trade Statistics.

Key Challenges in Business International Transfer

Several challenges specific to international transfers demand careful consideration:

Exchange Control Regulations: South African businesses must adhere to regulations imposed by the South African Reserve Bank (SARB), which may involve obtaining approvals for certain transfers.

Choosing the Right Banking Partner: Selecting a bank or financial institution with international transfer expertise and competitive exchange rates is crucial for optimizing costs and streamlining the process.

Managing Foreign Exchange Risk: Fluctuations in exchange rates can impact your profits. Businesses need strategies to mitigate this risk.

Evaluating Transfer Options: A Practical Framework

Navigating the complexities of international business transfers requires a structured approach:

Understanding Transfer Fees: Transparency is paramount. Compare fees charged by different providers, including transaction fees, intermediary bank fees, and any hidden costs.

Speed of Transfer: Consider the urgency of your payments and the processing times offered by different methods. Faster transfers might incur higher fees.

Security and Reliability: Select reputable providers with strong security measures to protect your funds and ensure reliable transfer execution.

By understanding these fundamental aspects of business international transfers, South African businesses can effectively manage the inherent risks and costs. This knowledge enables them to confidently expand their operations globally and forms the basis for choosing the appropriate transfer methods, which we'll discuss further in the next section.

Choosing Transfer Methods That Actually Work For Your Business

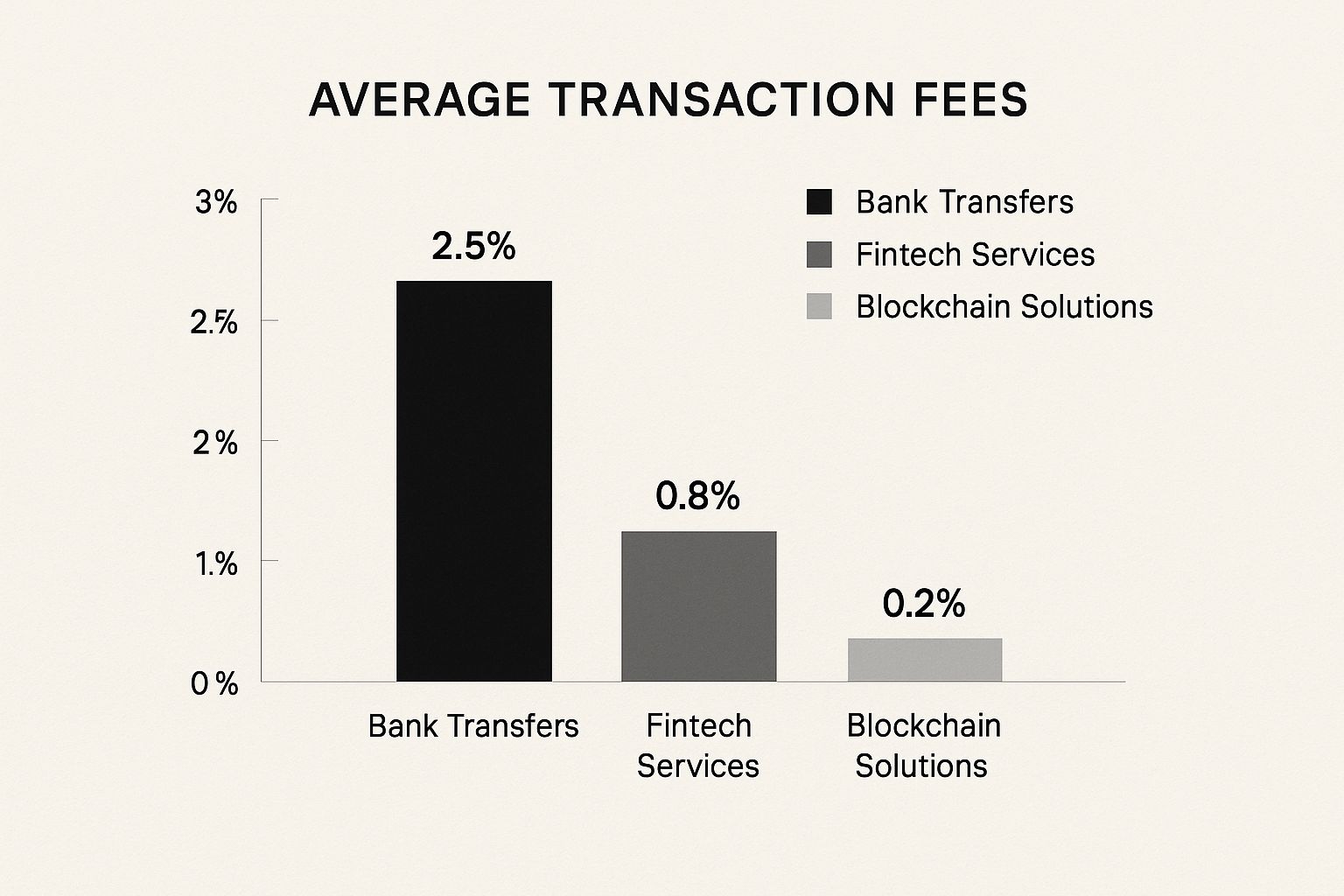

The infographic above illustrates the average transaction fees for different international transfer methods. Traditional bank transfers average around 2.5%, while fintech services are significantly lower at 0.8%. Blockchain solutions offer the lowest average fees, at just 0.2%. Choosing the right method can significantly impact your bottom line, so exploring these alternatives is crucial for cost savings.

Traditional SWIFT Transfers vs. Modern Alternatives

South African businesses have a variety of options for international transfers. Traditional SWIFT transfers, the long-time standard offered by most banks, can be slow, often taking several days. They also come with substantial fees. The lack of transparency around intermediary bank charges makes budgeting difficult and can lead to cash flow problems for regular supplier payments.

Modern fintech platforms offer faster and more cost-effective solutions. These platforms frequently bypass the SWIFT system by utilizing local banking networks. This results in quicker transfers and lower fees. For instance, Zaro offers real exchange rates without SWIFT fees, streamlining international transfers for South African businesses.

Efficient and cost-effective international business payments are vital for companies in the ZA region conducting cross-border transactions. Platforms like Wise serve over 70 countries with competitive fees, potentially reducing transaction costs significantly. However, while fintech solutions offer attractive features, they may not be suitable for all businesses, particularly those with very large transactions.

Specialized Business Payment Providers

Specialized business payment providers are another emerging option. These companies cater specifically to businesses with international payment needs. They offer features like bulk payments, automated processing, and integrated currency hedging tools. This can be particularly useful for businesses with complex or high-volume transfer requirements.

Choosing the Right Method for Your Business

The best transfer method depends on individual business needs. To help you decide, we've compiled a comparison table outlining the key factors to consider:

To help you choose the best method for your business, we've prepared a comparison table outlining different transfer options:

Business Transfer Methods Comparison: A Comprehensive Comparison of Different International Transfer Methods Showing Costs, Speed, and Suitability for Various Business Needs

| Transfer Method | Typical Cost | Processing Time | Best For | Regulatory Requirements |

|---|---|---|---|---|

| Traditional Bank Transfer (SWIFT) | 2.5% | 3-5 business days | Large, infrequent transactions | KYC/AML, Sanctions Screening |

| Fintech Platforms (e.g., Wise, Zaro) | 0.8% | 1-2 business days | Small to medium-sized businesses, frequent transactions | KYC/AML, Data Protection |

| Blockchain Solutions | 0.2% | Minutes to hours | Tech-savvy businesses, low-cost transfers | Varying by jurisdiction |

| Specialized Business Payment Providers | Varies | Varies, typically faster than SWIFT | Businesses with complex or high-volume needs | KYC/AML, Industry-specific regulations |

This table provides a general overview; actual costs and processing times can vary. It's important to research specific providers and their offerings.

Choosing the right method is crucial for minimizing costs and maximizing efficiency.

- Transaction Volume: Fintech solutions are often best for high-volume, low-value transactions.

- Transaction Size: Traditional bank transfers or specialized providers might be better for large, one-off transactions.

- Speed Requirements: Fintech platforms and some specialized providers offer faster processing than SWIFT transfers when speed is critical.

- Market and Currency: Certain methods might be more efficient or cost-effective for specific markets or currencies.

By considering these factors, you can select the method that best suits your needs, freeing up resources for business expansion in the global market. Diversifying your transfer methods across different markets and transaction types can further optimize your international payment strategy.

Managing Costs And Exchange Rate Risks Like A Pro

Successfully navigating international business transfers requires a solid understanding of cost management and mitigating the risks of fluctuating exchange rates. These fluctuations can significantly impact profit margins, especially for South African businesses engaged in regular international trade. Implementing effective strategies to control these factors is crucial for maintaining financial stability and achieving sustainable growth.

Hedging Strategies for South African SMEs

Large corporations often use complex hedging strategies. However, South African SMEs can benefit from simpler, yet effective techniques. Forward contracts, for instance, allow you to lock in an exchange rate for a future transaction. This provides certainty about the ZAR cost of imports or the ZAR revenue from exports, protecting your business from adverse exchange rate movements.

Additionally, natural hedging strategies can minimize currency risk without complex financial instruments. One such strategy is matching income and expenses in the same foreign currency.

Timing and Negotiation Tactics

Strategically timing large international transfers can significantly impact your costs. Transferring funds when the ZAR is strong, for example, can lower the cost of imports. Predicting currency movements is difficult, however. Building flexibility into your payment schedule is recommended.

You can achieve this flexibility by negotiating favorable payment terms with suppliers. This will help accommodate potential currency fluctuations. Negotiating better exchange rates with your financial institution is also worthwhile, particularly for businesses with strong banking relationships or high-volume transactions.

Pricing Models and Contingency Plans

Building currency risk into your pricing models is essential. This might involve adding a small percentage to your prices to account for potential exchange rate fluctuations. This helps maintain predictable profit margins even if the ZAR weakens.

Creating contingency plans for significant currency movements is equally important. This could involve adjusting prices or payment terms if necessary. Developing robust internal processes to regularly assess and address currency risk can protect your margins while keeping your pricing competitive. This proactive approach helps maintain consistent profitability despite exchange rate volatility.

Finally, understanding when to accept exchange rate risk versus when to hedge is key. For smaller, less frequent transactions, the cost of hedging might outweigh the benefits. However, for large, crucial payments, hedging is often a sensible measure to protect your bottom line. By combining these cost management and risk mitigation strategies, South African businesses can navigate the complexities of international transfers with confidence, ensuring sustainable growth and financial stability.

Navigating South African Compliance Without The Headaches

Successfully managing international business transfers in South Africa requires a deep understanding of more than just the transfer methods themselves. It necessitates a thorough grasp of compliance with the South African Reserve Bank (SARB) regulations. These regulations, while crucial for maintaining financial stability, can often appear complex and challenging to navigate. However, with a clear understanding of the key requirements and the implementation of efficient systems, compliance can become a seamless part of your international business operations.

Understanding Exchange Control Approval

Knowing when Exchange Control approval is needed is a critical first step. Not every transfer requires this approval. Certain transactions, however, such as significant capital outflows or investments in foreign assets, typically necessitate prior approval from an Authorised Dealer, usually a commercial bank. Working closely with your bank to understand these specific thresholds is essential to avoid potential delays in crucial payments.

Building Strong Relationships With Authorised Dealers

A strong relationship with your Authorised Dealer is invaluable. Open communication and a proactive approach to providing the required documentation can significantly streamline the approval process. For instance, keeping your bank informed of upcoming international transactions allows them to anticipate your needs and provide guidance on the necessary documentation. This proactive communication prevents last-minute issues and ensures the timely processing of your transfers.

Streamlining Your Approval Processes

Establishing clear internal procedures for initiating and authorizing international transfers is key to streamlining your internal approval processes. This includes:

- Assigning clear roles and responsibilities

- Setting specific approval limits

- Using standardized documentation

These systems ensure compliance while maintaining operational efficiency within your organization.

Documentation Best Practices and Reporting Thresholds

Meticulous record-keeping of all transfer-related documentation is paramount for demonstrating compliance. Keep detailed records of invoices, contracts, and approval notices. Understanding reporting thresholds is equally critical. Certain transactions, even if they don't require prior approval, must be reported to the SARB. Non-compliance with these reporting requirements can result in penalties. Consistent and organized documentation simplifies audits and provides valuable insights into your international transfer activity.

Handling Complex Transactions

Some international business transfers require special approvals due to their inherent complexity. This might include transactions exceeding specific limits, investments in restricted industries, or transfers to certain countries. Consulting with your Authorised Dealer and seeking expert advice can ensure you adhere to the correct procedures. While these transactions can present unique challenges, careful planning and open communication with regulatory bodies can minimize potential complications and delays. By adopting a proactive and organized approach to compliance, South African businesses can confidently manage their international transfers, adhering to all regulatory requirements, ensuring smooth operations, and facilitating growth in the global marketplace.

How Business International Transfer Affects South Africa's Economy

Understanding the broader economic context surrounding business international transfer is crucial for informed decision-making. Each transfer contributes to South Africa's overall trade position, influencing exchange rate stability and the associated costs of moving money across borders. This intricate link between individual business transactions and the national economy demands careful consideration for long-term success.

The Impact of Collective Transfer Activities

The combined activity of South African businesses engaged in international transfers significantly shapes the country's trade balance. A consistent surplus in exports creates a positive impact, boosting demand for the Rand and potentially strengthening it. Conversely, a trade deficit can weaken the Rand, increasing import costs and impacting businesses dependent on international suppliers.

This interplay between trade balances and exchange rates underscores the importance of efficient transfer processes for maintaining competitiveness. The sheer volume of business international transfers also influences the availability and pricing of services from financial institutions.

High demand can stimulate competition among providers, potentially offering businesses better exchange rates and lower fees. However, economic downturns or global instability can disrupt these services, causing delays and potentially higher costs. This inherent volatility emphasizes the need for businesses to diversify their transfer methods and cultivate relationships with multiple financial institutions.

Global Economic Trends and Transfer Services

Global economic trends exert considerable influence on the availability and pricing of transfer services. For instance, a global recession can decrease demand for South African exports, impacting the volume of international transfers and potentially affecting exchange rates. This interconnectedness necessitates that businesses monitor key global economic indicators to anticipate potential disruptions and adjust their transfer strategies accordingly.

International trade and business transfers are also intrinsically linked to a country's current account position. While specific data on South Africa's current account might not be readily accessible, international comparisons can provide valuable insights. The U.S. current-account deficit narrowing by $6.3 billion to $303.9 billion in the fourth quarter of 2024 demonstrates how shifts in international transactions influence a nation's economic indicators. More detailed statistics can be found here. This highlights the importance of staying informed about global economic developments and their potential effects on transfer costs and regulations.

South Africa's Integration With Global Markets

South Africa's integration with global markets presents both opportunities and challenges for businesses engaged in international transfers. Access to global markets broadens potential customer bases and supplier networks, encouraging economic growth. However, this integration also exposes businesses to global economic fluctuations and regulatory changes that can affect transfer costs and operational efficiency.

By analyzing trade patterns and economic data, businesses can anticipate potential shifts in transfer costs and regulatory requirements. Understanding how your business activities contribute to South Africa's current account position can help you understand long-term exchange rate trends. This knowledge empowers you to make informed decisions regarding your international operations, optimize transfer strategies, and navigate the complexities of international trade effectively. This proactive approach enables businesses to adapt to evolving market dynamics and mitigate potential risks.

Protecting Your Business From Transfer Fraud and Security Threats

When conducting international business transfers, security is paramount. A single breach can have devastating consequences, leading to significant financial losses and damage to your company's reputation. This section explores essential security measures to protect your South African business during cross-border transactions.

Common Fraud Schemes Targeting International Business Payments

Understanding how fraudsters operate is crucial for building effective defenses. Here are some common schemes targeting international business payments:

- Phishing: Criminals impersonate legitimate organizations to steal login credentials and financial information.

- Business Email Compromise (BEC): Hackers compromise company email accounts and manipulate payment instructions, diverting funds to their accounts. This is particularly dangerous for businesses making regular international payments.

- Invoice Fraud: Criminals intercept or forge invoices, altering bank details to redirect payments.

Building a Strong Defense: Practical Security Measures

Fortunately, there are practical security measures you can implement without hindering your business operations. Multi-factor authentication (MFA) adds an extra layer of security to all financial accounts, making unauthorized access significantly more difficult. Even if login credentials are compromised, MFA requires additional verification like a one-time code.

Secure communication protocols with international partners are also essential. This could include using encrypted email services like ProtonMail or secure file-sharing platforms such as ShareFile. Thorough due diligence on new recipients is also vital. Verify their legitimacy through independent sources and confirm bank details directly with the recipient.

Internal Controls and Employee Training

Robust internal approval processes are key to preventing fraudulent payments. Requiring multiple authorizations for large transfers or payments to new recipients adds a crucial layer of oversight. This could involve a combination of digital and physical approvals for enhanced security and compliance.

Training your team to recognize social engineering attempts is equally important. Educate employees about common tactics used by fraudsters, such as urgent payment requests or unusual communication styles. Encourage them to report any suspicious activity immediately.

Maintaining Security With Urgent Payments

Even when faced with urgent international payment requests, maintaining security standards is critical. Verify the urgency through alternative communication channels and never bypass established security protocols. Rushing a transfer under pressure increases your vulnerability to fraud. It's always better to delay a payment than become a victim of a costly scam. By implementing these proactive security measures, you can effectively mitigate the risks associated with international business transfers and protect your financial future. A proactive and vigilant approach to security is your best defense.

Future-Proofing Your Business International Transfer Strategy

The international payments landscape is constantly evolving. For South African businesses to maintain a competitive edge, adapting their business international transfer strategies is essential. This means staying informed about new technologies and regulatory changes that could impact cross-border transactions.

Emerging Technologies and Their Impact

Several key technologies are poised to reshape the future of international money transfers. Let's explore some of the most impactful developments:

Central Bank Digital Currencies (CBDCs): Still under development globally, CBDCs have the potential to offer faster and cheaper cross-border transactions, possibly bypassing traditional banking systems altogether.

Real-Time Payment Systems: These systems enable instant transfers, leading to improved cash flow and reduced delays. South Africa's Real-Time Clearing (RTC) system is a prime example of this technology in action.

AI-Powered Transfer Optimization: Artificial intelligence (AI) can analyze market data and predict currency fluctuations. This helps businesses optimize transfer timing and potentially minimize costs.

Evaluating New Service Providers and Technologies

Keeping pace with these advancements requires careful evaluation of new service providers and technologies. However, it's important to approach adoption strategically without disrupting current operations. A phased approach is recommended:

Pilot Testing: Test new solutions on a small scale before full integration. This helps identify and address potential issues early on.

Vendor Due Diligence: Thoroughly vet new providers, paying close attention to their security measures, compliance certifications, and overall track record.

Cost-Benefit Analysis: Weigh the potential cost savings and efficiency gains against the implementation costs and any associated risks.

To help visualize the timeline and impact of these emerging technologies, we've compiled the following table:

Future Transfer Technology Timeline

| Technology | Expected Timeline | Business Impact | Preparation Required |

|---|---|---|---|

| Central Bank Digital Currencies (CBDCs) | Mid to long-term | Potentially lower costs, faster transfers | Monitor CBDC developments, assess integration feasibility |

| Real-Time Payment Systems | Short to mid-term | Improved cash flow, reduced delays | Integrate with compatible systems, update internal processes |

| AI-Powered Transfer Optimization | Short to mid-term | Reduced costs, improved efficiency | Evaluate AI-driven solutions, integrate with existing platforms |

This table provides a roadmap for businesses looking to integrate these transformative technologies. The expected timelines allow for strategic planning and resource allocation.

Adapting to Regulatory Developments

Regulations governing international transfers are also subject to change. Staying informed is crucial:

Subscribe to Industry Updates: Keep abreast of regulatory changes from sources like the South African Reserve Bank (SARB) and reputable financial news outlets.

Engage with Compliance Experts: Consulting with experts ensures your transfer processes align with current and future regulations.

Build Flexibility Into Your Processes: Design adaptable transfer processes that can adjust smoothly to regulatory updates.

Preparing Your Team for the Future

Equipping your team with the right skills and knowledge is key to a future-proof strategy:

Training on New Technologies: Provide training on emerging technologies and their impact on transfer operations.

Developing Internal Expertise: Cultivating in-house expertise on international transfers and regulatory compliance reduces reliance on external consultants.

By implementing these strategies, you can ensure your international transfer operations remain efficient, compliant, and cost-effective. This proactive approach positions your business for continued success in the global marketplace.

Ready to optimize your international transfers? Explore how Zaro can help your South African business achieve faster, more cost-effective cross-border payments.