For any South African business operating on the global stage, the simplest and most cost-effective way to buy USD is to sidestep the traditional banks. Modern fintech platforms now offer the real exchange rate with minimal fees, giving you a transparent and direct path for managing foreign currency payments.

Why Buying USD in South Africa Feels So Complicated

If you're running a business in South Africa, you know the feeling. Trying to buy US Dollars can feel like navigating a maze. It’s not just about watching the numbers on a screen; you're up against volatile markets, confusing red tape, and hidden fees that slowly eat away at your bottom line.

This is a daily headache for importers trying to settle with US suppliers or tech startups paying for those essential USD software subscriptions. The whole process just feels unnecessarily complex.

At its core, the problem is a legacy system that wasn't built for the speed of modern business. The banks we're all used to often hide their profits in wide "spreads" on the exchange rate and then tack on hefty admin fees for good measure. This means the rate you get is rarely the "real" mid-market rate you see on Google, making it incredibly difficult to budget with any real accuracy.

The Unpredictable Rand

And then there's the rand. Its rollercoaster nature against the dollar is a huge challenge. The ZAR/USD rate is a sensitive beast, reacting to everything from local political news to a shift in global commodity prices. This constant fluctuation has a direct impact on your business.

Think about it: a small dip in the rand overnight could easily turn a R100,000 invoice into a R103,000 reality by morning. That kind of uncertainty makes financial planning feel like a guessing game for any business with international dealings.

The rand's long-term depreciation against the dollar adds another layer of strategy. You're always trying to time your purchase to avoid paying more than you have to, but trying to predict the market perfectly is a fool's errand.

Navigating the Historical Context

Looking back at the historical trends tells a clear story. The rand has been on a long, downward slide against the US Dollar since the 1990s. We’ve gone from around 3 ZAR to the dollar to rates that have pushed past 17 ZAR in recent years.

This isn't random; it's driven by deep economic factors like inflation differences, political climates, and global demand for our commodities. For any business needing to buy USD, this trend highlights just how critical it is to be smart about timing and protecting yourself from currency risk. Digging into historical exchange rate data can offer some valuable perspective.

This is precisely the frustration that modern solutions like Zaro were designed to solve, offering a much simpler process and far better rates.

Right, let's get into the heart of what really drives the cost when you buy USD: the exchange rate. It’s not just a number you see on your screen; it's the pulse of the market, constantly reacting to the health of both the South African and US economies.

Think of it this way: dozens of factors are constantly pushing and pulling on the rand's value.

What's Really Moving the Needle?

Here in South Africa, local events have a massive impact. An announcement from the South African Reserve Bank about interest rates can make the rand jump or dive in a matter of minutes. The same goes for big national news—everything from election outcomes to GDP reports can send ripples through the currency markets, directly affecting how many rands you need for each dollar.

But it's not all local. On the world stage, the rand often moves in step with commodity prices. South Africa is a major exporter of precious metals, so when gold or platinum prices climb, the rand often gets a lift. When those prices fall, our currency can weaken, making those dollar invoices a lot more expensive to settle.

Why Small Shifts Have a Big Impact

These fluctuations aren't just academic—they hit your bottom line, hard. A tiny shift of a few cents in the exchange rate can mean a difference of thousands of rands, especially on larger payments.

Let's look at a real-world scenario. You need to pay an American supplier $10,000.

- If the rate is 18.20 ZAR to the dollar, that invoice will cost you R182,000.

- But if you wait a day and the rate slips to 18.50 ZAR, the very same invoice now costs R185,000.

That’s a R3,000 loss overnight, simply due to market timing.

This isn't an exaggeration. Just in a recent six-month window, the ZAR/USD rate bounced between a low of about 17.3 ZAR and a high of nearly 19.8 ZAR. That kind of swing shows just how quickly your costs can escalate if you're not paying attention. If you're curious, you can dig into the data on recent currency movements and see these patterns for yourself.

The key takeaway here is to stop just reacting to today's rate. When you start to understand the forces behind the numbers, you can begin making smarter, more strategic decisions about when to exchange your money.

How to Choose Where to Buy Your US Dollars

When your business needs to buy US dollars, where you go is just as important as when you do it. The provider you choose in South Africa directly impacts your costs, the speed of your payments, and how much administrative hassle you have to deal with.

Let's be honest, most businesses still default to their main bank. It's the path of least resistance. But that convenience comes at a steep price. Banks are notorious for baking their profits into a wide exchange rate spread and then piling on extra SWIFT and admin fees. It's often impossible to tell what your transaction is really costing you.

This frustration is what pushes many companies towards specialised forex brokers. They're a step up, for sure. Because currency is their entire business, they can usually offer much sharper rates than the banks. The catch? Their platforms can feel a bit old-school and clunky, and they often have minimum transfer amounts that don’t work for smaller businesses making regular, lower-value international payments.

Modern Fintech is Changing the Game

This is where new-generation fintech platforms like Zaro have completely shaken things up. They were designed from the ground up to solve the exact problems businesses face with traditional providers: confusing fees and sluggish transfers.

By running lean online operations, these platforms can pass the savings directly to you, offering exchange rates that are incredibly close to the real mid-market rate. It's a fundamental shift in the broader financial services industry, moving away from hidden costs towards total transparency and efficiency.

The real magic is in the transparency. With a platform like Zaro, you aren't trying to decode a complicated fee structure. You see the real exchange rate and a single, clear fee. No hidden markups, no surprises.

A Side-by-Side Look

To really understand the difference, it helps to see the options laid out clearly. Here’s a quick comparison of what your business can expect.

Comparison of USD Purchase Methods in South Africa

| Feature | Traditional Banks | Forex Brokers | Fintech Platforms (e.g., Zaro) |

|---|---|---|---|

| Exchange Rate | Wide spread over mid-market rate | Competitive, but may vary | Real mid-market rate with no spread |

| Fees | High SWIFT & admin fees | Lower than banks, but can have fixed fees | Minimal or zero transaction fees |

| Speed | 2-5 business days | 1-3 business days | Often same-day or instant |

| Transparency | Low; hidden costs are common | Moderate; fees can be complex | High; clear, upfront pricing |

What does this mean in practice? Let's say you're paying a $5,000 supplier invoice. The difference between using your bank and a platform like Zaro could easily be hundreds, even thousands, of rands saved on that single transaction.

Suddenly, looking beyond your bank isn't just a nice-to-have; it's a core financial strategy for any South African business that wants to compete on the global stage.

How to Buy USD with Zaro: A Practical Guide

So, we've talked about what to look for when comparing providers. Now let's get into the nuts and bolts of how you can actually buy USD in South Africa using a modern platform like Zaro. The experience is a world away from traditional banking – it's all about speed, transparency, and putting you back in control.

Forget the stacks of paperwork and branch visits. Getting started is a one-time digital process. You’ll set up your business account and handle the FICA verification entirely online. Once you're approved, you're good to go.

Funding and Making Your Transfer

The whole process is refreshingly simple. First, you'll fund your Zaro account with Rands using a standard local bank transfer. Think of this as your home base, where your ZAR balance is ready to be converted into dollars whenever you need it.

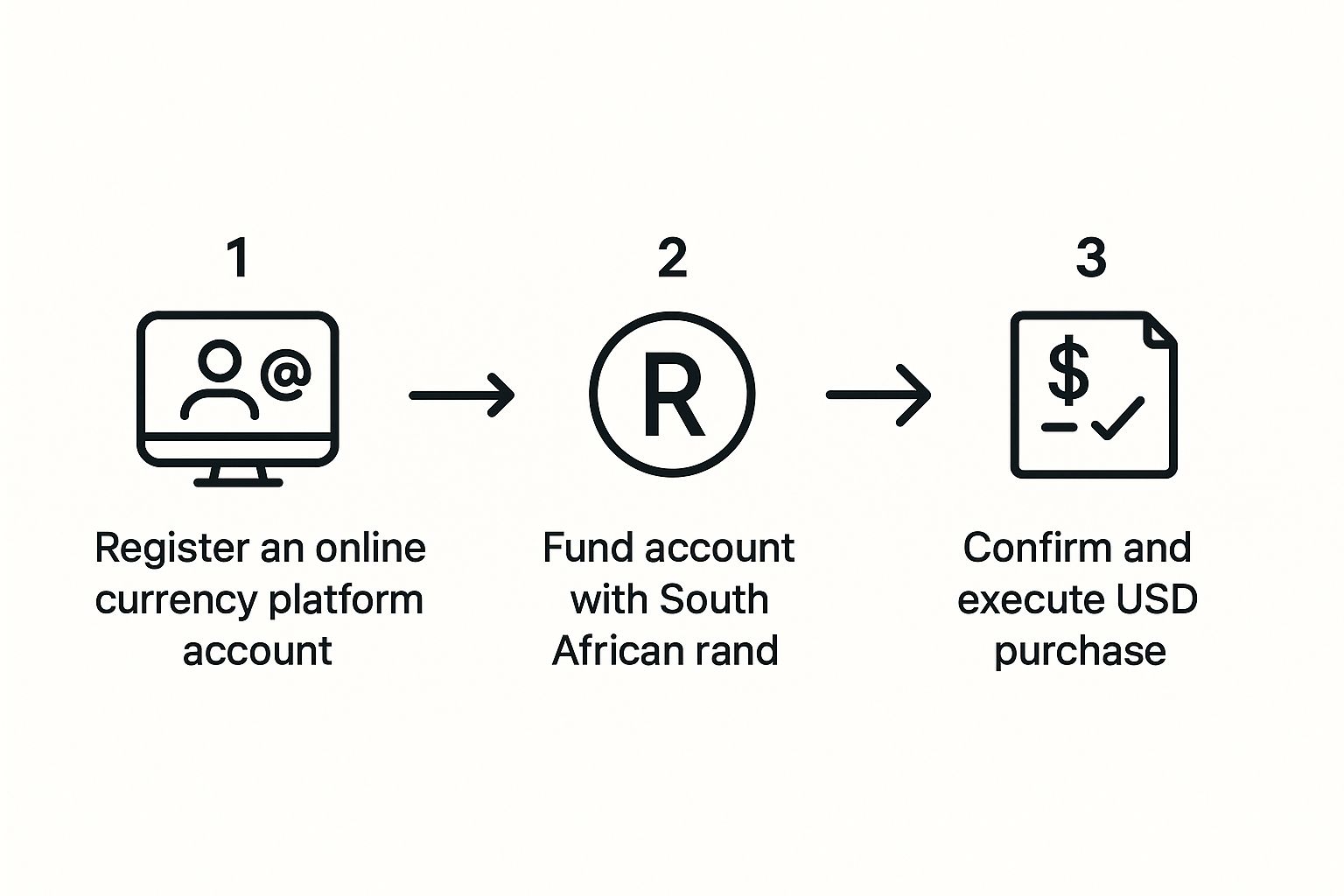

This diagram breaks down the three-stage flow for buying USD.

As you can see, it cuts out all the unnecessary middle steps, giving you a direct line from registration to getting your payment sorted.

When it's time to pay an international invoice, you just log in. You'll see the live mid-market exchange rate right there on the screen. No hidden spreads, no surprise fees. What you see is what you get.

Let's walk through a real-world example. Say you need to pay a $10,000 invoice to a software supplier in the US. Instead of the old routine of calling your bank for a quote and waiting around, you can simply:

- Top up your ZAR account if needed.

- Enter the $10,000 payment amount and the supplier's details.

- Lock in the live exchange rate with a click.

- Confirm the payment.

That's it. The funds are sent directly to your supplier’s US bank account, often landing much quicker than a typical SWIFT transfer.

The real game-changer here is control. With features like rate alerts, you can have the platform notify you the moment the ZAR/USD exchange rate hits a level you're happy with. This allows you to be strategic about when you buy, rather than just being forced to accept whatever the rate is on the day.

A Clear Interface Built for Business

The user-friendly dashboard is designed to put all the important information right where you need it, without any clutter. This transforms what used to be a complicated financial chore into a quick and simple action you can take care of in minutes.

Smart Strategies to Lower Your Exchange Costs

Getting a great rate when you buy USD in South Africa isn't about luck; it's about strategy. Once you move beyond the basics and adopt a few expert habits, you can shave significant costs off every single transaction, leaving more cash where it belongs—in your business.

A simple yet powerful tactic is to stop making exchanges over the weekend. Forex markets officially close on Friday afternoon and reopen early Monday morning. During this downtime, liquidity dries up, and providers often widen their exchange rate spreads to hedge against any big market moves. This almost always means you'll pay a premium for your dollars.

The Mid-Market Rate: Know What You're Paying

One of the most important concepts to get your head around is the mid-market rate. Think of this as the 'real' exchange rate—the exact midpoint between what buyers are willing to pay and what sellers are asking for on the global markets. Traditional banks rarely give you this rate. Instead, they add their own markup or "spread," which is how they make their profit, often hidden in the rate itself.

Modern platforms work differently, giving you direct access to the mid-market rate. This transparency means you're not unknowingly paying an inflated price for your currency. Before you hit "confirm" on any transfer, always compare the rate you’re being offered to the live mid-market rate. It's the only way to see the true cost of the transaction.

Recently, we've seen the USD/ZAR rate sitting around the 17.389 mark. Thanks to factors like an improved electricity supply, the Rand has actually strengthened by about 2.07% over the last year. Forecasts are even suggesting a modest climb towards 17.94 within the next twelve months. This positive trend could mean your Rands go further when buying dollars, as long as no major global events shake things up. For a deeper dive, you can explore more detailed currency forecasts to help time your transfers.

Plan Your Transfers with Purpose

Another highly effective strategy is to consolidate your payments. Making a bunch of small transfers often means you're getting hit with multiple fixed transaction fees, and those can stack up surprisingly fast. The trick is to plan ahead.

By bundling your payments into larger, less frequent transfers, you drastically reduce the impact of those fixed fees. It's a simple change to your payment schedule that can lead to very real savings over a year.

Here are a few pro tips to keep in mind for your next transaction:

- Set Up Rate Alerts: Most good platforms let you set up alerts. Use them to get a notification when the ZAR/USD rate hits a level you’re happy with.

- Keep an Eye on Trends: Pay attention to economic news, both local and international. Things like interest rate announcements can have a big impact on the Rand's performance.

- Avoid Volatile Times: Try not to exchange currency right when major global news is breaking. Volatility spikes, and so do the spreads.

By adopting these habits, currency exchange stops being a reactive expense and becomes a proactive part of your financial strategy.

Got Questions About Buying US Dollars? We’ve Got Answers.

When it comes to moving your business’s money across borders, it’s natural to have questions. Getting your head around foreign exchange can feel complicated, especially when you’re trying to manage cash flow and pay international suppliers on time.

We get it. We hear these questions all the time from South African businesses just like yours. Let's break down the most common ones so you can feel confident about your next USD transaction.

What’s the Deal with Legal Requirements for Buying Dollars?

In South Africa, every international payment is regulated by the South African Reserve Bank (SARB). This isn't just red tape; it's a standard compliance measure.

To make an international payment, you'll need to declare the reason for it using a Balance of Payment (BOP) form. This might sound intimidating, but modern platforms have built this requirement right into their process, making it a simple digital step rather than a mountain of paperwork.

How Quickly Will My Money Actually Get There?

This is where the old way and the new way really differ. If you’ve ever used a traditional bank for a SWIFT transfer, you know the waiting game. It can often take anywhere from 2 to 5 business days for the money to land in a US bank account. That’s a long time to wait when a supplier is breathing down your neck.

Fintech platforms have completely changed this. By using smarter payment networks, many can get your transfer delivered on the same business day. This isn't just a small convenience; it’s a major operational advantage for paying overseas staff or settling urgent invoices.

The bottom line is this: slow transfers are a hidden cost. The delays built into old banking systems waste your time, create uncertainty, and can strain your business relationships. Fast, reliable payments are the new standard.

How Can I Get the Best Possible Exchange Rate?

Trying to "time the market" is a fool's errand. The real secret to getting a great rate isn’t about being a forex trading genius; it's about transparency and avoiding hidden fees.

The single best thing you can do is find a provider that gives you the mid-market exchange rate – the real rate you see on Google – without adding a markup (or "spread"). That’s where banks and older services make their money.

A few other practical tips from our experience:

- Try to avoid transferring over the weekend. Exchange rate spreads often widen when the markets are closed.

- Use rate alerts. Set up a notification to ping you when the ZAR/USD rate moves in your favour.

- Don't leave it to the last minute. Planning ahead means you won't be forced into a bad exchange during a volatile market spike.

At the end of the day, control is everything. Choosing a transparent platform that shows you the real rate empowers you to make the smartest financial decision for your business.

Ready to stop overpaying on international transfers? With Zaro, you get the real exchange rate, zero hidden fees, and lightning-fast payments. See how much your business can save by visiting https://www.usezaro.com.