So, you need to buy US dollars in South Africa. You've got a few choices: your local bank, a specialised Bureau de Change, or one of the newer fintech platforms. Each has its own pros and cons when it comes to convenience, fees, and the all-important exchange rate. The real trick is knowing how they differ before you hand over your Rands. That’s how you get the most bang for your buck.

Understanding How Forex Works in South Africa

Ever seen a fantastic ZAR/USD exchange rate online, then walked into a bank only to be offered something much less appealing? You're not alone. The rate you see on Google is what’s called the "mid-market" or "spot" rate. Think of it as the wholesale price that big financial institutions use when trading massive amounts with each other. For the rest of us, it's a benchmark—not the rate we'll actually get.

Every forex provider, from the biggest bank to the smallest bureau, adds a markup (or "spread") to that rate. That's how they make their profit. It's the gap between what they pay for dollars and what they sell them to you for. On top of that spread, you'll often find commission fees, admin charges, and other costs baked in.

The real cost of buying dollars isn’t just the exchange rate they advertise. It’s the combination of their rate markup and all the extra fees. To get a true comparison, always ask: "For X amount of Rands, exactly how many dollars will I get in my hand?"

Key Factors Influencing Your Exchange Rate

The South African Rand is notoriously volatile. Its value can swing dramatically based on a whole host of factors, and knowing what they are can help you time your dollar purchase a bit better.

Here’s what you should keep an eye on:

- Local Economic News: Big announcements from the South African Reserve Bank (SARB) about interest rates, the latest inflation figures, or even just political rumblings can all rock the Rand's stability.

- Global Market Dynamics: Our currency doesn't exist in a vacuum. Decisions made by the U.S. Federal Reserve or shifts in the price of commodities like gold have a massive impact on the ZAR's strength. Just look at April 2025, when the USD/ZAR rate hit a high of 19.93, only to settle back down to around 17.70 by late August. That’s a huge swing in just a few months.

- The Provider’s Business Model: This is a big one. Digital platforms generally have much lower overheads than traditional banks with their physical branches. That often translates into better rates and lower fees for you.

At the end of the day, the foreign exchange market is a complex beast. Getting a wider view of the Forex industry's landscape can help you understand the forces at play. This knowledge shifts you from being someone who just accepts the first rate they're offered to an informed buyer who knows how to hunt down the best possible deal.

Where to Buy Your US Dollars: A Comparison

Deciding where to buy US dollars in South Africa can feel a bit overwhelming. Everyone claims to have the best deal, but the right choice really boils down to your specific needs. Are you grabbing a few hundred dollars for a holiday, or are you wiring a significant amount for a business invoice? Let's walk through the main players on the field.

High-Street Banks: The Familiar Face

Your first port of call might be your everyday bank, like FNB or Standard Bank. It’s the comfortable option—you know the people, you know the process, and it feels safe.

But that convenience often comes with a hefty price tag. Banks are notorious for baking significant markups into their exchange rates while also tacking on commission or admin fees. For a small amount, you might not notice the sting, but when you're dealing with larger transactions, those costs add up fast and can take a serious bite out of your Rands.

Bureaux de Change: The Airport Staple

Then you have the dedicated Bureaux de Change, like Travelex or Bidvest. You'll spot them in every airport and major shopping centre, making them a go-to for last-minute cash before a flight.

Because foreign exchange is their entire business, the staff usually know their stuff, and their rates tend to be a touch more competitive than what the big banks offer. Still, they have to cover the rent for those prime physical locations, and those overheads are passed on to you. They're a decent middle-ground option, but rarely the cheapest way to go.

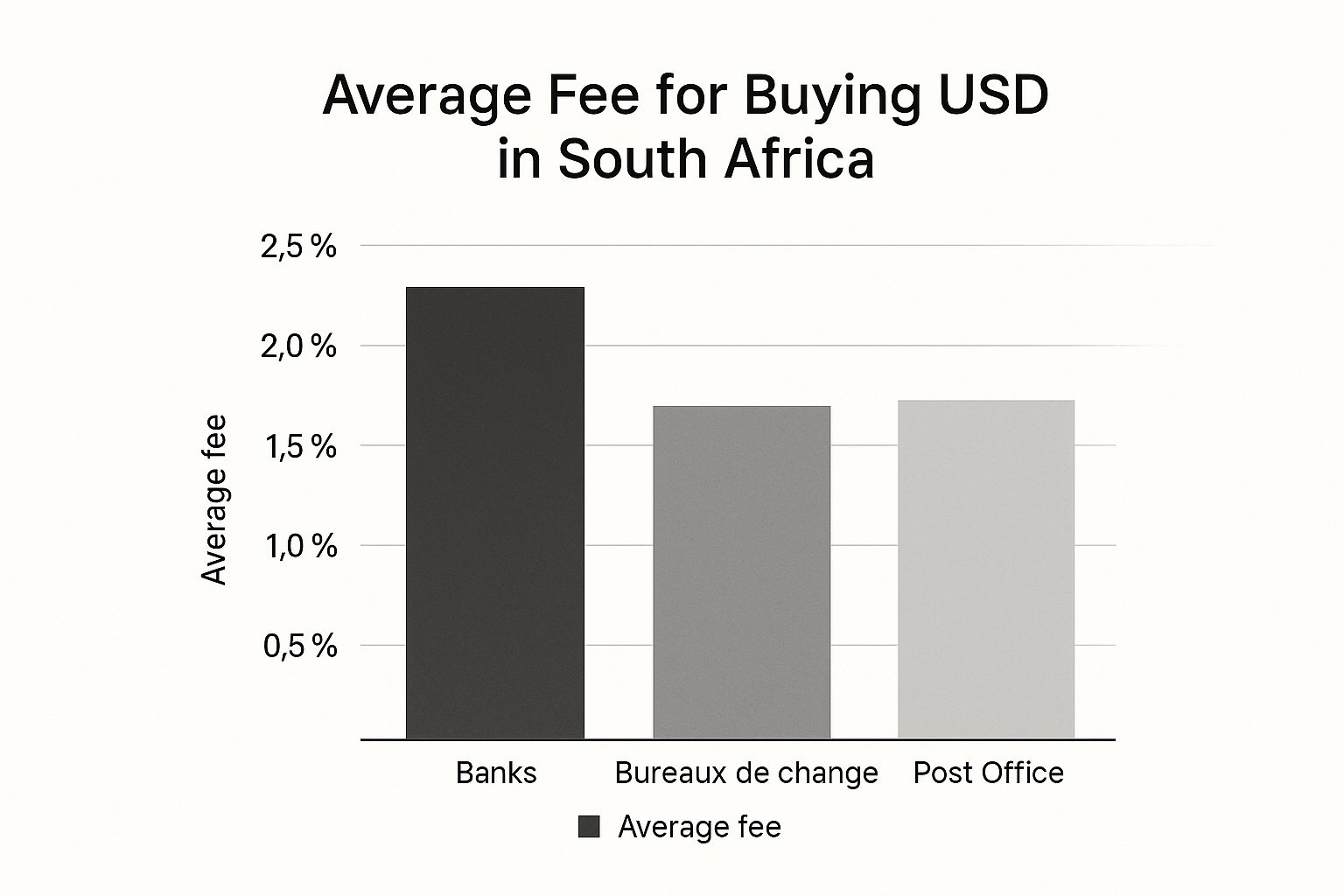

This visual comparison gives you a sense of the average fee structures you can expect.

As you can see, banks generally sit at the higher end of the cost spectrum, with Bureaux de Change offering a more moderate fee structure.

Fintech Platforms: The Digital Disruptors

The real game-changer has been the rise of digital forex platforms and fintech apps. These online-only providers have shaken up the market by cutting out the costs tied to a physical footprint. With no expensive branches to maintain, they can offer exchange rates much closer to the mid-market rate and charge dramatically lower fees—sometimes none at all.

Platforms like Zaro are built around this model of efficiency, showing you all the costs upfront with total transparency. For anyone sending money overseas regularly or making a large one-off payment, the savings can be massive. The only trade-off is that the entire process happens online, which might feel new to some, but the financial benefits are hard to argue with.

Before settling on a provider, it’s smart to run through a proper due diligence checklist. This helps you look beyond the flashy marketing to understand the true, all-in cost of your transaction.

Here’s a real-world example: Imagine you need to buy $2,000. With a bank’s typical 2.5% markup and fees, that transaction could easily cost you an extra R1,000 (or more) compared to a fintech platform with a much leaner fee structure. Those differences really start to matter over time.

To make things clearer, let's put these options side-by-side.

At-a-Glance Comparison of Forex Providers in SA

This table breaks down what you can generally expect from each type of provider, helping you match the service to your specific needs.

| Provider Type | Typical Fees | Exchange Rate Markup | Transaction Speed | Best Suited For |

|---|---|---|---|---|

| Major Banks | High (Admin fees, commissions) | High (Often 2% - 4%) | 1-3 business days | Familiarity and in-person service for existing customers. |

| Bureaux de Change | Moderate | Moderate (Better than banks) | Instant (for cash) | Last-minute holiday cash at airports and shopping centres. |

| Fintech Platforms | Low to zero | Very Low (Close to mid-market rate) | Minutes to 24 hours | Large or regular international payments; cost-conscious users. |

So, what's the bottom line? Choosing where to buy your US dollars is a straightforward trade-off between cost and convenience. If you’re in a rush and just need a small amount of cash, a Bureau de Change will do the job. But for almost any other scenario, taking a few minutes to get set up with a digital provider will almost certainly leave you with more dollars in hand for the same number of Rands.

The Paperwork You Actually Need for Forex

Let's be honest, dealing with the paperwork for buying dollars in South Africa can feel a bit like a trip to Home Affairs. It’s often the part everyone dreads. But it doesn't have to be a headache.

The whole process is governed by the South African Reserve Bank (SARB) and the Financial Intelligence Centre Act (FICA). These regulations are in place for a good reason—to track money movement and stop illegal activities. So, when a bank or a platform like Zaro asks for documents, they aren't trying to be difficult; they're legally obligated to.

Knowing what to expect and why it's needed is half the battle won. The great thing is, once you have your core documents sorted, the process becomes much simpler for future transactions.

Your Core Document Checklist

No matter where you go to buy your forex, you'll run into FICA. It's unavoidable. My advice? Get these documents ready beforehand to save yourself a massive amount of time and frustration.

Here’s the essential kit you’ll need:

- A valid South African ID: Your green bar-coded ID book or a new ID smart card works perfectly.

- Proof of residential address: This needs to be a recent document, no older than three months. Think of a utility bill or a bank statement that clearly shows your name and physical address.

If you're a foreign national living in SA, you'll need to provide your valid passport along with your residence or work permit instead of a local ID. The principle is the same: prove who you are and where you live.

Pro Tip: Keep digital copies of these documents on your phone or computer. When you’re using an online forex platform, you can upload them in seconds instead of digging around for a scanner. It's a game-changer.

Documents for Specific Scenarios

Once you've cleared the basic FICA check, the next set of documents depends entirely on why you're buying the dollars. Buying holiday spending money has a different paper trail than paying an overseas supplier.

For instance, if you're getting cash for a trip, you’ll almost certainly need to show proof.

This usually means providing:

- A valid flight ticket: It needs to have your name, destination, and travel dates clearly visible.

- Proof of accommodation: Sometimes, a hotel booking confirmation is also requested to support your application.

This paperwork links your purchase to your official travel allowance. But if you’re buying dollars in South Africa to pay for imported goods, the required document would be the supplier's invoice.

The key takeaway is that every scenario has its own requirements. Always double-check with your bank or forex provider to see exactly what they need for your specific transaction. A little preparation goes a long way to making the whole exchange smooth and quick.

Finding the Best Exchange Rates Like a Pro

Getting a good deal when you buy US dollars in South Africa isn't about luck—it's about strategy. The biggest mistake people make, time and time again, is leaving their currency exchange to the last minute at the airport. It's certainly convenient, but you'll pay a heavy price for it through some of the worst rates you can find.

Your best move is to simply plan ahead. Start watching the ZAR/USD exchange rate a few weeks before you need the cash. You don't need to be an expert, but just observing the daily movements gives you a feel for what’s a good rate and what’s not. This alone can save you from buying on a day when the Rand has unexpectedly weakened.

Look Beyond the Advertised Rate

That big, flashy number you see on an exchange board is rarely the full picture. The only figure that truly matters is the 'all-in' cost. This is the final amount you pay after they've added their exchange rate markup (the "spread") and any commission fees, service charges, or other hidden costs.

To get a straight answer, always ask this one simple question: "If I give you R10,000 right now, how many US dollars will I walk away with?" This cuts through all the jargon and gives you a concrete number, making it incredibly easy to compare different providers and find the best value.

A "no commission" offer often just means the provider has built a wider, less favourable spread into their exchange rate. Calculating the all-in cost is the only real way to know what you’re paying.

Understand Market Timing and Historical Trends

Timing your purchase can make a real difference. The South African Rand has always been sensitive to major local and global economic events. If you look back at historical data, you'll see a clear link between the Rand's strength and the international prices of our key exports, like gold and platinum.

For instance, a 10% jump in the gold price has often been followed by a 1-2% strengthening of the Rand against the dollar. You don't need to become a forex trader, but being aware of these trends helps you understand why the rate moves. After all, a one-rand difference in the exchange rate on a $2,000 purchase means R2,000 in your pocket.

For those planning larger or more regular currency purchases, it might be worth looking at long-term approaches. Investors often use what’s called a Dollar Cost Averaging strategy, where you buy a fixed amount at regular intervals to smooth out market volatility. While it's an investment technique, the core idea—avoiding putting all your eggs in one basket—is smart thinking for anyone dealing with large sums of foreign currency.

Your Annual Forex Allowances Explained

When you start looking into buying dollars in South Africa, you'll hear the term "forex allowance" pop up almost immediately. This isn't just banking jargon; it's a critical set of rules from the South African Reserve Bank (SARB) that dictates how much money you can legally move offshore each year. Getting your head around these limits is the first step to a smooth transaction.

Every South African resident over 18 gets two separate allowances to work with. These run on a calendar year, resetting on 1 January, so think of them as two different pots of money you can use for your foreign currency needs.

The R1 Million Single Discretionary Allowance

First, there’s the Single Discretionary Allowance, or SDA. This is your everyday, no-fuss allowance. It gives you the freedom to send up to R1 million out of the country per year without needing to get a tax clearance certificate from SARS.

It’s incredibly versatile and designed for most personal transactions. For instance, you can use your SDA for:

- Travel: Covering flights, accommodation, and spending money for your holiday.

- Gifts: Sending cash to family or friends who live overseas.

- Donations: Supporting an international charity you care about.

- Maintenance: Making alimony or child support payments.

Pretty much any legitimate personal expense you can think of fits under this R1 million umbrella. It’s the go-to allowance for most people’s regular forex needs because it's so straightforward.

The R1 million SDA is your easiest path for personal forex, no extra paperwork needed. Remember, it resets every January, giving you a fresh allowance for the new year.

The R10 Million Foreign Investment Allowance

But what happens if you need to move a much larger sum? That’s where the Foreign Investment Allowance (FIA) comes in. This second allowance lets you transfer an additional R10 million offshore each year, but it comes with one very important condition.

To use your FIA, you must first get a Tax Clearance Certificate from SARS. This document proves that your tax affairs are fully in order and that the money you’re sending is from a legitimate source. As the name suggests, this allowance is intended for investment purposes—think buying property in another country, investing in foreign stock markets, or other offshore ventures.

Getting the certificate is usually a quick process done online via SARS eFiling, as long as you're tax-compliant.

Got Questions About Buying Dollars?

It's completely normal to have a few questions when you're dealing with foreign exchange. To help you out, I've put together answers to some of the most common queries people have when buying US dollars in South Africa.

Should I Buy Dollars Here or Wait Until I Get to the USA?

This one’s a no-brainer: it is almost always better and much, much simpler to buy your US dollars before you leave South Africa.

The South African Rand (ZAR) isn't a major currency in the United States. If you try to exchange your Rands once you're there, you'll likely face terrible exchange rates and hefty service fees. It's just not a good deal. By sorting out your currency locally—whether through your bank, a bureau de change, or a digital platform—you'll get far more bang for your buck and save yourself a lot of hassle on arrival.

Can I Just Use My Credit Card to Buy Cash Dollars?

In short, no. You generally can't walk into a forex provider and buy physical US dollar notes with your credit card in South Africa.

Because of strict financial regulations, providers will almost always require payment via a debit card or an Electronic Funds Transfer (EFT) straight from your bank account. While you can use your credit card to pull cash from an ATM in the States, be warned: this is treated as a cash advance. That means you’ll be hit with sky-high fees and immediate interest charges. It's an expensive way to get cash.

Expert Tip: Online forex platforms can be a safe and cost-effective way to get your dollars. Just do your homework. Make sure the provider is an Authorised Dealer registered with the South African Reserve Bank (SARB). Also, check that their website is secure (look for HTTPS) and that their fees are laid out clearly before you commit.

What Do I Do with My Leftover Dollars When I Get Back?

So, the trip’s over and you have some greenbacks left in your wallet. You've got a couple of options.

You can sell them back to a forex provider here at home. Just keep in mind that their 'buy-back' rate will be different—and lower—than the rate you paid initially. That's how they make their money.

Another common move is to just hang onto the cash for your next trip. Officially, regulations say you should convert unused currency back to Rands within 30 days of returning, but this is rarely enforced for small amounts meant for personal use. Alternatively, if you have a foreign currency account, you can simply deposit them there.

For businesses looking for a smarter way to manage international payments, Zaro provides real exchange rates with zero spread and absolutely no hidden fees. Get the financial clarity and control your company needs by visiting Zaro.