So, you need to send money overseas or pay for something on an international website? It can feel a bit daunting, but Capitec has built its foreign exchange service right into the banking app to make it simpler.

Think of it as the go-to option for your everyday international payments, whether that's paying for your Netflix subscription in dollars or getting a birthday cash gift from your aunt in the UK. It’s a great starting point for moving money across borders with the bank you already know and trust.

Your Guide to Everyday International Transactions

Capitec’s approach to foreign exchange is all about making global finance work for your personal life. If you're a student, a regular online shopper, or have family living in another country, getting a handle on these transactions is key. The whole process is integrated into the Capitec app you use every day, which helps take the guesswork out of international payments.

Common Scenarios for Using Capitec Forex

For most of us, foreign exchange isn't about big, complicated investments; it's about practical, day-to-day things. This is exactly where Capitec’s service shines.

Here are a few situations where you might find yourself needing it:

- Online Shopping: Buying that must-have item from international sites like Amazon or ASOS.

- Digital Subscriptions: Paying for services like Spotify, Netflix, or cloud storage that are often billed in USD or EUR.

- Receiving Money: Getting a cash gift or payment from a friend or relative who lives overseas.

- Supporting Family: Sending money to your child studying abroad or helping out other family members.

If you’re managing finances across different countries, especially as a student, it’s worth looking into the best banks for international students to see how different banking partners stack up.

What You Will Need to Get Started

Before you jump in and make your first international payment, it’s a good idea to know what details you’ll need. Getting this information ready upfront makes the whole thing much quicker and smoother, whether you're sending money or receiving it.

To get an international transfer done right, you'll typically need the recipient's full name and address, their bank's name and SWIFT code, and their account number or IBAN. Having this ready beforehand saves a lot of back-and-forth.

Honestly, getting the details right is the most critical part of the whole process. Once you have the correct beneficiary information, sending the payment through the Capitec app is pretty straightforward. The app walks you through every step, from entering the amount to confirming the final details, making that first international transfer feel less like a headache and more like a simple task.

How Capitec's Foreign Exchange Rates and Fees Really Work

Ever sent money overseas and felt the amount that landed on the other side was a bit of a surprise? To get to the bottom of what a Capitec bank foreign exchange transaction really costs, you need to look at two things: the exchange rate you’re offered and the fees they charge. It's rarely just one or the other.

Think of the exchange rate you see on Google or a news site. That’s the mid-market rate. You can think of it as the wholesale price of a currency—the raw, direct rate banks and big financial players use to trade with each other, with no markups. The thing is, this rate is almost never the one you get as a retail customer.

Instead, banks add a small margin, often called a 'spread,' on top of the mid-market rate. This spread is the difference between the wholesale rate and the retail rate you're actually given. It’s not an itemised fee on your statement, but it’s a built-in cost that directly impacts how much foreign currency your rands can buy.

Decoding Capitec's Fee Structure

On top of the exchange rate spread, Capitec has a clear, fixed fee structure for its international payments. This is where they offer some predictability, making it easier to calculate at least part of the cost of sending or receiving money.

For outgoing payments in a foreign currency, you're typically looking at a fee of R175.00. If you're receiving an international payment, the fee is R50.00. These services are a lifeline for many South Africans, from residents managing family remittances to expats in places like the USA, UK, and EU. You can dig into a full breakdown of these costs on their official partner's site.

The key takeaway here is simple but crucial: the total cost of your transfer is the visible fee plus the hidden cost baked into the exchange rate markup. Getting a handle on both is non-negotiable for making smart money moves.

The Real-World Impact on Your Money

Let's make this tangible. Imagine the ZAR/USD mid-market rate is R18.00 to the dollar. When you go to send your money, you might find Capitec’s rate is closer to R18.50 (because you are buying dollars, so they sell them to you for more).

That 50-cent difference might not sound like much, but it adds up fast on a bigger transfer.

- At the mid-market rate: To get $1,000, you would need R18,000.

- With Capitec's marked-up rate: To get $1,000, you now need R18,500.

That R500 difference is the cost from the spread. When you add the R175 sending fee, the true cost of your transaction is actually R675. This is the price you pay for the convenience and security of the service.

To illustrate how this works in a typical transaction, let's break down the costs side-by-side.

Example Cost Breakdown Capitec vs Mid-Market Rate (Sending $1,000)

| Cost Component | Mid-Market Rate (Example) | Capitec Bank (Example) |

|---|---|---|

| Exchange Rate (ZAR/USD) | R18.00 | R18.50 |

| Rand Amount to Send $1,000 | R18,000 | R18,500 |

| Transfer Fee | R0 (baseline) | R175 |

| Total Cost in Rands | R18,000 | R18,675 |

As the table shows, the total cost isn't just the flat fee. The R500 difference from the exchange rate spread is the largest part of the cost in this example.

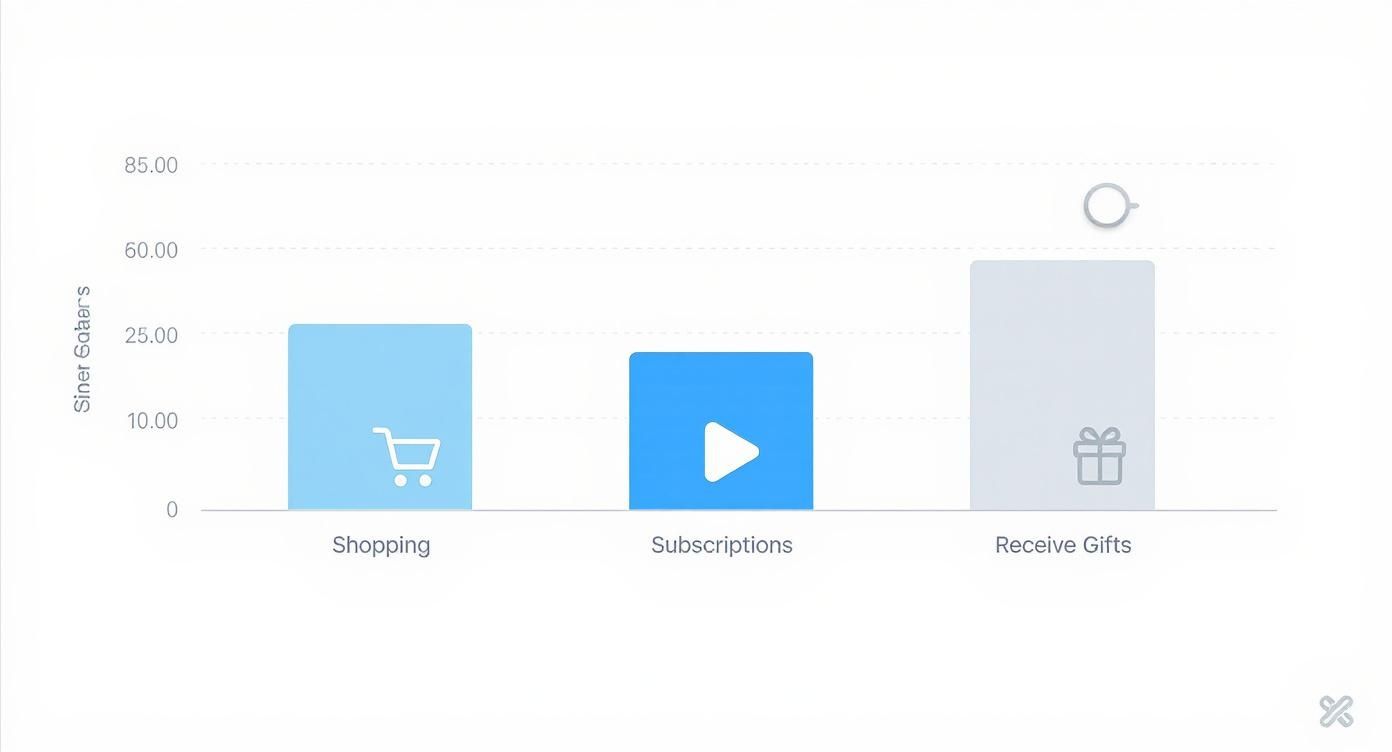

It's these kinds of everyday transactions—like online shopping, paying for subscriptions, or sending gifts—where these costs really come into play.

This chart drives home the point that common activities are often the biggest drivers for forex needs. By always calculating both the explicit fees and the implicit rate spread, you get a complete picture and can truly manage your money effectively when making international payments.

Getting to Grips with South Africa’s Forex Limits and Regulations

When you send or receive money across borders, it's not quite as simple as just hitting 'send'. Every international payment, including every Capitec bank foreign exchange transaction, has to play by the rules set out by the South African Reserve Bank (SARB). Knowing these rules is the secret to making sure your money moves smoothly.

Think of these regulations as the financial rules of the road. They’re in place to keep an eye on the capital flowing in and out of South Africa. For you, this means any money you send abroad is subject to annual limits, often called allowances.

Your Annual Allowances Explained

If you're a South African resident over 18, you have two main allowances for moving money out of the country each calendar year. These limits govern how much you can transfer for your personal use.

Single Discretionary Allowance (SDA): This is your go-to for most everyday international payments. You can send up to R1 million abroad per year without needing to get a tax clearance certificate from SARS. It’s quick and relatively hassle-free.

Foreign Capital Allowance (FCA): Need to make a bigger move, like buying property overseas or making a significant investment? This is where the FCA comes in. It gives you an additional R10 million allowance for transfers abroad each year.

A key thing to remember is that these allowances are per person, and they reset every calendar year (January to December). If you transact internationally often, keeping track of your usage is absolutely vital.

What You Can Use Each Allowance For

The two allowances are designed for different things, and knowing which bucket your payment falls into is the first step to getting it right. The rules are pretty specific about what goes where.

The Single Discretionary Allowance (SDA) is your flexible friend, covering a whole host of personal expenses:

- Gifts: Sending cash to family or friends living in another country.

- Travel: Paying for your flights, hotels, and holiday spending money.

- Donations: Supporting overseas charities or religious institutions.

- Maintenance: Sending alimony or child support payments.

The Foreign Capital Allowance (FCA), on the other hand, is strictly for investment-related activities. To use this allowance, you need to prove that your tax affairs are in good standing.

Before you can touch your R10 million Foreign Capital Allowance, you must get a Tax Compliance Status (TCS) PIN from the South African Revenue Service (SARS). This PIN is your proof that you're tax-compliant and gives the green light for the transfer.

This documentation isn't optional. It’s a core part of the process that Capitec, as an Authorised Dealer, must enforce. Planning ahead and getting your paperwork sorted will save you a world of headaches later. If you don't have the right documents, your transaction will be blocked, so a little bit of preparation goes a very long way.

Capitec Foreign Exchange for Small Businesses and Exporters

If you run a small business or export goods from South Africa, you know that dealing with international payments is just part of the job. You might be paying a supplier in China for parts or getting paid by a customer in Germany. How you handle that foreign exchange can make or break your profit on a deal. Capitec has a set of tools aimed squarely at helping you manage these cross-border transactions.

The biggest headache is currency risk. The rand’s value is constantly on the move, and a rate that looked great when you sent an invoice can turn a healthy profit into a loss by the time the money actually lands. This is why having a smart forex strategy isn’t just a nice-to-have; it's a core business function.

Capitec offers a few practical ways to get a handle on this volatility. Their digital trading platforms help you lock in rates and get payments out to your global partners without unnecessary delays.

Tools to Manage Your International Trade

To really get control over your foreign currency, you need the right kind of accounts and systems. Capitec provides solutions built for the specific headaches that importers and exporters face, aiming to make your international cash flow a lot more predictable.

Here are a couple of key tools on offer:

- Electronic Forex Trading Systems: These platforms let you buy and sell foreign currency online. Most deals are settled within two business days (this is called the spot market), which is perfect when you need to pay an overseas supplier on time.

- Currency Foreign Control (CFC) Accounts: A CFC account is a game-changer. It lets your business hold foreign currency—like US Dollars or Euros—without having to convert it into rands right away. This gives you far more control over currency swings and makes paying international suppliers a whole lot smoother.

Think of a CFC account as your financial shock absorber. Say you receive $10,000 from a client in the US. Instead of immediately converting it to rand (and paying a fee), you can hold it in your CFC account. Later, when you need to pay an American supplier, you can pay them directly from those dollars, completely avoiding two conversion fees and the risk of the rand weakening in the meantime.

Working Within the Rules

Every Capitec bank foreign exchange transaction happens under the strict supervision of the South African Reserve Bank (SARB). South Africa has a floating exchange rate, meaning the rand’s value bobs up and down based on global market forces. This affects everything from the cost of your imported goods to your overall profitability. This reality is why Capitec has increasingly focused on its forex services, which have become a significant contributor to its income. You can see a deeper dive into how market conditions affect banks in S&P Global's detailed analysis.

For any business owner, this regulatory environment makes one thing crystal clear: compliance is everything. You absolutely must ensure every cross-border payment is properly documented and declared to avoid stiff penalties and frustrating delays.

Getting this right often requires more than just good transaction management. Many businesses find that professional business advisory services are invaluable for creating a solid plan for their forex and compliance needs. With expert guidance, you can build a financial structure that helps your business do more than just survive internationally—it can help you thrive. By using the right tools and getting the right advice, forex can become a genuine competitive edge.

Practical Tips to Get Better Rates and Avoid Common Mistakes

When it comes to Capitec bank foreign exchange, getting the best value is less about luck and more about good habits. A little bit of timing, some upfront preparation, and knowing the common pitfalls can make a surprisingly big difference to your bottom line.

One of the most expensive mistakes you can make is rushing a payment. When you're in a hurry, you don’t have time to shop around, check the rates, or wait for a better moment. Planning your transfers even a few days ahead gives you the breathing room to watch how the rand is performing and pull the trigger when the rate is in your favour.

Smart Strategies for Maximising Your Money

You don't need to be a market analyst to get a better deal. It really just comes down to a few practical steps that tilt the odds in your favour and help you sidestep the traps that quietly drain your funds.

Here are a few actionable tips that actually work:

- Always Compare the Rate: Before you hit "confirm," do a quick search on Google or Reuters for the live mid-market rate. Comparing this to the rate Capitec offers instantly shows you the size of their spread—the real cost of your transaction.

- Get Your Documents Ready Early: Don't leave paperwork to the last minute. This is especially true for your Tax Compliance Status (TCS) PIN if you’re sending over R1 million. Having everything on hand prevents a last-minute scramble and potential delays.

- Avoid Peak Volatility: If your transfer isn’t urgent, try to avoid making it right after a major economic news announcement. Currencies can jump around wildly during these times, and you might get caught with a less-than-ideal rate.

These simple habits transform you from someone who just accepts the first rate they're given into an informed customer who understands exactly what they’re paying for.

Leverage Your Capitec Global One Card

For many South Africans, the easiest way to deal with foreign currency is right in their wallet: the Capitec Global One card. It’s a brilliant tool for travel and online shopping abroad, cutting out the hassle of formal transfers for smaller, day-to-day spending.

And it seems more people are catching on. Between March and August 2025, Capitec clients made around 1.9 million international card payments—that's a 24% jump from the year before. This trend shows a clear move towards simpler, more accessible ways to spend globally. You can read more about how South Africans are choosing Capitec for their international travel.

The bottom line is this: timing and preparation are your best allies. A last-minute transfer almost always costs more, either through a poor exchange rate or missed opportunities for a better one.

By blending the convenience of your card for everyday expenses with careful planning for larger transfers, you create a powerful and cost-effective strategy. This balanced approach ensures you make the most of Capitec's forex services while keeping unnecessary fees and bad rates at bay.

Your Top Capitec Foreign Exchange Questions Answered

Sending or receiving money across borders can feel a bit daunting, and it's natural to have questions. To clear things up, we've tackled some of the most common queries about using Capitec for foreign exchange.

Think of this as your quick guide to understanding processing times, what paperwork you'll need, and how your everyday bank card works on the global stage.

How Long Does an International Payment with Capitec Take?

When you send money overseas with Capitec, you can generally expect it to arrive within 2 to 5 business days.

Of course, this is a guideline. The final timing can be affected by a few things, like the destination country, the other bank's processing speed, and any public holidays either here in South Africa or on the other side. My best advice? If you've got a deadline, always send the payment well in advance to be safe. Incoming payments usually follow a similar timeline to clear into your account.

What Documents Do I Need to Receive Money from Overseas?

Getting money from abroad requires a small but crucial bit of admin. The main thing you'll need to do is complete a 'Reporting Mandate' right inside the Capitec app.

This isn't a Capitec rule, but a requirement from the South African Reserve Bank (SARB) for all international payments coming into the country. You'll also need to state the reason for receiving the money, whether it's a gift, for work, or something else.

Capitec will ping you a notification once the funds land. You have to complete this step in the app before they can release the money into your account. For bigger or more unusual transactions, don't be surprised if they ask for a bit more paperwork to stay compliant.

Can I Use My Capitec Card for International Online Shopping?

Absolutely. Your Capitec Global One card is a Mastercard, making it welcome at millions of online stores around the world.

When you click "buy" on an international website, the purchase amount is automatically converted from whatever currency it's in (like US Dollars or Euros) into Rands. The conversion uses the bank's exchange rate for that day, and you'll see a small currency conversion fee on your statement. It’s incredibly handy, but it's always smart to double-check your online payment limits in the app before you shop.

Are There Cheaper Alternatives to Capitec for Forex?

While Capitec is convenient, especially if you already bank with them, it's not always the cheapest game in town. Fintech companies that specialise in international payments can often save you a surprising amount of money.

Providers that live and breathe cross-border payments usually offer:

- Lower Transfer Fees: Their fee structures are often leaner and more transparent than traditional banks.

- Better Exchange Rates: They typically give you an exchange rate much closer to the real mid-market rate, meaning more of your money makes it to its destination.

Ultimately, the best option comes down to your priorities—is it pure convenience, low cost, or speed? It never hurts to get a quick quote from an alternative provider to see how it stacks up against the bank's total cost before you commit.

For South African businesses tired of hidden fees and watching their money disappear into slow transfers, Zaro offers a clear alternative. We give you access to real exchange rates with zero spread and no SWIFT fees, making sure your money is working for your business, not for the bank. Discover a faster, more cost-effective way to manage international payments by visiting https://www.usezaro.com.