When you look at the Capitec exchange rates on offer, it's important to know that what you see isn't exactly what you get. The rate they show you has a hidden markup baked into it, often called the spread, which quietly increases the cost of your international business payments. This small percentage is simply the gap between the rate Capitec gives you and the real, mid-market rate.

The True Cost of Capitec Exchange Rates for Your Business

If your South African business deals with international clients or suppliers, getting a firm grip on foreign exchange (FX) costs is non-negotiable. The convenience of using your everyday bank like Capitec for global payments can easily obscure the hidden expenses chipping away at your bottom line. The biggest cost isn't the upfront transaction fee; it's the exchange rate spread.

This spread is the margin Capitec adds on top of the mid-market rate—the true exchange rate banks use when they trade currencies with each other. This markup, which can be anywhere from 1% to 3%, becomes a direct cost to your business every time you convert money.

Seeing the Hidden Cost in Action

Let’s make this real. Imagine your business has a US supplier invoice to pay for $10,000. Here’s a simple breakdown of how that spread hits your wallet.

| Metric | Mid-Market Rate (No Spread) | Capitec's Quoted Rate (2% Spread) |

|---|---|---|

| USD/ZAR Rate | 18.00 | 18.36 |

| Total Cost in ZAR | R180,000 | R183,600 |

| Hidden Spread Cost | R0 | R3,600 |

In this example, a 2% spread means you’re paying an extra R3,600 on just one payment. It might not sound like a disaster on its own, but these costs add up fast over dozens of transactions, squeezing your cash flow and making your business less competitive.

For a business that regularly pays international invoices, the annual cost of these hidden spreads can easily run into tens of thousands of rands. That’s money that should be fuelling your growth, not disappearing into fees.

This is the core challenge for so many SMEs. Without knowing the mid-market rate and the actual spread your bank is applying, it's almost impossible to budget accurately for international costs. This lack of transparency introduces unpredictable expenses and complicates your financial planning. The main takeaway here is that the advertised Capitec exchange rates are only half the picture; the real cost is buried in the numbers.

Breaking Down Capitec's Forex Fees and Hidden Spreads

When your business handles an international payment with Capitec, you’re looking at two different costs. The first is the easy one to spot: a fixed, upfront transaction fee. But the second, and by far the bigger culprit, is the hidden margin Capitec adds to its exchange rates—what’s known in the industry as the spread.

To really get a grip on your international payment costs, you need to understand both. The fixed fee is simple enough to account for, but that exchange rate spread is a sneaky, variable cost that quietly chips away at your revenue every time you convert currency.

The Visible Costs Explained

Capitec is pretty transparent about its fixed fees for global payments. These are the charges you'll see listed on your transaction statement.

- Outgoing International Payments: You'll pay a flat R175.00 to send money out of the country.

- Incoming International Payments: Receiving money from abroad will cost you R50.00.

It’s also worth remembering that the SWIFT network often involves intermediary banks, and they can skim their own fees off the top. This means the amount that lands in your supplier's account—or your own—might be a little lighter than you expected. It's a common headache with the traditional banking system.

Unpacking the Hidden Exchange Rate Spread

The real damage to your bottom line, however, comes from the exchange rate spread. This is simply the gap between the mid-market rate (the "real" rate you see on Google or Reuters) and the less attractive rate Capitec actually gives you. That difference is pure profit for the bank and a direct cost to your business.

Capitec doesn't advertise its spreads, but our analysis at Zaro shows they typically add an FX spread of around 1–3% on major currency pairs like USD and GBP. To put that in perspective, if you're a South African exporter invoicing USD 500,000 a year, a 2% spread means you’re losing around USD 10,000—that’s roughly ZAR 170,000—just to hidden margins. And that's before you even pay the fixed fees. You can dig deeper into how these costs add up by reviewing the full Zaro analysis of Capitec's forex rates.

Think of the spread as a commission that’s charged on the total value of your transfer. The bigger the payment, the more you hand over to this invisible fee, making it especially punishing for businesses with regular or high-value international trade.

To show just how much of a difference this makes, let's run a quick simulation.

Cost Simulation: Capitec vs. Mid-Market Rate (USD 50,000 Transfer)

This table shows what happens when a South African business converts USD 50,000 into ZAR. We're comparing a typical Capitec rate against the real mid-market rate you'd get with a provider like Zaro.

| Metric | Capitec (Assumed 2% Spread) | Zaro (Mid-Market Rate) | Difference (Lost Revenue) |

|---|---|---|---|

| USD Amount | $50,000 | $50,000 | - |

| Mid-Market Rate | - | 18.50 ZAR/USD | - |

| Offered Rate | 18.13 ZAR/USD | 18.50 ZAR/USD | -R0.37 per USD |

| ZAR Received | R906,500 | R925,000 | -R18,500 |

| Visible Fee | R50 | R0 | -R50 |

| Total ZAR in Account | R906,450 | R925,000 | -R18,550 |

As you can see, the spread on a single USD 50,000 transaction results in R18,500 less in your account. For businesses that receive international payments regularly, this lost revenue compounds quickly, turning into a significant drain on profitability over the year.

A Practical Example: The Real Cost of an Invoice

Let's walk through another common scenario. Your business needs to pay a supplier in the UK an invoice for £20,000. How does the cost stack up?

Scenario Details:

- Invoice Amount: £20,000

- Mid-Market GBP/ZAR Rate: 22.50

- Capitec's Quoted Rate (2% Spread): 22.95 (that's 22.50 * 1.02)

- Capitec's Fixed Fee: R175.00

Now, let's do the maths.

Cost at the Mid-Market Rate:

£20,000 * 22.50 ZAR/GBP = R450,000- This is the true Rand value of the invoice before the banks get involved.

Cost with Capitec:

£20,000 * 22.95 ZAR/GBP = R459,000- Now, add the fixed fee:

R459,000 + R175 = R459,175

The difference is plain to see. The hidden spread alone costs your business R9,000 on just one payment. With the fixed fee, your total FX cost hits R9,175. If you're making a payment like this every month, you’re giving away more than R100,000 a year—all because of the spread.

This simple calculation shows why focusing only on the small, visible fees is a mistake. It’s the percentage-based spread baked into the Capitec exchange rates that really does the damage, silently eating into your margins and making it more expensive to do business globally.

How Capitec Stacks Up Against Other FX Providers in South Africa

If your South African business trades globally, picking the right foreign exchange provider is a make-or-break decision. Capitec is a familiar name, offering a straightforward banking platform many of us use daily. But when it comes to FX, its model is built on a traditional framework that often values simplicity over cost-effectiveness. Let's dig into how Capitec exchange rates and fees really compare to the old guard banks and the newer fintech players.

We need to go beyond just the advertised fees and look at what really hits your bottom line and your workload. I'll be comparing them on the transparency of their exchange rates, the size of that hidden spread, their upfront transaction fees, how fast the money actually moves, and how practical their platform is for a growing business.

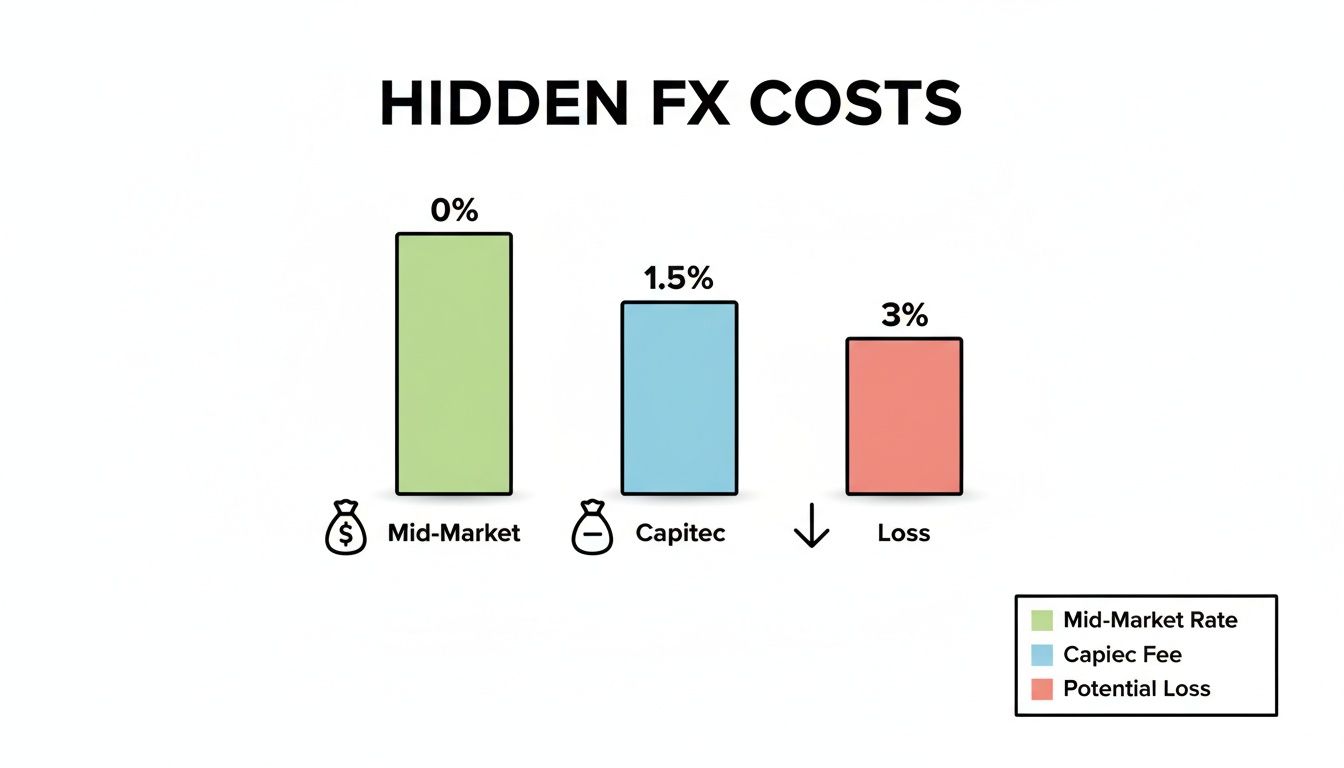

This bar chart gives you a quick visual on just how much those hidden spreads can cost you. It shows what you should get at the mid-market rate versus what you often lose to a bank's markup.

As you can see, while the mid-market rate is the true value of your money, the bank's spread takes a slice out of it before any other fees are even added to the bill.

Capitec vs Traditional South African Banks

Put Capitec next to the other big South African banks like FNB or Standard Bank, and you’ll notice they're playing a very similar game with foreign exchange. They all make their money from two places: the transaction fees you can see and the exchange rate spread you often don't.

On the surface, Capitec’s fixed fees for international payments—R175 to send and R50 to receive—look quite competitive, sometimes even cheaper than their larger competitors. But the real cost driver is that spread, and it’s a big deal across the board. Whether it’s Capitec, FNB, or Standard Bank, you can expect their spreads to be anywhere from 1% to over 3%.

The main difference often just boils down to convenience. If your business already runs on Capitec, doing your FX through the same app feels easy. But that ease comes at a price—you’re paying for it with less transparency and higher total costs hidden away in the rate.

Capitec vs Modern Fintech Solutions

This is where the real contrast becomes obvious. When you compare Capitec to a fintech provider like Zaro, you’re looking at two completely different approaches. These newer companies were built from the ground up to fix the slow, expensive problems of traditional banking, with a laser focus on transparency and speed.

Fintech providers are built on a completely different business model. Instead of profiting from murky exchange rate spreads, they give you access to the real mid-market rate and charge a clear, upfront fee. This completely flips the script on how much international payments should cost.

This isn't just a small improvement; it's a fundamental change in how foreign exchange is priced and handled. Let's break down what that means for your business day-to-day.

A Structured Comparison for Business Use Cases

To see the real-world impact, let's compare these providers based on scenarios that South African SMEs deal with all the time.

| Feature / Scenario | Capitec | Traditional Banks (FNB, Standard Bank) | Zaro (Fintech Alternative) |

|---|---|---|---|

| Exchange Rate Basis | Mid-market rate + 1-3% spread | Mid-market rate + 1-3.5% spread | True mid-market rate (no spread) |

| Cost Transparency | Opaque. The spread is buried in the final rate and isn't disclosed. | Just as opaque. Spreads are almost never published and change constantly. | Fully transparent. You see the real rate, and any fee is listed separately. |

| Visible Fees | Low fixed fees (e.g., R175 outgoing). Extra intermediary bank fees are possible. | Often higher fixed fees. SWIFT and intermediary fees are standard. | No SWIFT fees. Just a small, clear percentage-based transaction fee. |

| Transfer Speed | Typically 2-4 business days, at the mercy of the SWIFT network. | Similar to Capitec, often taking several business days to clear. | Much faster. Many payments land within 24 hours. |

| Business Functionality | Basic payment tools inside the banking app. Limited options for multiple users. | More corporate features, but often too complex and clunky for SMEs. | Designed for business teams with multi-user access, permissions, and accounting integrations. |

| Paying an Invoice of $10,000 | Costs you a hidden spread of ~R1,800-R5,400 plus the R175 fee. | The spread cost is similar or even higher, plus larger fixed fees. | The cost is a small, transparent fee. You lose R0 to the spread, saving thousands. |

| Receiving a Payment of €20,000 | You get less ZAR because of their conversion spread, plus you pay a R50 fee. | A similar story—a decent chunk of your revenue vanishes into the spread. | You get the full ZAR amount at the real rate, which means more of your money stays yours. |

The comparison draws a clear line in the sand. Capitec and the other traditional banks offer a bundled service that feels convenient, but their pricing model is fundamentally set up to work against the interests of any business making regular international payments. The cost of those hidden spreads adds up incredibly fast, quickly erasing any benefit from a slightly lower fixed fee.

For a South African SME, the choice really comes down to your priorities. If you only send one or two small international payments a year, the convenience of using your existing Capitec account might be good enough. But for any business that regularly deals with imports, exports, or international suppliers, the lack of transparency and high hidden costs from traditional banks are a serious and unnecessary drain on your finances. Fintech solutions like Zaro offer a direct way to slash these costs, make your cash flow more predictable, and simplify your entire financial workflow.

When Capitec's Forex Model Fails Real-World Business Scenarios

On-paper comparisons are one thing, but the true test of a bank’s forex service is how it holds up in the real world. For any South African business trading globally, the hidden costs baked into Capitec exchange rates can act as a constant drag on profitability. What seems like a small percentage point here or there quickly turns into a serious cost-management headache.

Let’s put aside the abstract numbers and walk through three everyday business situations. By running the figures, we can see exactly where Capitec’s model starts to hurt and what it really costs your business in rands and cents.

Scenario 1: The Exporter Repatriating USD Revenue

Picture a local software company that bills its American client $25,000 every month. The mission is simple: bring that money home to cover salaries and office rent, losing as little as possible to the bank along the way.

Let's say the mid-market rate is 18.20 ZAR/USD. A transparent provider like Zaro would process the conversion at this rate. Capitec, however, might apply a 1.8% spread, giving the business a much less attractive rate.

Here's how the numbers stack up:

- Mid-Market Value: $25,000 x 18.20 = R455,000

- Capitec's Offered Rate: 18.20 - (18.20 x 1.8%) = 17.87 ZAR/USD

- ZAR Received via Capitec: $25,000 x 17.87 = R446,750

- Immediate Loss to Spread: R455,000 - R446,750 = R8,250

Just like that, the company is out over R8,000 on a single transaction. Over a year, this hidden cost bleeds the business of nearly R100,000—money that could have funded a new developer’s salary or a much-needed marketing campaign.

The slow, steady erosion of revenue through exchange rate spreads is one of the biggest—and sneakiest—financial drains for South African exporters. This isn't a one-off fee; it's a recurring tax on your international success.

Scenario 2: The E-commerce Store Settling EUR Invoices

Now, think about an online store that imports unique goods from Germany. They have a quarterly invoice for €40,000 that needs to be paid, which means converting ZAR to EUR.

When you're buying foreign currency, the spread works against you in the other direction—the bank sells you the euros at an inflated price. With a mid-market rate of 19.50 ZAR/EUR, a 2% spread makes this payment a lot more expensive.

Let's break down the payment:

- Mid-Market Cost: €40,000 x 19.50 = R780,000

- Capitec's Selling Rate: 19.50 + (19.50 x 2.0%) = 19.89 ZAR/EUR

- Total Cost via Capitec: €40,000 x 19.89 = R795,600

- Extra Cost from Spread: R795,600 - R780,000 = R15,600

To pay just one invoice, the retailer is forced to cough up an extra R15,600. This directly eats into their profit margins, forcing a tough choice: absorb the cost or pass it on to customers through higher prices, risking a competitive disadvantage. Annually, these payments could cost the business over R60,000 in completely avoidable FX fees.

Scenario 3: The BPO Paying International Contractors

Finally, consider a Business Process Outsourcing (BPO) firm in Cape Town with a team of skilled contractors in the UK. Every month, they need to pay five contractors £1,500 each, totalling £7,500.

In the BPO world, predictable costs and tight margins are everything. Assuming a mid-market rate of 22.80 ZAR/GBP, Capitec’s 2.2% spread adds a significant burden.

The contractor payroll cost looks like this:

- Total Payment: £7,500

- Mid-Market Cost: £7,500 x 22.80 = R171,000

- Capitec's Selling Rate: 22.80 + (22.80 x 2.2%) = 23.30 ZAR/GBP

- Total Cost via Capitec: £7,500 x 23.30 = R174,750

- Monthly Overpayment: R174,750 - R171,000 = R3,750

The BPO is overpaying by R3,750 every single month. That’s R45,000 a year that simply vanishes. Worse, the slow SWIFT system means payments can take days to arrive, creating uncertainty for their valued contractors and adding operational friction on top of the financial cost.

In each case, the story is the same. The traditional banking model, built on opaque spreads, consistently siphons money away from the business. For South African companies competing on a global stage, these "small" percentages snowball into huge annual losses that directly impact their financial health and ability to grow.

A Practical Guide to Cutting Your Business's Foreign Exchange Costs

Knowing the true cost of Capitec exchange rates is your first win. But taking action to cut those costs is where you really start boosting your bottom line. For South African SMEs, sorting out your foreign exchange isn't some high-level corporate finance puzzle. It's a simple, practical process: audit, compare, and switch to better tools. This guide will walk you through exactly how to take control of your international payments and stop leaking money through hidden fees.

Your first move is a quick audit of your past international transactions. Pull up your payment records from the last six to twelve months and pinpoint every time you converted currency. For each payment, jot down the amount you sent or received, the exchange rate you got, and any upfront fees you paid.

This data is your starting point. It gives you a clear picture of what you've actually been paying and sets you up perfectly for the most important step: benchmarking.

Benchmarking What You're Really Paying

To see the markup you’ve been paying, you need a baseline. That baseline is the mid-market rate—the real, unfiltered exchange rate you see on Google or financial news sites, with no bank markup baked in. You can easily find historical mid-market rates online for the exact day and time of your past transactions.

Now, compare the rate Capitec gave you with the mid-market rate for each of those payments. The difference between the two is the spread, which is your hidden fee.

Here’s a simple way to calculate it:

(Your Bank’s Rate - Mid-Market Rate) / Mid-Market RateMultiply the result by 100 to get the percentage spread.

Do this for a few transactions, and you'll quickly spot a pattern. That percentage is the real cost you’ve been paying on top of any fixed fees. I guarantee it’s higher than you thought.

Exploring Transparent Alternatives

Once you have a clear handle on your costs, the next step is to look for providers who play by different rules. Modern fintech platforms like Zaro were built from the ground up to get rid of the murky pricing models that traditional banks rely on.

The fundamental difference is how they handle the exchange rate. Instead of quietly adding a hidden spread, they give you direct access to the real mid-market rate. They make their money from a small, completely transparent transaction fee, so you always know exactly what you’re paying. Moving from a hidden percentage to a clear, fixed fee changes everything.

Bringing a transparent FX provider into your business isn't about ditching your bank. It's about upgrading your financial toolkit. Think of it as plugging a major leak in your operations—one that directly boosts your profit margin on every single international deal.

Improving your FX management is a powerful move, and it fits perfectly within broader strategies to reduce operational costs and boost efficiency.

Making the Switch to Modern, Efficient Tools

Moving to a better system is far easier than you might imagine. Getting set up with a provider like Zaro is a simple digital process, designed for busy entrepreneurs. It involves a standard Know Your Business (KYB) verification to meet regulations, and from there, you’re in.

Here are the kinds of game-changing features you unlock:

- Dedicated Multi-Currency Accounts: You can hold balances in ZAR, USD, EUR, and other major currencies without being forced to convert your money right away. This gives you huge flexibility to manage your cash flow and pay international suppliers directly from your foreign currency balance.

- Zero SWIFT Fees: Because these platforms don't use the old, clunky SWIFT network, you completely avoid those notorious intermediary bank fees. This also means payments settle much faster, often within 24 hours.

- Business-Grade Controls: Modern platforms are built for teams. You can set up multiple users with custom permissions, giving your finance staff the access they need while you keep full oversight of every transaction.

By following these steps—auditing your costs, benchmarking against the real rate, and adopting a transparent provider—you can slash your FX expenses almost immediately. This isn’t just about saving a bit of cash; it’s about building a more predictable, efficient, and profitable foundation for your business's global ambitions.

Why Transparent Exchange Rates Are a Real Strategy for Growth

Looking closely at Capitec's exchange rates isn't just about shaving a few cents off a transaction. It’s a fundamental shift in how you manage your business's global finances, and it directly fuels growth. When your costs are predictable, you can build a healthy cash flow. Opaque bank spreads, on the other hand, throw a spanner in the works, making budgeting a nightmare and undermining any financial forecasting you try to do.

By ditching those hidden margins, you take back control. This clarity lets you price your goods and services more competitively for international customers and protect your profit margins with far greater certainty.

A Completely Different Way of Thinking

The difference between the old-school banks and the new fintech players isn't just about the price tag; it's about their entire business philosophy.

- The Traditional Bank Model (Capitec and co.): Their approach is to bundle the service and the cost together. They make their money from a hidden spread they tack onto the exchange rate, making it almost impossible to figure out the true cost ahead of time.

- The Modern Fintech Model (Zaro): This model separates the service from the cost. You get the real mid-market exchange rate, and they charge a small, upfront fee for facilitating the transaction. Everything is out in the open.

For any South African business with global ambitions, picking a transparent FX provider is a serious growth lever. It turns a historically unpredictable expense into a predictable, efficient part of your operations. That frees up cash you can put back into the business—think innovation, hiring top talent, or expanding your reach.

At the end of the day, cutting down on exchange rate costs makes your company more financially resilient. Every single rand you save from hidden fees goes straight to your bottom line. In a market this competitive, using every financial tool you can—starting with transparent exchange rates—is key to building a more profitable and scalable international business.

Got Questions About Capitec's Exchange Rates?

When you're dealing with international payments, the details can get a bit fuzzy. It's easy to get lost in the jargon of spreads and fees. To clear things up, we've answered some of the most common questions South African businesses ask about Capitec's forex services.

What's the Real Spread Capitec Is Charging?

Capitec doesn't advertise its forex spreads, but our research shows a typical margin of 1% to 3% is added to the mid-market rate. This applies to major currencies like the US Dollar, Euro, and British Pound. Think of this spread as a hidden fee; it's a slice they take before your money even leaves the bank.

Are There Cheaper Ways for a Business to Handle Forex?

Absolutely. This is where modern fintech providers like Zaro really shine, offering a clear cost advantage over the old-school banking model.

- Zero Spread: You get the real mid-market exchange rate, with no hidden markup. What you see is what you get.

- Lower Fees: Transaction fees are typically much lower and more transparent, often doing away with SWIFT charges altogether.

For any business making regular international payments, these savings add up fast.

The biggest difference comes down to transparency. A good fintech provider shows you the exact rate and a simple, clear fee. It takes all the guesswork and hidden costs out of the equation.

How Do I Figure Out the True Cost of a Transfer?

To get the full picture of what you're paying with Capitec, you'll need to do a quick calculation. First, check the live mid-market rate for your currency pair on a trusted source like Google or Reuters.

Then, compare that rate to the one Capitec is quoting you. The percentage difference between the two is the spread. Finally, add any upfront transaction fees (like SWIFT charges) to that hidden spread. That’s your total cost.

Can My Business Hold Foreign Currency in a Capitec Account?

Not really. Capitec’s business banking is built around converting ZAR to send payments abroad or receiving foreign currency and converting it back to Rand. It isn't designed for holding balances in USD, EUR, or GBP over time. If you need to manage international cash flow, you’ll be much better off with a specialised multi-currency account provider.

Take control of your international payments and stop losing money to hidden fees. Zaro gives your business access to the real mid-market exchange rate with zero spread. Learn more and get started with Zaro today.