If you've ever sent money overseas, you've probably felt that slight confusion when looking at exchange rates. The rate Capitec offers you isn't the same as the "real" rate you see on Google or the news. It’s crucial to understand that their rate includes a markup, known as a spread, on top of other fees. Getting to grips with this difference is the key to making your international payments a lot cheaper.

Understanding Capitec Foreign Exchange Rates and Why They Matter

Ever sent money abroad and wondered why the final amount received was less than you calculated? The answer is usually tucked away inside the bank's exchange rate. It helps to think about foreign currency as a product a bank buys and sells.

A bank will acquire currency at a wholesale price, which is known as the mid-market rate. This is the genuine, raw exchange rate—the midpoint between what buyers and sellers are offering for a currency on the global market. But when they sell that currency to you for your transfer, they don't give it to you at that price. They add their own margin on top.

The Role of Spreads and Fees

This markup is called a forex spread, and it's the primary way banks make a profit on foreign exchange services. It might only look like a tiny percentage, but on larger business transactions, that "small" spread can quietly snowball into a significant cost. It’s essentially a hidden fee that you won't see listed separately on your invoice.

On top of the spread, you'll often face other direct fees for the transaction. These can include:

- SWIFT Fees: A charge for using the international SWIFT network, which is the standard system for bank-to-bank transfers.

- Admin Charges: A fixed fee the bank charges just for processing the payment.

- Intermediary Bank Fees: Sometimes, your money has to pass through one or more other banks to reach its destination, and each of those banks can take a cut.

The real cost of an international transfer is the exchange rate spread plus any visible fees. Many people focus only on the fixed fee and overlook the much larger cost hidden in the rate itself.

Why This Matters for Your Business

For any South African business that pays overseas suppliers or gets paid by international clients, these costs hit your profit margin directly. Every rand lost to high forex costs means less profit on your exports or higher operating expenses on your imports. It's that simple.

Once you understand how Capitec foreign exchange rates are actually put together, you're in a much stronger position to make smarter financial choices. This knowledge is your first step toward finding more transparent and cost-effective alternatives, which ultimately helps protect your company's bottom line.

How Spreads and Fees Really Affect Your International Payments

If you want to get a true picture of what it costs to send money abroad, looking at the advertised transfer fee is only scratching the surface. The real cost is actually a one-two punch: the obvious, upfront fee and the much larger, often-hidden cost baked into the exchange rate itself. Understanding both is the key to protecting your business's profits.

The biggest culprit eating into your funds is the forex spread. It’s simply the gap between the 'real' mid-market exchange rate (the one you see on Google) and the less favourable rate your bank gives you. Think of it as the bank’s built-in profit margin for doing the currency swap. It might look like a tiny percentage, but on larger transfers, that margin can easily become the most expensive part of your transaction.

Getting to Grips with the Forex Spread

Let's break it down. Say the mid-market rate for USD to ZAR is R18.50. This is the genuine rate banks use when they trade with each other. But when you, the customer, need to send dollars, Capitec might offer you a "sell" rate of R18.85. That R0.35 difference on every single dollar is the spread. It’s their cut.

Here's how that small difference plays out in the real world.

Example: Paying a $5,000 USD Supplier Invoice

- Real Mid-Market Rate: R18.50 per dollar

- Capitec's Customer Rate (with spread): R18.85 per dollar

At the real rate, that invoice would cost your business R92,500 (5,000 x 18.50). But through the bank, you’re actually paying R94,250 (5,000 x 18.85). The spread alone just cost you an extra R1,750 on this one payment. That’s cash that never even left the country; it was simply absorbed by the bank as a conversion cost.

The forex spread is an indirect cost that won't appear as a line item on your statement. Its impact grows with the size of your payment, making it a massive drain on businesses that handle significant international transactions.

Don't Forget the Direct Fees

On top of the hidden spread, you've got the fixed, explicit fees. When you use traditional banking systems, these charges are part of the deal and add another layer of cost to your payments. Capitec, for example, has set fees for both sending and receiving money internationally.

These direct costs usually fall into two buckets:

- Outgoing Payment Fee: This is the standard charge for just starting the transfer. With Capitec, you're looking at a fixed fee of R175.00 for an outgoing international payment.

- SWIFT Network Fees: The global SWIFT network is a bit like a relay race. Your money might pass through several intermediary banks to reach its destination, and each one can take a little slice for their trouble. These fees are unpredictable and you often only find out about them when your supplier receives less money than you sent.

So, let's go back to that $5,000 invoice. The total cost is the R1,750 from the spread, plus the R175 upfront fee, plus any surprise SWIFT fees along the way. Suddenly, the true cost is a far cry from the simple transfer fee you were first quoted.

Right, let's break down how to find and make sense of Capitec's forex rates. Getting your hands on the latest numbers is the easy part, but knowing what they actually mean for your business is where the real work begins.

You can usually find Capitec's daily indicative rates on their mobile app or by giving their forex department a call. But when you get those numbers, you'll see two rates for every currency pair: a 'buy' rate and a 'sell' rate.

What’s the Difference Between "Buy" and "Sell" Rates?

It's simple once you look at it from the bank's point of view. Capitec is in the business of buying and selling currency, just like a shop buys and sells products.

The "Sell" Rate: This is the rate Capitec uses to sell you foreign currency. If you’re sending money overseas to pay a supplier, this is your rate. It’s what it costs you to buy, say, US Dollars with your Rands.

The "Buy" Rate: This is the rate Capitec uses to buy foreign currency from you. If you’re receiving a payment from an international client, this is the rate that applies. It's how many Rands you'll get for their Dollars.

You'll quickly notice the sell rate is always higher than the buy rate. That gap between them is the bank's spread—their built-in profit margin. For your business, it means you pay more Rands to send a dollar than you receive in Rands when a dollar comes in.

Locking in Your Rate with Spot Transactions

One of the tools Capitec offers to give you a bit more certainty is a spot market transaction. As an Authorised Foreign Exchange Dealer, they can lock in an exchange rate for you today, with the payment being settled within two business days.

This is a huge deal for anyone managing cross-border payments. It protects you from the market moving against you overnight. You can find out more about how this works on Capitec's foreign exchange services page.

A spot transaction means you can secure today's rate for a payment that will go through in the next 48 hours. This is your shield against sudden currency swings that could blow your budget, ensuring the Rand amount you planned for is the amount you actually pay.

Once you know where to find the rates and what they mean, you're in a much better position to accurately calculate the true cost of your international payments.

Let's Talk Real Numbers: Calculating the True Cost to Your Business

Spreads and fees can sound a bit abstract. The only way to really understand their bite is to see them in action, applied to the kind of transactions South African businesses handle every single day. When you put the numbers side-by-side, those hidden foreign exchange costs suddenly become very hard to ignore.

Let’s run through a classic scenario. Imagine your company needs to pay an invoice for $10,000 USD to an overseas supplier for crucial stock. It’s a standard part of doing business for any importer.

The Real-World Impact: Paying a US Supplier

For this example, we’ll use some realistic, yet hypothetical, figures:

- The Real Mid-Market Rate: R18.50 per USD

- A Typical Bank's Customer "Sell" Rate: R18.85 per USD (This is the rate they offer you, with their profit margin built-in)

Now, let’s do the maths and see what that $10,000 invoice actually sets you back in Rands.

If you could trade at the true mid-market rate, the invoice would cost you exactly R185,000 (that's 10,000 x 18.50). This figure represents the real, unfiltered value of the currency conversion.

But when you transact through the bank, using their customer rate, the payment suddenly costs your business R188,500 (10,000 x 18.85). That difference of R3,500 is the cost of the spread. It’s not a service fee; it’s a markup baked right into the exchange rate you’re given.

On just one $10,000 transaction, the exchange rate spread can easily skim thousands of Rands off your bottom line. This eats directly into your profit margin before you’ve even had a chance to sell the goods.

And remember, this calculation doesn't even factor in the standard international payment fee (often around R175) or any surprise fees from intermediary banks along the way, which push your total cost even higher.

Let's break that down into a simple table.

Cost Comparison for a $10,000 USD Invoice Payment

This table clearly illustrates the cost difference between a provider that gives you the mid-market rate and a typical bank that adds a spread to its exchange rate.

| Metric | Mid-Market Rate Provider | Typical Bank Rate |

|---|---|---|

| Exchange Rate Offered | R18.50 per USD | R18.85 per USD |

| Total ZAR Cost | R185,000 | R188,500 |

| Hidden Cost (Spread) | R0 | R3,500 |

| Fixed Transfer Fee | R0 (Example: Zaro) | R175 (Example) |

| Grand Total | R185,000 | R188,675 |

As you can see, the spread is where the real cost lies. It's often much larger than the fixed fee you see on your statement.

What About Receiving Money? The Freelancer's Dilemma

The story is just as painful when you’re on the receiving end.

Picture a local freelancer who’s just finished a big project for a client in Europe. They’re expecting a payment of €5,000. Here, the bank’s "buy" rate gets applied—and it's always less favourable than the mid-market rate because they’re buying the foreign currency from you.

- The Real Mid-Market Rate: R20.10 per EUR

- A Typical Bank's Customer "Buy" Rate: R19.75 per EUR

Based on the real rate, our freelancer should be getting R100,500 (5,000 x 20.10). That’s what their work is truly worth in Rands.

But once the bank takes its cut via the spread, the actual amount that lands in their account is just R98,750 (5,000 x 19.75). Just like that, R1,750 of their hard-earned income has vanished into the spread. And that’s before any receiving fees are tacked on.

These simple examples drive home a crucial point: whether you’re sending or receiving money internationally, the spread is a direct, and often significant, cost to your business. Putting a number to that cost is the first step towards finding smarter, more transparent ways to manage your foreign payments and protect your profits.

How Global Economics Influence Your Exchange Rate

Ever wondered why the exchange rate you get from Capitec today is different from yesterday's? It's not just a number they pull out of thin air. It’s a direct result of massive, constantly shifting economic forces playing out on the world stage. For any South African business dealing with international payments, getting a handle on this bigger picture is key to timing your transactions well.

South Africa uses what's known as a floating exchange rate system. This simply means the government doesn't peg the Rand (ZAR) to a fixed value. Instead, its price is set by the daily global tug-of-war between supply and demand. If international investors are buying up Rands, its value climbs. If they're selling, it drops. This is the engine behind those daily fluctuations.

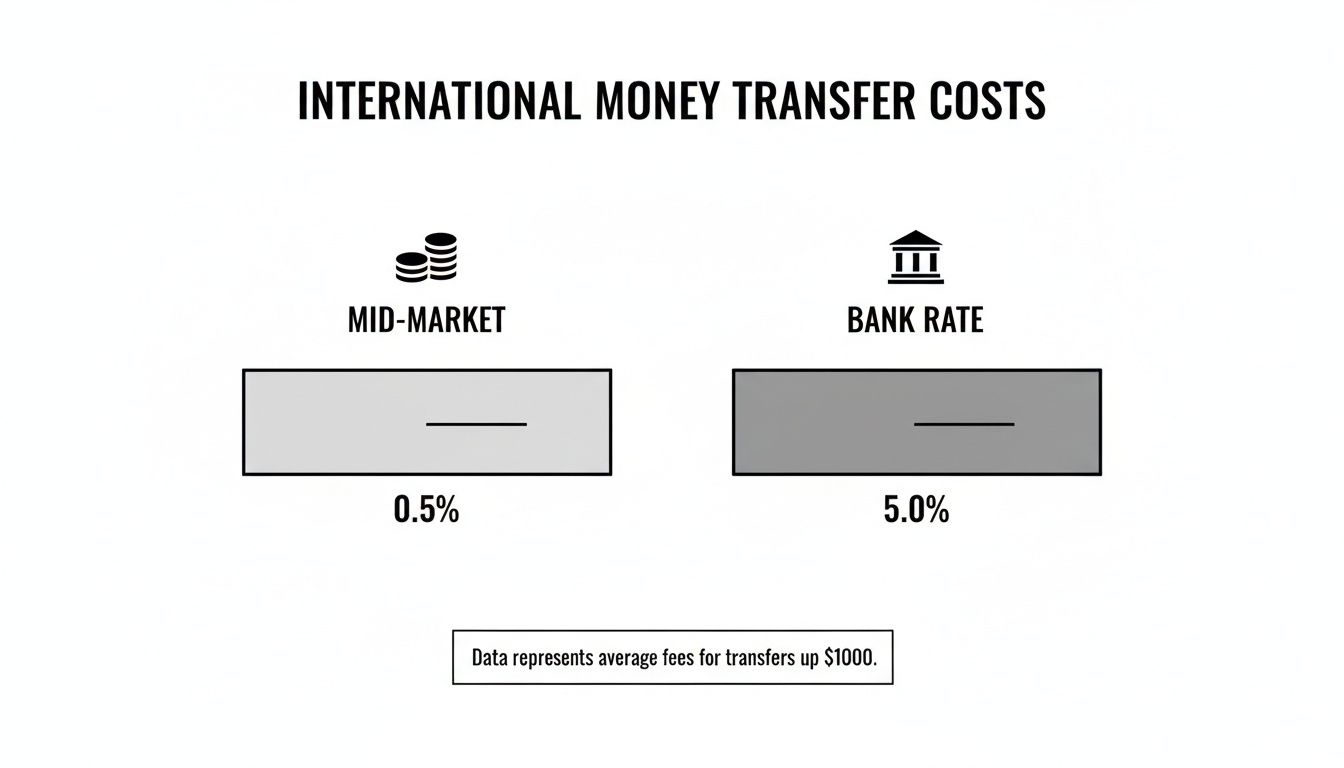

This chart really brings home the difference between the pure, mid-market rate and what you actually get from a bank once their markup is baked in.

As you can see, that spread isn't just a tiny fee—it's a significant cost layered on top of the currency's real value.

What Really Moves the Rand?

So, what causes this global supply and demand to shift? A few key factors are constantly at play, directly influencing the Capitec foreign exchange rates you’re offered. These are the very same signals that professional forex traders live and breathe by.

- Interest Rates: When the South African Reserve Bank (SARB) adjusts interest rates, it immediately changes how attractive the Rand is to foreign investors. Higher rates can draw in capital, giving the ZAR a boost.

- Inflation: If inflation is running high, it eats away at the Rand's buying power. This often causes its value to slide against more stable currencies, like the US Dollar.

- Commodity Prices: South Africa is a major exporter of resources like gold and platinum. The global prices of these commodities have a huge impact on our economy and, in turn, the strength of the Rand.

- Economic Stability: Confidence is everything. Global sentiment about South Africa's economic health and political climate plays a massive role. Good news can strengthen the Rand, while any hint of instability can send it tumbling.

The moment you grasp that the Rand is in constant reaction to global and local events, you start to see why forex rates are never static. It gives you the power to think more strategically about when you pull the trigger on a transfer.

This floating system creates a dynamic environment, with the SARB sometimes hiking its benchmark lending rate as high as 8.25% to curb inflation. You can read more about what this means for the Rand and your wallet on capitecbank.co.za.

Ultimately, you can't control these global currents. But by being aware of them, you can make smarter, more informed decisions and potentially time your transfers to lock in a better rate, saving your business real money.

Actionable Strategies to Reduce Your Forex Costs

Knowing how spreads and fees eat into your bottom line is one thing. Actually doing something about it is where the real savings happen. The good news is that slashing your foreign exchange costs doesn't involve some complicated financial strategy. It really just starts with breaking a simple habit: defaulting to your primary bank for every transaction.

The most powerful move you can make is to actively compare your options before you send money internationally. Every single time. If you just accept the Capitec foreign exchange rates offered to you without a second thought, you’re almost certainly leaving money on the table. A quick look at what alternative providers can offer often reveals far better terms.

Look Beyond Traditional Banks

Modern fintech platforms are completely changing the game for South African businesses. Unlike the big banks that bake their profits directly into the exchange rate, many of these newer providers have a totally different business model. They give you access to the real, mid-market exchange rate—the one you see on Google—without adding a hidden spread.

For instance, a platform like Zaro offers the spot exchange rate with zero spread and no SWIFT fees. This transparent approach means the rate you see is the rate you get. It cuts out the biggest and most unpredictable cost that comes with making international payments.

This changes the entire cost equation. Instead of watching thousands of Rands vanish into a hidden markup on a large transaction, you pay a clear, upfront fee. This fee is often dramatically lower than the combined costs you'd pay for a traditional bank transfer.

Your Simple Forex Savings Checklist

Before you hit "send" on your next international payment, just run through this quick checklist. It’s a simple process that will help you make the smartest, most cost-effective decision every time.

- Calculate the Total Cost: Never just look at the fixed transfer fee. Multiply the exchange rate by your transfer amount to see the total ZAR cost. Compare that to the mid-market rate to instantly see how much you’re losing in the hidden spread.

- Consider Timing: You can't predict the markets, of course, but being aware of major economic announcements can help you avoid making large transfers when rates are all over the place.

- Explore Modern Solutions: Before you commit to your bank, get a quick quote from a transparent fintech provider. The few minutes it takes to compare could literally save your business thousands.

By moving away from the default option and actively seeking transparency, you are taking direct control of your business's international payment costs. This proactive approach ensures more of your hard-earned money stays where it belongs: in your business.

Got Questions About Capitec's Forex? We've Got Answers.

Here are some quick, no-nonsense answers to the questions we hear most often about sending money overseas with Capitec. Let's clear up the confusion so you know exactly what to expect.

How Long Does a Capitec International Transfer Actually Take?

You can generally expect the money to land in the recipient's account in about four business days after Capitec processes it. Think of this as a guideline, not a guarantee. The final timing can easily be nudged by things like the destination country’s banking system, public holidays, and even time zone differences.

What's the Real Cost of Sending Money Abroad?

On the surface, Capitec charges a flat R175.00 fee for an outgoing international payment. But it’s critical to understand that this isn't the full picture. The total cost is that fee plus the hidden markup on the Capitec foreign exchange rate—the spread. On top of that, intermediary banks involved in the transfer can sometimes skim off their own fees along the way.

Don't forget: The true cost of your transfer is the R175 fee plus the hidden exchange rate spread. Always work this out before you hit 'send'.

What Details Do I Need to Receive Money from Overseas?

To make sure money sent from abroad finds its way to your account without any hiccups, the sender will need a few key pieces of information from you.

- Your Full Name: This has to be an exact match to what's on your ID or passport.

- Your Account Number: Your 10-digit Capitec account number.

- Capitec's SWIFT Code: This is their unique banking identifier, which is CABLZAJJ.

- Reason for Payment: A simple, clear reference like "Payment for Invoice 123" or "Family support".

Providing your full residential address is also a good idea. Getting these details right from the start helps avoid frustrating delays.

Are There Any Limits on How Much I Can Send or Receive?

Yes, there are. South African residents are subject to an annual limit for sending money out of the country, known as the Single Discretionary Allowance (SDA). This is capped at R1 million per person, per calendar year.

When sending, the smallest amount you can transfer with Capitec is R350. When receiving, keep in mind that for amounts over R50,000, you might need to complete a declaration with the bank to clarify the source and purpose of the funds.

Tired of playing guessing games with hidden fees and unpredictable costs? Zaro gives South African businesses direct access to the real mid-market exchange rate, completely free of spreads and SWIFT fees. See how much you could save on your very next international payment.