Need the right Capitec forex number? You can get straight through to their specialised forex team by dialling 021 809 4501. This is the dedicated line for their experts who can help with everything from international payments and exchange rates to tricky compliance questions.

Finding the Right Capitec Forex Contact Details

When you're dealing with international money transfers, getting hold of the right person quickly is essential. Capitec offers a few different ways to connect with their foreign exchange department, and each one is designed for different types of queries. The direct phone line is your best bet for immediate help, but other channels are great for less urgent matters.

To make things simple, we've put all the essential contact information together in one easy-to-use guide. Whether you're setting up a new transfer, checking on a payment, or just have a quick question, you'll find the best way to do it here.

Key Contact Methods

Here's a breakdown of the main ways to get in touch and what they're best for:

- Direct Phone Line: Perfect for urgent problems, complex questions, or when you need to speak directly with a forex specialist who knows the ropes.

- Email Support: A great option for sending documents or for non-urgent enquiries where having a written record is helpful. You can often start the process of setting up an FX Trade Account this way.

- In-App Services: The Capitec app is surprisingly handy. You can use it to receive international payments and manage certain transactions yourself, often without needing to make a call.

- Branch Visits: For those times when you need face-to-face help, especially with large or complex transactions that require in-person verification.

Keeping these details handy will make managing your international banking needs a much smoother and more effective process.

Understanding Capitec's Forex Operating Hours

When you're sending money across borders, timing is everything. Exchange rates can change in a heartbeat, so knowing exactly when you can reach Capitec's forex team is key to locking in a good rate and getting your payment processed smoothly.

Trying to get hold of a specialist outside of their working hours can be frustrating and might even delay your transaction. The last thing you want is to miss a payment deadline because you weren't aware of their schedule.

Standard Forex Support Hours

It’s best to plan your calls or branch visits around their official operating times to avoid any hold-ups.

- Phone Support: You can reach the forex team by phone from Monday to Friday, between 8:00 AM and 5:00 PM.

- In-Branch Forex Services: Most branches that offer forex services stick to the same hours as the phone support team. It’s always a good idea to quickly check your local branch's times before heading out.

- Weekends and Public Holidays: Keep in mind that the dedicated forex phone line is closed on weekends and all public holidays.

Pro Tip: Try to make your call earlier in the day. This gives you a buffer to sort out any unexpected questions or paperwork issues well before the cut-off for same-day international payments.

Getting Ready for Your Call to the Forex Team

When you're about to make an international payment, a bit of prep work goes a long way. Having all your information ready before you dial the Capitec forex number is the key to a quick, hassle-free transaction. It not only saves you time but also helps the Capitec team process your request smoothly and in line with South African exchange control regulations.

Nobody enjoys being put on hold while they scramble to find a missing piece of information. Just like with any important financial discussion, having your ducks in a row makes everything easier. If you want some general tips for preparing for important calls, they can make a real difference to how the conversation goes.

Your Essential Information Checklist

Think of this as your pre-flight checklist before making the call. Run through these points to make sure you have everything at your fingertips. This covers what you'll need for almost any standard international transfer.

Information About You

- Your full name, exactly as it shows on your ID or passport.

- Your South African ID number (or passport number if you're not a citizen).

- Your 10-digit Capitec account number.

Information About the Recipient (The Beneficiary)

- The beneficiary's full legal name or the registered name of their business.

- Their complete physical address and a contact number.

- The recipient’s bank account number or IBAN (for Europe and some other regions).

- The official name of the receiving bank and, crucially, its SWIFT/BIC code.

Information About the Transaction

- The exact amount and the specific foreign currency you're sending (e.g., 1,500 USD, 800 EUR).

- A clear and compliant reason for the payment. Be specific – for instance, "Invoice #1234 for consulting services" or "Gift to family member".

A Quick Heads-Up: South African regulations are strict about knowing why money is leaving the country. A vague reason like "payment" could get your transaction flagged for review, causing unnecessary delays. Be precise to keep things moving.

What You Can Sort Out with the Capitec Forex Team

When you ring the Capitec forex number, you're not just calling a generic help desk; you're connecting with a team that deals specifically with international money matters. Knowing what they can handle before you call can save a lot of time and get your issue sorted out much faster.

Their expertise covers the full spectrum of the forex process, from checking a simple exchange rate to chasing down a complex international payment.

Common Problems the Forex Team Can Solve

Most of the calls hitting the forex desk tend to fall into a handful of common areas. If your query matches one of these, you're definitely calling the right people.

Here’s a quick rundown of what they can help you with:

- Getting Live Exchange Rates: Need to know the current rand-to-dollar rate before you make a move? You can ask them for the real-time buy or sell rate for major currencies like USD, EUR, or GBP.

- Making a SWIFT Transfer: If you need to send money overseas, the team will walk you through the entire process, making sure all the beneficiary details and compliance information are spot-on.

- Tracking Inward Payments: Waiting on a payment from abroad? Give them the SWIFT reference, and they can help you trace where it is in the system.

- Understanding Forex Fees: They can break down all the costs for you. This includes Capitec's own R175 fee for sending money out, plus any potential fees charged by other banks along the way.

Forex Questions for Businesses

Business clients often have more specific needs, usually tied to managing cash flow and protecting themselves from currency fluctuations. The forex team is equipped to handle queries about spot transactions, which is when you exchange currency for immediate settlement.

They can also offer some basic guidance on managing currency risk. However, for more sophisticated strategies, you might find you need a more specialised service.

A frequent question we see from importers is, "How can I lock in an exchange rate for a payment I need to make in three months?" While Capitec's team is great for on-the-spot transactions, this kind of question really shows where dedicated business forex platforms start to have an edge.

A Look at Capitec's Business Forex Solutions

Capitec is making some serious moves to support South African Small and Medium Enterprises (SMEs) that trade across borders. They've put together a suite of forex solutions specifically for importers and exporters trying to find their footing in the global market.

For any business, especially those just starting out, these services offer a solid foundation for managing foreign exchange. If you're running a small company and venturing into international sales online, getting your forex right is a massive part of your financial strategy, alongside streamlining your ecommerce operations for small businesses.

What Capitec Actually Offers Business Clients

Capitec's business forex solutions are geared towards covering the fundamental needs of any company involved in international trade. Here’s a breakdown of the core services:

- Electronic Trading Systems: This is their digital platform where you can handle foreign currency transactions yourself. It gives you a good degree of control and cuts down on manual processes.

- Spot Transactions: Need to pay an overseas supplier or receive a payment right now? Spot transactions let you exchange currency at the live market rate, making it perfect for immediate settlements.

- Hedging Tools: Currency markets can be unpredictable. To help with this, Capitec provides some basic hedging tools. These are designed to help you lock in exchange rates and protect your business from the financial risks of a volatile rand.

It seems this focus on business banking is working. Forex transactions for Capitec's business clients jumped by an incredible 92% in their 2025 financial year, which points to huge demand from SMEs. This is part of a bigger trend for the bank, which saw its active business clients grow by 15% to a total of 218,207. You can dig deeper into Capitec's annual performance if you're interested in the numbers.

What to Do When Something Goes Wrong: Escalating a Capitec Forex Issue

Even with the best planning, forex transactions can sometimes hit a snag. If you've tried the main Capitec forex number and your problem still isn't sorted, it's time to follow their formal escalation process. Getting this right is the key to a quick resolution.

First things first, get your ducks in a row. Pull together all your documentation – we're talking transaction references, dates, amounts, and a record of any calls or emails you've already sent. A clear timeline of events makes it much easier for the complaints team to grasp the situation and get to work. Without it, you could face unnecessary delays.

The Formal Complaints Process

Capitec has a specific procedure for handling complaints to make sure nothing falls through the cracks. Here’s how to navigate it.

- Try the Frontline First: Always start with the standard forex support line. Many issues can be cleared up right there and then.

- Lodge a Formal Complaint: If you’re getting nowhere, it's time to make it official. The best way to do this is by sending a detailed email to their complaints department, laying out the entire issue.

- Get Your Reference Number: Once your complaint is logged, you'll be given a reference number. Guard this number with your life! You'll need it for every follow-up conversation.

Key Contact for Escalations

With all your information gathered and ready to go, here’s who you need to contact to get the ball rolling.

- Email: ComplaintsResolutionCentre@capitecbank.co.za

- Phone: 0860 10 20 43

Following this structured path gives the bank a clear, actionable case to work with. It not only helps them investigate properly but also puts you in a much stronger position to get the fair outcome you're looking for.

Exploring Alternatives for Business Forex

While the Capitec forex number is a great resource for personal or occasional international payments, businesses that trade globally often find themselves needing more powerful tools. The reality is that traditional banking forex can chip away at your profits through less-than-ideal exchange rates and hidden fees. For any business, every bit saved on currency exchange is money that goes straight back into growing the company.

This is exactly where specialised fintech platforms like Zaro come into the picture. They’ve built their services from the ground up to solve the common frustrations South African businesses face with international trade, making transparency and speed their top priorities.

Why Look Beyond Traditional Banks

So, what’s the real difference? It usually comes down to a few key things:

- Cost Savings: You get access to the real exchange rate without the hidden markups. Plus, you can often avoid those hefty SWIFT fees that banks charge for international transfers.

- Greater Control: Think enterprise-level features. You can set up multi-user access with specific permissions, giving your finance team the tools they need without handing over full control.

- Increased Efficiency: The process is just faster. You can manage and send payments online in minutes, cutting out the need for time-consuming branch visits and paperwork.

Even Capitec’s own numbers show how critical these services are becoming. In their 2025 results, they reported a massive 92% surge in business forex transactions. That’s a huge jump, driven by their 218,207 active business clients who are increasingly operating on a global scale. If you're interested in the market trends, you can learn more about Capitec's strategic focus on business forex.

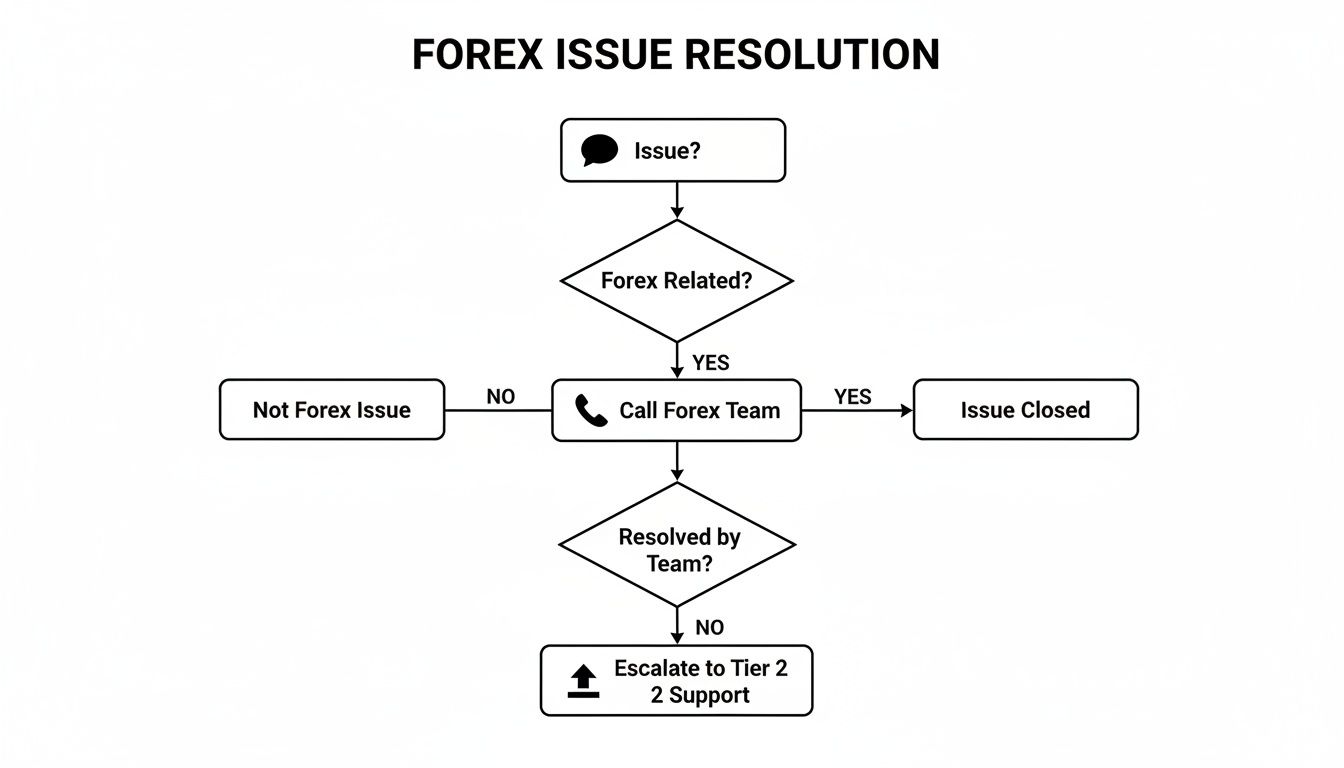

This flowchart shows the typical journey you'd take to resolve a forex query through standard channels, starting from the first contact and moving through to a potential escalation.

As you can see, the standard process is quite linear and can be a real headache for a busy finance team juggling multiple international payments. This is another area where business-focused platforms have an edge—they often provide a dedicated support manager, letting you bypass these generic steps and get answers straight away.

Frequently Asked Questions About Capitec Forex

Still got a few questions about the Capitec forex number or how their services work? Let's clear up some of the most common queries people have. We’ve put together some straightforward answers to help you sort things out quickly.

Can I Make International Payments on the Capitec App?

Yes, absolutely. For many straightforward international payments, the Capitec banking app is a great tool. You can easily send money in major currencies like USD, GBP, and EUR to a decent list of supported countries right from your phone.

But, it's not a one-stop shop for everything. If you're dealing with more complex business forex transactions or need to send a currency that isn't listed on the app, you'll still need to ring the Capitec forex number. The specialists on that line will walk you through the process to make sure everything is above board with South African exchange control regulations.

What Is the Difference Between the General and Forex Contact Numbers?

Think of it like this: the general Capitec contact number is for your day-to-day banking—checking your balance, asking about a card, that sort of thing. The dedicated Capitec forex number (021 809 4501) puts you straight through to the experts who live and breathe international payments, currency conversions, and exchange control.

Using the right number from the get-go is a game-changer. It means you skip the hassle of being bounced around and get the correct information from someone who actually knows the ins and outs of forex. It just saves you time and a lot of potential frustration.

Are There Charges for Calling the Capitec Forex Number?

Yes, there are. The Capitec forex number is a standard landline, so you'll be charged at the normal national call rates set by your service provider. It’s not a toll-free number, and the final cost will depend on whether you’re calling from a mobile or a landline and what your specific plan looks like.

Pro Tip: Want to keep your call costs down? Get all your documents and information ready before you even pick up the phone. A prepared call is a quick call, which means less time on the line and less money spent.

For South African businesses looking for a smarter, more cost-effective way to handle international payments, a platform like Zaro is a powerful alternative. You can skip the hidden fees and lock in the real exchange rate for every single transaction.