What They Don't Tell You About Exchange Rates

Let's be honest, those "cheap currency exchange" rates you see advertised? They're often not the whole story. I've spent time talking to forex traders in places like Johannesburg and Cape Town, and a key thing I've learned is that the "best" rate doesn't automatically mean the cheapest. There's more to it.

Why? Because hidden costs can sneak in and inflate that initial tempting figure. Things like spreads (the difference between the buy and sell rate), commissions, and service fees can add up. Think of it like booking a cheap flight and then getting hit with extra baggage fees and seat selection costs – suddenly, that "bargain" isn't so attractive.

Understanding Exchange Rate Types

Understanding the different types of exchange rates is crucial. The interbank rate is the rate banks charge each other – kind of like a wholesale price. Then there's the commercial rate offered to businesses, which is a bit higher. And finally, there's the retail rate, the one you and I usually see advertised. This is typically the most expensive. Knowing this helps you understand why some providers can offer seemingly cheaper options – they might be cutting their margins or operating on a different level.

To illustrate this further, take a look at the table below:

| Rate Type | Typical Margin | Who Uses It | Transparency Level |

|---|---|---|---|

| Interbank Rate | 0-0.5% | Banks | Very Low |

| Commercial Rate | 0.5-2% | Businesses | Low |

| Retail Rate | 1-5% or more | Individuals | Medium to High |

Exchange Rate Components Breakdown - This table shows how different rates compare and who typically uses them. Notice how the margins increase as you go from interbank to retail. This transparency, or lack thereof, is a key factor to keep in mind.

As you can see, understanding the type of rate you're getting is crucial for comparing apples to apples. Don't just focus on the headline number.

The Fluctuating Rand

The South African Rand (ZAR) exchange rate constantly fluctuates, impacted by everything from global market conditions to the local economy's performance. For example, back in June 2025, the ZAR/USD exchange rate was about 17.7421, which was quite different from the 19.93 high we saw just a few months earlier in April 2025. Looking at historical exchange rates can give you some perspective. This volatility means timing can play a role in how much you end up paying.

Hidden Fees and Transfer Speed

Many advertised rates don't include transfer fees, especially for smaller amounts. You might see a great rate, but a hidden R250 transfer fee could wipe out any savings. For example, exchanging R5,000 with a provider advertising a seemingly good rate but charging this fee might be worse than a provider with a slightly higher rate but no fees. Always look at the total cost, not just the exchange rate.

Another factor is the speed of the transaction. Even a delay of a day or two can mean the exchange rate moves against you, impacting your savings. This is especially true for larger amounts. When comparing providers, don't just look at the rate; consider the processing time to calculate the effective rate – the rate you actually get.

Reading The Market Like A Pro

Timing isn't everything when it comes to getting a good currency exchange rate, but with the rand as volatile as it is, picking the right moment can make a real difference. I've spoken to expats, business owners, and even a few forex traders here in South Africa, and they've shared some great insights into market patterns. You don't need to become a currency guru, but even a basic understanding can save you money.

One of the biggest things that influences the rand is commodity prices. South Africa is a huge exporter of gold and platinum, so when the global prices for these commodities shift, the rand often follows suit. For example, if the price of gold goes up, the rand tends to strengthen. That means you'll get more bang for your buck when exchanging into other currencies. Of course, the reverse is true too – if commodity prices drop, the rand can weaken.

Economic Indicators and the Rand

Commodities aren't the only story. Several other economic indicators play a role in the rand's value. Things like local political changes, interest rate adjustments, and even international economic news can all trigger market reactions. Keeping tabs on these factors can give you a sense of when the rand might fluctuate and help you time your exchanges strategically. Looking at historical data really shows you just how much the rand moves around. You'll see periods of strength and weakness, sometimes quite dramatically.

For example, the rand traded around 17.3 to the US dollar back in December – one of its strongest points recently. This was partly because the US dollar was weaker and precious metal prices were rising. But, as we know, economic or political instability can quickly flip that around. That's why keeping up with market trends and economic indicators is so important for finding the sweet spot for a cheap exchange rate. Discover more insights on South Africa's currency trends here.

Using Rate Alerts Effectively

Staying informed doesn't mean you need to be obsessively checking the exchange rates every five minutes. Tools like rate alerts can be lifesavers. Set them up to notify you when the rand hits your desired level, and then you can jump on a good rate without being chained to your computer. The key here is to separate the short-term noise (those daily ups and downs) from meaningful market movements (longer-term trends). Focus on the big picture and don’t get caught up in every little wiggle.

Seasonal Patterns and Market Hours

Believe it or not, even the time of year can have an impact. Some currencies follow seasonal patterns, which means certain times of the year are generally better for exchanging than others. Also, keep in mind that international market hours can influence the rates. Exchanging during London or New York trading hours might give you different rates than exchanging when those markets are closed. These little details might seem insignificant, but they can really add up, particularly when you're exchanging larger sums. Remember, knowledge is power when it comes to navigating the currency market and getting the best possible rates.

Where Smart People Actually Exchange Their Money

Forget those airport kiosks and your regular bank. If you're looking for a good deal on currency exchange, the people in the know – the frequent flyers, the property investors, the business owners – often go elsewhere. Chatting with folks here in South Africa, I’ve picked up on a few of their secrets for getting the best rates.

Beyond the Usual Suspects

Airport bureaux are infamous for their awful rates, relying on the fact that you’re stuck and need quick cash. There are exceptions, especially if you’re exchanging common currencies like USD or EUR, but usually, you'll find better deals elsewhere. Your bank might seem like a safe bet, but their exchange rates are often less competitive than specialist providers.

Online platforms, like Zaro, are really shaking things up for South Africans. They cut out the middlemen, which means lower fees and better rates. Here’s a peek at their website:

Zaro’s interface is clean and transparent, showing the exchange rate and fees upfront. No more hidden costs or guessing games like you often get with traditional methods.

The Rise of Peer-to-Peer and Crypto

Beyond online platforms, there’s also peer-to-peer (P2P) currency exchange. These platforms connect individuals directly, cutting out banks entirely. P2P can offer fantastic rates, particularly for less common currencies. Just make sure you choose a reputable platform with good security.

For bigger transactions, especially international ones, cryptocurrency bridges can sometimes be a faster and cheaper alternative. This does require understanding cryptocurrency and comes with the risks of market volatility, so it's not for everyone.

Local South African Gems

Don't forget about local South African exchange services. Many smaller providers offer surprisingly competitive rates, sometimes beating even the big international names. They can be a great resource if you’re dealing with less common currencies or need a more personal touch. Building a relationship with a local provider can also lead to better rates and service in the long run.

Fintech: Promise vs. Reality

Fintech solutions, like digital wallets and multi-currency accounts, promise easy and affordable currency exchange. But not all fintech services are created equal. Some are truly helpful, while others are all hype. Do your homework, compare fees, exchange rates, and read user reviews before signing up.

Security is paramount when you're dealing with your money. Be cautious of providers that seem too good to be true and stick with established companies if you're unsure. The best exchange method for you depends on your needs. A frequent traveler might prefer a multi-currency account, while a business making larger, less frequent transactions might find a specialized foreign exchange broker more suitable. The key is to explore your options, compare the all-in costs, and choose what works best for you.

The Real Cost Calculation Nobody Teaches You

Most people get tripped up by cheap currency exchange because they focus on the advertised rate. They completely miss the total cost. Think of it like buying a plane ticket – you see the base fare, but then get hit with baggage fees, seat selection charges, and so on. Currency exchange is the same. Let me show you how to calculate the real expense, factoring in all those sneaky fees, spreads, and hidden charges providers bury in the fine print.

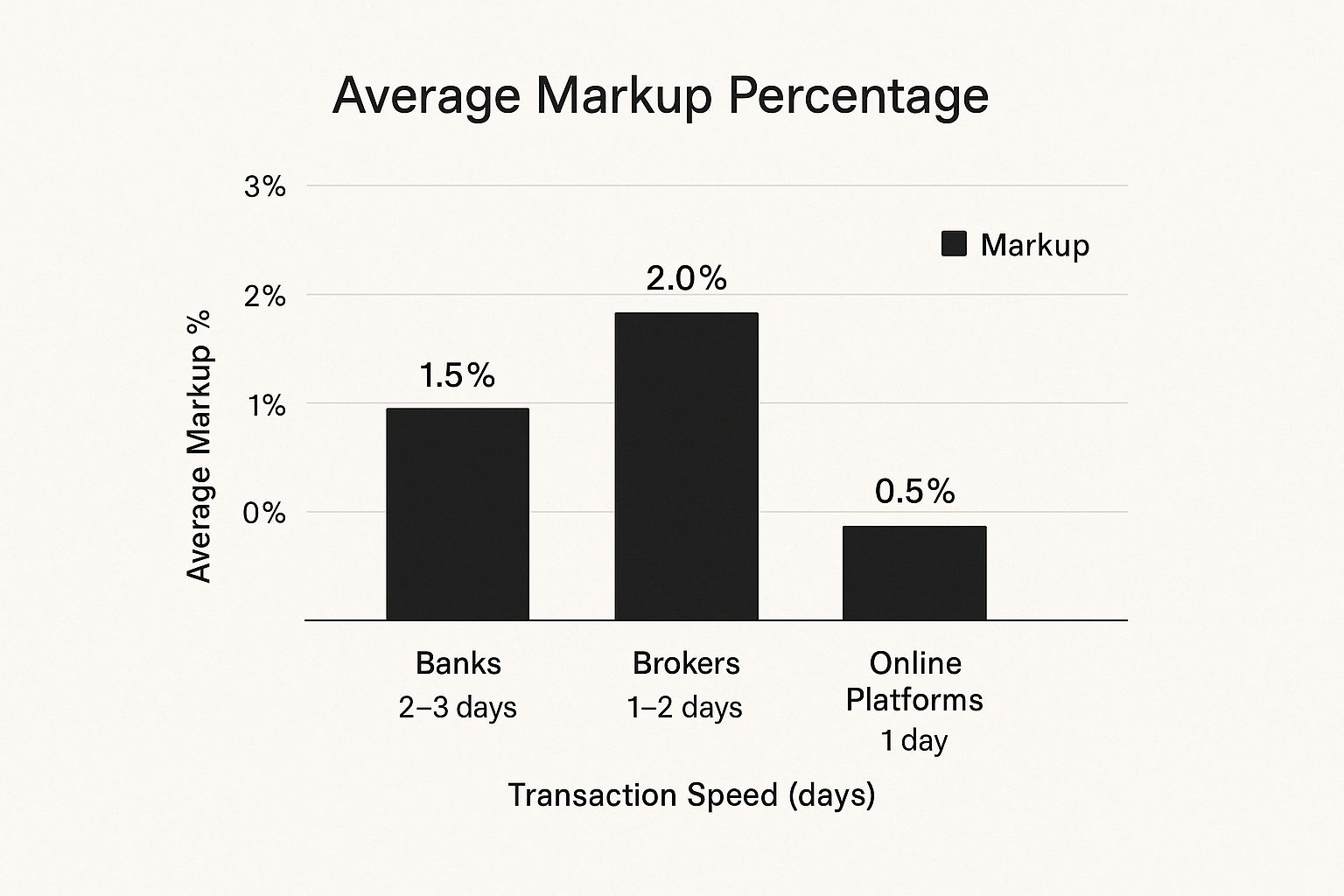

The infographic above gives you a visual breakdown of the average markup, fees, and transaction speeds for banks, brokers, and online platforms. Notice how banks, while seemingly safe, can actually cost you more with their slower processing and higher markups, especially when you’re exchanging larger amounts. Online platforms tend to be much faster and cheaper, making them a pretty compelling alternative.

Real-World Examples: Holiday Cash vs. Property Down Payment

Let me give you a couple of examples. Imagine you’re exchanging R10,000 for your holiday spending money. You see a provider advertising a rate of R17.50/USD. Sounds great, right? But then they slap you with a 2% commission, which adds R200 to your cost. Suddenly, another provider offering R17.60/USD but with no commission looks like a much better deal.

Now, think bigger. You're exchanging R500,000 for a property deposit overseas. The impact of even a small difference in the exchange rate is huge. A 0.5% difference can translate to thousands of rands. Even a seemingly insignificant R500 transfer fee suddenly becomes a big deal. This is why understanding the total cost is so crucial, especially with larger transactions.

Questions to Ask and Traps to Avoid

Before you commit to any provider, here are some key questions you absolutely must ask:

- What's the all-in cost, including every single fee and commission?

- What exchange rate is guaranteed for my transaction?

- How long will the transfer take, and is there a chance the rate could change in the meantime?

Watch out for marketing jargon like "guaranteed best rates". This is often a smokescreen for hidden fees. Transparency is key. Providers who clearly show all costs upfront are usually the ones offering the best value.

Negotiating for the Best Deal

Don't be shy about negotiating, particularly for larger sums. Many providers, especially brokers, are willing to match or even beat competitor offers. I've personally saved thousands of rands simply by asking, "Can you do any better?" For example, when I was exchanging a large amount for a property purchase, I negotiated a 0.2% reduction on the spread, which saved me a significant amount.

Finally, pay attention to delivery fees and processing times. Some providers offer free delivery, but it might take longer, exposing you to rate fluctuations. A faster, paid delivery option might actually be cheaper in the long run if the rate moves in your favor.

Let's look at a real-world comparison:

True Cost Comparison Matrix

Real-world comparison showing total costs across different exchange methods for common transaction amounts

| Exchange Method | R10,000 Total Cost | R50,000 Total Cost | Processing Time | Convenience Rating |

|---|---|---|---|---|

| Bank A | R10,200 | R51,000 | 3-5 Business Days | Moderate |

| Bank B | R10,150 | R50,750 | 2-3 Business Days | Moderate |

| Online Platform A | R10,050 | R50,250 | 1 Business Day | High |

| Broker A (Negotiated) | R10,080 | R50,400 | 1-2 Business Days | High |

This table clearly shows how seemingly small differences in fees and rates can add up, especially with larger amounts. While online platforms generally offer the lowest cost and fastest processing, negotiating with a broker can sometimes get you a surprisingly good deal. Always compare all your options before making a decision.

Technology That Actually Saves You Money

The world of cheap currency exchange? It's a whole different ballgame thanks to technology. Smart folks and businesses are using these tools to snag better deals consistently. But here's the rub: not all fintech apps are created equal, and sometimes, the old-school methods still have their place.

Finding the Right Tools for the Job

Let's ditch the jargon and talk about the tech that actually delivers. I'm talking about rate monitoring systems that act like your personal market watchers, so you can skip the constant checking. Then there are automated exchange services; these are like snipers for your currency needs, executing transactions the second the rate hits your sweet spot. They take the emotion and guesswork out of the equation, letting data, not your gut, drive your decisions.

For anyone juggling multiple currencies, multi-currency accounts are an absolute game-changer. Picture having accounts in ZAR, USD, and EUR all in one convenient spot. This makes international transfers smooth and often cheaper than traditional banking. Even some digital wallets offer competitive exchange rates and low fees, making them a great option for everyday spending.

And then there's the truly groundbreaking stuff: services like blockchain-based transfers and certain peer-to-peer networks that completely sidestep traditional banking. These can offer incredibly cheap rates, but be careful! Separate the real opportunities from the hype. Research thoroughly, understand the risks involved, and make informed choices.

Security and Emerging Technologies

When you're dealing with fintech and your hard-earned cash is on the line, security is non-negotiable. Look for providers with strong encryption, two-factor authentication, and transparent information about how your funds are protected. Be skeptical of providers with vague security policies or those promising unbelievably high returns. If it sounds too good to be true, it probably is. Stick with established providers if you’re hesitant.

The South African Reserve Bank offers some great resources for tracking historical exchange rates. This helps you identify trends and get a sense of where rates might be headed. For example, on June 6, 2025, the ZAR/USD spot rate was 17.7716, with forecasts predicting it to reach around 18.20 by the end of the quarter. Find out more about historical and forecasted rates here. This kind of info can be invaluable for timing your exchanges perfectly and maximizing your savings.

Maximizing Your Tech Advantage

It's not just about finding the right platforms, it's about how you use them. Technology can be a powerful tool for tracking your exchange history, analyzing your spending, and pinpointing areas to improve. Personally, I use a simple spreadsheet to log all my exchanges. It helps me see where I’m consistently getting the best rates and where I can refine my strategy.

Even in the digital age, building relationships with preferred providers can pay off. Many online platforms and fintech companies offer personalized support and sometimes even preferential rates to loyal customers. Don't be shy! Reach out, ask questions, and even negotiate for better deals, especially for larger transactions. Remember, technology is just a tool – it’s up to you to use it effectively.

Strategies For Big Money Moves

When you're transferring serious money—think down payments on a property, buying a business, or making substantial investments—the strategies you use are totally different. The potential savings are big enough to justify exploring options most people never consider. We're not talking about your typical online transfer platforms; we're diving into forward contracts, structured products, and even getting access to institutional-level rates.

Forward Contracts and Structured Products

A forward contract lets you lock in an exchange rate for a future date. Think about knowing exactly how much your rand will get you in dollars or euros months down the line. It's a huge stress reliever, especially in a volatile market like we have here in South Africa. I was chatting with some property investors recently, and they emphasized how crucial this is when buying overseas. It allows for accurate budgeting and eliminates the risk of the rand plummeting before the transfer.

Structured products offer more complex (and potentially more rewarding) options. These are custom-designed for specific timing needs and can help manage risk and potentially boost your returns. They're definitely not a DIY project though – you’ll want expert advice.

Accessing Institutional Rates and Negotiation

Believe it or not, individuals can sometimes access the same preferential exchange rates usually reserved for banks. It involves building relationships with specialized foreign exchange brokers. Talking to business owners here in SA, I've learned that negotiating with these brokers can unlock serious savings. They can often match or even beat the rates offered by online platforms, especially for large transactions.

When moving large sums internationally, keep in mind the legal side of things. Anti-money laundering regulations require specific paperwork for bigger transfers. A good broker can walk you through this.

Case Studies and Creative Solutions

I’ve heard stories of people saving a significant amount of money by strategically timing their large currency exchanges. One business owner I know saved a bundle by locking in a favorable rate months in advance of a big international payment using a forward contract. Others have used unconventional methods like cryptocurrency bridges to lower costs and speed up transactions. Just be aware, these are higher-risk options and require careful consideration.

Building Relationships and Contingency Plans

When dealing with large sums of money, a strong relationship with your financial providers is essential. They can offer tailored solutions and crucial support if things go sideways. For instance, a preferred provider might offer a better rate on a forward contract or give you access to a structured product perfectly suited to your needs.

Always have backup plans. If your primary provider isn’t available or their rates become less competitive, you need alternatives ready to go. Multiple provider relationships are a smart safety net, especially for time-sensitive transactions.

Your Practical Money-Saving Action Plan

Let's turn all this talk about exchange rates into a system you can use today to save some serious rands. This isn't theory; it's a personalized plan for getting the most out of your money.

Building Your Exchange Playbook

Just like you’d pack different clothes for different climates, you need different exchange strategies for different situations. Let’s create a playbook for:

- Urgent Travel: Spur-of-the-moment trip? We’ll figure out how to get the best on-the-go rates without getting fleeced.

- Planned Business Transactions: Regular international payments or a big one-off transfer? We'll build a system for comparing providers, negotiating better deals, and managing risk.

- Regular Remittances: Sending money home often? We’ll look at services specializing in remittances and focus on getting you the best value and reliability.

- Opportunistic Exchanges: See a great rate? We’ll set up alerts and a plan to pounce on favorable market swings.

Checklists, Warning Signs, and Evaluation

You'll get practical checklists for each scenario to guide you and help avoid expensive mistakes. For example, always look at the total cost—including fees and commissions—not just the exchange rate. A seemingly great rate can hide nasty surprises.

I’ll also point out the warning signs of a bad deal. Think airport exchange bureaux: super convenient, but often with sky-high fees to match those tempting rates. Convenience comes at a price.

And remember, don't just jump on the first "cheap" rate you see. We’ll build a process for evaluating providers, looking at reliability, security, and how transparent their fee structure is.

Real-World Savings and Time Investment

I've seen these strategies work wonders. A friend recently saved over R2,000 on a property transfer just by negotiating the spread with a broker. It took him maybe an hour to research and compare, but the return on that time investment was fantastic.

Let's be honest, though: finding the best exchange rates takes some effort. We'll talk frankly about the time commitment involved and how to find the sweet spot between time spent and money saved. It's all about balance.

Monitoring, Relationships, and Contingency Plans

We'll set up systems to monitor exchange rates for ongoing needs, so you can spot opportunities without constantly checking the markets. Having relationships with multiple providers gives you negotiating power. And we'll develop backup plans for market fluctuations, so you’re always prepared, no matter what the rand does.

Everyone's different. We’ll look at different approaches for various risk tolerances and tech comfort levels. The best strategy is the one you'll actually use.

Ready to start saving? Check out Zaro, a South African fintech platform making international transfers simpler, cheaper, and more transparent. Check out Zaro for more information.