Trying to get the best deal on currency exchange in South Africa can feel a bit like a maze. But at its heart, it's really about one thing: making sure you get the most Rand for your foreign cash, or the other way around. Whether you're a tourist on holiday, a business paying overseas suppliers, or an investor moving money across borders, the secret is to look past the flashy advertised rates and find a provider who is upfront about the real costs.

Your Guide to Currency Exchange in South Africa

This guide is designed to give you a solid footing for exchanging money in South Africa. Whether you're here for a safari, settling an international invoice, or bringing in investment capital, a little know-how goes a long way. The star of the show, of course, is the South African Rand (ZAR), a currency with a fascinating and dynamic personality on the world stage.

Because the ZAR is an emerging market currency, its value can change quite dramatically from day to day. Think of it like the price of avocados at the weekend market; it goes up and down based on supply, demand, and a whole host of other factors. These can range from local economic reports right through to how confident global investors are feeling. This natural volatility creates both challenges and opportunities for anyone dealing with currency exchange in South Africa.

Understanding the Rand's Recent Performance

This isn't just theory—it has a real impact on your pocket. Throughout the first half of 2025, for example, the Rand took quite a ride. The average exchange rate hovered around R18.38 to the US Dollar, but it wasn't a smooth journey. The currency strengthened and weakened, at one point hitting a peak of nearly R19.93 against the Dollar in April 2025.

Despite these wobbles, looking at the bigger picture, the Rand actually strengthened by about 2.66% over the 12 months leading into mid-2025. It’s a perfect illustration of just how fluid the market can be. You can dive deeper into the Rand's historical performance on ExchangeRates.org.uk.

This constant movement is exactly why you need a basic grasp of the market. A great rate today might not be so great tomorrow.

The real win in currency exchange isn't trying to perfectly time the market—that's nearly impossible. It's about focusing on the things you can control, like choosing the right service and cutting down on fees, to shield your money from those unpredictable swings.

To make sense of it all, it helps to break down the key factors that influence how much money you actually end up with. This table summarises what you need to watch out for.

Key Factors Influencing Your Currency Exchange

| Factor | What It Means for You | Tip to Maximise Value |

|---|---|---|

| Exchange Rate Markup | This is the hidden profit a provider builds into the rate they offer you, compared to the "real" mid-market rate. | Always check the offered rate against the live mid-market rate (a quick Google search will tell you). A smaller gap is better. |

| Transfer Fees | These are the explicit charges for the service, which can be a flat fee or a percentage of your transaction. | Look for providers with clear, low, or even zero-fee options. Digital platforms are often more competitive here. |

| Provider Type | Banks, airport kiosks, and online specialists all play by different rules with very different cost structures. | As a rule of thumb, online fintech platforms almost always beat the rates and fees offered by traditional banks or airport bureaux. |

By keeping these three elements in mind, you shift the power back into your hands, ensuring you get a fair deal every time you exchange currency.

The Forces Driving the Rand's Value

Figuring out the South African Rand (ZAR) is a bit like forecasting the weather. You have your local conditions—the things happening right here at home—but you also have to account for the massive global systems that can sweep in and change everything. These two sets of forces, the local and the global, are constantly interacting.

This interplay is what makes currency exchange in South Africa so dynamic. It’s the reason the rate you get quoted on Monday could feel like a distant memory by Friday. Once you get a handle on these key drivers, the "why" behind the numbers on your exchange receipt starts to make a lot more sense.

The Impact of Domestic Factors

First, let's look at the local weather. The health of South Africa's own economy and the stability of its political landscape have a direct and powerful effect on the Rand. When things are looking up, the currency tends to strengthen.

Here are the main domestic drivers to watch:

- Economic Performance: Good news is good for the Rand. Think strong Gross Domestic Product (GDP) growth, low inflation, and positive employment numbers. These are all signals of a healthy, functioning economy, which attracts foreign investment and boosts demand for ZAR.

- Political Stability: Investors prize predictability. A stable and consistent political environment gives them the confidence to put their money into the country. On the flip side, political uncertainty makes investors nervous, often causing them to withdraw funds and weaken the Rand.

- Interest Rates: The South African Reserve Bank (SARB) sets the country's interest rates, its main tool for managing inflation. When the SARB raises rates, it can attract foreign investors looking for higher returns on their cash, which in turn strengthens the ZAR.

Essentially, positive economic data and stable governance act like a strong tailwind, pushing the Rand's value higher.

Global Currents and Commodity Prices

While local factors set the immediate tone, the Rand is also at the mercy of massive global currents. Chief among these are the prices of commodities, as South Africa is a major global exporter of precious metals and natural resources.

The Rand is what experts call a "commodity currency." Its value is deeply linked to the global market prices of materials like gold, platinum, and coal. When the prices for these commodities rise, South Africa earns more foreign currency from its exports, which strengthens the ZAR.

This connection makes our currency incredibly sensitive to what's happening in the rest of the world. For example, if manufacturing picks up steam in China, the increased demand for South African iron ore can directly push up the Rand's value.

This mix of local and global pressures creates a constantly shifting picture. Take 2025, for instance. The Rand saw a significant appreciation against the US Dollar, strengthening by about 7.1% over the year. It moved between a low of 0.05065 USD and a high of 0.05708 USD. This swing was a textbook example of fluctuating commodity prices and changing investor attitudes towards emerging markets. You can see the full story of the ZAR to USD exchange rate in 2025 on Exchange-Rates.org.

Global Investor Sentiment

Finally, there's the mood of the market. Global investor sentiment—often called "risk appetite"—is a huge driver.

When investors around the world are feeling confident and optimistic, they are more willing to put their money into what they see as higher-growth (but higher-risk) emerging markets like South Africa. This is known as a "risk-on" environment, and it's generally great for the Rand.

But when global trouble starts brewing—maybe due to geopolitical conflict or a slowdown in a major economy—investors get scared. They pull their money out of riskier assets and run for cover in "safe-haven" currencies like the US Dollar or Swiss Franc. This "risk-off" mood causes capital to flow out of South Africa, weakening the Rand. Keeping an eye on these broader market tides is crucial to understanding the currency's day-to-day movements.

Getting to Grips with South Africa's Exchange Control Regulations

If you’re dealing with currency exchange in South Africa, you’ll quickly come across a unique set of rules called exchange controls. These aren't just bureaucratic hurdles; they are a fundamental part of how the country manages its economy, all overseen by the South African Reserve Bank (SARB).

Think of exchange controls as a framework to manage the flow of money in and out of South Africa. Their job is to keep the economy stable, protect the value of the Rand, and make sure financial transactions are above board. While "regulations" might sound a bit daunting, the basics are actually quite easy to understand.

For most of us, these controls boil down to annual allowances. These limits aren't there to stop you from making everyday international payments but to monitor and manage large sums of money leaving the country. Getting this right is the key to making sure your cross-border payments go through without a hitch.

Your Personal Allowances Explained

As a South African resident, the SARB gives you two main allowances for sending money overseas. These limits are pretty generous and cover most personal needs, whether you're planning a trip, sending a gift, or investing abroad. The first step to managing your forex legally is knowing the difference between them.

Here are the two key allowances:

- Single Discretionary Allowance (SDA): This is your most flexible option. Any South African resident over 18 can send up to R1 million offshore each calendar year without needing a tax clearance certificate. It’s designed for a whole range of personal payments.

- Foreign Investment Allowance (FIA): If you're looking to make bigger investments outside of South Africa, this allowance lets you send an additional R10 million offshore per calendar year. But unlike the SDA, this one requires you to get the green light from the South African Revenue Service (SARS) first.

It’s important to know that these allowances are separate and you can use both, giving you a potential total of R11 million to move abroad each year.

The whole idea is to give people the freedom to manage their personal and investment finances, while also giving the SARB the oversight it needs to prevent large-scale capital flight that could rock the economy.

Putting Your Allowances to Use

So, what can you actually do with these allowances? The Single Discretionary Allowance is what most people use for their day-to-day offshore payments. It's incredibly versatile.

For instance, your R1 million SDA can cover things like:

- Travel expenses: Paying for your flights, hotels, and spending money for that overseas holiday.

- Gifts and donations: Sending cash to family members or donating to a charity abroad.

- Alimony and maintenance payments: Meeting your financial commitments to dependents living in other countries.

- Small-scale foreign investment: Dipping your toes into offshore shares or property without the heavy paperwork of the FIA.

On the other hand, the Foreign Investment Allowance is purely for building an international investment portfolio. To use your R10 million FIA, you first have to show SARS that your tax affairs are clean. This involves getting a Tax Compliance Status (TCS) PIN, which you then give to your bank or forex provider.

Demystifying the Documentation

The paperwork you'll need for currency exchange in South Africa really just depends on which allowance you’re using. The system is designed to be straightforward for smaller amounts and, quite rightly, more thorough for larger transfers.

Here’s a simple breakdown of what you’ll generally be asked for:

| Transaction Type | Required Documentation | Key Consideration |

|---|---|---|

| Using the SDA (up to R1 million) | Your green bar-coded ID book or Smart ID card, and maybe proof of residence (like a recent utility bill). | This is a simple declaration process. You don't need any prior approval from SARS. |

| Using the FIA (up to R10 million) | Your ID, proof of residence, and a valid Tax Compliance Status (TCS) PIN for Foreign Investment. | The TCS PIN is the non-negotiable document here. You have to apply for it directly from SARS before you can transfer the funds. |

Whether you’re a resident, an expat sending money home, or just visiting, knowing these rules is crucial. For anyone looking for a simpler way to make compliant international payments, fintech platforms like Zaro are a game-changer. They often build these compliance checks right into their setup process, taking the guesswork out of meeting SARB regulations so you can focus on getting your money where it needs to go.

Comparing Currency Exchange Providers in South Africa

Choosing where to exchange currency in South Africa can feel a bit like navigating a maze. There are a few different paths you can take, and the one you pick will directly affect how much money you end up with. It's not just about finding a provider; it's about finding the right one for your needs.

Essentially, you have three main choices: the high-street banks we all know, specialised foreign exchange bureaux, and the newer, online fintech platforms. Each has its own way of doing things, complete with different exchange rate mark-ups, fees, and overall convenience. Let's dig into how they really compare.

The Traditional Route: Banks and Bureaux de Change

For many years, heading to your bank was the default option. It’s familiar, it feels safe, and you’re dealing with an institution you already trust. Similarly, bureaux de change—the kind you see at airports or in shopping centres—offer a straightforward, walk-in service for cash and transfers.

But that convenience almost always comes at a price. Banks are well-known for building a significant mark-up into their exchange rates. This means the rate they give you is quite a bit worse than the real, mid-market rate. That hidden margin is their profit. On top of that, they often add flat transfer fees, like SWIFT fees, which can easily add a few hundred Rands to every single transaction.

Bureaux de change operate in much the same way, especially those in prime tourist spots. You might see signs advertising "zero commission," but don't be fooled. Their profit is simply tucked away in an uncompetitive exchange rate. For any business making regular or large payments, these costs add up fast and can seriously erode your profits.

The Rise of Fintech and Digital Platforms

The old way of doing things is now being seriously challenged by fintech companies that operate completely online. These digital-first platforms were designed from the ground up to get rid of the expensive, slow processes of traditional currency exchange. By cutting out physical branches and outdated systems, their running costs are much lower—and they pass those savings on to you.

Platforms like Zaro give you access to the real mid-market exchange rate without an added spread. Instead of hiding costs, their business model is built on transparency, usually charging a small, upfront fee. This gives you financial clarity, which is a huge benefit for any business trying to manage its cash flow effectively.

The difference in speed is also night and day. A bank transfer can sometimes take several days to land, whereas a fintech payment can often be completed on the same day. For businesses that need to pay international suppliers promptly, that speed is invaluable.

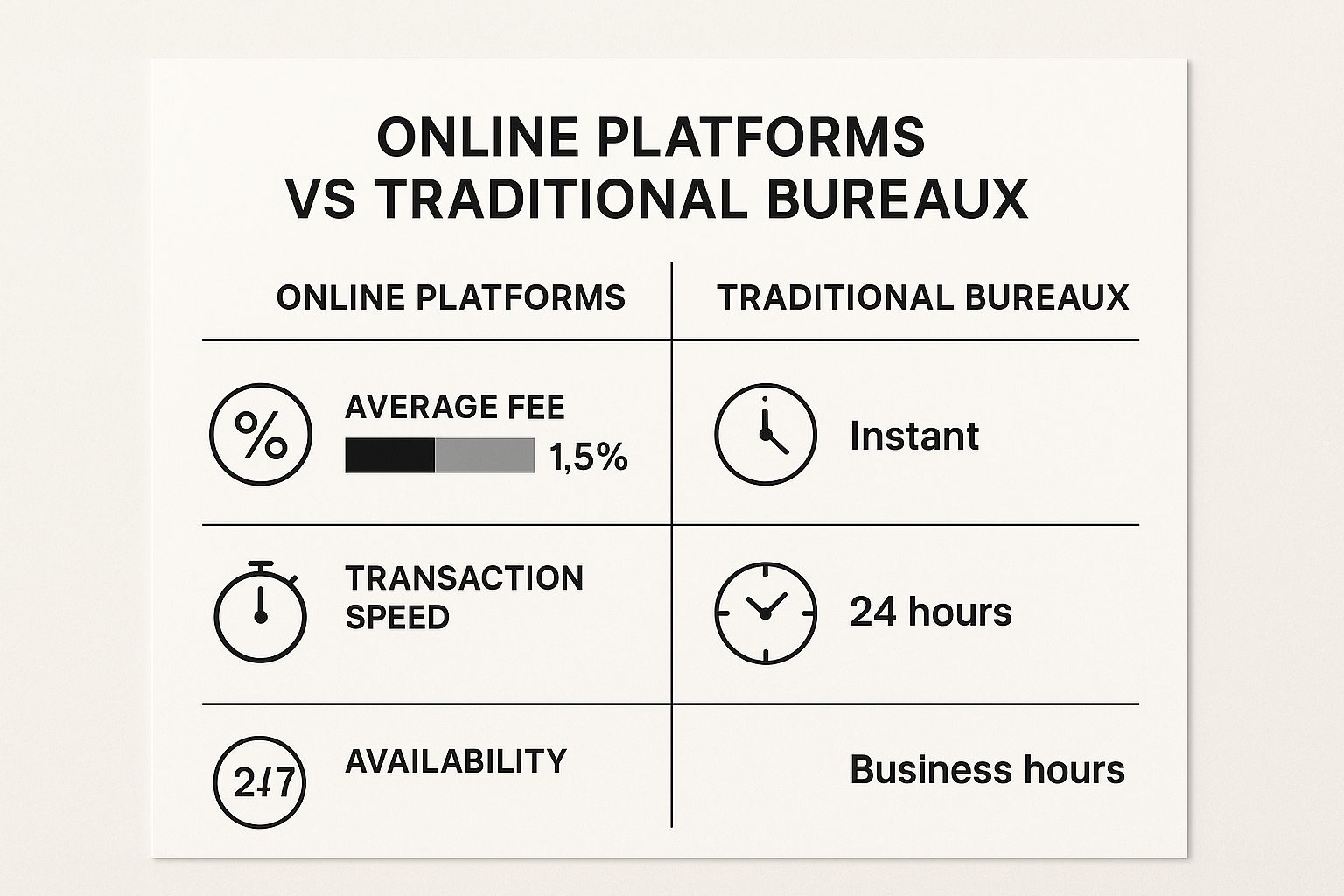

This image offers a great side-by-side look at the typical costs and speeds you can expect from online platforms versus traditional providers.

As you can see, digital platforms consistently come out on top with lower fees, quicker processing, and the convenience of being available anytime.

To help you see the practical difference, here's a quick overview of what you can expect from each type of provider.

Comparison of Currency Exchange Options

| Provider Type | Typical Exchange Rate | Common Fees | Speed | Best For |

|---|---|---|---|---|

| Traditional Banks | Mid-market rate + significant mark-up (1-4%) | High (e.g., SWIFT fees of R250-R500) | 2-5 business days | Existing bank customers who prioritise convenience over cost for small, infrequent transfers. |

| Bureaux de Change | Poor rate, especially for cash exchange | Often advertised as "zero commission," but the cost is hidden in the weak rate. | Instant for cash; 1-3 days for transfers | Travellers needing physical foreign currency immediately, despite the higher cost. |

| Fintech Platforms | Real mid-market rate or very close to it | Small, transparent percentage fee (e.g., 0.4%-1%) | Same day or next day | Businesses and individuals making regular or large international payments who want the best rate and transparency. |

This table makes it clear: while traditional options feel familiar, modern fintech solutions offer a much smarter, more cost-effective way to manage your money across borders.

A Real-World Cost Comparison

Let's put this into perspective with a real-life example. Imagine your South African business needs to pay an international supplier an invoice for $1,000 USD.

Scenario 1: Using a Traditional Bank The bank might quote you an exchange rate of R18.80 to the dollar, while the actual mid-market rate is R18.50. They also charge a R350 SWIFT fee. Your total cost would be (1,000 x 18.80) + 350 = R19,150.

Scenario 2: Using a Modern Fintech Platform A platform like Zaro gives you the real mid-market rate of R18.50. Let's assume it charges a clear, low fee of 0.5% for the transaction. Your cost would be (1,000 x 18.50) + (R18,500 x 0.005) = 18,500 + 92.50 = R18,592.50.

In this one transaction, just by choosing a different provider for their currency exchange in South Africa, the business saves R557.50. Now, imagine making dozens of these payments every month. The annual savings could easily reach into the tens or even hundreds of thousands of Rands.

The takeaway is clear. While banks offer a sense of familiarity, modern fintech solutions deliver far better value, speed, and transparency. For any business serious about optimising its international payments, exploring these digital platforms isn't just a good idea—it's a crucial strategic move.

Practical Tips for Saving Money on Currency Exchange

Getting the best deal on currency exchange in South Africa isn't about luck; it's about being smart and strategic. A few simple habits can make a huge difference, protecting your business from sneaky fees and poor exchange rates that chip away at your profits.

It’s all about maximising the value of every Rand. Whether you're paying an overseas supplier or bringing export income home, those small savings on each transfer really do add up over time.

Always Benchmark Against the Mid-Market Rate

The single most important tool you have is the mid-market rate. You can think of this as the ‘real’ exchange rate – it’s the midpoint between what buyers are willing to pay and what sellers are asking for a currency. This is the rate banks and big financial players use to trade with each other, and it’s the one you’ll see on Google or Reuters. Crucially, it has no hidden profit margin baked in.

Before you agree to any transfer, check the live mid-market rate. The gap between that number and the quote you’ve been given is the provider's mark-up. The smaller that gap, the better the deal you're getting.

The mid-market rate is your anchor point for fairness. Any rate you are offered should be judged by how close it gets to this real, unbiased number. It's the simplest way to see who is offering genuine value.

Plan Ahead and Avoid Last-Minute Exchanges

Urgency is the enemy of a good deal. One of the most expensive mistakes you can make is leaving your currency exchange until the eleventh hour. This often pushes you towards high-cost options like airport bureaux de change, who know you’re in a bind and charge a premium for the convenience.

By planning your international payments ahead of time, you give yourself breathing room to:

- Compare different providers to find the best mix of rates and low fees.

- Watch exchange rate movements and pounce when the rate is in your favour.

- Avoid the stress and inflated costs that come with rushed transactions.

Even planning just a day or two in advance can make a real difference, helping you sidestep that “convenience tax” charged by easy-access, but expensive, services.

Consolidate Payments to Reduce Transaction Fees

Every time you send money abroad, you’re likely hit with a fixed transaction fee. If you’re making several small payments to the same supplier, these individual fees can stack up fast and eat away at your funds.

A much smarter approach is to bundle those smaller payments into one larger transfer. While it might not always be practical, it’s a highly effective way to cut costs. You pay the fixed fee just once instead of multiple times, which immediately makes your payment more cost-effective. It's a simple process change that can lead to surprising savings over a financial year.

This strategic thinking is especially vital in the current economic climate. Broader challenges, such as a high unemployment rate which stood at approximately 32% as of April 2025, create economic fragility that directly impacts the Rand. For example, on 7 July 2025, the USD/ZAR rate was recorded at 17.6188, a snapshot of the constant fluctuations businesses must navigate. For deeper insights, you can explore detailed South African currency data on TradingEconomics.com.

Use Rate Alerts and Multi-Currency Accounts

Why not let technology do some of the heavy lifting for you? Many modern fintech platforms offer rate alerts that send you a notification when an exchange rate hits a target you’ve set. This means you can execute your transfer at the perfect moment without having to stare at market charts all day.

For businesses that regularly handle different currencies, a multi-currency account is a game-changer. It lets you hold funds in currencies like US Dollars, Euros, or British Pounds within a single account. You can receive payments from an international client and hold that foreign currency until the exchange rate improves, or use it to pay suppliers in the same currency, skipping a conversion—and its associated cost—entirely. It's a fantastic way to hedge against Rand volatility and save money.

FAQ About Currency Exchange in South Africa

Getting your head around foreign exchange can feel complicated, especially with South Africa's specific rules and players. Let's tackle some of the most common questions that pop up, whether you're a tourist visiting our shores, a resident managing your money, or a business trading globally.

What Is the Best Way to Exchange Currency for a Holiday in South Africa?

For holidaymakers, the golden rule is to use a mix of methods. Whatever you do, try to avoid exchanging big chunks of cash at airports—either in your home country or when you land here. They're notorious for offering the worst rates and slapping on high fees.

A much smarter approach is to bring just a small amount of South African Rand (ZAR) for those immediate costs, like a taxi from the airport or your first coffee. You can usually get this from a decent currency provider back home before you fly.

Once you’re in South Africa, these are your best bets for getting value:

- Use Low-Fee Cards: For day-to-day spending in shops and restaurants, a credit or debit card with low (or zero) foreign transaction fees is your best friend. The exchange rate you get is often very close to the real mid-market rate.

- Withdraw from Bank ATMs: Need more cash? Head to an ATM linked to a major South African bank like Absa, FNB, or Standard Bank. Steer clear of the independent ATMs you see in corner shops or tourist traps, as their fees can be brutal. Just remember to check what your own bank charges for international withdrawals.

- Look into a Travel Card: Modern fintech travel cards are fantastic for both spending and pulling cash. They often provide much better rates and lower fees than what you’d get from a traditional bank card.

Can I Open a Foreign Currency Bank Account in South Africa?

Absolutely. South African residents can open a foreign currency account (FCA) with most major authorised dealer banks in the country. Think of it as a great tool for anyone who regularly deals with money across borders.

An FCA lets you hold funds in currencies like US Dollars (USD), Euros (EUR), or British Pounds (GBP). This is incredibly useful if you earn an income from overseas, often pay for things abroad, or just want to shield some of your savings from the Rand's fluctuations.

Opening a foreign currency account is a practical way to manage your international financial exposure. It gives you the flexibility to receive and hold foreign funds without being forced to convert them into Rand at an inconvenient time or unfavourable rate.

The setup process is pretty standard, falling under the usual FICA requirements—you'll need your ID and proof of residence. Before you sign on the dotted line, it’s worth comparing the fees, which currencies are on offer, and any interest rates from different banks to find the account that’s right for you.

What Documents Do I Need to Send Money Out of South Africa?

The paperwork you'll need for an overseas transfer really depends on how much you're sending and which allowance you're using. The system is set up to be simple for smaller personal transfers and more rigorous for larger investment amounts.

For transfers that fall under your annual Single Discretionary Allowance (SDA)—currently R1 million per calendar year for adult residents—the process is a breeze. You'll generally just need to show your South African ID book or card and a proof of address.

Things get a bit more serious if you're sending larger sums using your Foreign Investment Allowance (FIA), which gives you an additional R10 million per year. For these transfers, you first need to get a Tax Compliance Status (TCS) PIN from the South African Revenue Service (SARS). This PIN proves your tax affairs are in order and must be given to your bank or forex provider to get the green light for the transfer.

Is It Safe to Use Online Currency Exchange Platforms?

Yes, provided you stick with reputable platforms, using online services for currency exchange in South Africa is generally very safe. The key is to make sure they are properly regulated. Any legitimate financial service provider, including online forex platforms, must be licensed to operate here.

In South Africa, you're looking for regulation from two main bodies:

- The South African Reserve Bank (SARB): The provider must be licensed as an Authorised Dealer or an Authorised Dealer with Limited Authority (ADLA).

- The Financial Sector Conduct Authority (FSCA): They also need to be registered with the FSCA, which looks after market conduct.

Before you even think about signing up, do a quick check on the FSCA website to verify their credentials. Trustworthy platforms also use strong security, like data encryption and keeping client money in separate accounts, to protect your funds and personal info.

Ready to stop overpaying on international transfers? Zaro offers South African businesses access to real exchange rates with zero spread and no hidden fees. See how our transparent, secure platform can reduce your operational overhead and give you complete control over your cross-border payments.

Discover a smarter way to manage your forex at https://www.usezaro.com.