So, you're looking at a currency trade and wondering, "What's my real risk here? What could I actually make?" That's precisely the question a currency trading profit calculator is designed to answer. It's a tool that lets you crunch the numbers on a potential forex trade before you put a single rand on the line.

Instead of just hoping for the best, you get a clear, data-driven forecast based on the parameters you set. It takes the guesswork out of the equation.

What Is a Currency Trading Profit Calculator?

Think of it as a financial flight simulator for your forex trades. Before you take off, you can plug in your flight plan—your currency pair, your entry point, how much you're trading—and see exactly where you might land. It's a way to map out the financial journey ahead.

For anyone trading in South Africa, from seasoned pros to those just starting out, this kind of forward-looking insight is invaluable. The calculator turns abstract market movements, like a small shift in the ZAR/USD rate, into tangible numbers. It shows you what that shift means for your bank account, which is a world away from just crossing your fingers and hoping for the best.

From Speculation to Strategy

At its heart, a profit calculator is a risk management powerhouse. It lets you play out different "what if" scenarios in seconds. What if the rate moves against me by 1%? What if it hits my target price? Answering these questions beforehand is what separates a calculated strategy from a blind gamble.

A profit calculator fundamentally changes how you approach the market. It moves you from being a passive speculator, hoping for a good outcome, to an active strategist who plans for multiple possibilities. It gives you the confidence to set clear profit targets and, just as importantly, firm stop-loss orders.

Here’s a look at what a typical currency trading profit calculator interface asks for.

As you can see, you need to provide some basic details: the currency pair you're trading, your trade size, and your planned entry and exit prices. Once you pop in those numbers, it spits out an instant result that can guide your next move.

Key Benefits for South African Traders

If you’re dealing with the South African Rand (ZAR), you know how volatile it can be. A calculator is especially useful here, as even small price swings can have a big financial impact.

Here’s how it helps:

- Sharpen Your Risk Management: You can see your maximum potential loss in black and white before you even think about hitting the ‘trade’ button.

- Set Achievable Goals: It gives you a realistic picture of what a trade could actually deliver, preventing you from chasing impossible profits.

- Make Quicker, Smarter Decisions: The market moves fast. Getting instant calculations means you can act on opportunities without hesitation.

How Do These Profit Calculators Actually Work?

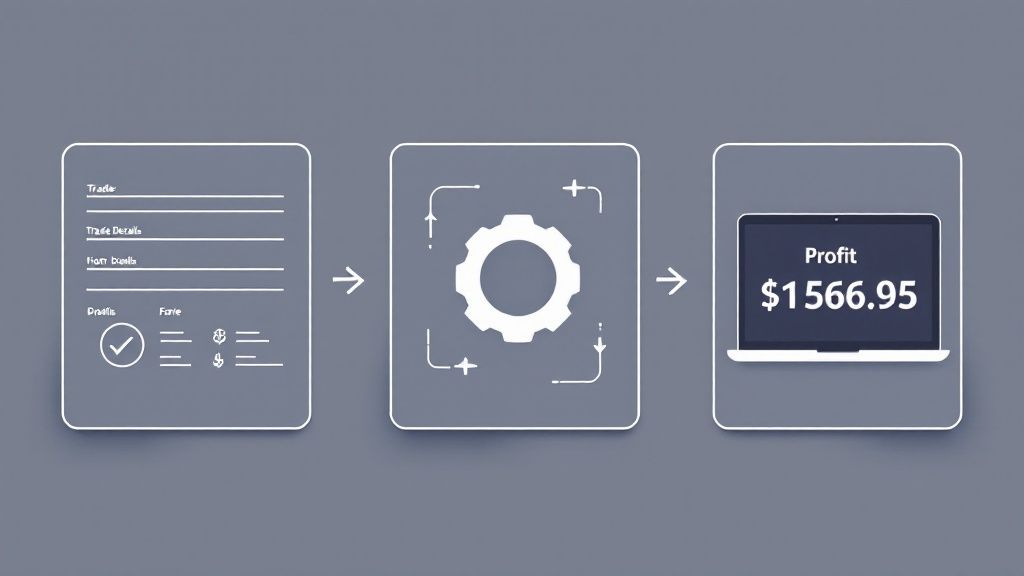

A currency trading profit calculator might look simple on the surface, but it's a powerful tool that does some heavy lifting behind the scenes. Think of it as a translator. It takes the often confusing language of the forex market—terms like 'pips' and 'lots'—and converts it into the one language every business understands: rands and cents.

At its core, the calculator is juggling three key pieces of information: the pip value, the lot size (your trade volume), and the price difference between where you entered and exited the trade. The basic logic is straightforward: the size of the price change, measured in pips, is multiplied by the size of your position to work out the financial result.

If you're new to forex, it’s really important to understand what a pip is in trading, as it's the tiny unit of price movement that ultimately determines your profit or loss.

Unpacking the Core Calculation

So, what’s happening under the bonnet? Every currency pair has what’s called a pip value, which is simply the monetary worth of a single pip movement. This value isn't fixed; it changes depending on the currency pair you're trading and the size of your trade. The beauty of a calculator is that it figures all of this out for you in an instant.

The fundamental formula it uses looks something like this:

(Price Difference in Pips) x (Pip Value) x (Lot Size) = Gross Profit or Loss

This single step saves you from a multi-stage manual calculation, eliminating the risk of errors and giving you an answer with just one click. The whole process is designed for speed and accuracy.

As you can see, the tool is designed to take complex trade details and turn them into a clear financial projection, giving you the confidence to act quickly.

Essential Inputs for Your Profit Calculator

To get an accurate result, you need to feed the calculator the right information. These are the standard data points it will ask for.

| Input Component | Description | Example (USD/ZAR) |

|---|---|---|

| Currency Pair | The two currencies you are trading against each other. | USD/ZAR |

| Trade Size (Lots) | The volume of your trade. 1 standard lot is 100,000 units. | 1.0 |

| Entry Price | The exchange rate at which you opened your position. | 18.2050 |

| Exit Price | The exchange rate at which you closed your position. | 18.2550 |

| Account Currency | The base currency of your trading account. | ZAR |

Having these details ready ensures you get a precise calculation without any guesswork.

A ZAR/USD Example in Action

Let's make this real with a scenario a South African exporter might face. Say you need to hedge against currency risk for a payment you’re due to receive in US dollars.

- Currency Pair: You're trading USD/ZAR.

- Trade Size: 1 standard lot (which equals 100,000 units of the base currency, in this case, USD).

- Entry Price: You buy USD when the rate is 18.2050 ZAR.

- Exit Price: The rand weakens, which is good for your position, and you close the trade at 18.2550 ZAR.

The price moved in your favour by 500 pips (18.2550 - 18.2050 = 0.0500).

Instead of you having to work out the pip value and do the maths, the profit calculator does it instantly. For this specific trade, it would show a gross profit of R5,000. It handles all the complex background calculations, freeing you up to focus on your strategy, not on your arithmetic.

Navigating ZAR Volatility with a Calculator

If there's one thing traders know about the South African Rand (ZAR), it's this: it's volatile. These constant swings create a high-stakes environment where fortunes can be made—or lost—in the blink of an eye. This makes it a tricky currency to handle, even for seasoned pros.

But these sharp price movements don't just happen out of nowhere. They're usually kicked off by a mix of local and global events that can flip the market's direction on a dime.

What Drives ZAR Price Swings

To understand why planning every single trade is so critical, you first need a feel for what makes the Rand move. A few key factors are almost always in play:

- Local Economic Data: When South Africa releases its latest inflation rates, GDP growth figures, or unemployment numbers, the ZAR often reacts immediately.

- Political Climate: Political stability—or instability—has a huge effect on investor confidence. This directly impacts how strong or weak the currency is.

- Global Commodity Prices: South Africa is a major exporter of commodities like gold, platinum, and coal. So, when global prices for these goods rise or fall, the Rand's value tends to follow suit.

For South African businesses that export or import goods, this volatility isn't just a number on a screen. It has a real-world impact on the value of their international invoices and payments.

Given the ZAR's rollercoaster nature, a currency trading profit calculator isn't just a nice-to-have. It's a fundamental part of your risk management toolkit. It lets you run the numbers and see how these wild swings could affect your profits before you put any real money on the line.

A huge piece of the profit puzzle in South Africa is the ZAR's volatility against major currencies like the US Dollar (USD). Take the USD/ZAR exchange rate, for instance. On one day it might be 17.3469, but historically it has shot up to around 19.93 ZAR per USD. This massive range shows exactly why using a calculator with real-time rates is non-negotiable for figuring out your true profit margins. You can explore more historical data on currency trends to see these fluctuations for yourself.

Preparing for Every Scenario

This is where a profit calculator becomes your best friend. It helps you brace for volatility by setting realistic goals and clear boundaries for every trade.

Before you even enter a position, you can plug in different potential exit prices—the good and the bad. In seconds, you can see your best-case profit and your worst-case loss quantified in black and white.

This kind of pre-trade analysis is absolutely crucial. It allows you to set sensible stop-loss and take-profit levels based on hard numbers, not gut feelings. You can figure out the exact price to set your stop-loss to ensure any potential loss stays within a range you're comfortable with, no matter what the market throws at you.

Suddenly, a volatile market isn't something to fear. It becomes a landscape of calculated opportunities.

How to Use a Profit Calculator: A Step-by-Step Walkthrough

Alright, enough with the theory. Let's get our hands dirty and see how these calculators work in the real world. Using one is surprisingly simple; it's less like doing complex maths and more like filling out a quick form to get a powerful financial forecast.

To make this practical, we’ll follow a common scenario for a South African business: an exporter who needs to manage the risk of a volatile Rand before getting paid in Japanese Yen (JPY). This guide will show you exactly how to transform abstract market numbers into a clear profit or loss figure.

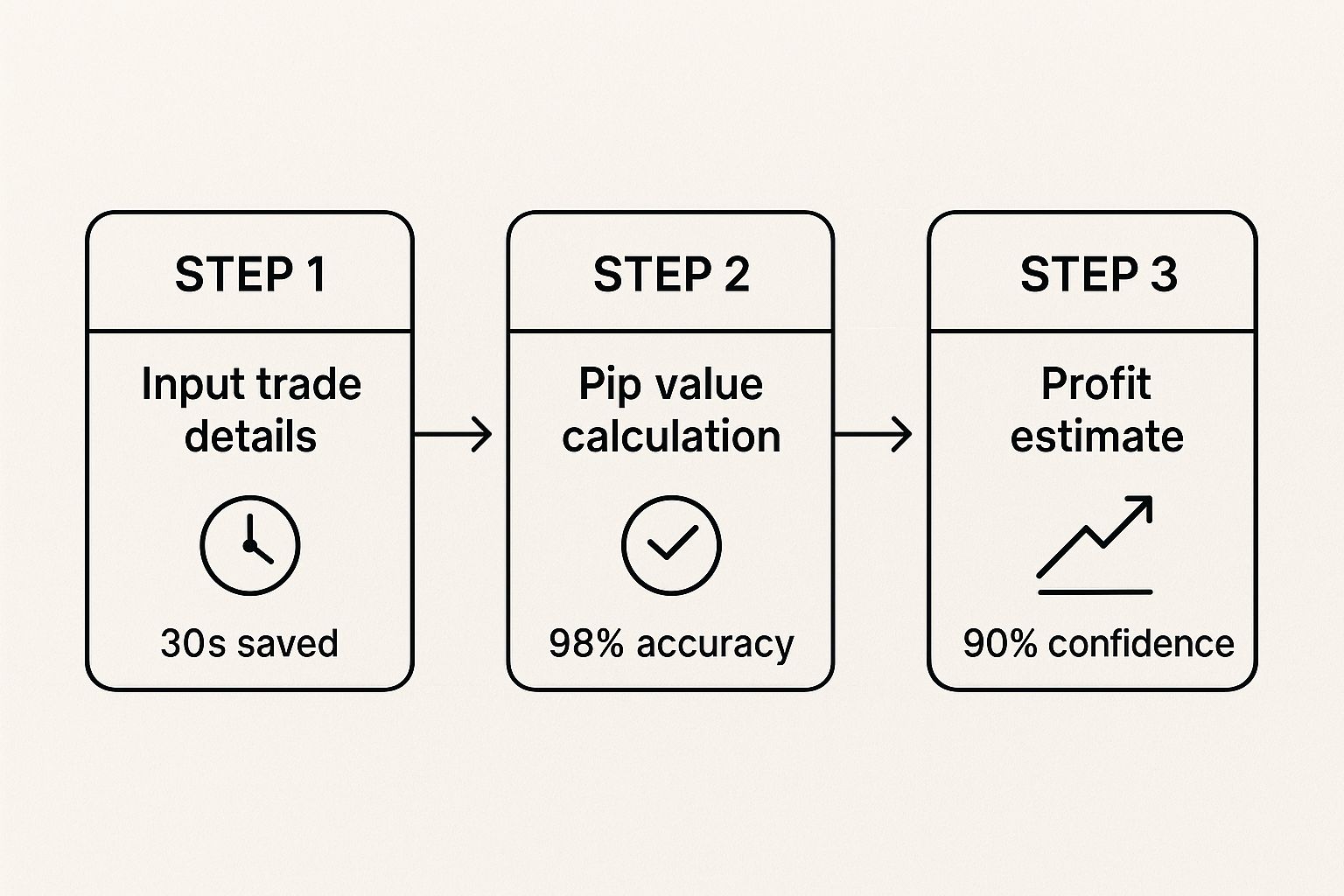

Step 1: Plug in Your Trade Details

First things first, you need to give the calculator the basic details of your planned trade. Think of this as setting the scene.

- Currency Pair: This is the what. You'll select the two currencies you're trading. For our exporter, this is ZAR/JPY.

- Account Currency: This is the where. Choose the home currency of your account, which ensures the final profit or loss is shown in a currency you actually use—in our case, ZAR.

- Trade Size (Lots): This is the how much. You need to specify the volume. A standard lot is 100,000 units, but you can also deal in mini (10,000) or micro (1,000) lots. For this example, we’ll stick with one standard lot.

These three pieces of information lay the foundation for the entire calculation.

A quick word of advice: the calculator is only as smart as the information you give it. Always double-check your numbers before you click 'calculate'. Garbage in, garbage out, as they say.

Step 2: Set Your Price Levels

With the trade basics locked in, it's time to map out your strategy by entering your planned entry and exit points. This is where you tell the calculator what price movement you’re banking on.

- Open Price: This is the exchange rate where you plan to jump into the market. Let's say our exporter opens the trade when the rate is 0.2050.

- Close Price: This is your goal—the rate at which you plan to exit. If the exporter believes the Rand will strengthen against the Yen, they might target a close price of 0.2100.

These two prices define the journey of your trade. The gap between them is what the calculator uses to figure out your potential outcome.

Step 3: Hit 'Calculate' and See the Result

Once all your details are in, just click the 'Calculate' button. The tool instantly crunches the numbers for you. It takes the difference between your open and close prices—in this case, a 50-pip move from 0.2050 to 0.2100 on a one-lot ZAR/JPY trade—and converts it into a real monetary value.

The result for this trade? A potential gross profit of R50,000.

Just like that, our exporter can see the exact financial impact of their hedging plan before putting a single Rand on the line. It turns a complicated currency calculation into a simple, decisive number you can build a strategy around.

Common Mistakes to Avoid When Calculating Profits

A currency trading profit calculator is a brilliant piece of kit, but remember the old saying: garbage in, garbage out. Even the most sophisticated tool will spit out misleading numbers if you feed it flawed information. These small errors can lead to big misjudgements, quickly turning what looked like a solid strategy into a painful financial loss.

Knowing the common pitfalls is the first step to dodging them. It’s all about creating a disciplined process where the calculator becomes a trusted ally for decision-making, not a source of false confidence. Let's walk through the most frequent mistakes we see traders in South Africa make.

By far the biggest blunder is forgetting about the hidden costs of trading. Your gross profit is a lovely number, but it’s not the one that lands in your bank account. Ignoring this simple fact will seriously distort your real financial picture.

Forgetting About Broker Costs

So many traders get caught up in the price movement between their entry and exit points, and that's a massive oversight. Broker fees are baked into every single trade you make, and you have to factor them in to get a true sense of your profitability.

These costs usually come in a few forms:

- Spreads: This is simply the difference between the buy and sell price of a currency pair.

- Commissions: A set fee your broker charges you for placing the trade on your behalf.

- Swap Fees: These are charges for holding a position overnight, and they can add up surprisingly fast on longer-term trades.

Always, always subtract these costs from the calculator's result to find your actual net profit.

A calculator is a tool for informed decision-making, not a crystal ball. Its purpose is to provide a clear mathematical output based on your inputs, helping you to plan for multiple scenarios and manage risk effectively.

Miscalculating Your Trade Size

Another classic slip-up is getting your trade size, or lot size, wrong. A trader might punch 1.0 into the currency trading profit calculator, thinking it’s a small position, when it actually represents one standard lot—that’s a hefty 100,000 units of the base currency.

This one simple mistake can blow up your projected profits and, more importantly, your potential losses, by a factor of ten or even a hundred. Before you hit 'calculate', double-check that you're using the correct lot size (standard, mini, or micro) that matches the actual volume you plan to trade. This ensures the risk you're calculating is the risk you're actually taking.

Forecasting Smarter with Historical Data

A good currency trading profit calculator does more than just crunch the numbers on a single, one-off trade. Its real power comes alive when you feed it historical data. Suddenly, it’s not just a calculator anymore—it’s a powerful forecasting tool.

Instead of plucking future price points out of thin air, you can model potential outcomes based on how a currency pair has actually behaved in the past. This shifts you from simply calculating a potential profit or loss to genuine strategic planning. You can build a trading strategy that’s ready for what the market might actually do, not just what you hope it will.

Using Past Performance to Predict Future Possibilities

Historical data gives your calculations context; it grounds them in reality. Let's say you're looking at a chart of the ZAR/USD exchange rate over the past year. You’ll quickly spot patterns—key price levels where the rate has repeatedly bounced back or struggled to push through. In trading, we call these support and resistance levels.

Once you’ve pinpointed these important price zones, you can plug them into your calculator to see what different outcomes could look like:

- Best-Case Scenario: What if the rate climbs back to a known historical resistance level? You can use that as your take-profit target.

- Worst-Case Scenario: What if the rate drops to a previous support level? That becomes a logical point for your stop-loss.

- Realistic Scenario: You could also use the average price movement from recent weeks to set a more moderate target.

This simple process takes your profit and loss projections out of the realm of guesswork and anchors them in demonstrated market behaviour. It helps you set goals that are actually achievable and manage your risk with far more confidence. For anyone looking to get more advanced with predicting financial outcomes, exploring practical cash flow projection models can provide some fantastic insights.

Building a Data-Driven Trading Plan

For any South African business dealing with the Rand, looking back at historical data is non-negotiable. The ZAR/USD pair, for instance, has shown significant annual variations for years. There's a clear trend of depreciation against the US dollar, driven by local economic conditions and inflation. A profit calculator helps you model these percentage changes to see how they impact your bottom line. You can discover more historical data insights on Wise.com to get a clearer picture.

By running simulations using historical highs and lows, you’re not just calculating a single trade. You are stress-testing your entire strategy against the market’s proven volatility. This ensures you’re prepared for the good, the bad, and everything in between.

This data-first approach transforms your currency trading profit calculator from a simple tool into a core part of your risk management plan. It empowers you to make smarter, more informed decisions that ultimately protect your business.

Frequently Asked Questions

When you're getting to grips with foreign exchange, it's natural to have questions, especially about the tools that can help you along the way. Let's clear up some of the most common queries people have about currency trading profit calculators.

Does a Profit Calculator Include Broker Fees?

Generally, no. Most of the free calculators you find online are designed to show you the gross profit – that’s the money you make purely from the currency’s price moving in your favour.

Things like broker commissions, spreads, and any overnight fees (swaps) usually aren't factored in. To get your net profit, the actual money that hits your account, you'll need to subtract these costs from the figure the calculator gives you. Some of the more advanced trading platforms might build these costs in, but it’s always best to double-check.

How Accurate Are These Calculators?

The maths behind the calculator is spot on. It’s simple arithmetic, so you can trust the calculation itself.

The real question is how accurate your inputs are. The final profit figure is only as good as the entry and exit prices you put in. A calculator will tell you precisely what you'll make or lose based on the scenario you give it; it can't, however, predict where the market will actually go.

Can Calculators Handle Exotic Pairs Like USD/ZAR?

They certainly can. Any decent profit calculator is built to handle the full spectrum of currency pairs, from the majors like EUR/USD to minors and, of course, exotics like USD/ZAR or GBP/ZAR.

For exotic pairs, the key is making sure the calculator has the correct pip value. Pip values for less common or more volatile currencies can be quite different from the majors, so having accurate, up-to-date data is crucial for getting a reliable result.

What Is the Difference Between Pips and Profit?

This is a fundamental concept that can trip up new traders, but it's pretty simple when you break it down.

Think of it like this:

- Pips measure the distance a currency’s price has moved. It's just a unit of measurement, like a centimetre.

- Profit is the actual money you gain or lose because of that movement.

A calculator’s main job is to turn that "distance" (the number of pips) into a real-world monetary value in Rands, taking into account the size of your position.

Ready to manage your international payments with the real exchange rate and zero hidden fees? With Zaro, South African businesses can send and receive global payments efficiently and affordably.