Trying to predict the Dollar-Rand exchange rate with any real accuracy can feel like a fool's errand. It’s one of the most volatile currency pairs out there, swayed by a constant push and pull of economic forces both at home and across the globe. For any South African business or individual with skin in the game, getting a handle on these forces is the first, most crucial step in managing foreign currency exposure.

This isn't just an abstract economic concept; the volatility has a real-world impact on everything from the cost of imported goods to the final value of your overseas investments.

Why Is the Dollar-Rand Rate So Hard to Pin Down?

Forecasting where the USD/ZAR is headed is notoriously tricky because it’s not just about one country's economy against another. It's a complex, living relationship influenced by everything from interest rate decisions made in Pretoria and Washington D.C. to the shifting moods of international investors. This constant flux creates genuine financial risk.

Think about it from a business perspective. If you're importing equipment from the US, a sudden weakening of the Rand can blow your budget overnight. On the flip side, an exporter might see their hard-earned profits dwindle if the Rand unexpectedly strengthens. This unpredictability makes long-term financial planning a massive headache and underscores why you can't just rely on a single forecast. Smart risk management is key.

The Constant Rollercoaster of Volatility

The defining feature of the Dollar-Rand pairing is its inherent volatility. We’re not talking about slow, gentle drifts here; we’re talking about sharp, sudden swings that can happen in the blink of an eye.

For example, in one recent six-month period alone, the rate swung by around 4.82%. It bounced between a high of 19.742 and a low of 17.250 ZAR to the Dollar, which actually marked a period where the Rand gained some ground. This kind of movement is typical and highlights the risks involved. You can dive into more historical data on USD-ZAR fluctuations and trends over at Exchange-Rates.org.

At its heart, currency volatility is simply a measure of risk. The Rand is an emerging market currency, which means it’s far more sensitive to global economic shifts and investor confidence than major currencies like the Euro or the Pound.

The Key Drivers Behind Exchange Rate Predictions

So, how do analysts even begin to form a prediction? They start by watching the "currents"—the primary drivers that influence the currency's direction. To get a better grasp on the complexities, exploring insights into capital flow dynamics and market conditions can add a whole new layer of understanding.

For now, let's break down the main forces at play.

Key Drivers of USD/ZAR Exchange Rate Predictions

Here’s a quick overview of the primary factors influencing the Dollar to Rand exchange rate, which we'll explore in more detail throughout this guide.

| Factor Category | Specific Influences |

|---|---|

| Local Economic Health | SARB interest rates, inflation data, GDP growth, political stability. |

| Global Market Forces | US Federal Reserve policy, global risk sentiment, commodity prices. |

| Investor Behaviour | Foreign direct investment (FDI), portfolio flows, market speculation. |

| Technical Indicators | Historical price charts, support/resistance levels, trend analysis. |

Each of these categories contains a world of data that analysts pour over to build their forecasts, and understanding how they interact is the secret to making sense of the Rand's movements.

South Africa's Economic Engine and the Rand

Before we can even begin to talk about dollar-rand exchange rate predictions, we need to pop the bonnet and have a good look at South Africa’s own economy. Think of the economy as the engine of a car; its performance directly impacts the strength and stability of the currency. A few key local components are constantly interacting, and a change in one can send ripples through the entire system.

The biggest driver here is undoubtedly monetary policy, which is steered by the South African Reserve Bank (SARB). The SARB's decisions, especially around interest rates, are absolutely critical.

Interest Rates: The Fuel for Foreign Investment

You can think of higher interest rates as a powerful magnet for foreign capital. When the SARB hikes its repo rate, it essentially offers international investors a better return on any investments they hold in rand. This prompts an inflow of foreign currency as investors buy up rand, which increases demand and, naturally, strengthens our local currency.

On the flip side, when rates are cut, that appeal fades. This can lead to capital flowing out of the country, putting the rand on the back foot. It's an incredibly delicate balancing act for the SARB, which has to weigh the benefits of attracting investment against the risk of stifling local economic growth with high borrowing costs.

The SARB’s own data tells this story clearly. If you look back, you’ll see that local factors—from trade balances to commodity prices—have a massive influence on the currency. The bank's decision to hold interest rates at 7% is a strategic move to keep inflation in check while trying to foster stability, and this directly affects the rand's standing against the dollar. You can dig into this yourself by reviewing the selected historical rates on the SARB's official website.

Economic Health: The Engine's Overall Performance

Beyond just interest rates, the general health of South Africa's economic engine is a massive factor. A few key performance indicators give us crucial clues about where the rand might be heading.

- Gross Domestic Product (GDP): Solid GDP growth points to a healthy, expanding economy. This builds investor confidence and provides a strong foundation for the rand.

- Inflation Rate: High inflation is a currency killer. It eats away at the rand's purchasing power, making it a much less attractive asset. The SARB targets inflation specifically to maintain currency stability.

- Employment Data: More people in jobs signals a robust economy and confident consumers, both of which are good news for the currency.

The daily movements of the rand can be quite dramatic, highlighting just how volatile it is.

This kind of daily data shows just how much the exchange rate can shift, which is why keeping a close eye on these economic indicators is so important.

Finally, there's the wild card: political stability. It's often the most unpredictable factor of all. Political uncertainty can spook investors, causing them to pull their money out of the country in a heartbeat.

A stable political environment is the bedrock of investor confidence. Any perceived instability, from policy uncertainty to social unrest, can trigger a flight to "safer" currencies like the US dollar, causing the Rand to weaken significantly.

At the end of the day, a strong local economy—one marked by healthy growth, managed inflation, and political stability—is the best foundation for a resilient rand.

How Global Events Move the Rand

While South Africa's internal economic health certainly sets the stage, it's often global events that direct the show. The Rand is incredibly sensitive to these international "weather patterns," which means a decision made thousands of kilometres away can cause serious ripples in our local currency markets.

This external influence is a core reason why nailing down accurate dollar rand exchange rate predictions is such a massive challenge.

The biggest player in this global arena? The United States Federal Reserve. When the Fed tweaks its interest rates, it's not just a domestic policy shift; it sends shockwaves through the entire financial world.

If the Fed raises US interest rates, dollar-denominated assets suddenly look a lot more attractive to global investors. Everyone wants a piece of the action. This rush for the greenback strengthens it against other currencies, and the Rand is no exception. So, even with a stable economy at home, the Rand can weaken simply because the Dollar became a better bet.

Understanding Risk-On vs. Risk-Off Sentiment

Beyond central bank policy, the collective mood of global investors plays a huge part. We often talk about this in terms of "risk-on" versus "risk-off" sentiment. Think of it like a crowd's reaction when the sky suddenly turns dark.

- Risk-On: When the global economy looks sunny and stable, investors feel brave. They’re willing to venture into emerging markets like South Africa, chasing higher returns. This "risk-on" appetite boosts demand for the Rand, helping it to strengthen.

- Risk-Off: But when uncertainty hits—a financial crisis, a geopolitical conflict, or a pandemic—investors run for cover. They pull their money out of assets they see as risky and pile into "safe havens." The US Dollar is the world's ultimate safe-haven currency.

This flight to safety creates a huge surge in demand for the US Dollar, causing it to strengthen dramatically. For the Rand, this "risk-off" mood means investors are dumping their ZAR holdings, leading to a sharp drop in its value.

This dynamic explains why a piece of bad news from the other side of the world can weaken the Rand, even when nothing has changed within South Africa's borders. In the currency world, perception of risk is often as powerful as reality.

Commodity Prices: A Tailwind or a Headwind

Finally, let's not forget commodity prices. As a resource-rich nation, South Africa's economic fortunes are tightly linked to the global appetite for materials like gold, platinum, and coal.

When global demand for these commodities is high, their prices shoot up. That translates to more foreign currency (mostly US Dollars) flowing into South Africa to pay for these exports. All those dollars need to be converted to Rand, which increases demand for our local currency and gives it a powerful tailwind.

On the flip side, a slump in commodity prices means less foreign cash coming in, which puts immediate downward pressure on the Rand.

How Experts Analyse and Predict Currency Moves

Trying to make sense of all the moving parts we've talked about can feel overwhelming. But when it comes to dollar rand exchange rate predictions, experts don't just throw darts at a board. They rely on established, time-tested methods to interpret what the market is telling them.

At its core, professional currency analysis boils down to two main approaches. Think of them as two different lenses for looking at the same problem. Used together, they provide a much clearer picture of what might be coming down the road for the USD/ZAR.

Fundamental Analysis: The Detective Work

Fundamental analysis is all about playing economic detective. It’s the process of digging into the "why" behind a currency's value. Analysts pour over macroeconomic clues—everything from interest rate announcements by the SARB and the US Fed to the latest inflation numbers, GDP growth figures, and even political headlines.

The central idea is pretty straightforward: a country with a strong, healthy economy should have a strong currency. So, if South Africa shows signs of sustained GDP growth and keeps inflation in check, it signals economic stability. This, in turn, makes the Rand more attractive to hold for the long term.

This method isn't about chasing daily price jumps; it's about assessing the underlying health of the economy that powers the currency.

Think of fundamental analysis like checking the engine and overall condition of a car before a long road trip. You're not just looking at the speedometer; you're ensuring the machine itself is sound and capable of reaching the destination.

Technical Analysis: Reading the Charts

If fundamental analysis is the "why," technical analysis is all about the "when" and "how." This approach is more like a seasoned weather forecaster studying historical storm patterns to predict where the next one might hit.

Technical analysts work from the belief that all the fundamental news and economic data is already baked into a currency's current price. Their job is to study price charts, hunting for recognisable patterns, trends, and important psychological price points that have mattered in the past.

A few key tools in their toolbox include:

- Support Levels: A price point where the Rand has historically found its footing and bounced back. It acts like a floor where buyers tend to show up in force.

- Resistance Levels: The opposite of support, this is a price ceiling that a currency pair struggles to punch through. It’s often where sellers step in and take their profits.

By pinpointing these levels, analysts can make educated guesses about where the USD/ZAR might be headed next, especially as it approaches these critical zones.

To make this clearer, let's compare the two approaches side-by-side. While they seem like opposites, most expert forecasts, like the one in the chart below, actually blend insights from both.

Fundamental vs Technical Analysis for USD/ZAR Predictions

| Analysis Type | Focus | Key Indicators | Analogy |

|---|---|---|---|

| Fundamental | The "why" behind a currency's value | Interest rates, GDP, inflation, political stability, trade balance | Checking a car's engine health before a long journey. |

| Technical | The "when" and "how" of price movements | Chart patterns, support & resistance levels, trading volume | Studying past weather maps to predict a future storm's path. |

Each method provides a different piece of the puzzle. Fundamentals give you the big-picture story, while technicals offer clues about market timing and sentiment.

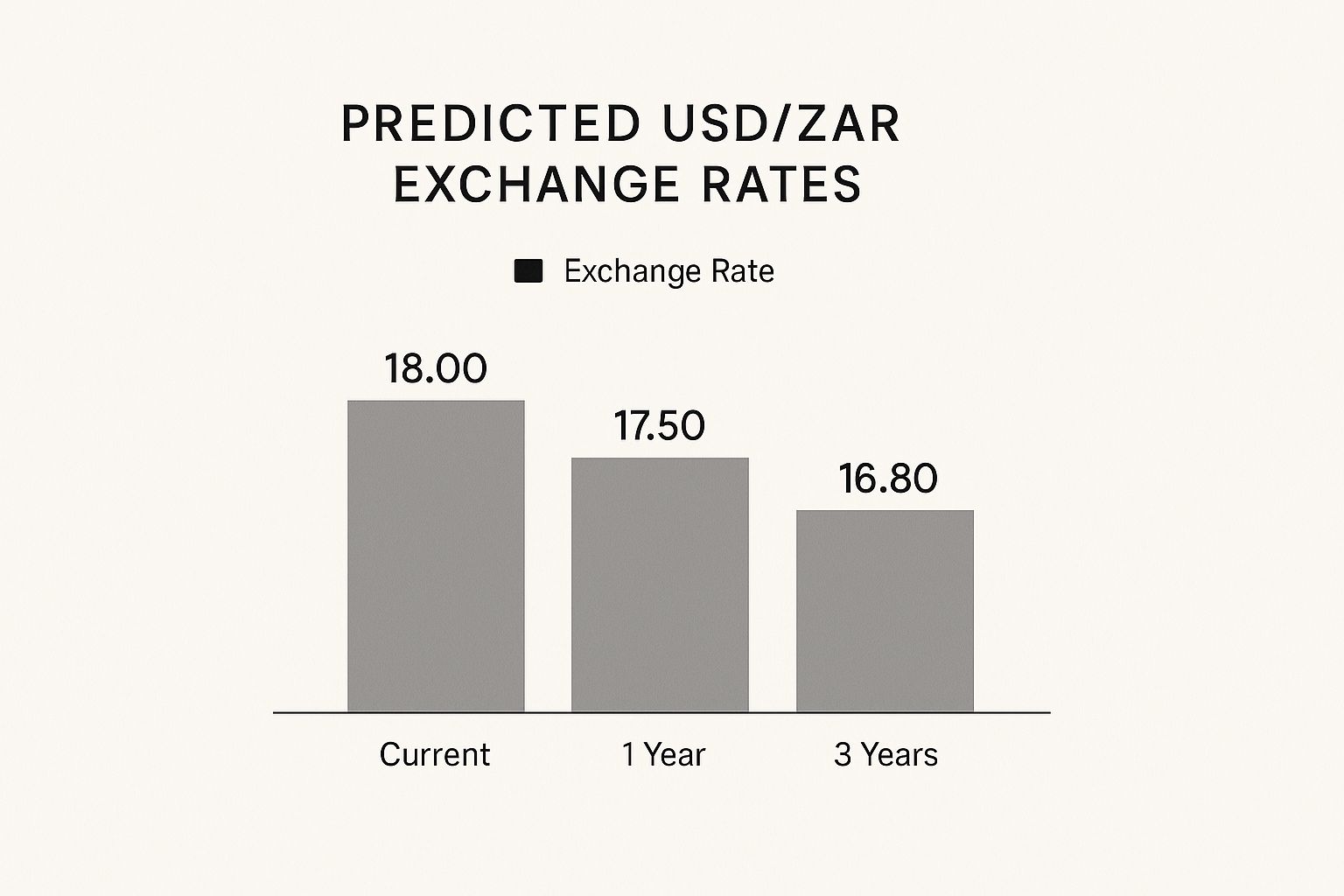

The infographic below illustrates how a blend of these analyses can translate into concrete projections over different timeframes.

As you can see, this particular forecast suggests a consensus view for the Rand to gradually strengthen against the Dollar over the next one to three years, a conclusion likely drawn from a combination of both fundamental and technical outlooks.

Practical Strategies to Handle Currency Risk

Knowing what drives the dollar to rand exchange rate is one thing. Actually shielding your business or personal finances from the rollercoaster ride is something else entirely. The good news is you don't have to just sit back and watch. There are real-world tools and strategies you can use to get a handle on the risk.

For businesses, especially those dealing with imports or exports, this means shifting from simply watching forecasts to actively managing your exposure. One of the most common and effective tools in the arsenal is the Forward Exchange Contract (FEC).

Think of an FEC as locking in a flight price today for a trip you’re taking in six months. You agree on a specific exchange rate now for a transaction that will happen down the line. This completely removes the guesswork, giving you certainty on your costs and protecting your profit margins. It's all about making your budgeting reliable.

Hedging Tools for Your Business

Beyond just fixing a rate, there are more flexible options available.

Currency Options: This is a bit like buying insurance for your exchange rate. You pay a small fee (a premium) for the right to exchange money at a set rate, but you don't have to. If the market swings against you, your rate is protected. But if it moves in your favour, you can just let the option go and trade at the better market rate. It’s the best of both worlds.

Foreign Currency Accounts: Simply holding accounts in both ZAR and USD can be a game-changer. It allows you to receive payments and pay suppliers in either currency without being forced into a bad exchange on a particular day. This creates a natural buffer against those sharp, short-term market movements.

Using these instruments transforms currency risk from a wild, uncontrollable threat into just another manageable part of doing business.

The real goal here isn't to try and outsmart the market—that's a fool's game. It's about building financial predictability so you can stop worrying about the Rand and focus on running your business.

Tips for Individuals

If you're an individual sending money overseas or managing foreign investments, timing can feel like everything. Instead of trying to nail the "perfect" day for one big transfer, consider a strategy called dollar-cost averaging.

This just means breaking up your large transaction into several smaller ones over a period of time. By doing this, you average out the exchange rate you get, which protects you from the disaster of moving all your money right when the Rand takes a sudden dip.

The latest forecasts give us some context for this. Projections suggest the Rand could trade near 17.38 ZAR per USD by the end of Q3, with a one-year outlook hovering around 17.49 ZAR per USD. And while the Rand has shown some strength recently, it’s still down 1.20% over the last 12 months. This just underlines why a careful, long-term approach is so valuable. You can dive into more detailed South African currency forecasts to help with your own planning.

Common Questions About Dollar Rand Predictions

Trying to make sense of dollar rand exchange rate predictions can feel like navigating a maze. It’s completely normal to have questions, and we hear a lot of the same ones from South African businesses and individuals who are just trying to get a clear picture.

This section is designed to give you direct, practical answers to those common queries. We’ll cut through the jargon to talk about how much faith you can put in these forecasts, where to find reliable information, and what you can actually do to stay on top of it all. Let's dive in.

How Reliable Are Long-Term USD ZAR Forecasts?

This is the big one, isn't it? The most honest answer is that you should view any long-term forecast—that’s anything looking beyond a year—with a healthy dose of scepticism. Analysts have incredibly sophisticated models, but the reality is that the sheer number of variables at play makes pinpoint accuracy over long periods almost impossible. Think about it: unexpected political shifts here at home or global economic shocks can throw even the best predictions completely off course.

So, what are they good for? Long-term forecasts are best used to understand the general direction the experts think the currency is headed, based on major economic trends. For instance, a forecast might suggest a gradual strengthening of the rand over three years, banking on expected improvements in South Africa’s economy.

A long-term forecast isn't a precise roadmap; it's more like a compass pointing you in a general direction. It’s great for high-level strategic planning, but it’s not the tool you want to use for timing your day-to-day transactions.

For practical business decisions, a far better approach is to focus on shorter-term forecasts (think 3-12 months) and combine them with solid risk management strategies.

What Are the Best Sources for Currency Predictions?

In a world full of opinions, finding trustworthy information is everything. A quick Google search will give you a flood of predictions, but it’s crucial to stick with established financial institutions and reputable news outlets. These are the places that employ dedicated economists who base their insights on data, not just speculation.

Here are the types of sources you should be looking at:

- Major Banks and Financial Institutions: Big local and international banks like Absa, Standard Bank, and JP Morgan regularly publish research and forecasts. These reports are usually packed with detailed economic analysis.

- Reputable Financial News Outlets: You can't go wrong with global names like Reuters, Bloomberg, and The Wall Street Journal. Locally, publications like BusinessDay offer daily market analysis and expert commentary on currency movements.

- Economic Data Providers: Organisations like the International Monetary Fund (IMF) and our own South African Reserve Bank (SARB) provide the macroeconomic data and outlooks that underpin many professional forecasts.

By pulling insights from a mix of these sources, you can piece together a much more balanced and well-rounded view of where the dollar-rand might be heading.

How Often Do Exchange Rate Predictions Change?

Exchange rate forecasts are living documents, not static predictions set in stone. They are constantly being revised as new information comes to light. A forecast released today might be tweaked next week—and that’s a good thing! It shows that analysts are reacting to the dynamic, ever-changing nature of the currency market.

What kind of things can trigger a sudden update?

- Central Bank Announcements: An unexpected interest rate decision from the SARB or the US Federal Reserve can change everything overnight.

- Key Economic Data Releases: Inflation figures, GDP reports, or employment numbers that come in much higher or lower than expected will almost certainly lead to revised forecasts.

- Geopolitical Events: Sudden political instability or global conflicts can dramatically shift investor sentiment and send currencies moving.

Because the market moves so quickly, it’s vital to follow the latest analysis available instead of relying on an old report. Staying current is your best defence against being caught out by a sudden shift in the market.

Navigating currency volatility doesn't have to be a constant headache. For South African businesses, having the right tools can turn uncertainty into a manageable part of your plan.

At Zaro, we give you a platform with access to the real exchange rate—no hidden markups or confusing fees. You can manage your international payments with confidence, knowing you have complete transparency and control. See how you can protect your profits and simplify your cross-border transactions at https://www.usezaro.com.