Planning your move from South Africa can feel like a mountain of paperwork and confusing rules, but things have actually become a lot simpler. The old, clunky ‘financial emigration’ system is a thing of the past. Now, it all boils down to one key thing: your tax residency status with SARS.

Understanding Emigration From South Africa Today

Thinking about moving overseas is a huge step, and the questions about your money, assets, and legal obligations can quickly become overwhelming. It’s a major life decision, and the financial side of things often seems the most tangled. The good news? The central idea you need to get your head around is much clearer than it used to be.

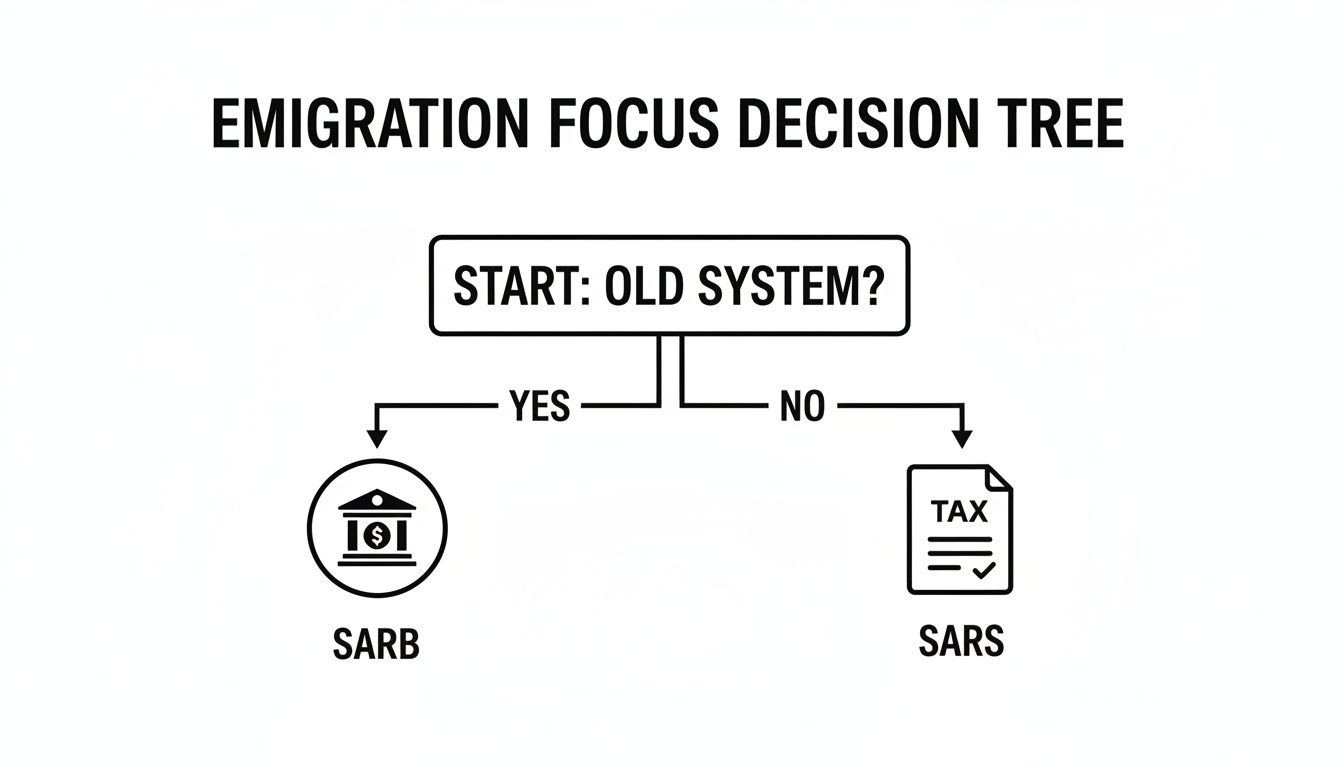

The most critical shift to understand is that the whole process has moved away from the South African Reserve Bank (SARB) and now sits firmly with the South African Revenue Service (SARS). This change means that when we talk about "emigration" today, we're really talking about your tax status.

You no longer have to navigate a complicated, bank-driven process to "financially emigrate." Instead, the main event is formally ceasing to be a tax resident of South Africa. Think of it as officially letting the government know that your financial centre of life has shifted to another country. This one action is what sets everything else in motion, from accessing your retirement funds to managing your local investments.

The Modern Approach to Emigration

Today's path to emigrating from SA is all about your relationship with the taxman. It’s less about where you physically are and more about where your financial and personal ties are strongest. This new system gives you a much more logical way to handle your affairs as you start your new life.

Here are the key things you'll be dealing with:

- Ceasing Tax Residency: This is the formal process of telling SARS that you no longer meet their definition of a tax resident. It's the cornerstone of the whole process.

- Managing Your Assets: You'll need to figure out what to do with your South African property, investments, and retirement funds now that you'll be a non-resident.

- Moving Your Money: There are specific rules and annual allowances for transferring your capital out of the country, and you'll need to follow the right procedures.

- Staying Compliant: It’s crucial to make sure all your final tax obligations in South Africa are settled to avoid any nasty surprises down the line.

By focusing on your tax residency, you create a clean break between your old financial life in South Africa and your new one abroad. This clarity is vital for avoiding problems like double taxation and ensuring you’re playing by the rules in both your old and new home countries.

This guide will walk you through each of these areas, step by step. We’ll break down the jargon and complex rules into simple, practical advice, showing you how this modern approach works in the real world. Our goal is to help you manage your finances, assets, and legal duties with confidence as you get ready for the future.

The New Rules of Financial Emigration

If you've heard the term ‘financial emigration’ tossed around by friends who left South Africa years ago, you need to know that the rulebook has been completely rewritten. On 1 March 2021, the old, often confusing system was scrapped. What was once a bank-led process revolving around the South African Reserve Bank (SARB) is now a thing of the past.

The new approach is far more straightforward and logical: it’s all about your tax status.

Forget the old SARB approvals. Today, the central question is simply: are you a tax resident of South Africa? The entire process has shifted firmly into the hands of the South African Revenue Service (SARS), making your departure a tax matter, not a banking one. This aligns your financial exit with your tax obligations, creating a much clearer path for anyone leaving the country for good.

This little decision tree sums it up perfectly. The old way involved the Reserve Bank; the new way is all about SARS.

The bottom line is simple: if you’re formally emigrating today, your journey starts and ends with SARS.

Understanding the Two Key Residency Tests

So, how does SARS figure out if you're a tax resident? They use a two-pronged approach to determine where your financial and personal life is truly anchored. Getting your head around these tests is the first real step in the modern emigration process.

The Ordinarily Resident Test

First up is the ordinarily resident test. This one is less about numbers and more about your life's 'centre of gravity'. It asks a fundamental question: where is your real home, the place you would naturally come back to after being away?

It’s not just a feeling, though. SARS looks for concrete, objective proof. They’ll consider things like:

- Where your main home and most of your personal belongings are.

- The location of your immediate family, like your spouse and children.

- Your ties to South Africa, such as memberships in clubs, religious groups, or business networks.

- Which country issued your driver's licence and passport.

If it's obvious your life is now centred outside South Africa, you'll likely pass this test and be considered non-resident. But if it's a bit of a grey area, SARS will move on to the second test.

The Physical Presence Test Explained

This is where it becomes a numbers game. The physical presence test is a strict calculation based on how many days you’ve actually spent on South African soil over the last few years. There’s no room for interpretation here.

To be considered a tax resident under this test, you have to tick all three of these boxes for a given tax year:

- You were in SA for more than 91 days in the current tax year.

- You were in SA for more than 91 days in each of the five previous tax years.

- You were in SA for a combined total of more than 915 days across those five previous years.

If you answer 'yes' to all three, SARS will classify you as a tax resident for that year, regardless of where your 'true home' is. To break this tax residency, you must stay physically outside of South Africa for a continuous stretch of at least 330 full days.

This move towards tax residency isn't unique to South Africa. It’s part of a global trend where tax authorities are focusing on substance over form. It ensures that when you genuinely move your life, you also move your tax obligations, which helps prevent confusion and potential issues with double taxation.

This new framework is also a reaction to a changing world. Historically, major political shifts in South Africa have always prompted people to move. Research, for instance, shows migration from the country roughly doubled between the late apartheid era and the post-1994 democratic transition, peaking around 1992. If you're interested, you can read the full research about these historical mobility trends for more context. It just goes to show that as the country evolves, so do the rules for those choosing to move abroad.

Exploring Your Visa and Destination Pathways

Choosing where you want to build your new life is easily the most exciting part of the emigration journey. But turning that dream into reality comes down to one critical document: a visa. Your visa is the legal key that unlocks the door to your chosen country, and honestly, securing it should be your top priority before you make any other big plans.

Think of it this way: your visa pathway actually determines your destination, not the other way around. You might have your heart set on Sydney, but if your skills and circumstances perfectly match Canada’s immigration policies, then your most practical path probably lies north. Figuring out the routes available to you is the very first strategic step in planning a successful move.

Popular Visa Routes for South Africans

Most popular destinations for emigration from SA have several visa categories, each built for different circumstances. While this is by no means legal advice, knowing the main types can help you see which doors might be open.

Skilled Worker Visas: This is the most common route by a long shot. Countries like Australia, Canada, and the UK use points-based systems to attract professionals with specific skills and work experience. Everything from your age and qualifications to your English proficiency and occupation will contribute to your score.

Ancestral Visas: Got a grandparent born in the United Kingdom? You might just be eligible for a UK Ancestry visa. It’s a unique pathway that offers a direct route to living and working in the UK for five years, after which you can apply to settle permanently.

Spousal or Partner Visas: If your partner or spouse is already a citizen or permanent resident of another country, this can be a very clear route to residency. The process mostly involves proving your relationship is genuine.

Investment or Business Visas: For those with significant capital or a strong entrepreneurial track record, these visas let you start a new business or invest in an existing one abroad. Be warned, though—the financial requirements are often substantial.

The visa application process can be long and demanding, often taking many months or even years. Starting early and understanding all the requirements upfront prevents costly delays and ensures you don't commit financially to a move that isn't legally possible yet.

Common Destinations and What They Look For

Different countries prioritise different types of immigrants, which usually reflects their current economic and social needs. For South Africans, a few key destinations have stayed popular over the years, partly because of the established communities and clear immigration programmes they offer.

This trend of skilled migration isn't new. Between 1989 and 2003, an estimated 520,000 South Africans moved abroad, with a huge chunk of them—around 120,000—being skilled professionals. This history really shows the long-standing appeal of overseas opportunities for qualified people.

Charting Your Course with Confidence

Understanding your options is the foundation of a well-planned move. If your goal is long-term settlement, then getting to grips with the various permanent residency pathways available in your target country is essential. The right visa not only gets you in but also lays the groundwork for your future, including potential citizenship and your financial life.

Doing this research carefully will help you approach your emigration from SA with clarity and a whole lot more confidence.

Your Financial Checklist for Leaving South Africa

Let's be honest, sorting out your money is the most intimidating part of emigrating from South Africa. It’s far more than just packing boxes and booking flights. You're essentially untangling your entire financial life from one country to plug it into another, and if you get it wrong, the consequences can be costly.

Think of the next few steps as your financial roadmap. Having a clear, step-by-step checklist turns an overwhelming task into a series of manageable actions. By following it, you'll avoid common pitfalls and prevent future headaches with tax authorities on both sides of the world.

1. Get Your Tax Compliance Status PIN

First things first: you need SARS's blessing. Before you can make any big financial moves, you have to prove you’re in good standing with the taxman. This is done by applying for a Tax Compliance Status (TCS) PIN specifically for "emigration."

This PIN is your official green light. It’s a digital certificate you'll show to banks and financial institutions, proving your tax affairs are squared away. It's mandatory for moving any money abroad beyond your basic annual allowance, so without it, your plans to transfer serious capital are dead in the water. Start this process early—it can take a few weeks if SARS has any queries.

2. Brace Yourself for the "Exit Tax"

This is the one that catches so many people out. The moment you officially stop being a South African tax resident, SARS performs what's called a "deemed disposal." It's a bit of a strange concept, but what it means is that SARS pretends you sold all your worldwide assets (except for your fixed property in SA) on the day before you left.

Of course, this "sale" triggers a tax event – specifically, Capital Gains Tax (CGT). This is what people commonly refer to as the "exit tax." You'll be taxed on the growth in value of assets like:

- Shares and unit trusts (both in SA and overseas)

- Your business interests

- Krugerrands

- Property you own outside of South Africa

Getting professional valuations for all your assets before you leave is non-negotiable. So many people underestimate their exit tax bill, and it’s a massive, expensive shock that can completely derail your financial planning.

A bit of smart planning can soften the blow. For instance, you could strategically sell certain assets before you officially cease tax residency. This allows you to control the timing of the CGT payment and avoids a surprise bill from SARS later on.

3. Plan How You'll Move Your Money

With your tax affairs in order, you can finally focus on getting your funds out of the country. South Africa’s exchange control regulations are strict, so you need to know the rules of the game.

To help you get started, we've put together a table summarising the main allowances you can use to transfer money abroad.

Key Financial Allowances for Moving Funds Abroad

| Allowance Type | Annual Limit per Person | Approval Body | Typical Use Case |

|---|---|---|---|

| Single Discretionary Allowance (SDA) | R1 million | None (Bank handles) | Travel, gifts, overseas study, small investments. No tax clearance needed. |

| Foreign Investment Allowance (FIA) | R10 million | SARS (via TCS PIN) | Larger investments, buying property abroad, funding your new life. |

Understanding these two allowances is crucial for a smooth transition.

4. Close and Consolidate Your Accounts

The simpler your financial footprint in South Africa, the easier your life will be once you're living overseas. Before you go, do a full audit of every account you have.

Shut down any credit cards you won't be using, consolidate your various bank accounts, and make sure to cancel any store cards or local subscriptions. Every account left open is another password to remember and another potential admin headache to manage from a different time zone. A clean financial break is the goal.

It’s also at this stage that you need to start thinking about the practicalities of life in a new country. Arranging solid international health insurance for expats is one of the most important financial safety nets you can put in place. Make sure to budget for this alongside all your other moving costs.

Managing Your South African Retirement Funds and Assets

For most South Africans planning a move abroad, their retirement funds and the family home are their biggest assets. It’s completely understandable that the question of what happens to this hard-earned wealth causes a lot of anxiety. The rules can be tricky, and one wrong move could have serious financial consequences down the line.

Navigating the web of regulations around retirement annuities, preservation funds, and property calls for a solid plan. The good news is that while the rules are firm, they’re also predictable. Once you get a handle on the process, you can make clear, informed decisions that will protect your financial future as you set out on your new adventure.

Let's break down exactly how to manage these critical assets. We’ll cover everything from the well-known "three-year rule" for unlocking your retirement savings to the practical pros and cons of selling versus renting out your South African home.

Accessing Your Retirement Annuity

Your Retirement Annuity (RA) has always been that untouchable nest egg for your golden years. But emigration changes the rules of the game. Once you are formally a non-resident, you’re allowed to make a full withdrawal of your RA funds, even before reaching retirement age.

There is, however, a very important catch: the three-year rule.

This rule means you have to prove to SARS that you've been a non-resident for tax purposes for three consecutive years before they'll let you touch your RA. This requirement was brought in to make sure that people ceasing their tax residency are doing so for the long haul.

Think of the three-year rule as a "cooling-off" period. It's your way of showing SARS that your move isn't just a temporary stint abroad. This waiting period is a non-negotiable part of your financial planning, so you need to factor it in from day one.

It's absolutely essential to build this timeline into your financial plans. During those three years, your RA funds will stay invested in South Africa, riding the ups and downs of the market. After the waiting period is over, you can apply to withdraw the full amount, which will then be taxed according to the retirement withdrawal lump sum tax tables.

What About Preservation Funds?

Preservation funds, which are often where your pension or provident fund savings from previous jobs are sitting, play by a slightly different set of rules. This is a critical distinction for your cash flow.

Unlike an RA, you don't have to wait three years to access these funds after you've ceased your tax residency. This is a game-changer for many emigrants, as a preservation fund can provide a much-needed capital injection far sooner than an RA.

You're generally allowed one full or partial withdrawal from a preservation fund before you retire. By formalising your non-resident tax status with SARS, you can trigger this withdrawal, giving you access to your money when you probably need it most – during those first few years of settling in a new country. Just like an RA, this lump sum will be subject to withdrawal tax rates.

Deciding What to Do with Your SA Property

Your property in South Africa is likely your biggest physical asset, and figuring out what to do with it is a massive decision. You really have two main paths: sell it before you go, or keep it and rent it out. There’s no single "right" answer here; the best choice depends entirely on your personal finances and long-term goals.

Here’s a quick rundown to help you weigh things up:

Selling Your Property

- Pros: This gives you a clean financial break. It frees up a significant amount of capital that you can then transfer abroad (using your Foreign Investment Allowance) to help you set up your new life. It also massively simplifies your tax situation, as you won't have to manage a major asset from another country.

- Cons: You’ll have to pay Capital Gains Tax (CGT) on the profit you make from the sale. You also lose your foothold in the South African property market, which might not be what you want if you ever see yourself returning.

Renting Out Your Property

- Pros: You get a steady stream of rental income in Rands, which can be very useful. It also means you hold onto a valuable asset in South Africa that could grow in value over time.

- Cons: You’ll become a non-resident landlord, which adds a layer of complexity. You will have to declare and pay income tax in South Africa on your net rental income, and you’ll absolutely need a trustworthy managing agent on the ground to look after the property for you.

This decision requires some serious thought. You need to consider your immediate need for cash, your willingness to manage an investment from thousands of kilometres away, and your long-term view of the SA property market.

Common Emigration Pitfalls and How to Avoid Them

Learning from the experiences of others is one of the smartest things you can do when planning to emigrate from SA. The path is well-trodden, but it’s also littered with common traps that can cost you dearly in time, money, and stress. If you know what they are ahead of time, you can navigate around them.

So many people fall into the same handful of errors, usually because of bad assumptions or incomplete information. We’re not talking about complex legal loopholes here, but simple oversights that can quickly snowball into major headaches. Let's walk through these mistakes so you can make your move as smooth as possible.

Underestimating the Exit Tax Bill

By far the most common and costly mistake is getting the "exit tax" calculation wrong. It’s crucial to remember this isn't some new tax; it’s a Capital Gains Tax (CGT) event that happens the moment you cease to be a tax resident. SARS basically treats it as if you sold off most of your worldwide assets on that day, and they want their cut of the growth.

Where do people go wrong? They often forget to include things like an international share portfolio or their interests in a family business, which leads to a much, much larger tax bill than they ever budgeted for.

How to Avoid It:

- Get Professional Valuations: Don't thumb-suck the value of your assets. You need to hire professionals to get proper valuations for everything from shares and property to art and collectibles before you tell SARS you’re leaving.

- Budget for It: Once you have a realistic CGT estimate, this number must go straight into your emigration budget. This alone will prevent a massive cash-flow crisis when you need your money the most.

A surprise tax bill running into hundreds of thousands of Rands can cripple your relocation plans. Treating the exit tax calculation as a critical, early-stage task is the single best way to protect your finances.

Neglecting to Formally Notify SARS

Another classic blunder is thinking that just because you've packed your bags and left South Africa, your tax obligations are over. That’s a very dangerous assumption. Unless you formally notify SARS and follow their process to cease your tax residency, they still see you as one of theirs.

This means SARS will continue to expect you to declare and pay tax on your worldwide income. You can quickly find yourself facing double taxation, not to mention penalties for non-compliance.

Making Costly Foreign Exchange Mistakes

Moving your life's savings from one currency to another is a massive financial step. Even tiny percentage differences in the exchange rate can have a huge impact. Too many people just default to their high-street bank for the transfer, completely unaware that they’re losing a huge chunk of their capital to uncompetitive rates and hidden fees.

Think about it this way: on a transfer of R2 million, a difference of just 2% in the exchange rate costs you R40,000. That’s a car, a rental deposit, or a whole lot of peace of mind down the drain.

How to Avoid It:

- Shop Around for Rates: Never, ever accept the first rate you're offered. Get quotes from your bank and compare them against specialist foreign exchange providers.

- Understand the Fees: Ask for a complete breakdown of all costs. This includes transfer fees, commissions, and the margin (the spread) they’re applying to the exchange rate.

- Plan Your Transfers: Don't leave your currency exchange until the last minute. Panicked transfers are always expensive ones. By watching the market and planning your exchange, you have a much better chance of securing a favourable rate.

By getting ahead of these common stumbles—the exit tax, the SARS notification, and the forex trap—you can navigate your emigration with confidence and make sure your hard-earned capital arrives safely with you.

Your Emigration Questions Answered

Moving abroad is a huge step, and the details can feel overwhelming. It's completely normal to have a long list of questions. Let's tackle some of the most common ones that come up when planning a move from South Africa.

Do I Have to Give Up My South African Citizenship When I Emigrate?

Absolutely not. This is a common point of confusion, but let’s be clear: ceasing your tax residency has no impact whatsoever on your citizenship status. You'll still be a South African citizen, your passport is still valid, and you keep all the rights that come with it.

Renouncing your citizenship is a completely separate and formal legal process. For the vast majority of people emigrating, it’s not something you even need to consider.

What Is the Exit Tax and How Is It Calculated?

The term "exit tax" can sound a bit intimidating, but it's not a special penalty for leaving. It’s actually a Capital Gains Tax (CGT) event. The day you officially cease to be a tax resident, SARS essentially treats it as if you sold all your worldwide assets.

This "deemed disposal" triggers CGT on the growth in value of assets like shares, business interests, and any property you own outside of SA. It's important to note that your fixed property in South Africa is excluded from this. Getting accurate, professional valuations before you leave is crucial—it helps you calculate what you owe and prevents any nasty financial surprises down the line.

Can I Keep My South African Bank Account?

Yes, you certainly can. Once you've finalised your tax emigration with SARS, you just need to notify your bank. They'll convert your account into a non-resident bank account.

The functionality might change slightly – for instance, your access to credit might be different – but it allows you to easily manage any lingering financial ties. You can still receive rental income from an SA property or dividends from local investments without any hassle.

Keeping a non-resident account is a smart move. It simplifies handling any ZAR-based income or local expenses without complicating your new tax status abroad.

What Happens if I Don’t Notify SARS That I've Left?

This is one mistake you really want to avoid. If you don't formally complete the process of ceasing your tax residency, SARS will continue to see you as a South African tax resident. That means they will legally expect you to pay tax on your worldwide income, no matter where you earn it.

This oversight can lead to some serious headaches, like being taxed in both South Africa and your new country (double taxation), not to mention potential penalties for non-compliance. Getting the official paperwork done is non-negotiable.

When moving your business finances or repatriating funds, hidden bank fees and poor exchange rates can significantly erode your capital. Zaro offers a better way for South African businesses, providing access to real exchange rates with zero spread and no hidden fees. Manage your international payments with clarity and efficiency by visiting https://www.usezaro.com.