In the forex market, your account equity is the real-time value of your trading account. It's a live, running total that combines your account balance with any floating profits or losses from your open positions.

Think of it this way: your equity is your account's current net worth. It's what you'd be left with if you closed every single one of your trades at this exact moment.

What Does Equity Really Mean in Forex Trading

When you're new to trading, it’s natural to fixate on your account balance. But that number is just a static record of your deposits, withdrawals, and the outcomes of trades you’ve already closed. It’s a look back at the past.

The concept of equity in forex, however, is all about the present. It’s the dynamic, live-action value of your entire trading operation as it stands right now.

Let's use an analogy. Imagine your trading account is a small business. Your balance is the cash you started with in the till. Your equity, on the other hand, is that starting cash plus the potential profit or loss from all the deals you're currently negotiating but haven't yet finalised. If those deals are looking good, your business's real-time value (equity) is high. If they're heading south, its value drops—even if the cash in the till hasn't changed.

Why Equity Matters More Than Balance

Grasping this difference is crucial for any trader. Your broker doesn't really care about your balance when determining your trading capacity; they look at your equity. It’s the true measure of your account's health and the actual capital you have available to absorb market swings or open new trades.

Equity is the most critical number on your trading platform. It’s the foundation for all your risk calculations, from margin requirements to potential margin calls. A falling equity is the first red flag that you might be in trouble.

Here’s a quick summary of how these two key metrics differ.

Equity vs Balance: A Quick Comparison

This table breaks down the core differences between your account balance and your equity, helping you see at a glance which metric to watch and when.

| Feature | Account Balance | Account Equity |

|---|---|---|

| Nature | Static; a historical record. | Dynamic; a real-time snapshot. |

| Calculation | Deposits - Withdrawals +/- Closed P/L. | Balance +/- Unrealised P/L from open positions. |

| When it Changes | Only when a trade is closed or funds are moved. | Fluctuates constantly with market movements while trades are open. |

| Primary Use | Tracks historical performance and account funding. | Measures current financial health and available margin for new trades. |

| Broker's Focus | Used for record-keeping and historical statements. | Used for margin calls and determining trading capacity. |

Ultimately, this dynamic nature is what makes equity the true indicator of your financial standing in the market. While your balance tells you where you've been, your equity tells you exactly where you are right now.

Focusing on equity empowers you to make sharp, proactive decisions about your trades and risk exposure. Ignoring it? That’s a bit like trying to drive a car while only looking in the rearview mirror.

How to Calculate Your Trading Account Equity

Knowing what equity means in forex is the first step, but being able to calculate it is where you really start to take control of your trading. Thankfully, the maths involved is surprisingly simple. Your trading platform handles it for you instantly, but it’s just basic addition and subtraction.

The core formula is beautifully straightforward:

Equity = Account Balance + Total Unrealised Profit or Loss

Let’s break that down. Your Account Balance is the starting line—it’s the cash in your account before you factor in any open trades. The Unrealised Profit or Loss, often called "floating P/L," is the combined, live value of all your active positions. This is the figure that dances up and down with every tick of the market.

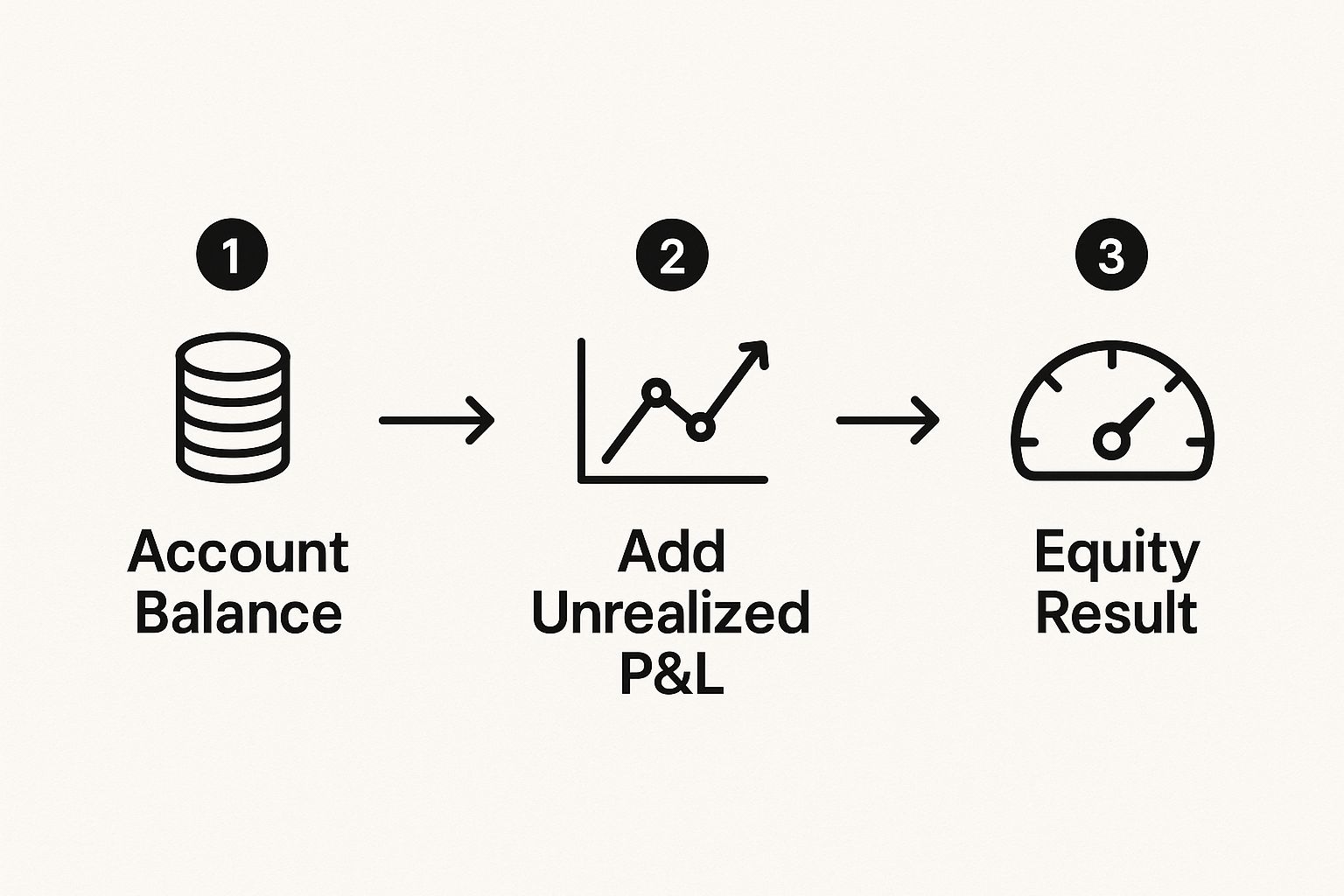

This flow diagram shows exactly how your static account balance and your dynamic open trades come together to give you a live equity value.

As you can see, it's a clear process: the fixed balance merges with the fluctuating profit or loss, creating the real-time value of your account at that very second.

A Practical South African Example

Let's ground this with a scenario a local trader might encounter. Imagine you've funded your account and have a starting balance of R20,000.

You decide to enter two different trades:

- A "buy" on USD/ZAR, which is currently in the green with an unrealised profit of +R2,500.

- A "sell" on EUR/ZAR, which has unfortunately moved against you, showing an unrealised loss of -R1,000.

To find your equity, you just combine these floating figures with your balance.

First, your total unrealised P/L is: R2,500 (profit) - R1,000 (loss) = +R1,500.

Now, let's plug that into the main formula:

- Equity = R20,000 (Balance) + R1,500 (Total Unrealised P/L)

- Your Equity = R21,500

At this very moment, your equity is R21,500. It's a live snapshot of your account's total worth. If you were to close both trades right now, that's the amount that would become your new account balance. While the trades remain open, this is the number that truly matters for understanding your financial standing in the market.

Of course, knowing your real-time value is only part of the picture. To truly measure how well you're doing, you also need to know how to calculate investment returns accurately. This helps you track the growth of your equity over time and see if your strategies are actually paying off. Think of this constant calculation as the heartbeat of your trading account, showing you its financial health in real-time.

Why Equity Is Your Key to Smart Risk Management

Focusing only on your account balance is one of the easiest and most costly mistakes a new trader can make. Your balance is just a historical record—a snapshot of past performance. Your equity, on the other hand, is the live, real-time number that dictates your ability to survive in the market. It's the central pillar of your entire risk management strategy.

Think of equity as your trading account's "health bar" in a video game. As long as it's healthy, you can stay in the fight. But if it drops too low, it's game over. Your broker is watching this health bar constantly to decide what you can and cannot do.

This single figure is the foundation for several critical risk metrics that govern your every move. Getting to grips with how these are connected is absolutely essential for protecting your capital.

How Equity Governs Your Trading Power

Your broker uses your equity to calculate your capacity to take on risk. This isn't just a friendly suggestion; it's a hard-and-fast rule hardwired into their platform. Your ability to open new positions—or even keep your current ones open—is directly tied to your equity level.

From this core number, your broker derives several key metrics that every trader needs to watch.

This table breaks down the essential risk management terms and shows how they all stem from your account equity.

Key Trading Metrics Derived From Equity

| Metric | Formula | What It Tells You |

|---|---|---|

| Used Margin | Total margin required for all open positions | This is the portion of your equity your broker has locked away as a security deposit to keep your current trades running. |

| Free Margin | Equity - Used Margin | This is the money you have left to open new trades. Think of it as your available firepower. |

| Margin Level | (Equity / Used Margin) x 100% | Arguably the most important health metric, this percentage shows your account's buffer against losses. A high level is good; a low one is a red flag. |

Understanding these formulas isn't just academic—it's what separates traders who manage risk from those who are managed by their risk.

A high margin level means you have plenty of breathing room to withstand market swings. A low margin level, however, signals that you are getting dangerously close to having your positions forcibly closed.

When your equity shrinks, your free margin disappears, and your margin level plummets. This is the direct path to a margin call, the final warning from your broker before they start closing your trades automatically.

The Dangers of a Falling Equity Level

When the market moves against your open positions, your unrealised losses grow, causing your equity to drop. If it falls to a certain point, it triggers two automated safety mechanisms designed to protect both you and the broker from catastrophic losses.

Margin Call: This is an alert that your margin level has fallen to a specific threshold (for example, 100%). At this point, you can’t open any new trades. You must either deposit more funds or start closing losing positions to free up margin.

Stop-Out: If your equity keeps falling and your margin level hits an even lower threshold (often 50%), the broker’s system will begin automatically closing your trades. It usually starts with the most unprofitable one to prevent your account from going into a negative balance.

This is why understanding equity forex meaning is about so much more than a simple definition; it's about active capital preservation. To truly master smart risk management and protect your equity, understanding and potentially using advanced risk assessment modeling techniques is invaluable. By actively monitoring your equity, you can take corrective action long before a margin call or stop-out becomes a real threat.

Managing Equity in the Volatile South African Market

If you're trading in South Africa, getting your head around the meaning of equity in forex is more than just learning a new term—it's a fundamental survival skill. The South African Rand (ZAR) has a well-earned reputation for being highly volatile, especially against major currencies like the US Dollar (USD) and the Euro (EUR). In simple terms, its value can swing wildly in a very short space of time.

These sudden, sharp movements have a direct and immediate effect on your open trades. A profitable USD/ZAR position that looks great one minute can see its gains vanish the next. Likewise, a losing trade can quickly get out of hand, causing your account equity to nosedive. This unpredictable environment makes careful equity management an absolute must-have in your trading strategy.

The ZAR's Impact on Your Trading Equity

What makes the Rand so twitchy? Its price is often pulled in two directions at once. It's sensitive to local economic news, like interest rate announcements from the South African Reserve Bank (SARB), but it’s also heavily influenced by global investor mood. This makes for a uniquely challenging trading environment where your account's real-time value is always under pressure.

To handle this, traders need to be on their toes:

- Watch Your Equity, Not Just Your Balance: Your equity is the true measure of your account's health, especially when news is breaking. Keep a close eye on it.

- Get Your Position Sizing Right: It’s easy to get carried away, but over-leveraging is a killer. Smaller positions are far less likely to cause a massive dent in your equity when the ZAR makes a sudden move.

- Use Stop-Losses Religiously: A well-placed stop-loss is your best line of defence. It’s what protects your equity from a trade that goes badly against you.

This isn't just good advice; it's essential. The forex market in South Africa is booming, with daily turnover now topping $20 billion USD, making it the biggest on the continent. With more everyday traders getting involved, more people are being exposed to the ZAR’s infamous volatility. This just reinforces how crucial solid equity management really is. You can dig into more data on Africa's forex market outlook to see why managing this risk is so critical.

For South African traders, equity is more than just a figure on a screen. It's a live indicator of how well you’re weathering the Rand's famous price swings. Protecting it is your number one job.

Why Local Context Is Key

Copy-pasting generic trading advice without thinking about the local market is a surefire way to lose money. A strategy that works wonders on a slow-moving pair like EUR/CHF could be a complete disaster when applied to the ZAR. Everything from your risk limits to how long you hold a trade needs to be tailored to the currency's unique personality.

Ultimately, mastering the meaning of equity in forex in the South African context means treating your equity as your business capital. It’s your lifeline. It calls for discipline and a relentless focus on preserving what you have. If you respect the ZAR's volatility and manage your equity with the care it deserves, you stand a much better chance of staying in the game long enough to succeed. It's about taking a definition and turning it into a practical, day-to-day survival guide.

How National Economic Health Affects Your Equity

Knowing what equity means on your trading platform is one thing, but that's just a small part of the story. The actual value of your equity is constantly being pushed and pulled by much bigger forces—specifically, the economic health of South Africa itself.

Think of the national economy as the ocean you're sailing on. You can't control the tides or the weather, but understanding the forecast helps you navigate the storms and protect your ship.

A country's economic stability has a direct, powerful impact on its currency's strength and volatility. For any South African trader, one of the most important numbers to watch is the nation's gross foreign exchange reserves. These reserves are like a national savings account, a rainy-day fund of foreign currency and gold that the South African Reserve Bank (SARB) can use to steady the Rand when global markets get choppy.

When our reserves are strong and growing, it sends a clear signal to the world: South Africa can pay its bills and defend the ZAR against speculators. This confidence helps calm the markets, reducing wild swings and creating a more predictable trading environment. Ultimately, it helps shield your account equity from the kind of extreme volatility that can wipe out a position in minutes.

The Role of Foreign Exchange Reserves

These reserves aren't just abstract figures on a spreadsheet; they have a very real impact on your day-to-day trading. Healthy reserves often translate into better trading conditions, like tighter spreads and fewer sudden price gaps. This makes it much easier to manage your risk and, most importantly, protect your equity.

Recently, South Africa's forex reserves hit a record high of around $68.415 billion USD. This massive figure is a mix of foreign currency, gold, and what are known as Special Drawing Rights (SDRs). A number like that boosts the country's financial credibility and its ability to absorb external shocks. For you, the trader, that means a more stable Rand and a less chaotic market to navigate. If you're interested, you can dig deeper into the data on South Africa's foreign exchange reserves to track how these numbers change over time.

By understanding these macroeconomic factors, you gain a strategic edge. You can better anticipate periods of high risk, adjust your position sizing accordingly, and make more informed decisions to protect your trading equity from forces beyond the charts.

At the end of the day, you can't influence national economic policy. But being aware of it transforms you from a purely reactive trader into a proactive one. This knowledge gives you the bigger picture, helping you understand why the market is moving and allowing you to manage your equity with far more skill and foresight.

Strategic Trade Timing for Equity Protection

Great equity management goes beyond just watching your open trades. It's a proactive strategy that hinges on knowing *when* to trade and, just as importantly, when to sit on your hands. Smart timing is your best defence against the kind of sudden, gut-wrenching losses that can wipe out your hard-earned capital in an instant.For traders in South Africa, certain times of the day are just plain risky. Getting a handle on these high-risk windows is a massive step towards protecting your equity.

Identifying High-Risk Trading Periods

One of the most dangerous times to hold a position is when the market is thin—what we call low liquidity. This typically happens when the major market sessions are closed, meaning there are fewer buyers and sellers to absorb large orders. The result? Wider spreads and choppy, unpredictable price movements.

A classic high-risk period for local traders is the lull between the New York session close and the Tokyo session open. Trading patterns in South Africa show this specific window, from about 4 pm to 1 am local time, can be particularly treacherous. Low liquidity can lead to sudden price spikes that can knock you out of a trade unexpectedly. You can explore more about South African forex market hours to get a better feel for these periods.

You also need to be extremely wary of major economic news releases. I'm talking about events like interest rate decisions from the South African Reserve Bank (SARB) or the US Federal Reserve. These announcements can trigger violent swings in the market. Trading around them without a solid plan is like sailing directly into a hurricane.

Smart traders don’t try to predict the news; they manage their exposure around it. If a high-impact event is on the calendar, reducing your position size or simply staying on the sidelines is a powerful way to protect your equity.

Ultimately, the deepest equity forex meaning is about capital preservation. Protecting what you have is always goal number one.

By strategically timing your trades and steering clear of these predictable danger zones, you start to stack the odds in your favour. It’s all about making deliberate, informed decisions instead of just reacting to market chaos. This kind of discipline is what keeps your equity safe, giving you the staying power to trade another day.

Got Questions About Forex Equity? We've Got Answers

Let's tackle a few common questions that pop up when traders are getting to grips with equity. It's a crucial concept, so it's worth making sure these points are crystal clear.

Can My Forex Equity Actually Be Higher Than My Balance?

Yes, it absolutely can. Think of it as a good sign—it means your open trades are currently in the green.

For instance, say you start with a balance of R10,000. If you open a few trades that are now showing a combined unrealised profit of R1,500, your equity will shoot up to R11,500. Your balance only changes once you lock in those profits by closing the trades, but your equity gives you that real-time snapshot of your account's total value.

What Happens if My Equity Dips Below My Used Margin?

This is where things get serious. If your equity falls below the margin you've used to open your positions, your margin level drops under 100%, and alarm bells should be ringing.

Your broker will issue a 'margin call'. This isn't just a friendly heads-up; it’s a critical warning that your account doesn't have enough funds to support your open trades. You won't be able to open any new positions, and if your trades continue to lose value, the broker will start to automatically close them out (a 'stop-out') to protect both you and them from further losses.

It’s a safety net, but one you never want to have to use. Keeping a close eye on your equity is the key to avoiding it.

Does Leverage Have a Direct Effect on My Equity?

Not on the calculation itself, but it hugely magnifies the swings in your equity. The formula for equity—your balance plus or minus your floating profits/losses—doesn't change.

The catch is that higher leverage lets you control much larger positions. This means even a tiny price movement against you can create a massive unrealised loss, causing your equity to plummet dramatically. So, while the equity forex meaning stays the same, using high leverage is like turning up the volume on your account's volatility. It amplifies everything, for better or for worse.

Are unpredictable exchange rates and hidden fees eroding your business profits? Zaro offers South African businesses a transparent solution for international payments. Send and receive funds globally at the real exchange rate with zero spread and no SWIFT fees. Take control of your cross-border finance by visiting https://www.usezaro.com.