When you're trading forex, the single most important number to watch isn't your balance—it's your equity. Think of equity as the live, real-time value of your entire trading account. It's your starting balance, plus or minus the running profit or loss from every single one of your open trades.

This figure tells you exactly where you stand financially, right now, at this very moment.

Getting to Grips with Your Account’s True Value

It’s helpful to think of your forex equity as a live "health monitor" for your account. It's a far more dynamic and useful number than your account balance. Your balance only changes when you deposit funds or close a trade, locking in a profit or loss. Equity, on the other hand, is constantly on the move, shifting with every single tick of the market. It gives you an immediate, up-to-the-second snapshot of your trading performance.

Let's break it down with a simple analogy. Imagine your trading account is a boat about to head out on the water.

- Your Balance is the value of everything on the boat before it leaves the dock. It’s a fixed number, a starting point.

- Your Equity is the true value of that boat once it’s out on the open ocean. It rises and falls with every wave (market movement), showing you what your account is actually worth in that moment.

The Simple Formula for Equity

Calculating equity is refreshingly simple, but it’s a formula every trader needs to have burned into their memory. It’s your static account balance combined with the ever-changing profit or loss from your live trades.

Equity = Account Balance + Unrealised Profit/Loss

This is why equity is the cornerstone of risk management. If you have open trades that are doing well, your equity will be higher than your balance. But if those trades are in the red, your equity will dip below your balance.

This is the number your broker is watching. Your equity determines how much margin you have available to open new trades and, crucially, whether you're getting dangerously close to a margin call. If you only ever look at your balance, you're sailing through a storm while staring at a picture of the calm harbour you left behind. Keeping a close eye on your equity is what will keep you afloat and help you make sharp, informed decisions in the fast-moving world of forex.

The Critical Difference Between Equity and Balance

It's a classic rookie mistake: confusing your account balance with your equity. They might look similar at a glance, but they tell you two completely different stories about your trading account's health. Getting this right isn't just a technicality; it's the foundation of smart account management.

Think of your account balance as a snapshot in time. It's like a printed bank statement from the end of last month – it was accurate then, but it doesn't reflect what's happening right now. This number only budges when you make a deposit or when you close a trade, locking in a profit or loss.

Account equity, on the other hand, is your live, up-to-the-second reality. It's the true current value of your account, factoring in all your open trades. If your balance is the history book, your equity is the breaking news ticker, constantly updating with every market tick.

A Tale of Two Numbers

So, why does this matter so much? Your balance shows you the results of your past decisions (your closed trades), but your equity shows you the potential outcome if you were to close everything at this exact moment. Leaning on your balance alone can give you a dangerously false sense of security or a skewed view of your actual risk exposure.

Equity is the most honest number on your trading platform. It doesn't sugar-coat anything. It tells you precisely what your account is worth right now, warts and all.

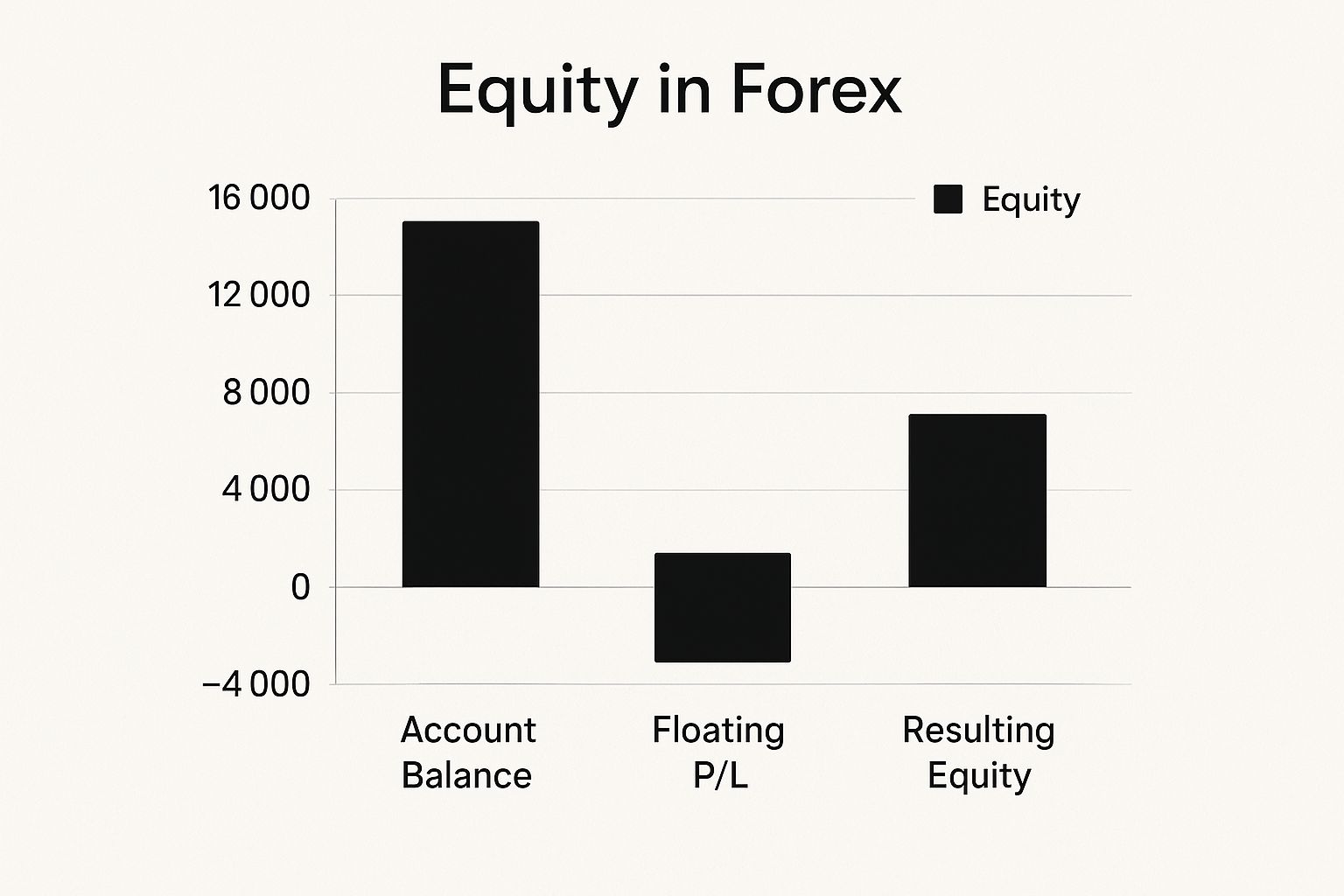

This simple diagram shows you how it all fits together. Your starting balance, plus or minus the floating profit or loss from your open trades, gives you your real-time equity.

As you can see, your equity can swing above or below your balance. It all depends on how your active positions are performing in the live market.

Equity vs Balance: A Quick Comparison

To really nail down the distinction, let's put them side-by-side. This table breaks down the core differences and should make it crystal clear why experienced traders live and die by their equity figure, not their balance.

| Attribute | Account Balance | Account Equity |

|---|---|---|

| Nature | Static. It only changes when trades are closed or funds are moved. | Dynamic. It fluctuates constantly with market movements while trades are open. |

| Calculation | The total of all closed trades, deposits, and withdrawals. | Balance + Total Floating (Unrealised) Profits and Losses. |

| Purpose | Shows your account's value based on past, completed actions. | Reflects the live, current cash-out value of your entire account. |

| Risk Indicator | A poor indicator of your current risk exposure. | The primary indicator for margin levels and potential margin calls. |

Ultimately, while your balance tells you where you've been, your equity tells you where you are right now. For any active trader, that's the number that truly matters for managing risk and making sound decisions in the heat of the moment.

How Equity, Margin, and Leverage Work Together

Getting your head around the basic meaning of equity is one thing. The real lightbulb moment happens when you see how it works hand-in-glove with two other massive concepts in trading: margin and leverage. These three don't exist in a vacuum; they're a dynamic trio that dictates everything from the trades you can open to how you manage your risk.

Think of margin as a good-faith deposit your broker asks for to open a position. It's not a fee they take; it's a slice of your own money that gets set aside to cover any potential losses. This deposit is their assurance that you have some skin in the game.

The total amount of this "deposit" tied up across all your open trades is called your Used Margin. That cash is locked in for now, but it’s still very much yours.

The Role of Equity in Free Margin

This is where the difference between balance and equity becomes absolutely crucial. Your power to open new trades doesn't come from your starting balance. It comes from your Free Margin, and your free margin is calculated directly from your equity.

The formula is incredibly simple, but it changes everything:

Free Margin = Equity – Used Margin

If your trades are in the green, your equity climbs, and so does your free margin. This gives you more firepower to open new positions or to simply ride out any market bumps. But when your trades are losing, your equity falls, and your free margin shrinks right along with it.

This is exactly why tunnel-vision on your balance is such a common mistake. A trader might have a R100,000 balance, but if they're sitting on R20,000 in floating losses, their equity is only R80,000. Their real capacity to trade and absorb further hits is based on that R80,000 number, not the R100,000 they started with.

Leverage: The Great Amplifier

Leverage is the tool that lets you control a huge market position with a relatively small amount of your own capital. For example, with 100:1 leverage, you can control a R100,000 position using just R1,000 from your account as margin. It’s a powerful amplifier for both your potential gains and, crucially, your potential losses.

Let's tie it all together with a practical view:

- Leverage is what lets you punch above your weight and open a large trade.

- Margin is the deposit you have to put down to access that leverage.

- Equity is the live, fluctuating value of your account that dictates how much Free Margin you have left to play with.

This relationship is the heart of risk management in forex. Leverage magnifies every single pip movement's effect on your equity. A small price shift in your favour can create a fantastic jump in your equity. On the flip side, a tiny move against you can cause a proportionally massive drop, chewing through your free margin at an alarming rate.

If your open trades lose enough value that your equity falls to the point where there's no free margin left, you’ll get a margin call. This is your broker's warning shot, telling you that your account is on thin ice and can't support your positions. If your equity keeps dropping, they will start automatically closing your trades—usually the biggest loser first—to stop the bleeding. Understanding this interplay isn't just theory; it's the key to survival.

Calculating Forex Equity with Practical Examples

Theory is one thing, but seeing how equity behaves in the heat of the moment is what really makes the concept click. So, let's move away from textbook definitions and dive into some practical, real-world examples. This will show you exactly how the equity meaning in forex plays out with every tick of the market.

Think of these calculations as what's happening behind the scenes in your trading account, second by second. For each scenario, we’ll look at the same key pieces of the puzzle:

- Initial Account Balance: The cash you started with before opening any trades.

- Trade Details: What you bought or sold, and at what price.

- Market Movement: How the price has shifted since you entered.

- Equity Calculation: The simple maths that reveals your account’s current value.

Example 1: The Winning EUR/USD Trade

Let's kick things off with a positive scenario. Imagine you think the Euro is about to climb against the US Dollar, so you decide to go long (buy) on the EUR/USD pair.

- Initial Account Balance: R20,000

- Trade Details: You buy 1 mini lot (10,000 units) of EUR/USD at 1.0750.

- Market Movement: The market moves in your favour, and the price rises to 1.0800.

First, we need to figure out your floating profit. The price moved 50 pips in your direction (1.0800 - 1.0750). On a mini lot, each pip is worth about $1, giving you a running profit of $50. Converting that back to our local currency at an exchange rate of, say, R18.50/USD, you're looking at a profit of R925.

Equity Calculation:

R20,000 (Balance) + R925 (Unrealised Profit) = R20,925 (Equity)Your equity is now higher than your balance. That’s because your open trade is in the green, and your account's real-time value reflects that potential gain.

Example 2: The Losing USD/ZAR Trade

Now for the other side of the coin—a trade that goes against you. We'll use a pair every South African trader is familiar with: the volatile USD/ZAR. This pair can offer big opportunities, but it also carries significant risk. The Rand's unpredictable swings, which saw an all-time high of 19.93 against the dollar in one recent year, can dramatically affect your equity in minutes. You can dig deeper into the Rand's historical performance over at Trading Economics.

- Initial Account Balance: R20,000

- Trade Details: You sell 1 mini lot (10,000 units) of USD/ZAR at 18.6500, betting on the Rand to strengthen.

- Market Movement: Unfortunately, the market turns, and the USD/ZAR price climbs to 18.7500.

The position has moved against you by 1000 pips (18.7500 - 18.6500). For a USD/ZAR mini lot, each pip is worth around R1. This means you're currently sitting on an unrealised loss of R1,000.

- Equity Calculation:

- R20,000 (Balance) - R1,000 (Unrealised Loss) = R19,000 (Equity)

- Notice how your equity has dropped below your balance. This is the market telling you the current liquidation value of your account is less than what you started with.

Example 3: Multiple Open Positions

Finally, let's look at a more realistic scenario where you're juggling a few trades at once—some winning, some losing. This is where tracking your equity becomes absolutely essential.

- Initial Account Balance: R50,000

- Trade 1 (Winning): A buy on GBP/USD that's showing a floating profit of +R3,500.

- Trade 2 (Losing): A sell on USD/JPY with a floating loss of -R1,200.

- Trade 3 (Losing): Another sell on EUR/AUD that's down by -R800.

To find your equity, you just need to tally up all the running profits and losses and apply them to your balance. It’s a simple sum.

- Total Unrealised P/L: +R3,500 - R1,200 - R800 = +R1,500

- Equity Calculation:

- R50,000 (Balance) + R1,500 (Net Unrealised Profit) = R51,500 (Equity)

Even with two trades in the red, your one strong winner is enough to keep your overall equity above your starting balance. This perfectly illustrates why equity is so crucial—it gives you a live, holistic snapshot of your entire account's health, not just the status of a single trade.

Using Equity for Smarter Risk Management

Any seasoned trader will tell you that while your account balance shows where you've been, your equity tells you where you're going. It's more than just a number on your screen; equity is arguably the most important tool you have for managing risk. Think of it like the fuel gauge in your car—it gives you a live, real-time reading of how much further you can safely go before you run the risk of stalling out completely.

Keeping a close eye on your equity acts as an invaluable early warning system. Long before your broker issues a dreaded margin call, a steady drop in your equity is the flashing red light on your dashboard. This lets you be proactive rather than reactive, buying you precious time to reassess your open trades and tweak your strategy before things get critical.

Equity as Your Trading Compass

Your equity figure should be the north star that guides all your major trading decisions. It's the metric that tells you when to push your advantage and, more importantly, when to pull back and play defence. By making equity the centrepiece of your risk analysis, you naturally develop a more disciplined and objective trading style.

Here are a few practical ways to let your equity guide you:

Cutting Losses Intelligently: When a trade moves against you, your equity takes an immediate hit. A solid rule might be to close any losing position if your total account equity drops by a set percentage, say 2%, in a single day. No exceptions, no second-guessing.

Securing Partial Profits: On the flip side, if a trade is performing well and your equity has jumped, consider closing a part of that position. This locks in some of the profit, boosts your real balance, and shields your equity from a sudden market reversal.

Avoiding New Risks: During a period of high volatility, you might see your equity swinging dramatically, even if your trades are technically in profit. That instability is a clear signal to hold off on opening new positions. Preserve your capital and wait for the market to settle down.

The Psychological Edge of Watching Equity

Focusing on your equity also offers a powerful mental advantage. Traders who obsess over the fluctuating profit and loss of a single trade are essentially signing up for an emotional rollercoaster. In contrast, those who keep their focus on the total equity of their account tend to stay far more detached, calm, and strategic.

This broader view helps build serious discipline. It shifts your mindset away from gambling on individual trades and towards professionally managing a portfolio of positions.

By managing the health of your total equity, you shift from gambling on individual trades to managing a portfolio of positions. This mindset is the hallmark of a professional trader.

Ultimately, this approach ensures you're making decisions based on the overall health of your account, not the emotional pull of one big win or a painful loss. More advanced traders even take this a step further, using tools like a Monte Carlo simulation to model how different market shocks could affect their equity, adding another layer of sophisticated risk management.

Your equity is your true bottom line. Protect it, manage it, and let it guide you toward more consistent, sustainable trading.

How Major Market Events Can Wreak Havoc on Your Equity

Your trading account isn't isolated from the real world; it's plugged directly into the chaos of global economics. Big news events—think interest rate announcements from the South African Reserve Bank or unexpected political headlines—can send currencies into a frenzy. This sudden volatility can make your equity skyrocket or, more often than not, nosedive in a flash.

Grasping this link is non-negotiable. A surprise announcement can whip the market against you, eating into your equity and vaporising your free margin before you can even react. This is precisely why a "set and forget" approach is so dangerous. The true equity meaning in forex hits home when you witness firsthand how fragile it is in the face of breaking news.

Economic Stability as a Buffer

A country’s overall economic health is a massive factor in how well its currency weathers these storms. Think of a nation's foreign exchange reserves as a financial shock absorber. When a central bank has a hefty reserve, it can step in to stabilise its currency during wild market swings, which provides a bit of a safety net for traders.

This is especially relevant for anyone trading in South Africa. The nation’s foreign exchange reserves, crucial for keeping the rand stable, recently hit a record high of around $68.415 billion. Having this large buffer gives the South African Reserve Bank more firepower to manage volatility and defend the rand's value. In turn, this can help smooth out some of the more violent equity swings for local forex traders. For a deeper dive, you can look into South Africa's foreign exchange reserves data.

How to Shield Your Equity When News Hits

You can't control the news cycle, but you absolutely can control how you prepare for it. Knowing what’s on the horizon gives you the chance to batten down the hatches before the market turns into a rollercoaster.

Here’s a simple game plan to stay safe:

- Live by the Economic Calendar: Check it every single morning. Get familiar with the release times for market-movers like Non-Farm Payrolls (NFP) or the latest inflation data.

- Lighten Your Load: It’s often smart to either close out your trades or scale back your position size right before a major news event. Trading through that kind of volatility is like gambling.

- Give Your Stop-Loss Some Room: If you must hold a trade through a news release, consider widening your stop-loss. This can prevent a sudden, wild price spike from kicking you out of a good trade prematurely.

At the end of the day, protecting your equity during market-moving events isn't about trying to guess the outcome of the news. It’s about respecting its raw power, knowing the risks, and taking sensible steps to shield your capital from the storm.

A Few Common Questions About Forex Equity

Now that we’ve unpacked the meaning of equity in forex, let’s tackle some of the questions that pop up most often. Getting these sorted will really cement your understanding and show you how equity plays out in the real world of trading.

Can Your Equity Be Higher Than Your Balance?

Yes, it absolutely can. This is actually the goal!

This happens the moment your open trades are in profit. All those unrealised gains get added to your starting balance, and voilà, your equity is now higher than your balance. Seeing your equity climb above your balance is the clearest sign that your trading strategy is working.

What Is Negative Equity in Forex?

This is a scenario every trader wants to avoid. Negative equity occurs when your floating losses are so severe that they not only erase your entire account balance but actually put you in debt to your broker.

Thankfully, it's quite rare. It usually takes a massive, unexpected market event, like a huge price gap over a weekend, to cause this. To safeguard traders, most reputable brokers now offer negative balance protection, which ensures you can't lose more than the money you deposited.

How Often Should I Check My Account Equity?

If you have trades open, you need to have one eye on your equity. Think of it as the live pulse of your trading account—it’s the most accurate, up-to-the-minute indicator of your financial standing.

How often you check depends on your trading style. A day trader might be glancing at it constantly throughout the day. A swing trader, on the other hand, might just check in a few times a day as part of their regular market analysis. The key is to never lose track of it while your capital is at risk.