For any South African business dealing with international suppliers or clients, the question isn't just "how do we make money on foreign exchange?" It's often "how do we stop losing so much of it?"

The answer, it turns out, is to sidestep the hidden costs that are baked into traditional banking. By moving away from the usual bank channels to a fintech platform offering zero spread and no SWIFT fees, you can claw back those hidden expenses and turn them into profit on every single international deal.

Unpacking the Hidden Costs in Foreign Exchange

Ever made or received an international payment through your bank, only to find the final amount is less than you budgeted for? That's not a miscalculation on your part. It’s the result of an old, opaque system where hidden costs chip away at your margins. The biggest culprit? The bank’s exchange rate spread.

The Problem with the Bank Spread

The 'spread' is simply the gap between the real mid-market exchange rate (the one you see on Google) and the less-than-ideal rate your bank gives you. This markup is how banks make their money on FX, and it’s almost never broken down on your statements.

Let's say the real ZAR/USD rate is R18.50. Your bank might offer to sell you dollars at R18.80 or buy your incoming dollars at R18.20. That R0.30 difference on either side of the transaction is pure profit for them and a direct loss for your business. On a $50,000 transaction, that tiny-looking spread just cost you R15,000.

The Reality Check: The bank spread isn't an optional fee; it's a built-in cost that quietly devalues every rand you convert. Across a year, these hidden costs can easily add up to tens or even hundreds of thousands of rands in lost profit.

The Double-Whammy: SWIFT and Correspondent Fees

On top of the spread, there's the SWIFT network – the old-school system banks use to send money across borders. This process often involves several "correspondent" banks along the way, and each one can take a slice of your money for simply handling the transaction.

These fees are frustratingly unpredictable and can include:

- Sending Bank Fees: The flat fee your own bank charges just to start the transfer.

- Intermediary Bank Fees: Charges skimmed off by one or more banks in the payment chain.

- Receiving Bank Fees: A final fee charged by the beneficiary's bank to process the payment.

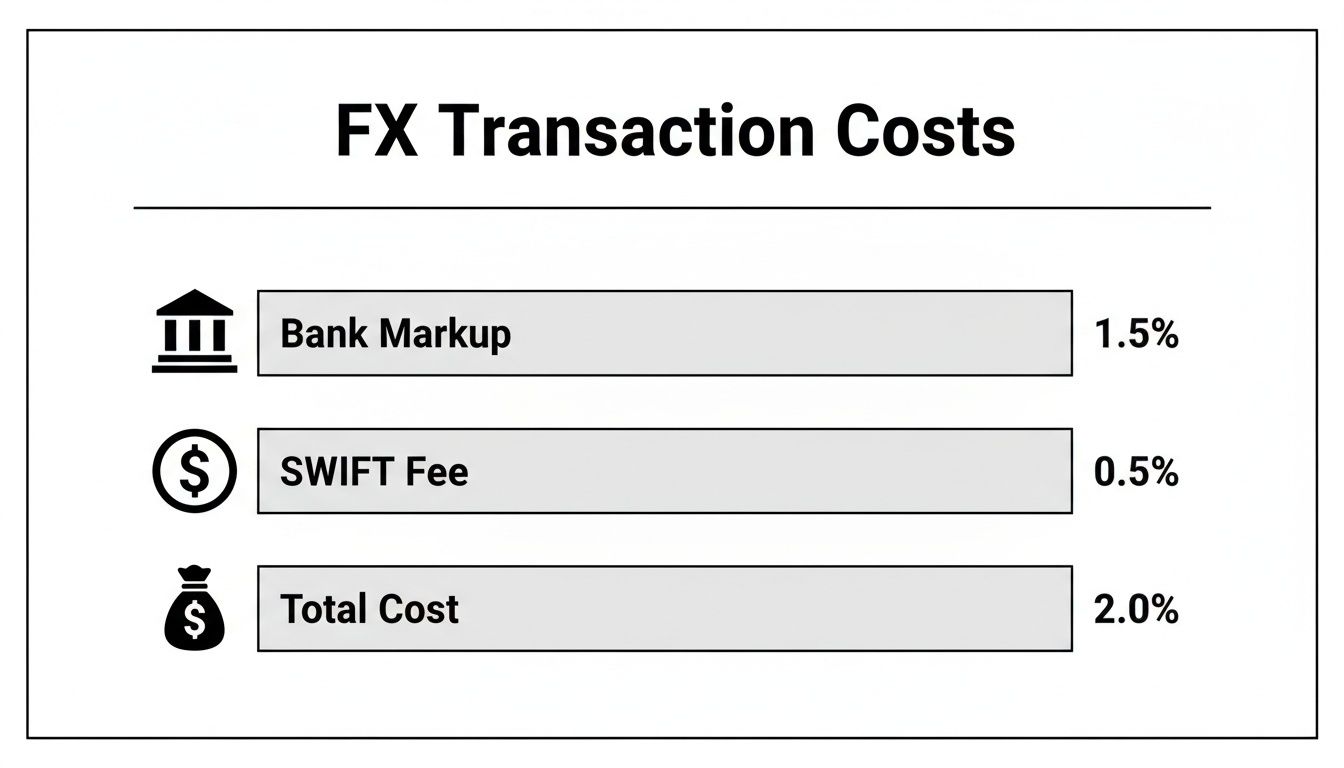

This chart breaks down where your money actually goes in a standard international bank transfer.

As you can see, the bank’s markup often dwarfs the explicit SWIFT fees, making it the single biggest cost you're paying.

Cost Comparison Traditional Bank FX vs A Zero-Spread Platform

To put this into perspective, here’s a real-world scenario showing the cost difference for a South African SME converting R1,000,000 to USD to pay an international supplier.

| Cost Component | Typical Bank Transaction | Zero-Spread Transaction |

|---|---|---|

| Amount to Convert | R1,000,000 | R1,000,000 |

| Mid-Market Rate | 18.50 ZAR/USD | 18.50 ZAR/USD |

| Bank's Quoted Rate (1.5% Spread) | 18.78 ZAR/USD | 18.50 ZAR/USD (No Spread) |

| USD Received by Supplier | $53,248.14 | $54,054.05 |

| Hidden Spread Cost | R15,000 | R0 |

| SWIFT & Other Fees | ~R750 | R0 |

| Total FX Cost | ~R15,750 | R0 (Platform fee may apply) |

The difference is stark. By simply avoiding the spread and transfer fees, the business gets an extra $805.91 to their supplier, which translates to a direct saving of over R15,000 on just one payment.

The South African FX Opportunity

This environment of high hidden costs exists right alongside a booming local market. South Africa's foreign exchange market hit USD 3,861.60 million in 2024 and is expected to grow significantly by 2033, fuelled by strong regional trade.

This growing volume means there's more opportunity than ever for businesses to get better rates and faster service – but only if you step away from the outdated banking model. Keeping an eye on trends in the global Digital Payments Market is crucial for anyone looking to make smarter FX decisions.

The solution is to bypass this expensive system entirely. A modern fintech platform gives you direct access to the real exchange rate with zero spread and no SWIFT fees. Instead of losing money to markups you can't see, you pay a simple, transparent fee. This isn't just about saving money; it’s about gaining control and turning your FX operations from a cost centre into a real strategic advantage.

Turn International Invoicing Into a Profit Centre

For most South African businesses that sell overseas, invoicing feels like a routine chore. You send the invoice, you get paid. Simple. But what if you could flip that thinking on its head and turn this everyday admin task into a genuine profit generator?

The whole game changes the moment you take control of the currency you invoice in. When you bill your international clients in South African Rand (ZAR), you're essentially handing them all the power—and all the risk. You’re letting the whims of their local market dictate your bottom line, and you’re leaving serious money on the table.

Why You Should Invoice in a Hard Currency

Here's the most powerful move you can make: start invoicing your international clients in a stable, globally recognised currency like the US Dollar (USD). It’s a simple switch, but it immediately puts a shield around your revenue, protecting it from the infamous volatility of the Rand.

Think about it. There’s often a long gap between when you issue an invoice and when the cash actually lands—30, 60, even 90 days. In that time, the ZAR can swing wildly. If the Rand strengthens against the dollar while you're waiting for payment, the ZAR value of your invoice shrinks. By invoicing in USD, you lock in that foreign currency amount. What you billed is what you get.

This one change gives you two massive financial advantages:

- Protection from Volatility: You completely sidestep the risk of the Rand strengthening before you get paid, which would have eaten into your ZAR revenue.

- Strategic Conversion Opportunity: It puts you in the driver’s seat. You get to decide when to convert your USD earnings back into ZAR, allowing you to pounce on favourable rate movements.

Holding Foreign Currency to Maximise Returns

The next logical step is to hold those incoming payments in a USD-denominated account. Forget letting your bank automatically convert the money into Rands at whatever rate they feel like giving you that day (after taking their cut, of course). Keeping the funds in dollars is a game-changer.

With a platform like Zaro, you can set up a USD account just for this. When your client pays your $10,000 invoice, the full amount sits safely in your account, untouched and waiting for your instruction. This single move transforms your finance team from passive observers into active currency managers.

By holding foreign currency, you shift from being a passive recipient of whatever rate the bank offers to an active manager of your company's international revenue. You decide the timing, you control the outcome.

Now, you have the flexibility to watch the market. You can keep an eye on exchange rate trends and wait for moments when the Rand is weaker against the dollar. Converting your USD to ZAR at R18.90 instead of R18.40 might sound like a small difference, but it directly boosts your local currency revenue. On that same $10,000 payment, that bit of patience could easily mean an extra R5,000 in your pocket.

A Practical Example of Timed Repatriation

Let's walk through a real-world scenario. Imagine a South African software development agency that has a client in the United States.

- The Invoice: On May 1st, the agency bills its US client $25,000 for a project, with 60-day payment terms.

- The Payment: As agreed, the client pays up on June 28th. The funds land in the agency's USD account, managed through their fintech platform.

- The Waiting Game: On that day, the ZAR/USD exchange rate is R18.35. An immediate conversion looks tempting, but the finance manager suspects the Rand might weaken soon due to upcoming economic news. They make the call to hold the $25,000 in dollars.

- The Strategic Conversion: Just two weeks later, their hunch pays off. The Rand weakens to R18.85 against the dollar. The finance manager sees their chance and converts the full amount.

Now, let's look at the numbers. The difference is stark:

- Immediate Conversion: $25,000 x 18.35 = R458,750

- Strategic Conversion: $25,000 x 18.85 = R471,250

By actively managing the timing, the agency just made an extra R12,500 in pure profit from a single invoice. This isn't risky speculation; it's smart financial management that turns a standard business process into a powerful tactical advantage.

Use Hedging to Protect Your Profit Margins

Volatility is the silent partner in every international deal. For any South African business, the Rand's frequent swings can turn a profitable sale into a loss in the time it takes for an invoice to get paid. This is where mastering foreign exchange shifts from an offensive tactic to a defensive one—it’s all about protecting the profits you’ve already worked hard to earn.

A lot of smaller businesses write off hedging as some complex financial tool reserved for massive corporations. Honestly, it's a straightforward and essential practice for any company with cross-border payments. The core idea is incredibly simple: you lock in an exchange rate for a future date, taking all the guesswork and uncertainty out of the equation.

This isn't about trying to speculate or outsmart the currency markets. It's about eliminating risk. By fixing your rate, you guarantee the ZAR value of a future payment or receipt, which means you can budget accurately and keep your profit margins secure.

Demystifying the Forward Contract

The most common and accessible hedging tool for SMEs is the forward exchange contract (FEC). Think of it as a simple agreement to buy or sell a specific amount of foreign currency on a set future date, but at a price you agree on today.

Let's walk through a real-world scenario. Imagine your business imports specialised equipment from the United States. You've just received an invoice for $50,000, which is due in three months. Right now, the exchange rate is R18.50/USD, so your total cost in Rand is R925,000. But what happens if the Rand weakens to R19.20 by the time you have to pay?

Without a hedge, your cost would suddenly jump to R960,000. That’s an instant R35,000 sliced right out of your profit. By using a forward contract, however, you could lock in that R18.50 rate today. No matter what the market does over the next 90 days, your cost is fixed at R925,000. You've just ring-fenced your margin.

Hedging provides budget certainty. It transforms an unpredictable future cost into a known, manageable expense, allowing your business to plan with confidence.

When Hedging Makes Sense for Your Business

While hedging every single small transaction might be overkill, it becomes absolutely critical in certain situations. Your finance team should seriously consider it when you're dealing with:

- Large Invoices: For any significant payment or receipt where even a small rate fluctuation could have a major financial impact.

- Long Payment Cycles: The longer the gap between invoicing and payment (say, 60-120 days), the more exposed you are to currency risk.

- Thin Profit Margins: If your margins are already tight, you simply can't afford to lose a few percentage points to a bad day on the currency markets.

- Project-Based Work: For projects with fixed budgets and long timelines, locking in the FX costs for imported materials or services is non-negotiable.

Navigating the South African FX Landscape

Thankfully, managing this risk is backed by a stable national financial environment. The South African Reserve Bank (SARB) has been strategic about building up the nation's foreign exchange reserves, which shows a strong capacity to manage currency volatility. The SARB’s focus on clear regulations has also helped spur a shift towards modern electronic trading platforms, which in turn helps lower transaction costs for businesses of all sizes. You can learn more about the role of reserves in the South African economy here.

This stability provides a reliable backdrop for your business to implement hedging strategies. And by working with a modern fintech provider like Zaro, you can easily set up forward contracts without the high fees and tedious paperwork that usually come with traditional banks.

On a platform like this, you can see the forward rate, book the contract in just a few clicks, and get complete visibility over your future currency commitments. This approach turns hedging from an intimidating financial instrument into what it should be: a standard, smart business practice. It’s a crucial defensive play that ensures the money you make on paper is the money that actually lands in your bank account.

Make Smarter FX Decisions with Economic Trends

Just reacting to the daily exchange rate is a surefire way to leave money on the table. If you want to really get a handle on foreign exchange and make it work for your business, you need to look past the numbers and understand the bigger economic forces making them move.

Connecting the dots between economic news and your company’s bottom line is a powerful skill. It allows your finance team to shift from a reactive, and often defensive, stance to a proactive one. You start timing transactions to your advantage, rather than just getting caught out by bad news.

This isn't about trying to become a day trader. It's about getting to grips with the core drivers of the ZAR/USD exchange rate so you can make informed, strategic decisions that protect your margins.

Key Economic Indicators to Watch

Certain economic announcements have a direct, and often immediate, impact on a currency's strength. For your business, this translates into real opportunities. Even just keeping a simple calendar of these key data releases can give you a significant edge.

Here’s what you should be keeping an eye on:

- SARB Interest Rate Decisions: When the South African Reserve Bank (SARB) hikes interest rates, it tends to attract foreign investment, which strengthens the Rand. This is often the perfect time to pay your international suppliers, as your Rands will stretch further and buy more dollars.

- Inflation Data (CPI): Higher-than-expected inflation can signal that the SARB might raise interest rates in the near future, which can also give the ZAR a temporary boost. On the flip side, runaway inflation can spook investors and weaken the currency.

- GDP Growth Figures: A strong Gross Domestic Product (GDP) figure points to a healthy, growing economy. This positive sentiment typically strengthens the Rand, making it a less-than-ideal moment to bring your USD earnings home, but a great time for making import payments.

- Commodity Prices: As a resource-rich country, the Rand is often tied to the prices of key commodities like gold, platinum, and coal. A rally in these prices can often lead to a stronger Rand.

By translating complex economic data into practical timing for your FX transactions, you can make the market work for you. A stronger Rand is your signal to pay foreign bills; a weaker Rand is your cue to bring export revenue home.

Translating News into Action

Let's walk through a practical example. Imagine your company is due to receive a $100,000 payment from a client in the US. You see that South Africa's latest GDP figures are due to be released next week, and the chatter among analysts is that the number will be stronger than expected.

Knowing this, you might anticipate a potential strengthening of the Rand right after the announcement. The smart move could be to hold off on converting that incoming payment until the news is out. If the Rand weakens unexpectedly instead, you haven’t really lost anything, but if it strengthens as predicted, you've just avoided cashing in your dollars at a less favourable rate.

Staying informed about how international bodies impact currency markets is also crucial. For example, when the IMF reclassified India's FX regime, it had significant knock-on effects. Understanding these global events is key to making smarter foreign exchange decisions.

Capitalising on Positive Macro Trends

The bigger picture for South Africa also provides vital context. Think back to 2025, when the Rand showed remarkable strength, hitting a three-year high. This wasn't a fluke; it was underpinned by solid macroeconomic developments: an upgraded credit rating, our exit from the Financial Action Task Force grey list, and four straight quarters of economic growth.

For your business, this kind of sustained positive momentum creates a more stable environment for planning. It means you can have more confidence when entering into longer-term contracts and making investment decisions that involve foreign currency. This knowledge transforms economic news from abstract headlines into a practical tool for your financial strategy.

Build FX Efficiency Into Your Operations

Making savvy moves on individual foreign exchange transactions is a great start, but real mastery comes from weaving efficiency directly into the fabric of your company's day-to-day operations.

This is about shifting from being reactive—scrambling for a good rate every time an invoice is due—to building a proactive system that consistently saves money and protects your profits. It demands a fundamental change in how your finance team views and manages every cross-border payment.

The first step? Stop treating FX costs as some unavoidable, mysterious expense. To manage something, you have to measure it. That means setting up clear Key Performance Indicators (KPIs) to give you a transparent view of what’s really going on with your foreign exchange. Without the data, you’re just flying blind, completely unaware of where money is leaking out of the business.

Establish Your FX Performance Metrics

You wouldn't run your sales department without tracking conversion rates or lead costs, so why manage millions in international payments without clear metrics? Putting a few core KPIs in place can instantly shine a light on hidden inefficiencies and reveal some seriously big opportunities for savings.

Your finance team needs to get a handle on the numbers. Here’s a rundown of the essential metrics you should be tracking to understand and improve your foreign exchange strategy.

| KPI | What It Measures | Why It Matters |

|---|---|---|

| Average Spread Paid | The gap between the real mid-market rate and the rate you actually get from your provider. | This is the biggest hidden cost in FX. Your goal should be 0%. Even a 1-2% spread can add up to tens of thousands of rands in lost profit over a year. |

| Total International Transfer Fees | All the explicit fees: SWIFT charges, correspondent bank fees, and any platform or administrative costs. | These are the costs you can see. Tallying them up reveals the direct price you pay just to move money, which can often be eliminated. |

| Hedged vs Unhedged Volume | The percentage of your foreign currency exposure that is protected against market volatility using hedging tools. | This shows how well you’re managing risk. A low number means you’re gambling with your profit margins every time the rand moves. |

| Time-to-Settlement | How long it takes for your payment to land in the recipient's bank account after you send it. | Faster is better. Quicker settlements improve your cash flow, strengthen supplier relationships, and reduce settlement risk. |

By keeping a close eye on these figures every month, your finance team finally gets the insights they need to make smart, data-backed decisions. It also gives them the proof they need to show the value of a structured FX strategy to the rest of the business.

A business that doesn't track its FX costs is essentially giving its bank a blank cheque. By implementing clear KPIs, you take back control and turn an unmanaged expense into a quantifiable business metric.

Once you have your KPIs, the next logical step is to centralise control. In many growing businesses, international payments are all over the place. A project manager might use their corporate card for a software subscription, while the procurement team pays a supplier through the main company bank account. This decentralised approach is a recipe for high costs and zero visibility.

Centralise Control for Complete Visibility

Bringing all international payments under a single, transparent platform is a game-changer. It gives your CFO or finance director a complete, real-time picture of every dollar, euro, or pound leaving the business. This consolidation immediately puts a stop to rogue payments made through high-cost, inefficient channels.

A platform like Zaro is designed specifically for this. By funnelling all your international transactions through one system, you gain several immediate advantages:

- Cost Control: You can enforce discipline across the entire organisation, ensuring every payment benefits from zero-spread exchange rates and no SWIFT fees.

- Cash Flow Visibility: See all your foreign currency balances and payment statuses in one place. This makes cash flow forecasting infinitely more accurate.

- Simplified Reporting: All your transactional data is centralised, making reconciliation and financial reporting much faster and less prone to errors.

And centralisation doesn’t have to mean creating bottlenecks. It’s about establishing good governance, and the right platform will let you do this without slowing anyone down.

Implement Multi-User Access and Permissions

To stay efficient while centralising control, you need to set up multi-user access with customised permissions. The goal is to empower your team to do their jobs without sacrificing financial oversight. You can create roles that perfectly mirror your operational needs.

For instance, you could configure permissions like this:

- Finance Clerk Role: Can load and prepare payments for approval, but can’t actually send any money.

- Finance Manager Role: Can approve and execute payments up to a certain threshold, say R100,000.

- CFO Role: Has full access to execute payments of any size and is the only one who can manage user permissions.

This kind of structure ensures a clear separation of duties and an approval workflow that protects the business from costly errors and unauthorised payments. It allows your team to move quickly and with autonomy, but all within a secure, controlled framework. Building these operational efficiencies transforms foreign exchange from a simple transaction into a well-managed business function that directly contributes to a healthier bottom line.

Your Top Foreign Exchange Questions, Answered

Jumping into foreign exchange can feel like learning a new language. There are new terms, new risks, and plenty of questions that come up. To get a real grip on how to make money with FX—or, more importantly, stop losing it—it helps to tackle these common queries head-on.

We’ve pulled together the top questions we hear from South African business owners and finance teams. Here are some clear, practical answers.

How Can My Small Business Start Hedging Against Currency Risk?

Getting started with hedging doesn't have to be some intimidating, complex affair. For most SMEs, the simplest and most effective first step is using a forward contract. Think of it as a tool that lets you lock in an exchange rate today for a payment you need to make or receive in the future. It’s all about creating budget certainty.

Let's say you have a USD 10,000 invoice to pay in 90 days. Instead of worrying about where the Rand will be in three months, you can use a modern FX platform to fix the rate right now. This completely sidesteps the risk of a weakening Rand, which could otherwise make that same invoice far more expensive when the time comes to pay.

The best way to start is to look at your books, identify your biggest and most regular foreign currency payments, and talk to a provider about setting up simple forward contracts for them. It’s a foundational move for protecting your profit margins.

Is It Better to Invoice My International Clients in ZAR or Their Local Currency?

For almost every South African business selling overseas, invoicing in a major "hard" currency like the US Dollar (USD) or Euro (EUR) is the smarter play. When you invoice in Rand, you're essentially handing all the currency risk over to your client. That can make your pricing feel unpredictable and less competitive from their perspective.

By invoicing in USD, you take back control. You can receive the funds into a dedicated USD account and then watch the market, choosing the best possible moment to convert it back to Rand.

Waiting for the right moment can make a real difference. If you think the Rand might weaken, you can hold onto your dollars. This simple bit of timing means you get more Rand for the same amount of dollars, turning a routine invoice into a chance to boost your revenue.

What Is the Real Exchange Rate and Why Don’t Banks Offer It?

You’ve probably seen it on Google. The "real" exchange rate, also known as the mid-market or spot rate, is the true price of a currency—the midpoint between what buyers are willing to pay and what sellers are asking for on the global market.

So, why don’t you get this rate from your bank? Because banks make their money on the "spread." They buy currency from you at a rate below the mid-market rate and sell it to you at a rate above it. That gap is their profit, and it's a hidden cost that eats into your bottom line with every single transaction. Newer fintech platforms are changing this by giving businesses direct access to the real rate, cutting out that unnecessary cost altogether.

How Do I Ensure My International Payments Are Compliant with South African Regulations?

Staying on the right side of South Africa's exchange control regulations is non-negotiable. The South African Reserve Bank (SARB) requires every single cross-border payment to be reported correctly, using the right Balance of Payments (BOP) category code.

This sounds like a lot of admin, but a good payment platform handles it for you. When you sign up, they’ll do a proper Know Your Business (KYB) check. Then, for every payment you make, the system simply asks you to select the reason for the transaction from a list. That's it. The platform automatically generates the report and submits it to the SARB on your behalf, keeping you fully compliant without the headache.

Ready to stop losing money on hidden fees and take control of your international payments? Zaro gives you access to the real exchange rate with zero spread and no SWIFT fees. Open your account today and see how much you can save. Learn more at https://www.usezaro.com.