At its core, foreign exchange in South Africa is the mechanism for swapping the Rand (ZAR) for other global currencies, like the US Dollar or Euro. For any business involved in importing or exporting, this isn't just a financial activity; it's the lifeblood of their operations. This constant trading sets the ZAR's value on any given day, which in turn affects everything from the price tag on imported electronics to the final profit margin of a local wine exporter.

The entire system is overseen by the South African Reserve Bank (SARB), which writes the rulebook for these international transactions, ensuring stability and order.

Understanding the South African Foreign Exchange Market

Imagine the foreign exchange (FX) market as a massive, dynamic global auction. Instead of art or collectables, the items up for bid are currencies. The South African Rand is one of the many currencies on the block, and its "price"—the exchange rate—is in constant flux, driven by how many people want to buy it (demand) versus how many want to sell it (supply).

For any South African business with international ambitions, participating in this market isn’t optional. It's a fundamental requirement of global trade. If a local manufacturer needs to purchase machinery from Germany, they have to sell Rands to acquire Euros. On the flip side, when a fruit farmer sells their harvest to a customer in the United States, they receive US Dollars that need to be converted back into Rands to cover local costs like wages and operational expenses.

The Key Players in the Market

The FX market isn't a single, monolithic entity. It’s better understood as an interconnected network of different players, each with a specific role. Getting to know who these participants are is the first step in demystifying how foreign exchange in South Africa really works.

The main participants you'll encounter are:

- The South African Reserve Bank (SARB): Think of the SARB as the referee and rule-maker. As the central bank, its main job is to maintain financial stability and manage the country's foreign reserves. It doesn’t trade for profit but will step in to influence the market and implement monetary policy.

- Commercial Banks: For most businesses and individuals, these are the frontline players. They act as the primary gateways, buying and selling foreign currency for their clients (and for their own books), facilitating the bulk of international payments.

- Businesses and Corporations: These are the real engines of the FX market. South African exporters are continuously selling the foreign currency they earn, while importers are always in the market to buy it. A large mining company exporting platinum, for example, becomes a major seller of US Dollars in the local market.

- Investors and Individuals: This diverse group ranges from large institutional investors shifting capital across borders to individuals sending money home to family or making personal offshore investments.

The sheer scale of this activity is staggering. South Africa’s reliance on FX is clear when you look at its trade in intermediate goods (the raw or semi-processed materials that fuel industry). In 2022, the trade surplus in just these goods hit $32 billion, representing a colossal volume of international payments that all required currency conversion.

It's this constant ebb and flow of money between all these players—driven by trade, investment, and policy—that creates the living, breathing market for foreign exchange in South Africa. Every single transaction, big or small, adds to the tide of supply and demand that ultimately decides the value of the Rand on any given day.

What Drives the ZAR Exchange Rate

The value of the South African Rand is rarely static. It shifts daily, sometimes minute by minute, reacting to a complex dance of local and global pressures. For any business involved in foreign exchange in South Africa, getting a handle on these drivers is non-negotiable—they directly shape your profitability and financial plans.

Picture the ZAR’s exchange rate against a major currency like the US Dollar as a seesaw. A whole host of economic and political factors act like weights, constantly being added or taken off either side, causing the Rand to rise or fall. A single headline about a new trade deal or a sudden shift in investor mood can instantly tilt the balance.

For businesses, these movements aren't just abstract numbers. A weaker Rand makes imported goods more expensive, squeezing margins for anyone bringing products into the country. On the flip side, it can be a massive advantage for exporters, who suddenly find themselves getting more Rands for the same amount of foreign currency earned.

Local Economic Indicators

Some of the biggest nudges on the ZAR's side of the seesaw come from right here at home. These are the vital signs of the country's economic health, and you can be sure that global investors are watching them like hawks.

Here are the key domestic factors at play:

- Interest Rates: When the South African Reserve Bank (SARB) hikes its main interest rate, it can be like a magnet for foreign capital. Investors looking for better returns on their money will bring foreign currency into the country, which helps strengthen the Rand.

- Inflation: High inflation eats away at a currency's buying power, making it less appealing. If South Africa's inflation rate starts climbing faster than that of its trading partners, the Rand will almost certainly feel the pressure and weaken.

- Political Climate: Investor confidence is incredibly sensitive to political stability. Any whiff of uncertainty, whether it's from heated policy debates or upcoming elections, can spook foreign investors and lead to capital flight, pushing the ZAR down.

- Economic Growth (GDP): A strong Gross Domestic Product (GDP) figure sends a powerful signal. It suggests a healthy, expanding economy, which builds confidence, attracts investment, and props up the Rand’s value.

A country's ability to manage its external finances is another critical factor. This is often measured by its foreign exchange reserves, which act as a financial safety net. A robust reserve level shows that a country can meet its international payment obligations, like paying for imports or servicing foreign debt.

This data is scrutinised as a real-time indicator of economic resilience. For example, in January 2025, South Africa’s foreign exchange reserves could cover 5.4 months of imports. This figure is never static; it reached a high of 10.4 months in June 2020 but dropped as low as 2.4 months back in October 2004, showing just how dynamic the country's external position can be. You can dive into more historical data on South Africa's import coverage from CEIC.

Global Market Forces

While what happens in South Africa is crucial, the ZAR doesn't live in a bubble. It's also heavily swayed by events on the other side of the world, which push on the opposite end of that seesaw.

The most significant global drivers include:

- Commodity Prices: South Africa is a major exporter of resources like platinum, gold, and coal. When global prices for these commodities climb, our export earnings swell. This brings more foreign currency into the country and gives the Rand a boost.

- Global Investor Sentiment: The ZAR is an emerging market currency, which is often code for a "higher-risk" asset. In times of global economic jitters, investors tend to ditch riskier assets and flock to "safe-haven" currencies like the US Dollar. This sell-off typically causes the Rand to weaken.

- Major Currency Strength: The performance of the world's big currencies, especially the US Dollar, has a direct knock-on effect. A strong Dollar often translates to a weaker Rand, simply because the Dollar becomes the go-to currency for international trade and investment.

By understanding how both our local report cards and the global market mood place weight on this economic seesaw, you can start to anticipate the Rand's next move. This knowledge turns confusing headlines into actionable insights for your business.

Navigating South Africa's Exchange Control Regulations

When you're dealing with foreign exchange in South Africa, you'll quickly encounter a unique set of rules known as exchange controls. It’s best to think of them as the official "rules of the road" for moving money across the country’s borders.

These regulations are put in place and managed by the South African Reserve Bank (SARB). Their goal isn’t to make your life difficult, but to shield the national economy from the shock of large, sudden outflows of money and to keep the financial system stable.

For any business or even an individual making international payments, getting to grips with these rules is more than just good practice—it's absolutely essential. Getting it wrong can lead to hefty penalties and frustrating delays. But once you understand the ‘why’ behind them, what seems like a complex barrier becomes a clear, straightforward process.

At their heart, these controls are about monitoring and influencing the flow of currency into and out of South Africa. This allows the SARB to manage the country's foreign currency reserves, which act as a vital safety net against external economic turbulence. A healthy reserve level is a sign of financial strength that inspires confidence in the global market.

Why Do We Even Have Exchange Controls?

Picture a small town that relies on a single reservoir for its water. If everyone decided to drain their share at the exact same time, the town would run dry in a heartbeat, creating a crisis. Exchange controls apply a similar principle to the country's pool of foreign currency.

They have a few critical jobs:

- Stopping Capital Flight: They act as a brake on a sudden, mass exit of capital, especially during times of economic jitters, which could send the Rand into a tailspin.

- Supporting the Rand: By carefully managing the money leaving the country, the SARB can help prop up the currency's value.

- Gathering Key Data: The rules mandate that transactions are reported, which gives policymakers a clear and accurate picture of the country's financial health.

A strong reserve base, fortified by these controls, is a cornerstone of economic stability. To give you an idea, by May 2025, South Africa’s gross forex reserves hit a new high of $68.116 billion, up from $67.585 billion just a month before. This growth demonstrates the country’s robust financial buffers. You can dig deeper into this data on South Africa's foreign exchange reserves at Trading Economics.

Allowances and Staying Compliant

The regulations lay out specific limits, or allowances, on how much money can be sent abroad. These limits are different for individuals and for companies, and knowing which applies to you is the first step to a hassle-free international payment.

For individuals, there are two main allowances to know:

- Single Discretionary Allowance (SDA): Every South African resident can send up to R1 million abroad each calendar year without needing a tax clearance certificate. This is for personal use, like overseas travel, gifts to family, or maintenance payments.

- Foreign Investment Allowance (FIA): If you're looking to invest your money offshore, you can send an additional R10 million per calendar year. For this, you'll need a Tax Compliance Status (TCS) PIN from SARS to confirm your tax affairs are in order.

For businesses, the rules are more closely tied to the reason for the payment. Paying for imported goods, services, or software licences is generally fine, but you must have the correct documentation to back it up.

Why Your Paperwork is So Important Every single cross-border payment needs a legitimate reason, and you must have the documents to prove it. This part is non-negotiable. If you're a business paying an international supplier, that means having a valid invoice. If you're an individual using your FIA, it means having the right tax clearance from SARS. The Authorised Dealers—the banks and financial institutions licensed to handle forex—are legally required to check this proof before they can process your payment.

Successfully navigating these controls really just boils down to knowing your allowances and keeping your paperwork in order. It turns compliance from a headache into a simple checklist, ensuring your money gets where it needs to go without any drama.

Common FX Challenges for South African Businesses

If you run a South African business that operates globally, you know the world of foreign exchange is a double-edged sword. It's the lifeblood of international trade, but the day-to-day reality of making and receiving payments can feel like navigating a minefield of hidden costs, frustrating delays, and wild market swings. These aren't just small annoyances; they're real problems that chew directly into your profit margins and create a massive drag on operations.

Picture a small design studio in Cape Town that needs to pay for software from a supplier in Europe. Or think about a wine estate in Stellenbosch waiting on a payment from a distributor in the UK. For businesses like these, the simple act of sending money across borders is often bogged down by complexity and uncertainty.

The Pain of Unfavourable Exchange Rates

The most obvious—and often most painful—challenge is the exchange rate itself. Businesses almost never get the "real" exchange rate you see on Google. Instead, traditional banks and financial institutions add a markup or spread to the rate. This acts as a hidden fee. It might look small on paper, but it adds up incredibly fast on large or frequent transactions, quietly eating away at the value of your hard-earned revenue.

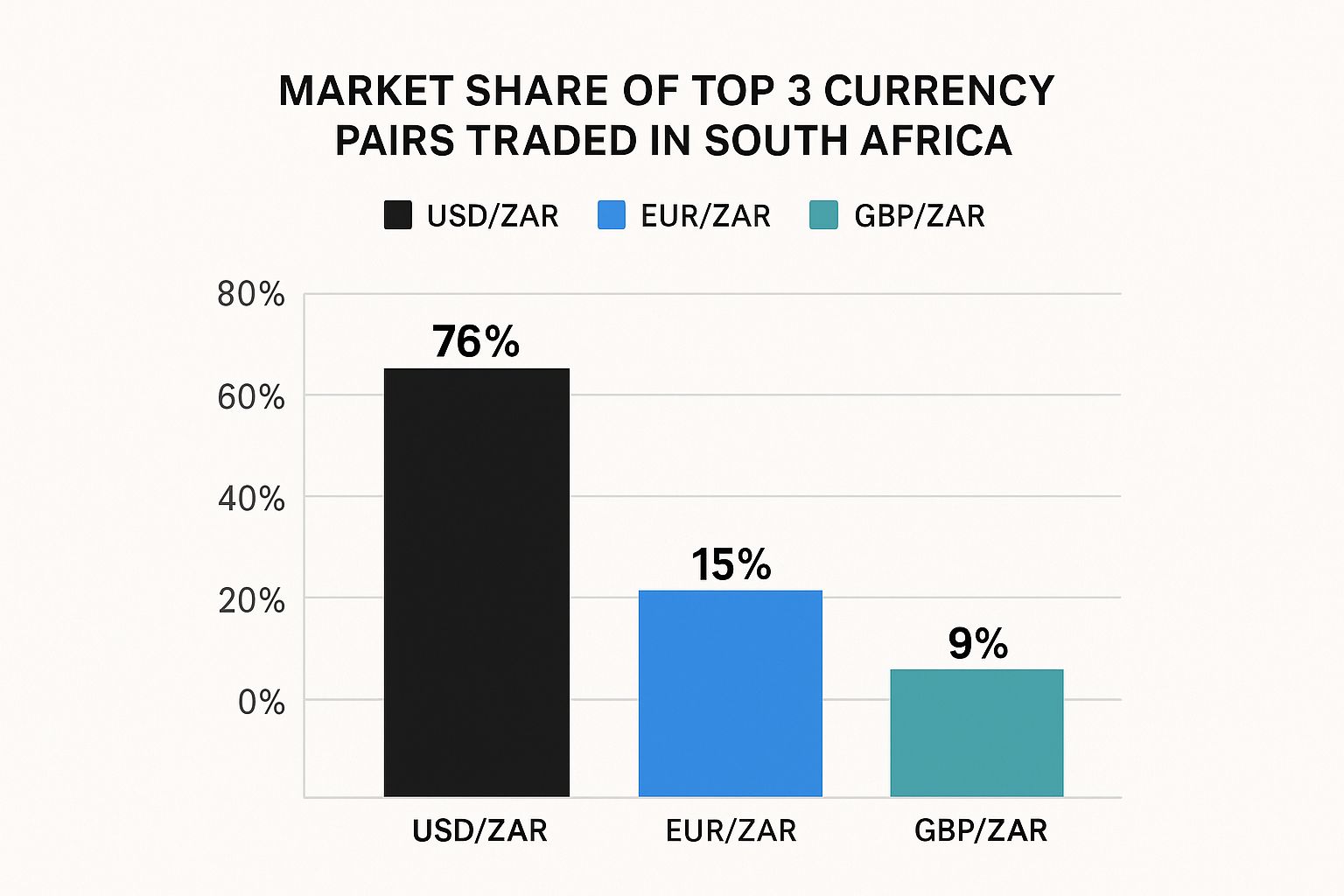

This problem is especially sharp when dealing with the most common currency pairs. This chart shows just how dominant a few pairs are in the South African market, which is where these spreads have the biggest impact.

As the data shows, the USD/ZAR pair accounts for over 76% of all trades. This means the vast majority of South African businesses are exposed to potential markups every time they transact in US Dollars.

Hidden Fees and Slow Settlement Times

Beyond the rate, a whole maze of other costs is waiting for you. Most business owners are painfully familiar with the sting of unexpected fees that only show up after a transaction is supposedly complete.

These often include:

- SWIFT Fees: Charges just for using the global network that handles most international bank transfers.

- Intermediary Bank Fees: If your payment gets routed through one or more banks on its way, each one can take a slice.

- Receiving Bank Fees: Even after your money is sent, the recipient's bank might charge a fee just to process the incoming funds.

The costs aren't just financial. The traditional banking system for foreign exchange in South Africa can be unbelievably slow. A single payment can take several business days to clear, leaving both you and your international partner in limbo. This kind of delay creates cash flow uncertainty and can strain relationships with suppliers and clients who expect to be paid on time.

This slow, manual process feels completely out of step with the speed of modern business. While other operations have become digital and instant, international payments often feel stuck in a bureaucratic time warp, forcing finance teams to waste valuable hours chasing payments and reconciling accounts.

To truly understand the difference, it's helpful to see a direct comparison of how a typical South African business would handle a payment through old vs. new systems.

Comparing Traditional vs Modern FX Platforms for SA Businesses

| Feature | Traditional Banks | Modern Platforms |

|---|---|---|

| Exchange Rates | Offer a retail rate with a significant, often hidden, markup (spread). | Provide rates much closer to the interbank rate with a small, transparent fee. |

| Fees | Multiple potential fees: SWIFT, intermediary bank, and receiving bank charges. | Typically a single, upfront fee. No hidden intermediary or receiving charges. |

| Speed | Transactions can take 2-5 business days to settle, causing delays. | Payments can often settle on the same day or within 24 hours. |

| Process | Involves cumbersome paperwork, manual data entry, and often a trip to the branch. | A fully digital, online process that can be completed in minutes from anywhere. |

| Transparency | Very little visibility. It's hard to track the payment's status once sent. | Real-time tracking and notifications provide full visibility from start to finish. |

| Support | Often relies on call centres or branch staff with limited specialised FX knowledge. | Access to dedicated FX specialists and proactive customer support. |

The contrast is stark. While traditional methods get the job done eventually, they introduce friction, cost, and uncertainty at nearly every step. Modern platforms are built to remove these exact pain points.

The Burden of Volatility and Administration

Finally, the Rand's natural volatility adds another layer of risk. A sudden dip in the ZAR's value between when you issue an invoice and when you get paid can completely wipe out your profit margin on a deal. For exporters, this means the Rands you finally receive can be worth far less than you planned for, turning financial forecasting into a guessing game.

This risk is made worse by the administrative headache. Kicking off an international payment usually means dealing with clunky paperwork, manual data entry, and a frustrating lack of visibility into where the payment actually is. For a growing business, these manual processes just don't scale. They create a bottleneck that holds back growth and efficiency.

Taken together, these challenges build a compelling case for seeking out more modern, transparent solutions.

How Modern Platforms Are Fixing the FX Headache

For too long, South African businesses have had to put up with a daily grind of managing international payments. Working with traditional banks can feel like navigating a maze blindfolded – a process riddled with hidden fees, bad exchange rates, and delays that make your head spin.

But the tide is turning. A new wave of financial technology (fintech) platforms is here, built specifically to tackle these long-standing frustrations. They're swapping out opaque, outdated systems for transparency and speed.

Instead of just accepting a poor exchange rate as a non-negotiable "cost of doing business," these platforms give you access to rates much closer to the real market. That single shift can put a significant amount of money back into your business, especially if you’re dealing with regular or large international transactions. It’s about putting you, the business owner, back in control of your own revenue.

Gaining Control Through Transparency and Speed

One of the most immediate benefits you'll notice with modern platforms is the end of hidden costs. The old banking model was notorious for "death by a thousand cuts" – SWIFT charges, intermediary bank fees, and receiving fees that would nibble away at a payment until it was a shadow of its original self. Today’s platforms for foreign exchange in South Africa replace that with a clear, upfront fee. You know exactly what you’re paying before you ever click "send."

This clarity runs through the entire experience. Some of the biggest upgrades include:

- Real-Time Tracking: Gone are the days of "send and pray." Now you can actually see where your money is at every step of its journey.

- Faster Settlement: Payments that used to take days to land can now be settled within 24 hours, sometimes even on the same day.

- Less Admin Overload: Digital platforms automate the tedious stuff like data entry and compliance checks, giving your finance team their time back.

The goal is simple but powerful: managing your company's international finances should feel as easy as managing your local accounts. By digitising the process and cutting out the middlemen, these platforms provide the control businesses need to compete on a global stage.

This speed and transparency have a real-world impact on your cash flow and business relationships. When you can pay an international supplier on time, every time, without sweating about settlement delays, you build trust and a much stronger supply chain.

Moving from Reactive to Proactive FX Management

Perhaps the biggest game-changer is the ability to shift from a reactive to a proactive financial strategy. We all know how volatile the Rand can be. A business waiting for a big export payment can see its profits erode overnight simply because of a bad currency swing.

Modern FX platforms arm you with the tools to manage this risk effectively. Features once reserved for massive corporations are now at the fingertips of small and medium-sized businesses, allowing you to:

- Hold Multiple Currencies: You can keep balances in USD or EUR, for instance. This lets you receive payments directly and only convert them back to ZAR when the rate is in your favour.

- Automate Workflows: Set up smooth, automated payment processes that cut down on human error and save countless hours of manual work.

- Get Full Visibility: A single, clean dashboard gives you a complete picture of all your international transactions, making financial planning and reconciliation a breeze.

By combining competitive rates, clear fees, and smart automation, platforms like Zaro are finally fixing what was broken. They turn foreign exchange from a source of stress into a real strategic advantage, giving South African businesses the confidence to operate globally.

Actionable Steps to Tweak Your FX Strategy

Moving away from old-school, expensive foreign exchange methods isn't just a nice-to-have anymore; it's essential if you want to stay competitive and grow. Taking charge of your international payments doesn't mean you have to tear down your whole financial system. With a solid plan, you can make smart, immediate changes that protect your bottom line and make your business run smoother.

Think of this as your playbook for building a better FX strategy from the ground up.

The first move? Figure out exactly what you're paying right now. You’d be surprised how many businesses don't know the true cost of their international transactions. It's usually not in the obvious fees but hidden away in a poor exchange rate.

Start with an FX Cost Audit

Before you can fix the problem, you need to know how big it is. This means taking a good, hard look at your past international payments to find all the hidden costs that have been quietly eating into your profits. Don't worry, it's simpler than it sounds and the clarity it brings is well worth it.

Here’s how to do a quick audit:

- Get Your Records: Grab all your international payment records from the last 6 to 12 months. For each one, you'll need the date, the amount sent, the currency, and the exchange rate your bank gave you.

- Find the Real Rate: For each transaction date, do a quick search for the mid-market rate (or interbank rate). This is the true, wholesale rate before any bank markups.

- Calculate the Spread: Now, compare the rate your bank gave you to the real rate. That difference is the spread, and it’s basically your hidden fee. Multiply this spread by how much you sent to see the real cost in Rands.

- Add the Obvious Fees: Lastly, add up any explicit costs you can see on your statements, like SWIFT fees or admin charges.

This little exercise is often a real eye-opener. When you see the total cost in black and white—money that could have been ploughed back into your business—it’s a powerful push to find a better way.

Once you know exactly what you’re paying, you can start shopping around. A modern platform can get rid of nearly all those hidden costs.

Choose the Right FX Provider

Here’s the thing: not all FX providers are the same. When you're looking at modern platforms that handle foreign exchange in South Africa, you need to focus on features that solve the problems you just uncovered. You're looking for a partner, not just a service that moves money.

Here's what you should be asking for:

- Total Transparency on Pricing: Always insist on seeing the real exchange rate with a clear, upfront fee. If a provider is cagey about its spread, walk away.

- Multi-Currency Accounts: This is a huge one. Having an account that can hold USD, EUR, or GBP is a massive advantage. It means you can get paid by international clients and wait for a better ZAR exchange rate before bringing the money home.

- Tools to Manage Risk: Look for access to things like forward exchange contracts (FECs). An FEC lets you lock in an exchange rate for a payment you need to make or receive in the future. It takes all the guesswork out of currency swings and makes your cash flow predictable.

- Easy Integration: The platform should slot right into how you already do business. It needs to automate the boring stuff and give you clear reports that make bookkeeping a breeze.

By taking these practical steps—auditing your costs, picking a transparent provider, and using modern tools to handle risk—you can completely change how you deal with foreign exchange. It's about shifting from being reactive and overpaying to being proactive and strategic, giving your business a real edge on the global stage.

A Few Common Questions About FX in South Africa

Getting your head around international payments can feel a bit overwhelming, especially with South Africa's unique rules. Let’s tackle some of the most common questions that come up.

Think of this as a quick-reference guide to help you manage your money across borders with a bit more confidence. We'll build on what we've already covered and give you some practical answers for real-world situations.

What Is the Best Way to Send Money Overseas from South Africa?

Honestly, the "best" way comes down to what you value most: cost, speed, or sheer convenience. For years, the only real option was your bank, but they aren't always the most efficient choice. Banks are familiar and feel safe, but they often build their profit into the exchange rate they offer you, and payments can take days to clear.

This is where modern financial platforms have really shaken things up. They tend to offer exchange rates much closer to the real market rate and are upfront about their fees. Plus, the whole process is digital, and your money often arrives within 24 hours. For most people, this blend of better pricing, speed, and ease of use makes them a far better option than traditional banks.

How Do Exchange Controls Affect Me Personally?

For individuals, the South African Reserve Bank (SARB) has set up two main allowances that you need to be aware of. Getting these right is the key to staying compliant.

- Single Discretionary Allowance (SDA): Every calendar year, you can send up to R1 million overseas for almost any personal reason—think holidays, gifts, or supporting family abroad. The great part is you don't need a tax clearance certificate for this.

- Foreign Investment Allowance (FIA): If you're looking to make investments offshore, you can send an additional R10 million per year. For this, however, you absolutely must get a Tax Compliance Status (TCS) PIN from SARS first.

For everyday personal transfers, that R1 million SDA is usually more than enough. But once you start talking about larger investment sums, navigating the FIA process is a non-negotiable step.

Can I Hold Foreign Currency in a South African Bank Account?

Yes, you can, and for anyone who deals with international payments regularly, it’s an incredibly smart move. Many modern financial platforms now let you open accounts that can hold multiple currencies, like US Dollars, Euros, or British Pounds, right here in South Africa.

This capability is a total game-changer. Imagine you're an exporter who just received a payment in USD. Instead of being forced to convert it to Rand on a day when the rate is poor, you can simply hold the payment in your USD wallet. You can then watch the market and choose to convert when the ZAR exchange rate is in your favour.

This simple feature gives you a massive amount of control. It lets you pay foreign suppliers directly from your foreign currency balance or time your conversions strategically. You go from being a passive victim of the daily rate to an active manager of your own foreign exchange.

Ready to stop overpaying for international payments? Zaro offers real exchange rates with zero spread and no hidden fees, giving your business the financial control it needs to succeed globally. Learn more about how Zaro can transform your cross-border payments.