Beyond Basic Currency Swaps: What Foreign Exchange Services Really Do

Think foreign exchange is just about swapping your Rands for Dollars or Euros? Think again. For South African businesses trading internationally, foreign exchange services are so much more. They're a strategic toolbox, offering a variety of instruments to navigate the complexities of global commerce. Think of it like this: big companies like Shoprite and MTN use forex as a core part of their international growth strategies. It's not just a transaction, it's a tool.

One key element is timing. Imagine needing to pay a supplier in US Dollars. Waiting for the "perfect" exchange rate is tempting, but market fluctuations can quickly wipe out any potential gains. That’s where forward contracts step in, acting like a safety net. By locking in an exchange rate for a future transaction, you gain predictability and protect your profits from sudden market shifts. For instance, a forward contract can protect you if the Rand strengthens after you’ve already agreed to a USD payment.

Many businesses also underestimate the wider range of services available. It's not just about simple currency swaps. Foreign exchange services also include things like currency hedging, market orders, and limit orders. Hedging helps you reduce the risk of unfavorable currency movements, while market orders guarantee immediate execution at the current market rate. Limit orders, on the other hand, let you set a target exchange rate, and the transaction only happens when the market reaches that specific level. These specialized tools can seriously improve your international transactions and even create new revenue opportunities. In 2025, the South African Rand (ZAR) averaged 18.4454 against the US Dollar (USD), showcasing fluctuations driven by local and global economic factors. The lowest point for the Rand in 2025 was 17.701 ZAR per USD on June 10th, highlighting the volatility inherent in the foreign exchange market. Discover more insights about ZAR/USD exchange rates here.

Unlocking Strategic Advantages with Forex

Forward contracts are just one example of how strategic forex services can be. Imagine a South African wine exporter using these contracts to secure good exchange rates months in advance. This provides price stability, allowing them to offer competitive prices to international buyers—a huge advantage in the global wine market. Or consider a Durban-based manufacturer who moved from reactive currency buying to a proactive hedging strategy. This not only cut their annual forex costs by a significant 15% but also removed the uncertainty around Rand volatility.

This strategic approach is about more than just keeping costs down. By understanding and using the full range of foreign exchange services, South African businesses can transform forex from a cost center into a source of competitive advantage. It unlocks new avenues for growth and profitability in the global marketplace. This change in perspective, from minimizing costs to gaining a strategic edge, can result in major gains in both profit and market share.

The Journey Of Your Money: How International Payments Actually Work

Imagine sending money to a supplier in Shanghai. It's not instantaneous – think of it less like sending an email and more like shipping a package. For a few days, your money takes a trip through a global financial network, a kind of relay race involving several banks, clearing houses, and regulatory checkpoints. This whole process is the core of foreign exchange services.

Let's follow a typical payment as it travels from your Johannesburg office to your supplier in Shanghai. Your South African bank starts by sending payment instructions – the amount and the recipient's details – through the SWIFT network. A SWIFT code is like an international bank address, making sure your money arrives at the right place.

Your payment then might go through one or more correspondent banks. These act as intermediaries, helping with transfers between banks that don't have a direct partnership. Imagine needing a connecting flight to a city your local airport doesn't serve directly. That’s the role a correspondent bank plays. Each bank in the chain verifies the payment information, ensures it complies with regulations, and then sends it on its way.

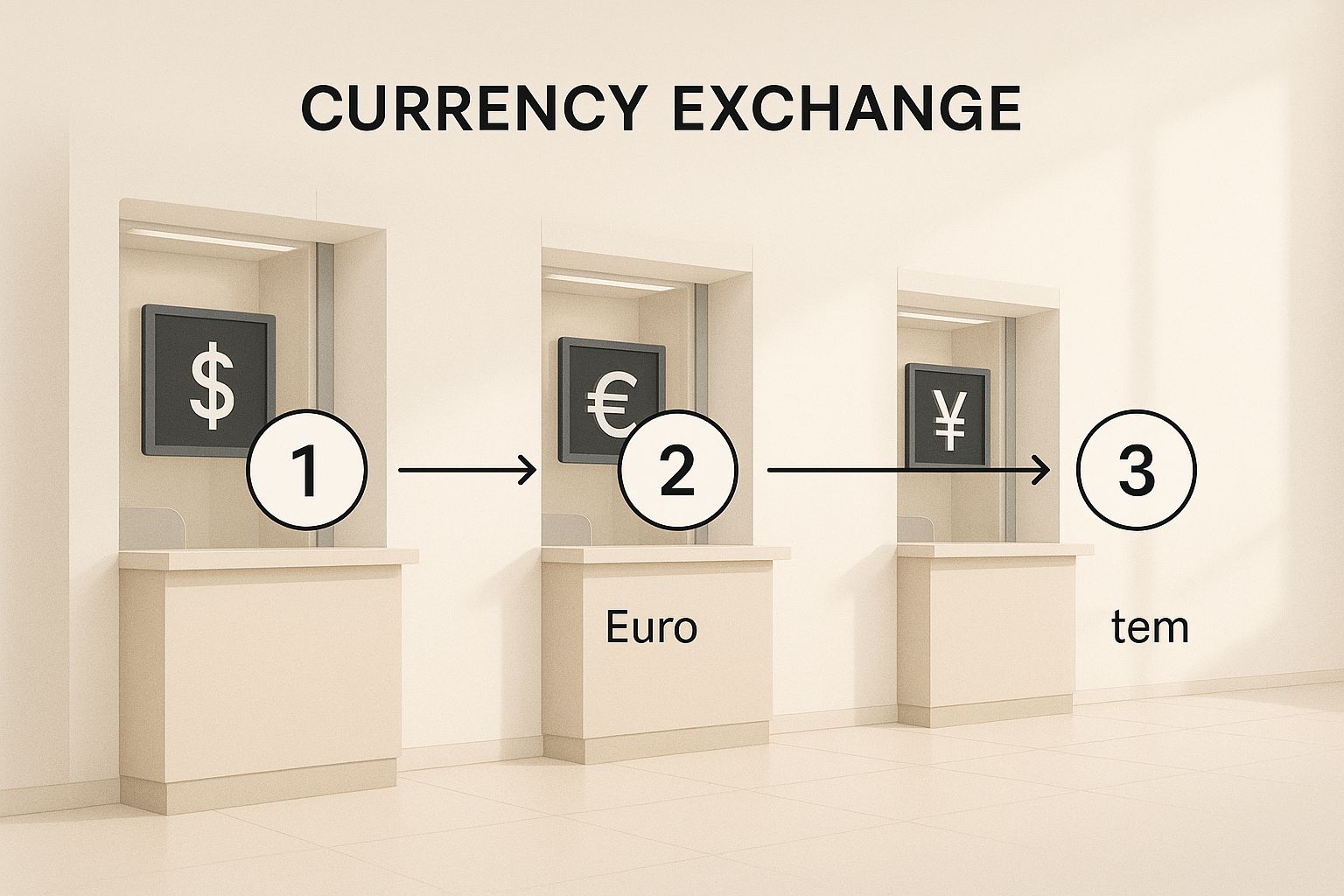

This infographic visualizes a minimalist depiction of the journey of your money through the global financial system, displayed through a series of digital currency exchange boards and counters.

This infographic visualizes a minimalist depiction of the journey of your money through the global financial system, displayed through a series of digital currency exchange boards and counters.

As the infographic shows, each step adds time. Different time zones and various regulatory requirements can cause further delays. For instance, a bank holiday at any bank in the chain puts your payment on hold until business resumes. All these factors explain why some transfers take hours, while others can take several days.

Exchange Rate Fluctuations and You

Exchange rates are another key aspect of international payments. The rate can shift between when you authorize a payment and when your supplier receives it. These fluctuations are a natural part of the foreign exchange market. However, this uncertainty can affect your bottom line, especially with larger transactions.

Understanding the Infrastructure

This network of banks, networks, and regulations is the unseen infrastructure that makes global trade possible. Understanding how it works helps you make smart choices about your foreign exchange services, finding the right providers and the right strategies for your business.

This knowledge lets you optimize transaction timing, minimize costs, and navigate the complexities of international payments. You become a proactive strategist instead of a passive participant, boosting the efficiency and cost-effectiveness of your global transactions. Platforms like Zaro can even help you sidestep some of these traditional steps, speeding up transfers and lowering costs. This understanding is essential for thriving in international business.

Navigating South Africa's Forex Rules: What Every Business Must Know

Doing business internationally in South Africa involves more than just exchanging currency. It means understanding the ins and outs of foreign exchange (forex) regulations set by the South African Reserve Bank (SARB). Think of the SARB as a referee, ensuring fair play and financial stability within the country’s economy. Their exchange controls act like traffic lights, managing the flow of money in and out to keep things running smoothly.

These controls have a direct impact on how South African businesses handle international transactions. For instance, importing goods or investing overseas often requires specific paperwork. The size of your business also matters. A small business might have different requirements and limits compared to a large corporation. Knowing the rules isn't just about avoiding legal trouble; it's about ensuring your international operations run without a hitch. Imagine trying to build a house without the proper planning permission – delays and extra costs would quickly become a major headache.

Understanding the Regulatory Framework

Dealing with import permits, approvals for international payments, and ever-changing regulations can feel overwhelming. But grasping the practical implications of these rules can actually empower businesses. Recent regulatory updates, for example, can significantly impact your day-to-day transactions. Changes in required documentation or allowable transaction amounts can disrupt your usual processes if you're not prepared. It’s like changing the rules of a game mid-match; you need to adapt your strategy to keep playing effectively.

South Africa's status as an emerging market presents unique advantages, like access to growing African markets. However, it also brings specific hurdles. Emerging market economies often experience greater volatility in their currencies – imagine a boat on choppy waters. South African businesses need to be prepared for these fluctuations to minimize potential risks. Unlike businesses in calmer economic waters with stable currencies, South African companies need to be more nimble and strategic in how they use forex services.

Furthermore, South Africa's foreign exchange reserves have grown considerably, reaching $68.116 billion in May 2025, up from $67.585 billion the previous month. Think of these reserves as a financial safety net. This robust reserve level provides a strong buffer against economic shocks and helps maintain stability in the forex market, crucial for managing currency volatility and supporting imports and debt obligations. Explore more about South Africa's foreign exchange reserves. This strong financial position gives South Africa more resilience in the face of global economic uncertainty.

To help illustrate the different types of forex services and their regulations, take a look at the table below:

South African Foreign Exchange Service Types and Regulations

This table compares various forex services available to South African businesses and outlines their regulatory requirements. Understanding these differences can help you choose the right service for your specific needs.

| Service Type | Regulatory Requirements | Processing Time | Typical Use Cases |

|---|---|---|---|

| Authorised Dealer (Bank) | SARB Authorisation, FICA Compliance | 1-3 Business Days | General import/export, international payments |

| Independent Forex Broker | Financial Services Board (FSB) Regulation | 1-2 Business Days | Bespoke forex solutions, larger transactions, hedging |

| Online Forex Platform | FSB Regulation, KYC/AML Compliance | Near Instantaneous | Smaller transactions, online payments |

This table provides a general overview, and specific requirements may vary. Consulting with a forex specialist is recommended for detailed guidance.

Successfully navigating the South African forex landscape requires more than just knowing the rules. It demands proactive engagement, continuous learning, and a strategic approach to foreign exchange services. By working within the framework and staying informed, businesses can transform potential obstacles into opportunities for growth and global success.

Turning Forex From Cost Center Into Competitive Advantage

South African businesses trading internationally often see foreign exchange (forex) services as a necessary cost, a bit like paying rent. But smart businesses realize forex isn't just about swapping currency; it's a strategic tool that can give them a real edge. This change in thinking – from minimizing costs to maximizing potential – is the difference between simply surviving in the global market and really thriving.

Real-World Examples of Forex as a Competitive Tool

Imagine a Cape Town winery exporting its finest wines. Fluctuating exchange rates make pricing tricky. But by using forward contracts, they can lock in favorable rates months in advance. This gives them pricing stability, allowing them to offer consistent and competitive prices to their international customers. Their competitors, relying on spot rates, might struggle to do the same. This predictable pricing becomes a strong selling point, attracting and keeping overseas buyers.

Think about a Durban-based manufacturer importing materials priced in US dollars. They used to buy currency reactively, leaving them exposed to the volatile Rand. By using a strategic hedging strategy through foreign exchange services, they've cut their yearly forex costs by 15%. This proactive approach saves money and eliminates worries about currency swings, letting management focus on their core business.

Beyond Cost Savings: Strategic Currency Management

Forward-thinking businesses are going beyond simple transactions and using currency analysis to time their purchases strategically. They're negotiating better deals with suppliers by offering payment flexibility using different forex tools. Picture a South African importer offering a European supplier early payment in Euros at a slightly better exchange rate. This strengthens the supplier relationship and benefits the importer's bottom line.

Some businesses even generate extra revenue through strategic currency positioning. This involves holding different currencies based on predicted market moves, effectively turning forex into a profit generator. This advanced strategy requires careful market analysis and understanding, but the potential rewards can be significant.

Transforming Your Forex Strategy

These examples show how foreign exchange services, used strategically, can transform a business. They go beyond simply enabling transactions, becoming tools for managing risk, boosting profits, and gaining a competitive advantage globally. Shifting the focus from "how do I minimize forex costs?" to "how do I use forex to outperform my competitors?" can unlock major growth and market opportunities. This strategic approach can translate into millions of Rands in extra profit and open doors to new international markets.

Choosing Your Forex Partner: What Matters Beyond The Headlines

Picking the right foreign exchange services provider is a big deal for South African businesses trading internationally. Many businesses make the mistake of focusing only on the exchange rates they see advertised. That's like buying a car based only on its color – you'd never ignore the engine, safety features, or reliability, would you? The real cost of forex involves a lot more than just the exchange rate, and those hidden factors can cause real headaches down the line.

Think about it: sometimes, how quickly your provider can execute a transaction is more important than saving a tiny bit on the rate, especially when markets are jumping around. Imagine needing to make a time-sensitive payment, only to have your provider take days to process it. Suddenly, that small rate difference seems insignificant compared to the potential disruption to your business. The same goes for technology. A clunky platform or poor integration can create internal chaos and inefficiency.

Customer service is another crucial element, especially when markets get turbulent. When you urgently need help or have critical questions, a responsive and knowledgeable support team is invaluable. Think about needing to make an important transaction during a period of Rand volatility and being unable to reach your provider. That scenario could seriously impact your business and your peace of mind.

Then there are the hidden fees. Those seemingly small charges can really add up, making the “cheapest” provider actually the most expensive in the long run. You want a partner who's upfront about their pricing and offers flexible contracts that can adapt as your business evolves. A provider that offers personalized solutions, like Zaro, can help you avoid these hidden costs and other potential problems.

Identifying Red and Green Flags

Some red flags should immediately make you wary of a forex provider. For instance, if a provider can't clearly explain their fees, that's a major warning. Transparency is essential in financial services. Other red flags include difficulty accessing your transaction history, slow processing times, and poor customer support.

On the other hand, green flags signal a provider that truly values your business. Look for proactive market updates, flexible contracts, and personalized support. Zaro, for example, prioritizes these elements, giving businesses the resources and support they need to navigate the complex world of foreign exchange. To illustrate the importance of a thoughtful forex strategy, consider South Africa's foreign exchange reserves. These reserves, a key measure of economic strength, were equivalent to about 5.4 months of imports as of January 2025, down from 6.1 months the previous month. This figure represents how long the nation could pay for imports with existing reserves without needing more foreign currency. Discover more insights about South Africa's foreign exchange reserves here.

Evaluating Your Options

Navigating the forex market can be tricky. To make the process easier, use a structured approach. The table below outlines the key factors to consider when choosing a foreign exchange provider.

Before we dive into the table, let's talk about what it's for. This matrix is designed to help you systematically compare different forex providers. It lists important criteria and shows how much each one matters to different types of businesses, so you can tailor your selection process to your own unique needs.

Foreign Exchange Provider Evaluation Matrix

| Evaluation Criteria | Weight for SMEs | Weight for Large Corps | Assessment Method |

|---|---|---|---|

| Exchange Rates & Fees | High | High | Compare quotes, analyze fee structures |

| Speed of Execution | Medium | High | Test transactions, review service level agreements |

| Technology & Integration | Medium | High | Demo platforms, assess API capabilities |

| Customer Service Quality | High | Medium | Contact support, read reviews |

| Security & Compliance | High | High | Verify certifications, review security protocols |

| Financial Stability | Medium | High | Research provider's background, check ratings |

This matrix is a starting point, and you can adjust the weights based on what's most important to your business. Choosing the right forex partner is an investment in your future. By carefully considering these factors – and not just focusing on the advertised rates – you can find a provider that genuinely supports your growth and international success.

Learning From Expensive Mistakes: Common Forex Pitfalls To Avoid

Stepping into the world of foreign exchange services can feel like navigating a minefield, especially for South African businesses. Even experienced business owners have stumbled into costly traps. But by learning from their missteps, you can sidestep similar financial woes. Let's explore some of the most common and painful mistakes businesses make, and how you can avoid them.

The Cost of Poor Timing

Imagine securing a lucrative international contract, only to see it slip away because your payment was stuck in compliance checks for three weeks. This delay, caused by a misunderstanding of forex regulations and processing times, cost the company the deal. Timing, as they say, is everything in foreign exchange. Delays, whether due to compliance or processing hiccups, can derail even the most promising opportunities.

Another frequent mistake is misjudging market fluctuations. Think of a service business that watched its quarterly profits evaporate when the Rand unexpectedly strengthened against the dollar after they’d locked in dollar-denominated contracts. They hadn't accounted for currency fluctuation risk and paid a steep price.

Provider Pitfalls

Choosing the wrong forex provider can also lead to significant headaches. Imagine partnering with a provider who has hidden fees and slow processing times. What initially seemed like a small saving on the exchange rate could end up costing you much more in lost time and unexpected charges. These kinds of experiences can disrupt your operations and put a strain on your cash flow.

Overlooking the quality of customer service is another provider-related pitfall. During a volatile market situation, reliable and responsive customer support is essential. A provider that's difficult to reach when you need them most can make a stressful situation even worse.

Compliance Complications

South Africa's forex regulations can be complex, and failing to understand them can lead to serious compliance issues. Imagine unknowingly violating exchange control rules and facing hefty fines or even legal action. Such an oversight can damage your company's reputation and create a significant financial burden. Even seemingly minor details, like documentation requirements, can have major consequences.

Avoiding the Pitfalls: Practical Strategies

This isn't just about scaring you with worst-case scenarios. Each of these stories offers valuable lessons. Learn to identify the red flags of a subpar forex service provider before they impact your business.

- Understand the importance of clear documentation

- Establish robust internal processes

- Maintain proactive communication with your provider

These seemingly small details can make all the difference in the complex world of foreign exchange.

Successful companies have learned to manage forex risk systematically.

- They prioritize clear communication.

- They maintain meticulous records.

- They choose their providers with care.

They use tools like forward contracts to mitigate exchange rate risks, gain a thorough understanding of the regulations, and build strong relationships with reliable forex partners like Zaro. These proactive strategies protect them from the costly mistakes that can cripple other businesses. By understanding these common errors and implementing these strategies, you can navigate the forex landscape with confidence and turn potential risks into opportunities for growth.

Your Forex Success Roadmap: From Strategy To Implementation

Let's get down to brass tacks and translate all this forex knowledge into a practical plan you can actually use to boost your business. Think of this as your personalized GPS for navigating the world of foreign exchange, guiding you from where you are now to a system that scales as your business does. This isn't just theory; it's about creating a real, actionable strategy.

Assessing Your Current Forex Needs

The first step is taking stock of your current forex activities. It's like checking the ingredients in your pantry before starting a new recipe. What currencies do you regularly deal with? What’s the typical volume of your transactions? Understanding your baseline forex activity is crucial for identifying areas for improvement and choosing the right tools.

Next, identify your current forex pain points. Where are the sticking points? Are fluctuating exchange rates eating into your profits? Are international payments slow and frustrating? Are you struggling to keep up with South Africa's forex regulations? Pinpointing these challenges is like diagnosing an illness – it's the first step to finding the right cure.

Building Your Forex Action Plan

Now that you have a clear picture of your needs and challenges, let's create an action plan. Think of this like a blueprint for your forex success, complete with specific steps, timelines, and key performance indicators (KPIs). It keeps you focused and helps you measure your progress.

Here's a sample plan you can adapt:

- Phase 1: Research and Selection (1 month): Research different forex providers, compare their services and fees, and choose the one that best fits your business. It's like choosing the right paint colors before you start decorating – it sets you up for success.

- Phase 2: Implementation (2 months): Integrate the chosen forex services into your current financial procedures. Set up accounts, configure payment systems, and train your team. Think of this as installing the new appliances in your remodeled kitchen – it's where everything comes together.

- Phase 3: Monitoring and Optimization (Ongoing): Keep a close eye on important metrics like transaction costs, processing times, and the impact of exchange rates. Regularly review and tweak your forex strategy as needed. This is the equivalent of regular kitchen maintenance to keep everything running smoothly.

Key Performance Indicators

Choosing the right KPIs is like choosing the right gauges for your car's dashboard. They tell you what's working and what needs adjusting. Here are a few examples:

- Cost Savings: How much are you saving on transaction fees and exchange rate losses?

- Processing Time: How quickly are your international payments being processed?

- Risk Management: How effective are your strategies for managing currency risk?

By regularly tracking these indicators, you can fine-tune your forex strategy for peak performance.

Scaling Your Forex Operations

As your business grows, your forex needs will evolve. Your strategy needs to be flexible enough to adapt. This means choosing providers with robust technology, adaptable contract terms, and scalable service offerings. It's like buying clothes that allow for growth – they accommodate your changing needs over time.

Building in-house expertise is also essential. Train your team on the ins and outs of forex management and stay up-to-date on the latest regulations and market trends. This expertise is like having a skilled chef in your newly renovated kitchen – they can maximize the use of your upgraded tools.

By following these steps, you can transform your business from a forex beginner to a strategic currency expert, optimizing your international transactions and unlocking your global potential. Ready to take control of your forex strategy? Start with Zaro, the fintech platform built for South African businesses. Explore Zaro today and experience the difference.