If your business earns money in foreign currencies, having a reliable way to calculate your South African tax is non-negotiable. A good foreign income tax calculator for South Africa is more than just a convenience—it's a critical tool for forecasting your obligations under our worldwide income tax system. It takes the guesswork out of converting foreign earnings to ZAR and applying the correct SARS tax brackets, helping you stay compliant and manage your cash flow.

Getting to Grips with Your Foreign Income Tax Obligations

For any South African business operating on a global scale—whether you're an exporter, a BPO, or a tech company paying international contractors—understanding your tax duties is fundamental. The South African Revenue Service (SARS) uses a residence-based tax system. In simple terms, if your business is a tax resident, you’re taxed on your income from everywhere in the world.

This has very real consequences. Every dollar, pound, or euro your business earns contributes to your total taxable income. When you bring that money home, it can easily push you into a higher tax bracket, leaving you with a much bigger tax bill than you anticipated. This is exactly why a foreign income tax calculator for South Africa is so essential for financial planning.

Why Your Worldwide Income Matters

The idea of "worldwide income" means SARS doesn’t distinguish between money earned locally and money from a client overseas. It all goes into the same pot when it’s time to calculate your final tax liability. A common mistake businesses make is only considering their local ZAR earnings for provisional tax estimates, which can lead to hefty underpayment penalties down the line.

Imagine your software company in Cape Town invoices a client in the US for $50,000. That income is taxable here in South Africa, even if the cash sits in a foreign bank account for a while. Getting your head around this is the absolute first step before you can even think about doing the numbers.

Key Takeaway: Your tax residency, not where you earned the money, determines what you owe SARS. You must declare all foreign earnings and include them in your total taxable income.

The Sting of Progressive Tax Brackets

South Africa’s tax system is progressive, which means the more you earn, the higher your tax rate gets. For the 2025 tax year (1 March 2024 to 28 February 2025), the rates kick off at 18% for income up to R237,100 and climb all the way to a maximum of 45% for anything over R1,817,001.

This structure makes accurate income forecasting incredibly important, especially with SARS reporting a rise in foreign asset disclosures. While you can often claim credit for taxes paid in other countries through Double Taxation Agreements (DTAs), this relief is capped at what you would have paid in South Africa anyway. You can find more detail on navigating these rules in this expert analysis on expatriate tax from Grant Thornton.

This is where a good calculator proves its worth. What happens if a big foreign contract pays out right at the end of the tax year? The right tool can instantly show you the tax impact.

What You Need for an Accurate Calculation

Before you start plugging numbers into a calculator, you need to gather the right information. The quality of your output depends entirely on the quality of your input.

Before you can work out your tax liability, you'll need to understand a few key components. The table below breaks down the essentials.

Key Factors for South African Foreign Income Tax

| Component | Description | Why It Matters for Your Business |

|---|---|---|

| Tax Residency Status | Confirms if your business is legally considered a resident for tax purposes in South Africa. | This is the foundation. It determines whether the worldwide income rule even applies to your business. Getting this wrong means the entire calculation is invalid. |

| Total Foreign Income | All revenue earned in any currency from sources outside of South Africa. | You need a complete picture of your earnings. Missing a revenue stream can lead to an incorrect declaration and potential penalties from SARS. |

| Conversion to ZAR | The process of converting your foreign currency earnings into South African Rand. | SARS has specific rules for this, often requiring the use of average exchange rates for the year, not just the daily spot rate. Using the wrong rate can skew your taxable income. |

| Foreign Tax Credits | A credit you can claim for taxes already paid to a foreign government on the same income. | This is your primary tool to avoid double taxation. Without documented proof of foreign taxes paid, you can't claim this credit and will end up paying tax twice. |

| Local Income & Expenses | All your South African-based income, plus all allowable business expenses you can deduct. | Your foreign income is added to your local income. Correctly calculating your deductible expenses is crucial for reducing your overall taxable income and final tax bill. |

Getting these elements right turns a daunting tax calculation into a manageable and strategic part of your financial planning.

First Things First: Are You a South African Tax Resident?

Before you even think about calculating tax on your foreign income, you need to be crystal clear on one thing: your tax residency status. This isn't just a box-ticking exercise; it’s the bedrock of your entire tax obligation to the South African Revenue Service (SARS).

Get this wrong, and every number you punch into a calculator will be based on a false premise. The consequences can be serious, leading to penalties and a whole lot of financial stress down the line. Your status determines whether SARS taxes you on your worldwide income or only on what you earn from South African sources.

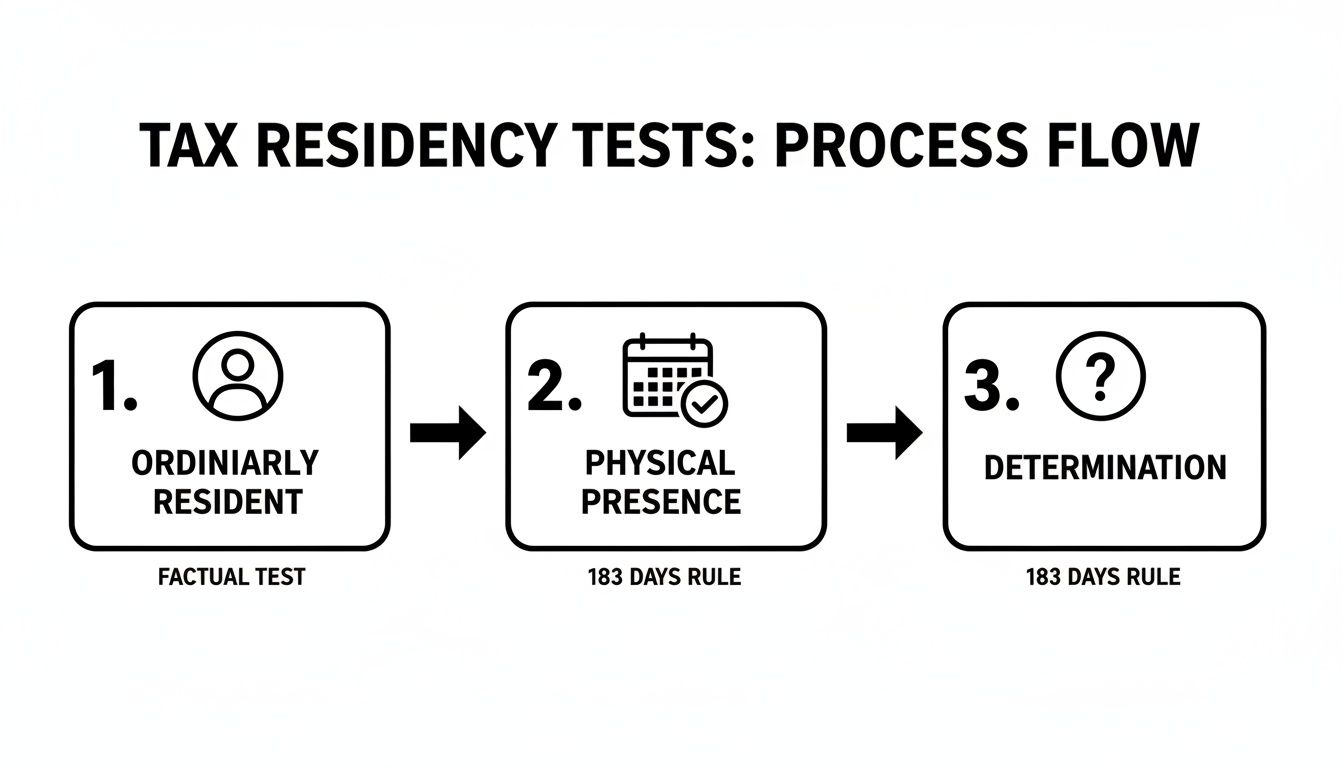

SARS uses two main tests to figure this out: the ‘ordinarily resident’ test and the ‘physical presence’ test. Let's break down what these actually mean for you.

The "True Home" Test: Ordinarily Resident

This first test is less about counting days and more about your life's centre of gravity. It can be a bit subjective, especially for entrepreneurs and business owners who are constantly on the move or have homes in different countries.

Simply put, SARS considers you ordinarily resident if South Africa is the country you naturally return to after your travels. It’s where your life happens—your real home.

To get a clearer picture, SARS will look at things like:

- Your primary home: Where does your spouse or partner live? Where are your most important personal belongings kept?

- Your economic ties: Is your main business based here? Where do you hold directorships or key investments?

- Your social roots: Are you a member of a local church, sports club, or community group?

Imagine you run an export business from Johannesburg. You might spend eight months a year meeting clients in Europe and Asia, but if your family lives in a house in Bryanston and your kids go to school there, SARS will almost certainly see you as an ordinary resident of South Africa.

The Day-Counting Test: Physical Presence

If the 'ordinarily resident' test doesn't provide a clear answer, SARS switches to a purely mathematical formula: the physical presence test. This is all about counting the days you spend in the country. No grey areas here.

You are considered a resident under this test if you tick all three of these boxes:

- You were in South Africa for more than 91 days in the current tax year.

- You were in South Africa for more than 91 days in each of the past five tax years.

- You have spent a total of more than 915 days in South Africa over those five preceding years.

You must meet all three conditions to be classified as a resident for the current year. If you fail to meet even one of them (and you aren't considered 'ordinarily resident'), you won't be a tax resident based on this test.

Accurately confirming your tax residency is the critical first step in managing foreign income tax. In some cases, having official proof is essential. For instance, certain countries like the UAE provide documents such as a Tax Residency Certificate UAE to formally establish residency, which becomes incredibly important when navigating double taxation agreements.

What if You're a Non-Resident?

So, what happens if you don't meet the criteria for either test? You’ll likely be classified as a non-resident for tax purposes, which completely flips your obligations on their head.

A non-resident is only taxed by SARS on income that comes from a South African source. This means money earned from your foreign clients, overseas investments, or international contracts generally falls outside SARS's reach.

For a business owner, becoming a non-resident isn't as simple as just spending more time abroad. It requires a clear, deliberate, and permanent departure from the country, with solid proof that you've cut your primary ties. It's a major move that absolutely needs careful planning and professional advice to get right.

Getting to Grips With Your Foreign Income Tax Calculation

Once you've navigated the residency tests and confirmed you're a South African tax resident, it's time to crunch the numbers. This is where things can get a bit tricky, but breaking it down makes it manageable. While a good foreign income tax calculator for South Africa is a lifesaver, understanding the mechanics behind it is key to getting it right.

Essentially, the whole process boils down to converting your foreign earnings into Rand, adding that to your local income, and then applying the correct SARS tax rules. Let's walk through it.

Step 1: Convert Your Foreign Income to South African Rand

First things first, you need to translate all your income from US Dollars, Euros, Pounds, or whatever currency you were paid in, into South African Rand (ZAR). This isn't as simple as just using the exchange rate on the day you got paid.

SARS is very specific about this. For your annual tax return, you have to use the average exchange rate for the tax year in question (which runs from 1 March to 28 February). SARS publishes these official tables every year, and they are what you must use for your final submission. I’ve seen people use daily spot rates thinking it's more accurate, but it's a surefire way to get a query from SARS.

This flowchart neatly summarises the residency tests, which are the absolute first thing you must be clear on before you even think about calculations.

As you can see, SARS first looks at where your "true home" is (the Ordinarily Resident test) before it moves on to just counting the days you've been in the country.

Step 2: Combine Your Local and Foreign Income

With your foreign earnings now in ZAR, the next job is to add this amount to any income you earned locally. This combined figure is your gross worldwide income, and it's the number SARS is focused on.

A common mistake, especially for businesses with irregular foreign payments, is not tracking this properly. Meticulous record-keeping is non-negotiable here. Every invoice, whether it was paid into your South African bank account or an offshore one, has to be tallied up.

My Two Cents: Don't leave all this admin for the end of the tax year. I always advise clients to keep a running spreadsheet. As each foreign payment comes in, log it. Once SARS publishes the average exchange rates, do the conversion then and there. It saves an unbelievable amount of stress come filing season.

For instance, say your business brought in R800,000 from local clients and your foreign projects, once converted, came to R400,000. Your total income for tax purposes is R1,200,000. It's from this combined amount that you'll then subtract your allowable business expenses to get to your final taxable income.

Step 3: Apply the Official SARS Tax Brackets

Now that you have your total taxable income, you can apply the official SARS tax rates. South Africa uses a progressive tax system, which means your income isn't all taxed at a single rate. Instead, it's divided into brackets, with different portions being taxed at progressively higher percentages.

Getting your head around these brackets is crucial. For the 2025/2026 tax year (starting 1 March 2025), the first R237,100 of taxable income is taxed at 18%. Income between R370,501 and R512,800 gets taxed at 31%, and the top bracket hits 45% for any income over R1,817,000. Landing a big international project can easily bump your total income into a higher bracket than you're used to.

For a detailed breakdown, PwC offers a fantastic summary of South Africa's personal income tax rates that’s worth bookmarking.

A Real-World Example: The Freelance Consultant

Let's put this into practice. Imagine a freelance IT consultant based in Durban who is a South African tax resident.

- Local Income: She bills R450,000 from her South African clients.

- Foreign Income: She lands a great project with a UK company, earning £20,000.

- Exchange Rate: We'll use a hypothetical SARS average exchange rate for the year of R23.50 to £1.

- Allowable Expenses: She has R70,000 in legitimate, tax-deductible business expenses.

Here’s how her calculation would play out:

- Convert Foreign Income: £20,000 x 23.50 = R470,000

- Calculate Gross Income: R450,000 (local) + R470,000 (foreign) = R920,000

- Determine Taxable Income: R920,000 (gross) - R70,000 (expenses) = R850,000

That R850,000 is her final taxable income. For the 2025 tax year, this amount places her in the 39% marginal tax bracket.

Step 4: Factor in Your Rebates and Medical Credits

You're almost there. The last step before you get to the actual tax you have to pay is to subtract any rebates and medical aid tax credits you qualify for. These are powerful because they reduce your tax bill directly, not just your taxable income.

- Primary Rebate: Every taxpayer gets this. For the 2025 tax year, it’s R17,757.

- Secondary/Tertiary Rebates: If you're 65 or older, there are additional rebates you can claim.

- Medical Aid Tax Credits: If you contribute to a registered South African medical aid, you can claim a fixed monthly credit. For 2025, it’s R364 per month for the main member and the first dependant.

These credits really do add up and can make a big difference to your bottom line. Our consultant, after working out the tax on her R850,000 income, would then subtract the R17,757 primary rebate plus any medical credits she's due. The number she's left with is what she'll pay over to SARS.

Untangling Exemptions and Foreign Tax Credits

Once you’ve worked out your gross tax liability, you’ve hit a big milestone. But the job isn't done. Now comes the part where we look at how to legally and ethically reduce the final number on your tax return.

This all comes down to understanding the specific exemptions and credits SARS offers. Get this right, and you could dramatically lower your final tax bill. For South Africans earning abroad, two parts of the Income Tax Act are absolutely critical: the Section 10(1)(o)(ii) exemption and the Section 6quat foreign tax credit. They sound complicated, but they serve very different purposes, and it's vital to know which one applies to your business.

The Section 10(1)(o)(ii) Exemption: Who It's Really For

You've probably heard chatter about a "foreign employment income exemption" and wondered if it could apply to your business. This is where Section 10(1)(o)(ii) comes in, but its scope is much narrower than many people think.

This exemption is specifically for South African tax residents who are employees of a foreign company. To qualify, you have to be physically outside of South Africa for more than 183 full days in any 12-month period, which must include at least one continuous stretch of more than 60 full days. It’s a fantastic tax break, but it’s designed for a traditional employment relationship.

For freelancers, independent contractors, and companies earning foreign revenue, this exemption almost never applies. The income you get from international clients is business revenue, not salary. Mixing them up is a common and very expensive mistake.

Claiming Foreign Tax Credits Under Section 6quat

For any South African business earning money overseas, this is your most important tool for avoiding the pain of double taxation. The Section 6quat credit lets you subtract the tax you've already paid to a foreign government from what you owe SARS on that same income.

Think of it as a rand-for-rand discount on your South African tax bill. If you earned income in the UK and paid tax to HMRC, you can use that payment to reduce what you owe here. The principle is straightforward: you shouldn't be taxed twice on the same profits.

Key Takeaway: The Section 6quat credit is your go-to for preventing double taxation. It lets you deduct foreign taxes paid from your South African tax liability, ensuring you ultimately pay the higher of the two countries' tax rates, not both combined.

To claim this credit, your paperwork has to be perfect. You need official proof of tax paid to the foreign revenue authority—think tax receipts or formal assessment notices. Without it, SARS won't grant the credit, and you’ll end up being taxed twice.

The All-Important Cap on Credits

There’s one crucial rule with Section 6quat: the credit is capped. You can't claim a credit that’s larger than the amount of South African tax you would have paid on that same slice of foreign income.

Let's walk through a real-world example.

- Foreign income: R200,000 (after converting to ZAR).

- Foreign tax paid: You paid R50,000 in tax to the foreign country (an effective rate of 25%).

- Proportional SA tax: Let’s assume your marginal tax rate in South Africa is 31%. The SA tax on that R200,000 would be R62,000.

In this case, you can claim the full R50,000 as a credit because it’s less than the R62,000 South African equivalent. Your SARS liability on that specific income drops from R62,000 to just R12,000. Simple.

But what if the numbers were different?

- Foreign income: R200,000.

- Foreign tax paid: You paid R70,000 to a high-tax country (a 35% effective rate).

- Proportional SA tax: The SA tax liability remains R62,000 (at 31%).

Here, your credit is capped at R62,000. You can’t claim the full R70,000 because the credit can never exceed the local tax liability. The good news is the credit completely wipes out the South African tax on that income, but you don't get a refund for the extra R8,000 you paid overseas.

The Role of Double Taxation Agreements (DTAs)

South Africa has Double Taxation Agreements (DTAs) with over 80 countries, and these are the legal bedrock of the Section 6quat system. To properly navigate your foreign tax obligations, it's worth getting familiar with understanding international tax treaties and how they prevent you from being taxed twice.

A DTA clearly defines which country gets the first bite of the tax apple for different types of income. For business profits, the primary taxing right usually goes to the country where the work was done. The other country—in our case, South Africa—is then obligated to provide relief, which it does through the Section 6quat credit. These agreements give you the legal certainty you need to claim your credits confidently.

A Smarter Way to Handle Your Forex and Tax Planning

Getting your tax calculation right is obviously crucial, but that's really only half the battle. Truly smart financial management means your tax strategy is directly linked to how you handle your foreign exchange (forex).

Think about it: the exchange rate you get when you bring your money home doesn't just impact your profit. It literally determines the final ZAR amount you declare to SARS, which is the foundation of your entire tax calculation.

This is where hidden bank fees can quietly drain your profits and make tax prep a nightmare. Most traditional banks build a markup of 2-5% into their exchange rates. That means the Rand value that actually lands in your account is often much less than what the real market rate says it should be, creating a frustrating gap between what you earned and what you received.

Bring More of Your Money Home

Clever forex management is all about closing that gap. When you use a platform that offers the real, mid-market exchange rate without adding a spread, you ensure the maximum value of your hard-earned foreign currency makes it back to South Africa. This isn’t just about making more money—it's about gaining clarity and accuracy for your tax records.

Using a transparent forex solution like Zaro gives you a precise ZAR figure to plug straight into your foreign income tax calculator for South Africa. You no longer have to guess the impact of hidden fees or try to track down the exact rate on a specific day. Instead, you get a clean, defensible number that lines up perfectly with your financial statements, making your SARS submission simple and bulletproof.

By getting rid of the typical 2-5% markup that banks charge, a business bringing back $100,000 could save anywhere from R37,000 to R94,000 (assuming a rate of R18.80/USD). That saving goes straight to your bottom line.

This kind of precision is absolutely vital. When SARS looks at your return, the numbers have to make sense. A clear audit trail from a transparent forex provider removes any doubt about how you arrived at your declared ZAR income.

Make Cross-Border Payments and Compliance Easy

Earning foreign income often means paying international suppliers, freelancers, or for software subscriptions. Juggling multiple currencies and payment systems can quickly become an admin headache, increasing the risk of small errors that can throw your tax filings into chaos.

This is where a multi-currency account changes the game. By holding funds in their original currency (like USD or EUR), you regain control over when you make payments or convert funds back to ZAR. It allows you to be strategic, timing your conversions to take advantage of more favourable exchange rates.

A good interface, like the one from Zaro shown here, gives you an instant, clear dashboard for managing all your currency balances. You can see your ZAR, USD, and other holdings at a glance, making it simple to track funds and make transfers without any hidden costs.

This integrated approach brings a few key advantages to your business and its tax planning:

- Lower FX Costs: Using the real spot exchange rate for every transaction means you stop losing money to hidden fees and maximise the value of every transfer.

- Better Audit Trails: Every transaction is clearly documented with the exact rate used, giving you a clean, easy-to-follow record for your accountants and for SARS.

- Simpler Compliance: Modern platforms often have compliance checks built-in, making sure your international payments meet all the necessary regulations without you having to do it manually.

In the end, by tying your forex management directly to your tax planning, you create a far more efficient and profitable financial operation. You bring more of your foreign income home and arm yourself with the clear, accurate data you need for a stress-free tax season.

Frequently Asked Questions About Foreign Income Tax

When you're dealing with foreign income, a lot of very specific, practical questions tend to pop up. For business owners and their finance teams, getting straight answers is crucial for staying compliant with SARS and planning your finances with confidence.

Let's walk through some of the most common queries we get from South African businesses.

Do I Have to Declare Income I Haven't Brought Back to South Africa?

Yes, absolutely. This is probably the single biggest point of confusion, and getting it wrong can be costly. If you're a South African tax resident, you're taxed on your worldwide income.

It makes no difference whether the money is still sitting in a US bank account or has yet to be sent home. The tax obligation kicks in the moment you earn the income, not when it physically arrives in your ZAR account. Ignoring this can lead to some pretty hefty penalties and interest from SARS, so it’s a rule you really need to follow.

Which Exchange Rate Should I Use on My Tax Return?

SARS is very specific about this. For your annual income tax return, you must use the average exchange rate for the tax year in question (1 March to 28 February). SARS publishes these official tables on its website every year, and using them is non-negotiable for your final submission.

Grabbing the daily spot rate from the day a transaction happened is a common mistake for annual filings. The only time you'd typically use a spot rate is for calculating provisional tax estimates or for specific events like working out a capital gain.

A word of caution: using inconsistent rates is a surefire way to get your return flagged for a closer look. To keep things clean and compliant, always stick to the official SARS average exchange rate tables for your final calculations.

How Does a Double Taxation Agreement (DTA) Change My Calculation?

A Double Taxation Agreement, or DTA, is essentially a treaty between South Africa and another country to make sure you don't get taxed twice on the same income. It doesn’t mean you pay no tax; it just sorts out which country gets the first bite.

If you've paid tax in a country that has a DTA with South Africa, you can claim that tax as a foreign tax credit here at home. This is done under the Section 6quat provision. It directly reduces the South African tax you owe on that income, effectively preventing double taxation.

Can I Use a Foreign Income Tax Calculator for My Provisional Tax?

Definitely. In fact, that's one of the best ways to use it. A good foreign income tax calculator for South Africa is a brilliant tool for figuring out your two provisional tax payments, due at the end of August and February.

By plugging in your forecasted annual income from all sources—both local and foreign—you can get a very reliable estimate of your total tax bill for the year. This helps you make accurate provisional payments, which is key to avoiding those nasty underestimation penalties from SARS and keeping your business's cash flow healthy.

Stop losing money to hidden bank fees on your international revenue. With Zaro, you get the real exchange rate with zero spread, ensuring more of your hard-earned money makes it home. See how much you can save and simplify your cross-border payments by visiting https://www.usezaro.com.