At its heart, forex account management is simply the professional handling of your business's foreign currency. For any South African company operating internationally, this means taking active control over your exposure to currencies like the Dollar, Euro, or Pound to shield your profits and maintain financial stability.

What Forex Account Management Means for Your Business

Think of your South African business as a ship navigating the often-choppy seas of global trade. Forex account management is both your compass and your rudder. It gives you the tools to steer through turbulent currency waves rather than just being tossed around by them. It’s all about having a deliberate, strategic plan for your company's foreign currency.

This isn't a game reserved for massive corporations. Any business buying or selling across borders feels the sting of currency swings. Whether you're paying a supplier in US Dollars, getting paid by a client in Euros, or investing overseas, you have forex risk. A proper management process helps you move from being a passive victim of the market to an active player protecting your bottom line.

The Strategic Importance for South African Businesses

The main goal here is to protect your profits from the wild ride that the South African Rand (ZAR) can sometimes take. A sudden drop in the Rand’s value could make that dollar-denominated invoice you need to pay a whole lot more expensive overnight, shrinking your margins instantly. On the flip side, a stronger Rand can reduce the value of the foreign income you've worked hard to earn.

This financial discipline is especially critical in our local market. South Africa is the biggest player on the continent's forex scene, with daily trading volumes exceeding $2 billion and around 190,000 active traders as of 2025. This intense activity, coupled with the ZAR's known volatility, creates a mix of serious risks and real opportunities. To learn more about the dynamics of South Africa's forex market, xglobalfx.co.za offers some great insights.

A structured approach to managing your forex involves a few key steps:

- Monitoring Exposure: Always having a clear, real-time picture of all your foreign currency assets and debts.

- Risk Assessment: Figuring out exactly how a big currency swing could affect your cash flow and profitability.

- Hedging Strategies: Using smart financial tools, like forward contracts, to lock in an exchange rate for a future payment or receipt.

- Optimising Payments: Strategically timing your international payments to catch more favourable rates whenever possible.

By putting a formal process in place, you turn forex from a source of stress into a manageable part of your business. It’s about building predictability in a market that's anything but, securing your company’s financial health and paving the way for confident global expansion.

Ultimately, solid forex account management gives your business the control it needs to operate on the world stage without constantly worrying about currency markets wiping out your hard-earned revenue.

Building Your Forex Management Strategy

Crafting a solid forex management strategy isn't about some kind of financial dark art. It’s about building a clear, repeatable process that anyone on your team can understand and follow. For a South African business, this is the key to moving from a reactive stance—where you’re constantly scrambling to deal with currency swings—to a proactive one.

The entire structure really boils down to three foundational pillars: strategic planning, tactical execution, and continuous review.

This approach turns a vague goal like "we need to reduce our currency risk" into a concrete, actionable plan. Think of it as a blueprint for your finance team, giving them the steps to protect your profits and forecast with more certainty, even when the Rand is on one of its wild rides.

The Three Pillars of Forex Strategy

A successful forex plan is methodical. It’s built in stages, where each step lays the groundwork for the next. This creates a solid framework for handling your international payments and receipts without taking on unnecessary risk from currency fluctuations.

You start with the big picture and then zoom in on the daily actions needed to make it happen.

Strategic Planning: This is your "why." It all starts with setting clear, business-specific goals. Is your main objective to lock in a rate for a big import payment due in three months? Or is it about making sure the revenue you earn from overseas customers doesn't lose its value before it hits your bank account? Nailing down these objectives is the absolute first step.

Tactical Execution: This is the "how." Once you know what you want to achieve, you can figure out how to do it. This involves the practical side of things, like choosing the right forex account, selecting hedging tools like forward contracts, and actually executing your trades according to the plan.

Continuous Review: And finally, this is the "what's next." The forex market doesn't stand still, and neither should your strategy. This pillar is all about regularly checking how you’re doing against your goals and adjusting your approach based on what the market is doing or if your own business operations change.

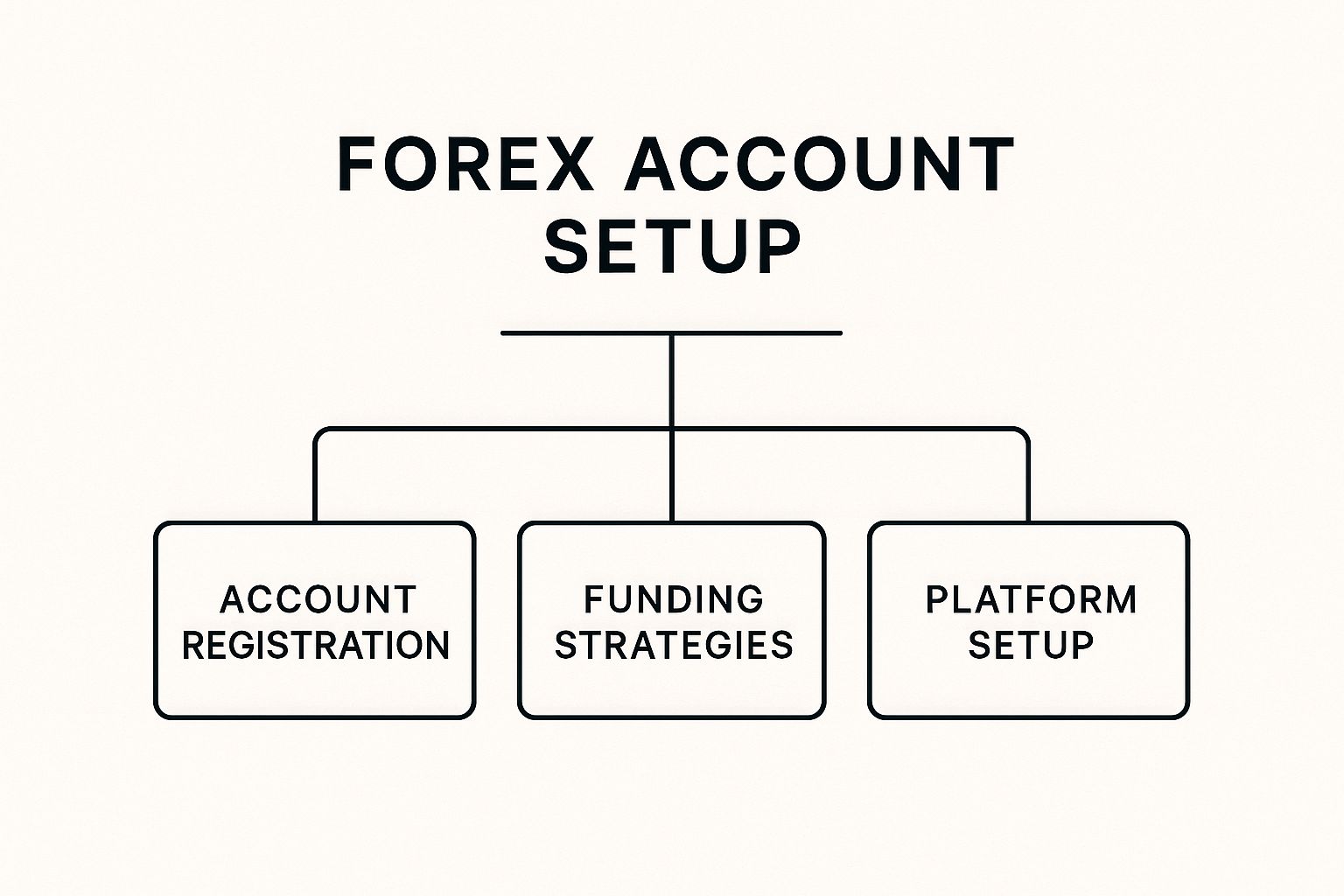

This visual breaks down the practical steps involved in getting the operational side of your forex account up and running.

As the diagram shows, a successful setup is about more than just filling out forms. It demands careful thought about how you'll fund the account and getting comfortable with the tools your chosen platform provides.

Aligning Strategy with Market Realities

Of course, your strategy can't exist in a bubble. It has to be grounded in what's actually happening in the wider economy. The forex market in South Africa is growing fast, which brings both opportunities and new complexities.

This isn't just a local trend. Across the continent, the number of retail forex traders has been jumping by about 30% annually since 2023. South Africa is at the forefront of this, with a daily forex turnover that some reports place at over $20 billion. This surge is fuelled by better internet and the explosion of mobile trading platforms, making the markets more accessible than ever. You can learn more about Africa's forex outlook and its projected growth with these insights from contentworks.agency.

A robust forex management strategy is not a "set it and forget it" document. It's a living guide that evolves with your business and the market, ensuring your financial decisions stay relevant and effective.

This dynamic environment means your planning has to account for these shifts. For example, the growing interest in digital assets alongside traditional forex might influence how you think about your company's financial portfolio. Good forex account management today means staying aware of these interconnected markets and building a strategy that's flexible enough to adapt.

By weaving these three pillars—planning, execution, and review—into the fabric of your financial operations, your business can build a resilient framework to manage its foreign currency exposure with real confidence.

Putting Essential Risk Controls in Place

When you're dealing with foreign exchange, especially the notoriously unpredictable South African Rand (ZAR), risk isn't just a part of the equation—it is the equation. Solid forex account management is less about making a killing on every single transaction and more about strategically protecting your capital from major hits. Putting a few non-negotiable risk controls in place is what separates a minor, manageable hiccup from a financial disaster that could seriously harm your business.

Think of these controls like the seatbelts and airbags in your car. You hope you never need them, but you’d be foolish to drive without them. In the same way, trading forex without using stop-loss orders or calculating your position size correctly is like driving down the N1 with a blindfold on. It’s only a matter of time before you hit something. These tools give you the framework to handle the ZAR’s swings with discipline, not emotion.

Automate Your Defences with Stop-Loss and Take-Profit Orders

The simplest, most effective risk controls are the automated ones that work for you in the background. They take the emotion out of the decision-making process, stopping you from desperately clinging to a losing trade or cashing out a winner too soon out of anxiety.

A stop-loss order is your ultimate safety net. It’s a pre-set instruction for your broker to automatically close out a trade if the price moves against you to a specific level. For example, say you buy USD/ZAR at 18.50. You could set your stop-loss at 18.30. If the exchange rate drops to that point, your position is closed, and your loss is capped at an amount you were comfortable with from the very beginning.

On the flip side, a take-profit order does the exact opposite. It automatically closes a winning trade once it hits your target price. Using that same example, you might set a take-profit order at 18.80. If the market moves in your favour and reaches that level, your profits are locked in before the tide has a chance to turn.

These automated orders are the bedrock of disciplined trading. They enforce your game plan even when you're not glued to the screen, giving you critical protection against sudden, sharp currency movements.

This kind of discipline is vital when you zoom out and look at the bigger picture. For instance, in May 2025, South Africa’s gross foreign exchange reserves hit a record $68.116 billion. While that kind of number can signal strength for the ZAR, economic news like this introduces new complexities. Managing the resulting volatility requires a structured approach. You can get a better feel for these market-moving factors by reviewing South Africa's foreign reserve data on tradingeconomics.com.

Master Your Position Sizing to Protect Your Capital

One of the most overlooked—yet most critical—parts of risk control is position sizing. This is simply the process of deciding how much of your capital you’re going to put on the line for any single trade. A classic rookie mistake is betting too big, where just one or two bad trades can blow a massive hole in your account.

The golden rule here is to only risk a small fraction of your total trading capital on any one position. Most experienced traders stick to a strict 1% to 2% rule.

Here’s a practical look at how that works:

- Know Your Capital: Imagine your business has a R200,000 forex account.

- Choose Your Risk Level: You decide to stick to a conservative 1% risk per trade.

- Calculate Your Max Loss: 1% of R200,000 is R2,000. That’s the absolute maximum you're prepared to lose on this one trade.

- Figure Out Your Position Size: Now, based on where you’ve placed your stop-loss, you can calculate the right trade size to ensure that if your stop-loss is triggered, your loss is exactly R2,000.

This methodical process ensures no single trade can ever put your business’s financial health in jeopardy. It’s all about staying in the game long enough for your strategy to pay off, absorbing the inevitable small losses while you wait for the winners. At its core, good forex account management is about playing the long game.

Choosing the Right Platforms and Tools

https://www.youtube.com/embed/4S2s8CJjqD4

Your technology stack is the engine room of your entire forex account management strategy. The right tools can give you a serious edge and critical insights, but the wrong ones can be a costly anchor, slowing you down at every turn. For any South-African business dealing with international trade, picking the right platforms isn't just a technical decision—it's the first real step toward taming currency risk.

This isn't just about choosing a trading platform. It's about building a complete ecosystem of tools that feed you information, automate routine tasks, and most importantly, protect your capital. From spotting market trends to checking how well you're doing, your tech stack really dictates what you’re capable of.

Core Trading Platforms: MT4 vs. MT5

For most businesses, the journey starts with selecting a trading platform. Globally, and especially here in South Africa, two names dominate the conversation: MetaTrader 4 (MT4) and its newer sibling, MetaTrader 5 (MT5). They might sound almost identical, but they cater to slightly different needs.

MetaTrader 4 (MT4): Launched way back in 2005, MT4 is the tried-and-tested veteran in the forex world. It’s loved for being straightforward, reliable, and having a massive community that has built countless indicators and automated trading bots (known as Expert Advisors). If your business is purely focused on hedging and trading currencies, MT4 is often more than enough to get the job done and is incredibly user-friendly.

MetaTrader 5 (MT5): The successor, MT5, is a true multi-asset platform. This means it doesn't just handle forex; it's built for stocks, futures, and commodities too. It comes packed with more advanced charting tools, more timeframes to analyse, and a handy built-in economic calendar. If your business has broader hedging needs beyond just currency pairs, MT5 is the more flexible and powerful choice.

For most South African businesses whose main headache is managing ZAR exposure against dollars, euros, or pounds, MT4's focused functionality is often the perfect starting point. However, if you're running more complex, multi-asset strategies, MT5 is the better long-term, future-proof option.

Essential Supporting Tools

A smart forex strategy needs more than just a trading terminal. To really level up your analysis and decision-making, you need to bring in a few supporting tools to give you the data and context you need.

The goal here is to shift from just executing trades to making genuinely informed financial decisions. Your tools should give you a crystal-clear view of market events, sharp analytical insights, and a transparent record of your performance.

This is where you need to think holistically about your technology. Consider adding these essentials to your toolkit:

1. Economic Calendars: Think of these as your early warning system for market turbulence. An economic calendar flags scheduled events like interest rate decisions from the South African Reserve Bank (SARB), inflation data releases, and GDP announcements. Simply knowing when these are happening helps you anticipate potential ZAR swings and adjust your positions before the market moves.

2. Analytical Software: While MT4 and MT5 have decent built-in analytics, specialised third-party software can offer much deeper insights. These platforms can provide advanced sentiment analysis, recognise trading patterns, and track your performance with far more detail, helping you fine-tune your risk management over time.

3. Account Management and Reporting Software: For any business, a clear audit trail and performance records are non-negotiable. Using platforms like Zaro that offer integrated account management can be a lifesaver. It simplifies international payments and gives your finance team clean, clear reporting—absolutely vital for both internal governance and staying compliant with SARS.

The Critical Importance of FSCA Regulation

Let's be absolutely clear: above everything else, the single most important factor when choosing any platform or broker is regulation. In South Africa, the authority you need to look for is the Financial Sector Conduct Authority (FSCA).

Never, ever work with a broker or platform that is not licensed by the FSCA. This regulation is your primary shield. It ensures your company's funds are kept in separate accounts (not mixed with the broker's own money) and that the provider operates under strict, enforceable standards. Choosing an FSCA-regulated partner isn't just a good idea; it's the ultimate risk control measure for your business.

Adopting Best Practices for Sustainable Growth

Getting forex account management right isn’t a one-off task you can tick off a list. It’s an ongoing discipline. For South African businesses, this is especially true. The ZAR’s infamous volatility can wipe out profits in the blink of an eye, so these best practices aren't just "nice-to-haves"—they're your lifeline to long-term financial stability and confident global growth.

Think of it like servicing a high-performance engine. You can skip an oil change or two, and the car might still run. But eventually, you're going to face poor performance and a very expensive breakdown. By embedding these habits into your financial workflow, you're not just avoiding disaster; you're building a solid foundation that turns a stressful, reactive task into a strategic advantage.

Commit to Continuous Learning

The global economy never stands still, and those shifts have a direct and often immediate impact on the Rand. Staying informed isn't optional; it's a core part of the job. A commitment to continuous learning means your finance team is always looking ahead, anticipating trends, understanding new regulations, and paying attention to geopolitical events that could send currencies tumbling.

This doesn’t mean you need to become a full-time market analyst. It’s about creating a habit of consuming reliable financial news, keeping an eye on the South African Reserve Bank's policy signals, and understanding how things like global commodity prices sway the ZAR. This knowledge empowers you to make proactive, intelligent decisions instead of just reacting to the noise.

Develop Disciplined Trading Psychology

One of the biggest risks in any kind of forex activity isn't the market—it's human emotion. Fear and greed are powerful motivators that can convince even the most seasoned finance professional to ditch a perfectly good strategy. The only defence is to build a culture of disciplined trading psychology.

This boils down to one simple rule: stick to the plan. Honour your pre-defined stop-loss and take-profit levels. Resist the urge to chase a runaway market or panic-sell during a dip. Emotional decisions are almost always poor financial decisions.

A well-defined strategy is your greatest defence against emotional trading. It provides a logical framework for action, ensuring that every decision is deliberate and aligned with your business objectives, not driven by market sentiment.

Maintain Meticulous Records

Keeping excellent records is non-negotiable, and for two very important reasons. First and foremost, you need it for compliance with the South African Revenue Service (SARS). Every single transaction, every profit, and every loss must be documented with precision to keep your tax reporting accurate and defensible.

Second, those records are a goldmine of strategic insight. By analysing your past performance, you can see exactly what's working and what isn't. This data-driven feedback loop is priceless for refining your strategy over time, helping you cut out costly mistakes and double down on what works.

- For SARS Compliance: Track every trade's entry and exit points, the exchange rates, and the final profit or loss in ZAR.

- For Strategy Refinement: Make a note of why you made each trade. Was it a straightforward hedge for an invoice, or an opportunistic move?

- For Performance Review: Use the data to calculate key metrics like your win/loss ratio, average profit per trade, and average loss. These numbers tell the real story of your effectiveness.

Schedule Periodic Strategy Reviews

Your business changes, and so should your forex strategy. The approach that worked perfectly six months ago might be completely wrong for your current needs or today's market conditions. Setting up periodic reviews is the only way to ensure your strategy stays relevant.

Put a recurring date in the calendar—quarterly is a good rhythm for most—to sit down with the team and put your entire approach under the microscope. Ask the tough questions:

- Are our forex activities still supporting our main business goals?

- Is our risk tolerance still right for the company's current financial health?

- Are our tools and technology still doing the job efficiently?

- Do we have new projects or international suppliers that demand a change in our hedging strategy?

By weaving these practices into your company's operational DNA, you build a robust system for responsible and effective forex account management. It's a system that not only protects your bottom line but actively supports sustainable, long-term growth.

A Few Common Questions Answered

When you're first getting into forex account management for your business, it's natural to have a lot of questions. Let's tackle some of the most common ones that South African businesses ask, breaking them down into simple, practical answers.

What’s the Real Minimum Capital I Need to Start?

This is a classic question, but the truth is, there’s no magic number. The capital you need isn't set by some official rule; it's dictated entirely by your business's situation. Think about factors like the scale of your international transactions, how much risk you're comfortable with, and the specific broker you end up working with.

Sure, some basic retail accounts might let you start with a few thousand Rand. But for a business that's serious about managing currency risk from international trade, that simply won't cut it. You'll need a much more substantial capital base to make any meaningful impact.

The key isn't to fixate on a minimum deposit. Instead, ask yourself: "How much capital do we need to properly execute our hedging strategy and ride out market volatility without it causing a cash flow crisis for our main operations?" We always suggest sitting down with a financial advisor to figure out a realistic and sustainable amount for your company.

The right amount of capital is whatever allows your business to manage risk effectively without being over-leveraged. It's about sustainability, not just meeting a broker's minimum deposit requirement.

Is the Money I Make from Forex Management Taxable in South Africa?

In a word, yes. Any profit your business makes from its forex activities is absolutely considered taxable income by the South African Revenue Service (SARS). How it's taxed, however, can differ.

SARS will generally look at your forex earnings in one of two ways:

- As Income: If you're trading frequently and it's a regular part of your business's financial operations, SARS will likely view the profits as normal income, taxed at your company's standard rate.

- As Capital Gains: If the trading is more sporadic and has the character of an investment, the profits could be subject to Capital Gains Tax (CGT) instead.

The difference really comes down to intent and frequency. Because this can be a grey area, keeping meticulous, detailed records of every single transaction is non-negotiable. Your best bet is to work with a tax professional who specialises in financial markets. They can help you stay compliant with SARS and make sure you're handling your tax obligations correctly.

How Do I Find a Forex Broker I Can Actually Trust?

This is probably the most important decision you'll make in this entire process. Partnering with the right broker is everything, and the number one thing you must check is their regulatory status.

Any broker or management service you even consider must be licensed and regulated by South Africa's Financial Sector Conduct Authority (FSCA). No exceptions. FSCA oversight is your most important layer of protection against bad actors. Once you've confirmed that, you can dig deeper and compare your shortlisted options based on these points:

- Reputation and Track Record: What are other businesses saying about them? Check reviews, look for testimonials, and see how long they've been around.

- Transparent Fees: Make sure all their costs—from spreads to commissions—are laid out clearly. There should be no nasty surprises or hidden charges.

- Good Customer Support: Before you commit, test them out. Are they responsive? Helpful? You'll need them eventually.

- The Right Tools: Does their trading platform have the features and tools your business actually needs to manage its risk?

For South African businesses looking to eliminate the complexity and hidden costs of international payments, Zaro offers a powerful solution. Manage your global transactions with real exchange rates, zero SWIFT fees, and complete financial control. Discover a better way to handle your cross-border finance.