When you hear "forex exchange," what comes to mind? For many South Africans, it might seem like something reserved for big banks and international corporations. But in reality, it's a global marketplace accessible to anyone with an internet connection, right here from home.

Forex is short for foreign exchange. At its most basic, it's the act of swapping one currency for another. Think of it as a massive, 24/7 global bazaar where instead of spices or textiles, countries' currencies are being bought and sold.

What Forex Exchange Means for South Africa

The goal for a trader is to profit from the constantly shifting values between these currencies. You might speculate on whether the South African Rand (ZAR) is going to get stronger or weaker against major players like the US Dollar (USD), the Euro (EUR), or the British Pound (GBP).

Let’s use a simple example. Say you believe the South African economy is on an upswing. You might decide to "buy" the ZAR by selling your USD. If your prediction is right and the Rand's value climbs, you can then sell your ZAR back for more US Dollars than you started with. That difference is your profit. Of course, the reverse is also true – if you anticipate bad news that could weaken the Rand, you might sell it, hoping to buy it back later at a lower price.

A Growing Financial Hub

The market for forex exchange in South Africa isn't just a small, niche activity; it's a booming part of our national financial landscape. We're seeing more and more local traders getting involved, and the world is taking notice.

The South African foreign exchange market was valued at an estimated USD 3.86 billion in 2024. It’s not slowing down either. Projections show the market is expected to hit USD 6.85 billion by 2033, growing at a steady rate of about 6.58% each year.

This rapid expansion makes it clear why understanding this market is so important. It's a dynamic space influenced by everything from local interest rate decisions by the SARB to global political events, creating unique opportunities for those who are prepared.

Core Concepts to Grasp

Before you can even think about trading, you need to get a handle on the jargon. The forex world has its own language, but the key concepts are straightforward once you break them down.

To get you started, here’s a quick rundown of the essential terms every South African trader should know.

Key Forex Concepts for South African Traders

| Term | Simple Explanation | Example with ZAR |

|---|---|---|

| Currency Pair | Forex is always traded in pairs. The first currency is the 'base,' and the second is the 'quote.' The price shows how much of the quote currency is needed to buy one unit of the base. | In the USD/ZAR pair, the price (e.g., 18.50) means it costs R18.50 to buy one US Dollar. |

| Pip | Short for 'Percentage in Point,' a pip is the smallest possible price change in a currency pair. It's how traders measure their profits and losses on a trade. | If USD/ZAR moves from 18.5000 to 18.5001, that is a one-pip movement. |

| Leverage | This is essentially a loan from your broker that lets you control a much larger position with a small amount of your own money. It magnifies both potential profits and potential losses. | With 100:1 leverage, you could control a R100,000 position with just R1,000 of your own capital. |

| Spread | This is the broker's fee for facilitating your trade. It's the tiny difference between the 'buy' price (ask) and the 'sell' price (bid) of a currency pair. | The broker might offer to sell USD/ZAR at 18.5050 (ask) but will only buy it from you at 18.5000 (bid). The 0.0050 difference is the spread. |

Getting comfortable with these fundamentals is your first real step. As you can see from the market's growth projections, there’s a compelling reason to learn. The South African forex scene is a fascinating intersection of our local economy and the massive global financial stage.

Understanding FSCA Regulations and Trader Protection

Before you jump into the world of forex exchange in South Africa, you need to get familiar with the rules of the road. Think of the forex market like a busy highway—you wouldn't dream of driving on it without traffic lights and clear laws. For South African traders, our chief traffic officer is the Financial Sector Conduct Authority (FSCA).

The FSCA is the country's main market regulator. It's an independent body with a clear job: to make sure our financial markets are fair, transparent, and working as they should. Their core mission is to protect you, the customer, from dodgy practices and financial crime.

Don't see the FSCA as a barrier. See them as your first and most important line of defence. Choosing a broker without an FSCA licence is like trying to navigate that highway blindfolded—it’s a risk you just don’t need to take.

What FSCA Regulation Means For You

So, what does it actually mean when a broker is "FSCA regulated"? It’s far more than just a fancy logo on their website. It’s a guarantee that they are held to a strict set of rules designed specifically to protect your money and your interests.

An FSCA-regulated broker is legally bound to follow several non-negotiable standards. These obligations are the bedrock of trader security in South Africa.

Here are the key protections you get:

- Segregated Client Funds: This is the big one. Your trading capital must be held in a bank account that is completely separate from the broker’s own business funds. This means they can't use your money to pay their bills, and your cash is protected if the broker runs into financial trouble.

- Transparent Operations: Regulated brokers have to be upfront about everything. All their fees, spreads, and service terms must be clearly stated. No hidden costs, no nasty surprises—just the information you need to make smart decisions.

- Fair Business Practices: The FSCA keeps a close eye on brokers to ensure they treat clients fairly, execute trades ethically, and don't make misleading promises in their advertising. This helps weed out manipulative tactics.

When you're looking at a broker's terms, it's also worth getting your head around dispute resolution processes, which often involves understanding arbitration clauses in their agreements.

Verifying a Broker’s Licence

This is a simple but absolutely critical step. Don’t just take a broker’s word that they are regulated—always check for yourself. The FSCA keeps a public database of all authorised Financial Service Providers (FSPs).

You can instantly verify a broker's licence by visiting the official FSCA website. Just search for them by name or their FSP number. If they don’t show up, they are not authorised to operate in South Africa. Simple as that.

This check takes two minutes, but it buys you incredible peace of mind. It confirms that the broker is legitimate and answerable to a powerful local authority. This accountability is what separates the serious players in the forex exchange South Africa market from the risky, unregulated outfits.

Ultimately, choosing an FSCA-regulated partner is the single most important decision you'll make to protect yourself on your trading journey.

What Moves the South African Rand

The South African Rand (ZAR) is notorious for its volatility. It often makes headlines with its dramatic swings, but what are the real forces pulling the strings? If you're involved in forex exchange in South Africa, understanding these drivers is non-negotiable—they directly hit your import costs, export profits, and investment returns.

Think of the Rand’s value like a small boat on a big ocean. It’s constantly being pushed and pulled by multiple currents, some local and some global. Learning to read these currents helps you anticipate where the boat is heading.

Unlike heavy-hitters like the US Dollar, which is swayed by a massive global economy, the Rand is uniquely sensitive to a few key factors. This might make it seem unpredictable, but it also means its movements are often tied to specific, trackable events.

The Power of Commodities

South Africa is a resource powerhouse, and our economy is deeply plugged into the global commodities market. This connection has a huge and direct effect on the Rand's value.

It’s a simple supply and demand story. When prices for key exports like gold, platinum, and coal are high, more foreign currency (mostly US Dollars) floods into the country to buy them. This increased demand for the ZAR strengthens its value. The reverse is also true: when commodity prices drop, the inflow of dollars slows to a trickle, weakening the Rand.

- Gold: As one of the planet's top gold producers, the ZAR often dances to the same tune as the gold price. A rising gold price is almost always good news for the Rand.

- Platinum Group Metals (PGMs): South Africa absolutely dominates the global supply of platinum and palladium. Because of this, the health of the global auto industry—a massive consumer of PGMs for catalytic converters—can directly influence the Rand’s performance.

This is why seasoned traders keep one eye on global commodity charts and the other on currency pairs like USD/ZAR. It’s not always a perfect one-to-one relationship, but it gives you a critical piece of the puzzle.

The SARB and Interest Rate Decisions

The South African Reserve Bank (SARB) is the other major player shaping the Rand's fate. Its main weapon is the repo rate—the interest rate at which it lends money to commercial banks.

This rate sets the tone for borrowing costs across the entire economy, and it's a huge magnet for foreign investment. Higher interest rates tend to make a country's currency much more attractive to international investors hunting for better returns on their cash.

When the SARB hikes interest rates, it can trigger an influx of foreign capital, which creates demand for the ZAR and pushes its value up. On the flip side, cutting rates makes the Rand less appealing and can cause it to weaken.

Because of this, the SARB’s Monetary Policy Committee (MPC) meetings are some of the most tense, closely-watched events on the economic calendar. The statements they release are scrutinised for clues about the future of forex exchange in South Africa.

Economic Data and Global Risk Appetite

Beyond commodities and central bank moves, the day-to-day health of the South African economy provides constant fuel for currency shifts. Key economic reports can signal strength or weakness, prompting traders to either buy or sell the Rand in droves.

A few of the most important data points to watch are:

- Gross Domestic Product (GDP): This shows the overall growth rate of the economy.

- Inflation Rate (CPI): It measures how fast prices are rising and heavily influences the SARB's decisions.

- Unemployment Figures: A crucial indicator of economic health and social stability.

- Trade Balance: The simple difference between what we export and what we import.

Finally, the Rand is also considered an "emerging market" currency, meaning its value is heavily influenced by global risk appetite. When investors are feeling confident about the global economy, they are more willing to buy assets in places like South Africa, which strengthens the ZAR. But when global fear and uncertainty take hold, they often dump riskier assets and run for "safe-haven" currencies like the US Dollar, causing the Rand to fall.

For instance, as of late September 2025, the spot exchange rate was relatively stable, hovering around 17.3580 ZAR/USD after a month of minor fluctuations, which reflected a period of calmer global sentiment. You can always track historical exchange rate data for a deeper analysis.

How to Find the Best Forex Broker for You

Choosing the right partner for your journey into forex exchange in South Africa can feel like the toughest part of getting started. With dozens of platforms all promising the moon, how do you cut through the marketing noise and find a broker that actually fits what you need? The trick is to approach it with a clear-headed, logical checklist.

Think of picking a broker like you’re hiring a critical member of your team. You wouldn't bring someone on board without checking their credentials, understanding what they charge, and making sure they have the right tools for the job. You need to apply that same level of scrutiny here. Your broker is your gateway to the market, and making the right choice can have a massive impact on your entire trading experience.

This isn't about finding some mythical "best" broker that works for everyone. It's about finding the best broker for you. Your experience level, how you plan to trade, and what you want to achieve financially will all point you in a specific direction.

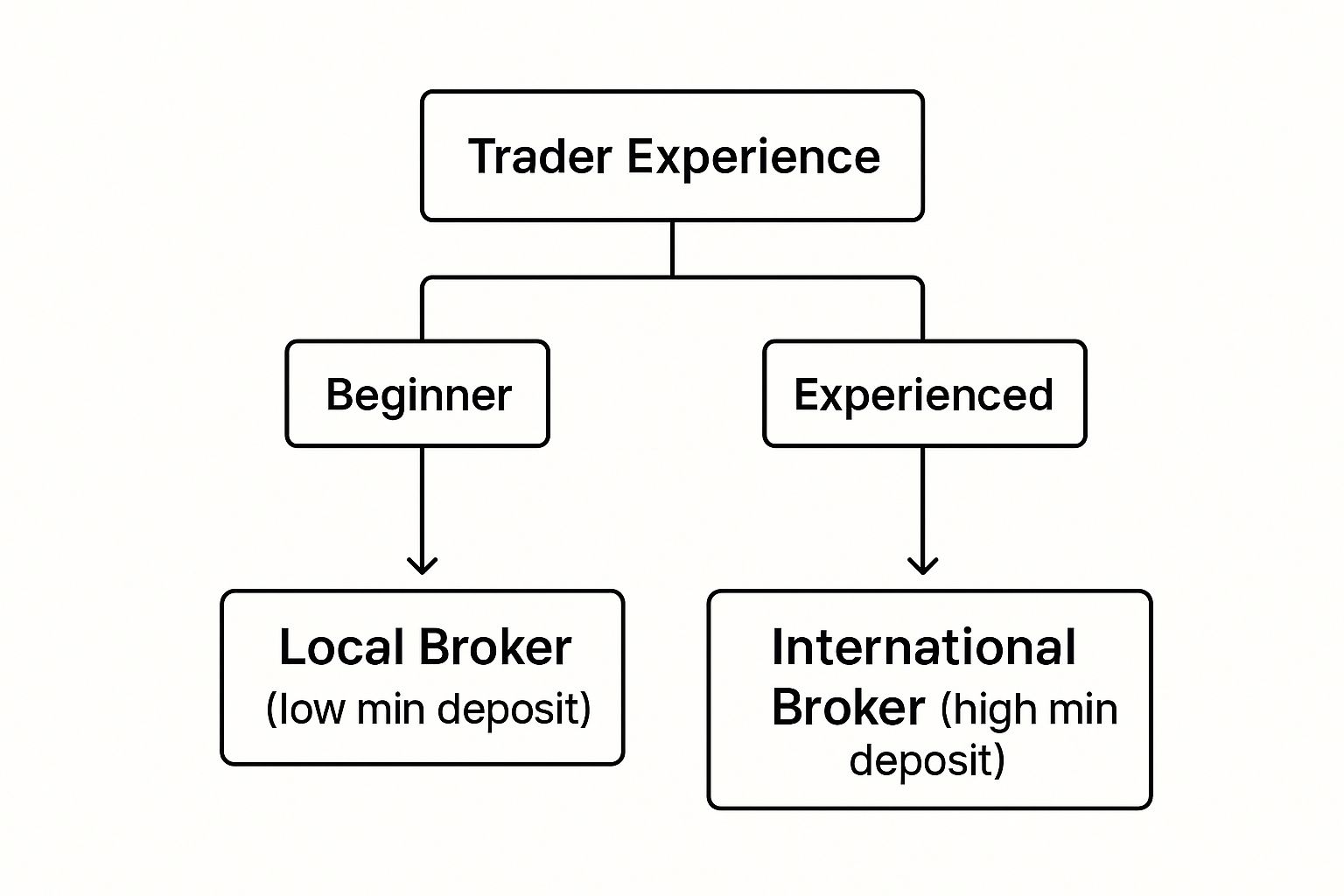

To give you an idea of how this works, here's a simple decision tree that shows how your experience might guide whether you start with a local or an international broker.

As you can see, newcomers often find their feet faster with local brokers who have lower barriers to entry. On the other hand, seasoned traders might actively seek out the advanced features and broader market access that bigger international platforms can offer.

Start with FSCA Regulation—Always

Your very first filter should be a deal-breaker: is the broker regulated by the Financial Sector Conduct Authority (FSCA)? As we’ve already touched on, this is your single most important layer of protection. An FSCA licence is your assurance that the broker operates legally in South Africa and plays by strict rules, including keeping your funds in a separate account from their own.

Don't just take their word for it. You must personally verify their Financial Service Provider (FSP) number on the official FSCA website. If you search for their FSP number and nothing comes up, walk away. Seriously. No flashy bonus or tight spread is worth the risk of putting your money with an unregulated company.

Analyse the Real Costs of Trading

Brokers make their money through a mix of fees, and if you don’t understand them, they can quietly eat into your profits. Look past the big "zero commission" headlines and dig into the real costs you’ll face on every single trade.

- Spreads: This is simply the tiny difference between the buy and sell price of a currency pair. The smaller or "tighter" the spread, the less it costs you to trade. It’s a good idea to compare the live spreads on major pairs like EUR/USD and USD/ZAR across a few brokers to see who really offers better value.

- Swap Fees: You might also hear these called overnight or rollover fees. They're charges for holding a position open from one day to the next. If you're a long-term trader holding positions for days or weeks, these small fees can really start to add up.

- Deposit and Withdrawal Fees: Does the broker charge you to put money in or take money out? Pay close attention to this, especially for local South African payment methods like EFT.

A broker can shout about zero commission but have incredibly wide spreads, making them far more expensive in the long run. Always do the maths to figure out the total cost per trade for a true, apples-to-apples comparison.

Evaluate Trading Platforms and Tools

The trading platform is your office, your cockpit. It absolutely must be reliable, easy to navigate, and packed with the tools you need to make sense of the markets. Here in South Africa, most brokers will offer you a choice between the two giants: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 has been the industry workhorse for years. It's famous for being rock-solid and has a massive community building custom indicators and automated trading strategies (known as Expert Advisors). MT5 is the newer version, offering more timeframes, more built-in indicators, and access to other markets like stocks. The best way to decide is to open a demo account and take both for a test drive. See which one feels right to you.

Prioritise Local Support and ZAR Accounts

Finally, don't forget the practical side of trading from South Africa. A huge plus is a broker that offers a ZAR-based trading account. This means you can deposit, trade, and withdraw in Rands, completely dodging those annoying and often costly currency conversion fees every time you move money.

Just as important is the quality of their customer support. Is there a local team you can call? Having someone in a Johannesburg or Cape Town office who understands the local banking system can be a lifesaver when you run into a funding issue or a technical glitch right in the middle of a trading session. Easy-to-reach, knowledgeable local support is a great sign that a broker actually cares about its South African clients.

To tie all this together, here’s a handy checklist you can use when you're comparing different brokers.

Broker Selection Checklist for South African Traders

| Feature | What to Look For | Why It Matters |

|---|---|---|

| Regulation | An active FSCA licence with a verifiable FSP number. | This is your primary protection against scams and ensures the broker meets strict financial standards. |

| Trading Costs | Tight, competitive spreads on major pairs (especially USD/ZAR), low swap fees, and zero deposit/withdrawal fees for local methods. | Lower costs directly translate to higher potential profits for you. Hidden fees can quickly erode your gains. |

| Account Type | A ZAR base currency option. | Avoids unnecessary currency conversion fees on all deposits, withdrawals, and trade calculations. |

| Trading Platform | A stable, user-friendly platform like MT4 or MT5 with reliable execution and the tools you need. | Your platform is your primary tool. It needs to be fast, reliable, and intuitive to use under pressure. |

| Customer Support | A local South African phone number and responsive support team available during SA trading hours. | When you need help, you want it fast and from someone who understands the local context. |

| Payment Methods | Easy, fast, and free local deposit options like EFT from South African banks. | Ensures you can fund your account and access your profits quickly and without hassle. |

Using a structured approach like this turns a confusing decision into a straightforward process of elimination. It helps you focus on the factors that genuinely matter for a successful and secure trading experience in South Africa.

Your First Trade: A Step-by-Step Walkthrough

Alright, we've covered the theory. Now it's time to roll up our sleeves and get practical. Making your first trade can feel like a big leap, but when you break it down into simple steps, it becomes a much clearer and more logical process. This guide is here to walk you through it, helping you build confidence by showing you exactly how to start safely.

We'll move from getting your account set up to actually placing that first trade. Most importantly, we'll hammer home the tools you need to protect your money right from the get-go. A solid foundation in risk management is non-negotiable for anyone serious about forex exchange in South Africa.

Step 1: Account Setup and Verification

First things first, you need to choose an FSCA-regulated broker and open an account. Think of it like opening a new bank account—it’s a standard procedure and a critical part of keeping your funds secure.

You'll have to provide some documents to verify who you are, which is part of the "Know Your Customer" (KYC) regulations. Don't be put off by this; it’s a good sign. It means your broker is legitimate and working to prevent financial crime.

- Proof of Identity: Your green bar-coded ID book, a valid ID card, or your passport will do the trick.

- Proof of Residence: A recent utility bill or bank statement with your address on it is usually required.

Once you’ve submitted your documents, verification typically takes anywhere from a few hours to a day or two.

Step 2: Funding Your Account in ZAR

With your account verified, it's time to deposit some funds. For us in South Africa, it's always smartest to use a broker that offers local payment methods and ZAR-denominated accounts. Why? It helps you sidestep unnecessary and often costly currency conversion fees.

Most good brokers support instant EFT or direct bank transfers from major South African banks like FNB, Standard Bank, and Absa. Getting money into your account should be quick and fee-free, so your capital shows up on your trading platform without delay.

Pro Tip: Don't skip the demo account! Before you put a single Rand on the line, spend a few days or even weeks trading on a demo platform. It's the perfect way to get a feel for the software, test out your ideas, and make all your beginner mistakes without any real financial pain.

Step 3: Placing Your First USD/ZAR Trade

Let's walk through a practical example. Imagine you've been watching the markets and you believe the South African Rand is likely to weaken against the US Dollar because of some upcoming economic news. In this scenario, you'd "buy" the USD/ZAR pair, speculating that its price will go up.

So, you open your trading platform (like MT4 or MT5) and bring up the USD/ZAR chart. The current price is sitting at 18.5000. You decide it's time to enter the market.

- Open a New Order: Look for the "New Order" button on your platform.

- Select the Pair: Choose USD/ZAR from the list of available currency pairs.

- Set Your Volume: This is your trade size. As a beginner, you should always start with the smallest possible lot size (like 0.01 lots) to keep your risk to an absolute minimum.

- Execute the Trade: You hit the "Buy" button to enter the trade at the current market price.

And just like that, you have an open position. But you're not done yet—the most crucial part is still to come.

Step 4: Setting Your Safety Nets

Placing a trade without setting protective orders is like driving a car without a seatbelt. It's just asking for trouble. Two essential tools, the stop-loss and the take-profit, are your best friends for managing risk automatically. Every single trade should have them.

Stop-Loss Order: This is your emergency exit hatch. It's an instruction you give your broker to automatically close your trade if the market moves against you by a specific amount. For our USD/ZAR buy trade at 18.5000, you might set a stop-loss at 18.4500. This puts a hard cap on your potential loss, protecting your account from a sudden, nasty market swing.

Take-Profit Order: This is how you lock in your winnings. It tells your broker to automatically close your trade once it hits your profit target. If you expect USD/ZAR to climb, you could set a take-profit order at 18.6000.

These two orders are vital. They remove emotion from your decision-making and enforce discipline, which are absolutely key to surviving and thriving in the fast-paced world of forex exchange in South Africa.

Common Questions About Forex in South Africa

Dipping your toes into the world of forex exchange in South Africa is bound to bring up a few questions. It’s a massive market, the lingo can feel like a new language, and getting a handle on the local rules is key to starting off on the right foot. This section tackles the most common queries we hear from new traders, with clear, straight-to-the-point answers to help you start your journey with confidence.

Think of this as your go-to FAQ. We’ll cut through the noise on the big topics—legality, startup costs, taxes, and which pairs to watch—so you can move ahead with a solid grasp of what really matters for traders here in South Africa.

Is Forex Trading Legal in South Africa?

This is usually the first question on everyone's mind, and the answer is a simple, resounding yes. Forex trading is completely legal in South Africa, but there’s a non-negotiable condition attached. You absolutely must trade through a broker that is licensed and regulated by our local watchdog, the Financial Sector Conduct Authority (FSCA).

The FSCA’s job is to keep the market honest and fair, protecting everyday people like you from scams and shady practices. Choosing an FSCA-regulated broker isn’t just good advice; it's the only way to ensure your money has legal protection under South African law.

You’ll see plenty of ads from unregulated international brokers, but going down that path means putting your capital at serious risk. If anything goes wrong, you have no local legal help to turn to.

How Much Money Do I Need to Start Trading Forex?

One of the biggest myths floating around is that you need a mountain of cash to start trading forex. The truth? The barrier to entry is surprisingly low. Many reputable, FSCA-regulated brokers in South Africa will let you open a live account with as little as R150 (around $10).

But just because you can start that small doesn’t necessarily mean you should. A minimal deposit is great for getting a feel for the platform with real money on the line, but it leaves you with virtually no wiggle room for mistakes or proper risk management.

A more realistic starting capital, say somewhere between R3,000 to R5,000, gives you far more breathing room. It lets you place smaller, more sensible trades relative to your account balance and ride out the normal market waves without getting a dreaded margin call.

Before you put any real rands on the line, do yourself a favour and spend quality time on a demo account. It’s a completely risk-free playground to test your strategies and get comfortable with your trading platform.

Are My Forex Profits Taxable in South Africa?

Yes, they 100% are. This is a crucial detail that trips up a lot of new traders. From the South African Revenue Service (SARS)'s perspective, any money you make from forex trading is considered income, which means it’s subject to income tax.

You’re legally required to declare all your trading profits on your annual tax return. How much tax you’ll pay depends on your total annual income, as your trading profits are simply added to your other earnings and taxed at your personal income bracket.

To stay on the right side of SARS, you need to keep meticulous records of everything. This includes:

- Detailed Trade Logs: Keep a spreadsheet of every trade—entry price, exit price, date, and the resulting profit or loss.

- Broker Statements: Download and file your monthly and annual statements from your broker without fail.

- Proof of Deposits and Withdrawals: Have a clear paper trail of all money moving between your bank and your trading account.

Given that tax laws can get tricky, having a chat with a qualified tax professional in South Africa is always a smart move to make sure you’re ticking all the right boxes.

What Are the Best Currency Pairs for South African Traders?

While you have access to dozens of currency pairs, traders in South Africa often find their groove by focusing on two main categories. Your choice will likely come down to your personal trading style and what you know best.

First up are the major currency pairs. These are the heavyweights of the forex world—think EUR/USD, GBP/USD, and USD/JPY. They come with two massive advantages:

- High Liquidity: You can get in and out of trades instantly, meaning your orders are filled fast without fuss.

- Low Trading Costs: The spreads (the broker's fee) on these pairs are usually razor-thin, which saves you money on every trade.

The second category, and one that's hugely popular here at home, involves our very own South African Rand (ZAR). Trading pairs like USD/ZAR, EUR/ZAR, and GBP/ZAR gives you a unique home-ground advantage.

When you trade the Rand, you can directly use your knowledge of the South African economy, political developments, and announcements from the South African Reserve Bank (SARB). You’re much closer to the information that moves these currencies, which can give you a real analytical edge. Many local traders find a sweet spot by mixing a few majors with ZAR pairs for a well-rounded approach.

Navigating international payments and managing foreign exchange can be a major hurdle for South African businesses. Hidden fees, poor exchange rates, and slow transfer times all cut into your bottom line. At Zaro, we provide a direct path to the real exchange rate, eliminating the spreads and fees that traditional banks charge. Our platform offers a clear, secure, and efficient way to handle global transactions in both ZAR and USD, giving your business the financial control it needs to grow. Discover how much you could save on your next international transfer by visiting https://www.usezaro.com.