A forex micro account is exactly what it sounds like: a trading account designed for trading in much smaller increments. Instead of dealing with huge sums of money, you trade in micro lots, which are bundles of 1,000 units of a currency. This brings the barrier to entry way down, making it a perfect starting point for anyone new to the forex world.

Your Starting Point for Forex Trading

Imagine learning to drive. You probably wouldn't start in a high-performance race car on a busy highway. You’d start in a regular car, in an empty parking lot, getting a feel for the controls. A forex micro account is that empty parking lot. It’s a real, live trading environment—not a simulation—but the stakes are deliberately kept low so you can learn without a major financial disaster.

The whole concept hinges on the micro lot. In the professional forex market, trades are usually measured in 'standard lots', which represent 100,000 units of currency. That's a serious amount of capital. A micro lot is just 1% of that size, making it far more manageable.

Why This Matters for New Traders

Because the lot size is so much smaller, your financial exposure on every single trade is drastically reduced. Each tiny price movement in the market, known as a 'pip', results in a much smaller profit or loss on a micro account. This isn't a bug; it's the main feature. It allows you to get a genuine feel for the market, test out your strategies, and experience the real psychology of having money on the line—all without risking your life savings.

Think of a forex micro account as the essential stepping stone between a risk-free demo account and a full-scale standard account. It’s where you truly learn to handle the emotional pressure of trading, something a demo account can never teach you.

A Gateway for South African Traders

Here in South Africa, the forex micro account has become the go-to entry point for everyday people wanting to trade currencies. Our local forex market is the largest in Africa, with over $20 billion changing hands every day. Since 2023, the number of retail traders has been jumping by about 30% each year, mostly thanks to easy-to-use mobile apps.

These accounts have blown the doors wide open. With brokers often requiring minimum deposits as low as $1 to $10, the foreign exchange market is no longer just for the big financial players. You can dig deeper into these trends in the 2025 outlook on Forex trading in Africa.

How Micro Lots, Leverage, and Margin Work Together

To really get your head around a forex micro account, you need to understand three moving parts that are completely intertwined: micro lots, leverage, and margin. Getting these concepts down is crucial because they directly control your trading power, your risk, and how much money you actually need to get started.

Let's break them down one by one.

The Secret Weapon: The Micro Lot

The star of the show in a micro account is, unsurprisingly, the micro lot. In the forex world, trades are sized in standardised blocks called 'lots'. The big players trade in 'standard lots', which are a hefty 100,000 units of a currency. A step down from that is the 'mini lot' at 10,000 units.

But the micro lot is the smallest of them all, representing just 1,000 units of your base currency.

This tiny trade size is exactly what makes micro accounts so brilliant for anyone new to the game. It drastically shrinks the value of each tiny price movement (known as a 'pip'). For instance, if you were trading the EUR/USD pair on a standard account, a single pip move would be worth about $10. On a micro account? That same one-pip shift is worth a mere $0.10.

This difference is massive. It means the market can swing against you without wiping out your account, giving you the breathing room you desperately need to learn from your mistakes.

To see how these account types stack up, take a look at the table below. It clearly shows how the lot size changes everything, from the amount of currency you're controlling to what each pip is worth.

Forex Account Types Compared: Lot Size and Pip Value

| Account Type | Lot Size (Units) | Pip Value (Approx. on USD Pairs) |

|---|---|---|

| Standard | 100,000 | $10.00 |

| Mini | 10,000 | $1.00 |

| Micro | 1,000 | $0.10 |

As you can see, the jump from a standard account to a micro account is huge. The financial impact of a trade is 100 times smaller, which is a massive safety net when you're just finding your feet.

What Is Leverage in a Micro Account?

Next up is leverage. Think of it as a tool that lets you control a much larger amount of currency with a small amount of your own capital. It’s like using a pry bar to lift something incredibly heavy—a small effort from you moves a much bigger object. In forex, your broker provides borrowed capital to amplify your trading position.

Leverage is always shown as a ratio, like 100:1. This simply means that for every R1 of your own money you put down, you can control R100 in the market.

A R1,000 deposit with 100:1 leverage gives you the trading power of R100,000. This is how traders with smaller accounts can open meaningful positions. But here's the catch: leverage magnifies everything—your potential profits and your potential losses.

This is exactly why starting with micro lots is so important. The small trade size puts a natural cap on your risk, so even with the magnifying effect of leverage, a losing trade won't be catastrophic while you're learning.

How Margin Ties It All Together

Finally, we have margin. Margin isn't a fee you pay; it's the good-faith deposit your broker requires you to set aside to open and maintain a leveraged trade. Think of it as the collateral you put up to access the broker's leverage. The specific amount of margin you need depends on your trade size and the leverage ratio.

So, here’s how it all connects:

- You decide to open a trade using a micro lot (1,000 units of currency).

- Your broker provides leverage (say, 100:1) to amplify your position.

- The margin is the small slice of your own money that gets locked in as collateral for that trade.

This system is perfectly designed to give new traders a safe, controlled way to experience the real market without taking on terrifying levels of risk.

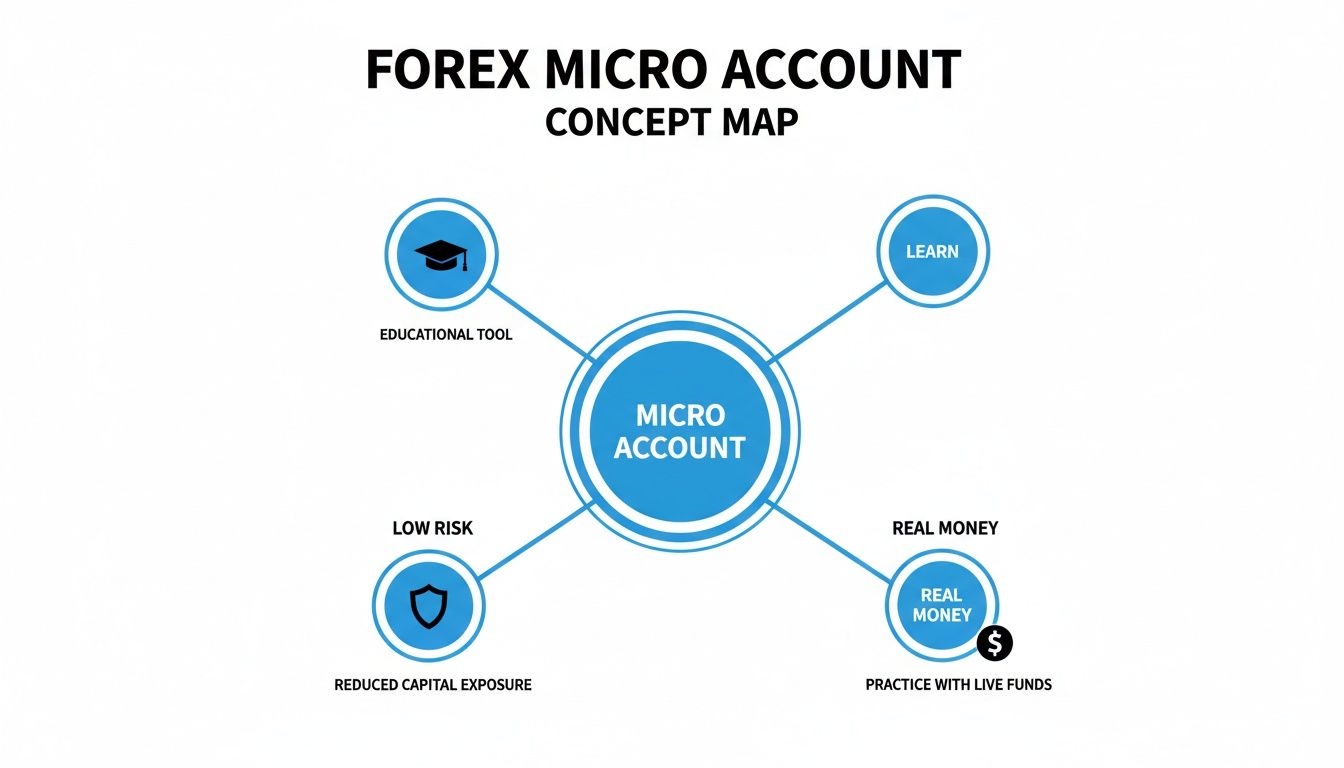

This concept map helps visualise how a micro account’s features—its educational focus, low-risk nature, and real-money practice—all work in concert.

It really drives home the point that these accounts are first and foremost learning tools, designed to help you build real-world trading skills with built-in safety features.

The Real Advantages for New South African Traders

For anyone in South Africa just starting to look at the world of forex, the sheer size of it all can be pretty daunting. A forex micro account completely changes that picture, offering a much more manageable and structured way to get started. Its benefits go way beyond just needing less money upfront.

These accounts are all about lowering the barrier to entry and letting you build real skills in a live market. Let's break down the three main reasons they're such a smart choice for new traders.

Minimal Capital Outlay

The most obvious perk is how little cash you need to get going. Standard accounts might ask for thousands of Rands, but you can often open a forex micro account with a tiny deposit—sometimes for less than the price of a decent coffee.

This accessibility takes a massive weight off your shoulders. You're not risking a huge chunk of your savings just to learn the ropes. It allows you to dip your toes into the market without the constant fear of a major loss, making it a genuinely practical first step for almost anyone.

Smarter Risk Management

It’s not just about the small deposit; the entire structure of a micro account teaches you about managing risk. Because you're trading in micro lots (1,000 units of currency), the value of each pip movement is incredibly small, often just a few cents. Think of it as a built-in safety net.

Let's be honest, when you're learning, you're going to make mistakes. A micro account ensures those mistakes are cheap lessons, not financial disasters. This is the perfect environment for building the solid trading habits you'll need later on.

This fits right in with how many savvy South Africans approach investing. It’s common practice to keep trading capital under 5% of a total investment portfolio to keep risk in check. And considering that about 72% of forex traders jump in with zero prior experience, the low-stakes nature of a micro account is an essential training ground. You can find more insights on trader behaviours and trends on seacrestmarkets.io.

An Authentic Market Experience

Sure, a demo account is great for figuring out where the buttons are on a trading platform. But it completely fails to simulate the one thing that defines trading: psychological pressure. Trading with fake money just doesn't feel the same as having your own hard-earned Rands on the line.

This is where a micro account shines.

A micro account lets you learn with real skin in the game, minus the life-altering risk.

You get to experience the real emotions of fear and greed that drive trading decisions, but at a level that won't leave you sleepless. Learning to control your emotional reactions is perhaps the toughest skill in trading, and a micro account is the perfect place to start that journey. It’s a real-world classroom for building the discipline and mindset needed to succeed long-term.

Navigating the Risks and Limitations

While a forex micro account is a fantastic training ground, it’s vital to walk in with your eyes wide open. These accounts are built for one primary purpose: education. They are not a ticket to generating a significant income. If you can get your head around that from the start, you can manage your expectations and use the account exactly as intended—to build your skills without blowing up your bank account.

The biggest reality check is that smaller risks naturally mean smaller rewards. The very feature that protects your capital—the tiny value of each pip—also keeps your profits equally small. You simply won't get rich trading on a micro account, and that's entirely by design. The real prize here isn't the money; it's the consistent learning and the slow, steady refinement of your strategy.

The Psychological Leap to a Standard Account

After getting the hang of things and finding some consistent success on a micro account, many traders hit an unexpected wall: the psychological jump to a bigger account. Let's be honest, trading with R100 feels worlds apart from trading with R10,000. The emotional weight of having real, substantial money on the line can make even a seasoned micro account trader throw their carefully crafted strategy out the window.

It’s crucial to have a solid plan for this transition. Moving up from a micro to a mini or standard account shouldn't just be about chasing bigger returns. It should be a deliberate step you take after hitting clear milestones, like maintaining profitability for several months and having unshakeable confidence in your trading plan.

Potential Broker Restrictions

Another thing to keep on your radar is that brokers don't always give their micro accounts the five-star treatment. It’s pretty common for them to offer slightly less favourable conditions on these entry-level accounts.

You might run into:

- Wider Spreads: The gap between the buy and sell price could be larger, which subtly eats into your potential profits over time.

- Fewer Tradable Instruments: Your access might be limited to major currency pairs, with fewer exotic pairs or other assets available.

- Limited Features: Some of the more advanced charting tools or analytical features could be reserved for traders on standard or premium accounts.

A forex micro account is a powerful tool for forging discipline and strategy, but its true value is only realised when you see it as a temporary, educational phase. The real goal is to build a foundation of skills you can confidently carry into bigger trading arenas.

Always do your homework and check a broker's specific micro account conditions before you sign up. To really sharpen your skills and manage risk effectively, getting a solid grip on technical analysis for beginners is a massive help for making sense of market movements, no matter what size account you're trading.

How to Choose a Regulated Broker in South Africa

Let's be blunt: your success and security in forex trading are only as good as the broker you choose. For South African traders just starting out with a forex micro account, picking a trustworthy and properly regulated broker isn’t just a good idea—it’s the most critical first step you will ever take.

The absolute non-negotiable is regulation. Here in South Africa, that means your broker must be authorised and overseen by the Financial Sector Conduct Authority (FSCA). Think of an FSCA licence as your first line of defence against scams and shady operations.

FSCA oversight forces brokers to play by a strict set of rules. A big one is that they have to keep your trading funds in segregated accounts, completely separate from their own company money. This simple but powerful rule means that if the broker ever runs into financial trouble, your capital is ring-fenced and can't be used to pay their debts.

Your Broker Vetting Checklist

Before you even think about depositing a single Rand, put every potential broker through this simple checklist. Any decent broker offering a forex micro account will be completely upfront about these details, so they should be easy to find.

- FSCA Regulation: Is their FSCA licence number displayed clearly on their site? Don't just take their word for it. Go to the official FSCA website and verify that number yourself.

- Minimum Deposit: How much do you need to open a micro account? Look for a low, manageable amount, usually somewhere between R200 and R1,000.

- Leverage Options: What leverage can you get on a micro account? Make sure they offer flexible options so you can start with a lower, safer level while you find your feet.

- Typical Spreads: What are their average spreads on major pairs like USD/ZAR or EUR/USD? The tighter the spread, the less it costs you to trade.

- Customer Support: Can you get hold of someone in South Africa? Having local support available during our business hours is a massive plus when you really need help.

Choosing an FSCA-regulated broker is the single most important decision you'll make. It ensures you are trading within a framework designed for fairness and investor protection, separating legitimate platforms from risky, unregulated operations.

Why a Strong Regulatory Framework Matters

Picking a regulated broker does more than just keep you safe; it puts you in a much better trading environment. The FSCA has been actively tightening its grip, demanding higher standards from any broker offering forex services in the country.

This directly helps traders like you by making sure your funds are safer and that you're treated fairly. As a result, FSCA-authorised brokers tend to offer better educational material and risk management tools—things like guaranteed stop-losses, which are essential for managing your risk on a forex micro account. You can learn more about how these economic frameworks protect consumers on deloitte.com.

Making an informed choice right from the start protects your investment and sets you up for a sustainable trading journey. Take the time to do your homework—it’s the best trade you can make before you ever place your first one.

When to Move Beyond a Micro Account

Think of a forex micro account as your training wheels. It’s the perfect place to learn the ropes, make mistakes without catastrophic consequences, and build your confidence. But it was never meant to be the final destination.

The real goal is to prepare you for the bigger leagues. Figuring out when to make that leap is a crucial decision, and it shouldn't be rushed or based on a whim. Moving up too soon is a classic, and often costly, mistake.

Instead of just chasing bigger profits, your focus should be on hitting clear, measurable milestones. This is about proving to yourself that your success isn't just a string of lucky breaks, but the result of a repeatable and strategic process.

Key Milestones for Graduating

So, what signs tell you it's time to level up?

First and foremost is consistent profitability. This doesn't mean you win every single trade—nobody does. It means that over a decent stretch of time, say three to six months, your account balance is steadily trending upwards. This proves your strategy can handle the market's natural ebbs and flows, not just a single favourable run.

Next up, you need a well-defined and documented trading strategy. You should be able to follow your own plan without letting your emotions get the better of you. Ask yourself honestly: can you stick to your rules for entries, exits, and risk management, even when you're having a bad day? If you're still winging it or bending your rules, you're not ready.

Graduating from a forex micro account is less about the size of your capital and more about the maturity of your trading process. It's an upgrade in responsibility, driven by proven skill, not just ambition.

Finally, you have to be financially ready. Before you even think about a mini or standard account where the stakes are much higher, you need to have enough risk capital. This is money you can genuinely afford to lose without it affecting your lifestyle or causing you sleepless nights.

Making the Leap with Confidence

Once you've consistently checked all three of these boxes, you can start planning the move. A smart approach is to do it incrementally. Consider graduating to a mini account before jumping straight into a standard account.

This gives you time to adjust to the psychological shift of trading with larger amounts of money. The pressure feels different when more is on the line, and a gradual step-up helps you manage that.

Ultimately, your goal is to make sure your skills, strategy, and capital are all aligned and ready for the next level. See this as a promotion you've earned through discipline and hard work. A methodical approach like this is how you build a sustainable trading career, instead of becoming another cautionary tale.

Common Questions About Forex Micro Accounts

Stepping into the world of forex trading always stirs up a few questions. Let's tackle some of the most common ones that traders in South Africa have about micro accounts, so you can get started with your head in the right place.

How Much Money Do I Need to Start?

This is where the forex micro account really shines—its accessibility. The exact starting deposit will depend on your broker, but you'll find many that let you open an account with as little as $5 to $50 (that’s about R90 to R900).

This incredibly low barrier to entry is intentional. It’s designed to give you a chance to trade with real money and feel the market, without having to put up a huge amount of capital right out of the gate.

Can I Make a Living with a Micro Account?

Let's be realistic here: it's highly unlikely you'll make a living wage from a micro account alone. By design, these accounts limit your risk, which naturally means your potential profits are also small.

Its true value isn't about generating a full-time income. Think of it as your live training ground—the perfect place to test strategies, learn discipline, and get a handle on market psychology without risking the farm.

The real profit from a micro account isn’t monetary; it’s the skill, experience, and confidence you gain. These are the assets that will serve you when you are ready to trade with larger amounts of capital.

Are Forex Profits Taxable in South Africa?

Yes, absolutely. Any profit you make from forex trading is considered income and is taxable in South Africa. You have a legal obligation to declare these earnings to the South African Revenue Service (SARS).

My best advice? Keep detailed records of every single trade. It's also a smart move to chat with a tax professional to make sure you're staying on the right side of the regulations.

What Is the Main Difference from a Demo Account?

The big difference comes down to one thing: real money. A demo account is a fantastic tool for learning the ropes of a platform using virtual cash, so there's zero risk involved.

A forex micro account, on the other hand, uses your own capital. Even though the stakes are low, the simple act of having real money on the line introduces the genuine emotional pressures of trading—like fear and greed. This is a crucial lesson that a demo account, for all its benefits, just can't teach you.

For South African businesses dealing with payments across borders, managing foreign exchange risk is a constant challenge. Zaro provides a clear, transparent solution with real exchange rates, zero spread, and no hidden fees, helping your business handle international payments efficiently. Find a better way to manage your company's FX needs by visiting the official Zaro website.