Trying to get a handle on the forex rate for USD can feel a lot like guesswork, but it really doesn't need to be. If you're running a South African business that deals with international trade or payments, the USD/ZAR rate is one of the most important numbers you'll look at.

Think of it simply as the price tag on the US dollar, paid for with our Rands. And that price tag is always on the move.

Your Essential Guide to the USD Forex Rate

This guide is designed to pull back the curtain on what makes that price tag jump around. We’ll look at everything from big global economic news right down to policy decisions made here at home. My goal is to cut through the confusing jargon and give you a straightforward way to understand what's really driving the numbers.

By the time you're done, you'll know where to look for the best rates and, more importantly, how to shield your business from the costly surprises that currency swings can bring. This is your practical playbook for making smarter financial moves in a global market. It doesn't matter if you're paying suppliers in the US, getting paid by international customers, or managing a remote team—a solid grasp of the forex rate is vital for your financial health.

Why This Rate Matters to Your Business

The USD/ZAR exchange rate isn't just a number you see on a news ticker; it has a direct, real-world impact on your costs and profits. A bad turn in the rate can make your imported goods more expensive overnight. On the flip side, a favourable move can instantly increase the value of the money you earn from exports.

For any South African business, ignoring currency fluctuations is like trying to sail without a compass. A seemingly tiny shift in the rate can completely wipe out the profit margin on a large deal, turning a good transaction into a loss.

Getting to grips with the dynamics of the forex rate for USD gives you a real strategic edge. It means you can:

- Improve Budgeting and Forecasting: You can more accurately predict what future USD expenses will actually cost you in Rands.

- Optimise Payment Timing: You have the insight to make international payments when the rate is in your favour, not against you.

- Protect Profit Margins: You can put strategies in place to guard against the risk of the currency moving the wrong way.

- Enhance Competitiveness: It allows you to price your goods and services much more effectively on the world stage.

At the end of the day, understanding the basics of foreign exchange is a core skill for any business with international exposure. This guide will give you the foundation you need to stop being a passive "rate-taker" and start actively managing your currency risk.

What Really Moves the USD to ZAR Exchange Rate?

The daily rollercoaster of the USD to ZAR exchange rate isn't just random market noise. It's the result of powerful economic forces constantly playing a game of tug-of-war with the value of each currency. For any South African business dealing with international payments, getting a handle on these drivers is the first, most crucial step to managing currency risk.

Think of it this way: international capital is like water, always flowing towards the highest, safest return. Interest rates, set by central banks, are the magnets that direct this flow. When the US Federal Reserve hikes its rates, holding US dollars suddenly becomes a more attractive proposition for global investors. Demand for the dollar goes up, and it strengthens against the Rand.

On the other side of the coin, when our own South African Reserve Bank (SARB) raises local interest rates, it can entice foreign capital into ZAR-based investments, giving our currency a much-needed boost. This constant push and pull between central bank policies is a major reason the forex rate for USD never sits still.

Commodities, Confidence, and the Rand

South Africa's economic heartbeat is closely tied to the global commodities market. We're a major exporter of precious metals like gold and platinum, so the health of our economy—and by extension, the Rand's value—often mirrors the prices of these resources. When commodity prices are booming, it usually means more US dollars are flowing into the country, which helps strengthen the ZAR.

But pure economic data never tells the full story. Investor sentiment and political stability are massive wildcards. Any whiff of bad news about South Africa’s political or economic future can send international investors running for the exits, pulling their capital out and weakening the Rand. This kind of "risk-off" mood often pushes them towards so-called "safe-haven" currencies like the US dollar, causing the USD/ZAR rate to shoot up.

The forex market is essentially a barometer of global confidence. It reacts in real-time not just to economic reports, but to headlines, political speeches, and subtle shifts in market mood. This is why having a proactive currency strategy is so essential.

Inflation's Slow Burn

Inflation—the rate at which the price of everything goes up—is another powerful, long-term force. It slowly eats away at a currency's purchasing power. A country with consistently high inflation will almost always see its currency weaken over time against one with lower inflation. So, the inflation gap between South Africa and the United States is another critical piece of the puzzle, shaping the long-term trend of the exchange rate.

All these forces blend together to create a market that’s dynamic and, at times, incredibly volatile. For example, in the year leading up to September 2025, the Rand actually saw a modest appreciation against the greenback, strengthening by about 1.53% over the 12-month period. More recently, it gained around 1.67% in a single month, trading near a ten-month high of about 17.35 ZAR per dollar, thanks in part to a rally in gold prices. You can dig deeper into these trends and find more performance data by checking out the latest reports from sources like Trading Economics about South Africa's currency.

By keeping a close watch on these key drivers, you can start to anticipate potential shifts instead of just reacting to them. This knowledge is the foundation for making smarter, more timely decisions on your international payments.

Here are the main signals to watch:

- Interest Rate Decisions: Keep an eye on announcements from both the US Federal Reserve and the SARB.

- Commodity Prices: Pay close attention to the global prices of gold, platinum, and coal.

- Political and Economic News: Stability and investor confidence are absolutely critical for the Rand.

- Inflation Data: Track the difference in inflation rates between South Africa and the US.

Uncovering the Hidden Costs in Forex Transactions

Ever noticed that the exchange rate you see on the news isn't the one your business actually gets? You're not alone. Many companies, especially small and medium-sized ones, unknowingly lose a chunk of their money to hidden fees and inflated markups when making international payments. Getting a handle on these costs is the first, and most important, step to protecting your bottom line.

The whole game boils down to understanding the difference between the mid-market rate and the customer rate.

Think of the mid-market rate as the "real" exchange rate. It’s the perfect midpoint between what buyers are willing to pay and what sellers are asking for on the global currency markets. This is the forex rate for USD you see flashing on Google or a financial news channel.

But when you go to your bank to make a transfer, they give you a customer rate, which has their profit margin baked right in.

The Spread: Where the Real Cost Hides

That profit margin is called the spread. It’s just like the difference between the wholesale price a shop pays for a product and the retail price you pay at the till. The bigger the spread, the more the bank or provider is making from your transaction.

Let's say the mid-market USD/ZAR rate is 17.50. A bank might offer to sell you dollars at 17.85. That 35-cent difference is their spread, and it directly chips away at the amount of foreign currency your business receives for its Rands.

The spread is often the single biggest hidden cost in any forex deal. It might look like a tiny fraction, but on larger payments, it can easily add up to thousands of Rands, quietly eating into your profit margins.

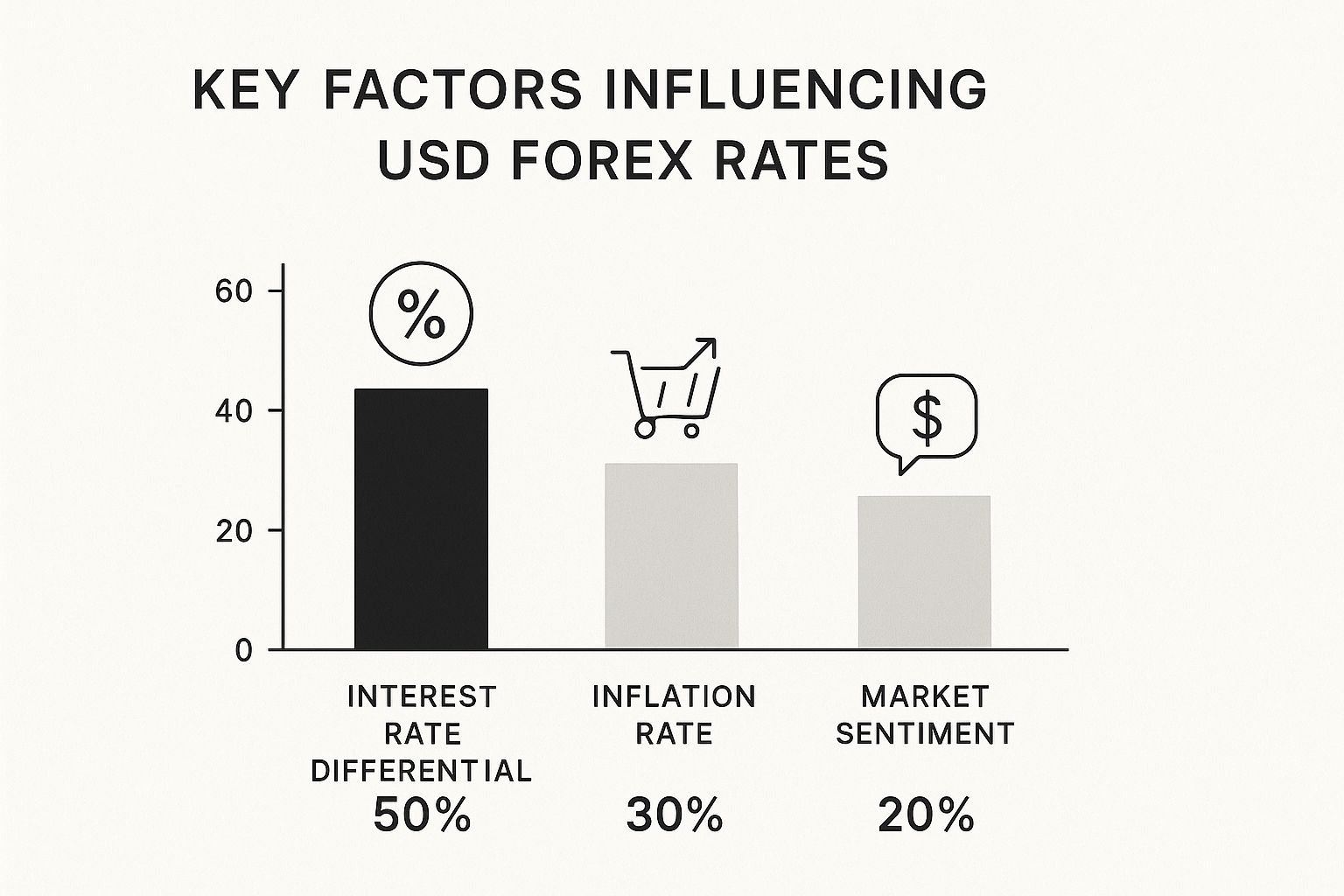

This is where things get interesting. The mid-market rate itself is constantly moving, influenced by huge global forces long before any provider adds their markup.

As you can see, things like central bank interest rate decisions and national inflation figures are massive drivers. They create the dynamic, ever-shifting base rate that spreads are then built on top of.

Don't Forget the Extra Fees

On top of the spread, a whole menu of other fees can inflate the total cost of your international transfer. These usually show up as separate line items on your statement, but they're easy to miss if you're not looking for them.

Keep an eye out for these common costs:

- Transfer Fees: This is a flat fee, sometimes called a SWIFT fee, charged just for processing the payment.

- Commissions: Some providers charge a percentage-based fee on the total value of your transaction.

- Intermediary Bank Fees: If your money has to pass through other banks to get to its destination, they might take a slice of the pie too.

When you add these fixed fees to a wide currency spread, the true cost of sending money abroad can be shockingly high. It's exactly this problem that modern fintech platforms like Zaro were designed to fix. They focus on transparency, often by offering transfers at the real mid-market rate and getting rid of these extra charges.

Let’s put this into perspective. Here’s a quick comparison to show just how much these different cost models can impact a standard international payment.

Forex Cost Comparison: Traditional Bank vs. Fintech

| Cost Component | Typical High Street Bank | Modern Fintech Platform |

|---|---|---|

| Exchange Rate Spread | 2-4% markup on the real rate | 0% (You get the mid-market rate) |

| Transfer/SWIFT Fees | R300 – R600 per transfer | R0 (No transfer fees) |

| Commissions | Often a percentage of the total amount | R0 (No commission charges) |

| Total Cost | High and often hard to predict | Low and completely transparent |

The difference is stark. While traditional routes hide costs in the rate and add extra fees, newer platforms prioritise a clear, simple structure that ultimately leaves more money in your business's account.

How to Find and Analyse the Live Forex Rate

To make smart financial decisions, you need access to reliable, real-time data. Tracking the live forex rate for USD isn't just for professional traders anymore; it's a must-do for any business dealing with international payments. Knowing where to look and what you’re looking at gives you the power to be proactive, not reactive.

Your first port of call should be finding an unbiased source for the mid-market rate. Think of this as the "true" exchange rate—the wholesale price before any bank or provider adds their markup. Financial news giants like Bloomberg and Reuters are the gold standard here, offering a clean, institutional-grade view of the market.

Mastering the Basics of a Currency Chart

Once you've found a reliable data source, the next step is learning how to read a basic currency chart. You don't need to become a technical analyst overnight. It's about pulling out the practical insights that can guide your payment timing and financial planning.

A currency chart is really just a visual story of how an exchange rate has behaved over time. It helps you see past the minor daily "noise" and spot the significant, longer-term trends that actually matter.

When you pull up a USD/ZAR chart, you want to focus on three key things:

- Trend Direction: Is the line generally heading up or down over weeks or months? An upward trend means the Dollar is getting stronger (it costs you more Rands to buy one). A downward trend means the Rand is gaining ground.

- Volatility: Are the movements small and steady, or are they wild, jagged swings? High volatility points to market uncertainty and, for you, increased risk.

- Historical Performance: Take a look at the highest and lowest points over the last year. This gives you crucial context. Is today's rate historically high, low, or just average?

Simply put, a chart turns a stream of raw numbers into real intelligence. It helps you judge whether a rate movement is just a temporary blip or the start of a bigger shift, letting you make decisions on the front foot.

For example, the USD/ZAR rate often moves by about 0.05 to 0.1 ZAR on any given day. But big economic news can cause sharp spikes, something every importer and exporter needs to watch closely. In the first half of September 2025, the rate swung between 17.31 and 17.57 ZAR, part of a broader trend showing the Rand slowly recovering from earlier highs near the 18.0 mark. You can explore more historical data to get a clearer picture of these movements and understand the historical USD to ZAR rates.

A Practical Example for Importers

Let's make this real. Imagine your business in South Africa has a $50,000 invoice to pay a supplier in the US.

The finance manager takes a quick look at the recent chart and notices the Rand has been steadily getting stronger over the past two weeks, moving from 17.80 down to 17.40.

Instead of paying right away, they decide to watch the trend for a couple more days. By waiting and making the payment at 17.40 instead of 17.80, the business saves a cool R20,000. That's not a small amount. This simple act of monitoring the market turns knowledge into direct, tangible savings on the bottom line. That's the real power of actively analysing the live forex rate.

How to Get Better Forex Rates

Knowing how the market works is only half the battle. The real goal is turning that knowledge into actual savings. For South African businesses, simply taking whatever forex rate for USD your bank gives you on the day is a sure-fire way to leak profit. But with a proactive currency strategy, you can shield your bottom line from volatility and lock in much better outcomes.

It's about shifting your mindset from being a passive rate-taker to an active manager of your business's currency exposure. This means using the right tools and, crucially, partnering with the right financial provider to stack the odds in your favour.

Lock in Your Rate with Forward Contracts

A forward contract is one of the most effective tools in your arsenal for managing currency risk. Think of it like pre-ordering your US dollars at a price you agree on today for a transaction that will happen down the road.

This simple agreement lets you lock in a specific exchange rate for a payment you need to make or receive up to a year from now. Say you're an importer with a $100,000 invoice due in three months. A forward contract takes all the guesswork out of it. You secure the rate now, and it doesn't matter if the market swings against you between now and then; your cost in Rands is fixed.

The benefits here are huge:

- Budget Certainty: Exchange rate risk vanishes, letting you forecast your costs and revenue with pinpoint accuracy.

- Margin Protection: You stop worrying about an unfavourable currency swing wiping out your hard-earned profit margins.

- Simplified Planning: It takes away the stress of constantly trying to time the market for your payments.

Choose the Right Forex Partner

Who you choose to handle your forex has a direct, massive impact on the rates you get and the fees you pay. Most businesses default to their traditional bank, but banks are notorious for building wide spreads into their rates and tacking on extra transfer fees, all of which quietly eats into your money.

Modern fintech specialists like Zaro work differently. They use technology to slash overheads and plug directly into global currency markets, allowing them to offer rates much closer to the real mid-market rate. This transparency means you see exactly what you're paying and get a better deal, free from hidden costs.

Working with a specialist isn't just about saving a bit on one transaction. It's about getting access to smarter tools, expert support, and a streamlined process that gives your finance team more control and a clearer view of your international payments.

A Proactive Strategy in Action

Let’s look at a real-world example. A Cape Town-based company imports electronic components from the US. For years, they paid their USD invoices through their high-street bank whenever they fell due, simply accepting the rate of the day. Their costs were all over the place, and a sudden dip in the Rand once erased nearly 15% of their expected profit on a major shipment.

They decided to switch to a proactive strategy. First, they started using forward contracts to lock in rates for their biggest orders three to six months ahead of time. Second, they moved all their transactions to a fintech platform that gave them the mid-market rate without the hidden fees.

The change was immediate and profound. By locking in a forex rate for USD at 17.50 for a $200,000 payment, they completely sidestepped a market shift that saw the rate climb to 18.10. That single decision saved them R120,000 and turned their financial planning from a reactive gamble into a predictable, strategic advantage.

A Historical View of USD/ZAR Volatility

To get a real feel for the future of the forex rate for USD, you first have to look back. The history of the USD/ZAR exchange rate isn't a straight line; it's a story of constant movement, showing just how much global and local events can shake the Rand’s value. Looking at this past performance makes one thing crystal clear: for a South African business, having a proactive currency strategy isn’t a nice-to-have, it’s an absolute necessity.

Think about it. Major global events almost always send ripples, if not waves, through our currency. Events like the 2008 financial crisis saw a massive "flight to safety," where investors dumped riskier assets and poured their money into US dollars. The result? The ZAR took a serious knock. On the home front, shifts in our political landscape or new economic policies can cause the exchange rate to react sharply, often overnight.

The Real-World Impact of Rate Swings

This isn't just theory for economists to debate; it has a direct and sometimes painful impact on your bottom line. The historical data shows a currency pair that swings between dramatic peaks and troughs, creating both huge risks and occasional opportunities. This constant movement, or volatility, is exactly why managing your foreign currency exposure has to be a core part of your business operations.

For those wanting a deeper technical understanding of how to measure these market jitters, you can explore various methods to calculate implied volatility.

A look at history turns volatility from a vague, confusing idea into a tangible business risk. When you see just how much the rate can move in a short time, it becomes obvious that simply accepting the rate on the day you need to make a payment is a massive gamble with your profit margins.

You don't even have to look that far back. Recent history gives us a perfect example of this rollercoaster. The forex rate for USD has been on a wild ride, pushed and pulled by what's happening both globally and right here in South Africa. For instance, in April 2023, the rate shot up to an all-time high of around 19.93 as the Rand weakened. But just a few months later, in September, it was trading closer to 17.38, having bounced around between 17.36 and 19.75 in the months prior.

To really paint a picture of this volatility, let's break down the numbers from the last five years.

USD/ZAR Rate Snapshot Past 5 Years

The table below gives a snapshot of the highest, lowest, and average exchange rates over the last five years. It's a stark reminder of the financial landscape South African businesses have had to navigate.

| Year | Highest Rate (ZAR) | Lowest Rate (ZAR) | Average Rate (ZAR) |

|---|---|---|---|

| 2023 | 19.93 | 17.31 | 18.05 |

| 2022 | 19.35 | 17.45 | 18.48 |

| 2021 | 19.78 | 16.72 | 18.27 |

| 2020 | 18.42 | 14.58 | 16.37 |

| 2019 | 15.75 | 13.43 | 14.78 |

These numbers aren't just for a history lesson. They're proof of the financial risk you face when your currency exposure is left unmanaged. They powerfully underline why a smart, forward-thinking strategy is so crucial to protect your business from these unpredictable swings.

Your Forex Rate Questions Answered

Diving into the world of foreign exchange can bring up a lot of questions. Let's tackle some of the most common ones that South African businesses face when dealing with USD to ZAR conversions. Getting these answers right is the first step to building a smarter currency strategy.

What’s the Best Time of Day to Exchange USD for ZAR?

Everyone’s looking for that perfect moment to click "exchange." While there isn't a single magical hour that guarantees the best forex rate for USD, you'll often find the market is most active when both US and South African business hours overlap. This higher trading volume can sometimes mean tighter spreads, which is good for pricing.

But honestly, trying to time the market down to the minute is a bit of a fool's errand. A much better approach is to zoom out and look at the bigger picture. Focus on longer-term trends and, more importantly, choose a financial partner that gives you consistently excellent rates and low spreads, no matter what time you transact.

The real win isn’t in timing the market perfectly. It’s in sidestepping the hefty spreads and hidden fees that traditional banks quietly bake into every single transaction you make.

How Do SARB Interest Rate Decisions Impact the Forex Rate?

The South African Reserve Bank (SARB) holds a lot of sway over the Rand's value. Think of it like this: when the SARB hikes interest rates, holding Rands suddenly becomes more appealing to global investors who are chasing better returns on their money. This flood of interest boosts demand for the ZAR, often strengthening it against the US Dollar.

On the flip side, when the SARB cuts rates, the incentive to hold Rands weakens, and investors might look elsewhere. This cause-and-effect relationship is why SARB announcements are such nail-biting events for the market—they can cause immediate and significant shifts in the exchange rate.

Can My Business Actually Get the Mid-Market Rate?

You've probably seen the "mid-market rate" on Google or financial news sites. This is essentially the wholesale price of a currency, the midpoint between what buyers are willing to pay and what sellers are asking for. Traditionally, this rate was a benchmark reserved for big banks trading with each other, not for everyday businesses.

This is where the game has changed. Modern platforms have torn up the old rulebook. By running lean and focusing on transparency, they can offer you exchange rates that are incredibly close to that true mid-market rate. It means more of your money stays where it belongs: in your business.

Stop losing money to hidden fees and unpredictable rates. With Zaro, you get access to the real mid-market exchange rate, empowering your business with transparent, cost-effective global payments. Learn more and get started today.