When you check the forex rates today in South Africa, you're really just looking at the price of another country's money. It's a price that's always on the move, shifting with global supply and demand. But here’s the most important thing to grasp right away: the rate you see on Google or the news is almost never the rate you'll actually get.

What Forex Rates Today in South Africa Really Mean

Diving into currency exchange can feel like trying to solve a complex puzzle, but it’s simpler than it looks. A good way to think about it is to imagine each currency, like our South African Rand (ZAR), as a product for sale in a massive global market. Its price isn't set in stone; it bobs up and down based on how many people are trying to buy it versus how many are trying to sell it at any given moment.

When you look up forex rates today in South Africa, you’ll always see them shown in pairs, like USD/ZAR or GBP/ZAR. This pair tells you how much of the second currency (the quote currency) it costs to buy one single unit of the first currency (the base currency).

Reading a Currency Pair

Let's take a real-world example. If you see the USD/ZAR rate quoted at 18.25, it simply means you'll need R18.25 to buy one US Dollar. The first currency in the pair, in this case the USD, is always the "one." This simple structure is the bedrock of all foreign exchange.

Now, things get a little more complicated when you actually want to make a trade. This is because your bank or forex provider will show you two different prices for every currency pair:

- Buy Rate: The price they are willing to pay to buy the base currency from you.

- Sell Rate: The price at which they are willing to sell the base currency to you.

The gap between these two rates is known as the spread, and it’s how financial institutions make their money on the transaction. It's a cost that's often baked into the rate, so it's not always immediately obvious.

Key Takeaway: The rate you find on a search engine or see on the news is typically the 'mid-market' or 'interbank' rate. Think of this as the wholesale price that banks use to trade massive sums with each other. The 'retail' rate you get as a business or individual will always have a markup—the spread—added on.

A Practical Snapshot of Forex Rates

To bring this all together, let's look at what these rates might look like for common currency pairs involving the Rand. Remember, the buy and sell prices will always be different, and a smaller gap between them means a better deal for you.

The table below gives an idea of how indicative exchange rates for the South African Rand (ZAR) are typically presented against major currencies.

Example ZAR Currency Pair Rates

| Currency Pair | Indicative Buy Rate (ZAR) | Indicative Sell Rate (ZAR) | Commonly Used For |

|---|---|---|---|

| USD/ZAR | 18.20 | 18.35 | International trade, paying invoices |

| GBP/ZAR | 22.95 | 23.15 | UK imports, travel, investments |

| EUR/ZAR | 19.60 | 19.80 | Eurozone trade, European suppliers |

This table helps illustrate the "buy low, sell high" principle from the provider's perspective. They buy USD from you at R18.20 but sell it to you for R18.35.

Getting your head around this structure is the first real step toward making smarter financial moves. Once you know how to read currency pairs and understand the difference between wholesale and retail rates, you can start to see the true cost of your foreign exchange. This knowledge puts you in a much stronger position to find providers who offer more transparent and competitive pricing.

The Forces That Shape the Rand's Daily Value

The value of the South African Rand isn’t fixed; it’s a moving target, constantly influenced by a complex mix of local and global forces. To really understand the forex rates today in South Africa, you need to look beyond the numbers on your screen and dig into the ‘why’ behind them.

Think of the ZAR’s daily movement like a weather forecast. You have local economic ‘systems’ brewing at home and global ones blowing in from overseas, and together they create the financial climate of the day. These systems can be powerful, making the Rand one of the more volatile currencies on the world stage. For any business or individual dealing with international payments, getting a handle on these drivers is crucial for planning and managing risk.

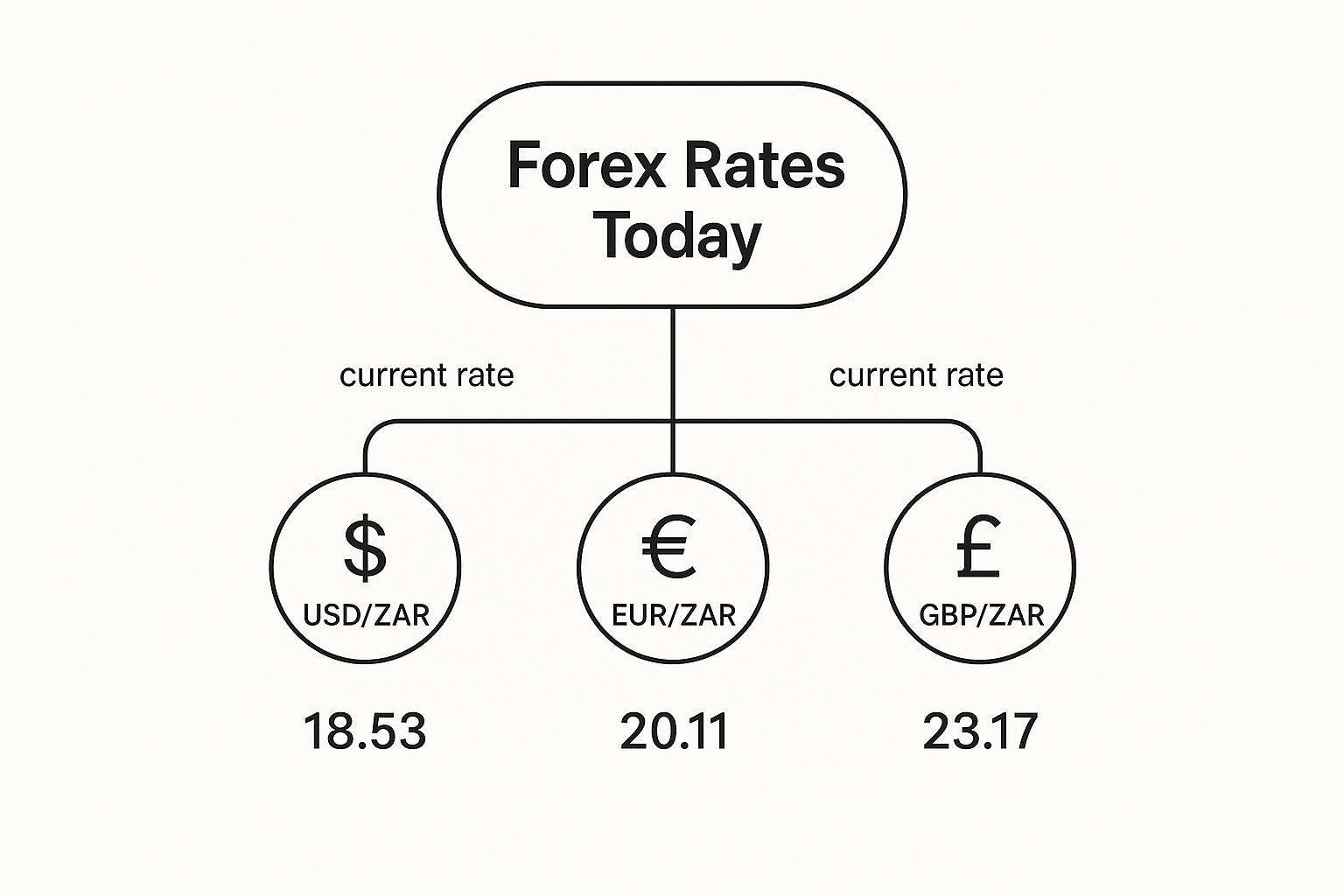

The image below highlights just how central the major currency pairs are—like USD/ZAR, EUR/ZAR, and GBP/ZAR—in today's forex market.

As you can see, these pairs are the main indicators traders and businesses watch, giving an immediate snapshot of the Rand’s health against the world’s biggest currencies.

Local Economic Pressures

Just like our local weather patterns, domestic factors create significant pressure on the Rand. These are the economic events and data points coming directly out of South Africa that have international investors glued to their seats.

One of the biggest local influences is the monetary policy set by the South African Reserve Bank (SARB). When the SARB adjusts the interest rate (the 'repo rate'), it sends a massive signal to the market.

- Higher Interest Rates: A rate hike usually makes holding Rands more appealing for foreign investors chasing better returns. This spike in demand can give the Rand a much-needed boost.

- Lower Interest Rates: On the flip side, a rate cut can do the opposite, potentially causing money to flow out of the country as investors look for higher yields elsewhere, weakening the Rand.

Other vital local signs include our inflation numbers (the Consumer Price Index), GDP growth figures, and employment statistics. Good news can build confidence in the South African economy and support the Rand, while bad news can see its value drop almost instantly.

Here’s a key principle to keep in mind: currency markets are always looking ahead. They often react more to what they think will happen with the economy than what's happening right now. This is why a simple policy announcement from the government can make the Rand jump or fall, long before the policy itself actually changes anything.

Global Economic Storms

While what happens at home is important, the Rand is also at the mercy of global ‘storms’ blowing in from abroad. As a relatively small, open economy, South Africa is especially sensitive to big international shifts.

The strength of the US Dollar (USD) is probably the biggest external factor. Because most major commodities, like oil and gold, are priced in dollars, a stronger greenback makes these goods more expensive for us. The USD is also seen as a ‘safe-haven’ currency. This means that when global uncertainty strikes, investors tend to sell off riskier assets and buy dollars, which puts pressure on emerging market currencies like our ZAR.

Another huge driver is commodity prices. South Africa is a major exporter of precious metals—think gold, platinum, and palladium.

When the global prices for these commodities climb, it bumps up the value of our exports. This brings more foreign currency into the country, which in turn increases demand for the Rand and strengthens it. Of course, a slump in commodity prices does the exact opposite.

This sensitivity creates constant movement. For instance, recent weekly forex data showed the ZAR swinging against the USD between a high of 0.0565 and a low of 0.0554. That’s a change of 2.00% in just one week. Moves of that size really highlight how reactive the Rand is to both local policy and global market jitters. You can see these patterns for yourself by looking up historical currency data from financial platforms.

Finally, geopolitical events and general investor mood play a massive role. Political instability in other emerging markets, major elections in the US or Europe, or changes to global trade deals can all create ripples that rock the forex market and hit the Rand. Understanding these forces helps explain why the forex rates today in South Africa can look so different from just yesterday.

How to Find Accurate Live Forex Rates

When you need to find the forex rates today in South Africa, a quick Google search might feel like a good starting point. But here’s the problem: those rates are often misleading. The numbers you see on search engines or news sites are usually the 'interbank' rate, a wholesale price that, unfortunately, isn't available to you or your business.

To make genuinely informed decisions, you need live, actionable data. It's crucial to understand your sources. Relying on delayed information is a bit like trying to drive down a busy highway by only looking in your rearview mirror; you can see where the market has been, but not where it is right now. For any business, the gap between a real-time rate and one that's even 20 minutes old can eat directly into your profit margins.

Finding reliable rates means looking past the surface-level results and tapping into platforms that are built for real-time financial data. It's about seeing the true cost of a transaction before you commit.

Differentiating Interbank Rates from Customer Rates

First things first, let's clear up a common and costly point of confusion. There are two main types of forex rates you'll come across, and knowing the difference is vital.

The Interbank Rate: You might hear this called the mid-market rate. This is the rate big banks use to trade massive volumes of currency with each other. It’s the purest form of an exchange rate, with no added fees or markups, and it’s the figure you’ll see on financial news channels.

The Customer Rate: This is the rate you are actually offered by your bank or a currency provider. It's the interbank rate plus a markup, which we call the spread. That spread is how the provider makes their money.

Think of it like buying fruit from a grocer. The interbank rate is what the grocer pays the farmer for a whole crate of apples. The customer rate is the price you pay for those same apples in the store, which has the grocer’s costs and profit baked in.

You will never get the interbank rate. Your goal is to find a provider whose customer rate is as close to it as possible. A smaller spread means a better deal and more transparency for your business.

Where to Find Reliable Live Rates

So, where do you go for a true picture of the market? You need sources that provide live, or at least near-live, data. These are the same tools that financial professionals rely on, and they're exactly what your business needs to stay ahead.

Here are the best places to look for reliable data in South Africa:

Dedicated Financial News Platforms: The heavyweights like Bloomberg and Reuters are the gold standard. While their full-blown terminal subscriptions are pricey, their public websites often provide free access to live spot rates for major currency pairs. This gives you a solid, real-time benchmark.

Forex Broker Trading Platforms: Brokers who serve traders offer platforms (like MetaTrader 4 or 5) that stream live rates constantly. Even if you have no intention of speculative trading, these are brilliant tools for watching the market move. You can see the actual buy and sell prices, which gives you a very clear idea of the spreads being offered.

Specialist Payment Providers: A new wave of fintech companies is shaking up cross-border payments by focusing on transparency. Platforms like Zaro, for instance, can provide access to real exchange rates with zero spread. This model strips away the hidden markups that traditional banks rely on, making them a fantastic source for getting actionable rates.

By tapping into these professional-grade sources, you can get a much clearer understanding of the forex rates today in South Africa. This arms you with the knowledge to benchmark any quote you receive, helping you to spot excessive fees and secure a much better deal on all your international payments.

What the Rand's Past Can Teach Us About Today

To really get a handle on the forex rates today in South Africa, you have to look backwards. The South African Rand has had a rollercoaster of a history, packed with periods of wild volatility. Its journey is a direct reflection of the country's economic and political story.

Think of the Rand's historical chart as an ECG of the South African economy. You can literally see the moments of strength and the periods of serious stress. Digging into this history isn't just for academics; it's a crucial tool for anyone doing long-term financial planning or running an international business. It reveals the currency's true character—one defined by both significant risk and surprising resilience.

Looking back helps us spot patterns that give us clues about what might happen today. It puts the daily ups and downs into context and explains why the Rand is known as one of the more lively currencies on the world stage.

Pinpointing Key Moments of Volatility

The Rand's ride against major currencies like the US Dollar has been anything but smooth. A few key periods really stand out, each tied to major events that sent shockwaves through the market. Political uncertainty, big policy changes at home, or global economic meltdowns have all left their scars on the ZAR's value.

For example, we've seen time and again how major political shifts can trigger a sharp drop as investor confidence gets shaky. On the flip side, periods of solid economic policy and a positive global mood have seen the Rand bounce back, sometimes with incredible speed.

These aren't just footnotes in a history book; they're powerful lessons in managing risk.

- Political Announcements: A sudden cabinet reshuffle or a change in key leadership? That can spark immediate uncertainty, often leading investors to sell off the Rand in a hurry.

- Economic Crises: Both local problems, like the ongoing Eskom energy crisis, and global shocks, like the 2008 financial meltdown, show just how sensitive the Rand is when investors get spooked.

- Commodity Cycles: South Africa is a commodity-driven economy. The boom-and-bust cycles of resources like gold and platinum are practically drawn onto the Rand's long-term chart.

Understanding these triggers helps businesses brace for future turbulence. It really drives home the need to manage currency risk proactively instead of just reacting when things go wrong.

A key takeaway from the Rand's history is its high beta. In simple terms, this means it tends to move more dramatically than the market average. It magnifies the good times but also deepens the losses when global stress hits. For any business importing or exporting, that volatility is a direct threat to profit margins.

A Closer Look at Recent History

We don't need a time machine to see this volatility play out. Just looking at the last year or so gives you a crystal-clear picture of the Rand's dynamic nature. A quick glance at recent performance shows the kinds of swings that businesses have to contend with.

Take 2025, for instance. The data shows just how much the USD/ZAR exchange rate can move around. Over 208 days, the average rate was about R18.30 to the US Dollar. But on July 3rd that year, it hit a low of R17.52—a massive drop from the annual average. You can dive into more detailed historical currency data to see how these swings line up with specific economic events.

That kind of movement within a single year really highlights the financial risk of holding foreign currency or making international payments without a solid plan. A rate that looks great one month can easily turn against you the next, affecting everything from paying supplier invoices to bringing profits back home.

This historical context is exactly why so many businesses are turning away from traditional banks with their confusing pricing and slow settlement times. When rates are this jumpy, getting real-time, transparent pricing isn't just a nice-to-have—it's essential. This is where platforms like Zaro come in, offering zero-spread exchange rates that protect businesses from the hidden costs that stack up during volatile times. By understanding the past, you can choose better tools to safeguard your financial future.

A Deeper Look at the ZAR's Real Value

While the daily swings of the forex rates today in South Africa grab all the headlines, they really only show a snapshot of a much bigger picture. To get a true sense of the Rand's strength and where it stands globally, we need to look past the day-to-day market noise. This is exactly what policymakers and major corporations do; they rely on a much smarter metric to judge South Africa's economic competitiveness over the long haul.

That metric is called the Real Effective Exchange Rate, or REER. It offers a far more honest assessment of the ZAR’s true value because it accounts for something crucial that daily rates completely ignore: inflation.

What Is the Real Effective Exchange Rate?

Think of the standard exchange rate you see on the news—the 'nominal' rate—as the sticker price of a new car. The REER, on the other hand, is like the car’s total cost of ownership. It doesn't just show the price tag; it considers the ongoing costs like fuel, insurance, and maintenance. In short, it tells you what your money can actually buy in another country compared to what it buys at home.

The REER works by measuring the Rand's value not just against one currency, like the US Dollar, but against a whole basket of currencies from our most important trading partners. Then, it makes a critical adjustment: it factors in the differences in inflation between South Africa and those countries. The result is a true measure of our international purchasing power.

Why REER Matters: A rising REER can be a warning sign that South African goods are getting too expensive for foreign buyers, which could put a damper on our exports. A falling REER, however, suggests our exports are becoming more competitive. But there's a flip side—it also means imports cost more for us, which can add fuel to local inflation.

Putting REER into Context

Let's break it down with a simple example. Say a loaf of bread costs R20 here in South Africa and $2 in the United States. If the daily exchange rate is R15 to the dollar, a quick calculation shows the American bread is more expensive (R30 equivalent vs. our R20).

But what happens if South Africa’s inflation is running at 6% while US inflation is only at 3%? Over time, the price of our local bread will climb much faster. The REER is the tool that accounts for this widening gap, revealing how the Rand's genuine purchasing power is shifting, not just its face value.

This deeper perspective is invaluable for any kind of strategic financial planning. It helps business leaders and economists answer some pretty critical questions:

- Is the Rand, at its core, overvalued or undervalued right now?

- Are our local production costs making us less competitive on the world stage?

- How will long-term monetary policy decisions likely impact our trade balance?

Looking at historical data is the key to spotting these powerful, slow-moving trends. The US Federal Reserve, for instance, maintains records of South Africa's REER going all the way back to 1971. This long-term view shows exactly how the currency has navigated decades of economic shifts by adjusting for things like the consumer price index and inflation differentials. You can explore this rich history of South Africa’s effective exchange rate data to see these valuation shifts for yourself.

By looking beyond the immediate forex rates today in South Africa and bringing the REER into your analysis, you can gain a powerful strategic advantage. This high-level view puts daily volatility into a much more meaningful context, revealing the underlying economic health and helping you make smarter, more resilient financial decisions for the long term.

Of course. Here is the rewritten section, crafted to sound like it was written by an experienced human expert.

Practical Ways to Handle Forex Risk

Knowing what drives the forex rates today in South Africa is one thing, but that knowledge won't shield your bottom line on its own. You have to take action. For any business or person involved in international payments, the Rand's infamous volatility isn't just a number on a screen—it's a real threat to financial stability.

The good news is, there are concrete, practical strategies you can put in place to manage this currency risk. It's about turning what you know about the market into a proactive financial plan. This way, you can protect your profits from wild swings and make decisions that save you money. It’s all about taking back control, whether you're paying an overseas supplier or repatriating export earnings.

Hedging Tools for Your Business

If your company frequently deals in foreign currencies, simply hoping for a good rate is a massive gamble. The most reliable way to get rid of that uncertainty is by using hedging instruments. These are financial tools designed specifically to lock in an exchange rate for a transaction that will happen down the line.

A classic and incredibly useful tool is the forward exchange contract (FEC). Think of it like pre-ordering your currency at a guaranteed price. You agree on an exchange rate today for a payment or receipt that will only take place weeks or even months from now.

How it Works: Let's say you have a $100,000 invoice due in three months. An FEC allows you to lock in the USD/ZAR rate for that payment today. It doesn’t matter what the live market does over the next 90 days—your rate is set in stone.

The Main Benefit: This completely eliminates the risk of a sudden drop in the Rand wiping out your profit margin. It gives you absolute certainty on your costs, which is a game-changer for accurate budgeting and financial planning.

A forward contract offers something truly priceless for a business: predictability. Instead of your finance team losing sleep over daily market jitters, they can focus on growth, confident in the exact ZAR cost of your future foreign commitments.

Smarter Habits for Everyone

While tools like forward contracts are perfect for large, scheduled business payments, everyone—from individuals to companies of all sizes—can benefit from smarter day-to-day forex habits. These practices are all about chipping away at costs and getting the most value out of every single transaction.

1. Compare Providers and Question the Fees

Don't just default to your bank. Traditional banks are well-known for offering wide spreads and tacking on hidden fees (like SWIFT charges) that push up the true cost of your transfer. Always get quotes from a few different sources before you hit send.

2. Look for Transparent Pricing

The biggest hidden cost is usually the spread—the markup a provider adds to the real exchange rate. Your goal is to find providers who offer rates as close to the interbank rate as possible. Modern fintech platforms like Zaro were built to solve this problem, often providing real exchange rates with zero spread. For a business, that can add up to huge savings on every single transaction.

3. Time Your Transfers (When You Can)

You can't predict the market with a crystal ball, but you can be smart about timing. Try to avoid making transfers during periods of known, high-impact volatility. Think moments just before a major interest rate decision from the SARB or during a national election. If a payment isn't time-sensitive, waiting a day or two for the market to calm down can sometimes make a surprising difference.

By blending these proactive strategies—hedging your big future payments and adopting smarter habits for everyday transactions—you build a robust defence against currency risk. This approach takes your understanding of the forex rates today in South Africa and turns it from simple observation into a powerful tool for protecting and growing your money.

Of course, here is the rewritten section with a more natural, human-expert tone.

Your Forex Questions, Answered

Even after diving into the details, you probably have a few practical questions rattling around. Let's tackle some of the most common ones that come up when dealing with forex rates in South Africa.

What’s the Best Time of Day to Exchange Currency?

This is the million-dollar question, isn't it? The truth is, there's no magic hour that guarantees the best rate every single time. The forex market is a 24/5 beast, moving through different sessions across the globe, from Sydney to New York.

That said, if you're looking for an edge, pay attention to the afternoon in South Africa. This is when the London and New York sessions overlap, creating the highest trading volume, or what we call liquidity. With so many buyers and sellers in the market, the gap between buying and selling prices (the spread) can often tighten up, potentially giving you a slightly better deal. Just be wary of making big moves late at night or first thing in the morning when the markets are quieter and rates can be less favourable.

Why Is the Rand So Volatile?

Ah, the rollercoaster rand. Its reputation for being a bit wild comes down to a potent mix of local and global factors.

- It’s a Commodity Currency: South Africa is a powerhouse exporter of gold, platinum, and other minerals. When the prices of these commodities swing on the world stage, the rand gets pulled right along with them.

- Global Nerves Play a Big Role: The rand is seen as an emerging market currency, which investors consider a bit riskier. When global events make investors nervous, they tend to pull money out of assets like the ZAR and flock to "safe havens" like the US dollar.

- Homegrown Headaches: Our own domestic issues—things like inflation figures, unemployment rates, political instability, and even load-shedding news—all add to the uncertainty. This directly impacts investor confidence and, you guessed it, the rand's value.

What does this mean for you? Volatility creates both risk and opportunity. But for a business, that risk can eat into your profits. This is precisely why having a solid risk management strategy and working with a transparent payment provider is non-negotiable.

How Can I Avoid Hidden Forex Fees?

Hidden fees can quietly drain your funds on international transactions. The number one offender is almost always the exchange rate markup or spread—that extra bit a provider quietly adds on top of the real market rate for their own profit.

The key to sidestepping these costs is demanding transparency. Always ask a provider to show you their spread. A better approach is to pull up the live mid-market rate on a trusted source like Reuters and compare it directly to the quote you've been given. Also, keep an eye out for fixed "transfer fees" or "SWIFT fees," which are standard practice at many traditional banks. This is where modern fintech platforms have really changed the game, building their services around clear, straightforward pricing from the start.

Stop letting hidden markups and unpredictable fees chip away at your profits. With Zaro, your business can finally access real exchange rates with absolutely zero spread. It’s all about complete transparency and real savings. Discover how much you can save on your next international transfer with Zaro.