Right, let's get one thing straight from the start. When you make money from forex trading in South Africa, SARS sees those profits as regular income, not as capital gains.

This is a crucial distinction. It means your trading profits are lumped in with your other earnings, like your salary, and taxed at your personal marginal tax rate. For some, that rate can climb as high as 45%.

How Forex Trading Is Taxed in South Africa

The biggest hurdle for most traders is getting their heads around the income versus capital gains debate. Thankfully, the South African Revenue Service (SARS) makes it pretty clear. It all boils down to your intention and how often you trade. If you're trading frequently and aiming for short-term profits, SARS views this as a business activity. That makes your earnings ordinary revenue.

Here's a simple way to think about it: if you bake and sell cakes every day, that’s a business, and your profit is income. But if you sell a single antique you inherited and have owned for years, that’s a capital event. For the vast majority of people trading forex, you’re in the cake-baking business, not selling a one-off family heirloom. Grasping this simple concept is the single most important step to getting your tax affairs in order.

Income vs. Capital Gains: The SARS Perspective

SARS examines the nature of your trading. Are you placing multiple trades each month to profit from the constant ebb and flow of currency prices? If so, they see this as a "scheme of profit-making." This label automatically classifies your profits as income, plain and simple.

For a gain to be considered capital, it generally has to come from a long-term, more passive investment. Imagine you converted Rands to US Dollars, parked those Dollars in a foreign account for a few years as a long-term hedge, and then converted them back. That might be viewed as a capital gain. But let's be realistic—this isn't what active retail traders are doing day in and day out.

Key Takeaway: For 99% of retail forex traders in South Africa, your profits are income. You need to declare them as such and pay tax at your normal income tax rate.

The Role of Official Exchange Rates

Now, when it comes to calculating your profits and losses, you can't just pluck a rate from your broker's platform. SARS has very specific rules: all foreign currency amounts must be converted into South African Rand (ZAR) for your tax return.

To keep things fair and consistent, the South African Reserve Bank steps in. They provide the official average exchange rates, which SARS then publishes quarterly. As a trader, you are required by the Income Tax Act, 1962, to use these official rates to report your income. You can find out more about the process and access the latest rate tables on the SARS website.

To help you keep track, here is a quick summary of the core principles we've just covered.

Key Forex Tax Principles at a Glance

This table summarises the essential rules every South African forex trader needs to know.

| Concept | SARS Treatment | Key Takeaway |

|---|---|---|

| Trading Profits | Taxed as Income (not Capital Gains) | Your profits are added to your other income (e.g., salary) and taxed at your marginal rate. |

| Trading Frequency | Frequent, short-term trades signal a "scheme of profit-making" | If you trade actively, SARS will always classify your gains as income. |

| Exchange Rates | Must use Official SARS Rates for conversion to ZAR | You cannot use your broker's live rates; you must use the official quarterly average rates. |

| Tax Rate | Your Personal Marginal Tax Rate (up to 45%) | The more you earn in total, the higher the tax percentage you will pay on your trading profits. |

Remembering these four points is the foundation for staying compliant and avoiding any nasty surprises from SARS come tax season.

Calculating Your Taxable Forex Profits and Losses

Alright, let's move from the theory to the practical side of things. Nailing down your taxable forex income might seem a bit daunting, but it all comes back to one core discipline: converting every single transaction into South African Rand (ZAR). This isn't just a suggestion; it's a non-negotiable for SARS.

Think of it this way: for SARS to read your financial story, it has to be written in a language they understand, and that language is ZAR. You can't just declare your final profit in dollars or euros. Every trade—both when you open it and when you close it—needs to be translated.

The Conversion and Calculation Method

The cornerstone of this whole process is using the official average exchange rates that SARS publishes for the tax year in question. You can't simply pull the live rate from your broker's platform at the exact moment of a trade. Instead, you have to use the official average rate for that period.

This rule exists to create a level playing field for all taxpayers, smoothing out the wild swings of intra-day price spikes. Your job, then, is to keep incredibly detailed records and apply these specific rates to find the ZAR value at two critical points:

- The moment you open a position.

- The moment you close that same position.

The difference between these two ZAR figures is what determines your taxable profit or your deductible loss for that one trade.

Let’s be crystal clear on this: Every single trade must be calculated individually. Your total taxable forex income or net trading loss for the year is simply the sum of all these individual calculations.

A Practical Example of Calculating Forex Tax

To make this less abstract, let’s walk through a real-world example. Imagine you're trading the EUR/USD pair, but your trading account is funded with US Dollars.

Step 1: Opening the Trade (Buying EUR) You decide to buy €10,000 when the EUR/USD rate is 1.08. This transaction costs you $10,800.

- First, you must find the ZAR value of this cost. Let’s assume the SARS average USD/ZAR rate for that day or period is 18.50.

- Opening Value in ZAR: $10,800 x 18.50 = R199,800

Step 2: Closing the Trade (Selling EUR) A week passes, and you close your position by selling the €10,000. The EUR/USD rate has moved in your favour to 1.10, netting you $11,000.

- Now for the new conversion. The SARS average USD/ZAR rate for this closing period might have changed. Let's say it's now 18.65.

- Closing Value in ZAR: $11,000 x 18.65 = R205,150

Step 3: Calculating the Taxable Profit The final step is simple subtraction—closing value minus opening value.

- Taxable Profit: R205,150 - R199,800 = R5,350

This R5,350 is the precise profit you must declare to SARS for this single trade. Following this disciplined, trade-by-trade method is the only way to guarantee your numbers are accurate and completely defensible if SARS decides to take a closer look at your return.

Trading as an Individual vs a Company

One of the first big decisions you'll face as a forex trader in South Africa is how to structure your activities. Should you trade in your personal name, or is it better to go to the effort of setting up a company? It's a crucial question because the answer has a direct knock-on effect on your tax bill, your admin load, and your personal liability.

When you trade as an individual, it's pretty straightforward. Your forex profits are simply added to your other income, like your salary, and taxed at your personal marginal tax rate. This is a sliding scale, so the more you earn in total, the higher the percentage of tax you'll pay on those trading profits. For anyone in the top income bracket, that rate can shoot up to a hefty 45%.

On the other hand, a registered company is a completely separate legal entity in the eyes of the law. It pays tax at a flat corporate rate, which currently sits at 27% (for the 2024/2025 tax year). This fixed rate can be a game-changer, offering a massive tax advantage if you're a consistently profitable trader who would otherwise be pushed into the highest personal tax brackets.

Tax Rate Comparison

Let's make this real with a quick example. Imagine two traders, Trader A (an individual) and Trader B (a company), who both make a net profit of R200,000 from their forex activities. We'll also assume Trader A already earns a good salary that puts them in the 45% tax bracket.

- Trader A (Individual): R200,000 profit x 45% = R90,000 tax bill

- Trader B (Company): R200,000 profit x 27% = R54,000 tax bill

Just like that, trading through a company in this scenario saves R36,000 in tax. But hold on, it’s never quite that simple. Tax is just one piece of the puzzle.

Important Consideration: That lower corporate tax rate is very appealing, but don't forget you still need to get the money out of the company for your personal use. You'll either have to pay yourself a salary (which attracts PAYE) or declare a dividend (which is subject to Dividends Tax). You absolutely have to factor in these second-tier taxes to see the full picture.

Beyond the Tax Rates

The choice isn't just about the numbers; it's also about structure, complexity, and protection.

- Administrative Burden: A company comes with responsibilities. You're looking at annual returns, financial statements, and staying compliant with the Companies Act. This adds a layer of admin and cost that an individual trader simply doesn't have to worry about.

- Liability Protection: This is a big one. A company provides limited liability, which creates a firewall between your business and personal life. If the business gets into financial hot water, your personal assets like your house and car are generally safe. As an individual, there's no distinction—you are the business.

- Expense Claims: While you can claim expenses either way, it's often much cleaner and more defensible to do so within a company structure. All your trading-related costs are neatly ring-fenced in one place.

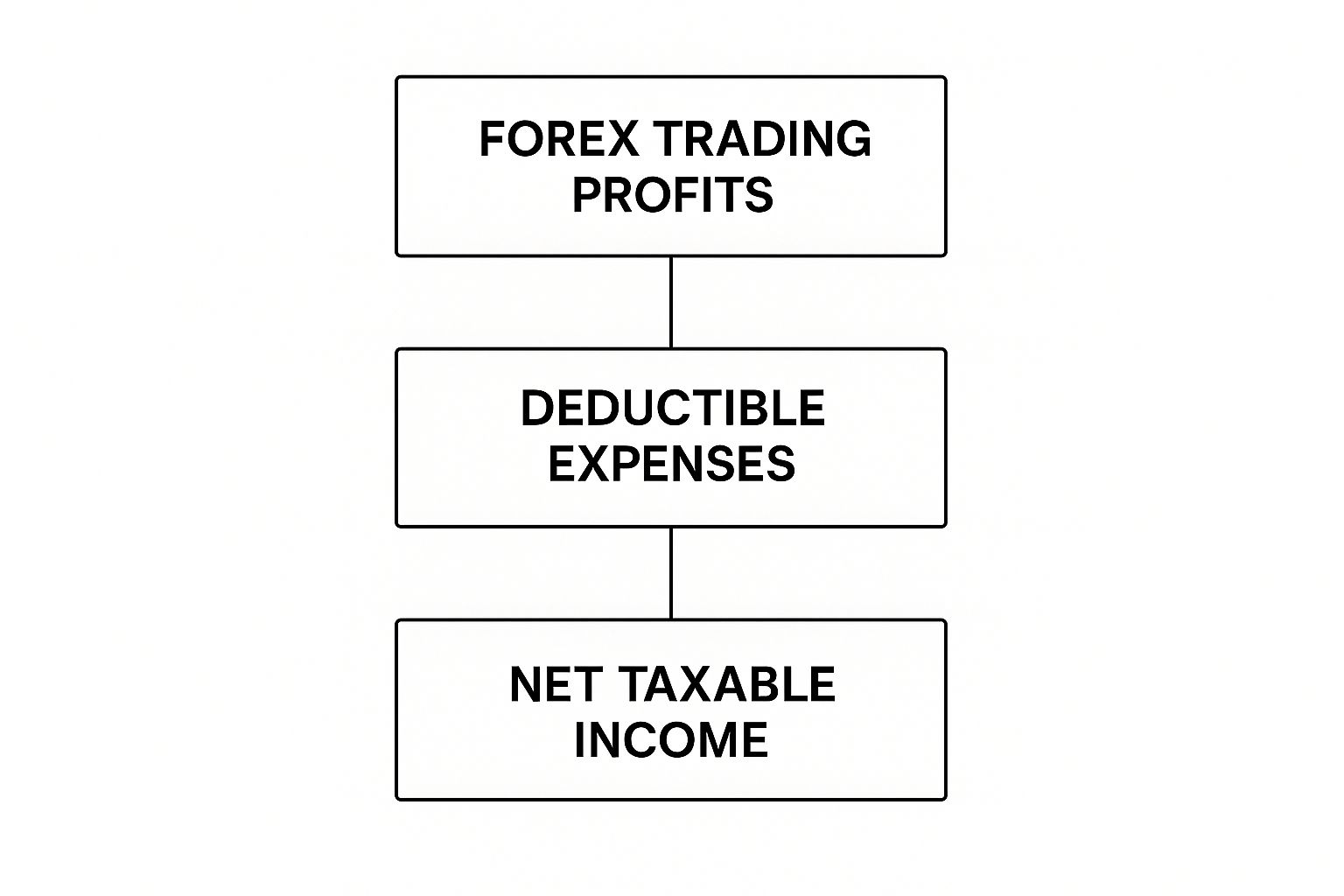

This infographic breaks down how your taxable income is calculated—a process that applies whether you're an individual or a company.

As the diagram shows, no matter which route you take, your taxable income is your gross profit less any allowable, deductible expenses. The real difference is the tax rate that SARS applies to that final number. Ultimately, picking the right path comes down to your profitability, your long-term ambitions, and how much admin you're willing to take on.

How to Declare Your Forex Income to SARS

When it comes to taxes, compliance isn't just about dodging penalties—it’s about having the confidence to manage your financial affairs properly. Knowing exactly how to report your forex income to the South African Revenue Service (SARS) can transform tax time from a stressful scramble into a predictable part of your business routine. Let's walk through how to stay on the right side of the law.

The main tool you'll use is your annual income tax return, the ITR12. Your net profit (or loss) from forex trading doesn't get its own special box; it gets rolled into your gross income along with everything else. This is precisely why those detailed calculations we've discussed are so critical—they provide the final figure you'll report to SARS.

Getting this right is a big deal. Tax collection is the lifeblood of the national budget, and the numbers show just how much it can fluctuate. In June 2021, South Africa's tax revenue hit an all-time high of over $13.5 billion, a world away from the low of under $1.5 billion back in April 2002. If you're interested in the bigger economic picture, you can dig into the trends impacting South Africa's fiscal management on CEIC Data.

The Golden Rule of Record-Keeping

If you take only one thing away from this guide, let it be this: meticulous record-keeping is non-negotiable. Without it, you have no way to substantiate your figures if SARS decides to take a closer look at your return. Your records are your only defence.

Think of it as building a case file for your tax declaration. Every piece of paper and digital file matters. This file absolutely must contain:

- Complete Broker Statements: You need every single statement for the tax year. These should show all trades, commissions, fees, and rollovers.

- ZAR Conversion Calculations: Keep a detailed spreadsheet or log that shows the ZAR value for the opening and closing of every single trade. Remember to use the official SARS average exchange rates.

- Proof of All Expenses: Hold onto invoices and receipts for any costs you plan to claim as deductions, whether it's for data, platform fees, or bank charges.

Demystifying Provisional Tax

For most traders who are turning a decent profit, waiting until the end of the tax year to settle up with SARS is a recipe for a cash flow nightmare. This is where provisional tax becomes your best friend.

Provisional tax isn't an extra tax. It's simply a system for paying your estimated income tax liability in advance. You'll make two payments during the tax year, with an optional third payment after year-end, to avoid facing a massive, unexpected bill.

If you earn income from sources other than a regular salary—like forex trading—you are generally required to register as a provisional taxpayer. By making these bi-annual payments, you keep your account with SARS current, sidestep any nasty under-estimation penalties, and manage your tax obligations smoothly. It’s simply the responsible way to handle your trading profits.

Claiming Business Expenses to Reduce Your Tax Bill

It’s one of the most common mistakes traders make, and it’s a costly one: paying more tax than you absolutely have to. This often happens simply because they don't claim every legitimate business expense they’re entitled to. You're essentially leaving money on the table for SARS. Let's fix that.

Bringing down your taxable income isn't some shady workaround; it's a perfectly legal and smart financial strategy. The whole idea is to subtract the real costs of your trading activities from your gross profits. This gives you a smaller net profit, which means a smaller tax bill. Simple. The trick is knowing exactly what costs you can subtract.

The Golden Rule for Deductions

When it comes to deductions, SARS operates on a very clear principle. An expense is only deductible if it was incurred “in the production of income.”

What does that actually mean? It just means the cost has to be a direct part of your effort to make trading profits. It can't be a personal expense, and it generally can't be a big capital purchase like a new laptop (which is handled differently through wear-and-tear allowances).

Think about it this way: your internet connection is vital for executing trades, so a portion of that cost is a no-brainer. Your daily coffee, on the other hand, is just part of living and has no direct link to generating a profit on a trade. You can't claim that.

This rule should be your North Star. For every single cost you think about claiming, ask yourself: "Did I spend this money specifically to make a trading profit?" If the answer isn't a firm "yes," don't claim it.

What Expenses Can You Claim?

With the "in the production of income" rule as our guide, let's look at the typical costs a serious forex trader in South Africa can almost always deduct. The key here is to keep meticulous records and receipts for everything.

Here are some of the most common deductible expenses for managing your forex tax in South Africa:

- Bank and Transaction Fees: Any charges from your bank for wiring money to your broker, withdrawals, or currency conversion fees tied to your trading account.

- Data and Internet Costs: A reasonable portion of your internet bill is claimable, as you can't trade without it.

- Trading Platform Subscriptions: This includes fees for charting software like TradingView, subscriptions to financial news services, or fees for specific trading platforms.

- Educational Materials: The cost of courses, books, or seminars you take to sharpen your trading skills is a valid expense. After all, you're investing in your ability to produce future income.

You have to be reasonable. Claiming a portion of your home internet makes sense. But trying to claim 100% of the bill when your entire family uses it for Netflix and homework is a red flag for SARS and will almost certainly be rejected.

The Home Office Deduction Trap

The home office expense is a classic point of confusion and a real minefield for traders. It feels logical—you trade from home, so you should be able to claim a slice of your rent or bond interest, right?

Unfortunately, the rules in South Africa are incredibly strict here.

To claim home office expenses, SARS requires the space to be used exclusively and regularly for your trading business. We're not talking about the corner of your dining room table or a spare bedroom that doubles as a guest room. It needs to be a dedicated room that, if an auditor walked in, would look and feel like nothing but an office. For most individual traders, this standard is extremely difficult to meet, making it a very risky deduction to attempt.

Understanding South African Exchange Control Rules

Getting your forex tax in South Africa right is only half the battle. The other, equally critical, piece of the compliance puzzle is navigating the rules set by the South African Reserve Bank (SARB). These are our exchange controls, and they dictate exactly how you can move money out of the country to fund an offshore trading account.

Think of SARB as the gatekeeper for all capital leaving South Africa. You can’t just wire unlimited funds to an international broker whenever you feel like it. Instead, every individual has two specific allowances they can use, and each one comes with its own purpose and rulebook. Getting this right is absolutely vital if you want to trade legally and steer clear of some very serious penalties.

These regulations are a cornerstone of the country's economic strategy, touching everything from our tax-to-GDP ratio to the daily management of foreign currency transactions. The annual allowances themselves have evolved over the years—for instance, the jump to R10 million back in April 2015 showed a significant policy shift. If you're interested in the bigger picture, you can dive into the history of taxation policies in South Africa on Wikipedia.

Your Two Key Allowances

As an individual trader, you have two main channels for sending money offshore legally. It's crucial to understand the difference between them, because mixing them up can land you in hot water.

The Single Discretionary Allowance (SDA): This is your first and simplest option. Every adult South African resident gets an annual allowance of R1 million. You can use this for all sorts of things like travel or gifts, but most importantly for us, you can use it to fund an offshore investment account without needing any special permission from SARS.

The Foreign Investment Allowance (FIA): If you're planning to move more significant capital, this is your next step. The FIA gives you an additional R10 million to transfer offshore each calendar year. But there’s a big catch with this one.

To use your FIA, you absolutely must get a Tax Compliance Status (TCS) pin from SARS first. This step, which most people just call "getting tax clearance," is how SARS confirms to the Reserve Bank that your tax affairs are squared away before you're allowed to move that kind of money.

The Tax Clearance Process for the FIA

Getting a TCS pin for your Foreign Investment Allowance isn't just a tick-box exercise; it's a formal application you have to make through SARS eFiling. As part of the process, SARS will comb through your records to ensure all your tax returns are filed and you don't have any outstanding tax debt.

Once they give you the green light, you'll receive a TCS pin that’s valid for 12 months. You have to give this pin to your bank or authorised dealer every single time you want to make a transfer using your FIA. If you don't have that pin, the bank is legally required to stop the transaction.

So, here's how these allowances work in practice:

- First, use your R1 million SDA for smaller transfers. It’s quick and doesn’t require any extra paperwork.

- Need to send more? Apply for your TCS pin from SARS.

- With your approved pin in hand, you can then use your R10 million FIA for those larger investment amounts.

Sticking to this framework ensures every Rand you send to an international broker is above board, keeping you safe from SARB's scrutiny and any potential fines.

Common Questions on South African Forex Tax

Even when you think you’ve got a handle on the rules, forex tax in South Africa can throw some real curveballs. When you're in the thick of it, dealing with actual trading losses or using an overseas broker, specific questions always seem to come up.

Let's dive into the most frequent sticking points. My aim here is to give you direct, practical answers to clear up that nagging uncertainty so you can handle your tax with confidence.

Can I Deduct Trading Losses From My Salary?

In most cases, yes, you can. If SARS considers your forex trading a legitimate business venture—meaning you're genuinely trying to make a profit—then your net loss from trading for the year can usually be set against other income, like your salary. This can make a real difference to your overall tax bill.

But you have to be careful of the "ring-fencing" rules, which you'll find in Section 20A of the Income Tax Act. These rules are there to stop people, especially high-income earners, from creating artificial business losses just to reduce the tax on their main income. If you keep posting significant trading losses year after year, SARS might decide to "ring-fence" them. This means you can’t use the loss to reduce your salary income anymore; you can only offset it against future profits from your trading.

Key Insight: Flawless record-keeping is your best defence. If you want to claim a loss, you need to be able to show SARS a detailed trading journal, a clear strategy, and solid proof that you were trading with the intention of making a profit. This is what will protect you from having your losses ring-fenced.

Is There Any Scenario Where Profits Are Capital Gains?

For an active retail trader, it’s almost unheard of. The line between income and capital gains is all about your intention and how often you trade. Active forex trading involves a high volume of short-term trades designed to cash in on price fluctuations. In the eyes of SARS, this is a clear "scheme of profit-making," which means the profits are automatically treated as regular income.

A situation that results in a capital gain would be completely different. Let's say you bought a lump sum of US dollars as a long-term investment, maybe to protect your savings against the Rand weakening. If you then held those dollars in an overseas bank account for a few years before converting them back to Rands, you could argue that the profit is capital in nature. For anyone trading regularly on a platform, however, you should always work on the assumption that you'll be paying income tax.

Does Using an International Broker Change My Tax Duties?

Not at all. Your tax obligations to SARS are exactly the same, no matter where your broker is based. As a South African tax resident, you are taxed on your worldwide income. Whether your profits are generated through a broker in Johannesburg or one in London makes zero difference to what you owe SARS.

The real difference is a practical one. Your statements from an international broker will be in a foreign currency, like US Dollars or Euros. It is your responsibility to convert every single transaction into ZAR using the official SARS average exchange rates for that tax year. You also need to make sure the way you fund that international account is fully compliant with South Africa’s exchange control regulations.

Navigating these complexities can be daunting, but Zaro simplifies the financial side of your global operations. By providing real exchange rates with zero hidden fees, we eliminate the unpredictable costs of international payments, ensuring your business keeps more of its hard-earned money.