Think of a forex time converter as your personal guide to the global market's pulse. It takes the confusing, overlapping 24-hour cycle of international trading and translates it into your local time. In short, it shows you exactly which markets are open for business, letting you spot the busiest—and often most profitable—times to trade.

Decoding the 24-Hour Forex Market Clock

The foreign exchange market never really sleeps. It’s a relentless, 24-hour-a-day, five-day-a-week beast that moves from one financial centre to the next. For a trader sitting in South Africa, this poses a real challenge. How do you keep track of when to trade if the market’s best moments don't align with a typical 9-to-5 day in Johannesburg or Cape Town?

This is where a forex time converter proves its worth. It’s far more than just a world clock showing you the time in another city. A good converter gives you a visual map of market activity, clearly laying out the four major trading sessions:

- Sydney

- Tokyo

- London

- New York

The real magic, however, is in seeing the session overlaps. When two massive markets are open at the same time—the London and New York overlap is the classic example—trading volume and liquidity go through the roof. This spike in activity often creates higher volatility and tighter spreads, which are the exact conditions many traders look for. A converter lets you see these critical windows instantly.

A forex time converter turns time zone confusion into a strategic advantage, allowing you to align your trading activity with peak market volatility and liquidity.

As South Africa’s trading scene continues to expand, timing becomes everything. The country stands as Africa’s largest forex hub, with daily turnover topping $20 billion, powered by an estimated 190,000 active traders. For anyone in this market, a time converter isn't just a nice-to-have gadget; it’s a fundamental part of a successful trading toolkit. You can learn more about the scale of forex trading in Africa to understand just how crucial precise timing is.

Why a Time Converter Is Your Trading Co-Pilot

Think of a forex time converter less like a simple clock and more like a strategic co-pilot for navigating the global markets. For any serious trader in South Africa, this tool isn't just nice to have—it's essential. It turns the confusing mess of global time zones into clear, actionable trading intelligence.

Its most important job? Making sure you show up to the market when the action is actually happening, not just when it’s convenient for you.

Pinpoint Opportunity and Avoid the Dead Zones

The biggest advantage is being able to capitalise on peak trading windows. There are specific hours each day when trading volume and volatility go through the roof, creating the best opportunities. A forex time converter helps you nail down these moments with absolute precision.

Take the London-New York overlap, for example. This is easily the most powerful window in the trading day. For a few hours, the world's two biggest financial centres are open at the same time, pumping enormous liquidity into pairs like EUR/USD and GBP/USD. If you're trading from Cape Town, this sweet spot lands late in your afternoon. Guessing when it starts and ends is a recipe for disaster; a converter tells you the exact times in SAST.

On the flip side, it helps you steer clear of the market's "dead zones." These are quiet periods with low liquidity where spreads can widen, making your trades more expensive and far less predictable. By showing you exactly when only one major market is open (or none at all), the tool helps protect your capital from poor trading conditions.

A forex time converter transforms your approach from reactive to proactive. It empowers you to build a trading schedule around market opportunities, not the other way around.

Ultimately, this lets you build a trading routine that fits your strategy perfectly. Instead of randomly checking charts hoping for some movement, you can plan your day around confirmed periods of high activity. You're aligning your focus with the market's natural rhythm, which is a much more disciplined way to trade.

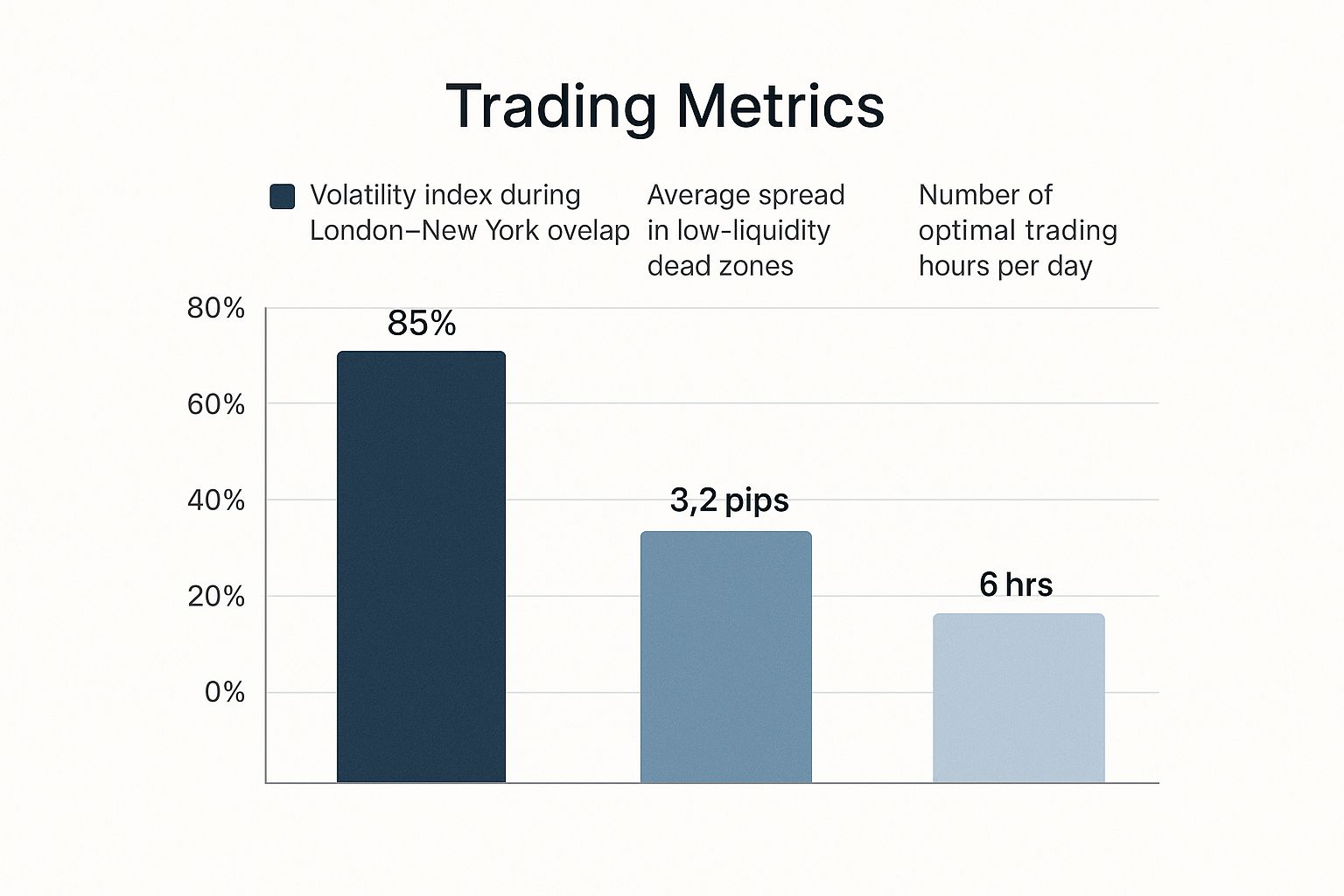

This infographic breaks down the key differences between trading during optimal and suboptimal times, showing the hard data behind why timing is everything.

The numbers don't lie. Lining up your trades with peak market overlaps almost always leads to higher volatility and much better trading conditions.

Navigating the Four Major Forex Trading Sessions

The forex market isn't a single, monolithic entity; it’s a living, breathing network that follows the sun around the globe. This 24-hour cycle is broken down into four distinct trading sessions, each with its own character and rhythm. For a trader in South Africa, understanding these sessions is like knowing the tide schedules before you go surfing.

A forex time converter is your essential navigation tool. It translates these global market pulses into your local South African Standard Time (SAST), showing you exactly when the action is happening and helping you avoid trading when the market is asleep.

Each session is anchored by a major financial centre, which naturally dictates which currency pairs see the most movement. By aligning your trading with these active periods, you're plugging into the market when it has the most energy and liquidity.

The Asian Sessions: Sydney and Tokyo

The global trading day quietly stirs to life in Sydney. As the smallest of the major sessions, it often sets a calm, predictable tone for the start of the week. The real momentum in the Asia-Pacific region builds a few hours later when Tokyo opens its doors, bringing Japan's massive economy into the mix.

- The Sydney session gets things rolling from around 23:00 SAST to 08:00 SAST.

- The Tokyo session follows, running from approximately 01:00 SAST to 10:00 SAST.

During these hours, you'll see the most action on pairs involving the Australian dollar (AUD), the New Zealand dollar (NZD), and of course, the Japanese yen (JPY). The period where Sydney and Tokyo overlap is the first real burst of liquidity for the day.

The European Session: London

When London wakes up, the entire forex market sits up and pays attention. This is the heavyweight champion. As the world's primary financial hub, London accounts for a staggering 40% of all daily forex volume. Its opening unleashes a tidal wave of liquidity and volatility.

The London session runs from 09:00 SAST to 18:00 SAST. This is prime time for major pairs like EUR/USD, GBP/USD, and USD/CHF. For South African traders, the timing is perfect, as the London morning aligns beautifully with our local business day.

The North American Session: New York

Last but certainly not least, the New York session brings the immense power of the US market online. Kicking off at 15:00 SAST and closing at 24:00 SAST, this session is heavily influenced by major US economic news releases, which can send shockwaves through the market.

Given that the US dollar is on one side of nearly 90% of all forex trades, this session is critical for virtually every currency pair you can think of.

The real magic happens during the London-New York overlap. From roughly 15:00 SAST to 18:00 SAST, the world's two largest financial centres are operating at the same time. This creates a period of peak liquidity and volatility—a golden window for many trading strategies.

A forex time converter makes visualising these sessions and their crucial overlaps effortless. To make it even simpler, here's a quick reference table showing how the major sessions line up with South African Standard Time.

Forex Market Sessions in South African Standard Time (SAST)

This table breaks down the opening and closing times for each major market session in SAST, giving you a clear guide to when specific currency pairs are most active.

| Market Session | SAST Opening Time | SAST Closing Time | Key Characteristics & Active Pairs |

|---|---|---|---|

| Sydney | 23:00 SAST | 08:00 SAST | Sets the initial tone. Active pairs include AUD/USD, NZD/USD. |

| Tokyo | 01:00 SAST | 10:00 SAST | Dominant Asian session. High volume for JPY pairs like USD/JPY. |

| London | 09:00 SAST | 18:00 SAST | Highest trading volume. EUR and GBP pairs are most active. |

| New York | 15:00 SAST | 24:00 SAST | Driven by US economic data. Peak volatility during overlap with London. |

Keeping this schedule handy helps you pinpoint the best times to trade, ensuring you're placing your orders when the market is most likely to move in your favour.

Weaving a Time Converter Into Your Daily Routine

Knowing when the major forex sessions open and close is great, but consistently acting on that knowledge is what truly makes a difference. The real trick is to make a forex time converter a non-negotiable part of your trading process, turning that theory into practical, profitable habits.

The aim is to stop glancing at times sporadically and start building a solid routine around global market hours. It all begins with one simple but crucial step: setting your converter to your local time zone—in our case, South African Standard Time (SAST)—and leaving it there.

By embedding a time converter into your workflow, you essentially automate repetitive tasks like mental time zone gymnastics. This frees up precious mental energy, letting you focus on what really matters: your trading strategy and market analysis.

Building Your Daily Workflow

Make it a habit: your first action of the day should be checking your time converter. Before a single chart is opened, get a clear picture of the day's key sessions and overlaps. This simple act provides a powerful framework for every decision that follows.

- Morning Review (Before London Opens): Glance at the converter to see how the Tokyo session is wrapping up. This gives you a sense of the market mood as you gear up for the London open. Are there any big news events scheduled for Europe?

- Midday Planning (During the London Session): As London hits its stride, use the converter to nail down the exact start time of the crucial London-New York overlap. This is your high-octane trading window.

- Afternoon Execution (The Overlap): This is where you should be most focused. The converter confirms you're operating right in the sweet spot of peak liquidity, which typically runs from 15:00 SAST to 19:00 SAST.

This kind of structured approach takes the guesswork out of the equation. You're no longer just reacting to whatever the market throws at you; you're deliberately positioning yourself for periods where you know activity will be highest.

A forex time converter isn’t just a tool you check; it’s a blueprint you follow. It transforms your trading day from a series of impulsive actions into a deliberate, time-aware strategy.

To really lock this routine in, bring technology into the fold. Set up calendar alerts for market opens and major economic data releases, making sure they're perfectly synced with the times on your converter. Most tools also let you customise the display to show only the sessions that matter for your specific currency pairs. This level of organisation ensures you never miss a beat, turning a simple converter into a powerful daily habit.

Choosing the Right Forex Time Converter

With so many tools out there, picking the right forex time converter can feel a bit like searching for a needle in a haystack. They aren't all built the same, and the best one for you really depends on how you trade. Are you always at your desk, or do you need a solid mobile app for trading on the move?

The goal is to find something that gives you more than just the time; it needs to offer genuine strategic insight.

A non-negotiable feature is automatic daylight saving time (DST) adjustment. Twice a year, major hubs like London and New York change their clocks. Getting this wrong manually is an easy mistake that could lead to a very costly trading error. A good converter takes care of this for you, no questions asked.

It's also crucial that the tool gives you a clean, visual snapshot of when the major market sessions overlap. You need to see, in an instant, when the markets are busiest—especially during that crucial window when both London and New York are open and liquidity is at its peak.

Must-Have vs. Nice-to-Have Features

To cut through the noise, it helps to separate the absolute essentials from the convenient extras. Think of it as building a simple checklist for your trading toolkit.

Core Features (Must-Haves):

- Automatic DST updates for all the big financial centres.

- A clear, visual layout showing open, closed, and overlapping sessions.

- The option to set your local time zone (SAST, for instance) as the main reference point.

Valuable Add-ons (Nice-to-Haves):

- A built-in economic calendar flagging major news releases.

- Push notifications or mobile alerts for market opening and closing times.

- A customisable interface that lets you hide the sessions you don't trade.

The surge in forex trading across South Africa, often as a way to generate another stream of income, highlights just how important reliable tools have become. With the local unemployment rate sitting at 32.9%, it's no surprise that many people have turned to the markets, leading to a massive spike in trading app downloads. You can read more about South Africa's booming retail forex market.

Think of your forex time converter as more than a simple clock. It’s a decision-making tool that brings clarity and confidence to your trading, helping you execute your strategy with precision.

While specialised forex converters are purpose-built for traders, you can also use general time conversion tools for broader scheduling. At the end of the day, the right choice is the one that feels intuitive to you and delivers rock-solid, accurate information every single time you sit down to trade.

Got Questions About Forex Time Converters? We've Got Answers

Even after you get the hang of what a forex time converter does, a few practical questions always seem to come up. Let's tackle some of the most common ones we hear from traders here in South Africa.

Do I Need to Worry About Daylight Saving Time?

Nope, and that's exactly why these tools are so brilliant. Any decent forex time converter automatically handles all the tricky Daylight Saving Time (DST) adjustments for you.

This is a huge relief compared to tracking it all yourself. When the clocks in London or New York jump forward or fall back, the converter updates instantly, so you're never caught an hour off guard. This feature alone saves traders from making costly mistakes that are all too common when just using a basic world clock.

What Is the Best Time to Trade Forex from South Africa?

If you're trading on South African Standard Time (SAST), the real action happens during the overlap between the London and New York sessions. This is your prime time, typically running from 15:00 SAST to 19:00 SAST.

During this four-hour window, the market is buzzing with the highest liquidity and volatility. For you, this means spreads are usually tighter and trading opportunities pop up more often, particularly for major pairs like EUR/USD and GBP/USD. A converter helps you nail this golden window without fail, every single day.

A world clock tells you the time, but a forex time converter shows you the opportunity. It gives you a strategic map of market activity that a simple list of city times just can't provide.

Can’t I Just Use a Regular World Clock?

You could, but it’s like using a map from the 1990s to navigate Sandton today—it shows you the basics but misses all the crucial, up-to-date details. A world clock is fine for knowing the time somewhere else, but it falls completely flat for serious trading.

A specialised forex time converter gives you a living, breathing picture of the market's rhythm. It doesn’t just show you the time; it shows you:

- Which major market sessions are live right now.

- Where the high-volume overlaps are happening.

- When a key session is about to wind down.

This kind of strategic view is infinitely more valuable for making sharp, timely decisions than simply knowing it's 9 AM in New York.

Ready to move beyond forex trading and manage your business's international payments with the same precision? Zaro offers South African businesses access to real exchange rates with zero spread, eliminating hidden fees and simplifying global transfers. See how much you can save on your cross-border transactions. Learn more at Zaro.