South Africa is the undisputed forex giant of the continent, and that creates a vibrant, competitive job market for traders with real skill. If you're looking for forex trader jobs South Africa, the first thing you need to do is get a proper handle on this ecosystem, especially in the key hubs like Johannesburg and Cape Town.

Understanding the South African Forex Job Market

To even have a chance at landing a role here, you've got to know where the actual opportunities lie. South Africa's financial sector isn't just big; it's sophisticated and well-regulated, making it a prime location for major international financial players to set up shop.

This isn't by chance. The market's credibility is anchored by the strict oversight of the Financial Sector Conduct Authority (FSCA). This robust regulation fosters a sense of trust, which in turn attracts serious, reputable employers. For you, this means a more secure and professional career path.

Why South Africa Is a Forex Hub

The country’s position as a financial leader isn't just talk; it's backed by some serious numbers. Retail forex trading is booming across Africa, and South Africa is leading the charge. The daily forex turnover here is a massive $20 billion, completely dwarfing that of other African nations. This growth is fuelled by the explosion in mobile trading and a population that's becoming more financially savvy. For a deeper dive, the 2025 outlook on forex trading in Africa offers some great insights.

All this liquidity and market depth makes for a rich hunting ground, with different types of employers all looking for talent.

For an aspiring trader, this means your job search isn’t limited to one type of company. The ecosystem is diverse, offering paths in banking, proprietary trading, and asset management, each demanding a slightly different skill set and mindset.

Who's Hiring Forex Traders in South Africa

Knowing who the key players are is crucial. It lets you fine-tune your CV, your cover letter, and your entire approach. Most of the top employers are clustered in a few main categories, primarily based in the financial centres of Johannesburg and Cape Town.

Here’s a snapshot of the main employer types you should be looking at.

| Employer Type | What They Look For | Primary Hubs |

|---|---|---|

| Proprietary Trading Firms | Traders with consistently profitable strategies and iron-clad risk management. They want to see your track record. | Johannesburg, Cape Town |

| Commercial & Investment Banks | Strong analytical abilities and often a formal finance degree. You'll be servicing corporate clients or managing the bank's own book. | Johannesburg |

| Hedge Funds & Asset Managers | Deep market knowledge and strong quantitative skills. Forex is part of a much larger, complex investment strategy here. | Cape Town, Johannesburg |

Each of these avenues offers a distinct career trajectory. Banks provide structure and corporate exposure, while prop firms offer a more performance-driven, eat-what-you-kill environment. Your personality and trading style will likely be a better fit for one over the others.

2. Sharpen the Skills That Get You Hired

Getting noticed for one of the top forex trader jobs South Africa has on offer takes more than just a passion for the markets. Let’s be clear: firms aren’t looking for hobbyists. They want professionals with a specific mix of hard and soft skills who can handle immense pressure and, above all, protect the firm's capital.

It all starts with your analytical abilities. You need to do more than just follow trends; you must be able to dig into complex economic data—think SARB interest rate decisions or US non-farm payroll reports—and instantly grasp how they’ll affect pairs like the USD/ZAR.

This isn't just about reading charts, either. A real quantitative edge is essential. This means you need a comfortable grasp of statistics and probability, which are the bedrock of developing and back-testing any viable trading strategy. Without that mathematical foundation, you're essentially just gambling.

The Make-or-Break Core Competencies

While technical skills are a given, what really sets a candidate apart is an almost obsessive focus on risk management. I can't stress this enough—it's the single biggest differentiator between a professional trader and someone who blows up an account.

A trader who can pull a 20% return with a tight 5% drawdown is infinitely more valuable to a prop firm or a bank than someone who makes a flashy 50% but suffers a 40% drawdown to get there. The game is about consistency and living to trade another day.

To prove you have this, you need to show you’ve mastered a few key disciplines:

- Position Sizing: You must be able to calculate the correct lot size for every trade, linking it directly to your account equity and pre-defined risk parameters. This is non-negotiable.

- Stop-Loss Strategy: It’s not enough to just place a stop-loss. You need a logical, repeatable system for where you place it, whether it's based on volatility, market structure, or a key technical level.

- Risk-to-Reward Ratios: Consistently hunting for setups where your potential profit is a multiple of your potential loss (aiming for 2:1 or better) is a hallmark of a professional approach.

Forging a Trader's Mindset

Finally, don't underestimate the psychological component. The market is a relentless test of your mental fortitude. Firms need to see that you can stay disciplined when a trade goes against you and avoid emotional blunders like "revenge trading" to win back losses.

This means being decisive enough to act on your analysis without freezing up, but also having the humility to know when you're wrong and cut a losing trade without a second thought. It's this blend of cool-headed confidence and strict discipline that South African financial firms are desperately looking for.

Crafting a Trader CV That Demands Attention

Forget everything you know about standard CVs. When you're chasing forex trader jobs in South Africa, a simple list of past duties just won't cut it. Your CV needs to function as your first and most critical trade, and you need to win it.

Recruiters and prop firm managers are looking for proof, not promises. They want to see a verifiable track record that showcases your trading skill. So, instead of burying your experience under a generic work history, bring your performance right to the front. I always advise traders to create a "Trading Performance Summary" section right at the top, just under their contact info. This is your chance to prove your worth before they even get to your previous roles.

Building a Verifiable Track Record

Don't have a long professional history? That's not a deal-breaker. You can build a credible track record using a demo account or a small live account over a period of three to six months. The trick is to treat it with absolute seriousness, sticking to a consistent strategy as if significant capital is on the line.

This discipline allows you to gather the specific metrics that South African financial firms truly care about.

- Sharpe Ratio: This is the gold standard for measuring risk-adjusted returns. It tells them how much return you're generating for the level of risk you take on.

- Maximum Drawdown: This shows the biggest drop your account experienced from a peak. It's a direct reflection of your risk management and resilience.

- Average Win/Loss: A straightforward metric that gives a quick glimpse into how effective your trading entries and exits are.

- Profit Factor: Calculated by dividing your gross profit by your gross loss, this provides a clear, immediate look at your strategy's overall profitability.

Your goal is to transform your CV from a list of past jobs into a compelling business case for why a firm should trust you with its capital. A well-documented track record with solid metrics is your most powerful tool.

Present this data cleanly. A small, clear table works wonders. It's also crucial to list the platforms you're proficient in, like MT4/MT5 or cTrader. By providing hard, quantifiable evidence right away, you immediately stand out from the crowd of applicants who merely talk about their "passion for trading". You're showing them you can actually do the job.

Finding the Best Forex Trading Opportunities

If you're serious about finding top-tier forex trader jobs in South Africa, you need to think beyond simply scrolling through mainstream job sites. Honestly, the most rewarding roles rarely pop up in a standard search. They're found through more specialised channels and good old-fashioned networking.

Your first port of call should be identifying the key financial recruitment agencies, particularly in hubs like Johannesburg and Cape Town. These agencies are the gatekeepers; they have deep-rooted connections with prop trading firms, major banks, and hedge funds. Getting on the radar of a recruiter who lives and breathes financial markets can mean your CV lands directly on the right desk, skipping the digital pile entirely. At the same time, make LinkedIn your best friend. Follow the big South African financial players and don't be shy about connecting with their talent acquisition teams or even desk managers.

Widen Your Search Net

When you do turn to job boards like PNet or Careers24, you've got to be smart about it. Think like a hiring manager, not just a job applicant. Searching for "forex trader" is too broad and will drown you in irrelevant listings. Instead, use more specific, strategic keywords to uncover those hidden opportunities.

- FX Analyst: This is a great one. It often leads to roles focused on market analysis and building trading strategies.

- Proprietary Trader: This search term hones in on firms that hire traders to manage the company's own capital—often where the real action is.

- Quantitative Trader: If you have a strong background in maths, stats, or programming, this is your keyword.

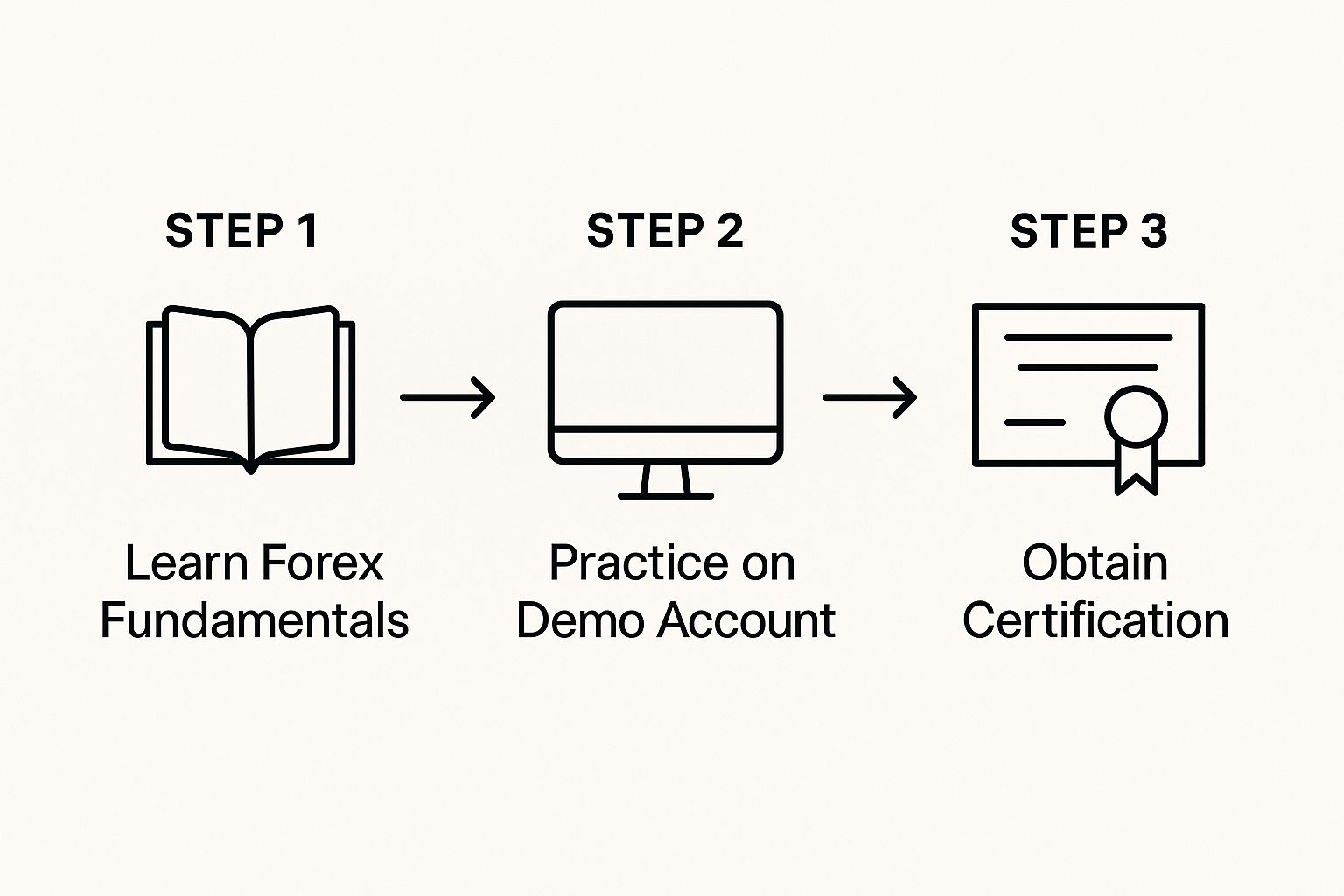

This visual lays out the foundational journey that many successful traders walk through well before they even think about applying for a job.

The image really drives home a key point: employers want to see proof of this progression, from learning the ropes to getting real-world experience. You need to show you’ve done the work. The market here is dynamic; South Africa carries the heaviest forex trading volume on the continent, and new tech is constantly shifting the ground under our feet. For instance, projections suggest that soon, around 65% of all forex orders could be executed by algorithms. Find out more about how technology is changing the SA forex market.

Don't forget, the best jobs are often the ones you never see advertised. Your most powerful tools are proactive networking and targeted outreach. This approach doesn't just help you find hidden gems; it shows employers you have the initiative and dedication they're looking for.

Nailing the Forex Trader Interview

Walking into an interview for a trading role isn't like any other job interview. It's a high-stakes test of your practical knowledge, your mental discipline, and how you handle risk when the pressure is on. Firms with forex trader jobs in South Africa are looking for one thing above all: proof that you can be trusted with their capital.

Get ready for some serious scrutiny of your trading strategy. You’ll be asked to dissect your thought process in real-time. A classic question is, "Walk me through your best trade from last quarter. What was your setup, your entry trigger, and how did you manage it to your exit?" You need to be able to explain every detail, from the macro setup down to the tick-by-tick execution.

Showing You've Got the Right Mindset

Beyond your technical skills, they’ll want to know if you have the right psychology for the job. Expect behavioural questions designed to see what happens when a trade goes south. They need to be sure you won’t make emotional decisions when the market gets choppy.

You'll likely hear questions like:

- "Tell me about a time you took a big loss. What went wrong, and what did you learn?"

- "How do you stay disciplined during a period of extreme volatility?"

- "What's your pre-market routine? Talk me through it."

The only way to answer these is with complete honesty. Admitting a mistake and explaining the logical steps you took to fix the underlying issue is far more powerful than pretending you have a perfect record. They want to see self-awareness, not a flawless hero.

Connecting Your Strategy to the Real World

Finally, you have to prove you see the bigger picture. Simply being a good chart reader isn't enough; you need a solid grasp of the global economy and how it directly impacts currency pairs. For example, knowing that South Africa’s gross foreign exchange reserves recently peaked at $68.415 billion is crucial. This number isn't just trivia; it signals the country's capacity to stabilise the rand, which directly affects market confidence and your trading environment. You can dig deeper into how these reserves impact the market through resources like TradingView's news updates.

When you can confidently discuss factors like these, you show you're more than just a technician—you're a trader with true commercial insight. The goal is to articulate your trading philosophy, explain your risk framework, and connect it all to what's happening in the real world. That’s how you convince them you’re the right person for the desk.

Answering Your Burning Questions About Forex Careers in SA

https://www.youtube.com/embed/tzN2UjfrmBQ

Even with the best roadmap, you’re bound to have some questions rattling around. It’s only natural. Getting into the forex trading world in South Africa is a big move, and it's smart to clear up any uncertainties before you commit.

Let’s tackle some of the most common queries I hear from aspiring traders. Getting these answered helps cut through the noise so you can focus on what really moves the needle.

Do I Really Need a Finance Degree to Get Hired?

This is probably the biggest question on everyone's mind. The short answer? Not necessarily, but it definitely helps. Major banks and traditional financial institutions will almost always prefer candidates with a degree in finance, economics, mathematics, or a related field. It’s a box they like to tick.

But the game is changing, especially with proprietary (prop) trading firms. These companies are often more interested in raw talent and a proven ability to perform. If you have a solid, verifiable track record that shows you can generate consistent profits while managing risk effectively, that can be far more powerful than a piece of paper. Your trading statement can become your best credential.

What Kind of Salary Can I Realistically Expect Starting Out?

Let's talk money. For a junior trader position in a hub like Johannesburg or Cape Town, you're likely looking at a base salary in the ballpark of R250,000 to R450,000 per year. The exact figure really hinges on the firm—a large investment bank will have a different structure than a boutique prop shop.

But that base salary is just the beginning.

The real earning potential in trading comes from performance bonuses. This is where your skill truly pays off. Your take-home pay is directly tied to the profits you generate, which means your total compensation can climb significantly higher than your base if you have a good year.

Should I Aim for a Local Broker or an International Firm?

This is a great question, and the right answer really boils down to your personal career goals. Both paths offer unique advantages for someone looking to build a career from South Africa.

- International Brokers: Working for a global powerhouse often means access to a wider range of markets, more advanced trading technology, and a clear, structured career ladder that could even lead to opportunities overseas.

- Local, FSCA-Regulated Brokers: Choosing a local firm gives you an incredible, hands-on understanding of the South African market's unique quirks and regulatory environment. This kind of specialised, on-the-ground knowledge is extremely valuable and can make you a sought-after expert.

Ultimately, neither is universally "better." The best fit depends on what you want to achieve, your trading style, and where you see yourself in the next five to ten years.

For South African businesses, managing international payments with the same sharpness as trading the markets is vital. Zaro offers a way forward, giving businesses access to real exchange rates without the hidden fees and costly markups that banks typically charge. To see how you can streamline your global transactions and protect your bottom line, find out more at usezaro.com.