So, what exactly is a forex trading account? Simply put, it's a specialised account designed for one thing: trading foreign currencies. It’s not like your everyday bank account that holds your Rands. Instead, it’s your dedicated portal to the global foreign exchange market, letting you speculate on currency movements, like the Rand versus the US Dollar.

Your Gateway to Global Currency Markets

Think of a forex trading account as your personal passport to the world's biggest financial stage. Your standard bank account is perfect for saving and daily spending here in South Africa, but a trading account is built for a completely different job—engaging with the fast-paced world of international currencies.

Its main role is to act as a bridge. It connects you, an individual trader, to the network of forex brokers who actually place your buy and sell orders. For most people, trying to access the forex market without one would be virtually impossible. This is the account where you'll deposit your trading funds, keep an eye on your open trades, and, hopefully, withdraw your profits.

More Than Just a Digital Wallet

It's easy to think of a trading account as just a place to hold money, but it's so much more than that. It’s an active hub that links directly with a trading platform, like the industry-standard MetaTrader 4 (MT4) or its successor, MetaTrader 5 (MT5). This powerful duo gives you everything you need to actually participate in the market.

Through your account, you get access to the essential tools of the trade:

- Real-Time Price Feeds: Watch live exchange rates for dozens of currency pairs as they tick up and down every second.

- Charting Tools: Dive into historical price data to spot trends and potential trading opportunities before putting any money on the line.

- Leverage Application: Use borrowed funds from your broker to open a much larger position than your initial deposit would normally allow.

- Order Execution: Instantly place buy or sell orders, set pre-defined profit targets, and use stop-loss orders to help manage your risk.

In essence, your trading account is the command centre for all your forex activities. It holds your funds securely, processes your instructions, and provides a clear record of your trading performance, all while being regulated to ensure fairness and transparency.

Before you jump in, it’s crucial to know that not all accounts are created equal. They come in various types, each with features designed for different trading styles, experience levels, and starting capital. Getting this foundation right is the first real step to making smart decisions on your trading journey.

Choosing the Right Account for Your Goals

Picking the right forex trading account is a lot like choosing the right tool for a job. You wouldn't use a sledgehammer to hang a picture frame, and you wouldn't use a tiny screwdriver to break up concrete. In the same way, the account you choose will either set you up for success or make your trading journey a frustrating uphill battle. This is your first major strategic decision, so it pays to get it right from the start.

Not all accounts are created equal. The differences go way beyond just the name on the broker’s website—they affect your trade sizes, how much each trade costs, and even the way your orders are filled. Let's break down the main types you'll come across so you can make a choice that actually fits your capital, experience, and what you’re trying to achieve.

The Essential Practice Ground: a Demo Account

Before you even think about putting your hard-earned Rands on the line, the single most important account for any new trader is the Demo Account. Honestly, think of it as a flight simulator for the currency markets. It gives you a full-featured trading platform with real-time market data, live charts, and every tool you'd have in a live account.

The only difference? You’re trading with virtual money. This completely risk-free environment is invaluable. It’s your sandbox for practising how to place trades, testing out different strategies, and just getting comfortable with the trading software. You get to feel the rhythm of the market's volatility without any of the real-world financial consequences. Most reputable brokers in South Africa offer free, unlimited demo accounts, and skipping this step is a classic rookie error that can be incredibly costly down the road.

Micro Accounts: The Ideal Starting Point

Once you've got the hang of things on a demo and you're ready to trade with real money, a Micro Account is almost always the best place to start. This account type was specifically designed for people kicking off with a smaller budget. Its defining feature is that you trade in "micro lots," which are just 1% of the size of a standard lot.

To give you a practical example, a one-pip move on a major pair in a standard account might see your balance change by R150. In a micro account, that very same one-pip move would only be about R1.50. This massive reduction in risk is exactly what you need when you're still learning the ropes.

Think of it like learning to drive. A Micro Account is your empty parking lot. You can stall, make a few clumsy turns, and learn the feel of the controls without the high-stakes pressure of a busy motorway. It lets you experience the real psychology of having money on the line, but with much, much smaller consequences.

Standard Accounts: For Growing Traders

As you build up your experience, screen time, and confidence, you’ll probably find yourself ready to move up to a Standard Account. This is the bread-and-butter account type offered by most brokers and is geared towards traders who are more comfortable in the market and are working with a larger capital base.

The main difference here is the contract size. Standard accounts use "standard lots," which represent 100,000 units of the base currency. This means that both your potential profits and your potential losses are significantly larger for every single pip the market moves. The trade-off is that these accounts often come with better trading conditions, like tighter spreads (the gap between the buy and sell price), making them a solid choice for intermediate to experienced traders.

ECN Accounts: For Direct Market Access

For the seasoned pros and high-volume traders, the ECN (Electronic Communication Network) Account offers a completely different ball game. Instead of the broker acting as the middleman (or "market maker"), an ECN account plugs you directly into a network of liquidity providers—we're talking big banks, hedge funds, and other major traders.

This direct-access model has some serious advantages:

- Ultra-tight Spreads: Because you're seeing raw prices from a deep pool of players, spreads can shrink to virtually zero.

- Transparent Pricing: There's no broker intervention marking up the price feed. What you see is what you get.

- Faster Execution: Your orders are matched and filled in a flash within the network.

The catch is that ECN brokers don't make their money from the spread. Instead, they charge a small, fixed commission on every trade you place. These accounts also tend to have higher minimum deposit requirements, making them best suited for professional traders who prioritise raw speed and total transparency above everything else.

Comparing Common Forex Account Types

To help you visualise the differences, here’s a quick side-by-side comparison. Think about where you are in your trading journey and see which column aligns best with your needs.

| Feature | Standard Account | Micro Account | ECN Account |

|---|---|---|---|

| Best For | Intermediate Traders | Beginners | Advanced/Pro Traders |

| Trade Size | Standard Lots (100,000 units) | Micro Lots (1,000 units) | Variable (Standard Lots) |

| Minimum Deposit | Moderate | Very Low (often < R200) | High |

| Cost Structure | Primarily Spread | Wider Spread | Spread + Commission |

| Risk Level | Higher | Lower | Highest |

Ultimately, the best account is the one that lets you execute your strategy effectively while managing risk at a level you’re comfortable with.

Specialised Account Types

Beyond the main three, many brokers offer specialised accounts to cater to specific needs. A common one for traders in South Africa is the Islamic Account, also known as a "swap-free" account. These are structured to comply with Sharia law, which prohibits earning or paying interest (riba). Instead of the daily rollover interest charges (swaps) for holding a position overnight, these accounts typically use a flat administrative fee.

Essential Features of a Great Trading Account

Once you have a rough idea of the account type you're after, it's time to get into the details. This is where you separate a truly great forex trading account from an average one. Think of it like buying a car; you might have decided on an SUV, but now you need to pop the bonnet, check the safety features, and get a feel for the running costs. These specifics will directly shape your trading experience and, ultimately, your profitability.

A few key elements are non-negotiable. We're talking about the broker's regulatory status, the actual cost of placing a trade, the tools you get, and how reliable the whole setup is. Let’s run through this essential checklist.

Regulation: The Unbreakable Foundation

Before you even glance at spreads or bonus offers, your first and most important check is regulation. Here in South Africa, that means making absolutely sure your broker is authorised by the Financial Sector Conduct Authority (FSCA). This isn't just a friendly suggestion; it's a must-do for protecting your money.

An FSCA-regulated broker has to play by a strict set of rules designed to protect you. This includes keeping your funds in a separate bank account from their own operational cash (segregation) and offering negative balance protection, which stops you from losing more money than you deposited. If you trade with an unregulated entity, you’re basically on your own, with no legal safety net if things go wrong.

This solid regulatory framework is a big reason South Africa has become a trading hub on the continent. The market here is huge, with local traders handling around $2.21 billion in volume every single day. With roughly 190,000 active daily traders, the FSCA's oversight is what keeps this vibrant community safe. You can discover more insights about Africa's top trading nations and see just how South Africa's mature approach fosters a secure trading environment.

Understanding Leverage and Margin

Two of the most powerful—and often misunderstood—features of any forex account are leverage and margin. In simple terms, leverage lets you control a large market position using a relatively small amount of your own capital. The broker effectively lends you the rest.

For example, with 100:1 leverage, you could control a R100,000 position with just R1,000 from your account. That R1,000 is called the margin—think of it as the good-faith deposit you need to open and maintain that leveraged trade.

Leverage is a double-edged sword. It can massively amplify your profits from small price movements. But, and this is a big but, it will amplify your losses just as fast if the market turns against you. Learning to use leverage wisely is one of the key skills that separates successful traders from those who quickly blow through their capital.

The True Cost of Trading: Spreads and Commissions

Every single trade you place has a cost, and these little fees can seriously eat into your profits over time. The two main costs you need to keep an eye on are spreads and commissions.

- The Spread: This is simply the difference between the buy (ask) price and the sell (bid) price of a currency pair. Brokers with tighter, lower spreads are cheaper to trade with because you're paying less on every transaction.

- Commissions: Some accounts, especially ECN types, charge a fixed commission for each trade on top of offering a very tight spread. For traders who place a lot of orders, this can actually work out cheaper than a standard account that only charges a wider spread.

Getting your head around these costs is critical. A broker with high spreads can easily turn a winning strategy into a losing one over the long run.

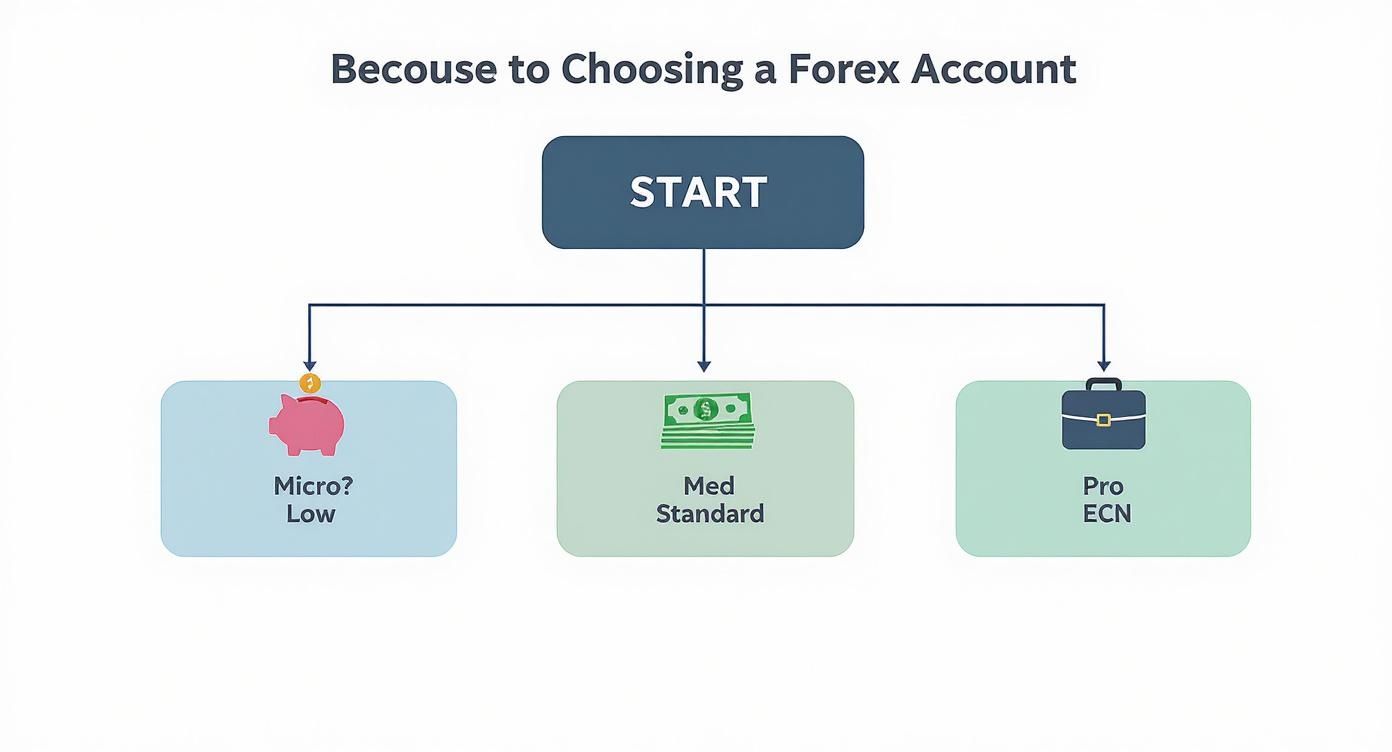

This decision tree infographic can help you quickly match an account type to your budget, which is a key first step in aligning your trading goals with the right features.

As the visual shows, your starting capital—whether it's small or professional-level—points you toward specific accounts like Micro, Standard, or ECN, each with its own cost structure.

Platform Stability and Support

Finally, don't overlook the quality of the trading platform itself. Most brokers offer industry standards like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are popular for a reason—they're reliable and packed with excellent charting tools. You need a platform that is stable, executes your orders instantly, and doesn't crash at a critical moment. Make sure it’s available on all the devices you use, too.

Just as important is good, responsive customer support. When you have an issue with a deposit, a trade, or a technical glitch, you need a support team you can actually reach. Look for brokers offering help via live chat, phone, and email, ideally with people available during South African business hours. A great trading account is always backed by a team you can count on.

Opening Your Forex Account Step by Step

Alright, you've done the homework and now you're ready to jump in and open your own forex trading account. It might sound a bit intimidating, but honestly, it's more straightforward than you’d think—pretty much like setting up any other online financial service these days.

To make it as simple as possible, I’ve broken the whole process down into five clear stages. Follow these, and you'll get your account set up securely and correctly, without any frustrating hold-ups. Let's get you to the starting line.

Step 1: Choose a Regulated Broker

First things first, and this is the most important decision you'll make: picking a reputable broker. As I've stressed before, regulation isn't just a nice-to-have; it's essential. For us here in South Africa, that means finding a broker licensed by the Financial Sector Conduct Authority (FSCA).

Working with an FSCA-regulated broker is your safety net. It ensures your money is protected and that the broker plays by the rules. Before you commit, head to the broker's website and scroll down to the footer—you should find their FSCA licence number proudly displayed there. A quick check here saves you a world of potential trouble later.

Step 2: Complete the Online Application

Once you've settled on a broker, it's time to fill out their online application. This is usually a quick affair, asking for the standard personal details you'd expect.

You’ll typically be asked for:

- Your full name, address, and contact details.

- Your date of birth and country of residence.

- A few questions about your trading experience and financial situation.

This isn't them being nosy; it’s about meeting regulatory requirements and understanding your needs as a trader. Just be honest and double-check your details to keep the process smooth.

Step 3: Verify Your Identity (KYC)

After you've submitted the form, you’ll need to verify who you are. This is a standard security measure called Know Your Customer (KYC), and every legitimate financial institution has to do it. It’s there to prevent fraud and money laundering, protecting both you and the broker.

To get this done, you'll usually need to upload clear copies of two documents:

- Proof of Identity: A valid South African ID, passport, or driver's licence will do the trick.

- Proof of Address: A recent utility bill, bank statement, or a municipal rates account works perfectly. Just make sure it’s less than three months old and clearly shows your name and physical address.

Most brokers have a secure portal to upload these documents. The verification process is usually wrapped up within 24 hours. Once that's done, your account is live and ready for funding.

Step 4: Fund Your Forex Trading Account

With your account fully verified, the next step is to deposit some funds. Good brokers in South Africa make this easy by offering familiar payment methods. Local bank transfers (EFT) are often the go-to option, as they're typically quick and cheap.

You'll also find options like debit/credit cards and various e-wallets. Before you deposit, take a moment to understand any fees involved. Knowing the costs is a key part of managing your trading—for a clear example, you can check out VTrader's fee structure. Most importantly, only start with an amount you're genuinely comfortable putting at risk.

Step 5: Install the Platform and Start Trading

You're on the home stretch! The final piece of the puzzle is to download your broker’s trading platform, which will almost certainly be MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Your broker will email you a download link along with your unique login details.

Install the software on your computer or phone, punch in your account number and password, and you're in. You now have a direct window to the live currency markets. My strongest advice? Don't dive straight into real trades. Spend some quality time on a demo account first to get a feel for the platform and how everything works.

Smart Risk Management for Your New Account

Getting your forex trading account open is one thing. Keeping it funded is another challenge entirely. The skill that truly separates consistently profitable traders from those who burn out is disciplined risk management.

Think of your trading capital as fuel for a long journey. If you gun it from the start, you'll run out of petrol long before you reach your destination. This is where you need to shift your focus from simply trading to actively protecting your capital.

Success in the South African forex market isn't about hitting the jackpot. It's built on a solid foundation of education, a clear strategy, and, most importantly, careful risk controls. While the FSCA's oversight provides a safe environment with reputable brokers, managing the day-to-day risks of the live market is all on you. You'll find that a disciplined approach is a common thread among all successful traders in South Africa.

Your Automated Safety Nets

Every trading platform gives you two incredibly powerful tools you should never trade without: the stop-loss and the take-profit order. Think of them as your automated safety nets, set up before you even enter a trade.

- Stop-Loss Order: This is your non-negotiable emergency brake. It automatically closes your trade at a price you set beforehand, capping your losses if the market suddenly moves against you.

- Take-Profit Order: This is your planned exit for a winning trade. It locks in your gains at a target price you've defined, so you don't give back your profits if the market reverses.

Using these tools religiously takes the emotion out of when to get out of a trade. It forces you to stick to your plan, even when the market gets wild and your gut is telling you to do something reckless.

The Golden Rule: Position Sizing

How much should you risk on a single trade? This is hands-down the most critical question in trading, and the answer lies in position sizing. It's simply the process of figuring out how large your trade should be based on your account size and your risk tolerance.

A rule of thumb that professional traders live by is to never risk more than 1% to 2% of your total account balance on any single trade.

Let's make this practical. Imagine you have R10,000 in your account. Following the 1% rule, the absolute most you can afford to lose on one trade is R100. This small, calculated risk means that even a string of losses won't wipe you out. It gives you the staying power to remain in the game.

This one habit is the firewall that prevents the kind of catastrophic loss that pushes most new traders out of the market for good.

Taming Your Trading Psychology

The final piece of the risk puzzle is you. Often, the biggest threat to your trading account comes from within, driven by the powerful emotions of fear and greed. Fear can cause you to panic and close a winning trade too soon, while greed can whisper in your ear to hold onto a losing position, hoping it'll turn around.

Here’s a simple framework to keep your emotions from sabotaging your account:

- Have a Trading Plan: Before you click "buy" or "sell," you must know your entry point, your stop-loss level, and your profit target. Write it down. Stick to it.

- Embrace Losses: Losing trades are not a sign of failure; they are a cost of doing business in the forex market. Every single pro trader takes losses. The secret is making sure your wins are bigger than your losses over time.

- No "Revenge Trading": After a loss, the temptation to jump right back in to "win your money back" is immense. Don't do it. That's an emotional decision. Stick to your plan and wait for the next quality trade setup.

By combining automated tools like stop-losses with intelligent position sizing and a disciplined mind, you build a fortress around your capital. This approach is what allows you to trade in the dynamic South African forex market for the long haul, focusing on sustainable growth instead of short-term gambles.

Why South Africa's Forex Market Is Booming

Ever wondered why forex trading seems to be everywhere in South Africa lately? It’s not just you. The local scene is buzzing, and for good reason. The market is growing at a serious pace, creating a fantastic and energetic environment for anyone thinking about opening a forex trading account.

A huge part of this explosion comes down to one thing: access. Thanks to solid internet coverage and incredibly powerful mobile trading apps, the biggest financial market in the world is now right in your pocket. You no longer need to be chained to a desk in a high-rise office; you can be analysing charts and placing trades from a coffee shop in Cape Town or your home in Johannesburg. This has thrown the doors wide open for a new wave of South Africans keen on managing their own money.

What’s Fuelling This Growth?

This isn't just a random spike in interest. There are some real economic and tech-driven forces pushing things forward. Getting your head around these will give you a much better feel for the trading landscape you're about to step into.

Three things, in particular, are really lighting the fire:

- Technology on Our Side: Modern trading platforms and slick mobile apps have made the whole process of opening and running an account ridiculously straightforward.

- The Hustle Is Real: More and more South Africans are looking for ways to generate an extra income stream or simply grow their wealth beyond a standard savings account. Forex trading offers that potential.

- Knowledge Is Power: There's a ton of great educational content out there now. People are getting more clued up on financial markets and feel more confident stepping in.

Put these together, and you have the perfect recipe for market growth, which is why South Africa has become such a hotspot for international brokers.

And this isn't slowing down. Projections suggest the number of retail forex traders in South Africa could jump by about 30% every year. That's a massive growth curve and exactly why the big global brokers are paying so much attention to the ZA market.

How This Affects Your Trading Account

So, what does all this activity mean for you, the individual trader? It's actually great news. The estimated daily trading volume in the local forex market is now over $20 billion. That’s a staggering amount of money changing hands every single day. You can read more about the growth of forex trading in Africa to get the bigger picture.

That huge volume translates into deep liquidity. In simple terms, it means that when you decide to buy or sell, there's almost always someone on the other side of the trade ready to take your offer. This ensures your orders get filled fast and at a fair price—a massive plus when you're just starting out.

Common Questions About Forex Trading Accounts

Even with a good grasp of the basics, it's totally normal to have a few questions buzzing around before you open a live forex account. Let's tackle some of the most common ones we hear from new traders in South Africa, so you can move forward with confidence.

How Much Money Do I Need to Start?

You can actually get started with a lot less than you might think. Many brokers offer Micro accounts that let you open with a deposit as small as R100 or R200. This is a great way to dip your toes into the live market without taking a big financial risk.

That said, trading with such a small amount can be tough. To give yourself enough room to manage trades properly and absorb the market's natural swings, a more practical starting point is somewhere between R3,000 and R5,000. The golden rule? Always master the platform on a demo account before you even think about putting real money on the line.

Are Forex Profits Taxable in South Africa?

Yes, they absolutely are. Here in South Africa, the South African Revenue Service (SARS) views your forex trading profits as income. This means your net profit for the tax year gets added to your other earnings and is taxed according to your personal income tax bracket.

I can't stress this enough: speak to a registered tax professional. They'll help you set up proper record-keeping and make sure you’re staying 100% compliant with SARS. It's not something you want to get wrong.

Can I Lose More Than I Deposited?

This is a huge fear for many new traders, but with a properly regulated broker, the answer is a firm no. Brokers authorised by the FSCA are required to provide something called Negative Balance Protection.

Think of this as a safety net. It automatically prevents your account from ever going into a negative balance, no matter how wild the market gets. You can't end up owing your broker money. Before you sign up with anyone, make it a non-negotiable to confirm they offer this crucial protection.

For South African businesses dealing with international payments, getting a fair deal on foreign exchange is a constant battle. Zaro cuts through the noise by giving you access to the real exchange rate with zero spread, which means you skip the hidden fees and markups that banks love to charge. To streamline your global payments and get a handle on your FX costs, check out their solution at https://www.usezaro.com.