Forex trading in Cape Town has opened up a compelling way to tap into the world's currency markets. For many, the idea of getting started with as little as R200 is a game-changer. This low barrier to entry, paired with the city's solid digital backbone, is helping to shift forex from a niche financial activity into a real opportunity for generating a second income. The trick, of course, is to get a firm grip on both the local economic factors and the practical steps needed to start trading.

Why Cape Town Is a Growing Forex Hub

Cape Town's rise as a forex trading centre didn't just happen by chance. It's a classic case of economic necessity meeting digital opportunity. The city, and South Africa as a whole, is dealing with unique economic pressures that naturally push people to look for new ways to build wealth.

Economic Drivers and Local Interest

The current economic climate is a major reason behind the explosion in forex's popularity here. Many Capetonians are on the hunt for ways to supplement their income beyond their day jobs, and forex trading offers a credible—though demanding—path. This has completely changed how people view currency trading; it's no longer just for the finance pros in Sandton but for anyone with a decent internet connection.

You can see this shift all across the Western Cape, from the lively city bowl to the quieter suburbs. With high-speed internet becoming more common and mobile trading apps getting better every day, you don’t need a fancy office setup anymore. You can literally manage your trades from a smartphone while grabbing a flat white in Sea Point or from your home office out in Bellville.

The Growth Amidst Challenges

What's really fascinating is how South Africa’s retail forex market has boomed even with stubbornly high unemployment rates. Despite official stats showing unemployment hitting 32.9%, retail forex trading volumes have jumped by an estimated 18% year-on-year. This points to a powerful trend: people are turning to the markets to create their own income streams, a pattern clearly visible in the forex trading Cape Town scene. Brokers have picked up on this, lowering the cost to get started and opening the doors to a much broader audience. You can dive deeper into how economic pressures are fuelling this growth in this detailed analysis of South Africa's forex boom.

Key Takeaway: The surge in forex trading in Cape Town is deeply connected to the pursuit of financial independence. It's the perfect storm of economic need and easier access to technology that has created such a fertile environment for new traders.

How to Select an FSCA-Regulated Broker

Let’s be blunt: choosing your forex broker is the single most critical decision you'll make as a trader in Cape Town. This isn't just about finding a platform with flashy charts. Your broker holds your capital, and that makes this partnership a matter of trust and security.

This is why I can't stress this enough: only work with a broker regulated by our own Financial Sector Conduct Authority (FSCA). It's a non-negotiable.

An FSCA licence isn't just a piece of paper. It means the broker must follow strict rules, the most important being that your funds are kept in segregated accounts, completely separate from the company's own money. Without that safeguard, your trading capital could be at risk if the broker runs into financial trouble.

Verifying a Broker's Legitimacy

Before you even think about funding an account, you need to do your homework. Don't just trust the FSCA logo on a broker's website—verify it yourself.

Head straight to the official FSCA website and use their public search tool. A legitimate broker will proudly display their Financial Service Provider (FSP) number, usually right at the bottom of their homepage. If you can't find that number, or if it doesn't check out on the FSCA register, walk away. It's a massive red flag.

The good news is that regulation and trading infrastructure have come a long way in South Africa. The FSCA's robust oversight has built a much safer environment for us retail traders. Combined with better internet and slick mobile apps, forex trading is no longer some exclusive club—it's accessible to a new generation looking for different ways to grow their wealth. You can get more insights on the growth of local trading platforms in South Africa and see how the landscape has evolved.

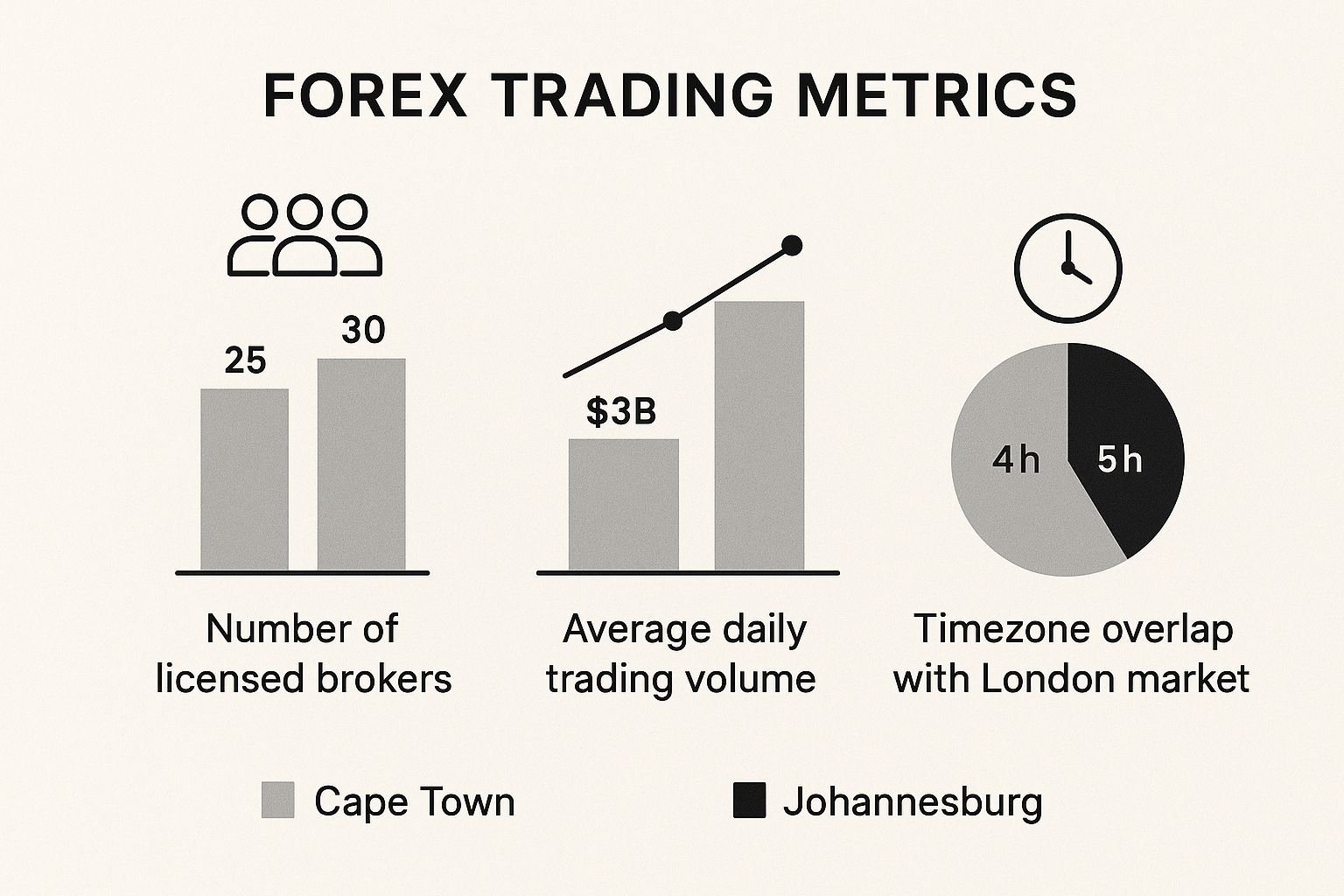

This image offers a great snapshot of the trading scenes in Cape Town versus Johannesburg, showing the unique flavour of each city's financial market.

While Joburg might have more licensed brokers and higher trading volumes, you can see Cape Town holds its own with significant daily activity.

Comparing FSCA-Regulated Broker Features

To help you get started, here's a quick comparison of what you might find when looking at different FSCA-regulated brokers. This isn't an exhaustive list, but it shows you the kind of features you should be comparing side-by-side.

| Broker Feature | Broker A | Broker B | Broker C |

|---|---|---|---|

| Minimum Deposit | R1,500 | R750 | R2,000 |

| Typical EUR/USD Spread | 1.5 pips | 0.8 pips | 1.2 pips |

| Trading Platform(s) | MT4, MT5 | MT5, cTrader | MT4, WebTrader |

| Local Support (ZA) | Yes (Phone, Email) | Yes (Live Chat) | No (Email only) |

| ZAR Accounts | Yes | Yes | No (USD only) |

Remember, the 'best' broker depends entirely on what you need. A trader focused on low costs might lean towards Broker B for its tighter spreads, while someone who values robust local support might prefer Broker A.

Key Factors in Your Broker Choice

Okay, once you've confirmed a broker is regulated, it's time to dig into the details that will affect your day-to-day trading.

Fee Structure: Look beyond the advertised spreads. What are the costs on the pairs you actually trade, like USD/ZAR? You also need to check for hidden costs like overnight swap fees, inactivity charges, or withdrawal commissions that can slowly bleed your account.

Trading Platforms: Most brokers will offer the industry standards: MetaTrader 4 (MT4) or its successor, MetaTrader 5 (MT5). The key is to find one whose platform is stable, easy to navigate, and works seamlessly on your devices, whether that's your desktop at home or your phone while you're out.

Customer Support: This is huge. When something goes wrong—and at some point, it will—you need help from someone who understands the local context. I always look for brokers with a South African phone number and support staff available during our business hours. A good tip? Test their live chat with a few questions before you sign up.

A great broker is a partner who equips you with the tools and security to succeed. A bad one is a constant roadblock. Take your time, scrutinise their costs, test their platform, and check their support before you deposit a single Rand. Your trading journey depends on getting this first step right.

Opening and Funding Your ZAR Trading Account

Alright, this is where the theory ends and the practical side of trading begins. You’ve done your homework and picked out a solid, FSCA-regulated broker. Now it's time to get your live account up and running.

The initial sign-up is usually a breeze—just a standard online form asking for your details. But your account won't be ready for action until you've cleared the verification hurdle. This is where South Africa's FICA regulations come into play, and it’s a non-negotiable step for any legitimate broker.

Navigating the FICA Verification Process

The Financial Intelligence Centre Act (FICA) requires your broker to confirm who you are and where you live. Don't see this as a hassle; it's actually a great sign that you're dealing with a company that takes security and anti-money laundering laws seriously.

You’ll need to have digital copies of two key documents on hand:

- Proof of Identity: Your green bar-coded ID book, a Smart ID card, or a valid passport will do the trick.

- Proof of Residence: A utility bill or bank statement that’s less than three months old. It must clearly show your full name and physical address.

Managing your finances is part of the game, which includes things like downloading bank statements for verification or just keeping records. It’s this documentation step that often trips people up, so preparing your files beforehand can save you a lot of back-and-forth.

Trader's Tip: I can't stress this enough: make sure the name and address on your proof of residence are an exact match to what you entered on your application form. Any small difference is the number one cause of frustrating verification delays.

Funding Your Account From Cape Town

Once your account gets the green light, it’s time to deposit your trading capital. For us here in Cape Town, this has become incredibly simple. The best brokers have integrated local payment methods that are both fast and cheap.

Here are the most common ways to fund your account:

- Local Electronic Funds Transfer (EFT): A straightforward transfer from your South African bank account. It's reliable and often my go-to recommendation.

- PayFast or Ozow: These are brilliant. They’re instant EFT gateways that let you fund your account immediately, skipping the usual one or two-day waiting period for a standard EFT to clear.

- Credit/Debit Cards: Fast and convenient, for sure. Just check with your bank about their fees for transactions with brokers, as they can sometimes add up.

ZAR Accounts vs Foreign Currency Accounts

Here’s a big decision you’ll need to make early on: should you open a ZAR-denominated account or one based in USD, EUR, or another major currency?

For most beginners, a ZAR account is the smartest move. It keeps things simple. When you deposit R5,000, you see exactly R5,000 in your trading platform. There are no currency conversion fees eating into your capital on deposits or withdrawals.

On the other hand, funding a USD account means your ZAR gets converted. While that sounds like a downside, some seasoned traders prefer it. It protects their trading capital from the day-to-day volatility of the Rand itself.

But if you're just getting your feet wet with forex trading in Cape Town, stick with a ZAR account. It’s the most direct and cost-effective way to start.

Placing Your First Trade on the Platform

Alright, your ZAR account is funded and ready to go. Now for the exciting part—actually placing a trade. You're about to get properly acquainted with your trading platform, which for most of us in Cape Town means either MetaTrader 4 (MT4) or its newer cousin, MetaTrader 5 (MT5). This software is your command centre for everything you'll do in the markets.

When you first open it up, don't be surprised if it looks a bit intimidating. With all the flashing numbers, charts, and buttons, it's easy to feel overwhelmed. But honestly, you only need to get comfortable with a few key features to get started.

For now, your main points of focus are the price chart—that big window showing you how a currency pair has moved over time—and the terminal window, which is usually at the bottom and shows your account balance and any open trades.

Before you jump in and click 'buy' or 'sell', it's crucial to understand how you actually tell the market what you want to do. These instructions are called order types, and they’re your tools for controlling your entries and exits.

Getting to Grips With Essential Order Types

You don’t need to memorise every single order type right away. Just focus on the main ones that will help you execute your plan and, most importantly, protect your trading capital.

- Market Order: This is the simplest one. It’s you telling your broker, "Get me in the market right now at the best price you can find." It’s direct and immediate.

- Stop-Loss Order: This is non-negotiable. Think of it as your safety net. It's an order you set in advance to automatically close your trade if the price moves against you to a certain point, capping your potential loss.

- Limit Order: This is for when you want to get into a trade, but only at a price that's better than what's currently available. A 'buy limit' is placed below the current price, and a 'sell limit' is set above it.

A trader without a stop-loss is like a driver without brakes. You might get away with it for a bit, but a disaster is pretty much inevitable. Always use a stop-loss. No exceptions.

A Real-World Example: Trading USD/ZAR

Let's make this practical. We'll walk through a hypothetical trade on the USD/ZAR pair, a popular choice for many involved in forex trading in Cape Town. Let's say your analysis leads you to believe the US Dollar is about to strengthen against our Rand.

You're looking to buy (or 'go long') USD/ZAR at the current market price of 18.5000. You've identified a potential target at 18.7000, but you're a sensible trader, so you first need to define your risk. You decide you’re not willing to lose more than R500 on this single idea.

Here’s how you'd think it through:

- Figure Out Your Position Size: Your platform will help with this. You know your maximum risk (R500) and where you want your safety net (your stop-loss, let's say at 18.4000). Based on these, you calculate the correct lot size for the trade.

- Set Your Stop-Loss: The first thing you do is place that stop-loss order at 18.4000. If the market turns and the price drops to that level, your trade closes automatically, and your loss is limited to that R500 you planned for.

- Set Your Take-Profit (Optional but Recommended): You can also place an order to automatically close your trade and bank the profit if the price hits your target of 18.7000.

With those parameters locked in, you hit the button to execute a market order to buy. Your trade is now live, but crucially, your downside is already protected by that stop-loss. This is how you trade with a plan, not just a hunch. It takes the raw emotion out of the equation and puts you in control from the very first step.

Smart Risk Management for Trading the Rand

Let’s be honest. Jumping into the market without a rock-solid risk plan is the quickest way to empty your trading account. It's easy to get caught up in the thrill of a winning trade, but your long-term survival in forex trading in Cape Town comes down to one thing: how well you protect yourself from the losses that will inevitably come.

This isn't the glamorous side of trading, but it's the absolute foundation of a lasting career. It’s about a fundamental mindset shift—stop chasing fast profits and start obsessing over protecting your capital. One big win feels fantastic, but a few unmanaged losses can take you out of the game before you've even had a real chance.

The Bedrock of Your Trading Plan

The most practical place to start is with the 1-2% rule. It's a simple concept, but its power is immense: never risk more than 1% to 2% of your entire trading capital on a single trade.

For instance, if you're working with a R10,000 account, your maximum loss on any one position should be between R100 and R200. Yes, it feels small. That's the whole point. This discipline ensures that a bad run of five or even six straight losses won't devastate your account. It gives you the breathing room to stick to your strategy and wait for the tide to turn.

Sticking to this rule forces you to kill the emotional urge to "go big" to win back a loss—a trap that ends countless trading journeys. You start treating each trade as just one of thousands you'll place over your career.

Your main job as a trader isn't to make money; it's to manage risk. Profits are just the reward for doing that job well.

Understanding Leverage and Rand Volatility

Leverage is a powerful tool. It lets you control a large market position with a relatively small amount of capital. South African brokers often offer very high leverage, but you have to treat it with immense respect. It’s a double-edged sword, especially when you’re trading a volatile pair like the USD/ZAR.

Of course, the appeal of high leverage is that it can magnify your profits. But it magnifies your losses just as quickly and brutally. A small move against your position can wipe out a significant portion of your account if you're over-leveraged. The ZAR is known for its sharp swings on the back of local and global news, so using high leverage without a bulletproof risk strategy is just asking for trouble.

Here’s how to handle it:

- Start low. Even if your broker offers 500:1 leverage, ignore it for now. Begin with something much more sensible, like 10:1 or 20:1, until you truly understand its impact.

- Focus on position size. At the end of the day, your risk is defined by your position size and where you place your stop-loss, not the leverage setting itself.

- Know the stakes. Always remember that without negative balance protection, you can lose more than you deposited. Make sure your broker offers this protection.

South Africa is the continent's forex powerhouse, with daily turnover estimated to be over $20 billion. The volatility in African currencies, often sparked by global economic shifts, creates huge opportunities but brings equally large risks. As a trader in Cape Town, you're right in the middle of this dynamic environment, which means discipline is non-negotiable. To get a broader perspective, you can learn more about Africa's evolving forex landscape and its future outlook.

By combining the 1-2% rule with a very cautious approach to leverage, you build a defensive foundation for your trading. This isn't about limiting your potential profits; it's about making sure you stay in the game long enough to actually achieve them.

Common Questions About Trading Forex in Cape Town

Diving into the world of forex trading in Cape Town? You've probably got a few questions bouncing around your head. It's completely normal. Getting these basics sorted out first is the smartest thing you can do before putting any of your hard-earned cash on the line.

The good news is that the landscape for local traders is pretty clear. We've got straightforward rules on everything from legality and taxes to the best times to actually sit down and trade. Let's get these common questions answered so you can start with confidence.

Is Forex Trading Actually Legal Here?

Absolutely. Forex trading in Cape Town is 100% legal. The crucial part, though, is that it's a regulated activity. To stay on the right side of the law and protect your funds, you must trade with a broker that's licensed by our own Financial Sector Conduct Authority (FSCA). Don't even consider an unregulated one.

It’s also worth remembering that the South African Reserve Bank (SARB) keeps an eye on money moving offshore. Sticking with a local, FSCA-regulated broker makes this a non-issue, but if you're thinking about funding an international account down the line, you'll need to be aware of the foreign investment allowance rules.

How Much Capital Do I Realistically Need?

This is a big one, and there's a common myth that you need a pile of cash to even start. That’s just not true anymore. You can find plenty of excellent, FSCA-regulated brokers that will let you open an account with a minimum deposit of just R200 to R500. The market is more accessible than ever before.

While you can start small, be realistic. Your potential returns are tied to your capital. A larger starting balance, say R5,000 or more, gives you far more breathing room to manage risk properly without every small loss feeling like a disaster.

Do I Pay Tax on My Forex Profits?

Yes, you do. The South African Revenue Service (SARS) views your trading profits as taxable income. For most retail traders who are actively buying and selling, these profits are taxed as personal income, not capital gains.

This is non-negotiable: you have to keep meticulous records of every single trade you make, both the wins and the losses. I strongly recommend chatting with a tax professional who has experience with traders. They'll make sure you’re staying compliant and filing your returns correctly, which can save you a world of headaches later on.

What Are the Best Times to Trade from Cape Town?

The forex market never sleeps, but that doesn't mean you should be trading at 3 AM. The real action happens when the major global market sessions overlap, which is when you get the most liquidity and volatility.

For us here in Cape Town, the sweet spot is the London-New York session overlap. This window generally runs from 3 PM to 7 PM South African Standard Time (SAST). If you want to see significant price moves and find the best opportunities, especially in popular pairs like EUR/USD or GBP/USD, that's your prime time to be at your screen.

For South African businesses managing international transactions, achieving clarity on foreign exchange rates is paramount. Zaro offers a transparent and cost-effective solution for cross-border payments, eliminating hidden fees and unpredictable markups. By providing access to real exchange rates, we empower your business to optimise cash flow and gain full control over its global finances. Discover a smarter way to handle international payments by visiting https://www.usezaro.com.