Ever wondered how to turn a hypothetical trade into real-world numbers? That’s where a forex trading profit calculator comes in. It’s an indispensable tool that takes your trading idea—the currency pair, your position size, and your entry and exit points—and gives you a clear financial forecast.

Essentially, it shows you the potential profit or loss in your own account currency, like ZAR, before you ever risk a single Rand.

Why a Profit Calculator Is a Trader's Best Friend

Before any seasoned trader clicks the ‘buy’ or ‘sell’ button, they know their potential risk and reward down to the last cent. This isn’t a gut feeling; it’s calculated planning. Think of a forex profit calculator as your financial simulator, turning an abstract trading setup into concrete numbers. It’s not a crystal ball, but it’s the next best thing for strategic preparation.

It’s like running through a pre-flight checklist before takeoff. By plugging in your intended trade parameters, you get an instant snapshot of the financial implications. This simple step is absolutely vital for solid risk management and for setting realistic trading goals.

Transforming Strategy Into Tangible Figures

The real magic of a profit calculator is how it bridges the gap between your chart analysis and your bank account. It makes the abstract tangible. You can see exactly what a 100-pip move on GBP/ZAR actually means in Rands and cents. That kind of clarity is what separates guessing from informed decision-making.

A good calculator helps you do a few critical things:

- Visualise the Outcome: Instantly see the potential profit or loss figures.

- Sharpen Your Strategy: Play around with different stop-loss and take-profit levels to find a risk-to-reward ratio you’re comfortable with.

- Protect Your Capital: Clearly understand how your trade size affects potential outcomes, which helps you avoid the classic mistake of over-leveraging your account.

A profit calculator forces you to take emotion out of the planning process. When you see the hard numbers staring back at you, you're far less likely to make impulsive decisions based on market hype or fear. It encourages a disciplined, business-like approach to every single trade.

Planning With Precision Before You Commit

Ultimately, using a forex profit calculator is about making deliberate, calculated moves. It’s your sandbox for modelling various scenarios without any financial risk. For traders exploring different methods of speculation, understanding the Spread Betting meaning for traders can also be useful, as it involves similar principles of calculating outcomes.

This pre-trade analysis gives you the confidence to act decisively when a real opportunity pops up. You’ll know exactly what’s at stake and what the potential reward is—the very foundation of long-term trading success. It shifts your mindset from simply hoping a trade works out to executing a well-defined financial plan.

The Core of Every Trade: Calculating Pips

Before you can even think about profit, you have to get to grips with the ‘pip’. It’s short for "point in percentage," and it's the smallest tick a currency pair can make. Every single profit calculation, whether you’re punching numbers into a forex calculator or scribbling on a notepad, starts right here.

For most currency pairs, a pip is the fourth decimal place (0.0001). So, if the EUR/USD shifts from 1.1050 to 1.1051, that’s a one-pip move. Simple as that. Getting this concept down is non-negotiable if you want to properly manage your trades and understand your risk.

How Pip Value Changes Between Pairs

Here's where it gets interesting: not all pips are worth the same amount of money. Their cash value depends entirely on which pair you're trading. A pip's value is always denominated in the quote currency—that's the second currency listed in the pair.

For example, with EUR/USD, the pip value is in US Dollars. Trade GBP/CHF, and it's in Swiss Francs. This is a critical detail, especially for us South African traders, because we eventually have to convert those profits back into Rand.

Let's break down how the pip value is determined for different types of pairs:

- Standard Pairs (like EUR/USD): The calculation is pretty straightforward. You take the pip size (0.0001), divide it by the current exchange rate, and then multiply that by your trade size.

- JPY Pairs (like USD/JPY): The Japanese Yen is the main exception to the rule. Here, a pip is the second decimal place (0.01), not the fourth. The calculation works the same way, you just start with 0.01.

- Exotic Pairs (like USD/ZAR): For local traders, this is where it hits home. With a pair like USD/ZAR, the pip value is already in Rand, which actually simplifies the whole process. The standard fourth-decimal-place rule still applies.

Pro Tip: Look, a forex trading profit calculator will do all this heavy lifting for you in a split second. But knowing how to do it yourself gives you a much better feel for the market. You start to intuitively grasp the real-world financial weight of a 50-pip stop-loss on USD/ZAR versus the same stop on EUR/USD, without having to reach for a tool every single time.

This screenshot from Dukascopy shows historical data for the USD/ZAR pair, which is a staple for many South African traders.

The chart clearly shows how the rate fluctuates. Each of those tiny movements is a pip, and those pips directly translate into your profit or loss in ZAR.

Nailing the Manual Pip Value Calculation

Let's walk through a manual calculation. It's an invaluable skill that shows you exactly what's happening under the hood of your calculator and helps you understand the mechanics of your trade.

Scenario: You’re looking to trade one standard lot (100,000 units) of USD/ZAR.

The textbook formula to find the pip value is:

(Pip in decimal form / Exchange Rate) * Lot Size = Pip Value in Quote Currency

If the USD/ZAR exchange rate is sitting at 17.4500, you might think the calculation is:

(0.0001 / 17.4500) * 100,000 = 0.573 ZAR per pip? Not quite.

Luckily for us, when the quote currency is the ZAR (or any currency your account is denominated in), the formula becomes much, much simpler. In fact, you can almost forget the formula.

For a standard lot of any ZAR-quoted pair, the pip value is a constant 10 units of the quote currency. This means for a standard lot of USD/ZAR, one pip move is always worth exactly R10. No complex maths needed.

Understanding this fundamental building block is the key to using a forex profit calculator effectively. It takes the mystery out of the numbers and connects those small price ticks on your screen to the real Rand value moving in and out of your account.

How Lot Size and Leverage Magnify Your Results

If pips are the basic unit of measurement in forex, then lot size and leverage are the financial horsepower behind them. These two factors work hand-in-hand to turn those small price movements into real-world profits or losses. Before you even think about plugging numbers into a forex trading profit calculator, you need to have a solid grasp on how they interact.

First up, lot size. This simply refers to the volume, or size, of your trade. It’s the difference between buying one share of a company versus buying a hundred; the bigger your stake, the bigger the potential outcome. In forex, we generally work with three standard lot sizes.

What Your Lot Size Really Means for Your Wallet

Picking the right lot size is probably one of the most critical risk management decisions you’ll ever make. Even a tiny price fluctuation can have a completely different financial impact depending on the size of the position you've opened.

Let's break down the common lot sizes you'll encounter:

- Standard Lot: This is the big one, representing 100,000 units of the base currency. Every pip move carries the most weight here. For a ZAR-quoted pair, a single pip is worth R10.

- Mini Lot: A popular middle-of-the-road option, a mini lot consists of 10,000 units. It provides decent exposure without the intense risk of a standard lot. With this size, one pip move is worth exactly R1.

- Micro Lot: The smallest size, coming in at 1,000 units. Micro lots are brilliant for beginners finding their feet or seasoned traders testing a new strategy with minimal risk. A one-pip move is worth a mere 10 cents.

So, picture this: you make a great call on a USD/ZAR trade and bank 50 pips. If you were trading a micro lot, that’s a R5 profit. Not bad. But with a standard lot, that very same 50-pip gain turns into R500. You can see why your choice of lot size is a cornerstone of any profit calculation.

Getting to Grips with Leverage: The Double-Edged Sword

Leverage often gets a bad rap, but it’s a fundamental tool in forex. It's what allows you to control a large position in the market using a relatively small amount of your own capital. Essentially, your broker is lending you the difference to give you more buying power.

For example, with 100:1 leverage, you only need R1,000 of your own money to control a R100,000 position. This gives you massively increased exposure to the market.

Leverage amplifies everything—your profits and your losses. It’s the reason you can make substantial gains from small pip movements, but it’s also why an adverse move can quickly deplete your account. Respecting leverage is the hallmark of a disciplined trader.

Let’s tie this all together with a practical South African example. Say you want to trade one mini lot (10,000 units) of GBP/ZAR. Without any leverage, you’d have to front the full Rand equivalent of £10,000 just to open the trade.

Now, bring in 100:1 leverage. You only need to put up one-hundredth of that amount as margin. This lets you get into the market and profit from pip movements on the full position size—which could be R230,000 if the GBP/ZAR rate is 23.00. When you punch these details into a forex profit calculator, it will calculate your outcome based on that full position size, showing you just how powerful this tool can be.

Let's See How This Works with a Real Trade

Theory is one thing, but seeing the numbers in action is where it all clicks. Let's walk through a practical example to really nail down how a forex profit calculator works its magic behind the scenes. Once you understand the mechanics, you'll be able to trust the tool and make smarter, faster decisions.

Picture this: you're a trader based in Johannesburg, keeping an eye on the GBP/ZAR pair – a favourite among many local traders. Your analysis tells you the Pound is looking strong and likely to climb against the Rand.

Setting Up the Trade

Based on your research, you decide to open a 'buy' position, betting on the price going up. To keep your risk in check, you opt for a position size of 0.5 lots. That’s the same as five mini lots, or 50,000 units of the base currency, which in this case is British Pounds (GBP).

A solid strategy always has an exit plan. You’ve set your take-profit target 150 pips above where you entered the market. So, the million-rand question is: if the trade goes your way, what does that 150-pip gain actually translate to in your ZAR trading account?

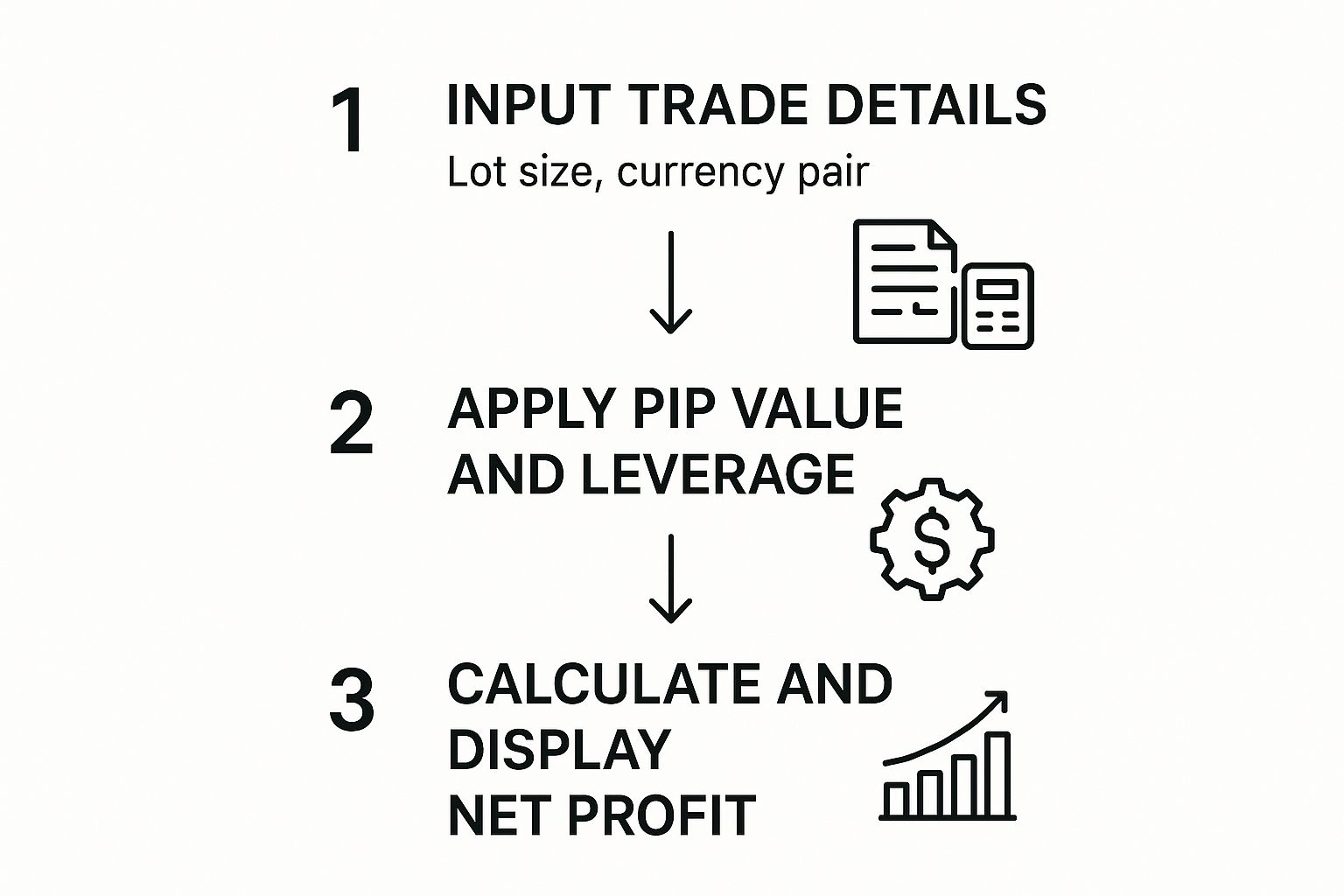

A good calculator does all the heavy lifting for you in a split second. The process is pretty straightforward, as this infographic shows. You plug in your trade details, and it spits out the final profit.

As you can see, it’s all about taking your trade parameters—like lot size and pip movement—and turning them into a clear monetary figure.

First, What’s Each Pip Worth in Rand?

Before we can calculate the total profit, we need to know the value of a single pip for our specific trade size. Luckily, since the quote currency in our GBP/ZAR pair is the South African Rand, this part is incredibly simple.

For any pair quoted in ZAR, the pip value for a standard lot (100,000 units) is always R10. Since we're only trading 0.5 lots, our pip value is just half of that.

- Pip Value Calculation: R10 (standard lot value) × 0.5 (our lot size) = R5 per pip

Simple, right? This means for every single pip the GBP/ZAR rate moves in our favour, our trade makes R5.

Now, Let's Calculate the Gross Profit

With the pip value sorted, figuring out the total profit is just a bit of basic multiplication. We're aiming for a 150-pip gain, and we know each of those pips is worth R5.

- Gross Profit Calculation: 150 pips × R5 per pip = R7,500

And there you have it. If the market moves as you predicted and hits your profit target, your trade will lock in a gross profit of R7,500. This is exactly the number a forex profit calculator would show you.

Key Takeaway: Walking through this manually shows you that the calculator isn't some mysterious black box. It's simply running a logical set of calculations based on pip value, lot size, and price movement to give you a clear financial forecast for your trade.

By the way, understanding past market behaviour is a huge advantage. The South African Reserve Bank provides a treasure trove of historical exchange rates, which is crucial for local traders. For example, records show that on September 26, 2025, the ZAR/USD exchange rate was around 17.4483. When you combine this kind of historical data with your own analysis, you can fine-tune your strategies and get better at predicting potential profits. You can dive into this data yourself on the official SARB statistics page.

Putting Your Calculator's Numbers to Work

Getting a number spit out by a forex profit calculator is the easy part. The real art, the thing that separates the pros from the punters, is knowing what to do with that number. Think of it less as a final score and more as a crucial piece of intel for your pre-trade reconnaissance.

This data is what allows you to look at a trade with cold, hard logic. Sure, a potential profit of R2,000 sounds fantastic on the surface. But is it worth a potential R3,000 loss? Suddenly, not so much. The calculator gives you the raw numbers you need to properly weigh this critical risk-to-reward ratio before you ever put a single Rand on the line.

Weighing Risk and Reward with Solid Data

The output from your calculator should be the bedrock for setting your take-profit and stop-loss orders. No more guesswork or plucking levels out of thin air. Instead, you can model different scenarios to see what makes sense.

For instance, running the numbers might show you that a 100-pip stop-loss would mean a R1,500 risk on your chosen lot size. At the same time, a 200-pip target would net you a R3,000 reward.

Just like that, you’ve confirmed a 1:2 risk-to-reward ratio—a very healthy foundation for a trade. By doing this simple maths beforehand, you shift from trading on a hunch to executing a calculated business decision.

A forex profit calculator transforms your thinking from, "I feel like the price will go up," to, "I am prepared to risk R1,500 for a potential R3,000 gain on this specific setup." That small change in perspective is a game-changer for building long-term discipline.

Bullet-Proofing Your Trading Mindset

Knowing your potential profit and loss before you even click "buy" or "sell" is a massive psychological advantage. Once a trade is live, it’s easy for emotions to take over. Fear can make you cut a trade short at the first sign of a drawdown, while greed can tempt you to hang on to a winner for far too long, only to watch it reverse.

When you have pre-calculated your profit and loss levels, you have a plan. You've already done the maths, and you've already accepted the potential risk. This gives you the confidence to trust your initial analysis and let the trade play out, shielding you from making impulsive, emotionally-driven mistakes.

For those of us trading in South Africa, this kind of stability is crucial. The Rand's performance directly affects our bottom line. For example, its relative strength around 17.3 against the USD in September 2025, supported by gold prices, had a direct impact on profit calculations for ZAR pairs. Given the currency's historical volatility, as detailed in this South African currency analysis, having precise calculations is non-negotiable for effective risk management.

Ultimately, your goal should be to turn that simple calculator into a core part of your strategic toolkit. It's not just about one trade's profit; it's about seeing how these numbers fit into your broader portfolio performance. If you want to get a better handle on the bigger picture of your financial gains, it's worth learning how to calculate investment returns like a professional. Adopting this integrated approach is what leads to smarter risk management and, over time, a more consistent and profitable trading journey.

Your Top Questions About Forex Profit Calculators

Even after you've got the basics down, you're bound to have a few more questions about using a forex profit calculator. That's completely normal. Let's walk through some of the things that trip up even experienced traders, so you can move forward with confidence.

One of the first things people ask is whether a calculator tells the whole story. The short answer is no. Most online calculators show your gross profit—the money you made just from the price moving in your favour.

To find your actual net profit, you need to do a little extra maths. You have to subtract any commissions your broker charges and any swap fees for holding a position overnight. Skipping this step gives you a false sense of how well you're doing, especially if you're a swing trader or you trade very frequently.

How Do Calculators Deal With Pairs Like USD/ZAR?

This is a great question, and it's especially relevant for traders here in South Africa. A good quality profit calculator is smart enough to handle the unique characteristics of different currency pairs. For an exotic pair like USD/ZAR, the tool is already programmed to know the pip value is in Rand (ZAR) because it's the quote currency.

What does that mean for you? It means the calculator doesn't need to do the extra conversion step that's required for a major pair like EUR/USD, where the pip value is in US dollars. It automatically works out the ZAR-based pip value and shows your final profit in your account's currency. It saves you a massive headache.

Can I Use a Profit Calculator To Plan Future Trades?

Absolutely! In fact, this is probably the most powerful way to use one. A forex calculator isn't just for looking back at closed trades; it's a forward-looking tool for planning your strategy. Before you put a single Rand on the line, you can run through all sorts of "what-if" scenarios.

- Test your exit points: Plug in different take-profit and stop-loss levels to see exactly how much you stand to gain or lose.

- Check your risk-to-reward ratio: Instantly see if a potential trade setup is actually worth the risk.

- Figure out your position size: Experiment with different lot sizes to understand how they affect your potential profit and loss.

This kind of planning becomes even more powerful when you combine it with historical data. In South Africa, many traders use platforms to backtest their ideas against past market movements, which are often swayed by local factors like commodity prices. Looking at this data helps build a more solid trading plan. If you're curious, you can see how professionals access historical forex information on Dukascopy to get an idea of what's available.

By making this part of your routine, the calculator transforms from a simple tool into a core component of your risk management. You'll start making decisions based on data, not gut feelings.

At Zaro, we're committed to helping South African businesses manage international finance with total clarity. It's time to say goodbye to hidden fees and unpredictable exchange rates on your cross-border payments. See how our platform can give your business a real competitive advantage at https://www.usezaro.com.