If you're looking for the sweet spot to trade forex in South Africa, aim for the hours when the big global markets overlap. The golden window is hands-down the London and New York session overlap, which runs from 15:00 to 19:00 SAST. This is when the market truly comes alive with the highest trading volume and volatility, creating the best opportunities. Getting these key hours straight is the first step to a smarter trading strategy.

Getting in Sync with the Global Forex Clock

The forex market never sleeps—it’s a 24-hour, five-day-a-week operation. But that doesn't mean every hour is a good time to trade. A better way to think about it is like a global relay race. As one major financial centre winds down for the day, it passes the trading baton to the next one just waking up. For us in South Africa, the trick is knowing who's running with the baton and when.

This worldwide activity is broken down into four main trading sessions: Sydney, Tokyo, London, and New York. Each one has its own personality, influenced by the economic pulse of its region. The real magic happens when these sessions overlap, as that’s when trading volume spikes and the market really starts to move.

The Four Major Forex Sessions

To figure out the best trading times here in South Africa, you have to translate these global sessions into our local time, South African Standard Time (SAST). This schedule is the bedrock of any solid trading plan.

Here’s a quick reference guide to the four major forex trading sessions and their corresponding times in SAST. It’s designed to help you pinpoint those key trading windows at a glance.

Global Forex Sessions in South African Standard Time (SAST)

| Market Session | Opens (SAST) | Closes (SAST) |

|---|---|---|

| Sydney | 23:00 | 08:00 |

| Tokyo | 01:00 | 10:00 |

| London | 09:00 | 18:00 |

| New York | 15:00 | 00:00 |

By lining up your trading with these sessions, particularly the high-traffic overlaps, you can make sure you’re in the market when it counts. It’s a simple way to avoid staring at your screen during quiet periods when there's low liquidity and prices are barely moving.

While we're focused on the South African perspective, it's always useful to grasp the universal principles for identifying the best time to trade forex to get a fuller picture. Mastering this schedule is your first real step towards trading smarter, not just harder.

Why South Africa is a Global Forex Hotspot

Before we jump into the mechanics of the forex clock, it’s worth taking a moment to appreciate just why South Africa has become such a big deal in the global trading community. It's not just another country on the forex map; it's the undisputed trading powerhouse of the entire African continent.

This didn't happen by accident. South Africa's prominence is built on a solid foundation: a sophisticated and well-regulated financial system. This creates a stable and secure environment that attracts everyone from big institutional players to individual retail traders. The local watchdog, the Financial Sector Conduct Authority (FSCA), ensures everything runs by the book, which builds a huge amount of trust.

Africa's Forex Trading Leader

The numbers really drive the point home. South Africa is miles ahead of any other African nation when it comes to forex.

- It handles an impressive $2.21 billion in daily forex volume.

- The market is incredibly active, with roughly 190,000 daily traders.

- Over 1,000 financial firms are involved in the forex scene.

This incredible activity isn't just from the big banks. A growing wave of everyday South Africans are getting into retail trading, seeing it as a direct route to global financial opportunities. You can dive deeper into the continent's market trends by checking out this detailed analysis of Africa's forex outlook.

Think of the global market as a massive, 24-hour city that never sleeps.

In this city, South Africa isn't some quiet suburb. It's a bustling, highly organised financial district—a crucial hub that plugs the entire continent into the world's currency flows.

Understanding this context is key. It shows you're not just trading from an isolated corner of the world; you're participating in a vibrant and globally significant market. When you learn to time your trades correctly, you're essentially learning how to tap into the powerful currents of this dynamic environment.

A Trader's Guide to the Four Major Market Sessions

To figure out the best forex trading times in South Africa, you first need to get a feel for the daily rhythm of the global market. The best way to think about it is like a relay race that never ends. As one major financial centre closes its day, another one opens, passing the baton across different time zones.

Each of these sessions has its own unique personality, bringing different currencies and levels of market energy into play. Learning this schedule is like a surfer learning to read the waves; it helps you catch the best moves instead of getting stuck in flat, choppy water.

The Asian Session: The Quiet Start

The global trading day quietly kicks off in our part of the world with the Sydney session, which is quickly followed by the Tokyo session. For traders in South Africa, this all happens during our late night and into the early morning hours. It's generally the calmest period of the trading day, meaning there's less money flowing and fewer big price swings.

But "quiet" doesn't mean you can't make a profit. This session is ideal if you're trading currency pairs involving the Australian dollar (AUD), New Zealand dollar (NZD), and of course, the Japanese yen (JPY). These are the "home" currencies for this session, so they see the most activity while Europe and America are still asleep. Trading strategies that rely on prices staying within a predictable range often work well here.

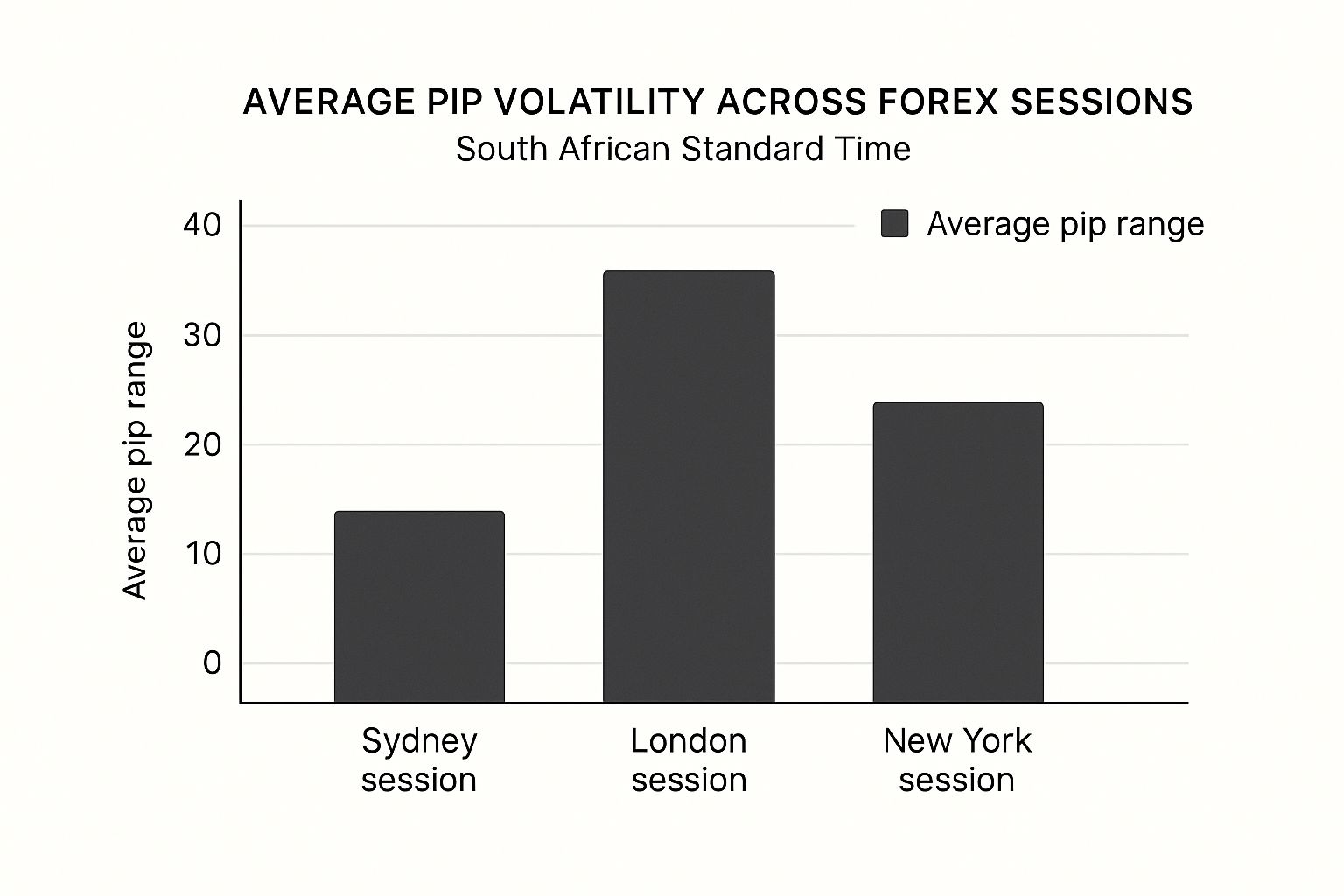

This chart really puts the difference in market energy into perspective.

You can clearly see how the London session injects a massive burst of energy and movement compared to the slower Asian open.

The London Session: The Market Comes Alive

Just as things are winding down in Tokyo, the London session throws its doors open, and the market’s pulse quickens dramatically. London is the absolute giant of the forex world, responsible for over 40% of all daily trading volume. When London comes online, liquidity and volatility go through the roof.

This is prime time for major European currencies like the Euro (EUR), British pound (GBP), and Swiss franc (CHF). The good news for us in South Africa is that this session lines up perfectly with our morning and afternoon, making it a fantastic time to be at your screen.

For many professional traders, the London open is the real start of the trading day. It’s when the day's major trends often take shape and when key economic news from the UK and Europe is released.

The New York Session: Peak Action

Later in our afternoon, the New York session gets underway, overlapping with London for several hours. This is when the king of all currencies, the US dollar (USD), steps into the spotlight.

That overlap period, when both the London and New York markets are open simultaneously, is the absolute busiest time of the day. It offers the highest volatility and the most liquidity, which can make it the most profitable window for trading. But be warned: it's also the most challenging and moves incredibly fast.

Tapping into the Market’s Pulse: How to Trade the Overlaps

While each market session has a life of its own, the real fireworks start when their timelines cross. Imagine it like two major highways merging during peak traffic – the flow of cars (or in our case, trading volume) intensifies dramatically. This is when the forex market truly comes alive, creating the biggest price swings and offering the best trading conditions.

For us here in South Africa, these overlap periods are pure gold. They are specific windows where traders from two massive financial hubs are online and active, injecting enormous amounts of capital into the markets at the exact same time.

The Main Event: When London Meets New York

Without a doubt, the most significant overlap is when the London and New York sessions are both in full swing. This power-packed period, running from 15:00 to 19:00 SAST, is widely seen as the absolute best time for forex trading in South Africa.

During this four-hour window, you have the world’s two largest financial centres battling it out. This clash of titans causes a massive spike in both liquidity and volatility, particularly in major currency pairs like EUR/USD, GBP/USD, and USD/CHF.

What does this mean for you? The intense activity leads to bigger and faster price movements, which is fantastic news for anyone looking to scalp or trade breakouts. The high volume also has a welcome side effect: it drives down transaction costs by tightening the bid-ask spreads.

There's another overlap worth noting, although it's a much shorter and slightly calmer affair. The Tokyo and London sessions briefly cross over from 09:00 to 10:00 SAST, which can often spark some action in pairs like EUR/JPY and GBP/JPY.

The difference in market energy between an overlap and a single session is like night and day. Let's break it down.

Market Overlaps vs Single Sessions A Volatility Comparison

Here's a quick look at how the high-energy overlap periods stack up against the calmer, single-session trading times, giving you a clearer picture of where the action is.

| Trading Window (SAST) | Characteristic | Volatility | Liquidity | Best for Currency Pairs Like... |

|---|---|---|---|---|

| 15:00 - 19:00 | London/New York Overlap | Very High | Extremely High | EUR/USD, GBP/USD, USD/CAD |

| 02:00 - 09:00 | Single Session (Tokyo) | Low to Medium | Medium | AUD/USD, NZD/JPY, USD/JPY |

By concentrating your trading efforts during these key overlap hours, you’re placing yourself right in the middle of the market’s most powerful currents. It’s a smarter way to trade, allowing you to catch the day's most significant moves without being chained to your screen all day.

How Daylight Saving Time Messes With Your Trading Schedule

Here’s a classic tripwire for South African traders: Daylight Saving Time (DST). We don't observe DST in South Africa, so our clocks stay the same year-round. But for major financial hubs like London and New York, the clocks shift twice a year, and this throws their market hours out of sync with ours.

It’s an easy detail to overlook, but it can completely derail your strategy. That high-volume London-New York overlap you've planned your day around? It suddenly starts an hour earlier or later. If you're not on top of it, you could miss the most profitable window of the day.

Keeping Track of the Time Shift

Thankfully, managing this is pretty simple once you know the dates to watch. The whole game is about knowing when Europe and North America "spring forward" and "fall back."

- For our winter (their summer), from March to November: London kicks off at 09:00 SAST, and New York joins the party at 15:00 SAST. This puts the best overlap between 15:00 and 19:00 SAST.

- For our summer (their winter), from November to March: Things shift. London opens at 10:00 SAST, and New York at 16:00 SAST. The prime trading overlap moves an hour later, running from 16:00 to 20:00 SAST.

The best habit you can build is to glance at your broker's server time or use an online economic calendar that adjusts for these changes automatically. It’s a two-second check that guarantees you're always perfectly lined up with global forex trading times and never get caught out by the seasonal time shift.

Matching Your Strategy to the Time of Day

A one-size-fits-all trading strategy simply doesn't work. The forex market has a distinct rhythm that changes throughout the day, and your tactics need to adapt along with it. How you approach the quiet, early morning Asian session should be completely different from your plan for the chaotic London-New York overlap.

Think of it like this: each session has its own personality. By understanding and aligning your strategy with these unique conditions, you can put yourself in a much stronger position to succeed.

For many South Africans, this isn't just theory—it's a practical reality. Juggling trading with a daily routine is a common challenge. With structural unemployment issues, particularly youth unemployment hovering above 60%, many have turned to forex trading as a vital alternative income stream. The accessibility of trading on a smartphone with deposits as low as R200 has made it a popular side hustle. You can read more about how economic factors are fuelling South Africa's retail forex boom.

Tailoring Tactics to Trading Sessions

So, how does this look in the real world? Let’s imagine a trader in Durban working a typical 9-to-5 job. For them, targeting the high-energy New York open in the late afternoon makes perfect sense.

Here’s a quick breakdown of how different strategies fit the various forex trading times in South Africa:

Range Trading: This approach works best when the market is calm and predictable, bouncing between clear support and resistance levels. The Asian session (overnight to early morning SAST) is perfect for this.

Breakout Trading: Looking to catch big, powerful moves? This strategy is designed for the high-volatility London-New York overlap (15:00 - 19:00 SAST), where prices often smash through key barriers.

Scalping: If you thrive on fast-paced action, scalping—making many small, rapid trades—is most effective during that same overlap period when the market is at its most liquid and volatile.

By selecting a strategy that matches not only the market's tempo but also your personal schedule and risk appetite, you move from just knowing the times to strategically exploiting them for better results.

Got More Questions? Let's Talk Trading Times

Let's quickly run through some of the most common questions we get from South African traders. Think of this as a rapid-fire round to lock in the key concepts we've covered.

What's the "Golden Hour" for Forex Trading in South Africa?

While the whole afternoon from 15:00 to 19:00 SAST is prime time, the real magic often happens between 15:00 and 16:00 SAST. This is the sweet spot. The London session is at its peak, and the New York traders are just storming in. The result? A massive spike in trading volume that can give major currency pairs a very clear sense of direction.

Can I Trade Forex on a Saturday in South Africa?

Unfortunately, no. The global forex market clocks out for the weekend. Trading halts around midnight SAST on Friday when New York closes up shop, and it doesn't get going again until the Sydney session kicks off late on Sunday evening, our time. Any trades you have open will just sit tight until the market reopens.

Be mindful of weekend news. A major political or economic event can happen while the markets are closed, causing a currency pair to open on Sunday at a price miles away from where it closed on Friday. This is what traders call a "gap."

How Do Our Public Holidays Affect the Forex Market?

Here’s the short answer: they don't. South African public holidays have virtually zero impact on the forex market's schedule. Because it's a decentralised global market, it marches to the beat of major financial hubs like London, New York, and Tokyo. So, while you might be enjoying a braai, the market is business as usual.

The only time you'll notice a slowdown is when a major global centre, like the US or the UK, has a national holiday. On those days, liquidity dries up, and the market can feel flat and unpredictable—often a good time to just sit on the sidelines. It's always a good idea to have an international economic calendar handy.

Are unpredictable bank rates and hidden fees eating into your business profits? Zaro offers South African businesses access to the real exchange rate with zero spread, making international payments faster and more affordable. Take control of your cross-border transactions and see how much you could save. Learn more about our transparent payment solutions at https://www.usezaro.com.