For South African businesses dipping their toes into the world of forex, the advertised FXTM (ForexTime) minimum deposit is $200. At first glance, that might just look like a number—somewhere between R3,600 and R4,000, depending on the day's exchange rate.

But for a business owner managing cash flow, this isn't just an entry fee. It's working capital.

What The FXTM Minimum Deposit Really Means For Your South African Business

When an SME looks at a forex trading platform, that first deposit is a strategic decision. It’s not just a fee to get started; it's the capital you have to lock up just to get a seat at the table.

For any business where every rand has a job, that's a serious commitment. That R4,000 isn't just sitting there. It's money that could be paying a supplier, covering a utility bill, or funding a small marketing campaign. It's about opportunity cost.

The Standard Starting Point

Globally, FXTM advertises a $200 minimum deposit to get started on its popular Advantage and Advantage Plus accounts. For a South African business, this means tying up a few thousand rand in a margin account—money that's no longer liquid or available for day-to-day operations.

You can get a closer look at the different account requirements on resources like BrokerChooser's deep dive into FXTM's deposit rules, but the core concept remains the same.

The real issue for a business isn't just the amount. It's the purpose of the funds. Money deposited into a trading platform is capital at risk. Money sent to an international supplier is capital in motion, working towards a clear business goal.

What This Deposit Gets You

Of course, that initial funding isn't for nothing. It’s your ticket to different levels of service on the platform. Generally, a higher deposit unlocks better trading conditions, like tighter spreads (the difference between buying and selling prices) and lower commissions.

This immediately forces a business owner or financial manager into a tough spot:

- Cost vs. Capability: Do you start small with a basic account, or do you commit more of your precious working capital to get access to professional-grade tools?

- Operational Funds vs. Speculative Capital: Are you comfortable putting money meant for running your business into an environment built for speculation, where its value can fluctuate with the market?

Ultimately, the FXTM minimum deposit is the first of many hurdles for a South African business. It sets the tone from the very beginning, highlighting the fundamental risk of using speculative trading tools for essential business operations.

How Your Deposit Unlocks Different Account Features

When you look at FXTM, it's easy to get drawn in by the low advertised starting deposit. But for a South African business owner, it's vital to understand that this isn't a one-size-fits-all number. The forextime minimum deposit is just the entry ticket; the real game starts when you decide which seat you want.

Think of it like buying a ticket to a concert. The cheapest ticket gets you in the door, but you might be miles from the stage with a terrible view. If you want a front-row experience with crystal-clear sound, you have to pay for a premium seat. FXTM's account tiers work much the same way—your initial capital determines the quality of the tools and trading conditions you get.

From a Small Start to a Serious Advantage

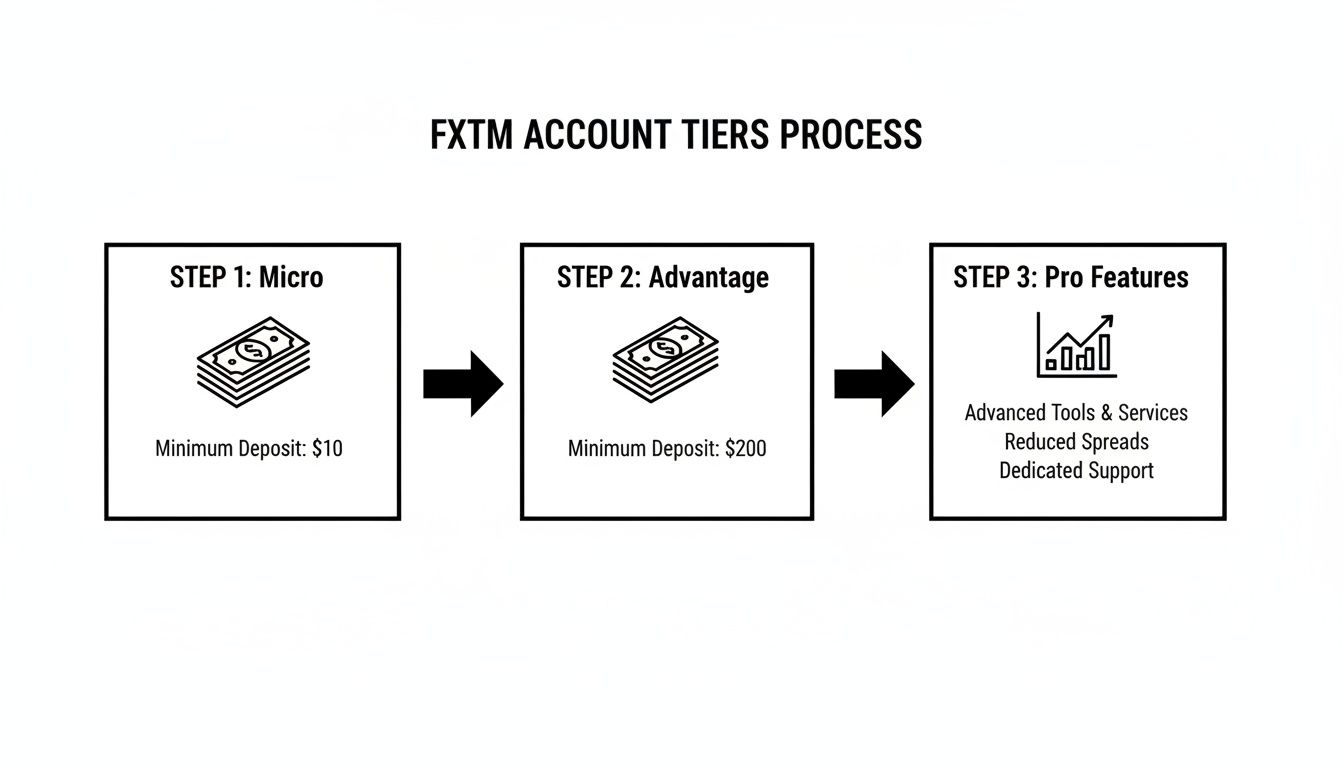

The difference between the account tiers is night and day. A beginner-friendly Micro account, for example, can often be opened for as little as $10. It’s a great, low-risk way for someone new to the platform to find their feet.

But let's be realistic—for a business needing to manage currency efficiently, this account just won't cut it. The serious features live in the Advantage account, and that requires a much bigger initial commitment.

The key takeaway here is that the headline-grabbing low deposit figure is often just marketing. For a South African CFO or business owner, the real minimum deposit is the amount that unlocks the professional tools you actually need.

Paying for Professional-Grade Tools

Getting access to better trading conditions has its price. The $200 minimum for an Advantage account is the gateway to features that are non-negotiable for a business, most notably tighter spreads. Spreads are simply the tiny difference between the buy and sell price of a currency, but you can think of them as a hidden fee on every single transaction. Over hundreds of trades, wide spreads can quietly drain your capital.

This link between deposit size and features isn't a secret; it’s confirmed across multiple industry reviews. FXTM advertises a low starting point, but the reality is much more layered. The Micro account’s low barrier to entry is a world away from the $200 needed for the Advantage account, which gives you raw spreads from 0.0 pips (plus a commission). This means you only get genuinely competitive pricing after you’ve committed at least R3,600 to R4,000. For a closer look at how these accounts stack up, broker review sites like FXStreet offer detailed comparisons.

For any South African business, this isn't a minor detail—it’s a major strategic point. It means that to use this platform for effective currency risk management, you have to tie up a significant chunk of working capital in a speculative trading environment from day one. That has very real implications for your company's cash flow and overall financial health.

How to Fund Your FXTM Account from South Africa: A Step-by-Step Guide

Getting your capital into your trading account is the first real step on your trading journey, and knowing how to navigate the FXTM minimum deposit process is crucial. For South African businesses, this isn't just a simple transfer; it’s a strategic move that involves a few important decisions.

It all starts in your MyFXTM client portal. Once you're logged in, head over to the ‘My Money’ section and click on ‘Deposit’. Think of this as the mission control for all your account funding.

You'll see a menu of payment options. This isn't just a list to skim through—it's a choice that impacts your speed, costs, and convenience.

Choosing Your Payment Method

The right choice really depends on your business's needs. Do you need the funds in your account now, or can you wait a few days for a potentially cheaper transfer?

- Bank Wire Transfers: This is the old-school, tried-and-tested method. It’s secure, but it’s also the slowest horse in the race. You could be waiting several business days for your money to land, which is a lifetime in the fast-moving forex market.

- Credit/Debit Cards (Visa/Mastercard): If you need speed, this is your best bet. Deposits are usually almost instant. A word of caution, though: your local South African bank might get nervous and flag or block the international transaction as a security precaution. It pays to give them a heads-up first.

- E-wallets (like Skrill or Neteller): These are a fantastic middle ground. Digital wallets like Skrill or Neteller act as a buffer between your bank and the broker, offering a fast and reliable transfer. They’ve become a firm favourite among traders for good reason.

Before you can deposit a single rand, FXTM needs to know who you are. This is part of a standard security protocol called Know Your Customer (KYC). It might feel like a bit of admin, but it’s a critical step to prevent fraud and stick to global financial rules.

Pro Tip: Get your documents sorted before you even think about depositing. You’ll need a clear copy of your ID (a passport or ID card works) and something to prove your address, like a recent utility bill or bank statement. Having these ready will save you a world of frustration and get you trading faster.

The amount you decide to deposit also determines the type of account and features you can access. The higher your initial deposit, the more advanced the trading conditions you can unlock.

As you can see, moving from the basic Micro account to the more professional Advantage tier requires a bigger capital commitment but opens the door to more powerful trading tools.

Comparison of FXTM Deposit Methods for South African Users

To make the choice clearer, here’s a quick comparison of the most common funding options available on FXTM for South Africans. This table breaks down processing times, potential fees, and what each method is really good for.

| Payment Method | Processing Time | Associated Fees | Best Suited For |

|---|---|---|---|

| Bank Wire Transfer | 3-5 Business Days | Can be high (bank-dependent) | Large, non-urgent deposits where security is the top priority. |

| Credit/Debit Cards | Instant | Often 0% from FXTM, but check for bank's foreign transaction fees. | Quick account top-ups and traders needing immediate market access. |

| E-Wallets (Skrill, Neteller) | Instant to a few hours | Low to moderate; check e-wallet for transfer fees. | Frequent depositors and traders looking for a fast, reliable intermediary. |

Each method has its place. For a small business needing to act on a market opportunity right away, a credit card deposit makes sense. For a larger, planned capital injection, a bank wire might be more appropriate despite the wait.

Finalising the Deposit and What to Expect

Once you've picked your method and typed in the amount, you’ll be securely redirected to your bank or payment provider's page to authorise the payment. Give it the green light, and the funds should hit your trading account within the timeframe FXTM states.

One last thing to remember: while FXTM might not charge deposit fees on their end, your bank or e-wallet almost certainly will. Always factor these "hidden" costs into your calculation. This entire process ties up real working capital, so making it as efficient and cost-effective as possible is just smart business.

The Real Risk Of Using Trading Platforms For Business Payments

Trying to handle your company's international payments through a leveraged trading platform like FXTM is a bit like using a Formula 1 car to deliver pizzas. Sure, it’s powerful and incredibly fast, but it’s simply the wrong tool for the job. More importantly, it introduces a level of risk that no business should ever have to face.

The problem boils down to a fundamental conflict of purpose. A business craves certainty. A trader, on the other hand, profits from uncertainty. When your finance department needs to pay an international supplier, the goal is straightforward: get a specific amount of money from point A to point B at a predictable cost. A trader's goal is entirely different; they aim to profit from the very currency fluctuations you're trying to avoid. Mixing these two worlds is a recipe for disaster.

The Dangers Of Leverage In Business Transactions

The single biggest danger here is leverage. In the trading world, leverage is a tool that lets you control a large amount of money with a very small deposit. Think of it as a financial amplifier—it magnifies your potential gains, but it also magnifies your potential losses. For a business, that second part is critical.

A platform like FXTM might dangle incredible leverage, sometimes as high as 3000:1 on certain accounts. This means even a small forextime minimum deposit can control a position hundreds of times its size. When you look at FXTM’s fee and leverage model, the $200 minimum deposit takes on a different meaning for South African businesses. With high leverage, that $200 (≈R3,600–R4,000) deposit can, in theory, control a position worth hundreds of thousands of rand.

This combination of a low entry barrier and sky-high leverage might seem tempting, but it drastically increases the downside risk.

Let’s say you need to pay a supplier $10,000. Instead of just converting your rand and sending the payment, you deposit R4,000 into a trading account. You then use leverage to open a $10,000 position, hoping the exchange rate moves in your favour before you have to pay. But what if it doesn't? If the market shifts against you by just a tiny fraction, that amplified loss could wipe out your entire deposit in an instant.

This catastrophic event has a name: a margin call.

Understanding Margin Calls

A margin call is what happens when your trading losses eat through your deposit until it hits a critical low point. To protect themselves, the broker automatically closes all your positions to stop any further losses. For you, this means your loss is locked in, and your account balance is often completely liquidated. That R4,000 you set aside for your supplier? It’s just gone, all because of a small, unpredictable market swing.

For a business, the fallout is severe:

- Total Loss of Funds: The money you allocated for a crucial operational expense has vanished.

- Failed Payments: Your supplier doesn't get paid, which can seriously damage your business relationships and credibility.

- Operational Disruption: Now you have to scramble to find new funds to make the original payment, putting a huge strain on your cash flow.

It’s crucial to understand the risks associated with brokers like Forex Capital Markets (FXCM), including potential margin debt issues when considering using these platforms for high-stakes transactions.

At the end of the day, a trading platform is built for one thing: speculation. Your deposit isn't a payment float; it's risk capital. By mixing operational funds with speculative tools, you are gambling with money your business simply cannot afford to lose. The potential upside of a slightly better exchange rate is completely overshadowed by the very real risk of a margin call wiping out your payment capital.

A Smarter Way For SMEs To Handle Global Payments

When you see the risks of mixing your company's operational funds with a speculative trading account, the solution becomes obvious. South African SMEs don't need another place to gamble on market swings; they need a tool built specifically for managing international payments. This is where a dedicated cross-border payment platform completely changes the game.

Picture a system designed for business from day one. Instead of wading through confusing fee structures and hidden spreads, you get total transparency. You’re not just getting a "good" rate; you're getting the real exchange rate—the one you see on the news—with no markups.

The Right Tool for the Job

This approach completely changes the role your money plays. When you put funds into a trading account, that capital is held as margin. It’s essentially collateral for a bet you're making on the market. But with a payment platform, you're just funding your account to pay a supplier. The money has one job: to settle an invoice quickly and securely.

That distinction is everything. There’s no such thing as a forextime minimum deposit because you aren't opening a trading position. You're just moving money from A to B.

The core difference is this: a trading platform requires you to put your capital on the sidelines as a bet. A payment platform puts your capital to work, directly fuelling your business operations without exposing it to unnecessary market gambles.

This model sidesteps all the speculative dangers we've talked about. There’s no leverage, which means there’s zero risk of a margin call wiping out your funds. A small dip in the currency market is just that—a small dip. It isn't a catastrophic event that could derail a crucial supplier payment and sour a valuable business relationship.

Efficiency and Security First

A purpose-built platform offers more than just safety from market volatility. It brings serious operational upgrades.

- No Hidden Fees: You can finally say goodbye to the nasty surprise of SWIFT fees that often bloat the cost of traditional bank transfers.

- Real Exchange Rates: What you see is what you get. This means your costings are accurate and your profit margins are protected.

- Direct Payments: Your capital goes straight to work, moving from your account to your supplier’s without ever sitting in a high-risk, speculative environment.

For small businesses ready to look beyond outdated banking methods, exploring the top cross-border payment solutions can be a huge step forward, boosting both efficiency and global reach. It’s a clear sign that businesses need specialised tools for the unique challenges they face.

Ultimately, deciding how to manage your international payments is a major strategic choice. You could use a high-performance tool built for market speculation, or you can pick a secure, reliable one built for business operations. For any South African SME that values growth and stability, the choice should be an easy one.

Put Your Capital To Work, Not On The Sidelines

Let's tie this all together. While a platform like FXTM is built for forex trading, its entire structure is a poor fit for what a South African SME actually needs. The whole model, from the FXTM minimum deposit to the high-stakes game of leverage, is designed for speculation—not the stable, predictable cash flow a business depends on.

Think about it this way: when you deposit funds into a trading account, that money isn't paying salaries or buying stock. It’s essentially just collateral. It sits on the sidelines, completely exposed to the whims of the market and the ever-present risk of a margin call wiping it out. You're putting essential operational funds in harm's way for a goal—chasing profits from currency swings—that runs completely counter to a business's need for stability.

The core message here is straightforward: your capital should be fuelling growth, not funding a gamble.

A business's working capital has a job to do, whether that's paying suppliers, managing payroll, or investing in new inventory. Locking it up in a speculative trading account stops it from doing that job and introduces a level of risk no SME should have to stomach.

It's time to draw a clear line between any personal trading activities and your core business payments. Using a specialised platform for your cross-border transactions ensures your funds are doing what they’re supposed to—driving your business forward—without the unnecessary financial exposure. Your capital belongs in motion, not parked on the betting table.

Frequently Asked Questions

When you're getting started with a new trading platform, it's natural to have questions. Here are some straightforward answers to the things South African business owners most often ask about funding and managing an FXTM account.

Can I Fund My FXTM Account Directly With South African Rand?

Yes, you absolutely can. FXTM makes it possible to deposit directly in ZAR. Once you make the payment, FXTM will convert your rands into your account's base currency, which is usually USD.

But there's a catch. This conversion isn't free. It’s done at FXTM's own exchange rate, which nearly always has a markup built into it. Think of it as a hidden fee that makes your deposit more expensive than it needs to be, especially compared to using a specialised payment service that offers rates much closer to the real mid-market rate.

What Happens If My Account Balance Drops Below The Minimum Deposit?

The minimum deposit is just a barrier to entry—it's what you need to get the account opened. It’s not a minimum balance you have to maintain. Your account balance can, and likely will, dip below that initial amount as you trade. You won't face any penalties for this.

The real thing to watch is your "margin level." If your trading losses eat into your capital and your available margin drops to a critical level, you'll face a margin call. This isn't a friendly reminder; it's an automated action where the platform starts closing your trades at a loss to protect itself from you going into debt.

A margin call is the platform's safety net, not yours. For a business, it can mean capital you earmarked for a crucial supplier payment vanishes in an instant.

Is Using FXTM A Good Way To Pay International Suppliers?

While you technically could try to use a platform like FXTM to pay an international invoice, it’s a terrible idea for a business. It’s like using a race car to deliver groceries—it’s the wrong tool for the job and introduces a massive amount of unnecessary risk.

Why? Because you're exposing operational funds to market volatility and the threat of margin calls. A simple payment becomes a high-stakes gamble. For paying suppliers, you need reliability and predictability, not speculation.

A dedicated cross-border payment service is built specifically for this. It offers secure, straightforward transactions with transparent exchange rates and no speculative risk whatsoever. It’s the professional, safe, and cost-effective choice for any serious business.

Ready to stop gambling with your operational funds and start making smarter international payments? Zaro gives South African businesses the real exchange rate with no hidden fees, making sure your money is safe and works for your business, not against it.