If your business is looking to expand globally, you’ve probably felt the sting of international payments. It can feel like a maze of high fees, confusing regulations, and endless paperwork. This is a daily headache for many South African CFOs and business owners.

This guide is designed to demystify the Financial Sector Conduct Authority (FSCA). Instead of seeing it as another regulatory roadblock, we'll show you how to view it as the framework that keeps the financial system stable and fair for everyone.

Why the FSCA Is Your Strategic Advantage

Getting to grips with the FSCA isn't just about ticking compliance boxes; it’s a real strategic advantage. It gives you the tools to build secure, transparent, and efficient financial operations for your business.

Think of the FSCA as the referee for the entire financial industry, from the big banks right through to the latest fintech platforms. Its job is to ensure everyone plays by the rules and puts customer interests first. For any business touching finance—especially one dealing with cross-border payments—FSCA compliance isn't optional, it's fundamental.

This oversight creates a stable economic playing field, giving you the confidence that any financial partner you choose is held to the highest standards. It's less about avoiding penalties and more about building a financial strategy that can withstand shocks and support growth.

The Impact on International Business

The FSCA South Africa is particularly important in the world of cross-border payments, a sector that's growing at an incredible pace. Here, fintech platforms have to operate with absolute transparency and iron-clad compliance, which is critical for SMEs sending and receiving money internationally.

To put it in perspective, digital cross-border payments flowing into South Africa hit a staggering $1.02 billion between November 2023 and March 2025 alone, positioning the country as the leader in sub-Saharan Africa. You can dive deeper into the data on South African cross-border payments on the SARB's official site.

This massive volume of money moving across borders is precisely why we need strong regulation. Choosing a compliant partner means your funds are handled securely and in line with South African law. It turns a potential regulatory headache into a genuine competitive edge.

Throughout this guide, we'll break down:

- What the FSCA actually does and why it should matter to you.

- How to quickly and easily check if a financial partner is FSCA-approved.

- Practical steps to ensure your own business stays on the right side of the rules.

Understanding the FSCA and Its Mandate

Think of the FSCA South Africa as the official referee for the country's financial markets. Its primary job is to make sure everyone, from the big banks down to the newest fintech startups, plays by a clear set of rules. These rules are there to shield businesses and consumers from being treated unfairly or being misled.

This role is a cornerstone of South Africa's "Twin Peaks" model of financial regulation, which came into effect with the Financial Sector Regulation Act of 2017. It's a clever system that splits the immense task of financial oversight between two specialised authorities, each with a different, yet complementary, job to do.

The Two Peaks of Regulation

The Twin Peaks system is all about creating balance. On one peak, you have the Prudential Authority (PA). It sits within the South African Reserve Bank (SARB) and its entire focus is on prudential regulation. Simply put, the PA makes sure that institutions like banks and insurers are financially solid and aren't taking on wild risks that could bring the whole system crashing down.

On the other peak is the FSCA, which is in charge of market conduct regulation. Its concern is less about a bank’s balance sheet and more about how that bank (and any other financial institution) behaves and treats its customers. The FSCA champions fairness, transparency, and efficiency. Its mandate is to protect you—the customer—from poor conduct and to maintain the integrity of the products and services you use.

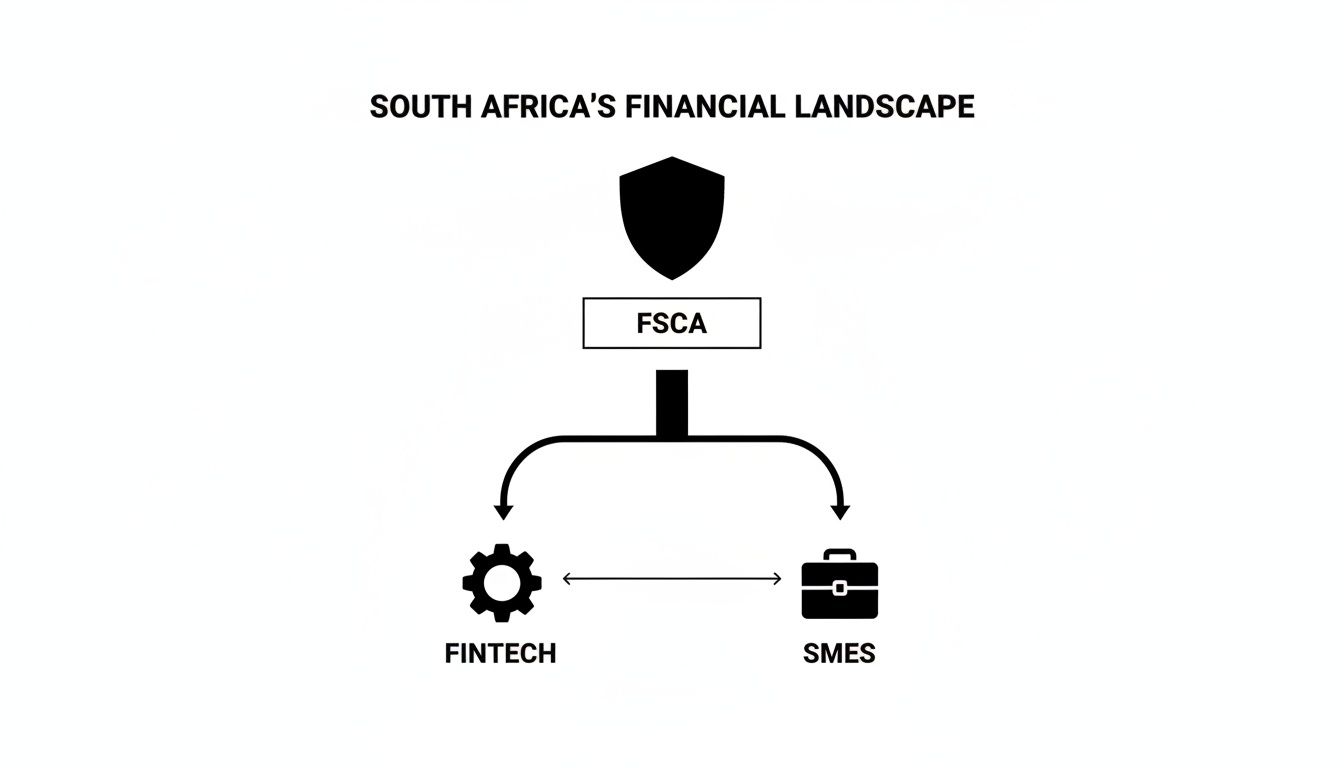

The diagram below shows how the FSCA sits at the top of this hierarchy, overseeing the conduct of key players in the financial sector, including fintechs and SMEs.

This structure makes the FSCA's role crystal clear: ensuring a fair playing field for every business that interacts with the financial system.

A Modernised Approach to Oversight

The FSCA is a major step up from its predecessor, the Financial Services Board (FSB). Where the FSB was often seen as reactive—stepping in after something had gone wrong—the FSCA was specifically designed to be more proactive and forward-thinking. It’s built to spot and tackle risks before they can cause widespread damage.

To understand this evolution, it's helpful to see the differences side-by-side. The old FSB and the new FSCA represent two very different philosophies of regulation.

FSCA vs FSB A Shift In Regulatory Focus

| Aspect | Financial Services Board (FSB) | Financial Sector Conduct Authority (FSCA) |

|---|---|---|

| Primary Focus | Compliance-based. Focused on whether institutions followed the rules. | Outcomes-based. Focuses on achieving fair outcomes for customers. |

| Approach | Often reactive, responding to complaints and market failures. | Proactive and pre-emptive, using data to identify and mitigate risks. |

| Mandate Scope | Primarily focused on non-banking financial services. | Broader mandate covering the conduct of all financial institutions. |

| Consumer Protection | An important component, but not the central organising principle. | The absolute core of its mandate. Protecting customers is the primary goal. |

This table shows a clear shift. The FSCA’s creation moved South Africa’s regulatory focus from a simple box-ticking exercise to a proactive approach that prioritises real, positive results for financial customers.

Key Takeaway: The goal is no longer just about compliance for compliance's sake. It's about achieving tangible, positive outcomes for the people and businesses who rely on the financial system every day.

So, what does the FSCA actually do? Its core functions are clear and have a real impact:

- Protecting Customers: This means making sure you are treated fairly and receive clear, honest communication from financial service providers.

- Promoting Market Integrity: The FSCA works to keep South Africa’s financial markets efficient, orderly, and trustworthy.

- Providing Education: It has a responsibility to help consumers and businesses understand financial products so they can make smart decisions.

- Enforcing Compliance: When someone breaks the rules, the FSCA steps in with decisive action to uphold the standards and deter bad behaviour.

Financial Activities That Require an FSCA Licence

If your business manages investments, gives financial advice, or handles international payments, you're playing in the FSCA's sandpit. Figuring out which specific activities fall under its regulatory net is more than just a box-ticking exercise; it's about protecting your business and your customers. The FSCA's reach is wider than many people think, extending far beyond the traditional worlds of banking and insurance.

At its heart, any business that provides advice or acts as a middleman for a "financial product" needs to be licensed as a Financial Service Provider (FSP). The term "financial product" is deliberately broad, covering everything from shares and bonds to retirement annuities and foreign exchange. So, if you're helping clients invest, manage their wealth, or even just pick an insurance policy, you absolutely need the FSCA's stamp of approval.

It's also worth remembering that even support roles need to be compliant. For instance, specialised services that are deeply integrated into the insurance world, like those from a Virtual Assistant for Insurance Agency, must operate within the rules set for licensed FSPs they support.

Forex and Cross-Border Payment Services

One of the most common areas where modern South African businesses bump into FSCA rules is with foreign exchange (forex) and cross-border payments. It doesn't matter if you're an exporter getting paid in dollars or an SME paying a supplier in Europe – these transactions are squarely under the FSCA's watch. Any platform that helps you swap currencies or send money internationally is providing a financial service.

This oversight is critical, especially in a market that's expanding so quickly. South African businesses are hungry for international trade. In fact, a staggering 56% of senders and 64% of receivers in SA plan to increase their cross-border payments. That’s a level of enthusiasm that leaves developed markets like the UK or Germany in the dust. You can find more global payment trends on electroiq.com.

Key Insight: Simply moving money across borders for your business means you need a licensed partner. The FSCA makes sure these partners have solid systems in place to prevent money laundering and, just as importantly, to protect your funds while they're on the move.

Other Regulated Financial Activities

Beyond forex, the FSCA regulates a whole host of services that many small and medium-sized businesses use every day. Knowing what these are is key to making sure every single one of your financial partners is playing by the rules.

Here are a few of the big ones:

- Investment Management: This is anyone who actively manages a portfolio of assets, like shares or bonds, for clients.

- Financial Advisory: If someone gives you recommendations or guidance on which financial products to choose, they need a licence.

- Insurance Broking: This covers anyone acting as an intermediary for short-term or long-term insurance policies.

- Crypto Asset Services: Since 2022, crypto assets have been officially classified as financial products. This means providers offering trading, custody, or advice must be licensed.

- Payment Services: This is a growing field that includes many fintech solutions that help you make and receive payments, and it's set to become even more regulated.

Teaming up with an unlicensed provider for any of these services is a massive risk, exposing your business to serious financial and legal trouble. Checking a provider’s FSCA status isn't just a good idea; it's a non-negotiable part of your due diligence.

How to Verify a Provider Is FSCA Regulated

Working with a financial service provider (FSP) that doesn’t have a valid licence is a bit like hiring a pilot who says they can fly but can't produce a certificate. It’s a massive, unnecessary risk. Verifying that a provider is properly regulated by the FSCA South Africa is an absolutely non-negotiable step in your due diligence.

Thankfully, it's not a difficult check. The FSCA keeps a public, searchable register of every authorised FSP, and running a quick search can save your business from a world of hurt—from fraud and fines to serious reputational damage. Any FSP worth its salt is proud of its regulatory status and will make its licence number easy to find.

A Simple Verification Process

You can confirm a provider’s status in just a couple of minutes. Here’s how you do it:

Find the FSP Number: First, locate the "FSP number" on the provider's website. You’ll usually find it in the website footer or on a dedicated legal or compliance page. If they’re legitimate, they’ll display it clearly.

Visit the FSCA Portal: Head over to the official FSCA website and navigate to their search tool for regulated entities.

Enter the Details: You can search by the FSP number or the company’s registered name. Searching by the number is the quickest and most accurate way to get a result.

Review the Results: The search will pull up the provider’s official details: their registered name, trading name, address, and—most importantly—their licence status. The portal will explicitly state if they are authorised and list the specific financial products they’re actually allowed to provide.

Critical Check: Don't just stop at seeing the word "authorised." You need to make sure the specific services you need from them are actually listed under their authorised activities. A licence for one thing doesn't give them a free pass to offer everything else.

Red Flags to Watch For

While most FSPs are above board, you'll always find a few trying to pull a fast one. Keep an eye out for these tell-tale signs of trouble:

- Vague Regulatory Claims: Be wary of phrases like "globally regulated" that conveniently forget to mention the FSCA South Africa. For South African operations, only an FSCA licence matters.

- Using Another Company’s FSP Number: Some dodgy outfits will illegally display the FSP number of a legitimate company. That's why you must always cross-reference the name on the FSCA portal with the company you're actually dealing with.

- No FSP Number in Sight: If you can't find an FSP number anywhere on their website, the safest bet is to assume they don't have one. Walk away.

Taking these simple steps puts you in control, allowing you to confidently select partners who are not only trustworthy but fully compliant with South African law.

The Real Risks of Non-Compliance

Turning a blind eye to the rules set by the FSCA isn't just a minor administrative slip-up. It's a fundamental business mistake with consequences that can ripple through your entire operation, hitting everything from your bank balance to your hard-earned reputation. The dangers of working with a non-compliant provider go far beyond a simple slap on the wrist.

Think of it this way: licensed financial providers aren't just making a loose promise to be good corporate citizens. They are legally bound by a strict set of rules designed to keep the entire financial system stable and trustworthy. This is precisely why a legitimate fintech partner will ask for what seems like a mountain of paperwork. They’re not trying to slow you down; they’re doing their job.

Core Obligations Under the FSCA

At the core of these duties are rigorous verification processes. Any proper Financial Service Provider (FSP) is mandated to run thorough checks to clamp down on financial crime. These are not optional extras; they're the absolute baseline.

- Know Your Business (KYB): This means they need to verify your company’s identity, who owns it, and what it actually does. It's about making sure they know exactly who they're in business with.

- Anti-Money Laundering (AML): FSPs must have robust systems in place to spot and report any unusual activity that looks like it could be related to money laundering or terrorism financing.

- Financial Intelligence Centre Act (FICA): This is the cornerstone of South Africa's AML framework. It requires strict customer identification and meticulous record-keeping.

If a potential partner seems a bit too relaxed about these checks, that’s a massive red flag. It shows they aren't just failing to meet their own legal obligations; they're also putting your business directly in the path of illicit funds and all the risks that come with them.

The FSCA's Enforcement Powers

The FSCA isn’t just a rulebook-writing body; it has real teeth and isn't afraid to use them. The regulator has a powerful toolkit for penalising non-compliance, and the fallout can be devastating. We're seeing a clear trend towards tougher enforcement, with administrative penalties skyrocketing to R943 million in the 2023/24 period alone.

Engaging with an unregulated entity means you have no recourse if something goes wrong. Your funds could be frozen or lost, and the FSCA cannot help you recover them from an illegal operator.

The penalties for non-compliance—whether for the FSP itself or a business that knowingly uses them—are severe:

- Crippling Fines: The FSCA can levy financial penalties large enough to sink a company.

- Licence Revocation: For an FSP, this is the ultimate price. Losing their licence means their business is over.

- Public Warnings: The regulator regularly names and shames non-compliant companies in public alerts, which can obliterate a reputation practically overnight.

This level of oversight is critical, especially as South Africa’s cross-border payments scene continues to expand, attracting both genuine innovators and fraudsters. The market is growing, driven by SME demand and a boom in cross-border financing, with loans to nonbanks reaching $16.49 billion and still climbing. You can explore more on South Africa's cross-border financing trends. In an environment with such high stakes, choosing a fully compliant partner isn't just good practice—it's the only way to operate safely.

Choosing Compliant Partners for Cross-Border Payments

Knowing the rules is one thing, but putting that knowledge into practice is what truly protects your company's financial health. When you’re choosing a fintech partner to handle international payments, your vetting process needs to be airtight and squarely focused on FSCA South Africa compliance. This goes far beyond just hunting for the best exchange rates; it’s about insulating your business from serious legal and financial blowback.

The right partner doesn’t just offer a service—they provide peace of mind. A fully compliant provider is like a shield for your business, making sure every cross-border transaction is processed securely and by the book. Before you even think about signing a contract, you need a solid framework for checking out any potential partners.

Your Due Diligence Checklist

You need to go into these conversations armed with a list of critical questions. How a provider answers them—or fails to—will tell you everything you need to know about their commitment to regulatory standards. Treat this as your non-negotiable checklist for building a secure financial partnership. A transparent, legitimate provider won't hesitate to give you straight answers and the documents to prove it.

Here are the essential questions every CFO or financial manager should be asking:

"Can you provide your FSP number?"

This is the first and most basic question. Any legitimate Financial Service Provider (FSP) will have their number clearly visible on their website and in their official documents."Which specific financial activities are you licensed for?"

Remember, an FSP licence isn't a free pass for everything. You need to verify that their licence explicitly covers the services you need, like cross-border payments or foreign exchange."How do you handle FICA and AML compliance?"

Get them to explain their Know Your Business (KYB) and Anti-Money Laundering (AML) procedures. A partner who takes this seriously will have a robust, multi-layered verification process."What security measures protect our funds?"

Ask about their data encryption standards, the security of their platform, and, crucially, how they keep client funds separate from their own company accounts.

Key Takeaway: A provider’s willingness to openly discuss their compliance framework is a strong indicator of their legitimacy. Hesitation or vague responses should be treated as immediate red flags.

By working through these questions methodically, you can assess potential partners with real confidence. This proactive approach ensures you end up with a provider who not only meets your business needs but also upholds the strict standards of integrity demanded by the FSCA South Africa. It’s a strategic decision that protects your business, builds a foundation of trust, and ultimately enables your global growth.

A Few Common FSCA Questions, Answered

Getting to grips with the FSCA often brings up some very practical, "what if" scenarios. Let's tackle a few of the most common questions that businesses run into, clearing up any confusion and reinforcing the key takeaways.

Is Forex Trading Regulated by the FSCA?

Yes, without a doubt. Any entity offering forex trading services, acting as a broker, or serving as an intermediary for forex transactions in South Africa must be a licensed Financial Service Provider (FSP). The rule is iron-clad and also covers providers of Over-the-Counter (OTC) derivatives.

Before you even think about working with a forex platform, your first and most critical step is to check their FSP licence number on the official FSCA portal. It's a simple search that can save your business from the immense risk of dealing with unregulated operators.

Do I Need My Own Licence to Make International Payments?

For the vast majority of businesses, the answer is no. You don't need to go out and get your own FSCA licence just to pay an overseas supplier or get paid by an international client.

The real responsibility here is choosing the right partner to handle those transactions for you. Whether you stick with a traditional bank or use a modern fintech payment platform, the company actually moving the money must have the right FSCA licence. Your job is to do your homework and make sure they are fully compliant.

The Twin Peaks, Simplified: The FSCA and the SARB aren't rivals; they're partners with different jobs. Think of it this way: the FSCA is the market referee, making sure everyone plays by the rules. The SARB’s Prudential Authority is the structural engineer, making sure the stadium (the financial system) won't collapse. Both are essential for a safe game.

What's the Difference Between the FSCA and the SARB?

This is a fantastic question, and the answer gets to the core of South Africa's "Twin Peaks" regulatory model. It's best to think of them as two specialist guardians with very different, but complementary, missions.

The FSCA is all about market conduct. Its entire reason for being is to police how financial firms behave and treat their customers. Is the advice fair? Are the products transparent? Are the markets efficient? That's the FSCA's turf. It’s there to protect consumers and businesses from bad practices.

The South African Reserve Bank (SARB), through its Prudential Authority (PA), is responsible for prudential regulation. Its focus is on the financial health and stability of the big players—banks, insurers, and other major institutions. While the FSCA is watching for fair play on the field, the PA is making sure the institutions themselves are sound enough to not go bankrupt and cause a system-wide crisis.

They are two sides of the same coin, working in tandem to keep South Africa's financial sector safe and trustworthy.