Futures trading in South Africa offers businesses and investors a way to manage the risk of fluctuating prices. Think of it as a financial tool for locking in a price today for something you’ll buy or sell down the line. It's particularly powerful for hedging against volatility in cornerstone industries like agriculture and mining, all overseen by the Johannesburg Stock Exchange (JSE).

Your Guide to an Essential Financial Market

Let's start with a real-world picture. Imagine you’re a maize farmer in the Free State, and your harvest is still months away. The current price for maize is great, but you have a nagging worry: what if it plummets by the time your crops are ready to sell? This kind of uncertainty can make it impossible to plan your finances or invest in that new tractor you need.

This is where a futures contract comes in. The farmer can use one to lock in today's strong price for their future harvest, effectively taking the guesswork out of their future income.

At its core, futures trading in South Africa is all about this simple agreement: a legally binding contract to buy or sell something—whether it's maize, gold, or US dollars—at a fixed price on a set date. Our farmer isn't gambling on the price; they're using a market mechanism to build certainty into their business plan.

Why Futures Trading Matters

This ability to manage price risk is crucial for the health of the entire South African economy. When commodity prices swing wildly, it creates massive headaches for producers and consumers. Futures markets provide a stable, structured place to handle that risk.

They serve a few key economic functions:

- Price Discovery: All the buying and selling activity in the futures market helps everyone agree on what an asset's fair value should be for future delivery.

- Risk Transfer: It creates a bridge between those who want to offload price risk (hedgers, like our farmer) and those willing to take on that risk in hopes of a profit (speculators).

- Economic Stability: By letting businesses secure future prices, futures help create more predictable revenue and steadier supply chains across the board.

A futures contract removes the 'what if' from business planning. It transforms unpredictable future prices into a known variable, allowing for more strategic decision-making and financial stability, whether you are a mining house or an agricultural producer.

What This Guide Will Cover

We've designed this guide to pull back the curtain on futures trading in a clear, practical way. We’ll walk you through everything from the basic concepts to how they're applied in the real world, giving you the knowledge needed to understand this powerful market.

We'll get into the nuts and bolts of the contracts, the essential role the JSE plays, and the risk management techniques that are non-negotiable for success. Whether you're a business owner looking to protect your profits or an investor searching for new opportunities, you'll walk away with the confidence to navigate the market with a solid footing.

How Futures Contracts Actually Work

To really get your head around futures trading in South Africa, you have to see past the simple idea of an 'agreement'. Think of a futures contract more like a detailed blueprint for a transaction that hasn't happened yet. It’s a completely standardised set of rules, ensuring that everyone trading on an exchange like the Johannesburg Stock Exchange (JSE) is playing the same game.

Every single futures contract is built on a few core, non-negotiable elements. They spell out exactly what's being traded.

The Building Blocks of a Futures Contract

First up is the underlying asset. This is the actual 'thing' the contract is all about. Here in South Africa, it could be a physical commodity like white maize, a financial instrument like a government bond, or even a currency pair like the ZAR/USD exchange rate.

Next, you have the contract size, which specifies the exact amount of the asset in one contract. A JSE-listed wheat futures contract, for instance, covers 50 metric tons. This standardisation is absolutely critical; it means a trader knows precisely how much they’re agreeing to buy or sell, with no guesswork involved.

Finally, there’s the expiration date. Sometimes called the delivery date, this is the set-in-stone future date when the contract has to be settled. It’s the finish line where both the buyer and seller must make good on their promises.

Together, these components create a rock-solid, enforceable framework. There’s no room for confusion about what's on the table, how much of it, or when the deal goes down.

Going Long Versus Going Short

In the futures world, you can make money whether prices are heading up or down. It all depends on the position you take.

Going Long (Buying): When a trader "goes long," they are buying a futures contract. They're essentially betting that the price of the underlying asset will increase before the contract expires. If they're right, they can sell the contract for more than they paid for it and lock in a profit. A speculator who thinks gold prices are about to climb would go long on a gold futures contract.

Going Short (Selling): Conversely, a trader "goes short" by selling a futures contract. They're predicting the asset's price will decrease. If the price drops as they expect, they can buy back the same contract for less money to close their position, and the difference is their profit. Our Free State farmer from earlier would go short, selling a maize futures contract to lock in a good price for his future harvest.

This two-sided nature is what makes the futures market so incredibly dynamic. It gives participants the tools to not only protect themselves from falling prices but also to speculate on rising ones.

The Moment of Expiration: Settling Up

So, what happens when the clock runs out and a contract hits its expiration date? This is where settlement happens, and it usually goes one of two ways.

Physical Settlement: In this scenario, the actual underlying asset changes hands. If a large bakery held a wheat futures contract to expiration, they would literally receive a delivery of 50 tons of physical wheat. This is common for agricultural and commodity contracts where businesses genuinely need the physical product.

Cash Settlement: More often than not, no physical goods are moved. Instead, the contract is settled with a simple cash payment. The profit or loss is worked out based on the difference between the price in the original contract and the market price at expiration. The net amount is then transferred between the two parties. This is the norm for financial futures, like those based on stock indices or currencies.

The massive growth in futures trading in South Africa shows just how essential these tools have become for navigating economic uncertainty. In fact, the local commodities market's nominal value is projected to reach an incredible US$1.61 trillion in 2025. It's expected to keep growing by 3.28% each year until 2030, all driven by the need for smarter risk management. You can discover more market projections about the South African commodities sector for deeper insights.

Remember, a futures contract is a legally binding obligation, not a casual suggestion. Unlike an options contract, which gives you the right to buy or sell, a futures contract compels you to fulfil the terms at expiration, whether through physical delivery or a cash settlement.

Understanding these mechanics is the first real step toward appreciating both the power and the responsibility that come with trading futures.

The JSE's Role in South African Futures

When you trade futures in South Africa, you're not just striking a private deal with someone on the other end of the line. Every single transaction happens inside a highly structured and regulated environment, and at the heart of it all is the Johannesburg Stock Exchange (JSE).

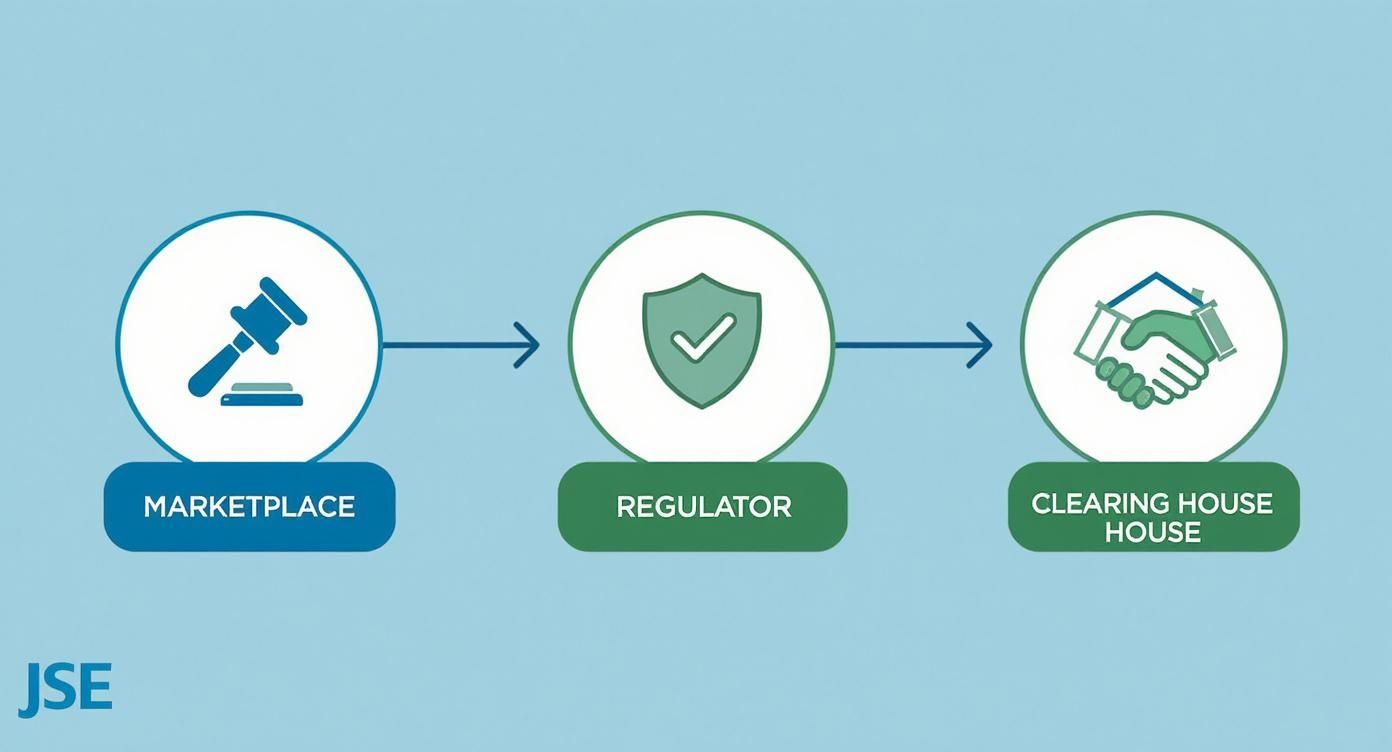

Think of the JSE as the guardian of the entire derivatives market. It plays three crucial roles at once: it's the marketplace, the referee, and the guarantor, all rolled into one. This structure is what builds trust, ensures fairness, and removes the kind of risks that would otherwise make futures trading far too dangerous for most businesses.

Without the JSE’s organised framework, the market would be a chaotic free-for-all, leaving everyone exposed to defaults and disputes.

The JSE as the Central Marketplace

First things first, the JSE provides the actual platform—both physical and digital—where buyers and sellers come together. This isn't some chaotic bazaar; it's a transparent and efficient marketplace. A perfect example is the JSE’s Commodity Derivatives Market, which offers a menu of contracts absolutely vital to our national economy.

Through the JSE, you can access a huge variety of instruments, including:

- Agricultural Products: Contracts for staples like white and yellow maize, wheat, and soybeans. These are the tools farmers and food producers use to protect themselves from price swings.

- Financial Instruments: This covers futures on interest rates, bonds, and currencies (like the popular ZAR/USD pair), which are essential for managing financial and import/export risks.

- Global Commodities: Thanks to smart partnerships with international exchanges like the CME Group, the JSE gives local traders a direct line to global benchmarks for products like crude oil and gold.

This central hub ensures everyone sees the same prices at the same time, a critical process we call price discovery. It’s this transparency that lets the market find a fair value for an asset based on real-time supply and demand.

The diversity of products available is a cornerstone of the JSE's value. To give you a clearer picture, here’s a breakdown of some key contracts you'll find.

Key Futures Contracts Available on the JSE

| Asset Class | Example Contract | Primary Use Case |

|---|---|---|

| Agricultural | White Maize (WMAL) | Farmers hedging crop prices; Millers securing input costs. |

| Equities | FTSE/JSE Top 40 Index (ALSI) | Investors speculating on or hedging against broad market movements. |

| Currencies | ZAR/USD Futures (ZAR/USD) | Importers/Exporters locking in an exchange rate to manage currency risk. |

| Interest Rates | 3-Month JIBAR Futures (STIR) | Banks and corporate treasurers hedging against interest rate fluctuations. |

This table only scratches the surface, but it shows how the JSE offers tools tailored for different sectors of the South African economy, from the farm to the boardroom.

The Regulator and Clearing House Functions

Beyond just being a marketplace, the JSE wears two other hats that are absolutely vital for market integrity. As the regulator, it sets and enforces the rules of the game. Every broker has to be registered and stick to strict codes of conduct, making sure the market runs ethically.

But perhaps its most important job is acting as a clearing house through its division, JSE Clear. This is where the JSE removes the single biggest fear in any private deal: the risk that the other person won't pay up.

When you trade a futures contract on the JSE, your agreement isn't actually with the person on the other side. Instead, JSE Clear steps into the middle, becoming the buyer to every seller and the seller to every buyer. This guarantees the contract will be honoured, even if one party defaults.

This guarantee is what turns a potentially high-risk environment into a secure and reliable one, giving businesses the confidence they need to hedge their commercial risks. It's the invisible force holding every single trade together.

The JSE Commodity Derivatives Market, in particular, has become an indispensable tool. In 2024, the exchange reported a 12% increase in traded commodity contracts, with open interest—a key measure of market participation—climbing to 1.8 million contracts. You can dig deeper into the numbers and see the JSE's commodity derivatives market performance for yourself.

Understanding Margin, Leverage, and Risk in Futures Trading

https://www.youtube.com/embed/RgmDywzNlZA

When you step into the world of futures trading in South Africa, you’ll immediately run into two concepts that are both powerful and widely misunderstood: margin and leverage. They're the engine that lets you control a large asset with a relatively small amount of cash, but mishandling that power is the fastest way to financial trouble.

It’s easy to think of margin as a down payment, but that’s not quite right. A better analogy is a good-faith deposit. When you open a futures contract, the initial margin you put down isn’t part of the purchase price; it’s more like a security deposit with your broker to prove you can cover any initial losses.

This deposit is what gives you access to leverage. Let’s say a single JSE wheat contract controls 50 tons of wheat, valued at around R250,000. The initial margin to open that trade might only be R25,000. You’re effectively controlling a quarter of a million rand’s worth of wheat with just 10% of its value.

This is a classic double-edged sword. If the wheat price moves in your favour, your return on that R25,000 deposit can be massive. But if it goes against you, the losses are also calculated on the full R250,000 contract value. A small dip in price can wipe out your margin deposit very quickly.

How Margin Requirements Actually Work

The initial margin isn't the only number you need to keep your eye on. Your broker will also set a maintenance margin – this is the absolute minimum equity you must have in your account to keep the position open. Think of it as a safety buffer.

If market fluctuations cause your account balance to drop below this maintenance level, you’ll get a dreaded margin call. This isn't a friendly reminder; it's a formal demand from your broker to add more funds immediately to bring your account back up to the initial margin level.

A margin call is a critical red flag. It means your trade has moved significantly against you. If you don't meet the call by depositing more funds, your broker will forcibly close your position to prevent further losses, locking in whatever loss you've incurred.

Let's break it down with a simple example:

- You open a futures position that requires R20,000 in initial margin.

- The maintenance margin for this position is set at R15,000.

- The market turns against you, and your account equity falls to R14,500.

- This triggers a margin call. You'll need to deposit R5,500 to bring your account back to the original R20,000 level.

This system is designed to protect both you and the brokerage from devastating losses. The JSE's clearing house plays a central role in managing these requirements, guaranteeing that trades are settled and the market remains stable.

This institutional oversight ensures everyone plays by the same rules, which is what gives futures trading in South Africa its integrity.

Must-Have Risk Management Techniques

Given how powerful leverage is, managing your risk isn't just a good idea—it's absolutely essential for survival. Seasoned traders never enter a position without knowing exactly where they'll get out if things go wrong.

The most basic and vital tool for this is the stop-loss order. This is a pre-set instruction for your broker to automatically close your trade if the price hits a certain level. It's your emergency exit, designed to cut your losses before they spiral out of control.

For example, if you go long on a futures contract at R100 and decide you can't stomach a loss of more than R10 per unit, you'd place your stop-loss order at R90. If the price falls to that point, your position is sold automatically. No hesitation, no second-guessing.

On top of that, smart traders live by strict capital management rules.

- The 2% Rule: This is a classic for a reason. Never risk more than 2% of your total trading capital on any single trade. It ensures that even a string of bad luck won't knock you out of the game.

- Diversification: Don't put all your eggs in one basket. Spreading your capital across different, non-correlated assets (like agricultural products and financial indices) can help buffer your portfolio against volatility.

- Position Sizing: This is crucial. Your position size should be calculated based on your stop-loss and the 2% rule, not just the low initial margin. This stops you from taking on a trade that's far too large for your account to handle.

By treating leverage with respect and using disciplined tools like stop-loss orders and proper position sizing, you can approach futures trading in South Africa with a strategy built for the long haul, not just a quick punt.

Hedging Strategies for South African Businesses

While it's easy to get caught up in the mechanics of margins and leverage, the real magic of futures trading in South Africa happens when businesses put them to work. For countless companies, from agricultural producers to manufacturers, futures contracts aren't for speculation; they're essential tools for managing risk. This strategic use is called hedging.

At its core, hedging is about protecting your business from wild price swings. Think of it as an insurance policy against market volatility. It lets a business lock in a price today for a commodity it needs to buy or sell down the road, turning a massive unknown into a fixed cost or a guaranteed revenue.

That kind of price certainty is gold for any business trying to budget, plan, and build for the long term. Let's look at how two very different South African businesses could use hedging to create stability.

The Short Hedge: Protecting a Producer

Picture a maize farmer in the North West. It’s March, her crop is in the ground, and she won’t be ready to harvest until July. The current maize price on the JSE is looking good, but she’s rightly worried. What if everyone has a great season? A bumper crop could send prices plummeting by the time she gets her maize to market.

This is where she can use a short hedge to shield her income.

- The Goal: She wants to lock in today’s strong selling price for her future harvest.

- The Action: She goes to the JSE and sells maize futures contracts that expire in July, matching the volume she expects to harvest.

- The Outcome: Come July, one of two things will happen. If the maize price has crashed as she feared, the lower price she gets for her physical crop is offset by the profit she makes on her futures contracts. If the price surprisingly shoots up, the extra cash from her harvest is cancelled out by a loss on her futures.

Either way, she has effectively secured the price from back in March, removing a huge amount of uncertainty from her business.

Hedging isn't about maximising profit; it's about minimising risk. The goal is to create predictable outcomes, allowing a business to operate with confidence regardless of which way the market swings.

The Long Hedge: Securing Input Costs

Now, let's flip the coin and look at a large bakery in Gauteng. Their business depends on a steady supply of wheat to make bread. Their biggest headache? A sudden jump in wheat prices, which could crush their profit margins or force them to pass on higher costs to customers.

To prevent this, the bakery uses a long hedge—the mirror image of the farmer’s strategy.

- The Goal: To fix the purchase price for the wheat they'll need in the coming months.

- The Action: The bakery buys wheat futures contracts on the JSE for a future delivery date.

- The Outcome: If the market price for wheat skyrockets, the extra they have to pay for the physical wheat is covered by the profit they make on their futures position. Their production costs remain stable and predictable.

These strategies are fundamental pillars of the South African economy. And it’s not just a local game; South Africa is deeply connected to global financial markets. For example, the MSCI South Africa Index Futures are traded on Eurex, a major European exchange, with daily volumes hitting around 2,500 contracts in October 2025. This shows how international investors get exposure to our market and underlines the global relevance of South African finance. You can find more about South Africa's presence on global exchanges to see the bigger picture.

Got Questions About Futures Trading in SA? We've Got Answers

As we’ve walked through the world of futures trading in South Africa, you've probably started asking yourself some practical questions. That’s a good sign—it means you're thinking like a trader. This section is all about tackling those common queries that pop up when the theory starts to meet reality.

Think of this as a quick chat to clear up any lingering confusion and help you connect the dots with confidence.

Do I Need to Be a Massive Corporation to Trade Futures?

This is a big one. Many people picture futures traders as giants in the agricultural or financial sectors, but that's not the whole story.

Not at all. While big companies are definitely key players, the JSE has structured its market to be surprisingly accessible. With a good, registered broker on your side, even individual retail investors can get in on the action.

The trick is having enough capital to cover your margin without stretching yourself too thin. Even more important is having a crystal-clear understanding of the risks you’re taking on. Many of the contracts on the JSE, particularly for commodities, are actually designed to suit smaller producers and even individual speculators. The non-negotiable part? You must partner with a reputable, JSE-approved broker who can provide the right platform and guide you properly.

What’s the Real Difference Between Futures and Options?

It’s easy to lump these two together, but they are fundamentally different beasts. Getting this distinction right is crucial.

A futures contract is a binding obligation. You are locked in. When you sign it, you’ve legally committed to buying or selling a specific asset, at a set price, on a future date.

An options contract, however, gives you the right, but not the obligation, to do the same. You can buy a 'call' option (the right to buy) or a 'put' option (the right to sell). For this flexibility, you pay a fee called a 'premium'.

Here’s a simple way to look at it: a futures contract is like signing the final deed on a house—you’re committed. An options contract is like paying a non-refundable deposit to secure the option to buy that house later. If you change your mind, you can walk away, but you lose the deposit (your premium).

This difference is everything. Options limit your potential loss to the premium you paid, making them useful for more complex strategies. With futures, the leverage involved means your potential losses can be significantly larger than your initial deposit.

How Does SARS Tax Profits and Losses From Futures Trading?

Navigating the tax implications in South Africa can be tricky, as it really depends on why you're trading. SARS looks at whether your activity is pure speculation or a genuine hedging strategy for your business.

For the most part, if you're speculating, any profits are treated as income and taxed at your marginal income tax rate. There isn't a special, lower capital gains tax for short-term profits made from futures.

However, if you're a farmer hedging against a drop in maize prices, for example, those gains or losses are typically considered part of your business's regular income and expenses. This directly impacts your company's overall taxable income.

Because the rules have nuances and the penalties for getting it wrong are steep, this is one area where you absolutely should not wing it. Get in touch with a qualified tax professional in South Africa who understands financial derivatives. They can give you tailored advice and make sure you’re fully compliant with SARS.

What Are the First Steps to Start Trading on the JSE?

Ready to get started? A methodical approach is your best friend here. Don't just jump in. Follow this simple path to begin your journey into futures trading in South Africa the right way.

- Learn, Then Learn Some More: This is the most important step, period. Before you do anything else, make sure you genuinely understand everything in this guide—from how contracts work to managing risk. Never, ever trade something you don't fully grasp.

- Find a JSE-Registered Broker: You can't just log into the JSE yourself. You need to open an account with a brokerage firm that is a registered member of the JSE's derivatives market. Do your homework here. Compare brokers, their platforms, and their fee structures to find one that feels right for you.

- Go Through the Paperwork: Expect to fill out a detailed application, provide your FICA documents (ID and proof of address), and answer a questionnaire about your risk tolerance. This is for your own protection—it ensures you know you’re dealing with high-risk instruments.

- Fund Your Account: Once approved, you’ll need to deposit money. Make sure you have enough to cover the initial margin for the trades you’re planning, plus a healthy buffer to handle any market swings against you.

- Practise in a Safe Space: Almost every decent broker offers a demo or simulated trading account. Use it! This is your free-of-charge, risk-free training ground. Get comfortable with the trading platform, test out your strategies, and feel the rhythm of the market before a single rand is on the line.

When you're running a business, unpredictable costs and risks from international payments can chip away at your financial stability. Zaro cuts through the noise, offering a transparent and efficient way to send and receive money globally at the real exchange rate, with no hidden surprises. Secure your company's bottom line—visit Zaro's official website to see how you can manage cross-border transactions the smart way.