If you're looking to trade forex, one of the first tools you'll need to get comfortable with is an fx margin calculator. Think of it as your upfront cost calculator. It tells you exactly how much of your own capital—the margin—you need to put down as a good-faith deposit to open a leveraged trade.

It instantly clarifies the capital required for a position, so you know right away if you have enough funds to meet your broker's requirements. This simple check is crucial for avoiding over-leveraging and preventing nasty surprises down the line.

What Forex Margin Really Means for SA Traders

Let's get one thing straight: forex margin isn't a fee you pay to the broker. It's more like a security deposit they hold onto while your trade is active. It's the slice of your own money that allows you to control a much larger position, thanks to the power of leverage.

Getting a firm grip on this concept is your first line of defence, especially when dealing with volatile pairs like the USD/ZAR where the market can swing dramatically. Suddenly, an fx margin calculator becomes less of a simple tool and more of a strategic partner in your trading journey.

Core Margin Concepts Explained

To make any sense of an fx margin calculator, you need to know the lingo. There are three key terms you'll see pop up constantly on your trading platform:

- Required Margin: This is the exact amount of money your broker locks up to open and maintain a specific trade. It’s the number the calculator spits out.

- Free Margin: This is what’s left in your account. It's the capital you have available to open new positions or, just as importantly, to absorb any losses from your current trades. Consider it your financial safety net.

- Margin Level: This is a crucial health check for your trading account, calculated as (Equity / Required Margin) x 100. If this percentage dips too low, you'll get a margin call from your broker.

A high margin level is a great sign—it means you have a healthy account with plenty of cushion to withstand market movements. A low margin level, on the other hand, is a red flag that you're getting dangerously close to a margin call, where your broker might start closing your positions automatically to stop further losses.

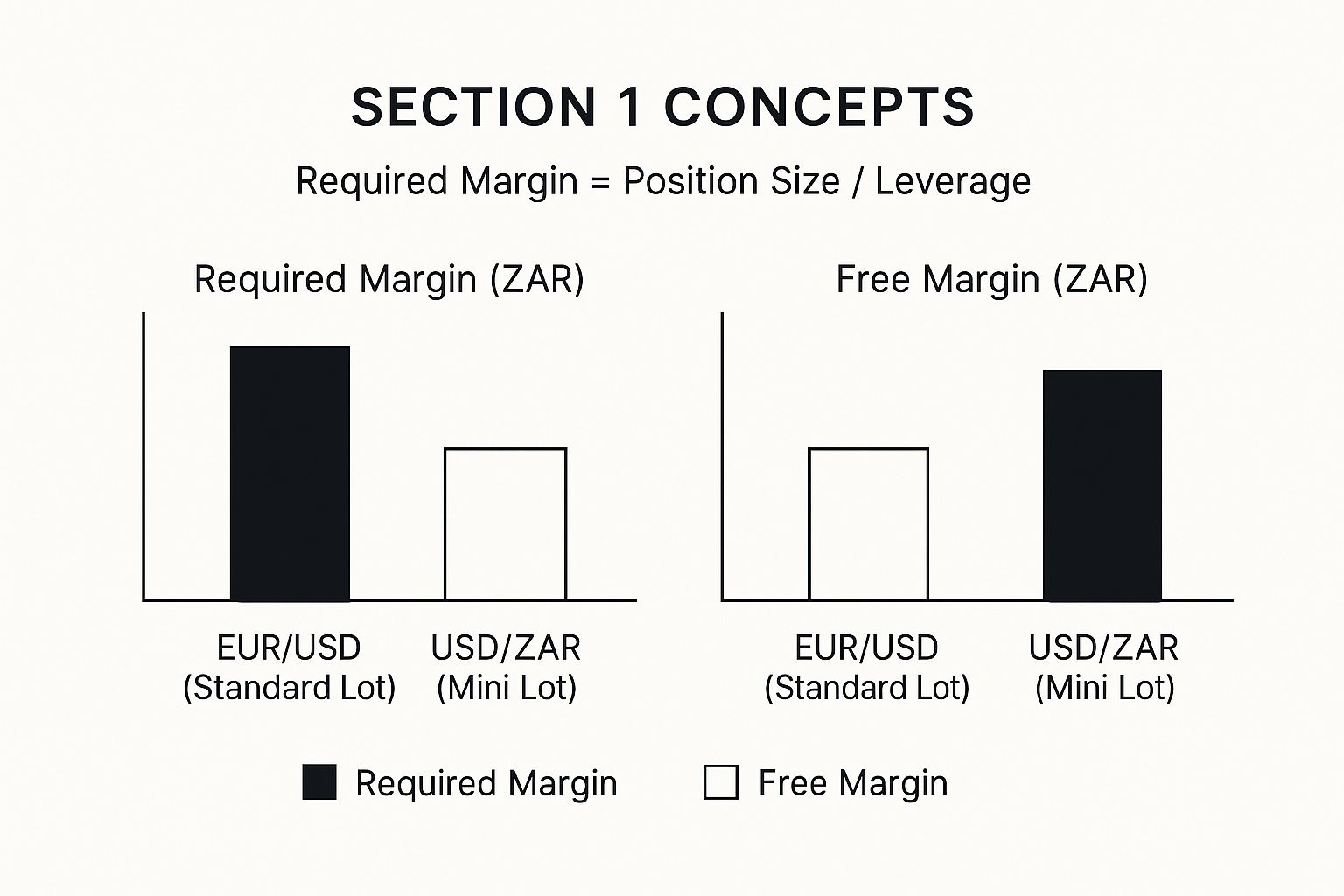

This chart gives you a clear visual on how your required and free margin can shift depending on what you're trading.

As you can see, opening a position on a more volatile pair like USD/ZAR can tie up your capital very differently than trading a major pair, even if the trade size is smaller.

Why Margin Matters in South Africa

The rise of forex margin calculators in South Africa goes hand-in-hand with the incredible boom in retail forex trading here. The number of local traders is estimated to have skyrocketed by over 300% between 2015 and 2025, with total deposits now topping ZAR 8 billion.

This explosive growth is what pushed the Financial Sector Conduct Authority (FSCA) to introduce leverage caps, making savvy margin management more critical than ever for local traders. It's well worth your time to get familiar with the FSCA's regulations to understand their impact on the market.

The concept of using a small amount of capital to control a larger asset isn't unique to forex; it's a fundamental principle in many areas of finance, such as securities-based lending. By mastering these core ideas, you’re not just learning to trade—you’re building a solid foundation for smarter, safer financial decisions.

Breaking Down the FX Margin Calculation

So, what’s actually going on under the hood when you use an fx margin calculator? It’s not some cryptic magic. Knowing the mechanics helps you move from just clicking buttons to truly understanding your risk and exposure.

At its heart, the calculation is refreshingly simple.

The basic formula is: Required Margin = Position Size / Leverage.

This little equation figures out how much of your own money the broker needs to set aside for the trade. But to really get a feel for it, let's walk through a couple of real-world scenarios that South African traders see every single day.

How Margin Works in a ZAR Account

Your account's base currency is a huge factor. As a trader in South Africa, your account is likely denominated in Rands, which means your required margin will always be calculated and displayed in ZAR. A good calculator handles all the currency conversions for you seamlessly.

Let's say you want to trade a major pair like EUR/USD. The total value of your position has to be converted into ZAR before your leverage is factored in.

Here’s a practical example to make it crystal clear.

Scenario 1: Trading a Standard Lot of EUR/USD

- Trade Size: 1 standard lot (100,000 EUR)

- Leverage: 1:30

- EUR/USD Rate: 1.0800

- USD/ZAR Rate: 18.50

First, the calculator finds the position's value in US Dollars: 100,000 EUR × 1.0800 = $108,000.

Next, it converts that into our local currency: $108,000 × 18.50 = ZAR 1,998,000.

Finally, it applies your leverage to get the margin: ZAR 1,998,000 / 30 = ZAR 66,600.

That ZAR 66,600 is the amount of your capital that will be locked in to open this trade.

The Special Case of Volatile ZAR Pairs

Now, let's switch gears and look at trading a pair that includes our own currency. Pairs like USD/ZAR are a completely different animal, and managing your margin here is critical because of the volatility.

For those of us trading in South Africa, an fx margin calculator isn't just a convenience—it's essential. The Rand is known for its wild swings. Daily volatility for USD/ZAR can easily top 1.5%, which dwarfs the 0.5% you might see on a quiet day for EUR/USD. This means the risk of sudden market moves and margin calls is much higher.

In fact, data suggests that local traders who consistently use margin calculators can cut their odds of getting a margin call by up to 40%. If you're interested in the data, you can see more on ZAR pair volatility from platforms like GhostTraders.

Let’s run the numbers for a smaller trade on the Rand.

Scenario 2: Trading a Mini Lot of USD/ZAR

- Trade Size: 1 mini lot (10,000 USD)

- Leverage: 1:20 (brokers often offer less leverage on more volatile pairs)

- USD/ZAR Rate: 18.50

The position value is already in USD, so we just convert it to Rands: 10,000 USD × 18.50 = ZAR 185,000.

Now, we apply the leverage: ZAR 185,000 / 20 = ZAR 9,250.

For this smaller, local-pair trade, you’d need ZAR 9,250 as your required margin.

Key Takeaway: See how both the trade size and the currency pair itself completely change the amount of capital you need to put up? A smaller trade on a volatile local pair requires far less upfront margin than a large position on a major pair.

This is the kind of instant clarity an fx margin calculator gives you. To pull it all together, the table below gives a side-by-side comparison of a few different scenarios.

Sample Margin Calculations for a ZAR Account

This table shows how the required margin can change depending on the currency pair, trade size, and your chosen leverage, all from the perspective of a ZAR-based account.

| Currency Pair | Lot Size (Units) | Leverage | Approx. Position Value (ZAR) | Required Margin (ZAR) |

|---|---|---|---|---|

| EUR/USD | 100,000 | 1:30 | R 1,998,000 | R 66,600 |

| USD/ZAR | 10,000 | 1:20 | R 185,000 | R 9,250 |

| GBP/JPY | 1,000 | 1:30 | R 23,200 | R 773 |

| AUD/CAD | 50,000 | 1:30 | R 675,000 | R 22,500 |

As you can see, the numbers vary significantly. Manually calculating this for every potential trade is not just tedious; it's a recipe for mistakes. Using a tool ensures you get it right every single time.

Using Your Margin Calculator for Smarter Risk Management

Knowing how to work out your required margin is one thing, but that’s just the starting line. The real magic happens when you start using an FX margin calculator before you even think about placing a trade. It stops being a simple calculation tool and becomes your first line of defence in protecting your capital.

Running the numbers upfront gives you an instant reality check. You can see straight away if a trade you're considering is simply too big for your account. It’s a basic, yet powerful, check that helps you sidestep the rookie mistake of over-leveraging, where even a small market move against you can cause some serious damage.

Planning Trades Around Your Available Margin

A seasoned trader never looks at the margin for a single trade in a vacuum. They're always thinking about the bigger picture—how will this one position impact the overall health of my account? The name of the game is to always keep a healthy cushion of free margin. This is your buffer zone, ready to absorb the wild swings the market can throw at you without warning.

So, before you jump into a new position, punch the details into the calculator to see the required margin. Then, deduct that figure from your current free margin. What’s left is your safety net.

An experienced trader once told me, "Never use more than 1% to 2% of your account balance as margin for a single trade." This isn’t a hard rule, but it's a brilliant guideline for ensuring one bad trade doesn't wipe out a significant portion of your capital.

Getting into this habit completely changes your approach. You move from reacting to problems to proactively managing your risk before it even becomes a problem. That discipline is what separates traders who last from those who don't.

Stress-Testing Your Entire Portfolio

What happens when you’re juggling several open trades at once? This is where a margin calculator really proves its worth for managing risk across your whole portfolio. You can run a simulation to see the total margin needed for all the positions you want to open.

It’s a simple process:

- Calculate the margin for each trade you plan to take.

- Add up all the required margin amounts.

- See how that total impacts your overall free margin and margin level.

Think of it as a stress test for your account. It shows you your total exposure in a single number. If that combined margin figure looks uncomfortably high, that’s your cue to scale back your position sizes or maybe not open all those trades at the same time. It helps you stay in the driver's seat.

Simulating What-If Scenarios

One of the most valuable—and surprisingly underused—features of a margin calculator is the ability to game out "what-if" scenarios. Before you commit, you can see how a big, unexpected market swing could affect your margin.

This is especially critical for us here. South African forex brokers have built sophisticated margin calculators into their platforms, largely because of the ZAR's notorious volatility. These tools instantly tell you the required margin, a crucial figure when insufficient capital can trigger a forced liquidation of your trades. For example, trading a standard lot of USD/ZAR is going to tie up a lot more of your margin than the same size trade on a pair like EUR/USD, even at the same leverage. If you want to dig deeper into the numbers behind this, you can find a more detailed margin calculation guide on IFC Markets.

By modelling these potential swings, you get a clear picture of how much breathing room you actually have before a dreaded margin call. This foresight is what allows you to build in a proper buffer and trade with real confidence, not just hope.

Common Margin Calculation Mistakes to Avoid

Getting your head around forex margins is one thing, but avoiding the common slip-ups that can drain your account is another. I've seen it happen time and time again—even a tiny miscalculation can lead to a world of pain. Using an FX margin calculator is a great start, but knowing where traders usually go wrong is what really keeps your capital safe.

These aren't complex errors. In fact, they’re often simple oversights, but they can have a massive impact on your trading.

Misinterpreting Your Base Currency

This one trips up a lot of new traders. Let's say you’re trading from your ZAR account and want to open a position on EUR/GBP. The margin isn't calculated directly on the euro value. Your platform first has to convert the value of the base currency (that’s the EUR) into ZAR before it can figure out the margin requirement.

If you forget this conversion step, you'll almost certainly underestimate how much margin you need, leaving you with far less free margin than you thought you had. It’s a classic mistake that can put your account on the back foot before the trade even gets going.

Overlooking Broker-Specific Rules

Here’s a critical point: margin requirements are not universal. What one broker requires can be completely different from another, and they often change based on the specific instrument you’re trading.

Brokers will almost always set different margin rates for different types of currency pairs. The margin needed for an exotic pair like USD/TRY, for instance, is going to be much higher than for a major like EUR/USD. This is simply because the risk and volatility are higher.

On top of that, brokers can—and often do—change margin requirements when the market gets choppy or just before a major news announcement. Always check your broker’s specific rates for the exact pair you’re about to trade. Never, ever assume.

Trader's Tip: Before a big news event like the Non-Farm Payrolls (NFP) report, pop onto your broker's site or platform. Check if they plan to temporarily increase margin requirements. A quick five-minute check can be the difference between staying in a trade and being stopped out by a margin call.

Underestimating Volatile Pairs

For those of us trading in South Africa, it's easy to get caught out by ZAR pairs. The USD/ZAR is famously volatile, and brokers know this. To cover their own risk, they demand higher margin deposits for it.

A trader might spot what looks like a perfect setup on USD/ZAR but fail to account for the higher margin. They end up tying a massive chunk of their account into one high-risk trade, leaving very little room to manoeuvre.

Here’s how that plays out:

- Scenario: A trader calculates their margin for a USD/ZAR position using the standard 1:30 leverage they use for EUR/USD.

- The Mistake: Their broker, however, has a stricter rule for ZAR pairs and only offers 1:20 leverage.

- The Outcome: The actual margin required is 50% higher than they planned for. This crushes their free margin and dramatically increases the chance of a margin call if the trade moves against them even slightly.

This is precisely why a reliable FX margin calculator that lets you specify the instrument is an absolute must-have.

Ignoring the Impact of Leverage

Finally, let's talk about leverage. It’s tempting to just accept the maximum leverage your broker offers. It feels powerful, letting you control huge positions with just a small amount of capital.

But it’s a double-edged sword. High leverage magnifies your losses just as quickly as your gains. Maxing out your leverage on every single trade is one of the fastest ways to blow up an account because it leaves you zero buffer against normal market swings.

A much smarter way to operate is to use a calculator to figure out the lowest leverage you can get away with for your intended position size. This approach keeps your risk in check and ensures you have a healthy margin level, giving your trades the breathing room they need to work out.

A Practical Guide to Zaro's FX Margin Calculator

Knowing the theory is one thing, but building real confidence as a trader comes from putting it into practice. This is where Zaro's FX margin calculator becomes an essential part of your toolkit. It's designed to give you instant clarity on the capital you need before you enter a trade, cutting out the guesswork and helping you make smarter decisions.

Let's break down exactly how to use it. You'll notice the interface is clean and simple, focusing only on what's necessary to give you a precise margin figure in seconds.

Here’s what you’ll see when you open it up:

As you can tell, it only asks for a few key details to work its magic. It crunches the numbers for you, giving you an accurate margin requirement so you understand your financial commitment from the get-go.

Understanding Each Input Field

To get the most out of the calculator, it helps to understand what each field means and why it's there. Every single input plays a direct role in the final margin calculation, reflecting the unique conditions of the trade you're planning.

- Currency Pair: This is where you select the forex pair you intend to trade, like USD/ZAR. The base currency (the first one in the pair) is what really matters, as its value determines the overall size of your position.

- Account Currency: Simply set this to your trading account's currency. For most of us in South Africa, this will be ZAR. The calculator automatically handles the conversion, so you see the margin in Rands.

- Leverage: Pop in the leverage ratio your broker provides for that specific pair (for instance, 1:30). It's crucial to remember that this often changes depending on whether you're trading a major, minor, or exotic pair.

- Trade Size (Lots): Enter how big you want your position to be, measured in lots. As a quick refresher, one standard lot is 100,000 units of the base currency, a mini lot is 10,000, and a micro lot is 1,000.

With just those four pieces of information, you're set. The tool pulls real-time exchange rates to do the maths, which means the number you see is always relevant to what’s happening in the market right now.

A Real-World Example with Gold (XAU/USD)

A great margin calculator isn't just for currency pairs. You can just as easily use it to work out the margin for commodities like Gold, which is typically priced against the US Dollar (XAU/USD).

Let's run through a quick example for a small Gold position.

Our Trade Details:

- Instrument: XAU/USD

- Account Currency: ZAR

- Leverage: 1:20 (leverage for commodities is often a bit lower)

- Trade Size: 0.1 lots (which is the same as 10 ounces of Gold)

Once you plug these details into the Zaro calculator, it instantly shows you the required margin in Rands. You'll know the exact capital needed, which lets you decide if the trade fits within your risk management plan without fumbling with manual conversions.

This is a perfect example of how the calculator becomes an indispensable tool in your day-to-day trading. It’s all about getting the clarity you need to execute your strategy with confidence and precision, making informed decisions on the fly.

Frequently Asked Questions About FX Margin

Even once you get your head around the theory, a few questions always pop up when it comes to putting margin calculations into practice. I've pulled together the most common ones I hear to help clear up any confusion and make sure you're on solid ground.

What's the Difference Between Margin and Leverage?

It's easy to get these two mixed up, but think of it this way: leverage is the tool your broker offers you, and margin is the security deposit you have to put down to use it. They’re basically two sides of the same coin.

So, if your broker offers 1:30 leverage, it means you can control a R30,000 position with just R1,000 of your own money. That R1,000 is your required margin. The higher the leverage, the smaller the deposit you need for the same trade size. Just remember, this also cranks up your risk, which is why having a good fx margin calculator on hand is so crucial for seeing the whole picture.

How Often Should I Really Use an FX Margin Calculator?

Honestly? Before every single trade. This isn't something you do once in a while; it needs to be a core part of your pre-trade checklist, no exceptions.

Making this a habit helps you do a few critical things:

- You’ll know the exact capital you need to lock up for the position.

- It forces you to check if the trade size actually fits within your risk management rules.

- You get a clear view of how this new trade will impact your account's free margin and overall margin level.

Pro traders don't guess—they calculate. Building this simple step into your routine creates the kind of discipline that separates consistently profitable traders from those just hoping for the best. It’s fundamental to trading responsibly.

Does the Required Margin Change After I Open a Trade?

No, the initial required margin for a specific trade is locked in the moment you open it. It won't change as long as that position is active.

What does change, second by second, is your account's overall margin level. This is because your account equity is constantly moving with the market. If a trade goes against you, your equity drops, and that brings down your margin level percentage.

If that percentage falls below your broker's threshold (often around 100%), you'll get a margin call. If it keeps falling and hits the stop-out level (say, 50%), your broker will start automatically closing your trades to protect you from bigger losses. This is exactly why you need to watch your overall margin level far more closely than the initial margin on any single trade.

Ready to manage your global payments with clarity and control? Zaro offers transparent, real-time exchange rates with zero hidden fees, empowering your business to make smarter financial decisions. Stop guessing and start knowing your real costs. Explore how Zaro can transform your international transactions today.