Think of an FX profit calculator as a digital tool that instantly works out the potential profit or loss on a foreign exchange trade. It takes the guesswork and slow manual maths out of the equation, giving you crucial financial foresight before you put any capital on the line.

Why an FX Profit Calculator Is Your Trading Co-Pilot

Navigating the currency market can feel like sailing a vast, unpredictable ocean. A currency chart shows you the waves, sure, but it doesn't tell you where you'll actually end up. This is where an FX profit calculator comes in. It’s like a financial GPS, your indispensable co-pilot plotting your course by showing potential outcomes before you ever leave the harbour.

This tool is all about shifting from high-risk guesswork to data-driven confidence. Rather than relying on a gut feeling, you can plug in the key variables—your currency pair, position size, and your entry and exit prices—and get a clear projection of the trade’s financial impact.

From Uncertainty to Strategic Advantage

For any South African business involved in international trade, whether you're a solo trader or a large-scale exporter, this kind of clarity is a massive advantage. It gives you the power to model different scenarios, tweak your strategy on the fly, and manage your risk with precision.

A calculator turns abstract market movements into cold, hard numbers. It answers the most important question for any business or trader: "What is my potential profit or loss on this specific trade?"

This proactive approach is really the bedrock of consistent success in the volatile forex markets. When you understand your potential returns upfront, you’re in a much better position to make informed decisions. It helps you to:

- Validate Trading Ideas: Quickly test if a potential trade is even viable before committing any funds.

- Manage Risk Effectively: See your potential losses in black and white, which helps you set sensible stop-loss levels and protect your capital.

- Improve Strategic Planning: Understand how different exit points impact your bottom line, allowing for smarter trade management.

Ultimately, an FX profit calculator gets rid of the element of surprise. It empowers you to approach the market not as a gambler, but as a strategist who has already weighed the risks and rewards. This turns market uncertainty into a calculated, repeatable process for hitting your financial goals.

Decoding The Math Behind Your FX Profits

At its heart, any FX profit calculator runs on a surprisingly simple formula that turns market shifts into real-world Rands and cents. You don't need to be a financial wizard to get it. Understanding the maths behind the scenes gives you real control, showing you exactly how your trade's outcome is decided.

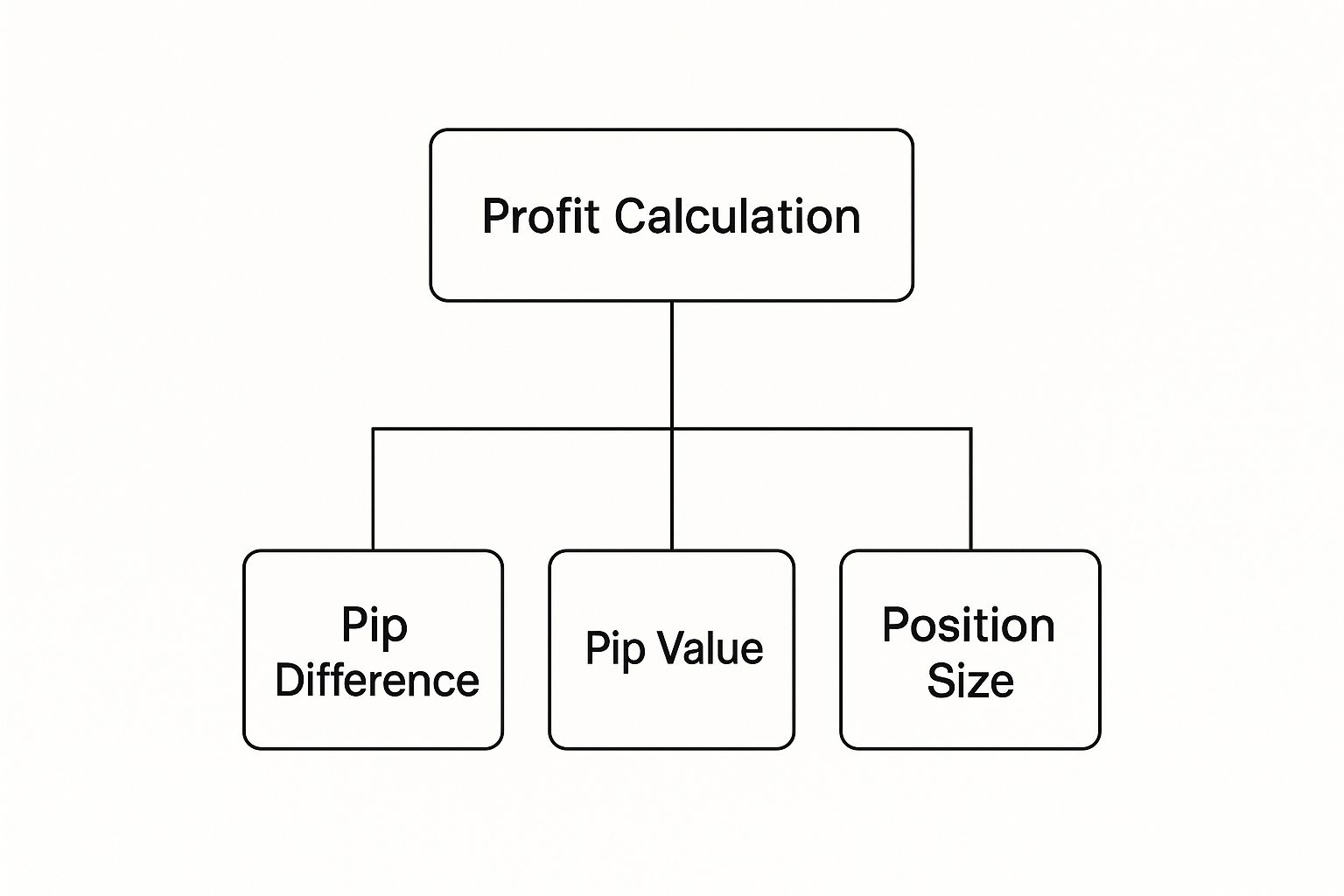

Ultimately, it all comes down to three key ingredients.

This diagram shows how these core components—Pip Difference, Pip Value, and Position Size—are the foundation for figuring out your profit.

As you can see, each piece of the puzzle is distinct but absolutely necessary. When you put them together, you get your final profit or loss.

The Building Blocks of Your Calculation

Let's pull back the curtain on how an FX profit calculator really works. Think of it like a recipe – get the ingredients right, and the result is predictable.

To truly understand how forex profits are calculated, we need to look at each variable. The table below breaks down the essential components, turning abstract concepts into concrete examples you can actually work with.

Key Components of the FX Profit Formula

| Component | Description | Example (ZAR/USD) |

|---|---|---|

| Position Size | The total amount of currency you're trading. A bigger position means each small market move has a much larger effect on your bottom line. | You're exporting goods and expecting a payment of $100,000. |

| Pip Movement | A "pip" (percentage in point) is the smallest unit of change in a currency pair. Your profit depends on how many pips the rate moves in your favour. | The ZAR/USD rate moves from 17.3300 to 17.3400. This is a 100-pip move. |

| Pip Value | This is what one pip is worth in real money for your specific trade. It connects the abstract "pip" to a concrete Rand value. | For a $100,000 position, each pip might be worth R10. |

The core formula is as simple as it gets: Profit/Loss = Pip Movement × Pip Value.

Your calculator does this heavy lifting for you in a split second. It calculates the pip value based on your trade details and then multiplies it by the price change to spit out a clear financial result.

The Role of The Exchange Rate

The current exchange rate is the engine driving the whole calculation. It doesn't just set the value of your pips; it's the real-time pulse of the market. Those fluctuations are what create the opportunity for profit in the first place.

For example, the South African Reserve Bank (SARB) tracks these crucial figures. On 19 September 2025, the Rand was trading at 17.33 to the USD. Looking at historical data, it's clear that long-term variations can easily exceed 10% in a single year. It's these very shifts that an FX profit calculator helps you make sense of.

Think of the calculator as your personal translator. It takes all the complex market data—like exchange rate volatility and pip values—and turns it into a single, understandable number that helps you decide what to do next.

By getting a handle on these components, you stop being a passive observer of the final number. You start to understand why the result is what it is. This deeper insight is what allows you to make sharper, more informed financial decisions for your business.

A Practical Walkthrough with ZAR and USD

The theory is great, but nothing beats seeing the numbers in action. Let's put the FX profit calculator to the test with two real-world scenarios involving the ZAR/USD currency pair. This will show you exactly how profit is calculated in both pips and, more importantly, in Rands.

Getting hands-on with these examples takes the guesswork out of the equation. We’ll look at a ‘long’ (buy) trade and a ‘short’ (sell) trade to see how the maths works no matter which way the market moves.

Example 1: The Profitable Long Trade

Let's say you're a trader in South Africa, and your analysis suggests the US Dollar is about to strengthen against the Rand. You decide to buy USD (go long on USD/ZAR), hoping to sell it back later at a higher price for a tidy profit.

- Your Move: You BUY the USD/ZAR pair.

- Position Size: You're trading one standard lot, which is $100,000.

- Your Entry Price: You jump in when the rate is 17.3300.

- Your Exit Price: The market moves just as you predicted, and you close your position by selling at 17.3800.

First, let's figure out the gain in pips.

The difference is simply 17.3800 (Exit) - 17.3300 (Entry) = 0.0500. In forex terms, that's a 500-pip gain.

Now for the important part: what does that mean in Rands? For a standard lot of $100,000 on the USD/ZAR pair, each pip is worth a clean R10.

The Maths: 500 pips × R10 per pip = R5,000 Profit

It’s a great illustration of how a seemingly small shift in the exchange rate can lead to a substantial gain when you're dealing with a standard position size.

Example 2: The Profitable Short Trade

Now, let’s flip the script. This time, you believe the Rand is going to flex its muscles and strengthen against the Dollar. You'd 'short' the USD/ZAR pair, which means selling USD now to buy it back cheaper later.

- Your Move: You SELL the USD/ZAR pair.

- Position Size: Again, let's stick with one standard lot of $100,000.

- Your Entry Price: You open your position by selling at 17.3600.

- Your Exit Price: The Rand strengthens as you hoped, and you buy back your position to close the trade when the rate hits 17.3000.

So, how many pips did you make?

The calculation is 17.3600 (Entry) - 17.3000 (Exit) = 0.0600, which works out to a 600-pip profit.

Since we know the pip value is R10, the total profit is straightforward:

The Maths: 600 pips × R10 per pip = R6,000 Profit

Understanding this kind of volatility is crucial. The USD/ZAR pair is known for its big swings—it even hit an all-time high of 19.93 in recent years. This history, which you can explore further on platforms like TradingEconomics.com, really drives home why an FX profit calculator is an indispensable tool for South African businesses. It helps turn market risk from a headache into a calculated opportunity.

How Exporters Protect Profits with FX Calculation

For South African businesses selling to the world, an FX profit calculator isn't just a trader's gadget; it's a core part of their strategic toolkit. It helps them defend their hard-earned profit margins from the wild swings of the currency market, turning a major financial risk into something they can actually manage.

Let's walk through a real-world scenario. Picture a Western Cape wine exporter who lands a fantastic order from a US buyer. The deal is for $250,000, with payment due on delivery in three months. Here's the catch: all their costs—production, bottling, shipping, insurance—are paid in South African Rands (ZAR). That three-month gap between setting the price and getting the cash is where the danger lies.

If the Rand strengthens against the US Dollar during that time, the $250,000 will convert into fewer Rands when it finally lands in their bank account. This isn't just a minor inconvenience; it could completely erase their profit margin. This is exactly why a proactive approach to FX calculation is so critical.

Setting a Confident USD Price

Before they even think about sending that final invoice, the exporter's finance team will essentially use an FX profit calculator in reverse. They start with their total costs in ZAR and then add their desired profit margin. This gives them a clear break-even point and a target revenue in their home currency.

Here’s a look at how they might crunch the numbers:

- Calculate Total Costs: First, they add up every single expense, from labour in the vineyard to the logistics of getting the wine overseas. Let’s say this comes to R3,850,000.

- Define Profit Margin: They're aiming for a healthy 20% profit on this deal, which works out to R770,000.

- Determine Target Revenue: Adding the costs and profit together, they know they need to bring in a minimum of R4,620,000 after converting the USD payment.

Now, they can look at the exchange rate. If the current USD/ZAR rate is 18.50, they can quickly calculate their expected revenue: $250,000 x 18.50 = R4,625,000. Perfect. This covers their costs and hits their profit target.

But they don't stop there. They also need to model a worst-case scenario. What happens if the Rand strengthens to 17.50? Suddenly, that same $250,000 payment is only worth R4,375,000, pushing them into a loss.

By forecasting these potential outcomes, the business can make much smarter decisions. They might build a small buffer into their USD price to absorb some risk, or perhaps use a financial tool like a forward exchange contract to lock in the current favourable rate.

This strategic approach turns FX calculation from a reactive "what-if" exercise into a powerful, proactive shield. It gives them the clarity to price their products with confidence, protect their bottom line, and keep their international ventures predictable and—most importantly—profitable.

Of course, beyond simple calculators, many growing exporters depend on more sophisticated tools. They often integrate professional accounting software like CCH ProSystem fx to get a comprehensive handle on their foreign exchange exposure. Ultimately, this kind of foresight is what separates the businesses that thrive internationally from those that are just trying to survive.

Using Historical Data to Sharpen Your Forecasts

A standard FX profit calculator is fantastic for a quick snapshot of a single trade. It tells you what you stand to make or lose between specific entry and exit points. But to build a truly resilient financial strategy, you need more than a single picture; you need the entire photo album. This is where historical data steps in, turning a simple calculator into a powerful tool for forecasting and testing your strategy.

Think of it like preparing for a big rugby match. You wouldn't just check the current score. You'd go back and analyse every game the opposition has played, studying their patterns, their strengths under pressure, and where they tend to falter. Historical forex data lets you do the exact same thing with your financial strategies, helping you move from one-off guesses to building a system based on solid past performance.

The Power of Backtesting Your Strategy

This process of using historical data to vet your ideas has a name: backtesting. It's all about running your trading rules against past market data to see how they would have actually performed. For South African exporters and traders, this means you can simulate your approach against the historical swings of the ZAR to see if it would have held up and been profitable over time.

This isn't just some academic exercise. It’s a completely practical way to manage your expectations and fine-tune your methods before a single Rand is on the line. Historical forex data is the bedrock of this process, allowing financial analysts and traders to put their strategies through the wringer.

In South Africa, serious market players use deep datasets—everything from tick data to detailed bar data across multiple timeframes—to get a really granular view of market behaviour. Running simulations with these comprehensive historical forex datasets gives you a much more realistic picture of how things might play out.

By digging into this past data, you can answer crucial questions that a simple calculator can't touch:

- How often does my strategy actually win? This gives you a clear sense of your probability of success.

- What's the average profit or loss per trade? This sets a realistic expectation for returns.

- What was the single biggest loss I would have taken? This is absolutely vital for managing risk and making sure you don't get wiped out.

From Calculation to Confident Forecasting

When you start blending historical analysis with your FX profit calculator, you elevate your game from simple arithmetic to strategic forecasting. It gives you the context you need to prove your ideas, helping you build a system backed by data, not just gut feeling.

By looking back, you learn how to look forward with much greater clarity. Backtesting uncovers the potential flaws and strengths in your strategy, allowing you to make adjustments based on evidence, not emotion.

Ultimately, this approach gives you the confidence that your strategy is built on a solid foundation. You gain a much deeper understanding of how it might perform, not just on a good day, but also when the market gets volatile. For anyone serious about protecting and growing their capital in the foreign exchange market, that kind of insight is invaluable.

Still Have Questions About FX Profit Calculators?

Even once you get the hang of the formula, a few practical questions almost always pop up when you start plugging in numbers. While the basic tool is simple, things like broker fees, leverage, and different currency pairs can make you second-guess your results. Let's clear up some of the most common sticking points.

Getting these details right is the difference between a rough estimate and a reliable financial projection. By tackling these questions head-on, you can use the calculator with confidence and make it a truly useful part of your financial toolkit.

Do FX Calculators Account for Broker Fees and Spreads?

This is a big one, and the short answer is usually no. Most of the standard FX profit calculators you’ll find online are built to show you the gross profit on a trade. They focus purely on the price movement between when you enter and exit a position.

In reality, your final net profit—the money that actually hits your account—will always be a bit lower because of trading costs. You have to remember to subtract these fees yourself to get the true picture of your earnings.

There are two main costs you can't ignore:

- The Spread: This is simply the tiny difference between the buying price (the ‘ask’) and the selling price (the ‘bid’) of a currency pair. It’s a cost that’s baked into every single trade.

- Commissions: Some brokers also charge a set fee for opening and closing a trade. This is a separate charge that can vary quite a bit from one provider to the next.

While sophisticated trading platforms might show your real-time net profit with these costs already factored in, a standalone calculator won’t. Always account for these expenses to avoid getting an inflated idea of your returns.

How Does Leverage Change My Profit Calculation?

Leverage is an incredibly powerful tool that can magnify your results, but here’s the key thing to understand: it doesn't actually change the core profit formula. Your profit is still calculated the same way: the number of pips you gained multiplied by the value of each pip.

So, how does leverage fit in? It lets you control a much larger position with a smaller amount of your own capital. For example, you might use just R10,000 of your own money to control a R1,000,000 position in the market.

The profit or loss is calculated on the full R1,000,000 position, not just your initial R10,000. This is why leverage is a double-edged sword—it amplifies potential profits and potential losses in equal measure.

An FX profit calculator is vital here because it shows you the potential outcome based on the full position size you’re trading, helping you manage the much higher risk that comes with using leverage.

Can I Use a Calculator for Cross-Currency Pairs?

Yes, you certainly can, but there's an extra step involved. A cross-currency pair is any pair that doesn't include your account's base currency. For instance, if your business account is in ZAR and you're dealing with the EUR/GBP pair, your profit will first be calculated in the quote currency—in this case, British Pounds (GBP).

To understand what that profit means for your South African business, you need to do one more conversion. The profit you made in pounds must then be converted back into Rands using the current GBP/ZAR exchange rate.

The good news is that many of the better FX profit calculators out there can do this for you automatically. You just need to tell it which pair you're trading and specify that your account's base currency is ZAR, and the tool will handle the rest, giving you a final profit figure in Rands.

Navigating cross-border payments and FX conversions often comes with hidden costs that quietly eat away at your profits. With Zaro, you get the real exchange rate with zero spread and absolutely no hidden fees. Our platform provides South African businesses with direct access to ZAR and USD accounts, which makes international payments faster, cheaper, and far more predictable. It’s time to take control of your foreign exchange and see what transparent pricing can do for your bottom line.