At its most basic, FX trading is simply about swapping one currency for another. You’ve probably done it yourself when exchanging Rands for Dollars before a trip. In the financial markets, however, the goal isn't just to get foreign cash for your holiday; it's about speculating on how the value between two currencies will shift, hoping to make a profit from that movement.

Let's break down exactly what that means.

What Is FX Trading and Why Does It Matter?

Think of the global economy as a massive, constantly moving web. Every time a South African company imports electronics from China, a German tourist pays for a safari in Kruger Park, or a government secures an international loan, currencies have to be exchanged. All these transactions, big and small, feed into what we call the foreign exchange (or forex/FX) market.

FX trading is the act of buying one currency while selling another at the same time. The whole point is to profit from the ever-changing exchange rates between them.

For example, if you believe the South African Rand (ZAR) is about to get stronger against the US Dollar (USD), you would buy ZAR with your USD. If you're right and the Rand's value climbs, you can then sell your ZAR back for more USD than you started with, pocketing the difference as profit.

The Scale of the Global Forex Market

Unlike the Johannesburg Stock Exchange (JSE) or Wall Street, the FX market doesn’t have a physical home. It’s a decentralised, over-the-counter market—a vast electronic network connecting banks, corporations, and individual traders across the globe.

Because it operates across different time zones, from Tokyo to London to New York, it’s open 24 hours a day, five days a week. This makes it the largest and most liquid financial market in the world, with trillions of dollars changing hands every single day.

This sheer scale has opened the doors for everyday people. It’s no longer just the territory of big banks and multinational corporations. Anyone with an internet connection and a solid trading platform can now get involved. This accessibility has fuelled incredible local growth. In fact, the South African forex trading market has seen its daily turnover jump from an estimated $14 billion to around $20 billion in the last five years alone, driven by wider internet access and strong regulation. You can find more details on this growth trend in this analysis from sashares.co.za.

At its heart, the FX market is all about supply and demand. Things like economic reports, interest rate decisions from central banks, and major political events all shift sentiment, causing traders to buy or sell a currency and moving its price up or down.

Why Understanding FX Trading Basics Is Valuable

Getting a handle on the fundamentals of FX trading gives you a powerful lens through which to view the global economy. You start to see how international events can ripple through currency values, affecting everything from the price of your imported coffee to the bottom line of local export businesses.

This knowledge is especially powerful for South African business owners and finance teams. A solid grasp of FX dynamics helps you make smarter decisions when you’re:

- Paying invoices from international suppliers.

- Receiving payments from overseas customers.

- Managing the financial risks that come with currency fluctuations.

By mastering these core ideas, you’re laying the groundwork to confidently navigate one of the most dynamic financial markets on the planet.

Learning the Language of the Forex Market

Jumping into any new field feels like learning a foreign language, and forex is no exception. To trade with any real confidence, you first need to get a handle on the lingo. Think of this section as your personal translator, breaking down the core terms you'll see every single day. Getting these fundamentals down is the first step to making sharp, informed decisions.

At its heart, forex trading is all about currency pairs. You're never just buying a single currency; you're always buying one while simultaneously selling another. It’s a constant tug-of-war, and your job is to predict which currency will come out on top. These pairs are sorted into three main groups, depending on how much they're traded around the world.

The Major, Minor, and Exotic Pairs

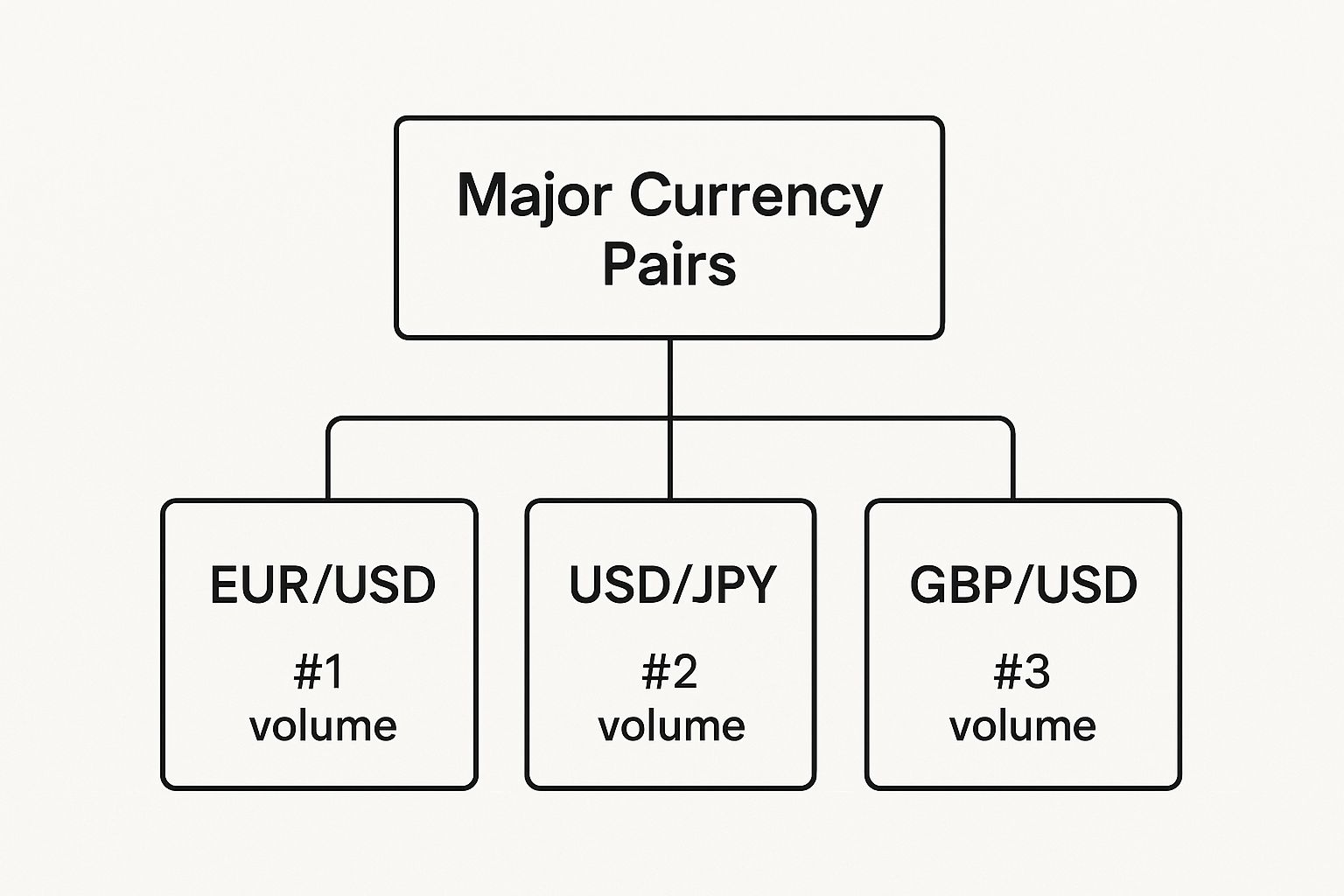

First up, you have the majors. These are the heavy hitters of the forex world. They always involve the US Dollar (USD) on one side, paired with another powerhouse currency like the Euro (EUR) or the British Pound (GBP). Because they're traded in such massive volumes, they tend to be less wild and have tighter spreads, which is why so many beginners start here.

This image really drives home just how dominant the major pairs are, showing the top three by trading volume.

As you can see, the EUR/USD is the undisputed champion, traded more than any other pair on the planet. The USD/JPY and GBP/USD follow, clearly showing just how central the US Dollar is to the global financial system.

Next are the minors, which are also called cross-currency pairs. These pairs still involve major world currencies, but they leave the US Dollar out of the equation. Think EUR/GBP or AUD/JPY. They’re plenty liquid, but you might find they have a bit more kick in terms of volatility compared to the majors.

Finally, we get to the exotics. This is where a major currency gets matched up with one from a smaller or emerging economy—like our own South African Rand (ZAR). A classic example is the USD/ZAR. Exotic pairs can present some fascinating trading opportunities because of their higher volatility, but they also come with wider spreads and, consequently, a higher degree of risk.

To help you see the differences at a glance, here’s a quick comparison of the three types of currency pairs.

A Comparison of Currency Pair Types

| Pair Type | Description & Example | Liquidity | Typical Spread | Best For |

|---|---|---|---|---|

| Majors | Pairs that include the USD and another major currency. Example: EUR/USD | Very High | Very Low (tight) | Beginners, low-risk strategies, high-frequency trading. |

| Minors | Pairs of major currencies that exclude the USD. Example: EUR/GBP | High | Low to Medium | Traders with some experience, diversifying beyond majors. |

| Exotics | A major currency paired with one from an emerging economy. Example: USD/ZAR | Low | High (wide) | Experienced traders, high-risk/high-reward strategies. |

Choosing the right pair type really depends on your experience level and how much risk you're comfortable with.

How to Read a Forex Quote

When you see something like EUR/USD = 1.0750 on a trading screen, you’re looking at a standard forex quote. It’s pretty straightforward once you know the rules.

- The first currency (the EUR in this case) is called the base currency. This is the one you’re looking to buy or sell.

- The second currency (here, the USD) is the quote currency. This is what you'll use to make the transaction.

So, that quote is simply telling you that one Euro is currently worth 1.0750 US Dollars. If you get a feeling the Euro is about to climb, you’d "buy" the pair. If you think it’s heading for a fall, you’d "sell" it. Simple as that.

Getting to Grips with Bid, Ask, and Spread

Look closely at any trading platform, and you’ll notice you don't just see one price for a pair—you see two.

- Bid Price: This is the price the broker will pay to buy the base currency from you. In other words, it's the price you get when you sell.

- Ask Price: This is the price the broker will sell the base currency to you for. It's the price you pay when you buy.

The gap between these two numbers is known as the spread. You can think of it as the broker's commission for handling your trade. For a business using a platform like Zaro, which provides real exchange rates with zero added spread, understanding this concept is key to seeing the value. In the world of retail forex trading, a tighter, smaller spread is always what you're after because it means lower costs for you on every trade you make.

Understanding How the Global FX Market Works

Unlike the JSE, which has a clear opening and closing bell, the foreign exchange market never really sleeps. Think of it less like a single building and more like a massive, decentralised global network. There’s no central headquarters. Instead, trading simply follows the sun around the planet, passing the baton from one major financial hub to the next.

This creates a seamless market that runs 24 hours a day, five days a week. It’s a non-stop cycle of activity that offers constant opportunities, but it also demands a different mindset than trading stocks. Getting your head around this continuous flow is a core part of learning the fx trading basics.

The Major Trading Sessions

The trading day is typically broken down into four key sessions, named after the city dominating the financial world during those hours. Each one has its own personality and trading volume.

- Sydney Session: This is where the trading week officially kicks off. Things often start a bit slower here, as it’s the smallest of the major sessions, but it sets the tone for the day to come.

- Tokyo Session: Just as Sydney winds down, Tokyo is ramping up. Key economic data from Japan, China, and the rest of Asia often drops during these hours, sparking big moves in pairs like USD/JPY and AUD/JPY.

- London Session: London is the absolute heart of the global forex market, responsible for the largest slice of daily transactions. When London opens, liquidity and volatility shoot up.

- New York Session: The final leg of the day brings the US market online. This session has a huge impact on all USD pairs and is another period of intense liquidity and activity.

These sessions don't just run back-to-back; they overlap. And it’s in these handover periods that the market really comes alive, simply because more traders are active at once.

The most critical overlap happens when the London and New York sessions are both open. This four-hour window is usually the busiest, most volatile part of the trading day. It’s where you'll find some of the biggest opportunities, but also the greatest risks.

The Key Players Shaping the Market

Those price wiggles you see on a chart are the result of millions of participants making buy and sell decisions. These players range from colossal institutions that can single-handedly move markets to individuals like you, trading from home.

- Central Banks: Institutions like the South African Reserve Bank (SARB) or the US Federal Reserve are the titans of the market. They manage their country’s currency, set interest rates, and control foreign exchange reserves. Their policy announcements can send shockwaves through currency values.

- Commercial Banks: Major banks facilitate the vast majority of FX transactions for their clients and also trade on their own behalf. They make up a massive portion of the daily trading volume.

- Investment Managers and Hedge Funds: These are the big speculators. They trade currencies for large investment funds, often betting on long-term macroeconomic trends.

- Corporations: Multinational companies aren’t just speculating; they use the forex market for practical business needs, like converting profits from foreign sales back to their home currency or paying for imported goods.

- Retail Traders: This is where you come in. Thanks to online brokers, individuals can now access the very same market as the big players, speculating on currency movements with their own capital.

How Global News Moves Currencies

Knowing the market's structure is one thing, but understanding what makes it tick is another. Currencies are incredibly sensitive to a wide range of economic and political news, so staying informed is non-negotiable. Key drivers include interest rate decisions, inflation reports, employment figures, and political stability.

For instance, a country's ability to manage its finances is vital. South Africa's gross foreign exchange reserves recently hit a record high of $68.415 billion. A strong reserve position like this acts as a buffer, supporting the Rand and maintaining stability, which gives both local and international traders confidence. You can dig deeper into South Africa's economic indicators at Trading Economics.

Ultimately, every news release and economic report feeds into the market's collective psychology, influencing how all these players act and creating the price changes that drive FX trading.

Leverage and Margin: A Powerful Tool to Handle with Care

In forex trading, you'll hear the term "leverage" thrown around a lot. It's one of the most powerful, and frankly, most misunderstood concepts for new traders. Let's break it down with a simple analogy. Imagine trying to lift a huge, heavy boulder with just your bare hands—you wouldn't get very far. But what if you had a long, sturdy lever? Suddenly, you can multiply your own strength and move something immense.

That's exactly what leverage does in trading. It's a facility offered by your broker that lets you control a large position in the market with a relatively small amount of your own capital. While this can supercharge your potential profits, it’s a double-edged sword that demands your full respect.

How Leverage Works in Practice

Leverage is always shown as a ratio, like 50:1 or 100:1. If your broker offers 100:1 leverage, it means that for every R1 of your own money, you can control R100 in the currency market. The small amount of your own capital that you put up is called margin.

It’s crucial to understand that margin isn't a fee or a transaction cost. Think of it more like a good-faith deposit—the collateral you need to open and maintain your position. Without leverage, you’d have to front the entire value of your trade, which would lock most people out of the market entirely.

The Two Sides of the Coin: Leverage magnifies your potential gains, but it also magnifies your potential losses by the exact same ratio. A small market move against your position can lead to substantial losses, sometimes even wiping out your initial deposit.

Let’s look at a quick example. Say you want to open a R100,000 position on the USD/ZAR pair.

- Without Leverage: You would need the full R100,000 in your account.

- With 100:1 Leverage: You would only need to put up R1,000 as margin (R100,000 divided by 100).

This is what gives traders access to the market without needing massive amounts of capital. But this access comes with a huge responsibility.

The Dreaded Margin Call

Because your margin is acting as collateral, your broker keeps a close eye on your open trades. If the market turns against you and your losses begin to erode your required margin, you'll get a margin call.

A margin call is basically a warning from your broker that your account balance has dropped below the minimum level needed to keep your trades open. At this point, you have a choice to make, and you need to make it fast:

- Add more funds to your account to get back above the margin requirement.

- Close some or all of your positions to release the margin being used.

If you don’t do either, your broker will step in and start closing your positions for you to limit their own risk. This almost always happens at the worst possible moment for you, and it’s a surefire way to quickly burn through your trading account. Recognising the danger of a margin call is absolutely fundamental to survival in FX trading.

Using Leverage the Smart Way

The secret to using leverage safely is to treat it with caution and start small. New traders should always opt for the lowest leverage setting their broker offers. It might feel limiting, but it's a blessing in disguise—it forces you to trade smaller sizes, which naturally caps your risk while you're still finding your feet.

Here are a few ground rules:

- Start with low leverage: Forget the allure of high ratios until you can prove you’re consistently profitable on a demo account.

- Always use risk management: Every single trade needs a stop-loss order. This defines your maximum acceptable loss before you even enter the trade.

- Risk a tiny fraction of your capital: A golden rule is to never risk more than 1-2% of your entire account balance on any one trade.

By taking this disciplined approach, you can learn to use leverage for what it is—a powerful tool—instead of letting it become a fast track to an empty account. Successful trading is a marathon, not a sprint built on chasing risky, oversized profits.

Essential Risk Management Strategies for Traders

Let's get one thing straight: successful trading isn't about having a crystal ball and winning every single trade. It's not even close. The real secret to longevity in the markets is mastering the art of defence—knowing how to protect your capital so you can stay in the game long enough for your winning strategies to play out.

This section is your survival guide. Forget hoping for the best; we're going to talk about the discipline that separates professional traders from gamblers. Think of this as learning how to build a fortress around your trading account.

Your Automated Safety Nets

Before you even think about clicking "buy" or "sell," every single trade needs two pre-planned exit points. These aren't just good ideas; they're non-negotiable parts of the trade itself. These orders act as your automated safety nets, taking emotion completely out of the equation when the price hits your levels.

- Stop-Loss Order: This is your eject button. It's an order you place to close your trade automatically if the price moves against you to a specific point. Its only job is to cap your potential loss. Think of it as your emergency brake.

- Take-Profit Order: On the flip side, this order locks in your gains. It automatically closes your trade when the price hits your predetermined profit target, stopping greed from turning a solid win into a disappointing loss.

Let's say you buy EUR/USD at 1.0750, expecting it to rise. You might set a stop-loss at 1.0700 (to limit your loss to 50 pips) and a take-profit at 1.0850 (to secure a 100-pip gain). Once set, your platform does the work, protecting you from catastrophic losses or last-minute hesitation.

Is This Trade Even Worth It? Calculating Your Risk-to-Reward Ratio

Before you commit your money, you have to ask a simple but crucial question: "Is the potential reward worth the risk I'm about to take?" The risk-to-reward ratio gives you a clear, mathematical answer.

It’s just a simple calculation where you divide your potential profit by your potential loss.

Risk-to-Reward Ratio = (Take-Profit Price - Entry Price) / (Entry Price - Stop-Loss Price)

Using our EUR/USD example again:

- Potential Profit = 1.0850 - 1.0750 = 100 pips

- Potential Risk = 1.0750 - 1.0700 = 50 pips

- Risk-to-Reward Ratio = 100 / 50 = 2

That gives you a 1:2 risk-to-reward ratio. In plain English, you're risking R1 to potentially make R2. Many seasoned traders won't even glance at a trade unless it offers at least a 1:2 or 1:3 ratio. Why? Because it means their winners can comfortably pay for their losers over the long run.

The Golden Rule of Sizing Your Bets

If you remember only one thing from this section, make it this: only risk a tiny fraction of your total trading capital on any single trade. The professional standard, and a rule you should burn into your brain, is to risk no more than 1-2%.

That might sound timid, but it’s the key to your survival. With a R10,000 account, a 1% risk means your maximum loss on one trade is just R100. This is what saves you. It insulates you from the emotional and financial devastation of a few bad calls in a row, ensuring you have enough capital left to trade another day.

This disciplined approach is vital in a market as dynamic as Africa's. South Africa is leading the charge with a daily forex turnover now over $20 billion, and more retail traders are joining every day. While that growth brings opportunity, it also brings serious volatility. Strict risk rules are the only way to navigate these waters successfully. You can learn more about the trends shaping the continent in this 2025 outlook on forex trading in Africa from Contentworks.agency.

By combining stop-losses, smart risk-to-reward ratios, and disciplined position sizing, you're not just trading—you're building a robust defensive system. This framework is the true foundation of long-term success.

How to Start Your FX Trading Journey

Alright, you've got the theory down. Now for the exciting part: turning that knowledge into action. Getting started in forex trading isn’t about making a mad dash for the markets. It’s a deliberate process, one where each step builds upon the last to create a strong foundation for your entire trading career.

Let's walk through the practical steps to take you from a curious beginner to a prepared trader, ready to make your first moves with confidence and care.

Step 1: Choose a Regulated Broker

Your first move is arguably the most critical: picking the right broker. In South Africa, this is a non-negotiable point. You must partner with a broker licensed and regulated by the Financial Sector Conduct Authority (FSCA).

Think of the FSCA as your financial watchdog. Their seal of approval means the broker operates under strict rules designed to protect your money and ensure fair practice. It’s the difference between trading on a secure platform and venturing into the unknown.

Step 2: Master the Platform with a Demo Account

Before you even think about putting a single Rand on the line, open a demo account. Seriously. It’s like a flight simulator for traders—you get to experience the real market environment, test drive the platform, and execute trades using virtual money. This is where you learn the ropes of fx trading basics without any of the financial risk.

A demo account is your personal training ground. It’s where you’re supposed to make mistakes, figure out what works (and what doesn't), and build muscle memory for your chosen platform. Skipping this step is one of the most common and costly mistakes new traders make.

Stay in the demo environment until you feel completely at ease. You should be able to place trades, set stop-loss orders, and navigate the platform without hesitation. Once you've seen some consistent results and feel confident, then—and only then—should you consider funding a live account.

Step 3: Develop a Simple Trading Plan

A trading plan is your business plan for the markets. It’s a set of rules you create for yourself to keep emotions out of your decision-making. It doesn't need to be complicated, but it must be clear.

Your plan should cover the essentials:

- Your Goals: What are you aiming for? Make it specific, like "target a 5% return per month."

- Risk Rules: Decide exactly how much you're willing to risk on a single trade—a common rule is 1% of your total capital. Also, set a maximum loss you'll accept in one day.

- Entry & Exit Strategy: What specific market conditions will trigger you to open a trade? And just as importantly, what will tell you it's time to get out?

- A Trading Journal: This is your logbook. Record every trade, why you took it, the outcome, and what you learned. Reviewing it is how you’ll spot your strengths and weaknesses, which is vital for long-term improvement.

Step 4: Learn the Two Styles of Market Analysis

To make educated guesses about where the market is headed, you need a framework. There are two main ways to analyse the markets, and the best traders know how to use both.

- Fundamental Analysis: This is the "big picture" view. You'll look at economic reports, interest rate changes, political news, and anything else that could affect a country's economic health and, by extension, its currency's value.

- Technical Analysis: This approach is all about the charts. Technical analysts study historical price patterns, use indicators, and look for recurring shapes to forecast what might happen next.

By blending the "why" of fundamental analysis with the "when" of technical analysis, you give yourself a much richer, more complete view of the market. This dual perspective is what allows you to move from simply guessing to making genuinely informed trading decisions.

Got Questions? Let's Clear a Few Things Up

Even with a solid grasp of the basics, a few questions always pop up. It's completely normal. Let's tackle some of the most common ones I hear from people just starting out in the world of foreign exchange.

How Much Money Do I Really Need to Start Trading?

This is probably the number one question on everyone's mind, and honestly, the answer is often less than you'd think. With leverage and brokers offering micro or cent accounts, you could technically get your feet wet with just a few hundred Rand.

But let's be realistic. The best starting amount is money you are 100% prepared to lose. Thinking in terms of R5,000 to R10,000 gives you a much more practical cushion. This kind of capital provides the flexibility to navigate the learning curve without getting knocked out by minor market fluctuations.

What Are the Best Hours to Trade Forex?

While the market technically never sleeps, not all hours are created equal for trading. The real action, where you'll find the highest liquidity and the biggest price moves, happens when major market sessions overlap.

For many South African traders, the sweet spot is the London-New York session overlap. This window, usually from about 15:00 to 19:00 SAST (South Africa Standard Time), is when two of the world’s biggest financial hubs are buzzing. The result is often significant volatility and plenty of trading opportunities.

Ultimately, the 'best' time comes down to your personal strategy and which currency pairs you're focused on.

Can I Actually Teach Myself to Trade FX?

You absolutely can. Today, there's a treasure trove of online resources, books, and regulated demo accounts that make self-learning more achievable than ever before. The secret ingredient? Discipline. You have to treat it like a business, not a hobby.

- Nail the basics first: Don't move on until you truly understand concepts like pips, leverage, and proper risk management.

- Practice, practice, practice: Seriously, spend a few months on a demo account before putting any real money on the line.

- Keep a trading journal: Track every single trade. This is how you learn from your wins and your losses.

Success isn't about finding a magic formula; it's built on consistent learning and disciplined execution.

Is FX Trading Just Gambling?

It can be, if you treat it that way. But it certainly doesn't have to be. Gambling is throwing money at an uncertain outcome based on a hunch. Professional trading is the complete opposite—it’s a structured approach built on solid analysis and watertight risk management.

A real trader follows a plan, calculates their risk-to-reward ratio on every position, and uses stop-losses to protect their capital. A gambler is driven by hope and emotion. By focusing on strategy and defence, you start to operate like a business owner, not someone pulling a slot machine lever.

Ready to put this knowledge to work for your business's international payments? With Zaro, you can stop speculating and start using real-time exchange rates to your advantage. Say goodbye to hidden fees and hello to complete transparency on your cross-border transactions. Find out how much you could save with Zaro.