For traders in South Africa, the starting line with FXTM is pretty straightforward. The FXTM minimum deposit is set at $200 for their most popular accounts: the Micro Account and the Advantage Account.

This approach keeps things simple, so you’re not bogged down by a complicated tier system right from the get-go.

Your Quick Guide to FXTM Minimum Deposits

Think of your first deposit like the fuel for a road trip. A bigger tank might get you further without stopping, but a smaller, affordable amount is all you need to get the engine started and explore the local roads. FXTM sets a clear, accessible starting point so you can jump into the market without a massive initial investment.

This isn't just an entry fee; it's your starting capital. It's the money you'll use to open your first positions and the foundation of your entire risk management plan. For any South African business or individual trader, getting this number right is the first step in building a solid trading strategy.

Starting Points for Each Account

While the $200 entry point is the same across the main accounts, what you get for that money changes. The trick is to pick the account that actually fits your trading style. The Micro account, for example, is a classic entry point for beginners, whereas the Advantage account is built for traders who know what they're doing and want the tightest spreads possible.

To make it crystal clear, here’s a quick breakdown of what you need to get started with each of FXTM's primary accounts in South Africa.

FXTM Minimum Deposit by Account Type

| Account Type | Minimum Deposit (USD) | Ideal For |

|---|---|---|

| Micro Account | $200 | New traders wanting to learn the ropes with smaller trade sizes. |

| Advantage Account | $200 | Experienced traders looking for raw spreads and a commission-based model. |

| Advantage Plus | $200 | Traders who prefer a zero-commission setup with slightly wider spreads. |

You can see that FXTM has positioned its $200 minimum deposit to be accessible, especially for traders in emerging markets. Sure, it might be a bit higher than some ultra-low-cost brokers, but it's competitive when you factor in FXTM's transparent fee model.

For example, with that $200 deposit and leverage of up to 1:30, you'd only need about $33 in capital to open a single micro lot position. It's crucial to explore more detailed analysis of their fee structures to get a full picture of the costs involved before you commit your funds. Knowing these details upfront is key to managing your trading budget effectively.

Choosing the Right FXTM Account for Your Deposit

Picking the right account is about more than just hitting the FXTM minimum deposit. It’s really about matching your trading style and experience level to the right environment. Think of it like buying a car: a brand-new driver probably wants something simple and automatic, whereas a seasoned racing enthusiast needs a high-performance machine they can control completely. FXTM's accounts work in a similar way.

The Micro Account is basically your learner's permit for the trading world. It’s built for beginners, letting you trade with smaller contract sizes, known as micro lots. This is a huge advantage because it lowers your risk, giving you a safe space to test strategies with a small deposit without the pressure of having a lot of capital on the line.

On the other hand, the Advantage Account is for the pros. It’s designed for experienced traders who want the tightest spreads possible and are comfortable with a commission-based fee structure. With this account, you get direct market access with raw spreads—sometimes starting from 0.0 pips—and pay a small, fixed commission on every trade. It’s a classic trade-off: you pay a clear fee to get much better pricing on your trades.

Matching Your Deposit to Your Trading Style

How much you deposit directly impacts the trading conditions and tools you can get your hands on. For instance, a trader who focuses on scalping (making lots of quick, small trades) will get massive value from the Advantage account’s razor-thin spreads. If the spreads were wider, they'd quickly eat away at any potential profit.

Conversely, someone playing the long game—a position trader or long-term investor—might find the simplicity of the Advantage Plus account more appealing, as all the costs are built into the spread, with no separate commissions to worry about.

FXTM also offers a Cent account option, which only requires a $50 USD deposit (around 930 ZAR). This gives smaller South African businesses an even more accessible entry point for micro-trading. This tiered system—from the $25,000 needed for an FXTM Pro Account right down to the $50 for a Cent account—is how brokers cater to traders with very different amounts of capital. You can dig deeper into how brokers set up their deposits for South African traders over at TradeFX.co.za.

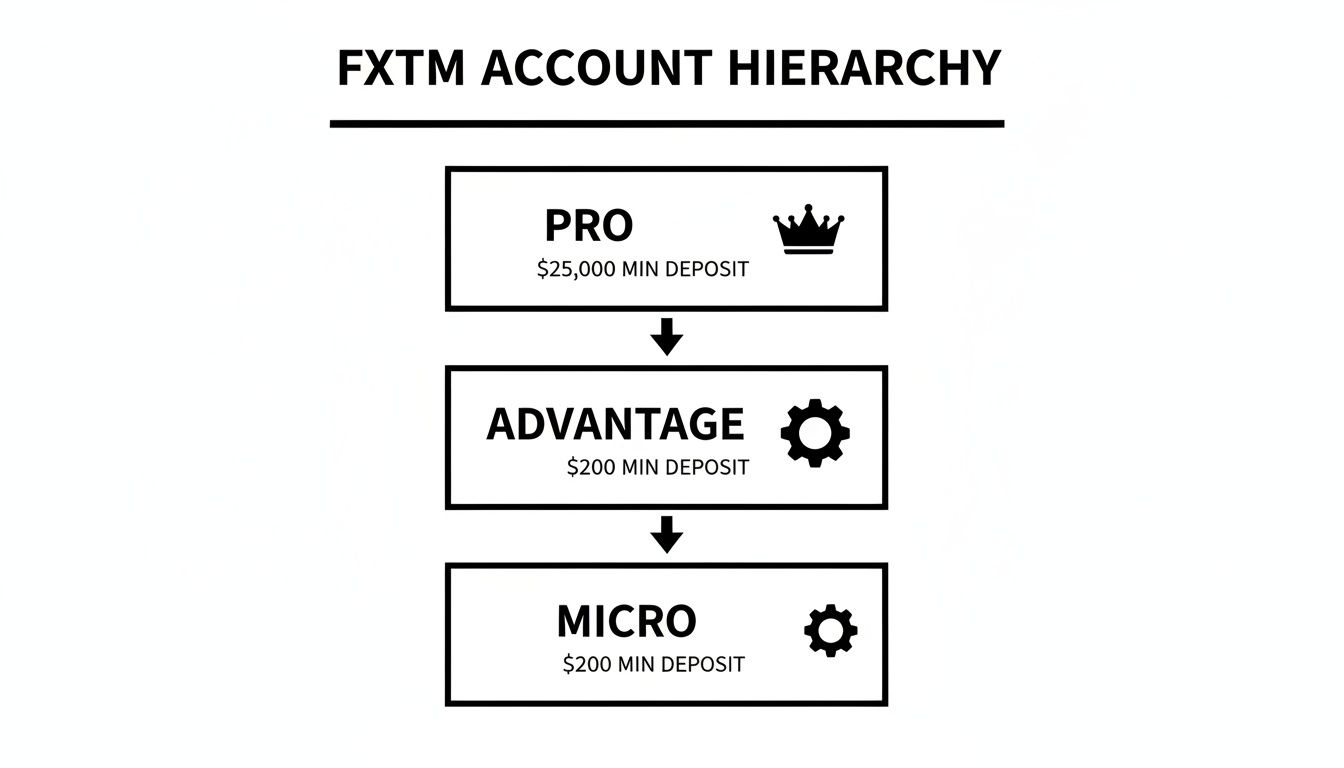

The diagram below breaks down the deposit tiers for FXTM's main account types.

As you can see, there’s a significant jump in capital required to access the Pro account. This really positions the Micro and Advantage accounts as the go-to entry points for most retail traders. Getting it right from the start means lining up your capital with your trading strategy to give yourself the best possible chance of success.

How to Fund Your FXTM Account from South Africa

So, you’ve picked your account type. Now it’s time to get some funds in there so you can actually start trading. Think of it like topping up your airtime—there are a few different ways to do it, and the best one for you depends on whether you value speed, convenience, or cost.

FXTM makes this pretty straightforward for South African traders, offering several familiar ways to make that first deposit. Each option has its own quirks when it comes to processing times and fees, so let's break them down.

Popular Funding Methods for ZAR

When you log into your client portal, you’ll find a solid range of localised payment options. FXTM has clearly done its homework to make the process feel familiar for South Africans.

Here are the most common ways to get your account funded:

Local Bank Transfers: This is a popular choice for a reason. You can send ZAR directly from your local bank account, whether you're with FNB, Capitec, or another major bank. It’s secure and reliable, though you'll need a bit of patience as it can take 1-3 business days to reflect.

Credit and Debit Cards: If you want to get trading right away, using your Visa or Mastercard is the quickest route. Deposits are almost always instant, meaning your funds show up in your trading account within minutes.

Electronic Wallets (E-Wallets): Services like Skrill or Neteller are another go-to for speedy transactions. Just like card payments, e-wallet deposits are typically instant and offer a great, secure alternative to using your bank directly.

A Quick Heads-Up: While instant methods like cards and e-wallets are fantastic for their speed, always be mindful of any fees from the payment provider's side. FXTM does not charge for deposits, but third-party services sometimes have their own fee structures.

No matter which method you choose, the steps are simple. Once you're logged into your FXTM portal, head over to the "Deposit" section, pick your payment option, and follow the prompts.

One final but crucial tip: make absolutely sure the name on your bank account, card, or e-wallet exactly matches the name on your FXTM trading account. This isn't just a small detail; it’s a required security check to comply with anti-money laundering regulations and prevent any frustrating delays.

Clearing the Hurdle of Account Verification

There’s nothing more frustrating than being ready to fund your account, only to find your deposit is stuck in limbo. For new traders, this is a surprisingly common headache, and more often than not, the culprit is an incomplete account verification.

Brokers like FXTM that are properly regulated have a legal duty to confirm who their clients are. This process is called Know Your Customer (KYC), and it's a non-negotiable part of the setup. Think of it as the digital equivalent of a bank asking for your ID book—it's a standard security measure to prevent fraud and keep the trading environment safe for everyone.

Getting your verification sorted out right from the start is the best way to ensure your FXTM minimum deposit lands in your account without a hitch.

Getting Your Documents Ready

To breeze through the verification process, it pays to have your documents ready before you even start. This simple bit of prep work can turn what could be a delay into a quick box-ticking exercise.

You'll need to have digital copies of two types of documents:

- Proof of Identity: A clear photo or scan of a government-issued ID that hasn't expired. Your best bets are a passport, national ID card, or driver's licence.

- Proof of Residence: A document from the last three months showing your full name and current address. A recent utility bill, bank statement, or a municipal rates statement works perfectly.

One of the most common reasons for rejection is a mismatch between the details on your documents and what you entered during signup. Consistency is key—make sure the name and address are identical across the board.

Once you’ve uploaded clear, readable copies, the verification team can get to work. After they give the green light, your account will be fully active for both deposits and withdrawals, clearing the way for you to start trading.

When Trading Platforms Are Not the Right Tool for the Job

While a platform like FXTM is brilliant for speculating on financial markets, it's a completely different beast from what a South African business needs to manage its international payments. A trading account is built for one thing: trying to grow your capital by trading market movements. It was never designed to handle the day-to-day operational needs of a business.

Trying to pay your global suppliers or international staff through a trading platform is a bit like using a Formula 1 car to do your weekly grocery shopping. It’s simply the wrong tool for the job. Your funds are seen as trading capital, not operational cash, which can create a real headache when it comes to compliance and simple logistics.

This distinction is absolutely crucial. When your business needs to settle an invoice with a supplier in Europe or pay your remote team in Asia, you need a system built specifically for payments, not speculation.

The Pain Points of Traditional Business Payments

For years, South African businesses have had little choice but to rely on traditional banks for cross-border transactions. Unfortunately, that route is often painfully slow and surprisingly expensive. The whole process is usually weighed down by several key issues that directly hit a company’s bottom line and efficiency.

These common problems probably sound familiar:

- High Wire Fees: Banks are notorious for charging hefty fees to send international payments through the SWIFT network.

- Poor Exchange Rates: Instead of giving you the real-time market rate, banks add their own markup, which is basically a hidden cost.

- Slow Settlement Times: It can take several business days for an international transfer to finally land, causing frustrating delays in your supply chain and payroll.

These costs quickly add up and can seriously eat into your profit margins, especially if your business makes frequent international payments. The worst part is the lack of transparency, which makes it incredibly difficult for finance teams to accurately forecast their real operational expenses.

While traditional trading platforms focus on fiat currency pairs, it's also worth considering other digital asset classes. Understanding the fundamental differences in fiat currency vs cryptocurrency can help broaden your financial perspective beyond conventional trading tools.

Got Questions About the FXTM Minimum Deposit? We've Got Answers

Whenever you're getting started with a new broker, a few practical questions always pop up. It's completely normal. To help you get funded and start trading without any hitches, we’ve put together the answers to the most common queries we see from South African traders about the FXTM minimum deposit.

Getting these details sorted out first means you can fund your account confidently and get back to focusing on your trading strategy.

What’s the Absolute Lowest I Can Deposit in Rands?

If you're looking for the lowest barrier to entry, FXTM's Cent Account is your best bet, often requiring a deposit as small as $10 USD. But here's the crucial part: that amount isn't fixed in ZAR.

The exact Rand equivalent you'll pay depends entirely on the live USD/ZAR exchange rate on the day you make the transfer. It’s always a smart move to check the current rate before you commit. Also, remember that your bank or payment service might have its own minimum transaction limit, which could be higher than what FXTM asks for.

Can I Fund My Account Using Capitec or FNB?

Yes, absolutely. You can easily use major South African banks like Capitec, FNB, Standard Bank, and others to get money into your FXTM account. The most common ways to do this are through a local bank wire transfer or by simply using your Visa or Mastercard debit/credit card.

For the most current list of supported banks and detailed instructions, it’s always best to log into your FXTM client portal and check the deposit section. Payment partners can change from time to time, so going straight to the source is the safest bet.

Key Takeaway: If your deposit gets declined, don’t panic. It's usually a simple fix. First, make sure your account is fully verified, you have the funds available, and the name on your bank account or card matches your FXTM account name exactly.

What Should I Do If My Deposit Fails?

A failed deposit is annoying, but the fix is usually pretty simple. Before you do anything else, run through this quick mental checklist:

- Is my account fully verified? You won't be able to deposit until you’ve completed the KYC (Know Your Customer) process.

- Are there sufficient funds? Double-check that your bank account or e-wallet has enough cash to cover the deposit amount.

- Are all my details correct? A simple typo in your name or account number is a common culprit.

If you’ve gone through these steps and the payment still won't go through, your next move is to contact FXTM’s customer support. They can investigate the specific transaction, tell you exactly why it failed, and walk you through the solution.

Does the Minimum Deposit Amount Change Depending on Your Country?

Yes, it can. While the base minimums for accounts, like $200 for the Advantage accounts, are set in USD, the actual amount you pay in your local currency will obviously change with the exchange rate.

What’s more important is that the payment methods and deposit rules can be different from one country to the next. This is all down to local banking regulations and the specific payment processors FXTM has partnered with in that region. The lesson here? Always log into your personal client area to see the exact deposit options available to you in South Africa.

For South African businesses that need to pay international suppliers or global teams, a trading platform simply isn't the right tool for the job. Zaro offers a purpose-built solution designed for transparent and low-cost cross-border payments. With real exchange rates, no SWIFT fees, and top-notch security, we help you save money and take the headache out of your global finances. Find out how you can simplify your international payments at https://www.usezaro.com.