At its most basic, forex is just the process of swapping one currency for another. You’ve probably done it yourself at an airport kiosk before travelling overseas. The global foreign exchange (forex) market is where these same exchanges happen, but on an unimaginable scale, underpinning everything from global trade to tourism. It is, by a huge margin, the largest and most liquid financial market on the planet.

Your First Step into the World of Forex

Picture the forex market not as a single building, but as a vast, decentralised network that never really sleeps, operating 24 hours a day, five days a week. Unlike a stock exchange with a physical trading floor, forex trading is electronic and happens over-the-counter (OTC). This simply means that deals are made directly between two parties—be they banks, corporations, or individuals—through a massive computer network.

This constant buzz of activity is the lifeblood of the global economy. For a South African company like Zaro, paying a software provider in the United States means they have to exchange South African Rands (ZAR) for US Dollars (USD). That single payment becomes a tiny drop in the ocean of daily currency flows that keep international business running smoothly.

Understanding Currency Pairs

To really get how forex works, you first need to grasp the idea of currency pairs. In forex, you’re never just buying or selling a currency in isolation. You're always trading one for another. The most heavily traded pair on the planet is the EUR/USD, which pits the Euro against the US Dollar.

Before we dive deeper, let's get the basic terms down. This table gives a quick summary of the fundamental concepts you need to know.

Core Forex Concepts at a Glance

| Concept | Simple Explanation |

|---|---|

| Base Currency | The first currency in a pair (e.g., USD in USD/ZAR). Its value is always 1. |

| Quote Currency | The second currency in a pair (e.g., ZAR in USD/ZAR). It shows how much is needed to buy one unit of the base currency. |

| Exchange Rate | The price of the base currency in terms of the quote currency. |

| Over-the-Counter (OTC) | A decentralised market where parties trade directly with each other, not on a central exchange. |

Now, with those terms in mind, let's look at a real-world price.

When you see a quote for USD/ZAR at 18.50, it’s telling you that one US Dollar costs 18.50 South African Rands.

- The Base Currency here is the USD. It's the currency you're "buying".

- The Quote Currency is the ZAR. It's the currency you're using to "pay".

This simple pricing structure is the universal language of the forex market. It instantly tells you the relative strength of one currency against another.

Why Do Exchange Rates Change?

If only it were that simple! The value of these pairs is constantly on the move. These shifts in the exchange rate all come down to one of the oldest principles in economics: supply and demand. When more people want to buy a currency (high demand), its value goes up. If there’s more of a currency available than people want (high supply), its value drops.

The forex market isn't just for practical needs like paying invoices. It's also driven by speculation. Traders bet on which way they think a currency's value will go, and in doing so, they provide the deep liquidity and price movement that define the market.

This dynamic is influenced by countless factors, from interest rates set by central banks and major economic reports to unexpected geopolitical events. For any business with international dealings, these fluctuations create both risks and opportunities. Understanding how this all works is the first step to managing your international payments effectively, which is exactly what this guide will walk you through.

The Major Players Driving the Forex Market

To get a real grip on how forex works, you need to understand who is behind the trillions of dollars zipping around the globe every day. This isn't some faceless machine. Think of it as a massive, bustling city where different groups are constantly interacting for their own reasons, and all that activity is what makes prices move.

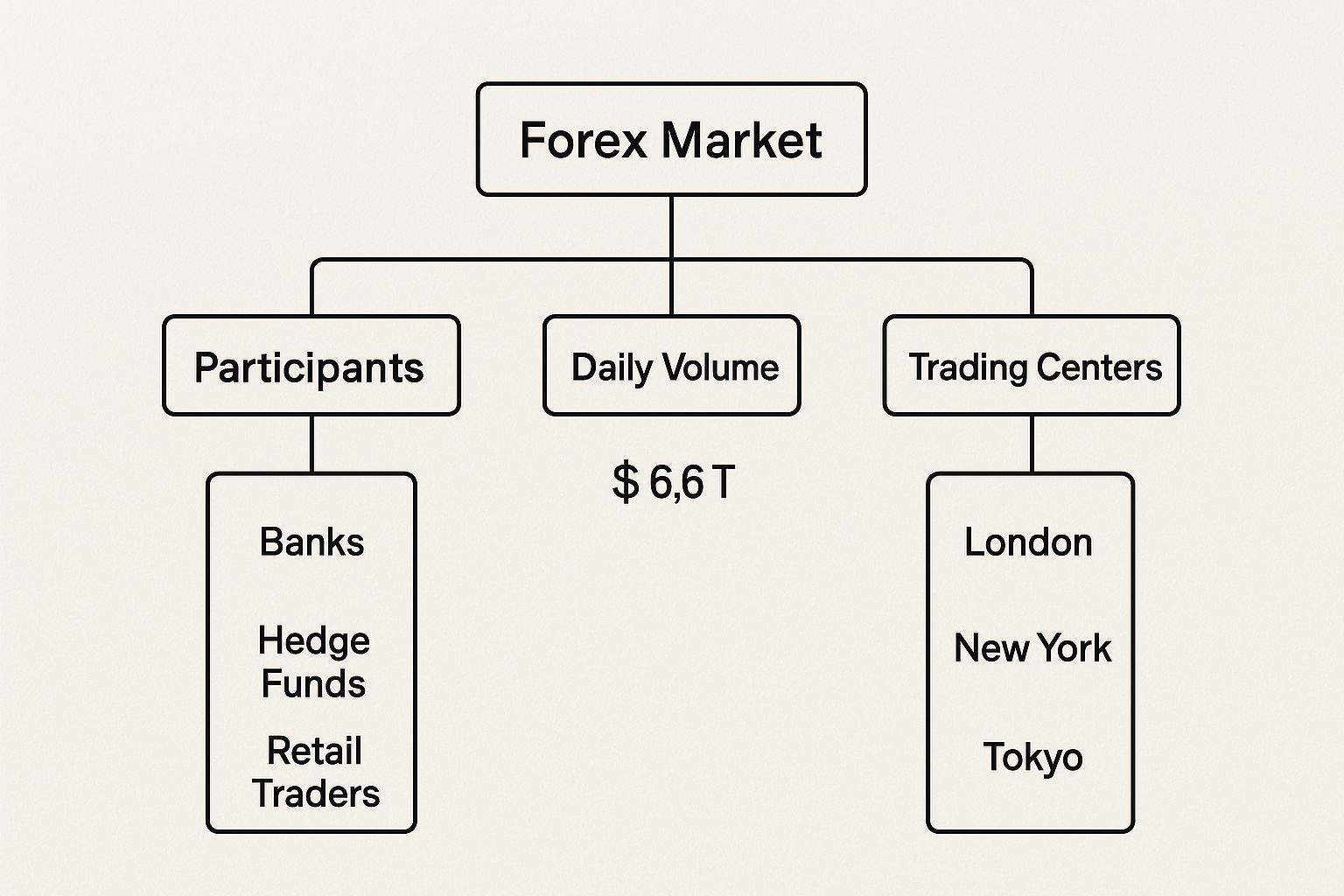

The infographic below really puts the market's hierarchy into perspective. It breaks down the key players, the incredible daily volumes they're responsible for, and the main global trading hubs where all the action happens.

As you can see, even though there are lots of participants, the lion's share of the volume is concentrated right at the top with the big banks. London, New York, and Tokyo are the undeniable epicentres of this global market.

The Institutional Giants

Sitting at the apex of this pyramid are the major commercial and investment banks. This is the heart of the "interbank market," where the real heavy lifting in forex trading occurs. Giants like HSBC, JPMorgan Chase, and Deutsche Bank aren't just trading for one reason; they're in the market for several.

- Handling Client Business: They're the ones executing massive trades for multinational corporations, like a South African retailer needing to pay a supplier in China.

- Trading for Themselves: They also run proprietary trading desks, where they speculate on currency movements to turn a profit for the bank's own account.

- Making the Market: Critically, they provide liquidity by constantly quoting both a buy (bid) and a sell (ask) price. They make their money on the tiny difference between those two prices, known as the spread.

Their trading volumes are staggering, often in the billions of dollars for a single transaction. This sheer size makes them the primary force setting and moving exchange rates.

The Guiding Hand of Central Banks

Then you have the central banks, like the South African Reserve Bank (SARB) or the US Federal Reserve. These institutions play a completely different game. Their objective isn't profit at all; it's to manage their nation's currency, keep inflation in check, and ensure the economy remains stable.

A central bank’s main tools are monetary policy—think interest rate changes—and direct foreign exchange intervention (FXI). By buying or selling huge amounts of its own currency, a central bank can directly influence its value to steer the economy through rough patches.

For instance, if the Rand starts to weaken too fast, the SARB might step in. It could sell some of its US Dollar reserves to buy Rands on the open market. This sudden increase in demand helps to prop up the Rand's value. It's why traders and businesses like Zaro hang on every word from central bank governors—their decisions can send immediate shockwaves through the market.

Corporations and Investment Funds

Next in line are multinational corporations and large investment funds. A South African company importing machinery from Germany needs to swap Rands for Euros to pay the bill. This isn't a speculative bet; it's a crucial business function called hedging. They're simply protecting themselves from the risk of the exchange rate moving against them before the payment is due. While these trades are smaller than interbank deals, they add up to a massive slice of the market's daily volume.

Investment funds, on the other hand, are here purely to speculate. Hedge funds, pension funds, and asset managers analyse economic data and global trends to bet on which way a currency is headed. They often use significant leverage to magnify their potential profits.

The Rise of the Retail Trader

Finally, we have retail traders. These are individuals like you and me, trading our own capital through online brokerage platforms. While any single retail trade is a drop in the ocean, the sheer number of people trading from their laptops has exploded in recent years. Collectively, they've become a noticeable force, typically speculating on short-term moves in popular currency pairs like EUR/USD or USD/ZAR.

Getting to know these different players is the key. When you understand their unique motivations—a bank providing liquidity, a corporation hedging risk, a central bank stabilising its economy, or a speculator chasing profit—you can start to truly interpret why the market moves the way it does. It's the dynamic push and pull between these diverse goals that explains how the forex market really works.

What Determines Forex Prices?

Ever wondered why the South African Rand is up one day and down the next? At its heart, the answer is refreshingly simple: supply and demand.

Think of a currency just like any other commodity. If investors all over the world suddenly decide they want to buy Rands, the demand skyrockets, and its price—the exchange rate—climbs. Conversely, if more people are selling Rands than buying them, the supply swells, and its price tumbles.

Of course, these shifts aren't happening in a vacuum. They’re driven by a relentless flow of new information that shapes how traders, investors, and businesses feel about a country's economic prospects. From major economic reports to breaking political headlines, every new development can tip the scales, making a currency more or less attractive in a heartbeat.

The Power of Economic Data

Economic indicators are like a country's financial report card. When the numbers are good, they signal a healthy, growing economy, which naturally attracts foreign investment and boosts demand for the local currency. Weak data does the opposite. For businesses like Zaro clients who deal with international payments, getting a handle on these factors is crucial for managing currency risk.

Here are the heavy hitters—the economic reports that really move the market:

- Interest Rates: This is arguably the biggest driver of them all. When a central bank raises interest rates, it's usually to curb inflation. For investors, higher rates mean a better return on their money, which increases demand for that currency and strengthens its value.

- Inflation: High inflation eats away at a currency's purchasing power. If a country's inflation is climbing faster than its trading partners', its currency will likely weaken over the long run.

- Gross Domestic Product (GDP): As the broadest measure of economic activity, a strong GDP report signals a healthy, expanding economy. This acts like a magnet for foreign capital and is a big thumbs-up for the currency.

- Employment Data: Reports on job creation and unemployment give us a real-time snapshot of consumer health. More people in jobs means more spending, which fuels economic growth and gives the currency a solid foundation.

Political Stability and Market Sentiment

Beyond the hard numbers, there's the "vibe" of the market—what we in the industry call market sentiment. It plays a massive role.

Political stability is everything. A country with a stable government and predictable policies is seen as a safe haven for investment. On the flip side, political turmoil or uncertainty can send investors running for the exits, causing a currency's value to plummet.

Major news events, from national elections to international trade disputes, can shift this sentiment in an instant. This is a core part of how forex works; prices are constantly reflecting the collective hopes and fears of millions of people reacting to events as they unfold.

For a currency like the South African Rand, a unique blend of local and global factors creates a dynamic and often volatile environment. Its value isn't just tied to our own economic performance, but also to swings in global commodity prices and the overall investor appetite for risk.

A perfect example played out at the start of 2025. The Rand experienced significant volatility, bouncing between mixed signals at home and broader global pressures. In January 2025, the USD/ZAR rate swung wildly between R19.20 and R18.33. This turbulence was fuelled by conflicting local data—like a drop in manufacturing output happening at the same time as a rise in retail sales—alongside major policy news like the signing of the Expropriation Bill. For a more detailed look at what moved the markets then, you can find a great analysis on Sable International.

This complex dance between economic data, political events, and market mood is what sets a currency's value from one moment to the next. For any South African business involved in global trade, understanding these forces is the key to reading the stories behind the price charts and making smarter financial decisions.

Alright, let's break down how a forex trade actually happens, moving from market theory to the practical steps you'd take. Knowing what drives currency prices is one thing, but understanding the nuts and bolts of placing a trade is where the rubber really meets the road. This is how you turn your market insights into action.

At its heart, every forex trade is a straightforward bet on where a currency pair is headed. You’re simply speculating whether the first currency in the pair (the base) will get stronger or weaker against the second (the quote). This leaves you with two basic moves.

- Going Long (Buying): If you're convinced the base currency is about to climb, you "go long" by buying the pair. For example, buying EUR/ZAR means you're banking on the Euro gaining strength against the South African Rand.

- Going Short (Selling): On the flip side, if you think the base currency is set to fall, you "go short" by selling the pair. Selling EUR/ZAR means you expect the Euro to lose ground to the Rand.

So, how do you make these trades? Your entry point to the market is a forex broker. They're the ones who provide the trading platform and the live market access you need to open, manage, and close your positions.

Decoding the Language of a Trade

To trade smartly, you have to speak the language. A few key terms pop up in every single trade, and getting to grips with them is essential.

First up is the pip, short for "percentage in point." Think of it as the smallest standard step a currency pair's price can take. For most pairs, including EUR/ZAR, a pip is the fourth decimal place (0.0001). If EUR/ZAR moves from 20.1550 to 20.1551, that’s a one-pip shift. Pips are the fundamental unit you use to count your profits or losses.

Next, you need to know about the lot, which is simply the size of your trade. The industry standard is a 100,000-unit lot of the base currency. Now, that’s a hefty sum for most individuals, so brokers offer smaller, more manageable sizes too:

- Mini Lot: 10,000 units

- Micro Lot: 1,000 units

The lot size you pick has a direct impact on how much each pip is worth, which in turn defines your potential profit or loss on the trade.

Leverage and Margin: A Double-Edged Sword

This is where things get really interesting. How does an everyday trader control a position worth thousands, or even hundreds of thousands, of Rands? The answer is a powerful tool called leverage.

Leverage is essentially a loan from your broker that allows you to control a large market position with a relatively small amount of your own money. For instance, a leverage ratio of 100:1 means that for every R1 of your own capital, you can command R100 in the market. This magnifies your exposure, amplifying both your potential gains and, crucially, your potential losses.

The small slice of your own funds required to open that leveraged position is called margin.

Margin isn’t a transaction fee. It’s better to think of it as a good-faith deposit that your broker holds onto while your trade is open. It’s the collateral that secures the leveraged position.

Getting your head around this relationship is non-negotiable. While leverage creates the opportunity to make significant profits from tiny price movements, it's also the single biggest risk in forex trading. Using it without a solid understanding can wipe out an account astonishingly quickly. This is why a disciplined risk management strategy isn't just a good idea—it's essential for anyone who wants to trade for the long haul.

Forex Trading in the South African Context

While forex is a massive global network, it's crucial to zoom in and see how it actually works on the ground here in South Africa. Our local market isn't just a small outpost; it's a unique and lively hub for the entire continent, supported by a financial infrastructure that's head and shoulders above many of its neighbours. This has created the perfect environment for a thriving forex scene.

This growth isn’t just happening in the boardrooms of big banks, either. We've seen an incredible boom in retail participation, meaning more everyday South Africans are getting involved. This shift is driven by a couple of key things: people are becoming more financially savvy, and, crucially, mobile trading platforms have put the market right in our pockets. Anyone with a smartphone can now trade global currencies.

Regulatory Oversight by the FSCA

One of the main reasons the local market feels so established is the firm hand of our regulator. Here in South Africa, the forex market is overseen by the Financial Sector Conduct Authority (FSCA). Think of the FSCA as the market's referee, making sure everything is fair, efficient, and transparent.

For you, whether you’re a trader or a business owner dealing with international suppliers, this is incredibly important. It means any FSCA-licensed broker has to play by a strict set of rules. This includes keeping your money separate from their own company funds and ensuring their trading practices are fair. Opting for an FSCA-regulated broker gives you a vital layer of security and peace of mind when your capital is at stake.

The presence of a strong regulator like the FSCA builds trust and stability. It helps protect consumers from fraud and ensures that market participants, from large institutions to individual traders, operate on a level playing field.

A Continental Leader in Currency Trading

There’s no debating South Africa's top-dog status in Africa's currency markets. As of early 2025, our daily forex turnover has surged past $20 billion. That’s a massive figure, and it's powered by both our sophisticated financial systems and that booming retail sector, which is part of a continent-wide trend seeing an estimated 30% annual growth rate in participation.

This expansion is also getting a boost from increased volatility in other African currencies and the parallel rise of digital assets like cryptocurrencies, another area where South Africa is leading the charge. You can get a deeper dive into these trends in a detailed 2025 outlook on forex and crypto growth in Africa on contentworks.agency.

It’s this specific blend of factors that makes understanding the South African context so essential. For any local business, like a client of Zaro needing to pay an overseas invoice, the inner workings of our forex market—from its regulators to its key players—directly impact the exchange rates you get and, ultimately, the cost of competing on a global stage.

When it comes to the forex market, central banks are the giants in the room. Institutions like our own South African Reserve Bank (SARB) or the US Federal Reserve aren't playing the game for profit. Their mandate is much bigger: they're tasked with steering the national economy, keeping inflation in check, and managing the country's currency.

Their actions send massive ripples through the market, and anyone involved in forex—from big banks to small businesses—pays close attention.

The main tool in a central bank's toolkit is monetary policy, and the most powerful lever they pull is the interest rate. Think of it this way: when a central bank hikes its key interest rate, it suddenly becomes more rewarding for foreign investors to hold that currency. They're chasing a better return, so they buy more of it, and that increased demand can push the currency's value up.

Cutting rates? That usually does the exact opposite. This cause-and-effect relationship is one of the core mechanics of the forex market, and it’s why traders and businesses spend so much time trying to predict what the banks will do next.

A central bank’s decision doesn't just happen out of the blue. It’s a direct reaction to the latest economic numbers. A speech from the governor or a surprise rate change can instantly reshape how the world sees a country's economic strength, triggering immediate and often dramatic swings in exchange rates.

The Power of Foreign Exchange Reserves

Interest rates are a big deal, but central banks have another ace up their sleeve: a massive stockpile of foreign currencies and gold known as foreign exchange reserves. This is their war chest, giving them the ammunition to jump directly into the market if things get too volatile.

For instance, if the rand (ZAR) started to fall too fast, the SARB could step in. It might sell some of its US dollar reserves and use the proceeds to buy rands on the open market. This move boosts demand for the rand, helping to put a floor under its value and stabilise the price.

This is why the size of a country's reserves is seen as a major signal of its financial health and its capacity to handle economic shocks.

South Africa, in particular, has been demonstrating this strength recently. By May 2025, the nation's foreign exchange reserves hit a new record high of $68.116 billion. This strong position, supported by substantial gold holdings and smart management of forward positions, gives the SARB real power to defend the rand and navigate choppy waters during times of global uncertainty. For a closer look at these historic reserve levels, you can find a great breakdown on South Africa's financial stability on tradingeconomics.com.

This ability to strategically deploy reserves is a critical safety net. It gives the market confidence and shows that the central bank is serious about maintaining stability—a crucial element for any business involved in cross-border trade.

This isn't just theory for financial traders. For a business using a platform like Zaro to handle international payments, understanding these forces provides vital context for the exchange rates you see every single day.

Common Forex Questions Answered

Even after you've got the basics down, you’ll probably still have a few questions about how forex trading works on a practical level. Let's tackle some of the most common questions we hear from South African businesses and newcomers to the market. My goal here is to give you clear, straightforward answers that build on what you've already learned.

Can I Start Forex Trading in South Africa with a Small Amount?

Absolutely, yes. You don't need a fortune to get started. Many brokers who are properly regulated by the Financial Sector Conduct Authority (FSCA) in South Africa offer accounts that let you begin with a surprisingly small deposit, sometimes as low as R100-R200.

This is made possible by a concept called leverage, which is a tool that allows you to control a much larger position in the market with only a small amount of your own money. Just remember, leverage is a double-edged sword. It can magnify your gains, but it will also amplify your losses just as quickly. Starting small is a smart move—it lets you get a real feel for the market without risking significant capital.

Is Forex Trading Legal and Regulated in South Africa?

Forex trading is completely legal and officially regulated in South Africa. The primary watchdog for the industry is the Financial Sector Conduct Authority (FSCA), which is responsible for setting the rules and protecting consumers.

It’s incredibly important that you only work with a broker who is licensed by the FSCA. This isn’t just a recommendation; it's your main line of defence. Regulated brokers must follow strict rules, like keeping client funds in separate accounts and maintaining transparent business practices. This creates a much safer trading environment for you.

Choosing a regulated broker isn't just a suggestion; it's the most important decision you'll make to protect your funds. The FSCA's oversight ensures there are standards in place to promote fair and ethical market conduct.

What Is the Best Time to Trade Forex in South Africa?

The forex market never sleeps—it runs 24 hours a day, five days a week. But that doesn't mean all hours are equal. The best times to trade are when the market is buzzing with activity, meaning both liquidity (how easily you can buy or sell) and volatility (how much prices are moving) are high.

For traders here in South Africa, the sweet spot is usually during the overlap of the London and New York trading sessions. This window typically falls between 3 PM and 7 PM SAST (South African Standard Time). During these hours, major currency pairs like EUR/USD, GBP/USD, and of course, USD/ZAR, tend to see their biggest price swings, which can create more trading opportunities.

What Is the Difference Between a Base and Quote Currency?

Getting this concept right is fundamental to understanding forex. Every currency pair, like USD/ZAR, is structured to tell you its value at a glance.

- Base Currency: This is the first currency in the pair (the USD in our example). Think of it as the "base" of the transaction—its value is always 1.

- Quote Currency: This is the second currency listed (the ZAR). It tells you how much of the quote currency is needed to buy one single unit of the base currency.

So, if you see the USD/ZAR rate quoted at 18.50, it means you need 18.50 South African Rands to buy one US Dollar. When you "buy" the USD/ZAR pair, you're buying the base currency (USD) while selling the quote currency (ZAR), essentially betting that the US Dollar will get stronger against the Rand.

For any South African business making international payments, navigating these market dynamics is a daily reality. Zaro is designed to help you sidestep the usual complexities and high costs of traditional forex. We give you access to real exchange rates without the hidden fees, giving your business a clear financial advantage. Learn more about how you can simplify your global transactions at the Zaro website.