If you're asking, "how much can I actually earn from forex trading?" the answer isn't a simple rand amount. It's all about percentages. For a disciplined newcomer finding their feet, a realistic monthly return usually falls somewhere between 1% and 5% of their trading capital. This means your earnings potential is tied directly to the size of your account and, more importantly, your skill in managing it.

What Forex Traders in South Africa Realistically Earn

First, let's cut through the noise. Forget the flashy social media posts promising instant wealth and supercars. Proper forex trading in South Africa is a serious business, not a get-rich-quick scheme. Your income isn't a fixed salary; it's measured in percentage gains on your capital.

It helps to think of your trading account like the stock in a small business. The more stock you have, the more sales you can potentially make. In the same way, a larger trading account can support bigger positions and potentially generate more profit, but this power must always be balanced with watertight risk management.

Benchmarking Your Potential Returns

So, what's a realistic target to aim for? While elite professional traders might hit higher numbers, achieving a consistent monthly return of 1% to 5% is a very respectable and achievable goal, especially when you're still honing your craft. Anyone promising consistently higher returns is likely taking on massive, account-blowing risks.

Let's put that into perspective with some real-world numbers for a South African trader:

- A Conservative Goal: A 2% monthly return on a ZAR 20,000 account works out to ZAR 400.

- A Moderate Goal: A 5% monthly return on that same ZAR 20,000 account would bring in ZAR 1,000.

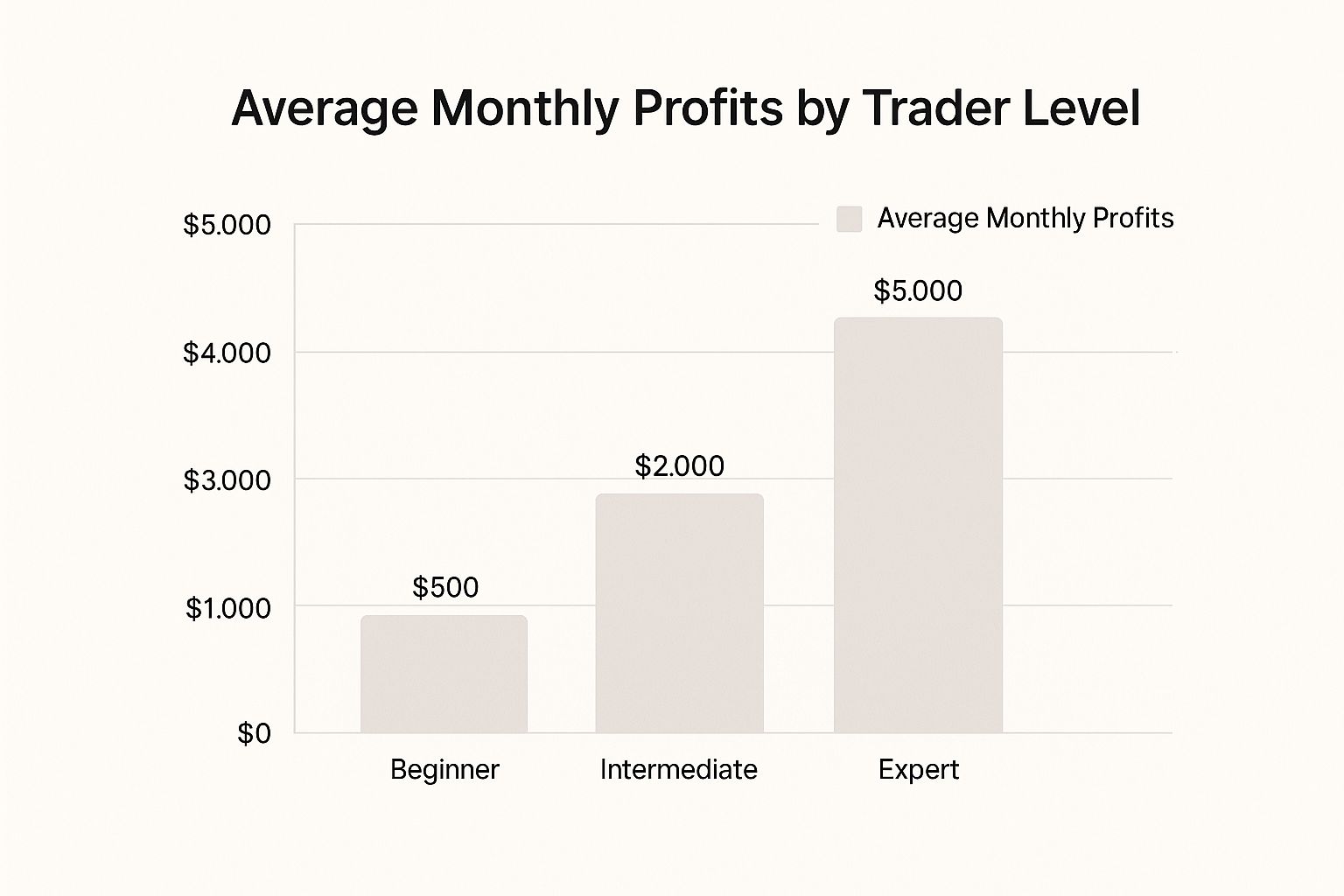

This image helps to visualise how your potential earnings can scale as your experience and capital grow.

The takeaway is clear: while you might start small, a commitment to learning and refining your strategy can lead to very meaningful income growth over time.

To give you a clearer picture, let's break down a few scenarios based on different starting capitals and return goals.

Realistic Forex Earning Scenarios in South Africa

| Initial Capital (ZAR) | Conservative Monthly Return (2%) | Moderate Monthly Return (5%) | Aggressive Monthly Return (10%) |

|---|---|---|---|

| ZAR 10,000 | ZAR 200 | ZAR 500 | ZAR 1,000 |

| ZAR 25,000 | ZAR 500 | ZAR 1,250 | ZAR 2,500 |

| ZAR 50,000 | ZAR 1,000 | ZAR 2,500 | ZAR 5,000 |

| ZAR 100,000 | ZAR 2,000 | ZAR 5,000 | ZAR 10,000 |

As you can see, the numbers scale directly. While the 10% column looks appealing, remember that it comes with significantly higher risk. Most successful traders build their wealth in the 2% to 5% range, focusing on consistency above all else.

The Mindset of a Profitable Trader

Ultimately, the most important question isn't "how much can you earn?" but "how can you consistently protect and grow your capital?" True professionals focus on capital preservation first and profits second.

The most successful traders don't chase massive, risky wins. Instead, they build wealth through the disciplined application of a proven strategy, understanding that small, consistent gains compound into significant earnings over the long term.

This approach demands patience. It requires treating every single trade as a calculated business decision. It's this disciplined mindset—not some secret indicator or a risky "all-in" strategy—that separates the traders who thrive from those who quickly burn through their starting funds.

Why Forex Trading Is Gaining Momentum in South Africa

It seems like everyone is asking, "how much can you earn from forex?" these days, and it’s no surprise. South Africa is seeing a massive wave of interest in retail forex trading, driven by a perfect storm of economic pressure and incredible new technology. It’s not just a trend; it's a fundamental shift in how people are thinking about their financial futures.

A big part of the appeal comes down to the search for alternative income. With a tough economic climate and a high unemployment rate, South Africans are getting creative, looking for ways to generate cash and build wealth beyond the traditional 9-to-5. For many, forex trading offers a direct, accessible route into the world’s largest financial market.

The Impact of Technology and Accessibility

Technology has completely changed the game, tearing down the old walls that kept everyday people out of the markets. Gone are the days when you needed a fortune and a seat on a trading floor. Today, a smartphone and a decent internet connection are all it takes to get started.

This new accessibility has fuelled explosive growth. Local brokers in South Africa are reporting a huge spike in new accounts being opened every month. Trading apps are climbing the download charts, used by everyone from professionals in Sandton to entrepreneurs in township internet cafés. Brokers have jumped on this, marketing heavily to new investors with offers like minimum deposits as low as ZAR 200. It’s never been easier to get in on the action. You can read more about this trend and its impact on the local market.

The accessibility of modern trading platforms has turned what was once an exclusive activity into a viable option for everyday South Africans looking to take control of their financial independence.

What this really means is that the potential to earn from forex is no longer a privilege reserved for the financial elite. The combination of low startup costs and powerful mobile tech has created a much more level playing field.

A Growing Appetite for Financial Education

Hand-in-hand with this tech boom, we've seen an explosion in online financial education. Anyone curious about trading now has a library of information right at their fingertips, making it possible to learn the ropes without spending a fortune.

This new learning environment includes:

- Free Online Content: You can find countless free tutorials, webinars, and articles that break down even the most complicated trading ideas into simple, clear lessons.

- Demo Accounts: Almost every reputable broker offers a free demo account. This is absolutely critical, as it lets you practise your strategies with virtual money before you put any real capital on the line.

- Structured Courses: For those who want to go deeper, there are plenty of online courses and mentorship programmes that offer structured training in market analysis and, most importantly, risk management.

All this available knowledge is empowering a new generation of traders. They’re stepping into the market with a better understanding that success in forex is about skill, strategy, and discipline—not just getting lucky. This drive for self-education is a huge reason why forex trading is gaining so much momentum across the country.

The Pillars That Dictate Your Trading Profits

So, how much can you really make from forex? The honest answer isn't a single number. It’s a reflection of how well you master a few core principles. Profitable trading isn't about stumbling upon a secret formula; it’s a business built on four solid pillars.

Think of it like building a table. Your success depends on the strength of four "legs": your capital, your risk management, your psychology, and your market knowledge. If one of them is weak, the whole thing wobbles and collapses. By focusing on strengthening each one, you gain real control over your potential earnings.

Pillar 1: Your Trading Capital

Your starting capital is the fuel for your trading engine. It directly influences the size of the positions you can open and, by extension, how much you can make on any single trade.

But here’s the most important rule of all: only trade with money you can comfortably afford to lose.

This isn't about being negative; it's about trading smart. When you're using money earmarked for rent or groceries, every little market dip feels like a personal crisis. That kind of fear leads to disastrous, emotional decisions—like closing a good trade too soon or clinging to a losing one in false hope.

Treat your starting capital like a business investment. It’s a tool for learning and growing, not a lottery ticket. Starting with a smaller amount that won’t break you allows you to hone your skills without the crippling pressure of financial desperation. It’s the foundation for long-term survival in the markets.

Pillar 2: Watertight Risk Management

If capital is your fuel, risk management is your shield. It's the set of non-negotiable rules that protects your money from catastrophic losses and keeps you in the game long enough to succeed.

The most successful traders aren't always the best at predicting the market's next move. Instead, they are masters of controlling their risk.

A cornerstone of this is the famous 1% rule. It's a simple but incredibly powerful guideline: never risk more than 1% of your entire trading account on a single trade.

For example, if you have a ZAR 20,000 account, the 1% rule means your maximum loss on any trade is capped at ZAR 200. This discipline ensures that even a string of bad luck won't wipe you out, giving you the time and capital to fight another day.

Sticking to this one habit is probably the single most important factor in determining your long-term forex earnings. It forces you to be selective and prevents one bad emotional decision from destroying your account.

Pillar 3: Bulletproof Trading Psychology

The real battle in forex isn't fought on the charts; it's fought between your ears. Your biggest enemies are often greed, fear, and impatience. Greed tempts you to bend your rules for that "once-in-a-lifetime" trade, while fear makes you second-guess yourself and panic at the worst possible moment.

Developing a disciplined trading psychology comes down to a few key habits:

- Stick to Your Plan: You need a clear trading plan with rules for when to get in, when to get out, and how much to risk. Your job is to follow it. No exceptions.

- Accept Losses: Losing trades are a cost of doing business in this industry. A professional sees a loss as a business expense, not a personal failure.

- Practise Patience: The best traders know how to wait. They wait for high-quality setups that meet their criteria instead of forcing trades out of boredom or a need for action.

Pillar 4: Deep Market Knowledge

Finally, your ability to analyse the markets is what gives you an edge. This doesn't mean you need an economics degree, but it does require a real commitment to learning. A solid knowledge base allows you to build a trading strategy that actually fits your personality and risk tolerance.

To really get a handle on your potential earnings, it's vital to know the tools of the trade. This includes understanding the mechanics of instruments like spread betting and other financial products.

Successful traders develop a deep understanding of either technical analysis (studying price charts and patterns), fundamental analysis (analysing economic data), or often a blend of both. This knowledge is what gives you the confidence to execute your plan and make informed decisions, turning your trading from a gamble into a calculated strategy.

A Practical Look at Calculating Profit and Loss

Alright, let's move away from the theory and get our hands dirty with a real-world example. Seeing how a trade plays out, from start to finish, is the best way to understand how you actually make or lose money in forex.

Let’s imagine a trader in Johannesburg, we'll call him Sipho.

Sipho has just funded his new trading account with ZAR 10,000. He's smart and disciplined, so he follows the golden rule of risking no more than 1% of his capital on any single trade. For him, that means his maximum risk per trade is ZAR 100. This isn't just a random number; it's a critical rule that ensures a few bad trades won't knock him out of the game.

He’s been watching the market and believes the US Dollar is about to gain strength against the Rand. Based on this, he decides to trade the USD/ZAR pair.

What a Winning Trade Looks Like

Sipho opens a "buy" position on USD/ZAR, getting in at an exchange rate of 18.2000. Before he does anything else, he sets up his safety nets.

His stop-loss order is placed at 18.1500. If the market turns against him and hits this price, his trade will automatically close, capping his loss at the ZAR 100 he planned for. For his target, he sets a take-profit order at 18.3000, aiming to make ZAR 200.

This setup gives him a 1:2 risk-to-reward ratio—risking ZAR 100 to potentially make ZAR 200. It's a classic strategy many professional traders use.

As it turns out, Sipho's analysis was spot on. The USD/ZAR rate climbs, hits 18.3000, and his take-profit order is triggered. The trade closes, banking a ZAR 200 profit. His account balance is now ZAR 10,200. A successful trade, executed according to plan.

And When a Trade Goes South

Now, let's rewind and imagine the market didn't cooperate. Sipho still enters his "buy" trade at 18.2000, with his stop-loss firmly in place at 18.1500.

This time, however, some unexpected economic news from the US hits the wires, and the Dollar weakens. The USD/ZAR pair tumbles, eventually hitting his stop-loss at 18.1500. His platform automatically closes the trade.

He’s lost money, but because he stuck to his 1% rule, the damage is contained to exactly ZAR 100. His account now sits at ZAR 9,900. Nobody likes a losing trade, but his capital is largely intact, and he lives to trade another day.

This is the reality of trading within a massive global market where trillions of dollars change hands every day, causing these constant price swings.

As the chart shows, the US Dollar dominates global trading, which is a big reason why pairs like USD/ZAR are so popular with South African traders.

The Double-Edged Sword of Leverage

You might be wondering how Sipho could risk just ZAR 100 to make ZAR 200 from such a small price change. The answer is leverage.

Think of leverage as a short-term loan from your broker. It lets you control a much larger position in the market than your own capital would allow.

Leverage is a powerful tool. It can magnify your profits from tiny market movements, but you have to remember that it’s a double-edged sword. It will amplify your losses just as quickly and brutally.

For example, with 100:1 leverage, Sipho's ZAR 100 deposit could control ZAR 10,000 worth of currency. That's how he was able to turn a fractional price shift into a ZAR 200 gain. But it's also why, without a stop-loss, a negative move could have cost him far more than his initial ZAR 100. This is exactly why strict risk management isn't just a suggestion—it's absolutely essential.

How Regulation and Technology Shape the Trading Landscape

The environment you trade in is just as important as the strategy you use. In South Africa, two massive forces dictate your safety and your chances of success: solid local regulation and the incredible pace of new technology. If you don't get a handle on both, you’re trading with one hand tied behind your back.

Think of the Financial Sector Conduct Authority (FSCA) as your first line of defence. They’re the official watchdog for all things financial in South Africa, and their job is to make sure brokers play fair and are transparent with their clients. A broker that isn't FSCA-regulated? That's a huge red flag – it’s like dealing with an unlicensed bank. You just don't do it.

Verifying Your Broker Is Crucial

Let me be clear: choosing an FSCA-regulated broker is non-negotiable. This oversight means your money is kept safe in segregated accounts, so the broker can't dip into your funds to cover their own running costs. More importantly, it gives you a legal leg to stand on if a dispute ever arises.

Thankfully, checking a broker’s credentials is easy.

- Find their FSP Number: Every legitimate broker has to display their Financial Service Provider (FSP) number on their website. You'll usually find it tucked away in the footer.

- Verify on the FSCA Website: Head over to the official FSCA site and pop that FSP number into their public search tool. This will instantly tell you if the broker is the real deal and if their licence is active.

This simple, five-minute check could be the difference between a successful trading journey and losing your entire investment to a dodgy operator. The peace of mind that FSCA protection provides is a big reason why so many South Africans now feel confident enough to trade.

How Technology Levels the Playing Field

Alongside that robust regulation, technology has thrown the doors of forex trading wide open. Not long ago, this was a world reserved for big banks and financial institutions. Now, thanks to tech, anyone with a smartphone can get involved.

This shift has brought some game-changing advantages that directly impact your potential earnings:

- Mobile Trading Apps: You can now analyse charts, execute trades, and manage your entire portfolio from pretty much anywhere you can get a signal.

- Low Barriers to Entry: Getting started is more affordable than ever. Thanks to better financial rules, many brokers now offer minimum deposits as low as ZAR 200, which lets traders with smaller amounts of capital get a foot in the door.

- Educational Resources: The amount of free knowledge out there is staggering. Webinars, tutorials, and trading simulators have massively boosted the skills and risk awareness of local traders. You can discover more about these local trends to see just how much the landscape has changed.

The combination of a secure, regulated environment and powerful, accessible technology means that South African traders are better equipped than ever to succeed in the global forex market.

What this all means is that many of the old obstacles are gone. The focus is now right where it should be: on your skill, your discipline, and your strategy. By staying within the safe harbour of FSCA regulation and making the most of the incredible tools at your fingertips, you build a much stronger foundation for your trading.

Answering Your Top Questions About Forex Earnings

When you're starting out in the world of forex, it's natural to have a lot of questions. Let's dig into some of the most common ones we hear from new traders in South Africa, giving you clear, honest answers to help you start on the right foot.

Think of this as a way to lock in the key ideas we've already discussed, so you can move forward with confidence and a proper sense of what this journey really involves.

Can I Start Forex Trading in South Africa with ZAR 1000?

Yes, you certainly can. These days, many brokers regulated by the FSCA offer accounts with very low minimum deposits, which has opened the doors for many more people. Starting with ZAR 1000 is a great way to get your feet wet with real money on the line, even if the stakes are small.

It's crucial, however, to keep your expectations in check. With an account that size, your profits on any single trade will naturally be small. The real win here isn't the money you'll make, but the experience you'll gain. Use this as your "live-fire" training ground to get a feel for the market, practise disciplined risk management, and test your strategy without the stress of risking a large sum of money.

How Long Does It Take to Become a Profitable Forex Trader?

There's no magic number here. The path to consistent profitability is different for everyone, and it really comes down to your dedication, discipline, and how well you learn from your mistakes (and your wins!). Some traders manage to find their groove in a few months, but for many others, it can easily take a year or more of hard work.

Profitability isn't just about finding a secret strategy. It's about mastering your own psychology and sticking to your risk management plan, no matter what.

Most seasoned traders would agree that the first 6 to 12 months are all about survival and learning. Your main goal shouldn't be to make a fortune, but simply to protect the capital you have.

Are Forex Trading Profits Taxable in South Africa?

Yes, they are. Any profit you earn from forex trading is viewed as income and is taxable in South Africa. This means it's on you to keep detailed and accurate records of all your trading activity—that includes every winning and every losing trade.

You'll need to declare your net profit to the South African Revenue Service (SARS) when you file your annual tax return. Tax laws can get tricky, so we strongly advise speaking with a qualified tax professional. They can make sure you're ticking all the right boxes and staying compliant.

What Is the Biggest Mistake New Traders Make?

Without a doubt, the single biggest and most destructive mistake is terrible risk management. New traders often get swept up in the excitement and end up risking way too much of their account on one trade, hoping for that one big score that will change everything. That's not trading; it's gambling.

A professional trader's first job is always capital preservation. They protect their account by following strict rules, like never risking more than 1-2% of their capital on a single trade and always using a stop-loss order. This is the discipline that allows them to weather the inevitable losing streaks and stay in the game long enough to come out ahead.