When you start trading forex, you'll hear the term "pip" thrown around constantly. It's the fundamental unit of measurement for price changes in a currency pair, often as small as $0.0001 for pairs like the EUR/USD.

Think of it like this: a pip is to forex what one cent is to the Rand. It's a tiny, standardised increment that helps you track market movements and, ultimately, calculate your profit or loss.

What Is a Forex Pip Explained

The name "pip" is an acronym for "Percentage in Point" or "Price Interest Point." It's a universal yardstick that ensures traders everywhere speak the same language. A 20-pip gain means the exact same thing whether you're trading from Johannesburg or London, removing any confusion from your market analysis.

For most of the major currency pairs you'll encounter—like EUR/USD or GBP/USD—a pip represents a change in the fourth decimal place. So, if you see the EUR/USD price move from 1.1050 to 1.1051, that's a one-pip increase. Simple as that.

Of course, there's an exception to the rule. For currency pairs that include the Japanese Yen (JPY), such as USD/JPY, a pip is measured by the change in the second decimal place. A move from 145.50 to 145.51 is a one-pip jump.

A Quick Note on Pipettes

Modern trading platforms have become even more precise, often showing an extra decimal place in their price quotes. This tiny fraction of a pip is called a pipette, and it's worth one-tenth of a standard pip.

For example, if the EUR/USD is quoted as 1.10505, that last digit—the "5"—is the pipette. While this extra precision is useful, most traders still anchor their strategies around full pips when setting their profit targets and stop-loss orders. Getting a solid grasp on pips is the first real step before you can figure out what that movement means for your account balance in Rands and cents.

Why Pips Are the Heart of Your Trading Strategy

If you want to get serious about forex trading, you have to get comfortable with pips. This isn't just about memorising a definition; it's about learning to speak the language of risk and reward. Every single move you make—setting a profit target, placing a stop-loss—is measured in these tiny increments. Think of them as the fundamental building blocks of any disciplined trading plan.

By framing your trades in pips, you can strip away the emotion and look at the numbers objectively. For example, is a potential 50-pip gain worth risking 25-pips? That simple question is the essence of a solid risk-to-reward ratio, and it all starts with pips. It forces you to move past gut feelings and focus on what really matters: making calculated, repeatable decisions.

From Pips to Profitability

This kind of strategic thinking is what really separates the amateurs from the pros. Instead of just crossing your fingers and hoping a trade works out, you can define your exact exit points for both winning and losing scenarios. It gives you a solid, repeatable framework for every position you open.

Pips are the universal yardstick for measuring performance in forex. A 30-pip gain is a 30-pip gain, no matter if you're trading the Euro against the Dollar or the Yen against the Pound. This standardisation is what allows you to accurately track your strategy's performance over time and make smart, data-driven adjustments.

Ultimately, understanding how much one pip is in forex is the bridge between the abstract squiggles on a chart and the real money in your account. It’s what lets you:

- Quantify Risk: Know precisely how much capital you have on the line before you ever click "buy" or "sell."

- Define Targets: Set clear, realistic profit goals for every trade.

- Maintain Discipline: Stick to your plan and avoid making impulsive decisions in the heat of the moment.

Trading without a firm grasp of pips is like flying blind. When you make them the centre of your strategy, you gain the clarity and control you need to build long-term success in the markets.

How to Calculate the Value of One Pip

It’s one thing to know what a pip is, but the real game-changer is understanding what it’s actually worth in Rands and cents. This is where those tiny price movements become real money, and knowing how to calculate their value gives you genuine control over your trades.

The calculation itself isn’t as scary as it might look. Once you get the hang of it, you’ll be able to manage your risk with much greater precision.

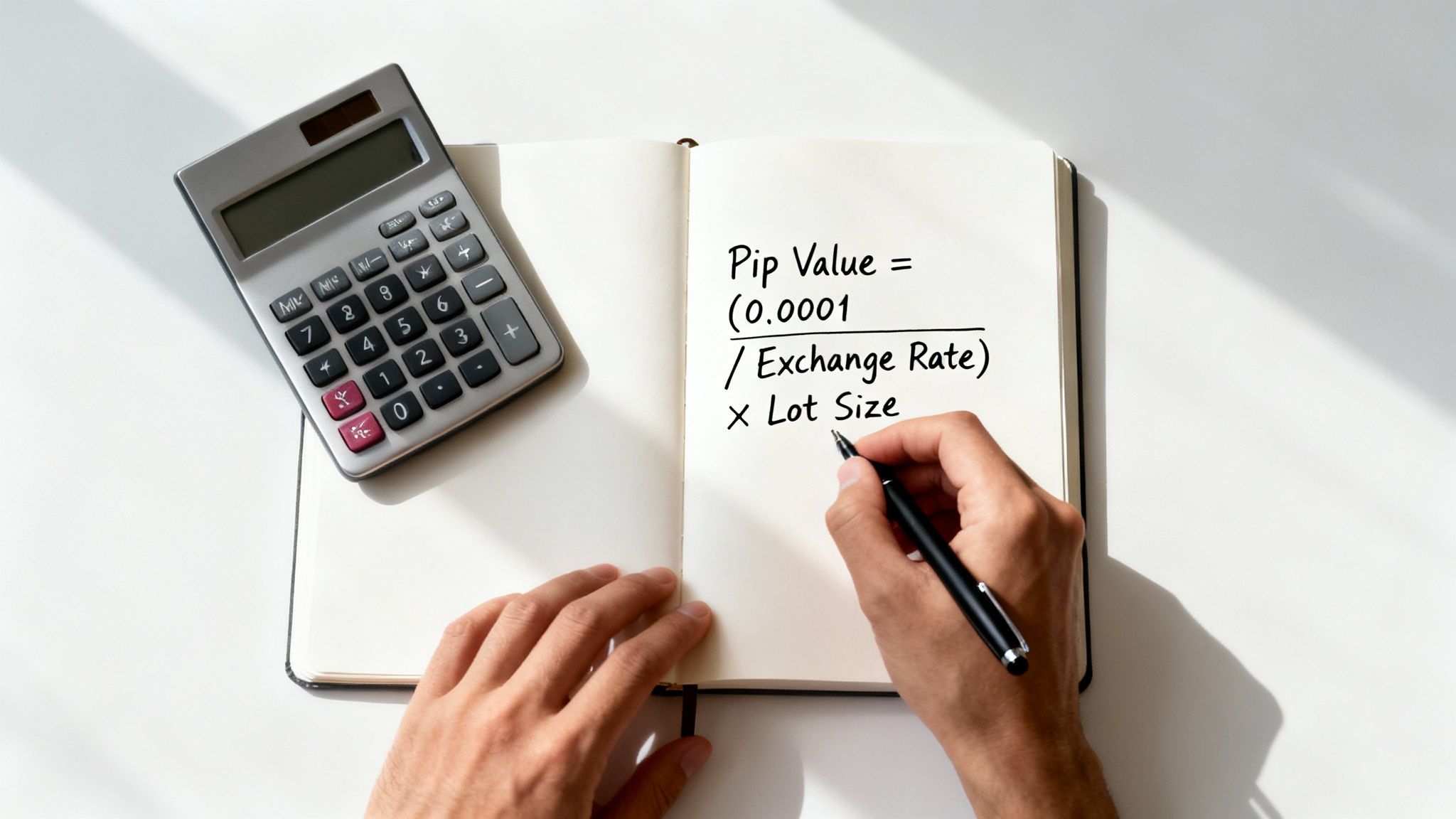

The go-to formula for working out how much one pip is in forex is:

Pip Value = (Pip in Decimal Form / Exchange Rate) * Lot Size

I know, it looks a bit technical at first glance. But trust me, each piece of this puzzle is straightforward. Let’s break it down so you can see how it all fits together.

Breaking Down the Pip Value Formula

To really get to grips with the calculation, you just need to understand the three moving parts that determine a pip's final value.

- Pip in Decimal Form: Think of this as the standard size of a pip. For most currency pairs, like the EUR/USD or GBP/USD, this is always 0.0001. The main exception is pairs involving the Japanese Yen (JPY), where a pip is 0.01.

- Exchange Rate: This is simply the current market price of the currency pair you're looking at. Because it’s always changing, it directly affects what a pip is worth in your account's currency.

- Lot Size: This is just the size or volume of your trade. A standard lot is 100,000 units of the base currency, a mini lot is 10,000, and a micro lot is 1,000. The bigger your lot size, the more money each pip movement represents.

A Practical Calculation Example

Right, let’s put the theory into practice. Imagine you're looking to trade the EUR/USD pair using a standard lot, and your trading account is in US Dollars.

Here’s what we’re working with:

- Currency Pair: EUR/USD

- Pip in Decimal Form: 0.0001

- Current Exchange Rate: 1.0800

- Lot Size (Standard): 100,000 units

Now, let's slot these numbers into our formula:

Pip Value = (0.0001 / 1.0800) * 100,000

First, divide the pip by the exchange rate: 0.0001 / 1.0800 = 0.00009259.

Next, multiply that tiny number by your lot size: 0.00009259 * 100,000 = €9.259.

Notice the result is in Euros (the base currency). We just need to convert it back to our account currency (USD) using the exchange rate: €9.259 * 1.0800 = $10.00.

Here’s a handy shortcut: for any pair where the USD is the quote currency (the second one listed), one pip on a standard lot will always be worth $10. Remembering this simple rule makes figuring out your risk on the major pairs a whole lot faster.

Calculating Pip Value for USD/ZAR in South Africa

While there's a general formula for working out pip values, things get a whole lot simpler for South African traders using ZAR-denominated accounts. When you're trading a pair where the Rand is the quote currency (the second one in the pair), like USD/ZAR, the pip value becomes fixed.

This is a huge advantage. It cuts out all the extra conversion steps, letting you see exactly how market movements are hitting your bottom line, in real-time. You don’t have to stress about a fluctuating exchange rate changing the value of your pips; it’s a constant you can build your strategy around.

The Fixed Pip Value for USD/ZAR

For local traders, the answer to how much one pip is in forex for USD/ZAR is standardised based on your trade size. This setup is perfect for anyone in South Africa wanting to manage their risk and profits accurately in their own currency. If you want to play around with this yourself, you can use a real-time pip calculator for USD/ZAR on fxverify.com to see it in action.

Here’s a simple breakdown of how it works for different trade sizes:

- Standard Lot (100,000 units): One pip movement is worth exactly ZAR 10.00.

- Mini Lot (10,000 units): One pip is worth ZAR 1.00.

- Micro Lot (1,000 units): One pip is worth ZAR 0.10 (or ten cents).

Having these fixed values makes calculating your potential profit or loss incredibly straightforward. No guesswork needed.

A fixed pip value means you can instantly translate market movements into Rands. If you're trading a mini lot and the market moves 50 pips in your favour, you know you've made exactly ZAR 50—it's that simple.

Let’s put this into a practical scenario. Imagine you open a trade on USD/ZAR with one mini lot. You decide to set your stop-loss 30 pips away from your entry price and your take-profit target 60 pips away.

Because you know the pip value is a fixed ZAR 1.00 for a mini lot, you instantly know your risk and reward:

- Your maximum potential loss on this trade is ZAR 30.

- Your potential profit target is ZAR 60.

This kind of clarity empowers you to make sharp, confident decisions. It ensures every trade you place lines up perfectly with your risk management strategy, without you having to pull out a calculator every time.

Why the Value of a Pip is Not Universal

While the idea of a pip is a standard unit of measurement in forex, its actual monetary value is anything but standard. Thinking of it as a fixed amount is a common mistake that can cost you dearly. The Rand value of one pip is dynamic, changing with the specific currency pair you’re trading and the base currency of your account.

A pip’s value in a GBP/USD trade, for instance, will be completely different from its value in a USD/CHF trade. This is because the pip value is always determined by the quote currency (the second one in the pair) before being converted back to your account's currency.

How the Quote Currency Dictates Value

The quote currency is the real engine behind the shifting value of a pip. To get a practical sense of this, let's look at how it works with different pairs.

Pairs with USD as the Quote: When you trade pairs like EUR/USD or GBP/USD, the pip value is naturally calculated in U.S. Dollars. For a standard lot, this is a clean $10 per pip. Simple enough.

Pairs with a Non-USD Quote: Now, consider a pair like EUR/GBP. Here, the pip value is calculated in British Pounds (£). You then have to convert that pound value back into your own account currency (like ZAR), which adds an extra step to your risk calculation.

This is exactly why experienced traders often use automated pip calculators. When you're juggling multiple trades across different pairs, trying to do these conversions manually is just asking for trouble.

The JPY Anomaly and Your Account Currency

There’s a major exception to the four-decimal-place rule: pairs involving the Japanese Yen (JPY), like USD/JPY. For any JPY pair, a pip is measured by the second decimal place (0.01), not the fourth.

For South African traders focusing on pairs like USD/ZAR, understanding these nuances is crucial. Data shows that pip values can swing quite a bit depending on the pair and your account’s denomination. Trading platforms often highlight that knowing the precise pip value helps local traders accurately measure potential profits or losses, protecting them from unexpected risk. For a more detailed look, you can find a good breakdown of how pip calculators work on fxcm.com.

At the end of the day, figuring out how much one pip is in forex isn't about memorising a single number. It’s about looking at the specific pair you're trading, your position size, and your account's base currency to get a true picture of your financial exposure.

Common Questions About Forex Pips

Even with the basics down, it’s completely normal for a few questions to pop up. The world of forex has its own language, so let's tackle some of the most common queries traders have about pips to help you feel more comfortable.

What Is a Pipette in Forex?

You've probably noticed that many trading platforms quote prices with an extra decimal place. For instance, the EUR/USD might show up as 1.10505. That tiny fifth digit is what we call a pipette.

Simply put, a pipette is just one-tenth of a standard pip. While it allows for more precise pricing—which is handy for certain high-frequency trading styles—most traders still set their stop-loss orders and profit targets using full pips. It helps to think of pips as the rands and pipettes as the cents of market movement.

Do Pips Have the Same Value for All Pairs?

This is a crucial point: no, they don't. A pip's monetary value isn't a one-size-fits-all deal. Its actual worth depends on three things:

- The specific currency pair you're trading.

- Your trade size (e.g., standard, mini, or micro lot).

- Your trading account's base currency (like ZAR, USD, or EUR).

A one-pip move on a standard lot of EUR/USD, for example, is worth $10. But if you're a South African trader with a ZAR account trading USD/ZAR, that same one-pip move is worth ZAR 10. The value is always calculated in the quote currency (the second one in the pair) first.

Can a Pip's Value Change During a Trade?

Yes, and this is where things can get interesting. If neither currency in your traded pair matches your account currency, the pip value will actually fluctuate along with the market.

Let's say you have a ZAR account and you're trading EUR/GBP. The pip value is first worked out in Pounds (£). To figure out what that's worth in Rands, your platform has to convert it using the live GBP/ZAR exchange rate, which is always on the move.

This is exactly why trading pairs where your account currency is the quote currency (like a South African trading USD/ZAR) makes life so much easier. It gives you a fixed, predictable pip value, which makes managing your risk far more straightforward and avoids any nasty surprises in your profit and loss calculations.

Managing international payments involves understanding exchange rates on a much larger scale. Zaro offers South African businesses a way to bypass the hidden fees and unpredictable costs of traditional forex. With our platform, you can send and receive global payments at the real exchange rate, ensuring complete transparency and control over your finances. Learn more at Zaro.