It’s a simple formula on paper, isn’t it? Revenue minus costs, divide that by revenue, then multiply by 100. But that simple percentage—your profit margin—tells you everything about how much you actually keep from every rand you make. For anyone exporting from South Africa, getting this right isn't just good business; it's a matter of survival.

Why Margin Calculation Is a Survival Skill for SA Exporters

When you’re a South African business competing on the world stage, knowing your margins is far more than just a bookkeeping chore. In a market where the Rand can swing wildly and cross-border costs pop up unexpectedly, this is your primary defence. Let's move past the textbook definitions and get into a practical framework for calculating your margins and, more importantly, protecting them.

Think of your margin calculation as a financial GPS. It shows you exactly where your money is going and how much of it is left for you at the end of the journey. Without that clarity, it's frighteningly easy for hidden costs to chew away at your revenue, especially when you're dealing with international payments.

The Shrinking Profit Landscape in South Africa

The pressure on local businesses to protect their margins isn't just a feeling—it’s a stark reality backed by data. Across South Africa's formal business sector, the ability to convert turnover into actual profit has been on a worrying decline.

A crucial analysis from Statistics South Africa revealed that back in 2007, businesses kept 11 cents of every rand earned. Fast-forward past the 2009 recession, and by 2015, that figure had plummeted to just 6 cents per rand as expenses began to outpace income.

For exporters, this trend is a massive red flag. The high fees, SWIFT charges, and poor exchange rates from traditional banking systems are a direct assault on these already razor-thin margins.

What You Will Learn in This Guide

This guide is built to give you the tools to fight back against that margin erosion. We're going to break down the three fundamental profit margins every exporter needs to have a handle on:

- Gross Profit Margin: The first, most basic check. Is the product or service you're selling profitable before we even think about overheads?

- Operating Profit Margin: This one gets to the heart of your business efficiency. How good are you at turning revenue into profit from your core day-to-day operations?

- Net Profit Margin: The ultimate bottom line. After every single cost is accounted for—from salaries to taxes to interest—what percentage of your revenue is left?

Mastering these three calculations gives you a powerful diagnostic tool for your company's financial health. You’ll be able to spot inefficiencies, price your products more intelligently, and build a more resilient business that can withstand the pressures of the global market. This isn't just about maths; it's about making the strategic moves that will help your business thrive.

Getting to Grips With Gross Profit Margin to Nail Your Pricing

Think of your Gross Profit Margin as the first, most fundamental health check for your business. It answers a simple, crucial question: for every rand you bring in from a sale, how much is left after you’ve paid for the direct costs of making that product?

Honestly, if you're not making enough money at this stage, no amount of clever operational tweaks down the line will fix a broken business model. This margin cuts through the noise and shows you the core profitability of your product before you even think about overheads like rent, salaries, or marketing. For South African exporters juggling fluctuating costs and currencies, getting this number right is the bedrock of smart pricing and sustainable growth.

But before you can even start, you have to accurately calculate Cost of Goods Sold (COGS). This isn’t just about the price of raw materials; it’s about every single direct cost involved in getting your product out the door.

Your COGS calculation should always include:

- Raw materials: The cost of every component that goes into your product.

- Direct labour: Wages for the people physically making the goods.

- Shipping and freight: The costs to get those raw materials to your factory.

- Import duties and taxes: Any levies you pay on imported parts or materials.

- Direct production overheads: Things like the electricity used by your production machines or specific equipment maintenance.

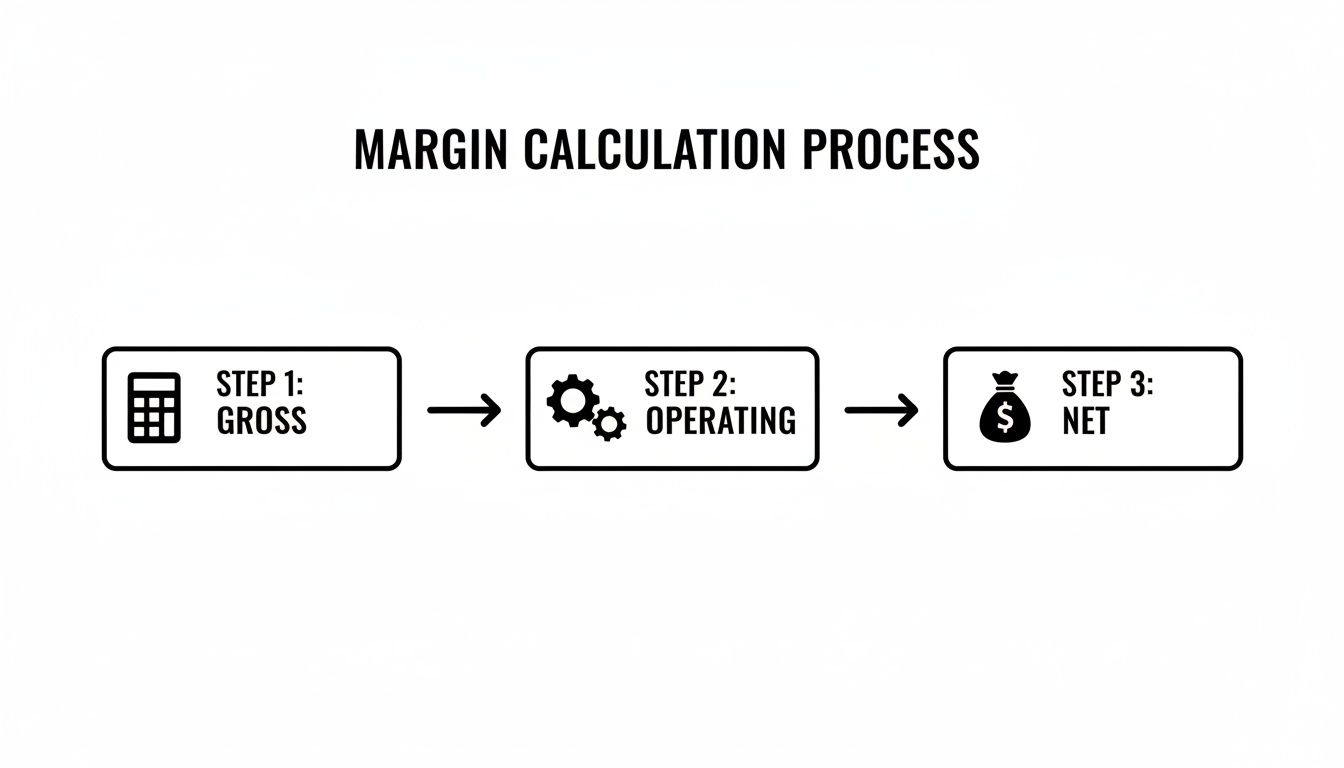

As you can see from the flow below, mastering this first level is non-negotiable. Everything else builds on it.

The visual lays it out clearly: Gross Margin is your starting point. From there, you move to Operating and then Net Margin, with each step giving you a clearer picture of your company's real financial health.

The Gross Profit Margin Formula

The actual calculation is refreshingly simple. Its power, however, comes from the accuracy of the numbers you plug into it.

Gross Profit Margin Formula:

((Total Revenue - Cost of Goods Sold) / Total Revenue) x 100

Let's quickly unpack that. Total Revenue is simply the total cash you've generated from sales. Your Cost of Goods Sold (COGS) is the sum of all those direct costs we just talked about. The result gives you a percentage—a clear indicator of the profit you make on each and every sale.

A Real-World Example for a SA Exporter

Let's imagine you run a Cape Town business that makes high-end leather bags. You import the finest leather from a supplier in Italy for $5,000 USD and sell the finished bags to a distributor in Germany for €15,000 EUR.

This is where hidden costs can absolutely wreck your numbers.

Paying your Italian supplier: You use your regular bank to send the $5,000. The bank gives you an exchange rate of R18.50/USD, but the real mid-market rate is actually R18.10/USD. On top of that, they charge a R500 SWIFT fee.

- Hidden FX markup cost: $5,000 x (R18.50 - R18.10) = R2,000

- Total ZAR Cost: ($5,000 * R18.50) + R500 = R93,000

- What you should have paid was closer to ($5,000 * R18.10) = R90,500. You've instantly lost R2,500 before you’ve even started production.

Adding other direct costs: Your local materials and direct labour for this specific batch of bags come to R30,000.

- Total COGS: R93,000 (leather payment) + R30,000 (local costs) = R123,000

Getting paid from Germany: You receive the €15,000. Your bank converts this into rand for you at R19.20/EUR, even though the real rate is R19.60/EUR.

- Total Revenue in ZAR: €15,000 * R19.20 = R288,000

Now, let's plug these numbers into our formula:

((R288,000 - R123,000) / R288,000) x 100 = 57.3%

On the surface, 57.3% looks pretty healthy. But the painful truth is that a big chunk of your profit was quietly eaten by bad exchange rates and fees. These hidden FX markups are the silent killers of gross margin. Using a platform like Zaro that gives you the real spot rate and transparent fees means the margin you calculate is the margin you actually get to keep.

Taking a Closer Look: Is Your Business Actually Efficient?

If your Gross Profit Margin tells you whether your product makes money, your Operating Profit Margin tells you if your business is making money. It's a crucial health check on how well you're managing the entire operation, not just the cost of what you sell.

This margin digs deeper than gross profit because it brings your Operating Expenses (OPEX) into the picture. OPEX covers all the day-to-day costs of keeping the lights on—things that aren't directly tied to producing one specific item. We’re talking about salaries, office rent, marketing budgets, and utilities.

For any South African exporter, these costs can be substantial and varied. A Joburg-based software firm, for instance, might have high OPEX from international server hosting fees and pricey developer tools. On the other hand, a wine exporter from Stellenbosch will likely spend a fortune on global trade shows and building distribution partnerships.

The Operating Profit Margin Formula

First, you need to figure out your operating profit. It's simply your gross profit minus all those operating expenses. Once you have that, the formula is straightforward, giving you a percentage that reflects how efficiently you run your shop.

Operating Profit Margin Formula:

((Gross Profit - Operating Expenses) / Total Revenue) x 100

A high operating profit margin is a great sign. It shows you have a tight grip on your overheads and are effectively turning revenue into profit from your core activities. But if that margin starts to shrink, it’s often a red flag that your running costs are creeping up faster than your sales.

Let’s Walk Through an Example: A Durban Tech SME

Imagine a tech company in Durban building logistics software for American clients. In a single quarter, they bring in $100,000 USD in revenue.

We already know their Gross Profit was $75,000 USD after covering direct project costs like freelance developer fees and specific software licences.

Now, let's look at their operating expenses for that quarter:

- Salaries: R450,000 for their permanent admin and sales team.

- Office Rent & Utilities: R90,000.

- Marketing & Advertising: $5,000 USD for their international campaigns.

- General Software Subscriptions: $1,000 USD for tools like their CRM and accounting software.

The first rule of these calculations: get everything into one currency. Let's work with an exchange rate of R18.20/USD.

Convert USD Expenses to ZAR:

- Marketing: $5,000 x 18.20 = R91,000

- Subscriptions: $1,000 x 18.20 = R18,200

Tally Up Total OPEX in ZAR:

- R450,000 (Salaries) + R90,000 (Rent) + R91,000 (Marketing) + R18,200 (Software) = R649,200

Convert Revenue and Gross Profit to ZAR:

- Total Revenue: $100,000 x 18.20 = R1,820,000

- Gross Profit: $75,000 x 18.20 = R1,365,000

Now that all our numbers are in Rands, we can plug them into the formula.

((R1,365,000 - R649,200) / R1,820,000) x 100

(R715,800 / R1,820,000) x 100 = 39.3%

The company's operating profit margin is 39.3%. This tells the management team that for every Rand that comes in the door, nearly 40 cents is left as operating profit after paying for everything it takes to run the business.

From Numbers to Action

This percentage isn't just for a spreadsheet; it's a guide for what to do next. A margin of 39.3% is pretty healthy, but what if they wanted to push it higher? They could dive into their OPEX and start looking for savings.

Maybe it's time to renegotiate the office lease. Or perhaps they could do an audit of their software subscriptions and cut out the tools nobody is actually using. Every little bit helps. Streamlining internal tasks, like automating payment approvals to reduce admin time, also directly cuts down OPEX and nudges that margin up. It's these small, consistent tweaks that build a much more resilient and profitable business in the long run.

Finding Your True Profitability with Net Profit Margin

Alright, after we’ve accounted for production costs and the day-to-day running expenses, we get to the real litmus test of a business's health: the Net Profit Margin. This is the bottom line. It's the final number that tells you what percentage of your revenue is left as actual profit after every single cost has been paid.

Think of it as the most honest picture you can get of your company's ability to turn sales into cash in the bank. This margin takes everything into account—your COGS, all your operating expenses, plus interest on any loans and, of course, the taxman's share. For a South African business earning foreign currency, this is where the real impact of your financial choices, especially around international payments, comes sharply into focus.

The Net Profit Margin Formula

The calculation itself is straightforward. You take your net income (what people often just call 'net profit') and measure it against your total revenue.

Net Profit Margin Formula:

(Net Income / Total Revenue) x 100Where Net Income = Total Revenue - All Expenses (COGS + OPEX + Interest + Taxes)

A healthy net profit margin is a sign of an efficient business that also manages its debt and tax obligations well. It really is the final word on your profitability.

Real-World Example: An SA Exporter Repatriating USD

Let's walk through a practical scenario. Imagine a South African design agency that's just completed a major project for a client in the United States, earning them $50,000 USD. We'll track how their choice of banking partner directly hits their bottom line, using a market exchange rate of R18.30/USD for our baseline.

First, here’s a quick look at their financials for this period:

- Total Revenue: $50,000 USD

- Total Expenses (COGS + OPEX): R450,000

- Interest on Business Loan: R25,000

- Corporate Income Tax (CIT) Rate: We'll use 27% for simplicity.

Now, let's play out two different ways they could bring that $50,000 USD home.

Scenario 1: Using a Traditional Bank

The agency opts to use its regular business bank. The bank offers an exchange rate of R17.85/USD—quite a bit lower than the market rate—and adds a R600 fee for the incoming transfer.

- Calculate Revenue in ZAR: ($50,000 x R17.85) - R600 = R891,900

- Calculate Profit Before Tax: R891,900 (Revenue) - R450,000 (Expenses) - R25,000 (Interest) = R416,900

- Calculate Tax Payable: R416,900 x 27% = R112,563

- Calculate Net Income: R416,900 - R112,563 = R304,337

- Finally, Calculate Net Profit Margin: (R304,337 / R891,900) x 100 = 34.1%

Scenario 2: Using a Modern Platform

This time, the agency uses a service like Zaro, which gives them the real exchange rate of R18.30/USD without any hidden fees.

- Calculate Revenue in ZAR: $50,000 x R18.30 = R915,000

- Calculate Profit Before Tax: R915,000 (Revenue) - R450,000 (Expenses) - R25,000 (Interest) = R440,000

- Calculate Tax Payable: R440,000 x 27% = R118,800

- Calculate Net Income: R440,000 - R118,800 = R321,200

- Finally, Calculate Net Profit Margin: (R321,200 / R915,000) x 100 = 35.1%

The difference is stark. Simply by choosing a provider that doesn't bake a big spread into the exchange rate, the agency’s net profit margin jumps by a full percentage point. On this one transaction, that’s an extra R16,863 straight into their pocket.

What’s a Good Net Margin in South Africa?

For any South African SME working with international clients, it’s crucial to know what a "good" margin looks like here at home. Data from Stats SA shows that while the average across all businesses is about 11 cents profit per rand of turnover, this can vary wildly between industries.

The trade sector, for example, makes up a massive 36% of turnover but operates on a razor-thin 4% margin. For them, every single cent saved on cross-border costs is vital. On the other hand, business services tend to be the most profitable, followed by personal services and manufacturing. You can dive deeper into these industry benchmarks over on the Stats SA official website.

At the end of the day, a 'good' net margin isn't just about chasing a number. It's about fiercely protecting every cent of your hard-earned revenue from being chipped away by inefficient financial processes. Your net profit calculation is the tool that proves you're succeeding.

Common Margin Calculation Mistakes to Avoid

Getting your margins right is the foundation of smart business decisions. It’s also surprisingly easy to make small errors that can throw your entire financial picture out of whack. For South African businesses, especially those juggling multiple currencies, these little slip-ups can be particularly costly.

When your numbers are off, it's not just a spreadsheet error. It can lead you to underprice your products, completely misread your profitability, and make strategic calls based on faulty data. Let's walk through some of the most common mistakes I see and, more importantly, how you can avoid them.

Misclassifying Your Costs

One of the most frequent stumbles is putting an expense in the wrong bucket. This usually happens when trying to separate the Cost of Goods Sold (COGS) from your Operating Expenses (OPEX). Just remember: COGS are the direct costs of making what you sell, while OPEX are the costs of keeping the lights on.

A classic example I’ve seen is an administrative salary getting lumped into COGS. That salary gets paid whether you sell one widget or a thousand, so it clearly belongs in OPEX. Making this mistake inflates your COGS, which crushes your gross profit margin on paper and gives you a distorted view of your product’s actual profitability.

Actionable Tip: Create a simple but clear chart of accounts that spells out exactly what goes into COGS versus OPEX. Make it a point to review this with your team every quarter. Consistency is absolutely crucial for tracking your margins accurately over time.

Forgetting About Cross-Border Payment Fees

When you're looking at the big picture, it’s easy to gloss over the small transaction costs. But for anyone exporting from South Africa, these "small" fees can add up to a significant number. I’m not just talking about your standard bank charges; things like intermediary bank fees and SWIFT charges can take a serious bite out of your revenue.

Think about it: you’re expecting a $10,000 payment. If R500 in various fees is skimmed off the top before the money even lands in your account, your real revenue isn't the ZAR equivalent of $10,000. It's that amount minus R500. Forgetting to factor this in means you're overstating your revenue from the get-go, which messes up every single margin calculation that follows.

Ignoring the Hidden Cost of the FX Spread

This is, without a doubt, one of the most painful and overlooked costs for South African exporters. The "spread" is the gap between the real mid-market exchange rate and the less favourable rate you get from your bank. This isn't just a tiny rounding difference; it's a direct, often hidden, cost that eats into your profit.

Let's put it in real terms. Say the mid-market rate is R18.50/USD, but your bank offers you R18.10. That R0.40 difference might not sound like much, but on a $100,000 transaction, it’s a R40,000 loss.

You won't see this listed as a "fee" on any statement. It’s profit that simply disappears during the currency conversion. If you don't account for this spread, the revenue figure you're using for your margin calculations is fundamentally flawed.

To truly understand how to calculate business margin, you have to start with the actual Rand value you bank, not a theoretical number based on a rate you never actually received. This is precisely why working with a transparent FX platform is so vital—it helps you sidestep this hidden cost, ensuring the margin you calculate is the margin you actually get to keep.

Your Free Exporter Margin Calculator Template

Understanding the theory behind margins is one thing, but putting it into practice is where you'll see a real difference in your business. To make that happen, we’ve created a free, downloadable spreadsheet template specifically for South African exporters. This isn’t some generic calculator; it’s a hands-on tool designed to bring some much-needed clarity to your finances.

The template gives you a clean, organised way to track your numbers and see exactly where your money is going. The screenshot above gives you a peek at the dashboard—just plug in your revenue and cost data, and watch your margins update instantly.

Inside, you'll find a logical layout that demystifies the whole process of how to calculate business margin accurately. It’s been built from the ground up to handle the unique challenges that come with international trade.

Key Features of the Template

We've split the calculator into different tabs so you can focus on one metric at a time without feeling overwhelmed. This separation helps ensure you can work out each margin with precision.

- Dedicated Margin Tabs: It has separate, pre-formatted tabs for your Gross, Operating, and Net Profit Margin calculations.

- Built for Exporters: You’ll find specific fields for things that are easy to forget, like currency conversion rates, international bank fees, and other cross-border costs.

- Comprehensive Final Example: A fully filled-out tab is included to walk you through a complete scenario, pulling everything we've discussed in this guide into one clear example.

Think of this tool as your bridge from guesswork to certainty. Using it consistently helps build a solid monthly financial reporting habit, giving you an honest, real-time picture of your business's health.

How to Use the Calculator

Getting started is simple. Just pop in your total revenue, then move over to the Cost of Goods Sold section. The sheet is designed to walk you through each input logically, from your direct production costs right down to your final net profit.

Here’s a practical tip: when you're calculating revenue from a USD sale, make sure to input the actual ZAR amount that landed in your bank account after conversion. Don't use a theoretical spot rate. This small step forces you to see the true impact of exchange rate spreads and fees on your top line, giving you a brutally honest margin figure.

For an even more specialised tool to get a grip on your channel economics, you might want to look into a dedicated retail profit margin calculator. Our template is a fantastic first step, giving you a tangible asset to bring this kind of financial discipline into your day-to-day operations for better control and sharper decision-making.

Got Questions? We've Got Answers

Once you've got the basics of calculating your business margins down, a few practical questions almost always pop up. Let's tackle some of the most common ones we hear from South African exporters.

How Often Should I Be Running These Numbers?

In a perfect world, you'd calculate your margins monthly. For any business dealing with international trade from South Africa, this gives you the clearest, most up-to-date picture of your financial health. If monthly isn't feasible, you absolutely must do a full review every quarter.

Why so often? Because things change fast. A dip in the rand or a sudden price hike from a supplier can erode your profitability almost overnight. Regular checks mean you can spot these trends early and adjust your pricing or cost structure before it becomes a real problem. This is where having a good financial platform with a clean transaction history really pays off—it makes the whole process much less of a headache.

So, What's a "Good" Profit Margin in South Africa?

This is the classic "how long is a piece of string?" question. The honest answer is, it completely depends on your industry. There's no single magic number that works for everyone.

For instance, businesses in the trade sector often work on razor-thin margins, sometimes as low as 4%, making their money on huge volumes. On the flip side, professional services can command much higher margins. The best approach is to research the benchmarks for your specific field, but don't get too fixated on them.

Your most important benchmark is always yourself. Beating your own numbers from last quarter is a far better sign of a healthy, well-run business than just hitting some generic industry average.

How Can I Boost My Margins Without Just Hiking Prices?

Raising prices is the most obvious lever to pull, but it's rarely the only one—and often not the best. You can make a huge impact by focusing on the other side of the equation: your costs.

You could start by trying to negotiate better rates with your international suppliers or doing a deep dive into your operational processes to trim unnecessary overheads. These are solid long-term strategies.

But for a quick win, look at your hidden financial costs. The money you lose on poor exchange rates and hidden banking fees can be staggering. Simply switching to a cross-border payment provider that gives you the real, transparent exchange rate without a nasty markup can instantly add percentage points back to your bottom line. You've already earned that profit; it's time to stop giving it away.

Ready to stop losing profit to hidden fees and poor exchange rates? With Zaro, you get the real spot rate on all your international transactions. See how much you could save on your next payment. Learn more about Zaro's transparent pricing.